- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Navigating the Irish Property Market as an American Buyer

Image Source: pexels

Yes, you can buy property in Ireland as an American. Many Americans find buying a home in ireland appealing for several reasons:

- Strong family or ancestral ties to Ireland influence nearly 60% of buyers.

- Many prefer rural settings and seek a friendly, welcoming community.

- Popular choices include houses, cottages, or country homes in places like Galway, Cork, and Dublin.

You should understand that buying property in the irish property market does not grant residency. Knowing the legal and tax rules helps you avoid surprises.

Key Takeaways

- Americans can buy property in Ireland with the same rights as Irish citizens but must get a PPS number and hire an Irish solicitor to handle legal steps.

- Owning property does not grant residency or citizenship; you must apply for visas separately if you want to live in Ireland long-term.

- The Irish housing market has rising prices and limited supply, so plan your budget carefully and consider different locations like cities, coast, or rural areas.

- Start buying by organizing your finances, researching properties online, and working with trusted estate agents and solicitors experienced with international buyers.

- Be prepared for extra costs like stamp duty, legal fees, and annual property taxes, and always get a property survey to avoid hidden problems.

Can Americans Buy Property?

Legal Rights

You can buy property in Ireland as an American. Ireland welcomes foreign nationals buying property, and you face no restrictions based on your nationality or residency. You have the same ownership rights as Irish citizens. This means you can purchase residential or commercial property, hold the title in your name, and sell or rent it as you wish.

Here is a table that summarizes the main legal aspects for Americans buying property in Ireland:

| Aspect | Details |

|---|---|

| Legal Restrictions | No restrictions on Americans or non-residents buying residential or commercial property in Ireland. |

| Ownership Rights | You have the same rights as Irish citizens. |

| Required Identification | You must obtain a Personal Public Service (PPS) number, similar to a US Social Security number. |

| Solicitor Requirement | You need to hire an Irish solicitor to handle legal paperwork and ensure a smooth transaction. |

| Tax Obligations | You must pay stamp duty (1-2% for residential, 6% for commercial), capital gains tax (33%), local property tax, and withholding tax on rental income if you are a non-resident landlord. |

| Planning Permissions | You may need permission for new construction or major changes to the property. |

When you start the process of buying property, you will need to provide valid identification and proof of funds. You must also get a PPS number before you can complete the purchase. Your solicitor will help you with all legal steps, including checking the title, handling contracts, and registering your ownership.

If you plan to rent out your property, you must follow Irish tax rules. Non-resident landlords must appoint a tax collection agent in Ireland. You will also need to pay local property taxes each year.

Tip: Always work with a solicitor who has experience helping Americans with acquiring property in ireland. This will help you avoid legal issues and make the process easier.

Residency Rules

Owning property in Ireland does not give you the right to live there full-time. Buying property does not grant you residency, a visa, or citizenship. You can visit Ireland as a tourist for up to 90 days without a visa. If you want to stay longer, you must apply for the correct visa or residency permit.

Here are some important points about residency and property ownership:

- You do not get automatic residency or work rights by buying property.

- If you want to live in Ireland long-term, you must apply for a visa or use an investment program.

- The Immigrant Investor Programme (IIP) offers a pathway to residency, but it requires a large investment (at least $2,150,000 USD in Irish Real Estate Investment Trusts or $1,075,000 USD in an Irish business).

- Even with the IIP, you must visit Ireland at least once per year and meet other requirements.

- To become a citizen, you must live in Ireland for at least five years and meet naturalization rules.

Note: Buying property alone will not help you get a visa or citizenship. You must follow Ireland’s immigration laws if you want to stay longer than 90 days.

The process for Americans is similar to that for other non-EU citizens. You do not need to live in Ireland to buy property, but getting a mortgage can be harder if you do not have a history of living or working in Ireland. Most buyers use cash or arrange financing in their home country.

If you plan to use your property as a vacation home or rental, you can do so without living in Ireland. If you want to move to Ireland, you must plan for the visa process separately from buying property.

