- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Ireland Property Buying Guide for International Investors

Image Source: pexels

You can buy property in Ireland as a foreigner, including as an American, with almost no restrictions. You need a Personal Public Service Number (PPSN) to complete the process. A solicitor will help you with all legal steps. Buying property does not give you the right to live in Ireland, but certain investment programs may help if you want to stay long-term.

Key Takeaways

- Foreigners, including Americans, can buy property in Ireland with almost no restrictions and full ownership rights.

- You need a Personal Public Service Number (PPSN) and a solicitor to handle legal steps and contracts.

- The Irish property market shows strong growth, especially in cities like Dublin, Cork, Galway, and Limerick, with good rental demand.

- Buying property does not grant residency; you must follow visa rules or consider the Immigrant Investor Programme for residency through investment.

- Plan carefully by researching areas, understanding costs and taxes, using trusted professionals, and managing currency exchange to ensure a smooth purchase.

Irish Property Market

Image Source: pexels

Why Invest in Ireland

You may find the irish property market attractive for several reasons. Ireland has a strong economy and a growing population. Many people want to live in cities like Dublin, Cork, and Galway. The country offers a stable legal system and clear property rights for international buyers. You can buy property as part of a real estate investment strategy, and you do not face major restrictions as a foreigner.

Note: The irish housing market often appeals to investors who want steady growth and long-term value. You may also see high demand for rental properties, especially in areas near universities and business centers.

The current irish housing market also benefits from limited housing supply. This shortage helps keep prices high and supports future growth. If you want to invest in property, you may find good opportunities in both cities and rural areas.

Market Trends

The irish property market has seen strong price growth in recent years. In the second quarter of 2025, average home prices rose by 12.3%. Over the past five years, prices have increased by more than 60%. The current irish housing market shows:

- House prices rose by 8.7% in 2024, compared to 4.1% in 2023.

- Secondhand homes increased by 10.5%, while new builds went up by 5.2%.

- The median house price reached about $390,000 USD in early 2025, but prices vary by region.

- Some areas, like Cavan and Donegal, saw growth rates above 13%.

- Many buyers face affordability challenges. A first-time buyer couple needs about $39,000 USD for a deposit and $88,000 USD in income to buy a median-priced home.

Experts say the irish property market may continue to grow by 6-10% each year into 2025. However, some warn that prices could be overvalued by 8-10%. You should watch for possible corrections, like those seen between 2008 and 2012. Policy changes and new housing projects may help balance the irish housing market in the future.

Buying Property in Ireland

Legal Rights for Foreigners

You can buy property in Ireland as a foreign national without facing restrictions based on your citizenship. The Irish legal system treats you the same as local buyers when it comes to property ownership. You have the right to purchase residential or commercial real estate, and you can own as many properties as you wish. The process of acquiring property in Ireland does not require you to live in the country or hold any special visa.

Note: Buying property in Ireland does not grant you residency or citizenship. You must follow separate visa or residency permit rules if you want to live in Ireland.

You need to meet certain legal requirements of buying real estate in Ireland. You must obtain a Personal Public Service Number (PPSN) for tax purposes. This number helps the government track property taxes and other obligations. You also need to hire a solicitor. Your solicitor will guide you through contracts, legal checks, and the registration process. In some sensitive areas, such as those with environmental or historical protections, you may face extra regulations. These rules apply to all buyers, not just foreign nationals buying property.

Buy Property in Ireland as an American

If you want to buy property in Ireland as an American, you will find the process straightforward. You do not face any nationality-based restrictions or extra requirements. You have the same rights as Irish citizens and other foreigners. You do not need to meet a minimum investment amount, and you can buy as many properties as you like. You do not need to open a local bank account, but having one can make it easier to manage expenses and payments.

Here is a summary of what you need to know as an American buyer:

- You do not need to be a resident or citizen of Ireland to buy property.

- You must get a PPSN for tax identification.

- You should hire a solicitor to handle legal checks and contracts.

