- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Ultimate List of Net 30 Companies for Managing Cash Flow

Image Source: unsplash

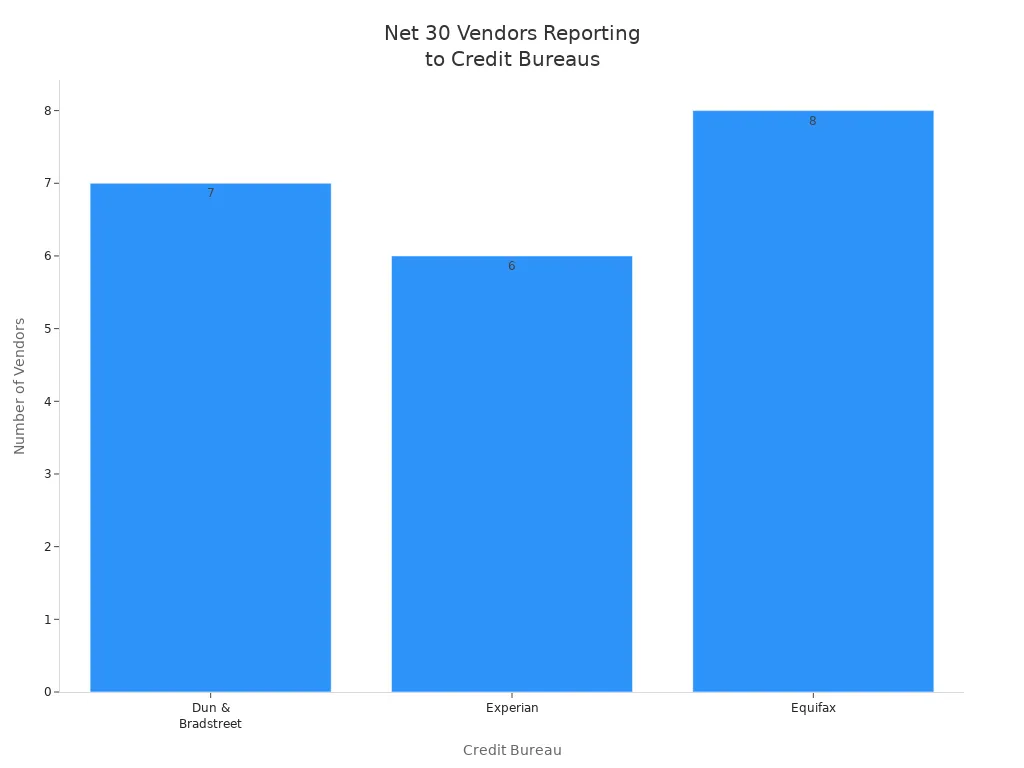

If you own a business, you know how important it is to manage cash flow and keep your operations running smoothly. Many businesses in the United States struggle with cash flow. About 70% have less than four months of operating cash available. Over 80% experience negative effects when cash runs low. You need tools that help you avoid these problems. A net 30 account lets you buy now and pay later, which can give your business more breathing room. The right net 30 companies help you build business credit and report your payment history to major bureaus. Not every net 30 account does this. Look at the table below to see which vendors report to Dun & Bradstreet, Experian, and Equifax.

| Vendor | Dun & Bradstreet | Experian | Equifax |

|---|---|---|---|

| Grainger | Yes | Yes | Yes |

| Creative Analytics | Yes | Yes | Yes |

| Quill | Yes | Yes | Yes |

| Wise | N/A | Yes | Yes |

| Uline | Yes | N/A | Yes |

| Home Depot | Yes | Yes | Yes |

| Amazon | N/A | N/A | N/A |

| CEO Creative | N/A | N/A | N/A |

| Growegy | N/A | Yes | Yes |

| JJ Gold | Yes | N/A | Yes |

| Staples | Yes | N/A | N/A |

| HD Supply | N/A | N/A | N/A |

When you choose net 30 companies that report to credit bureaus, you can build a strong business credit profile. This makes it easier to get more funding and better terms in the future. Take action now to set up your first net 30 account and start improving your business finances.

Key Takeaways

- Net 30 accounts let you buy now and pay within 30 days, helping you manage cash flow and keep your business running smoothly.

