- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Tips for managing Chase foreign transaction fees when spending abroad

Image Source: pexels

Chase foreign transaction fees usually range from 1% to 3% of each purchase you make outside the United States. You might not notice these charges right away, but they can add up quickly during your trip. Foreign transaction fees apply when you use your card in another country or buy something online from a non-U.S. store. Understanding how chase foreign transaction fees work helps you avoid surprises on your statement. Planning ahead lets you save money and enjoy your travels with less stress.

Key Takeaways

- Chase foreign transaction fees usually range from 1% to 3% and apply when you use your card outside the U.S. or shop from foreign merchants online.

- Some Chase credit cards, like Chase Sapphire Preferred and Chase Sapphire Reserve, do not charge foreign transaction fees, helping you save money while traveling.

- Using your Chase debit card abroad can cost you a 3% fee plus a $5 ATM fee for each withdrawal, so plan to withdraw larger amounts less often to reduce fees.

- Always pay in the local currency when abroad to avoid extra charges from dynamic currency conversion and get better exchange rates.

- Keep your contact info updated with Chase and check your card’s terms before traveling to avoid surprises and enjoy smoother transactions.

Understanding Chase Foreign Transaction Fees

Image Source: unsplash

What Is a Foreign Transaction Fee?

A foreign transaction fee is a charge you pay when you use your card for purchases outside the United States or with merchants that process payments through banks in other countries. Chase foreign transaction fees usually range from 1% to 3% of the total amount you spend. You might see this fee added to your statement after you buy something in another currency or shop online from a store based outside the U.S.

Chase calculates foreign transaction fees for credit cards as a percentage of your total purchase. This includes the cost of the item, shipping, and taxes. For most Chase credit cards, the fee falls between 2% and 5%. You will see the fee listed on your statement, either as a separate line or under credit card fees. Some Chase checking accounts, like Chase Private Client Checking℠, offer debit cards that do not charge foreign transaction fees, but most Chase debit card holders pay a fee when making purchases abroad.

Both Chase and the payment network (such as Visa or Mastercard) may add their own charges. This means the total foreign transaction fee can include more than one part. You should always check your card’s terms to know exactly how much you will pay.

Tip: You can avoid many international credit card fees by choosing a card that does not charge foreign transaction fees. Always review your card’s fee schedule before traveling.

When Are Foreign Transaction Fees Charged?

Chase applies foreign transaction fees in several situations. You pay this fee when you use your Chase debit card or Chase credit card for purchases in another country. You also pay the fee if you shop online from a merchant that processes payments outside the U.S., even if you pay in U.S. dollars. The fee amount depends on your card. Some cards charge 0%, while others charge up to 3%.