- You will pay taxes such as Local Property Tax, Capital Gains Tax, and inheritance tax. The US-Ireland tax treaty may affect your tax situation.

- Brexit does not affect your ability to buy property in Ireland.

- You must follow Irish visa or residency rules if you plan to live in your property.

Acquiring property in Ireland gives you full property ownership rights, but it does not give you the right to live in the country. You must apply for the correct visa or permit if you want to stay long-term. Many Americans choose to buy property in Ireland for investment, vacation, or future retirement. The process remains clear and accessible for you as a foreign buyer.

Buying Process

Image Source: pexels

Finding a Property

You start your journey by searching for properties that fit your needs and budget. Many buyers use popular Irish property websites like Daft.ie, MyHome.ie, or Property.ie. These sites list homes, apartments, and investment properties across Ireland. You can also contact local estate agents who know the market well. Viewing properties in person helps you get a real sense of the neighborhood and the condition of the home.

Tip: Always check if the estate agent is registered with the Property Services Regulatory Authority. This protects you from scams and ensures you work with a trusted professional.

Making an Offer

Once you find a property you like, you can make an offer through the estate agent. You should have your finances ready, including a deposit (usually about 10% of the price) and proof of funds or mortgage approval. If the seller accepts your offer, you pay a booking deposit, often around 2% of the property price. This deposit takes the property off the market and starts the next steps.

The process usually follows these steps:

- Research properties and arrange viewings.

- Save for your deposit and extra fees like stamp duty and solicitor fees.

- Get mortgage approval in principle if you need financing.

- Place your bid and negotiate if needed.

- Pay the booking deposit when your offer is accepted.

- Notify your solicitor to begin contract work.

Note: The booking deposit is refundable until you sign the contract. After signing, you risk losing the deposit if you withdraw.

PPSN and Documentation

To complete the purchase, you need certain documents. A Personal Public Service Number (PPSN) is important for tax purposes and helps with property registration. While not always mandatory for buying property, you need it if you plan to work, invest, or pay taxes in Ireland. Your solicitor will guide you on how to apply for a PPSN if you do not already have one.

You also need:

- Proof of identity (passport or national ID)

- Proof of address (utility bill or bank statement)

- Proof of funds or mortgage approval

- Tax documents for stamp duty and registration

Tip: Your solicitor will help you collect and submit all required paperwork. This ensures you meet the legal requirements of buying real estate in ireland.

Hiring a Solicitor

You must hire a qualified solicitor to handle the legal side of buying property. The solicitor checks the property title, reviews contracts, and manages payments. They also make sure you follow all legal steps and protect your interests. You can find a reputable solicitor through the Law Society of Ireland.

Your solicitor will:

- Review the contract for sale

- Check the property’s legal status and title

- Conduct searches for planning permissions and debts

- Handle anti-money laundering checks

- Advise you on taxes and fees

Note: If you cannot sign documents in person, you can give your solicitor power of attorney to act for you.

Contracts and Registration

After your solicitor finishes all checks, you sign the contract of sale. You must sign this contract in front of a Commissioner of Oaths, who acts like a notary. The contract will set a completion date for final payments and when you get the keys.

Your solicitor will:

- Make sure the seller has clear ownership

- Prepare and submit all forms to Tailte Éireann, the state body for property registration

- Register your ownership with the Land Registry or Registry of Deeds

Here is a table showing key legal checks and contract requirements:

| Step | Description |

|---|---|

| Proof of Ownership | Registration with Tailte Éireann proves ownership and is guaranteed by the State. |

| Legal Due Diligence | Checks title, seller’s background, and planning compliance. |

| Contract for Sale | Uses a standard contract with warranties and disclosures. |

| Registration Process | Submits forms and deeds to Tailte Éireann for official registration. |

| Anti-Money Laundering | Verifies your identity and source of funds. |

| Tax Considerations | Includes stamp duty (1%-12% of price) and capital gains tax if you sell in the future. |

After you pay the balance and complete the sale, you receive the keys to your new property. Your solicitor registers your ownership, making you the official owner.

