- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

PayPal Friends and Family Made Simple: Fees, Limits, and More

Image Source: unsplash

PayPal Friends and Family lets you send money to people you know and trust. You use this feature for personal payments, not for buying or selling things. With PayPal, you can move money quickly and safely—most users like how easy and secure it feels. Unlike PayPal’s Goods and Services option, Friends and Family does not give buyer or seller protection.

- Over 400 million people use PayPal worldwide.

- People choose PayPal Friends and Family because it often has no fees for sending money within the same country using a linked bank account or PayPal balance.

- Many people now use peer-to-peer payments for small amounts because they are fast, simple, and reliable.

Key Takeaways

- Use PayPal Friends and Family only to send money to people you trust, like friends or family, for personal reasons.

- Sending money with this feature is usually free if you use your PayPal balance or linked bank account in the U.S.; using cards or sending internationally may cost fees.

- You cannot cancel payments or get buyer protection with Friends and Family, so always double-check recipient details before sending.

- Avoid using Friends and Family for buying goods or services; use PayPal Goods and Services instead to get buyer protection.

- Compare PayPal Friends and Family with other options like Venmo and Zelle to pick the best method for your needs and keep your money safe.

PayPal Friends and Family: How It Works

Image Source: unsplash

How Does It Work

You might wonder how it works when you use PayPal Friends and Family. This feature lets you send money to people you know, like your parents, siblings, or close friends. You use it for things like splitting a dinner bill, paying your roommate for rent, or sending a birthday gift. The friends and family feature is not for buying things from strangers or paying for services.

When you send money, you pick the friends and family option. PayPal moves your payment quickly, and the person gets the money in their PayPal account. You do not get buyer or seller protection with this feature. If you send money and something goes wrong, PayPal will not help you get your money back. That is why you should only use it with people you trust.

Who Should Use It

You should use PayPal Friends and Family if you want to send money to someone you know well. This could be your best friend, a family member, or a trusted roommate. If you need to pay someone back for lunch or send money for a group gift, this option works well. You should not use it for business deals or to pay for things you buy online from people you do not know.

Tip: Always double-check the recipient’s details before you send money. Once you send a payment with the friends and family feature, you cannot cancel it if you made a mistake.

Here is a quick look at how you send money using PayPal Friends and Family:

- Log in to your PayPal account on the website or app.

- Choose “Send & Request” on desktop or “Payments” in the app.

- Enter the recipient’s email, phone number, or PayPal username.

- Pick the payment type “Friends and Family.”

- Enter the amount and add a note if you want.

- Select your funding source, like your bank account, PayPal balance, or card.

- Review the details and send your payment.

You can also use a PayPal.Me link if your friend shares one with you. Just click the link, enter the amount, choose the friends and family option, and send the money.

Friends and Family vs. Goods and Services

You might see two choices when you send money with PayPal: Friends and Family or Goods and Services. It is important to pick the right one. Here is a table to help you see the main differences:

| Aspect | PayPal Friends and Family (Personal Payments) | PayPal Goods and Services (Purchases) |

|---|---|---|

| Purpose | Sending money to friends/family for gifts, splitting bills, or expenses | Paying for items or services like auctions, merchandise, or digital goods |

| Fees | Free if funded by bank account or PayPal balance (US only); fees apply if funded by debit/credit card | Seller pays a small fee to receive money |

| Buyer Protection | Not covered by PayPal Purchase Protection | Covered by PayPal Purchase Protection for eligible transactions |

| User Experience Note | Intended for personal, non-commercial transactions | Intended for commercial transactions involving goods or services |

If you pay for something you buy online, always use Goods and Services. This way, you get PayPal’s buyer protection. If you just want to send money to someone you trust, use Friends and Family. Picking the right option keeps your money safe and helps you avoid problems.

How to Send

Step-by-Step Guide

You want a convenient way to send money to someone you trust. PayPal makes this easy. Here’s how you can send PayPal Friends and Family payments using both desktop and mobile:

On Desktop:

- Log in to your PayPal account.

- Click “Send & Request” at the top.

- Enter the email, phone number, or username of the person you want to pay.

- Choose “Sending to a friend.”

- Enter the amount and add a note if you like.

- Pick your payment method.

- Review everything, then click “Send Money Now.”

On Mobile:

- Open the PayPal app and log in.

- Tap “Payments” at the bottom.

- Select “Send.”

- Enter the recipient’s details.

- Choose “Friends and Family.”

- Type in the amount and add a note if needed.

- Pick your payment method and tap “Send.”

Tip: Always double-check the recipient’s details before you send money. Once you send PayPal Friends and Family payments, you cannot cancel them.