Irish Housing Market Overview

Market Trends

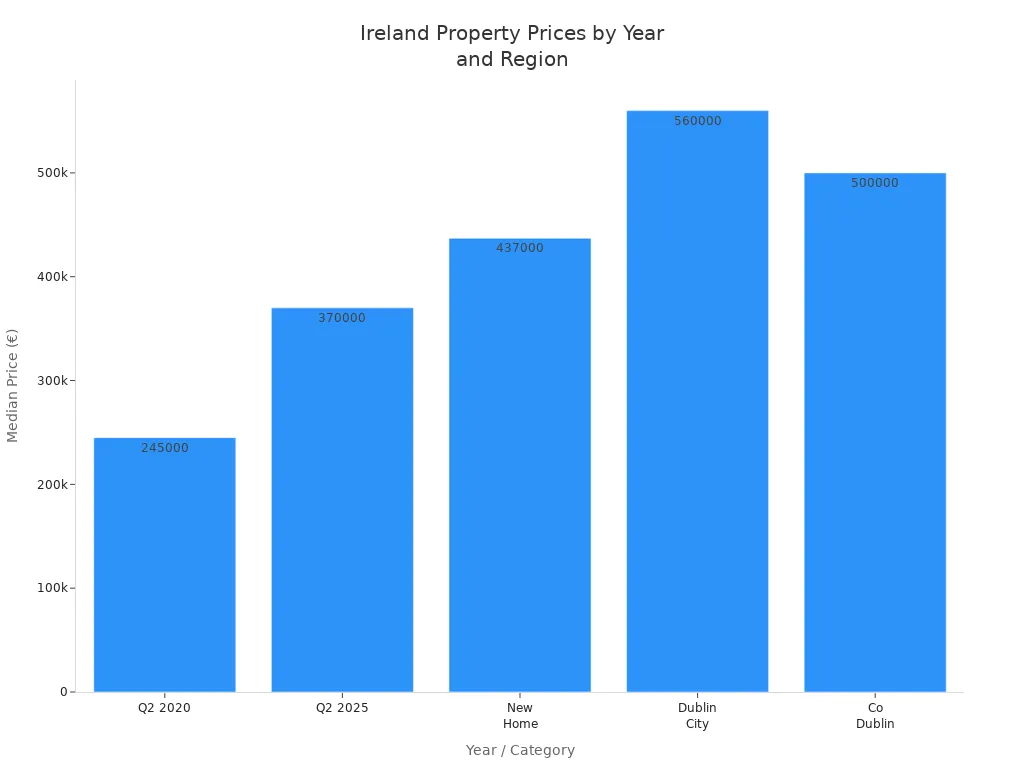

You will notice that the irish housing market has changed a lot in the past five years. Prices have gone up quickly, and the number of homes for sale has dropped. Here are some important trends you should know:

- National property prices increased by 12.3% year-on-year in 2025, which is the biggest jump in ten years.

- The number of second-hand homes listed for sale fell from 67,000 in 2019 to about 51,000 in 2025. This means fewer choices for buyers.

- Only about 12,000 homes were available for sale across Ireland in mid-2025. Experts say a healthy market needs more than 30,000.

- Construction of new homes remains slow, so supply cannot keep up with demand.

- More people are looking at modular homes because they are faster and cheaper to build.

You can see how prices have changed in the table below. This will help you understand the average price of a home in ireland and how it compares to different regions.

| Metric | Value (USD) | Notes |

|---|---|---|

| Median home price Q2 2025 | $400,000 | 9.5% increase year-on-year |

| Median home price Q2 2020 | $265,000 | Baseline for 51% increase |

| Price increase since 2020 | 51% | Significant rise over 5 years |

| Median new home price | $473,000 | 30.4% premium over pre-owned homes |

| Median price premium for energy-efficient homes (A & B rated) | $110,000 | Compared to lower rated homes |

| Median price Dublin city | $606,000 | Most expensive urban area |

| Median price Co Dublin | $541,000 | Most expensive region |

| Volume of home sales Q2 2025 | 11,734 | 13% decrease year-on-year |

| Number of homes > $867,000 Q2 2025 | 753 | Increase from 675 in Q2 2024 |

| Apartment price growth Q2 2025 | 6.7% | Slower than previous year (10.3%) |

| House price growth Q2 2025 | 9.5% | Increased from 6.8% in Q2 2024 |

You will find that the irish property market remains strong because of population growth, higher wages, and low interest rates. However, the shortage of homes makes it harder for buyers.