Tip: Always conduct a property survey before final payment. This helps you find any hidden problems and negotiate repairs or price reductions.

Costs and Taxes

Purchase Price & Deposit

When you buy a home in Ireland, you need to know the typical prices and how much money you must pay upfront. In 2024, the average price for a new home is about $350,000 USD (using an exchange rate of 1 EUR ≈ 1.09 USD). If you look at second-hand homes, the average price is closer to $310,000 USD. In popular areas like Dublin, prices often start at $625,000 USD. You must pay a deposit of at least 10% of the purchase price. For a new home, this means you need about $35,000 USD for the deposit. In Dublin, the deposit can reach $62,500 USD or more. Some government programs, such as Help to Buy, may help you with the deposit if you qualify.

Tip: Always check the latest exchange rates before you transfer large sums. Currency changes can affect the total amount you need.

Stamp Duty & Fees

You must pay stamp duty and other fees when you buy property in Ireland. Stamp duty is a tax on the transfer of property. The rate depends on the value and type of property. Here is a table to help you understand the main costs:

| Fee/Tax Type | Rate/Amount | Description/Notes |

|---|---|---|

| Stamp Duty on Property | 1%, 7.5%, or 10% | Based on property value and transaction type. |

| Stamp Duty on Company Shares | 7.5% | Applies if you buy shares in a company that owns property. |

| Residential Zoned Land Tax | 3% | Charged on undeveloped land zoned for housing (from March 2025). |

| RZLT Surcharges | 10% to 30% of annual RZLT liability | Extra charge for late payment of the Residential Zoned Land Tax. |

| Other Transaction Fees | Varies | Includes legal fees, surveyor fees, and other costs similar to those in other EU countries. |

Note: Legal fees usually range from $2,000 to $4,000 USD. You may also pay for a property survey and registration.

Ongoing Taxes

After you buy your property, you must pay ongoing taxes each year. The main tax is the Local Property Tax (LPT). The amount depends on the value of your home. For most homes, this tax ranges from $120 to $2,000 USD per year. If you rent out your property, you must pay income tax on rental earnings. If you sell your property later, you may owe capital gains tax on any profit. Ireland also has inheritance tax if you pass the property to someone else.

Tip: Keep good records of all payments and taxes. This helps you avoid problems with the tax office.

Financing & Currency

Mortgage Options

You can apply for a mortgage in Ireland as a foreign national, including as an American. Several major Irish lenders, such as AIB, Bank of Ireland, Finance Ireland, ICS Mortgages, and Permanent TSB, offer mortgage products to non-residents. You will find both fixed-rate and variable-rate mortgages. Fixed-rate mortgages give you stable payments, while variable-rate mortgages can change over time.

Most banks require you to have legal residence in Ireland, often with a Stamp 1, 1G, or 4. You usually need to show at least one year of residence and employment in Ireland. Lenders prefer if your income is in euros, but some may consider other currencies. You must provide documents like your passport, proof of address, bank statements, and proof of income. Banks also check your credit history and your ability to afford repayments.

Here are some key lending rules:

- Loan-to-Income (LTI) limit: Up to 4 times your annual income for first-time buyers, 3.5 times for others.

- Loan-to-Value (LTV) limit: Minimum deposit of 10% for first-time and second-home buyers, 30% for investment properties.

- Interest rates: Average between 3.65% and 3.75%.

- Approval in Principle (AIP): Takes about 2-4 weeks before final approval.

You will also pay extra fees, such as stamp duty, solicitor’s fees, valuation fees, and insurance. Mortgage brokers can help you find the best lender and guide you through the process.

Tip: Using a mortgage broker can make the process easier, especially if you do not live in Ireland.

Currency Exchange

If you buy property in Ireland using funds from outside the eurozone, you need to manage currency exchange. Exchange rates between the US dollar and the euro can change quickly. Even small changes can affect the total amount you pay for your property.

