- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Zelle Compares to ACH and Wire Transfers

Image Source: pexels

You might wonder about the zelle transfer type when you send money. Zelle is not a wire transfer. Instead, it uses the ACH network. The ACH network processes close to 1.5 billion payments annually in the United States. Zelle stands out because it moves funds faster than traditional ACH transactions. Although zelle uses ACH, it is not the same as a standard ACH transfer. Knowing the key differences between zelle, ACH, and wire transfers helps you pick the right money transfer option.

Key Takeaways

- Zelle sends money almost instantly using the ACH network, making it faster than traditional ACH transfers.

- Zelle is easy to use with just an email or phone number but works only with U.S. bank accounts and has limits on how much you can send.

- ACH transfers are low-cost and good for regular payments but usually take 1 to 3 business days to complete.

- Wire transfers handle large or urgent payments quickly but cost more and cannot be reversed once sent.

- Always double-check recipient details before sending money with Zelle, ACH, or wire transfers to avoid mistakes and fraud.

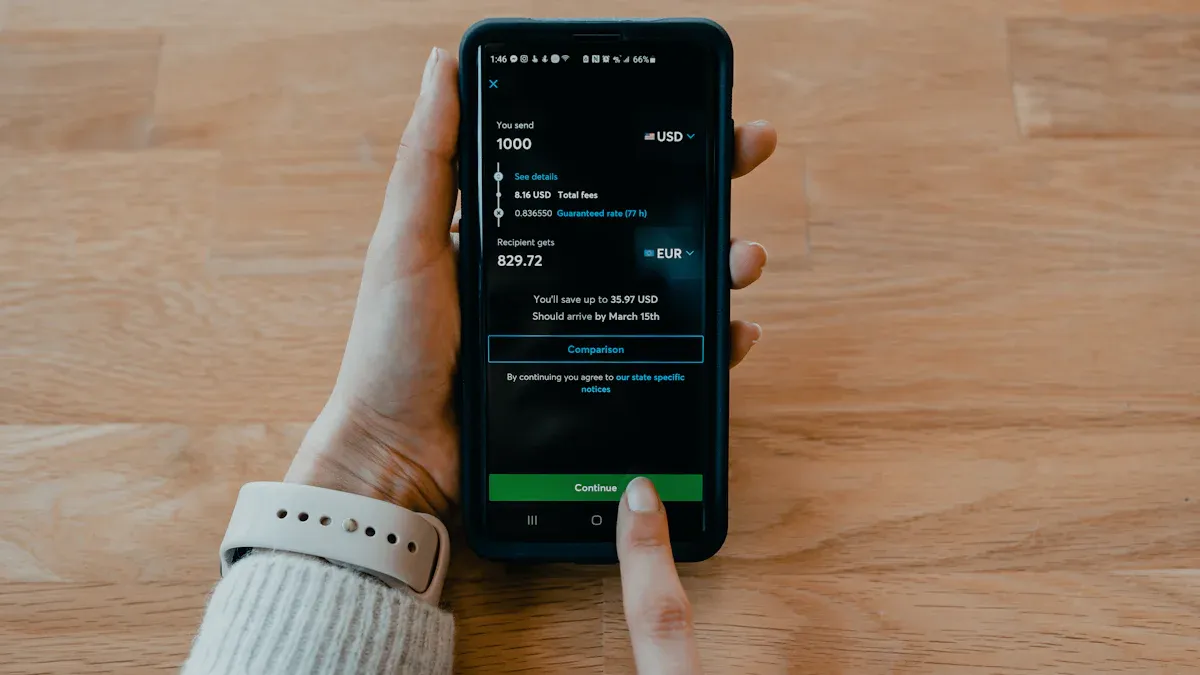

Zelle Transfer Type

Image Source: unsplash

ACH or Wire?

When you hear the term zelle transfer type, you might wonder if Zelle works like an ACH transfer or a wire transfer. Zelle is not a wire transfer. Instead, Zelle uses the ACH network to move money between banks. This means that every time you send money with Zelle, you are using the ACH system, but in a faster way than most other ACH payments.

