- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Sending Money from Chime to Cash App Made Easy

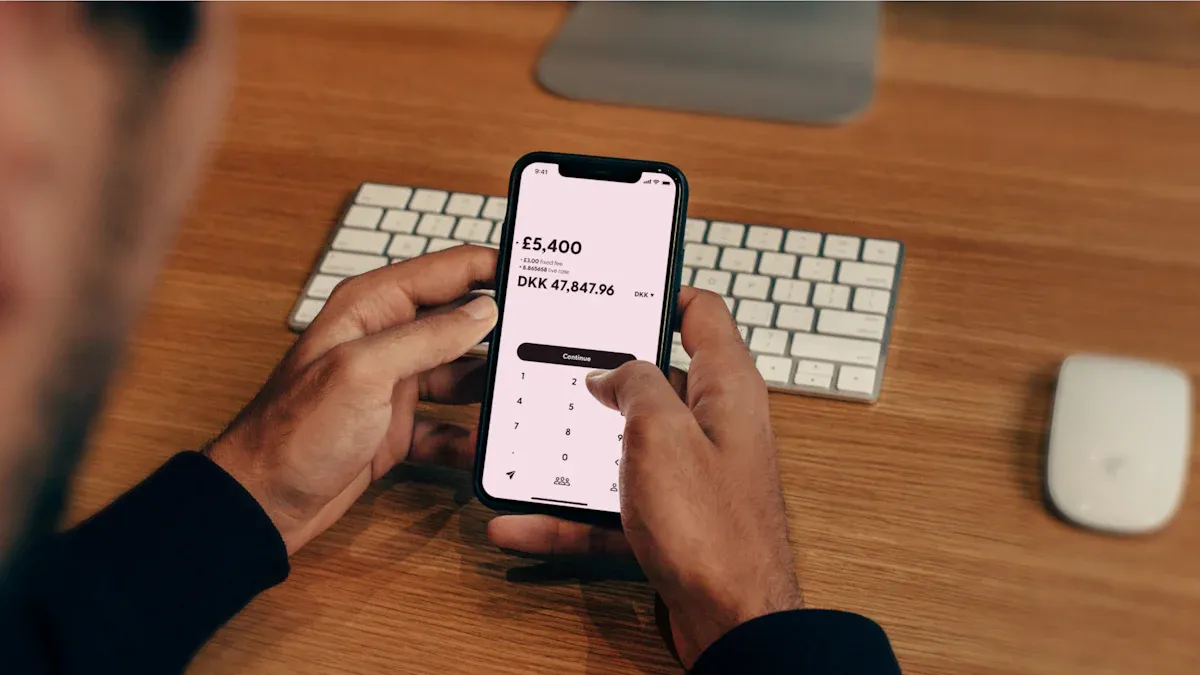

Image Source: pexels

You can easily send money from your Chime account to your Cash App account. Most people use three main ways to send money from Chime to Cash App:

- Link your Chime account directly to Cash App.

- Add your Chime debit card to Cash App.

- Use Chime’s Pay Anyone feature to send money with just an email or phone number.

Sending money from Chime to Cash App is usually instant and does not cost extra. You might wonder, how long does it take to send money from Chime to Cash App? In most cases, transfers appear right away. You will see step-by-step guides soon.

Key Takeaways

- You can send money from Chime to Cash App using three easy methods: linking your Chime account, adding your Chime debit card, or using Chime’s Pay Anyone feature.

- Most transfers happen instantly and usually do not cost any fees, making it fast and affordable to move your money.

- Chime sets daily and monthly limits on transfers, so check your app to avoid delays and plan your payments accordingly.

- If a transfer fails, check your internet, account balance, and recipient details, then update your apps or contact support for help.

- Always double-check your information before sending money to keep your transfers safe and smooth.

Ways to Send Money from Chime to Cash App

Image Source: unsplash

You have several easy ways to send money from Chime to Cash App. Each method gives you a fast and secure way to move your money. Most transfers are instant and do not charge extra fees. Let’s look at your options.

Link Chime Bank Account

You can link your Chime account directly to your Cash App account. This method lets you transfer money from Chime to Cash App quickly. When you link your accounts, you get the best of both worlds. Chime gives you a stable banking experience, while Cash App makes it easy to send money fast. You need to verify your email and phone number on both apps. Make sure you have the latest versions of Chime and Cash App. A strong internet connection helps the linking process go smoothly. Security features like encryption and multi-factor authentication keep your money safe.

Tip: If you have trouble linking your Chime account, check your network connection or restart your device.

Add Chime Debit Card

Another way to send money from Chime to Cash App is by adding your Chime debit card. This method is simple and works well for most people. You just enter your card details in Cash App. Once added, you can transfer money right away. Keep in mind, Chime sets daily spending and withdrawal limits. These limits reset every night. Sometimes, Cash App may decline a transaction even if you have enough money. If this happens, try updating your card info or contact Chime support.

Use Pay Anyone Feature

Chime’s Pay Anyone feature lets you send money to friends or family using just their email or phone number. You do not need to know if they have a Chime account or a Cash App account. This feature is great if you want to send money fast and without extra steps. The transfer is usually instant and does not cost anything. You can use this option if you want to send money from Chime to Cash App without linking accounts or cards.