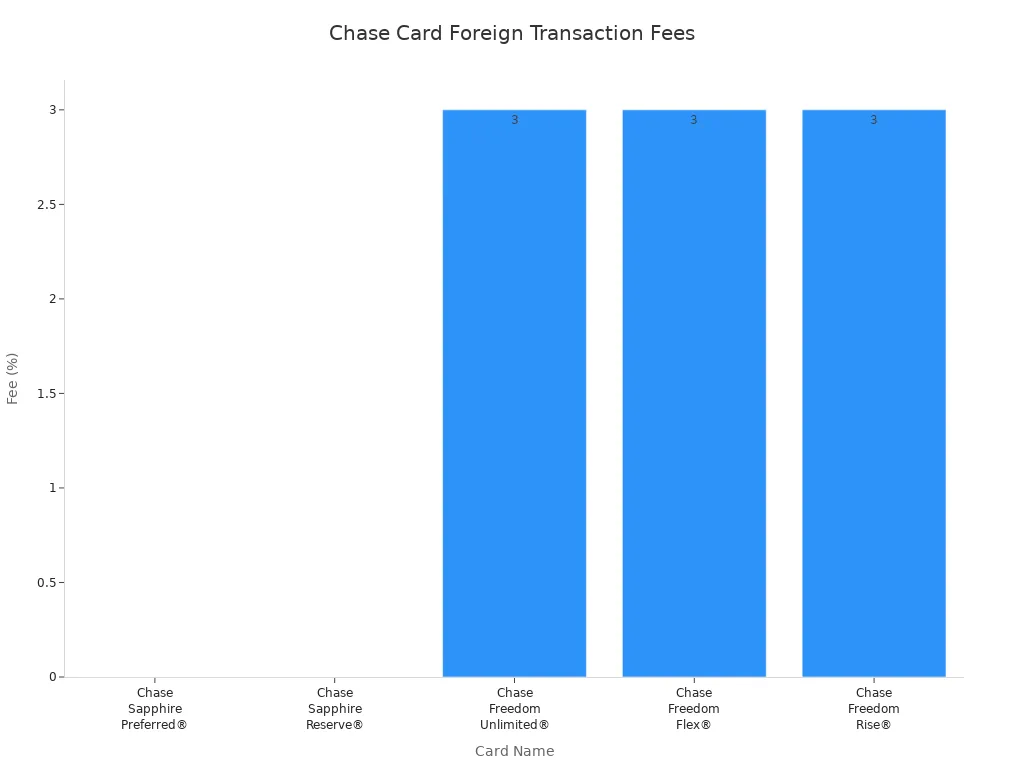

Here is a foreign transaction fee chart for popular Chase cards:

| Card Name | Foreign Transaction Fee |

|---|---|

| Chase Sapphire Preferred® | 0% |

| Chase Sapphire Reserve® | 0% |

| Chase Freedom Unlimited® | 3% |

| Chase Freedom Flex® | 3% |

| Chase Freedom Rise® | 3% |

You can see from this foreign transaction fee chart that some cards, like the Chase Sapphire Preferred and Chase Sapphire Reserve, do not charge foreign transaction fees. Other cards, such as the Chase Freedom Unlimited and Chase Freedom Flex, charge a 3% fee on each international transaction.

You should always check the foreign transaction fee chart for your specific card before you travel or make purchases from international merchants. This helps you avoid unexpected charges and manage your spending better.

Note: The chase international transaction fee can apply even if you are in the U.S. but the merchant processes your payment through a foreign bank.

Chase foreign transaction fees can add up quickly if you use your card often while traveling. Both credit card fees and debit card fees may apply. You should also remember that international credit card fees may differ from those charged for using a chase debit card. Always plan ahead and choose the right card to save money on international transactions.

Chase Debit Card Foreign Transaction Fee

How the Fee Works

When you use your Chase debit card outside the United States, you need to watch out for foreign transaction fees. The chase debit card foreign transaction fee is 3% of the total amount you spend in a foreign currency. This fee applies every time you make a purchase or withdraw cash in another country. If you use your card at an ATM, you also pay a $5 foreign ATM fee for each withdrawal. This $5 charge is fixed, so you pay it every time you take out money from a non-Chase ATM outside the U.S. or U.S. territories.

Tip: U.S. territories include places like Puerto Rico, Guam, and the U.S. Virgin Islands. If you use your card in these areas, you may not pay the foreign ATM fee.

Here is a quick summary of chase debit card fees when you travel:

- 3% foreign transaction fee on purchases and withdrawals in foreign currency

- $5 foreign ATM fee for each withdrawal at a non-Chase ATM outside the U.S. and U.S. territories

You should always check your account terms before you travel. Some premium Chase accounts may waive these fees, but most accounts do not.

ATM Withdrawals and Additional Charges

When you use your Chase debit card at an ATM abroad, you might face more than just Chase’s fees. Many foreign ATMs charge their own fees, called surcharge fees. These fees come from the ATM owner or network, not from Chase. They can vary by location and can add up quickly.

- You pay the $5 foreign ATM fee from Chase for each withdrawal.