Wire transfers use a different system. They send money directly from one bank to another, often for large sums or international payments. Zelle does not use the wire transfer system. You do not need to visit a bank branch or fill out long forms. You only need the recipient’s email address or phone number.

The table below shows how zelle payments compare to traditional ach payments:

| Feature | Traditional ACH Payments | Zelle Payments |

|---|---|---|

| Transfer Speed | Typically takes 2-5 business days | Usually completes within minutes |

| Availability | Offered by most U.S. banks | Not available at all banks; also accessible via Zelle app |

| Security | Payments can be returned or reversed, enhancing security | Fraud cases reported; reversals are rare |

| Convenience | Requires account and routing numbers for first-time transfers | Uses email or phone number for transfers |

You can see that zelle payments stand out because of their speed and convenience. Zelle uses the ACH network, but it does not work like a standard ach transfer.

How Zelle Uses ACH

Zelle uses the ACH network in a special way. When you send money with Zelle, the process looks different from a regular ach transfer. Here is how zelle payments work step by step:

- You start a zelle payment using your bank’s app or the Zelle app. You enter the recipient’s email or phone number.

- Your bank checks your identity and makes sure you have enough money in your account.

- Zelle moves the money from your bank to the recipient’s bank almost instantly. It does not wait for the usual ach batch processing.

- The recipient gets a message to enroll in Zelle if they have not already done so.

- Once enrolled, the recipient’s bank links their account to their contact information. Zelle uses secure messaging to finish the transfer.

- Both banks confirm the payment. The recipient’s bank puts the money into their account right away.

This process skips the delays you see with most ach payments. Zelle uses the ach network’s infrastructure, but it speeds up the process so you and the recipient do not have to wait days for the money to arrive.

Note: Zelle payments are sometimes called instant ach payments. They use the same network as other ach payments, but the money moves much faster.

You should remember that while Zelle uses the ACH network, it is not the same as a regular ach transfer. Zelle gives you a quick and easy way to send money, but it does not offer the same protections as some other ach payments. Always double-check the recipient’s details before you send money with Zelle.

What Is Zelle, ACH, and Wire?

Zelle Overview

You can use zelle to send money quickly to friends, family, or anyone with a U.S. bank account. Zelle started in 2017 and is owned by Early Warning Services. Many banks in the United States support zelle, so you often find it in your bank’s app. Zelle payments move money almost instantly, making it a popular choice for person-to-person transfers. You only need the recipient’s email address or phone number. Zelle uses the ach network to process these transfers, but it speeds up the process compared to traditional ach payments. You do not pay extra fees for most zelle transactions. Zelle works best for small, everyday payments between people you know.

ACH Overview

The ach network began in the early 1970s. The Federal Reserve and the banking industry created it to handle large numbers of electronic payments. Today, you use ach for payroll deposits, bill payments, and even some person-to-person transfers. Ach payments move in batches, not one at a time. This means your payment may take one to two business days to reach the recipient. Some banks now offer same-day ach, but most ach payments still take longer than zelle. Ach is low-cost, often just a few cents per transaction. You use ach for regular, repeated payments like rent, utilities, or paychecks. Ach works for both local and international transfers, but speed and cost can vary.

Wire Transfer Overview

Wire transfers have a long history. Western Union started the first wire system in 1871. Today, you use a wire transfer when you need to send money fast and securely, often for large amounts. A wire moves money directly from your bank to another bank. The process does not use batch processing like ach. Instead, each wire transfer happens individually. You often pay higher fees for a wire, usually $25 to $50 USD for each transfer. Wire transfers work well for urgent payments, real estate deals, or sending money overseas. You get fast delivery, but you must provide detailed information about the recipient’s bank. Wires are hard to reverse, so you need to double-check all details before sending.

Here is a quick look at the history of these payment systems:

| Payment System | Founding Year | Historical Highlights |

|---|---|---|

| Wire Transfer | 1871-1872 | Western Union launched the first electronic fund transfer in 1871. |

| ACH Network | Early 1970s | Federal Reserve and banks developed ach; first operated in 1972. |

| Zelle | 2017 | Early Warning Services launched zelle as a mobile payment system. |

You now know how zelle, ach, and wire transfer systems work and what makes each one unique.