- Choose net 30 vendors that report your payments to major credit bureaus to build a strong business credit profile and improve financing options.

- Pay your net 30 invoices on time to avoid fees and boost your business credit score quickly and safely.

- Prepare your business with key documents like EIN and DUNS number before applying to increase your chances of approval.

- Use net 30 accounts to access supplies immediately, improve cash flow, and build trusted relationships with vendors for future growth.

Top Net 30 Companies

When you want to manage cash flow and build business credit, choosing the right net 30 companies is important. Here is a comprehensive list of net 30 companies that many business credit experts recommend. Each vendor offers unique benefits, and some are known as the best net 30 vendors for easy approval or for serving specific industries.

Uline

Uline stands out as one of the best net 30 vendors for shipping supplies, warehouse equipment, and packaging materials. You can open a net 30 account with Uline by providing your business details, tax ID, and references. Uline reports your payment history to Dun & Bradstreet, Experian, and Equifax, which helps you build a strong business credit profile. Approval depends on your business creditworthiness, but many businesses find the process straightforward. Uline does not charge annual fees or require a minimum order for reporting, making it a reliable net 30 vendor for both new and established businesses.

Tip: Uline is often recommended for businesses that want to start building credit quickly with major bureaus.

Quill

Quill is one of the best net 30 vendors for office, cleaning, and breakroom supplies. This vendor reports to Dun & Bradstreet, which helps you establish a business credit file. Quill is widely recommended by business credit vendors because it does not require a personal guarantee. You need to make a minimum purchase of $100 for your payment to be reported. Quill is ideal for businesses that regularly buy office supplies and want to improve cash flow. However, it may not be the best fit for startups with limited credit history or those with very small supply needs.

Grainger

Grainger is a top choice among net 30 companies for maintenance, repair, and operations products. You can apply for a Grainger net 30 account if your business is at least three months old and has a DUNS number. Grainger reports to Dun & Bradstreet, Experian, and Equifax, which helps you build business credit with every on-time payment. There is no minimum order required, but placing an order of at least $50 ensures your payment history gets reported. Grainger is a reliable net 30 vendor for businesses in construction, manufacturing, and facilities management.

Staples Business Advantage

Staples Business Advantage offers net 30 accounts to businesses with at least 20 employees. This program gives you access to over 20,000 products, including office supplies, electronics, and furniture. Staples reports to Dun & Bradstreet, Experian, and Equifax, making it one of the best net 30 vendors for building business credit. You get a $1,000 credit limit and frequent discounts. Staples is a good fit for businesses with ongoing office supply needs and those looking for a vendor account that supports credit growth.

Crown Office Supplies

Crown Office Supplies is known for fast approval and is one of the best net 30 vendors for easy approval net 30 accounts. You need to pay a $99 annual fee and have your business registered in the United States for at least 90 days. Crown Office Supplies reports to Dun & Bradstreet, Experian, and Equifax. No personal guarantee is required, and approval is based on your business’s creditworthiness. This vendor is a great option for businesses that want to build credit quickly and need office or educational products.

| Eligibility Requirement | Details |

|---|---|

| Business Age | 90 days |

| EIN | Required |

| Annual Fee | $99 |

| Reports To | D&B, Experian, Equifax |

Wise Business Plans

Wise Business Plans offers net 30 accounts for business planning, market research, and marketing services. This vendor reports to Experian, Equifax, and Creditsafe, helping you build credit with multiple bureaus. Wise Business Plans is suitable for a wide range of businesses that need flexible payment terms for professional services. The application process is simple, and approval is easy if you have an EIN and a business address. Many new businesses choose Wise Business Plans because it helps separate business and personal credit.

The CEO Creative

The CEO Creative is one of the best net 30 vendors for startups and small businesses. You can get easy approval net 30 accounts with a simple application and no personal credit check. The CEO Creative offers a $5,500 credit limit and charges a $49 annual membership fee. This vendor reports to Equifax and Credit Safe, helping you build business credit fast. You can buy electronics, office supplies, and creative services like graphic design and branded merchandise. The CEO Creative is a top pick for businesses that want to grow their brand and manage cash flow.