Note: The official methods supported by Chime and Cash App include direct transfers, online banking, and third-party payment services. These options give you flexibility and security when you transfer money from Chime.

No matter which method you choose, sending money from Chime to Cash App is quick and easy. You can pick the way that fits your needs best.

Step-by-Step Guide to Send Money

Image Source: unsplash

You have several ways to send money from Chime to Cash App. Each method is simple and works well for different needs. Here’s how to get started with each option.

Link Chime to Cash App

If you want to link your Chime account to Cash App, you can do it in just a few minutes. This method lets you transfer money from Chime to Cash App directly. You can use your Chime account as a funding source for your Cash App account.

Follow these steps to link your Chime account to Cash App:

- Open Cash App on your phone or tablet.

- Tap your profile picture in the top right corner.

- Select “Linked Banks” from the menu.

- Tap “Link Bank” to start the process.

- Search for “Chime” and select it.

- Enter your Chime login details (email and password) to connect through Plaid.

- If you prefer, you can skip Plaid and enter your Chime routing and account numbers manually.

Tip: You can find your Chime routing and account numbers in the Chime app. Go to the “Move Money” section, then tap “Direct Deposit.” Your numbers will appear there.

Verification steps:

- If you use Plaid, your account links instantly.

- If you enter your routing and account numbers manually, Cash App will send two small deposits to your Chime account. Check your Chime account after 1-3 business days. Enter the deposit amounts in Cash App to finish verification.

- Cash App may ask for a verification code or extra security checks. This keeps your money safe.

Note: Double-check your account details before you finish. If you have trouble, make sure your internet connection is strong. If linking fails, try again or contact support.

After you link your Chime account to Cash App, you can transfer money between accounts whenever you need.

Add Chime Debit Card to Cash App

You can also add your Chime debit card to Cash App. This method is quick and works well if you want to send money right away.

Here’s how to add your Chime debit card:

- Open Cash App on your device.

- Tap your profile picture in the top right corner.

- Select “Linked Banks.”

- Tap “Link debit card.” If you already have a card, you can replace it by selecting “Replace card.”

- Enter your Chime debit card number, expiration date, 3-digit CVV, and your zip code.

- Tap “Link Card” to finish.

Tip: Make sure your Chime debit card is active and has not expired. You can check your card status in the Chime app under “Settings” or “Card Settings.”

Once you add your Chime debit card, you can send money from Chime to Cash App instantly. If you run into problems, update your card info or contact Chime support.

Helpful reminders:

- Make sure you have enough money in your Chime account before you transfer.

- Some cards may not work for online transfers. If you get an error, check with Chime to see if your card allows online transactions.

- If your transfer does not go through, double-check your card details and try again.

Use Pay Anyone to Send Money

Chime’s Pay Anyone feature lets you send money to anyone using just their email or phone number. You do not need to know if they have a Chime or Cash App account. This is a great way to transfer money from Chime if you want to keep things simple.

To use Pay Anyone, follow these steps:

- Open the Chime app and go to the “Pay Anyone” menu.

- Select the person you want to pay from your contacts, or enter their email address or phone number.

- Enter the amount of money you want to send.

- Double-check the details to make sure everything is correct.

- Add a message if you want.

- Tap “Pay” to send the money.

Note: If the person you send money to does not have a Chime account, they will get a message with instructions. They have 14 days to accept the money by entering their debit card details. If they do not accept in time, the money returns to your Chime account.

Tips for a smooth transfer:

- Always check that you have enough money in your Chime account before you send money.

- Make sure you enter the correct email or phone number for the recipient.

- If you send money to a Chime member, the transfer is instant and cannot be reversed.

- If you send money to someone who is not a Chime member, remind them to accept the payment within 14 days.

If you want to know how to transfer funds quickly, Pay Anyone is a great choice. You can send money from Chime to Cash App users by entering their Cash App-linked email or phone number.

Tip: If a transfer fails or gets reversed, check your account details and try again. If you have problems, contact Chime support for help.

No matter which method you choose, you can transfer money from Chime to Cash App easily. Pick the way that works best for you and enjoy fast, secure transfers every time.

Transfer Money from Chime to Cash App: Limits and Fees

Transfer Limits

You might wonder, “How much can I transfer from Chime to Cash App?” Chime sets clear limits for sending money. These limits help keep your account safe. When you send money from Chime to Cash App, you need to know the limits of transferring money from Chime to Cash App.

Here are some important limits for sending money:

- Chime usually lets you send up to $2,000 per day with your debit card.

- The weekly limit is often $10,000.

- If you use the Pay Anyone feature, you can send up to $2,000 per day and $10,000 per month.

- Cash App may also set its own limits for how much you can receive.

Note: The limits for sending money can change. Always check the latest details in your Chime app before you transfer. If you reach your limit, you must wait until the next day or week to send more.

You should always keep the chime to cash app transfer limits in mind. Knowing the limits of transferring money from Chime to Cash App helps you plan your transfers better.