You should compare rates from different banks and currency exchange services. Many buyers use Hong Kong banks or specialized currency brokers to get better rates and lower transfer fees. Some services let you lock in an exchange rate for a set period. This protects you from sudden changes in the market.

| Service Type | Typical Features |

|---|---|

| Bank Transfers | Secure, but may have higher fees and less flexibility |

| Currency Brokers | Better rates, lower fees, rate-lock options |

| Online Platforms | Fast transfers, easy tracking, competitive rates |

Note: Always check the latest USD/EUR exchange rate before sending money. Planning your transfers can save you thousands of dollars.

Risks & Considerations

Market Volatility

You should know that the Irish property market has a history of sharp ups and downs. In the early 2000s, banks made it easy for people to borrow money. This led to a big jump in house prices, with values rising about 8% each year above inflation. When the global financial crisis hit in 2007 and 2008, prices dropped by about 50% over four years. Many people lost money because they bought at the peak. After 2013, prices started to rise again, but the number of homes for sale stayed low. This shortage pushed prices higher. Changes in how much banks will lend and how many homes are available can cause prices to swing up or down. You need to watch these trends if you want to invest in Ireland.

Note: Always check recent price trends and lending rules before you buy. This helps you avoid buying at a risky time.

Property Management

If you do not plan to live in your Irish property, you must think about how to manage it. You can hire a local property manager to handle repairs, rent collection, and tenant issues. This service costs money, but it saves you time and stress. You should also learn about local rental laws. Ireland has rules that protect tenants and set limits on rent increases. If you ignore these rules, you could face fines or legal trouble. Good property management helps you keep your investment safe and your tenants happy.

Common Pitfalls

Foreign buyers often face challenges when buying property in Ireland. Here are some common mistakes:

- Not hiring a solicitor who knows Irish property law. This can lead to costly errors.

- Skipping a full structural survey or local builder inspection. You might miss hidden repair needs.

- Misunderstanding the bidding process. You should set a clear price limit and know that private treaty sales can be very competitive.

- Struggling to get a mortgage. Lenders may ask for a deposit of 30% to 50%.

- Forgetting to arrange house insurance and life assurance before mortgage approval. These can require health checks and add extra costs.

- Lacking local knowledge. This can lead to missed steps and unexpected expenses.

Tip: Prepare well, work with trusted local experts, and always double-check each step. This helps you avoid costly surprises.

Best Places to Buy

Dublin

You will find Dublin at the top of many lists for the best places to buy property in Ireland. The city offers a wide range of property types, from modern apartments to historic townhouses. Dublin attracts investors because it serves as Ireland’s business and tech center. Rental demand stays high, especially near universities and business districts. You may see higher prices here than in other cities, but the strong rental market supports steady returns.

Cork

Cork stands out as a vibrant city with a growing tech and pharmaceutical sector. You can choose from city apartments or family homes in the suburbs. Cork’s property market offers more affordable options compared to Dublin. The city’s culture, food scene, and access to the coast make it popular with both renters and buyers. Many investors see Cork as one of the best places to buy property in Ireland for long-term growth.

Galway

- Galway appeals to you if you want strong rental demand from students and young professionals.

- You will notice that property prices in Galway are lower than in Dublin, making it a more affordable investment.

- Ireland’s legal system lets you buy, rent, and sell property without needing citizenship or residency.

- Rental yields in Galway reach about 5-7%, thanks to limited supply and high demand.

Limerick

| Location | Rental Yield | Average Monthly Rent (USD) | Tenant Profile | Key Advantages |

|---|---|---|---|---|

| Limerick City | 6-7% | $1,090-$1,530 | Mixed demographics | High rental yields, urban regeneration growth |

Limerick gives you some of the highest rental yields in Ireland. You can buy property here for about 40% less than in Dublin. With a budget of $654,000, you could purchase a large five-bedroom house in the suburbs. The city’s ongoing regeneration projects and strong demand from students and workers make it one of the best places to buy property in Ireland.