Newegg Business

Newegg Business is a leading net 30 company for electronics, IT equipment, and software. You can apply for a net 30 account with no minimum order and no fees. Newegg Business reports your payment activity to Dun & Bradstreet and Equifax, which helps you build a strong credit profile. This vendor is ideal for IT companies, e-commerce businesses, and anyone needing technology products. Newegg Business is also known for its detailed application process, which helps ensure your business information is accurate.

Creative Analytics

Creative Analytics is a business credit vendor that specializes in marketing and digital services. You can open a net 30 account if your business has been operating for at least 30 days and has an EIN and DUNS number. Creative Analytics reports to Dun & Bradstreet, Experian, and Equifax. The application process checks your business credit, but not your personal credit. This vendor is a good choice for businesses that want to invest in marketing while building credit. Creative Analytics is also one of the reliable net 30 vendors for easy approval net 30 accounts, especially for those focused on digital growth.

Note: Many of these net 30 companies are known for easy approval net 30 accounts, making them accessible to new and growing businesses. When you choose the best net 30 vendors for your needs, you can improve cash flow, access essential supplies, and build a strong business credit profile.

Understanding Net-30 Accounts

What Is a Net 30 Account?

A net 30 account is a type of trade credit that lets you buy goods or services and pay the full amount within 30 calendar days from the invoice date. Many financial institutions define a net 30 account as a short-term loan from the seller to the buyer. You receive an invoice after your order, and the payment is due by the 30th day. Some suppliers may offer early payment discounts, such as “2/10 Net 30,” which means you get a 2% discount if you pay within 10 days. The main goal of a net 30 account is to help you manage your business finances without needing to pay right away.

- A net 30 account gives you 30 days to pay after you get billed.

- The seller includes “net 30” in the invoice terms.

- The 30-day period usually starts from the invoice date.

- Late payments can lead to extra fees or legal action.

How Net-30 Accounts Work

Net-30 accounts work by giving you a set period—30 calendar days—to pay for your purchases. The billing cycle starts when you receive the invoice. You must pay the full amount by the due date. If you pay early, you might get a discount. For example, “2/10 Net 30” means you save 2% if you pay within 10 days. Net-30 accounts are common in many industries because they balance the needs of both buyers and sellers. You get more time to pay, while sellers build trust and goodwill. If the due date falls on a weekend or holiday, the next business day is often used. Some businesses may choose other terms, like Net 15 or Net 45, but net 30 accounts remain the most popular.

Tip: Always check your invoice for the exact payment terms and due date. Clear communication helps avoid late fees.

Why Net-30 Accounts Matter for Cash Flow

Net-30 accounts play a big role in helping you manage cash flow. When you use a net 30 account, you can buy inventory or services now and pay later. This delay helps you keep more cash in your business for daily expenses or growth. Many small businesses use net-30 accounts as a short-term credit line. This flexibility lets you secure what you need without using your working capital right away. Timely payments on net-30 accounts also help you build business credit, which can lead to better financing options in the future. Vendors like Uline and Quill report your payments to credit bureaus, making it easier for you to access more credit as your business grows.

- Net-30 accounts help you conserve cash flow by delaying payment.

- You can use the extra time to collect money from your own customers.

- Good payment history on net-30 accounts improves your business credit profile.

Building Business Credit

Image Source: unsplash

How Net 30 Companies Report to Bureaus

When you open vendor accounts with net 30 companies, you start building your business credit profile. These companies send your payment history to credit agencies like Dun & Bradstreet, Experian, and Equifax. Each time you make a payment on time, the vendor reports this activity. This helps you grow your business credit score. If you miss a payment or pay late, the negative mark can lower your business credit score. You want to work with business credit vendors that report to more than one credit agency. This gives your business credit profile a stronger foundation.

Not all vendors report to every credit agency. Some only report to one, while others report to several. Before you apply for vendor credit, check which credit agencies the vendor uses. This step helps you make sure your payments help your business credit score grow. Over time, a strong payment record with net 30 vendor accounts can help you qualify for better credit terms and higher limits.

Note: Always pay your invoices on time. On-time payment is the fastest way to build a positive business credit history.