Fees and Processing Times

You may ask, “What is the cost to send money from Chime to Cash App?” The good news is that most transfers do not have extra fees. Chime and Cash App both offer fee-free transfers for most users. You can move your money without worrying about hidden costs.

| Transfer Method | Typical Processing Time |

|---|---|

| Direct transfer (Chime to Cash App) | Usually completes within minutes (under 5 minutes) |

| Peer-to-Peer (P2P) transfer | Usually quick, similar to direct transfers |

| Online bank transfers (ACH) | Typically 1-3 hours or 1-3 business days |

| Check or cash order | Slower, can take several business days |

| Third-party fee processors | Variable, from several hours up to multiple days |

Most people see their money arrive in Cash App within minutes. If you use an ACH transfer, it might take a few hours or up to three business days. The cost to send money from Chime to Cash App is usually $0, but always check for updates in your app.

Tip: If you ever wonder, “How long does it take to send money from Chime to Cash App?”—most transfers finish in less than five minutes.

Troubleshooting Sending Money from Chime to Cash App

Failed Transfers

Sometimes, your transfer from Chime to Cash App might not go through. This can feel frustrating, but you can fix most problems quickly. Here are some common reasons why transfers fail:

- Not enough money in your Chime or Cash App account

- Wrong recipient details, like an incorrect $Cashtag, phone number, or email

- You hit your daily or weekly sending limits

- Poor internet connection or app glitches

- Security checks or fraud alerts on your account

- Expired or locked Chime debit card

If you run into trouble, try these steps:

- Check your internet connection. A strong Wi-Fi signal helps.

- Make sure you entered the right recipient info and card details.

- Confirm you have enough money in your account.

- Update your Cash App and Chime apps to the latest versions.

- Look at your transfer limits. If you reach them, wait until they reset.

- If your card is locked or expired, unlock it or request a new one.

- Contact Chime or Cash App support if you still have issues.

Tip: Use your own cards and only send money to people you trust. This helps avoid security blocks.

Cancel or Reverse a Transfer

You might want to cancel or reverse a transfer if you made a mistake. Most payments on Cash App and Chime happen instantly. Once you send money from Cash App to Chime or the other way, you usually cannot cancel it. If you sent money to the wrong person, ask them to refund it. If you think you were scammed, contact Cash App support right away. You can also report the problem to your bank if you used your Chime debit card, but banks have limited power to reverse these payments.

Note: Chime lets you report errors within 60 days. They will investigate and may credit your account if they find a mistake.

Sending Without a Debit Card

You can still send money from Chime to Cash App even if you do not have a debit card. Try these options:

- Use Chime’s Pay Anyone feature. Enter the recipient’s email or phone number linked to their Cash App.

- Move money from Chime to a linked checking account, then add those funds to Cash App.

- Use third-party payment services that support both Chime and Cash App.

Many users like the Pay Anyone feature because it is simple and does not need account linking. However, these methods may take longer than using a debit card. Standard transfers can take a few days, while instant transfers may cost extra.

Tip: Always double-check recipient details and review your transaction before you send money.

You can send money from Chime to Cash App quickly and with little hassle. Most users find the process smooth, but sometimes you might face issues like incorrect card details or network problems. Here’s what helps most:

- Double-check your card info and account balance.

- Keep your apps updated.

- Reach out to Chime support by phone, email, or live chat if you need help.

| Platform | Average User Rating | What Users Like Most |

|---|---|---|

| Chime | 4.5 out of 5 | Easy to use, helpful support |

| Cash App | 4.2 out of 5 | Fast transfers, simple design |

Pick the method that works best for you. If you follow the steps, you’ll move your money with confidence.

FAQ

Can you send money from Chime to Cash App without a debit card?

Yes, you can. Use the Pay Anyone feature in your Chime app. Enter the recipient’s email or phone number linked to their Cash App. You do not need a debit card for this method.

How long does it take for money to show up in Cash App?

Most transfers from Chime to Cash App appear within minutes. If you use an ACH transfer, it may take up to three business days. Always check your app for updates on your transfer status.

Are there any fees when sending money from Chime to Cash App?

You usually pay no fees for standard transfers between Chime and Cash App. Instant transfers may have a small fee. Always review the fee details in your app before you send money.

What should you do if your transfer fails?

First, check your internet connection and account balance. Make sure you entered the correct recipient details. Update your apps if needed. If you still have trouble, contact Chime or Cash App support for help.

While transferring money between domestic apps like Chime and Cash App is straightforward, what about sending money across borders? High fees, unfavorable exchange rates, and slow transfers can turn international remittances into a frustrating experience. This is where BiyaPay steps in. We offer a seamless solution for converting and sending money globally. Forget about hidden costs; with BiyaPay, you can enjoy real-time currency exchange rates and incredibly low remittance fees, starting from just 0.5%. Our platform supports the free conversion of various fiat currencies and digital currencies, providing flexibility and speed.

You can use our Real-time Exchange Rate Calculator to see how much you can save, and with support for most countries and regions worldwide, you can be sure your money gets where it needs to go, fast—often arriving on the same day. Ready to simplify your global money transfers? Register now and start your first transfer in minutes.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.