Choosing Payment Method

When you send money, PayPal shows you different ways to pay. You might see your PayPal balance, a linked bank account, or a card. PayPal often puts the options with no fees at the top, like your balance or bank account. If you pick a method that has a fee, PayPal will show you the fee before you finish.

You can always change your payment method by clicking “Change” on the payment page. Make sure you pick the right one for your needs.

Many people make mistakes when they send money. Here are some common ones:

- Using Friends and Family to pay for goods or services. This breaks PayPal’s rules.

- Sellers asking for Friends and Family payments to avoid fees. This is a red flag.

- Thinking Friends and Family payments have buyer protection. They do not.

- Sending money to people you do not know. This can lead to scams.

Note: Always use the Goods and Services option if you buy something. This gives you PayPal’s Purchase Protection.

Fees

Image Source: pexels

Domestic vs. International

You probably want a low-cost way to send money to people you trust. The friends and family feature in PayPal helps you do that, but the fees can change based on where the money goes. If you send money within the United States, you can enjoy fee-free transactions when you use your PayPal balance or a linked bank account. If you use a credit or debit card, PayPal charges a 2.9% fee plus a fixed amount, usually around $0.49.

If you send money to someone in another country, the fees get higher. PayPal charges a 5% fee for international transfers, with a minimum of $0.99 and a maximum of $4.99. If you use a card or PayPal Credit, you pay the 5% fee plus an extra 2.9% and a fixed fee. Currency conversion fees also apply, usually adding 3-4% to the exchange rate.

Here’s a quick look at how the fees compare:

| Transaction Type | Funding Source | Fee Description |

|---|---|---|

| U.S. Friends & Family | PayPal balance or bank | No fee |

| U.S. Friends & Family | Credit/debit card | 2.9% + $0.49 |

| International Friends & Family | PayPal balance or bank | 5% ($0.99 min, $4.99 max) |

| International Friends & Family | Credit/debit card | 5% + 2.9% + $0.49 + currency conversion fees |

Funding Source Differences

The way you fund your payment changes the fees you pay. If you use your PayPal balance or a linked bank account, you get fee-free transactions for payments within the United States. If you use a debit or credit card, PayPal adds a 2.9% fee plus a fixed amount. For international payments, using a card means you pay both the 5% base fee and the extra card fee, plus currency conversion costs.

| Payment Type | Funding Source | Fee Description |

|---|---|---|

| U.S. Friends & Family | PayPal balance or bank | No fee |

| U.S. Friends & Family | Debit/credit card | 2.9% + $0.49 |

| International | PayPal balance or bank | 5% ($0.99 min, $4.99 max) |

| International | Debit/credit card | 5% + 2.9% + $0.49 + currency conversion fees |

If you want to avoid extra fees, always use your PayPal balance or a linked bank account when possible.

Who Pays the Fees

You, as the sender, pay any fees for using the friends and family feature. PayPal shows you the fee before you finish the payment. The person receiving the money does not pay anything. You see all the options and fees clearly during the process. By confirming the payment, you agree to pay the fees and accept the risks. PayPal reminds you that the friends and family feature is for personal payments with people you trust.

Note: Always check the fee summary before you send money. This helps you avoid surprises and keeps your payments simple.