Rural & Emerging Areas

You may want to look at Ireland’s rural and coastal regions. These areas have seen property prices rise by 23% since the pandemic. Hotspots like Lahinch and Kilmore Quay have seen even bigger jumps, with prices up 39% and 54%. Many buyers choose these locations for their natural beauty and strong vacation rental market. In counties Galway and Cork, short-term rentals can bring in over $21,900 each year. Remote work trends help drive demand, and properties in scenic areas often sell faster than those inland.

Average Prices

Residential real estate prices in Ireland vary by location. In Dublin, you may pay $625,000 or more for a home. Cork and Galway offer lower prices, often between $310,000 and $390,000. Limerick stands out for affordability, with prices about 40% below Dublin’s average. Rural and coastal areas show rising prices, but you can still find good value if you look outside the main cities.

Buying a House in Ireland: Residency & Investment

Residency Rules

When you think about buying a house in ireland, you may wonder if owning property gives you the right to live there. The answer is simple. Property ownership does not grant you any residency rights in Ireland. You can buy property as a foreigner, including as an American, without holding a visa or residency permit. You only need standard documents like your passport and proof of funds.

Here are some important points to remember:

- You do not get residency or a visa just by buying a house in ireland.

- You can visit Ireland for up to 90 days without a visa if you are American, but you need a proper immigration status for longer stays.

- Living in your Irish property without the correct visa is illegal and can lead to deportation.

- Property ownership and your visa or residency status are completely separate under Irish law.

If you want to stay in Ireland for more than 90 days, you must apply for the right visa or permit. The rules for long-term residency focus on your immigration status, not your property ownership.