Property Types

When you look at property types available in ireland, you will see many choices. The irish housing market offers both residential and commercial options. Here are some of the most common types:

- Terraced, detached, and semi-detached houses are popular in towns and cities.

- Apartments and condos are easy to find in large city centers.

- Historic homes, such as Georgian and Victorian houses, attract buyers who like classic styles.

- Freehold properties include the land, while leasehold properties come with long-term leases and possible fees.

- Some properties, especially older ones, may have preservation rules or restrictions on changes.

For commercial buyers, you can choose from office buildings, retail spaces, and industrial buildings like warehouses and factories. Each type serves different needs, so you should think about your goals before you buy.

Note: Always check if a property is freehold or leasehold. This affects your rights and future costs.

How to Buy Property in Ireland as an American

Steps to Start

You should begin the buying process by getting your finances in order. This step helps you understand what you can afford and prepares you for the costs of buying property. Here is a simple list to guide you:

- Review your financial situation and start saving for a deposit at least six months before you plan to buy.

- Secure approval in principle for a mortgage if you need one. This shows sellers you are a serious buyer.

- Calculate extra costs, such as legal fees and stamp duty, so you do not face surprises later.

- Research the Irish property market and make a list of features you want in your new home.

- Once you find a property you like, instruct a solicitor to handle the legal paperwork and guide you through the buying process.

You must also obtain a Personal Public Service Number (PPSN) before you can pay stamp duty or complete the purchase. If you were not born in Ireland, you need to fill out a REG1 form and provide certified identification and proof of address. Your solicitor will help you with these steps.

Tip: Always keep your documents ready. You will need certified copies of your passport and a utility bill for anti-money laundering checks. If you pay cash, you must show proof of funds, such as a certified bank statement.

Finding Real Estate

You can start your search for property by using popular Irish websites like Daft.ie, MyHome.ie, and Property.ie. These sites list many homes and make it easy to compare prices and locations. You can also contact local estate agents who know the market well and can help you find the right property.

When you choose an estate agent, check their credentials on the Property Services Regulatory Authority website. This step protects you from scams and ensures you work with a trusted professional. If you want extra help, you can hire a buyer’s agent who will look out for your interests.

You should also decide if you want to buy a home in a city, a coastal area, or the countryside. Each location offers different benefits and price ranges. Make a list of your must-have features, such as the number of bedrooms, outdoor space, or proximity to schools and shops. This list will help you focus your search and save time.

Making an Offer

Once you find a property you like, you can make an offer. The buying process in Ireland usually follows these steps:

- Place a bid on the property after checking your budget and considering extra costs like stamp duty and solicitor fees.

- If the seller accepts your offer, pay a booking deposit (usually about 2% of the price) to the estate agent. This deposit counts toward the final contract deposit.

- Tell your solicitor to request the contract and title documents from the seller’s solicitor.

- Inform your mortgage broker or lender so they can issue a loan offer and arrange a property valuation.

- Arrange a property survey to check for any problems with the home before you move forward.

- Your solicitor will review the contract and ask questions about planning permission or local charges. This step can take several weeks.

- After you get all the answers you need, you sign the contract and pay the rest of the deposit (usually 10% of the price minus the booking deposit).

- The mortgage funds are released and sent to the seller’s solicitor on the closing day.

- You do a final inspection and collect the keys from the estate agent.

Note: You can sign contracts remotely, but you must print and sign them before a witness. Irish banks do not accept electronic signatures. If you cannot travel, you can appoint someone with power of attorney to sign for you.

Closing Process

The closing process in Ireland involves several important steps. Your solicitor plays a key role in making sure everything goes smoothly. Here is what you can expect:

- Your solicitor sends questions about the property (called Requisitions on Title) to the seller’s solicitor.

- You and your solicitor prepare and sign the Deed of Conveyance, which legally transfers ownership to you.

- You must pay stamp duty before the purchase is complete. Your solicitor handles this payment.

- On the completion date, the ownership transfers, the funds are sent, and you receive the keys to your new home.