Limits and Safety

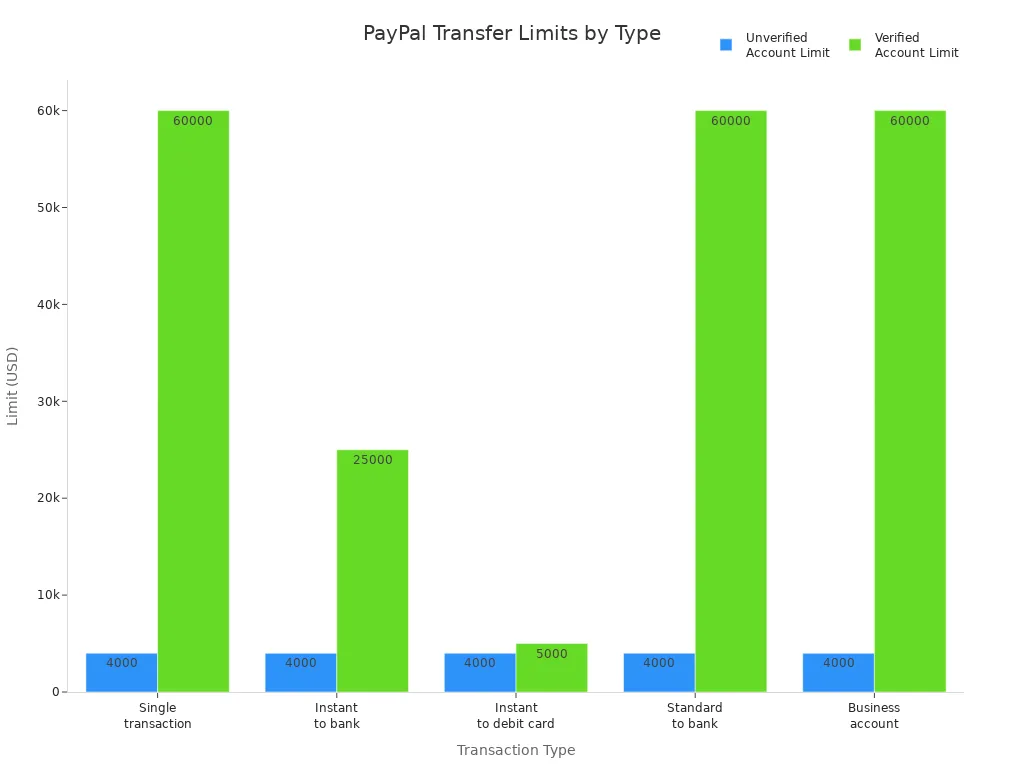

Transaction Limits

You might wonder how much money you can send with the friends and family feature. PayPal sets different limits based on your account status. If you have not verified your account, you can only send up to $4,000 per transaction. Once you verify your account, you can send up to $60,000 at a time, but sometimes PayPal may cap this at $10,000 depending on the currency or where you send the money. Instant transfers to a bank or debit card have lower limits.

Here’s a table to help you see the main limits:

| Transaction Type | Unverified Account Limit | Verified Account Limit | Notes |

|---|---|---|---|

| Single transaction | $4,000 | Up to $60,000 (may be capped at $10,000) | Limits may vary by currency or destination country |

| Instant transfer to bank | $4,000 | $25,000 | Available for eligible bank accounts |

| Instant transfer to debit card | $4,000 | $5,000 | Debit card transfers include a small fee |

| Standard transfer to bank | $4,000 | No daily cap, subject to per-transaction limits | Takes 1–3 business days; no fee for standard transfers |

| Business account transfers | $4,000 | Up to $60,000 (may be capped at $10,000) | No weekly transfer limits |

Buyer Protection and Risks

When you use paypal friends and family, you do not get buyer or seller protection. If you send money and something goes wrong, PayPal will not help you get your money back. Here are some important things to remember:

- The friends and family feature does not offer refunds or dispute resolution.

- If you send money to the wrong person, you cannot reverse the payment.

- Scammers often ask for payments through this feature because it removes protection.

- If your account gets hacked and someone sends money without your permission, you must prove your account was compromised to get a refund.

Many scams use the friends and family feature. Scammers might pretend to be someone you know, ask for urgent payments, or offer fake deals. Once you send money, you cannot recover it. Always double-check who you are sending money to and never use this feature for buying goods or services.

When to Use or Avoid

You should use the friends and family feature only for personal payments. Good times to use it include sending a birthday gift to a friend, paying your roommate for rent, or splitting a bill with family. Avoid using it for business, paying for products, or sending money to someone you do not know well.

Tip: Always use the Goods and Services option if you are buying something. This keeps your money safer and gives you access to PayPal’s buyer protection.

If you use paypal friends and family for business, you risk losing your money and breaking PayPal’s rules. This can lead to account freezes or even bans. Stick to using this feature for trusted people and personal reasons.

Friends and Family Feature vs. Other Options

PayPal Goods and Services

When you use PayPal, you see two main choices: Friends and Family or Goods and Services. Each option works best for different situations. If you want to send money to someone you know, Friends and Family is the right pick. If you buy something or pay for a service, you should use Goods and Services. This option gives you buyer protection, so PayPal can help if something goes wrong with your purchase.

Here’s a quick table to help you compare:

| Aspect | PayPal Friends and Family | PayPal Goods and Services |

|---|---|---|

| Intended Use | Sending money to personal contacts | Paying for goods or services |

| Fees | Usually free if funded by bank account or PayPal balance; fees apply if funded by debit/credit cards or currency conversion | Seller pays 2.99% fee; buyer pays no fee |

| Buyer/Seller Protection | No buyer or seller protection | Buyer automatically covered by PayPal Purchase Protection |

| Account Restrictions | Only personal accounts can send/receive; business accounts cannot receive Friends and Family payments | Business accounts can receive payments; designed for commercial transactions |

| User Satisfaction Issues | Confusion leads some users to use Friends and Family for purchases to avoid fees but lose protection | Fees charged to sellers but provide security and protection |

| Cross-border Fees | Fees apply on currency conversion for both types | Fees apply on currency conversion for both types |

Many users feel confused about fees. If you use a card or send money across countries, you might see extra charges. Always check the details before you finish your payment.