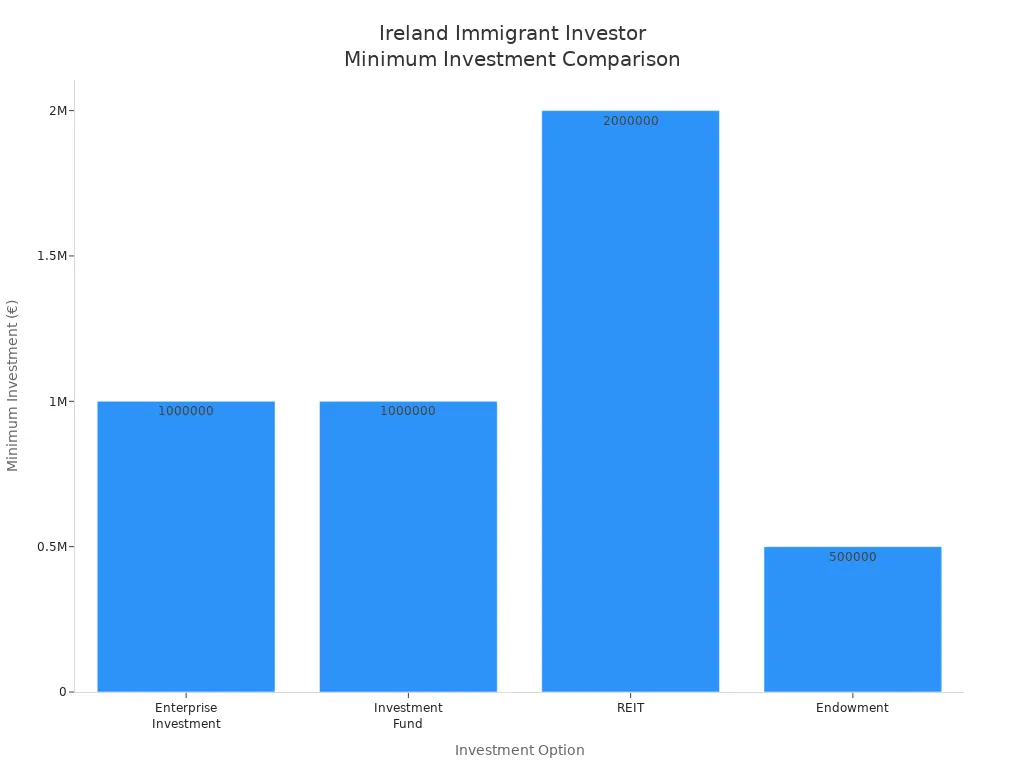

Immigrant Investor Programme

Ireland offers an Immigrant Investor Programme (IIP) for people who want residency through investment. This program does not include direct property purchases. You must invest in approved options, such as Irish businesses, funds, or public projects. The minimum investment starts at $545,000 USD (using an exchange rate of 1 EUR ≈ 1.09 USD) for endowments and $1,090,000 USD for enterprise or fund investments.

Here is a table showing the main options:

| Investment Option | Minimum Investment (USD) | Investment Duration | Key Features and Conditions |

|---|---|---|---|

| Enterprise Investment | $1,090,000 | Minimum 3 years | Invest in Irish businesses; must support jobs; no speculative or corporate investments. |

| Investment Fund | $1,090,000 | Minimum 3 years | Invest via approved funds; equity in Irish companies; fund managers regulated by Central Bank of Ireland. |

| Real Estate Investment Trust (REIT) | $2,180,000 | Minimum 3 years | Invest in Irish REITs; shares held for 3 years; income-producing, diversified property investments. |

| Endowment | $545,000 | N/A | Donation to public benefit projects; no financial return; lower minimum for group donations. |

If you join the IIP, you do not need to live in Ireland full-time to keep your residency permit. You must keep your investment and show good character and financial stability. You can renew your residency after two years and then every five years. If you want citizenship, you must live in Ireland for at least 12 months before applying and for four of the previous five years.

Tip: Always check the latest rules and approved investment options before you apply for the IIP. The program does not accept direct property purchases, so plan your investment carefully.

When you start buying property in Ireland, you need to follow clear steps. Work with a local solicitor to handle contracts and legal checks. Always review all costs, including taxes and fees. Use trusted professionals for advice and help with currency exchange. Research each area and property type before you decide. Careful planning makes buying property in Ireland a smooth process.

FAQ

Can you buy property in Ireland without living there?

Yes, you can buy property in Ireland even if you do not live there. You do not need to be a resident or citizen. You only need to follow the legal steps and provide the required documents.

Do you need a local bank account to buy property in Ireland?

You do not need a local bank account, but having one helps with payments and ongoing expenses. Many buyers use Hong Kong banks or international transfers. Always check the latest USD/EUR exchange rate before sending money.

What taxes do you pay when owning property in Ireland?

You pay Local Property Tax each year. If you rent out your property, you pay income tax on rental earnings. When you sell, you may owe capital gains tax. Stamp duty applies at purchase. All taxes must be paid in USD, converted at the current exchange rate.

How long does the property buying process take in Ireland?

| Step | Typical Timeframe |

|---|---|

| Property Search | 2-8 weeks |

| Offer to Contract | 2-4 weeks |

| Legal Checks | 4-6 weeks |

| Completion | 2-4 weeks |

The whole process usually takes 2-4 months.

Navigating Ireland’s dynamic property market as an international investor requires a partner that understands both global finance and local nuances. While you secure your investment with a PPSN and a trusted solicitor, managing the cross-border financial logistics—especially currency exchange and fund transfers—can be a significant hurdle, often eroding your returns with high fees and unfavorable rates.

BiyaPay streamlines this crucial financial aspect of your Irish property journey. Our platform offers real-time, transparent currency conversion, allowing you to lock in competitive rates for EUR transfers and make payments directly to solicitors or developers. With remittance fees starting from just 0.5% and support for swift, secure transactions, we ensure more of your capital is invested in your property, not lost to costly fees. Check the live exchange rate for your transfer today and experience a seamless, efficient way to manage international investments.

Simplify your financial strategy and protect your investment value. Open your BiyaPay account to get started.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.