- If you used a mortgage, the title deeds go to your lender. If you paid in full, you keep the deeds.

- After closing, you should arrange home insurance, register with the local authority, update the electoral register, and transfer utilities to your name.

The average timeline for buying property in Ireland is about five to six months from start to finish. In Dublin, the process may move a bit faster. Legal steps usually take two to three weeks, but delays can happen if paperwork is not ready.

Important: Buying property in Ireland does not give you residency or citizenship. You must follow Irish immigration rules if you want to live there full-time.

The buying process can seem complex, but you can make it easier by working with experienced professionals. Your solicitor will guide you through every step, from acquiring property in Ireland to registering your ownership. If you plan ahead and stay organized, you can enjoy buying real estate in Ireland with confidence.

Costs and Taxes When Buying Property

Image Source: pexels

Stamp Duty

When you buy a home in Ireland, you must pay stamp duty. This is a government tax on property purchases. The rate depends on the price of the property. You pay a higher rate if the price is above certain thresholds. Here is a table that shows the current stamp duty rates. (All amounts are shown in USD. Use the latest exchange rate to convert from EUR.)

| Stamp Duty Rate Category | Rate (%) | Description |

|---|---|---|

| First $1,080,000 (approx. €1 million) | 1% | Applies to the first $1,080,000 of residential property purchase price |

| Next $540,000 (approx. €500,000) | 2% | Applies to the portion of the purchase price between $1,080,000 and $1,620,000 |

| Amount over $1,620,000 (approx. €1.5M) | 6% | Applies to residential properties valued above $1,620,000 |

| Bulk purchase of 10+ units (not apartments) | 15% | Applies to bulk purchases of 10 or more residential units (excluding apartments) |

You pay stamp duty only once when buying property. Your solicitor will calculate and pay this tax for you during the closing process.

Legal and Professional Fees

You will need to pay several legal and professional fees when buying property in Ireland. These fees cover the work of solicitors, surveyors, and other experts. The table below shows typical costs. (All amounts are in USD, based on current exchange rates.)

| Fee Type | Typical Cost / Rate |

|---|---|

| Solicitor Fees | $1,620 – $3,240 |

| Surveyor Fees | $325 – $540 |

| Valuation Fees | $215 – $325 |

| Mortgage Broker Fees | 1% commission from lender plus $325 – $810 |

Solicitor fees in Ireland are usually lower than real estate agent commissions in the United States. However, you may notice that solicitors in Ireland work at a slower pace. In Ireland, you do not have your own buyer’s agent. The seller’s estate agent handles most of the process. This is different from the United States, where buyers often have their own agent at no extra cost.

Note: You may also need to pay for home insurance, mortgage protection, and moving costs. These are not required for every buyer.

Ongoing Taxes

After buying property, you must pay annual property taxes. These taxes apply to all owners, including Americans.

- Local Property Tax (LPT): You pay this tax every year. The amount depends on the market value of your home.

- Vacant Homes Tax (VHT): If your property is used as a home for less than 30 days in a year, you pay this tax. It is seven times the basic LPT rate.

- Residential Zoned Land Tax (RZLT): If you own zoned and serviced residential land, you pay 3% of its market value each year.

You may also pay commercial rates if you own business property. If you rent out your property, you must pay income tax on rental income. The U.S.-Ireland tax treaty does not exempt you from these Irish property taxes.

Tip: Always budget for these ongoing costs when planning your purchase.

Things to Consider When Buying Property in Ireland

Zoning and Land Use

When you look at property in Ireland, zoning and land use rules play a big role. Local development plans decide if land is for residential, commercial, agricultural, or industrial use. You must check if the property matches your plans. Zoning affects what you can build, how big it can be, and even the style of the building. Always verify planning permissions before you buy. Some areas have special rules, especially near important sites like military bases or critical infrastructure, but these rarely affect most buyers. You can buy different types of land, including agricultural, residential, and commercial, without needing to live in Ireland or get special permits. Common issues include boundary disputes, right of way problems, and missing planning permissions. These are important things to consider when buying property in ireland.

Tip: Work with a local solicitor to check zoning compliance and planning permissions. This helps you avoid legal trouble later.