Venmo and Zelle

You might wonder how PayPal compares to Venmo and Zelle for quick personal payments. Venmo lets you send money instantly to friends. You can use a bank account or debit card for free, but credit card payments cost 3%. Venmo also has social features and a debit card. Instant transfers to your bank cost 1.75%, while standard transfers take 1-3 days and are free.

Zelle works a bit differently. It moves money right between bank accounts, usually in minutes. You do not pay any fees to send or receive money with Zelle, but you must use a U.S. bank account. Zelle does not support cards. Once you send money with Zelle, you cannot get it back if you make a mistake. Zelle uses bank-level security and FDIC insurance, but it does not offer much help if you send money to the wrong person.

Here’s a table to compare the three:

| Feature/Aspect | PayPal Friends & Family | Venmo | Zelle |

|---|---|---|---|

| Transfer Speed | Instant within PayPal; bank withdrawals 1-3 days (instant withdrawal fee 1.75%) | Instant between users; standard bank transfers 1-3 days; instant transfer fee 1.75% | Instant bank-to-bank transfers (minutes) |

| Fees | Free if funded by bank or PayPal balance; 2.9% + $0.30 if funded by card; instant withdrawal 1.75% | Free if funded by bank or debit card; 3% fee for credit card payments; instant transfer 1.75% | Completely free; no fees for sending or receiving via bank accounts; no card support |

| Security | Buyer/Seller Protection frameworks; secure transaction monitoring | Encryption, PIN/fingerprint security; limited protection if sent to wrong recipient | Bank-level security; FDIC insured; payments irrevocable; limited fraud protection |

| Funding Sources | Bank accounts, PayPal balance, credit/debit cards | Bank accounts, debit cards, credit cards (with fees) | Only U.S. bank deposit accounts; no card support |

| Additional Notes | Broad global reach; supports merchant processing and buyer/seller protections | Social features, teen accounts, Venmo debit card | No social features; no purchase protection; limited dispute resolution |

Choosing the Right Method

You have many ways to send money. If you want to make quick personal payments to friends or family, PayPal Friends and Family, Venmo, and Zelle all work well. Think about what matters most to you. Do you want buyer protection? Use PayPal Goods and Services. Do you want no fees and instant transfers? Zelle could be your best choice if both you and the recipient have U.S. bank accounts. If you like social features or want to split bills, Venmo makes it easy.

Tip: Always double-check the recipient before you send money. Pick the method that fits your needs and keeps your payment safe.

PayPal Friends and Family gives you a quick way to send money to people you trust. You get strong security and easy transfers, but you do not have buyer protection and must watch out for fees. Always double-check the recipient and use this feature only for personal payments.

Best practices for safe use:

- Use PayPal Friends and Family only with people you know.

- Confirm recipient details before sending.

- Avoid using it for purchases or with strangers.

Remember to pick the right payment method for your needs and always check the latest updates on PayPal’s policies.

FAQ

Can you cancel a PayPal Friends and Family payment?

You cannot cancel a Friends and Family payment once you send it. Always double-check the recipient’s details before you hit send. If you make a mistake, you must contact the recipient and ask them to return the money.

Does PayPal Friends and Family have buyer protection?

No, you do not get buyer protection with Friends and Family payments. If you pay for goods or services, always use the Goods and Services option. This way, PayPal can help if something goes wrong with your purchase.

What happens if you send money to the wrong person?

If you send money to the wrong person, PayPal cannot reverse the payment. You need to reach out to the recipient and request a refund. PayPal will not step in for Friends and Family transfers.

Are there limits on how much you can send with Friends and Family?

Yes, PayPal sets limits based on your account status. Here is a quick table:

| Account Type | Single Transaction Limit |

|---|---|

| Unverified | $4,000 |

| Verified | Up to $60,000 |

Check your PayPal account for your exact limit.

Navigating the nuances of PayPal Friends and Family highlights a common challenge: the trade-off between convenience and cost, especially for international transfers or when using cards. While ideal for trusted personal transactions, its lack of protection and potential fees for certain funding sources can be a drawback for broader financial needs.

For a more versatile and cost-effective solution for both personal and business payments, consider BiyaPay. Our platform simplifies domestic and international transfers with a transparent fee structure, including remittance fees starting from just 0.5%. Easily check the real-time exchange rate for any currency pair before you send, ensuring you always get the best value and complete clarity on costs, without any surprise deductions for the recipient.

Upgrade your money transfer experience with greater flexibility and lower costs. Create your BiyaPay account today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.