Zelle vs. ACH vs. Wire: Comparison

Image Source: unsplash

Speed

When you send money, speed matters. Zelle stands out because it moves funds almost instantly. You can send money with Zelle and the recipient usually gets it within minutes. Zelle works 24/7 through many banking apps.

- Zelle transfers are generally completed within minutes.

- Funds sent via Zelle are typically available instantly or within minutes.

- Zelle operates 24/7 through integration with mobile banking apps.

ACH transfers take longer. Most ACH payments finish in one to three business days. Some banks offer same-day ACH, but you may pay extra for that. Wire transfers can be fast, too. A wire transfer often completes in minutes or by the next business day, depending on the bank’s system.

| Transfer Type | Typical Completion Time | Notes |

|---|---|---|

| ACH | 1-3 business days | Same-day ACH available for a fee |

| Wire Transfer | Minutes to next day | Some wire transfers settle immediately |

| Zelle | Minutes | Instant or near-instant, 24/7 |

Cost

You want to know how much each transfer costs. Zelle is usually free when you use it through your bank or the Zelle app. ACH transfers are also low-cost or free at most banks. Wire transfers cost much more. You may pay $25 to $50 USD for each outgoing wire transfer. Incoming wire fees are usually up to $15 USD. Some banks waive these fees for certain accounts, but most people pay them. ACH vs. wire transfer costs show a big difference, with ACH being much cheaper.

| Transfer Type | Typical Fees and Hidden Costs | Notes |

|---|---|---|

| Wire Transfers | $30+ outgoing, $15 incoming, exchange rate markups, third-party costs | Fees vary by bank; higher for international wires |

| ACH Transfers | Often free or low-cost | Cheaper than wires; some providers offer free ACH receiving |

| Zelle | Usually free or very low fees | No international transfers supported |

Security

Security is important for every transfer. Zelle uses your bank’s security systems, but it has seen high-frequency, lower-value fraud attempts. ACH fraud is rising as more people use it, but losses are lower than with checks. Wire transfers do not have much public fraud data, but once you send a wire, it is hard to get your money back if something goes wrong.

| Payment Method | Fraud Pattern Description |

|---|---|

| Zelle | High-frequency, lower-value fraud attempts |

| ACH | Increasing fraud attempts, but lower losses than checks |

| Wire Transfer | No specific data found |

Tip: Always double-check the recipient’s details before sending money with Zelle, ACH, or a wire transfer.

Limits

Each method has different limits. Zelle limits depend on your bank. For example, Bank of America lets you send up to $3,500 per day and $20,000 per month. Other banks have similar limits. ACH transfers usually have higher limits than Zelle, but banks do not always share the exact numbers. Wire transfers allow the largest amounts, sometimes up to $250,000 or more per day.

| Bank | Zelle Daily Limit | Zelle Monthly Limit |

|---|---|---|

| Bank of America | $3,500 | $20,000 |

| Wells Fargo | $3,500 | $20,000 |

| Citibank | $2,500 | $15,000 |

Wire transfer limits are much higher and suit large payments.

Reversibility

You should know if you can reverse a payment. Zelle payments are almost never reversible. Once you send money, you cannot get it back unless the recipient sends it back. ACH transfers can sometimes be reversed, especially if there is a mistake or fraud. Wire transfers are usually final. After you send a wire, you cannot cancel it.

Note: Always check your bank’s policy before sending a large ACH or wire transfer.

Pros, Cons, and Best Uses

Zelle

You can use Zelle for fast payments between people or businesses in the United States. Many banks support Zelle, so you often find it in your banking app. Here are some main advantages:

- You send and receive money within minutes.

- Most transactions have low or no fees.

- You do not need to handle cash or checks.

- Zelle supports contactless payments, which are safer and more hygienic.

- You get digital records for easy bookkeeping and tax preparation.

- Zelle works with many major U.S. banks, making it widely accessible.

However, you should know the drawbacks:

- Zelle only works with U.S.-based bank accounts and debit cards.

- Payments are instant and cannot be canceled or reversed.