Investment Incentives

Ireland welcomes foreign buyers and offers a stable legal system that protects your investment. The country ranks high for property rights and has low corruption. These factors make Ireland attractive for American buyers. You may find tax incentives for non-resident property owners, and the government supports foreign investment. The process for buying property is clear and reliable. You also benefit from a streamlined immigration process if you plan to stay longer. These features act as indirect incentives and help you feel secure about your investment.

Risks and Pitfalls

You should know the risks before you buy. Properties in flood zones may not have flood insurance, which can lead to big losses. If you buy above a business, you might face noise or fire risks. Rent Pressure Zones limit how much you can raise rent, which affects profits. New homes cost more but have fewer hidden problems. Older homes may need expensive repairs. Getting a mortgage as a non-resident often means higher interest rates and a bigger down payment. Legal issues like title problems or missing planning permissions can delay your purchase. The Irish market can change quickly, and selling a property may take time. Ongoing costs include taxes, insurance, and maintenance. Managing tenants and repairs can also be challenging. These are key things to consider when buying property in ireland, especially since property buying restrictions and local rules can affect your plans.

Choosing Professionals

Solicitors

You need a solicitor to guide you through the buying process in Ireland. A good solicitor checks the property title, handles contracts, and makes sure you follow Irish law. Clark Hill PLC offers legal support for Americans. Their team helps with conveyancing, leases, and company formation. They also resolve disputes and ensure your purchase meets all legal requirements. You should choose a solicitor who has experience with international buyers. This makes the buying process smoother and helps you avoid mistakes.

Tip: Ask your solicitor for regular updates. Clear communication helps you understand each step and keeps your purchase on track.

Estate Agents

Estate agents help you find the right property and negotiate with sellers. Esales International stands out for Americans. They market properties worldwide in over 70 languages and connect you with agents in the USA and Ireland. Their team gives advice on pricing and legal steps. You get regular updates and can track buyer interest. Many buyers say Esales International is professional, responsive, and cost-effective. You should always check that your estate agent is registered with the Property Services Regulatory Authority.

- Estate agents can:

- Show you homes that fit your needs

- Advise on local prices

- Recommend currency exchange services

- Help with paperwork

Surveyors

A surveyor checks the property for problems before you buy. This step protects you from hidden costs. Property Industry Ireland (PII) connects you with trusted surveyors and other experts. Surveyors look for issues like damp, structural damage, or planning problems. You should always get a survey before you sign a contract. This helps you avoid surprises and gives you peace of mind.

Note: A surveyor’s report can help you negotiate a better price if they find any issues.

Best Places for Buying Real Estate in Ireland

Image Source: unsplash

When you start looking for the best places to buy property in ireland, you will see many options. Each area offers something different. You should think about your lifestyle, budget, and long-term plans before you choose.

Cities

Cities in Ireland give you access to jobs, schools, and entertainment. Dublin stands out as the largest city. You will find modern apartments, historic townhouses, and new developments. Prices in Dublin are higher than in other places, but you get strong rental demand and good transport links. Cork and Galway also attract many buyers. Cork has a growing tech industry and a lively food scene. Galway is famous for its arts and festivals. If you want city life, these are some of the best places to buy property in ireland.

Note: City properties often cost more, but you can rent them out easily if you do not plan to live there full-time.

Coastal Areas

Many people dream of living near the sea. Ireland’s coastline stretches for over 3,000 miles. You can find charming villages, sandy beaches, and dramatic cliffs. Areas like County Kerry, County Clare, and County Donegal offer beautiful views and peaceful settings. You might like Kinsale for its sailing or Dingle for its friendly community. Coastal homes can be more affordable than city homes. These spots are among the best places to buy property in ireland if you want a slower pace and natural beauty.

| Coastal Area | Main Attraction | Typical Price (USD) |

|---|---|---|

| Kinsale | Sailing, food | $430,000 |

| Dingle | Scenery, wildlife | $390,000 |

| Bundoran | Surfing, beaches | $320,000 |

Rural Locations

If you want space and privacy, rural Ireland gives you many choices. You can buy cottages, farmhouses, or even land for new homes. Counties like Mayo, Leitrim, and Roscommon have lower prices. You will enjoy quiet villages, green fields, and a strong sense of community. Rural areas suit buyers who want to escape busy city life. These locations often offer the best value when buying real estate in ireland.