Choosing Vendors for Credit Building

You want to choose net 30 vendors that help you build business credit quickly and safely. Use these steps to pick the best vendors for your business:

- Look for vendors that report payment history to major business credit bureaus like Dun & Bradstreet, Experian, Equifax, and Creditsafe.

- Check the minimum purchase amount needed for the vendor to report your payment to the credit agencies.

- Confirm which credit bureaus the vendor reports to and see if there are any membership or annual fees for net 30 accounts.

- Some vendors may ask for a personal credit check, especially if your business is new. Decide if you are comfortable with this step.

- Monitor your business credit reports often. This helps you track your progress and fix any errors.

You should also pick vendors whose products or services match your business needs. This way, you use vendor credit for things you already buy. Good business credit helps you get better terms from other lenders and suppliers. A strong business credit score can also help you get loans, leases, and even lower insurance rates.

Tip: Build relationships with vendors who have a good reputation and strong customer service. This can help your business grow and make credit building easier.

Applying for a Net 30 Account

Image Source: pexels

Preparing Your Business

Before you apply for a net 30 account, you need to make sure your business is ready. Vendors want to see that your company is real and in good standing. You should gather important documents and set up your business details. Most vendors look for the following:

- Employer Identification Number (EIN)

- Dun & Bradstreet (DUNS) number

- Legal business name and address

- Business registration and proof of good standing with your state

- Authorized officer information, such as name and contact details

- A professional website that shows your business is active

- Identity verification documents, like a government-issued ID or business license

- Business bank account information

- Proof that your business has been active for at least 90 days

- No negative payment history with business credit bureaus

Having these items ready helps you open a net 30 account faster and shows vendors you are serious.

Application Process

You can follow a simple process to apply for a net 30 account. Most vendors use similar steps:

- Find vendors that offer net 30 accounts and match your business needs.

- Check if the vendor reports to business credit bureaus.

- Complete the application with your business name, EIN, and other details.

- Submit required documents, such as your business registration and bank account information.

- Review the payment terms, fees, and credit limits.

- Wait for the vendor to review your application and check your business credit.

- Once approved, start using your net 30 account to make purchases.

Some vendors may ask for an initial purchase to show your commitment before they extend net 30 terms.

Tips for Approval

You can increase your chances of approval by following a few smart strategies:

- Choose vendors known for easy approval net 30 accounts, like Crown Office Supplies.

- Provide complete and accurate business information on your application.

- Use vendors that report to major business credit bureaus to help build your credit.

- Pick vendors that do not require a personal credit check if your business is new.

- Always pay your net 30 account invoices on time to build a positive payment history.

- Build strong relationships with vendors to improve your chances to qualify for net 30 terms in the future.

- Use accounting software to track due dates and avoid late payments.

If you follow these steps, you can open a net 30 account and start building your business credit with net-30 accounts.

Benefits of Using Net 30 Vendors

Improved Cash Flow

You can improve your cash flow when you use net 30 vendors. These accounts give you a 30-day window to pay for goods or services. This means you receive what you need right away but delay payment until your business collects revenue. Many businesses find this delay acts like a free short-term loan. You keep more money available for daily operations or new opportunities. Net 30 terms help you manage cash flow by matching your payments with incoming funds. You can also plan your finances better and handle slow periods with less stress.

- Net 30 terms give you more financial flexibility.

- You can invest in growth without immediate cash outflows.

- Payment delays help you keep cash reserves for emergencies.

Automating payment reminders and monitoring your cash flow regularly can help you avoid late fees and keep your business running smoothly.

Access to Supplies and Services

Net 30 vendors give you access to a wide range of supplies and services. You can buy inventory, office products, or even marketing services without paying upfront. This access helps you keep your business stocked and ready to serve customers. Many businesses use net 30 accounts to build strong relationships with suppliers. Vendors often reward reliable customers with better terms or discounts. You can expand your vendor network and enjoy more choices for your business needs.

- You receive goods or services immediately and pay later.

- Net 30 accounts support steady business growth and supply chain resilience.

- Building trust with vendors can lead to loyalty and repeat business.