- There is no purchase protection.

- Fraud risks are high, including phishing and account takeovers.

- If you send money to the wrong person, you may not recover your funds.

Tip: Use Zelle for trusted contacts and small payments. Always double-check recipient details before sending money.

ACH

ACH transfers help you manage regular payments and business needs. You can schedule payments and automate your finances. Here are some benefits:

- You control cash flow by scheduling payments.

- ACH saves time with automation and recurring payments.

- Fees are lower than checks or wire transfers.

- Transactions are encrypted, reducing fraud risk.

- ACH is ideal for rent, payroll, and supplier invoices.

- You help the environment by avoiding paper checks.

But ACH has some limits:

- Banks set maximum dollar limits per transaction or period.

- Processing takes 1-2 business days, so it is not good for urgent payments.

- Transactions are not instant and process in batches.

- Fraud or unauthorized access can still happen, so you must stay alert.

ACH works best for regular, non-urgent payments where cost and automation matter most.

Wire Transfers

Wire transfers give you speed and security for large or urgent payments. You can use a wire to send high-value payments, such as for real estate or business deals. Here are the strengths:

- Wire transfers move large sums quickly, often within hours.

- You can send money across borders with reliable networks like SWIFT.

- Strict verification and encryption make wire transfers secure.

- Wire transfers support high transaction limits, even millions of USD.

- You get direct bank-to-bank transfers, reducing delays.

Still, wire transfers have risks:

- Wire transfers cost more, with fees from $25 to $50 USD per transfer.

- Once you send a wire, you cannot reverse it.

- Fraud risks include phishing, fake invoices, and man-in-the-middle attacks.

- Banks must follow strict rules to prevent money laundering and report large transfers.

Use a wire transfer for urgent, high-value, or international payments. Always confirm recipient details to avoid costly mistakes.

You now know the key differences between Zelle, ACH, and wire transfers. Use this table to help you choose the best money transfer method for your needs:

| Factor | Zelle | ACH | Wire Transfers |

|---|---|---|---|

| Speed | Instant | 1-3 days | Minutes to 1 day |

| Fees (USD) | Free | $0.01–$5 | Up to $50 |

| Best Use | Quick, small | Routine, small | Large, urgent |

Think about your priorities for speed, cost, and security. Always check with your bank for details before you send money.

FAQ

How fast does Zelle send money compared to ACH and wire transfers?

Zelle usually sends money within minutes. ACH transfers take one to three business days. Wire transfers can take minutes or up to one day. Zelle works best for quick payments.

Can you use Zelle for international transfers?

You cannot use Zelle for international transfers. Zelle only works with U.S. bank accounts. For sending money to other countries, you should use a wire transfer or another service.

What happens if you send money to the wrong person with Zelle?

If you send money to the wrong person with Zelle, you cannot cancel the payment. You must contact the recipient and ask them to return the money. Always double-check the recipient’s details before sending.

Are there fees for using Zelle, ACH, or wire transfers?

| Transfer Type | Typical Fee (USD) |

|---|---|

| Zelle | $0 |

| ACH | $0–$5 |

| Wire Transfer | $25–$50 |

Zelle is usually free. ACH transfers cost little or nothing. Wire transfers have higher fees.

Navigating the complex landscape of payment methods—weighing the speed of Zelle against the reliability of ACH and the power of wire transfers—highlights a universal need for a service that combines the best of all worlds: low cost, high speed, and global reach. If high fees, slow processing times, and limited accessibility have been a barrier to your financial operations, it’s time to explore a modern solution.

BiyaPay offers a superior alternative for both domestic and international value movement. By leveraging digital assets and traditional finance, we provide a seamless experience. Our platform features a transparent, low remittance fee structure starting from just 0.5% per transaction. You can instantly check the real-time exchange rates for numerous fiat and digital currencies before converting and sending funds, ensuring you get the best possible value. With support for transfers to most countries and regions, often achieving same-day settlement, BiyaPay is built for the pace of modern life and business.

Experience the future of finance with swift registration, robust security, and unparalleled efficiency. Register with BiyaPay today and transform how you move money.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.