Tip: Rural properties may need more repairs, so always get a survey before you buy.

You can find the best places to buy property by visiting different regions and talking to local experts. Each area has its own charm and investment potential.

Practical Tips for U.S. Buyers

Managing Remotely

You may not always travel to Ireland during your property search. Many American buyers manage the process from abroad. You can use video calls to view homes and speak with estate agents. Many Irish agents offer virtual tours and digital documents. This helps you see the property and ask questions in real time.

You should choose professionals who have experience working with international clients. Your solicitor can handle most paperwork by email or courier. You can sign contracts in front of a witness in the United States. If you cannot travel for closing, you can give someone power of attorney to sign on your behalf.

Tip: Keep all your documents organized in a secure digital folder. This makes it easy to share files with your solicitor and estate agent.

You should also plan for time zone differences. Ireland is five hours ahead of Eastern Standard Time. Schedule meetings and calls when both you and your Irish contacts are available.

Currency and Transfers

When buying a home in ireland, you will need to transfer funds from the United States to Ireland. Exchange rates can change quickly. Even a small change can affect the total price you pay. You should compare rates from different banks and money transfer services. Some buyers use Hong Kong banks or specialized currency brokers to get better rates and lower fees.

Here is a table to help you compare options:

| Transfer Method | Typical Fee (USD) | Processing Time | Exchange Rate Margin |

|---|---|---|---|

| U.S. Bank Wire | $30 – $50 | 1–3 days | 2–4% |

| Hong Kong Bank Wire | $20 – $40 | 1–2 days | 1.5–3% |

| Currency Broker | $0 – $20 | Same day – 2 days | 0.5–2% |

Note: Always confirm the final amount in USD and EUR before you send money. Ask your solicitor for their client account details and double-check them for security.

You should notify your U.S. bank about large transfers to avoid delays. Keep records of all transactions for your tax and legal files.

Buying property in Ireland as an American can feel straightforward when you know the steps. You start by checking your finances, then find the right property, and work with trusted professionals. You pay attention to legal rules, taxes, and local market trends.

Remember to ask for help from a solicitor or estate agent with experience in international buyers. This support makes your journey smoother.

You can find great opportunities in Ireland’s property market. With careful planning, you take confident steps toward owning your dream home or investment.

FAQ

Can you get a mortgage in Ireland as an American?

You can apply for a mortgage in Ireland as an American. Irish banks may ask for a larger down payment and proof of income. Many buyers find it easier to use cash or arrange financing through a U.S. or Hong Kong bank.

Do you need to visit Ireland to buy property?

You do not need to visit Ireland to buy property. You can complete most steps remotely. Your solicitor and estate agent can handle paperwork and viewings. You may sign documents in front of a witness in the United States.

How long does it take to buy a home in Ireland?

The process usually takes five to six months from start to finish. Delays can happen if paperwork is missing or if there are legal issues. Working with experienced professionals helps you avoid most delays.

What ongoing costs should you expect after buying?

You pay annual property taxes, insurance, and maintenance costs. If you rent out your property, you pay income tax on rental income. You should also budget for repairs and possible management fees.

Can you rent out your Irish property as a non-resident?

You can rent out your property as a non-resident. You must follow Irish tax rules and may need a tax collection agent in Ireland. Rental income is subject to Irish income tax, even if you live in the United States.

Successfully navigating the Irish property market as an American buyer is a significant achievement, but managing the financial aspects—particularly international fund transfers and currency exchange—can be a complex and costly final hurdle. High bank fees and volatile exchange rates can unexpectedly diminish your investment capital.

BiyaPay provides an elegant solution for the cross-border financial needs of your new Irish property. Our platform allows you to securely transfer funds for your down payment, solicitor fees, and ongoing expenses with remarkable efficiency. Benefit from remittance fees starting as low as 0.5% and use our real-time exchange rate tool to lock in the best rates for EUR/USD conversions, ensuring transparency and maximizing the value of every dollar you send.

Secure your investment’s financial future from the start. Register for a BiyaPay account to manage your international transactions with ease and confidence.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.