Strengthening Business Credit

Using net 30 vendors is one of the best ways to strengthen your business credit. Each on-time payment gets reported to major business credit bureaus. Over time, you build a positive payment history. This history helps raise your business credit score and makes it easier to qualify for loans or better terms. Many businesses see their credit improve after using net 30 accounts for several months. A strong business credit profile opens doors to more financial flexibility and growth.

- Consistent payments help you build a solid business credit score.

- Vendors that report to multiple bureaus give you more credit-building power.

- Good business credit can lower your costs and improve your financing options.

Remember, the benefits of using net 30 vendors go beyond just supplies. You gain financial flexibility, better vendor relationships, and a stronger business credit profile.

Maximizing Net 30 Accounts

Paying On Time

You need to pay your net 30 accounts on time to build strong business credit. Each on-time payment helps your credit profile grow. Vendors report your payment history to business credit bureaus. Late payments can hurt your credit score and make it harder to get more credit in the future. Set reminders for each payment due date. Use accounting software or a calendar to track your net 30 accounts. Paying early can sometimes help you get discounts and show vendors you are reliable.

Tip: Paying your net 30 accounts before the due date can improve your business credit faster.

Expanding Vendor Relationships

You can grow your business by expanding vendor relationships. Start with a few net 30 accounts that match your business needs. As you build trust, ask vendors for higher credit limits or better terms. Good vendor relationships can lead to more credit options and special deals. When you show vendors that you pay on time, they may offer you more products or services. This helps your business get what it needs and keeps your business credit strong.

- Build trust with vendors by making regular purchases.

- Ask for credit limit increases after several months of good payment history.

- Use net 30 accounts from different vendors to diversify your credit profile.

Monitoring Credit Reports

You should check your business credit reports often. This helps you see how net 30 accounts affect your credit. Look for errors or missing payment records. If you find mistakes, contact the credit bureau to fix them. Monitoring your credit reports lets you track your progress as you use net 30 accounts. You can see which vendors report your payment history and how your business credit score changes over time.

| Step | Action |

|---|---|

| 1. | Get your business credit reports |

| 2. | Review payment history from net 30 accounts |

| 3. | Check for errors or missing information |

| 4. | Dispute any mistakes with the bureau |

Note: Regularly checking your credit reports helps you protect your business credit and spot problems early.

You can use net 30 companies to improve your cash flow and build a strong credit profile. Choose vendors that report to major bureaus and match your business needs. Pay your invoices on time to keep your credit healthy. Responsible account management helps you qualify for better credit terms. Start by applying to a recommended vendor and track your credit growth each month.

FAQ

What is a net 30 account?

A net 30 account lets you buy products or services now and pay the full amount within 30 days. Many vendors offer these terms to help you manage cash flow and build business credit.

Do all net 30 vendors report to business credit bureaus?

No, not all vendors report to credit bureaus. You should check if a vendor reports to Dun & Bradstreet, Experian, or Equifax before you apply. This step helps you build your business credit profile.

How much does it cost to open a net 30 account?

Some vendors charge annual fees, such as $49 or $99. Others do not charge fees. Always review the vendor’s terms and check the current USD amount. You can find exchange rates here.

Can startups get approved for net 30 accounts?

Yes, many net 30 vendors offer easy approval for startups. You need an EIN, a business address, and sometimes a small initial purchase. Some vendors do not require a personal credit check.

While managing your cash flow with Net 30 accounts is crucial for domestic business, what about your international trade? As global supply chains become more common, businesses often face challenges with cross-border payments—high fees, unfavorable exchange rates, and slow transfers. These issues can disrupt your cash flow and damage your business credit. BiyaPay offers a powerful solution for seamless international payments. We provide real-time exchange rates and incredibly low remittance fees, starting from just 0.5%, allowing you to make international payments more efficiently and affordably.

Our platform supports the free conversion of various fiat currencies and digital currencies, so you can pay suppliers and partners worldwide with confidence. The fast registration process and same-day delivery feature ensure your funds arrive quickly. Don’t let cross-border financial hurdles hinder your business growth. Use our Real-time Exchange Rate Calculator to see how much you can save, and get started with a global financial solution that supports your business. Register now to simplify your international payments and take control of your global cash flow.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.