- You pay the 3% foreign transaction fee on the amount you withdraw if it is not in U.S. dollars.

- The ATM operator may charge an extra fee, which is separate from Chase debit card foreign transaction fee.

Note: Some Chase accounts, like Chase Sapphire Checking, may refund these extra ATM fees. Always check your account benefits before you travel.

If you want to avoid high chase debit card fees, try to limit the number of ATM withdrawals you make. Take out larger amounts less often to reduce the total foreign ATM fee you pay. Always look for fee information on the ATM screen before you complete your transaction.

No Foreign Transaction Fees Cards

Image Source: pexels

Chase Credit Cards with No Foreign Transaction Fees

You can avoid international credit card fees by choosing a Chase credit card that offers no foreign transaction fees. Many Chase credit cards fall into this category. Here are some popular options:

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Amazon Prime Rewards Visa Card

- Aeroplan Card

- Southwest Rapid Rewards Priority Credit Card

Chase’s website lists 29 credit cards with no foreign transaction fees. This includes several cards from the Chase Sapphire and Chase Freedom families. The Amazon Prime Rewards Visa Card also charges no foreign transaction fees on purchases outside the United States. If you want a credit card that doesn’t charge foreign transaction fees, you have many choices from Chase.

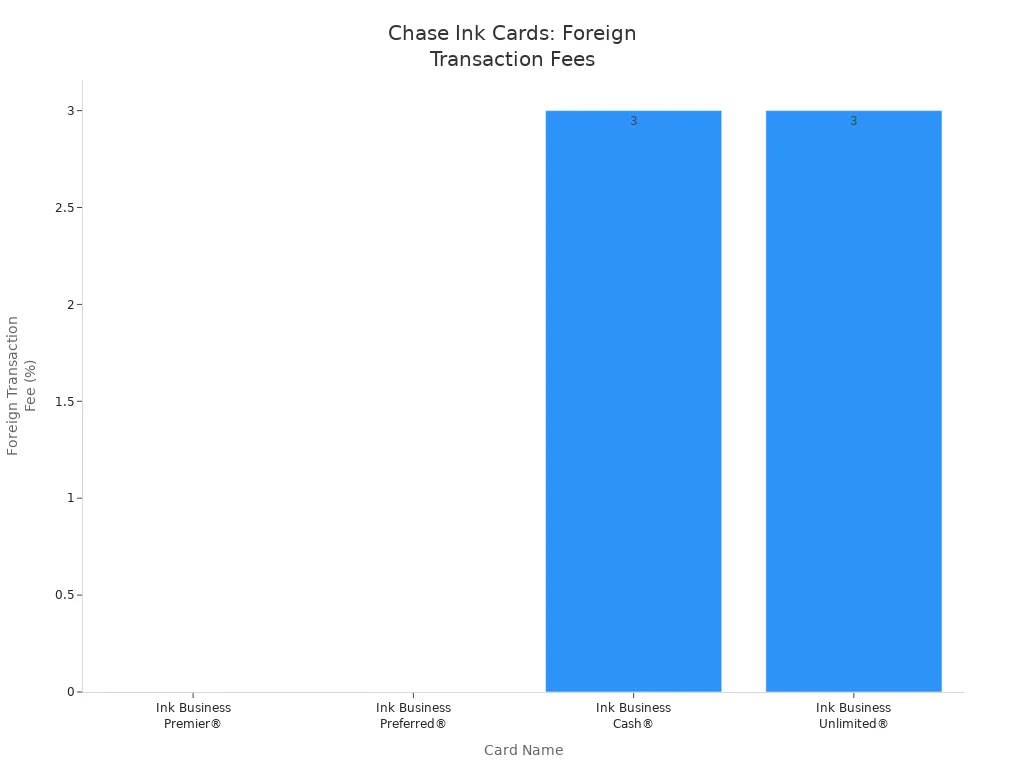

Some Chase Ink business cards offer no foreign transaction fee card benefits, while others do not. Always check the card’s terms before you apply. The table below shows which Chase Ink business cards charge international credit card fees:

| Card Name | Foreign Transaction Fee | Annual Fee |

|---|---|---|

| Ink Business Premier® Credit Card | No foreign transaction fee | $195 |

| Ink Business Preferred® Credit Card | No foreign transaction fee | $95 |

| Ink Business Cash® Credit Card | Charges 3% foreign transaction fee | $0 |

| Ink Business Unlimited® Credit Card | Charges foreign transaction fee | N/A |

The Chase Sapphire Preferred and Chase Sapphire Reserve cards stand out for international travel. Both cards have no foreign transaction fees and offer strong travel benefits. The table below compares their main features:

| Feature | Chase Sapphire Preferred | Chase Sapphire Reserve |

|---|---|---|

| Foreign Transaction Fees | None (0% foreign transaction fees worldwide) | None (0% foreign transaction fees worldwide) |

| International Acceptance | Accepted worldwide | Chip-enabled for enhanced security and wider acceptance abroad |

| Security Features Abroad | Standard security | Chip-enabled technology for enhanced security |

| Travel-related Rewards & Protections | Points on travel purchases, travel insurance benefits | Points on travel purchases, travel insurance benefits |

Note: Always review official Chase card details or trusted financial review sites to confirm current credit card fees.

How to Choose the Right Card

Selecting the best no foreign transaction fee card depends on your needs. Consider these factors when you compare Chase credit cards for international use:

- Think about your spending habits and how often you travel.

- Travel rewards credit cards give higher rewards on flights, hotels, and car rentals.

- Many travel cards offer perks like airport lounge access, free checked bags, priority boarding, travel insurance, and rental car coverage.

- No foreign transaction fees help you save on international purchases.

- Large sign-up bonuses and the ability to transfer points to airline or hotel programs can boost your rewards.

- Compare annual fees and decide if the benefits outweigh the cost.

- Read the card’s terms, including interest rates, redemption rules, and blackout dates.

- Use your card for travel bookings and expenses to maximize rewards.

You can avoid unnecessary chase credit card fees and international credit card fees by choosing a card that fits your travel style. Always check for no foreign transaction fees before you travel. This helps you manage credit card fees and enjoy your trip without extra costs.

Tips to Avoid Foreign Transaction Fees

Pay in Local Currency

When you travel abroad, you often see the option to pay in either U.S. dollars or the local currency at stores, hotels, or restaurants. Always choose to pay in the local currency. This simple choice helps you avoid foreign transaction fees that come from dynamic currency conversion. Merchants may offer to convert your purchase to U.S. dollars, but they usually add a commission fee and use a poor exchange rate.

For example, a traveler in Japan used a Chase credit card to buy a flight. The airline offered to convert the price from Japanese yen to U.S. dollars. If the traveler accepted, the total cost would have been $151.14, which included a 6.5% commission. By paying in yen, the traveler paid only $141.89. This saved more than 6.5% on just one purchase. Over a whole trip, these savings can add up. Chase also recommends paying in local currency to get the best exchange rate and avoid extra fees.

Tip: Always check your receipt before you pay. Make sure the amount is in the local currency to avoid hidden charges.

Choosing the local currency lets Chase apply its own exchange rate, which is usually better than the rate offered by the merchant. This strategy helps you avoid foreign transaction fees and keeps your travel costs lower.

Plan ATM Withdrawals

ATM withdrawals can cost more than you expect when you travel. You pay fees to both Chase and the ATM owner. For each withdrawal, Chase charges a $5 fee, and the ATM owner may add another fee, sometimes as high as $3.50. If you use out-of-network ATMs twice a month, you could pay over $100 in fees each year.

To avoid foreign transaction fees and reduce ATM costs, plan your withdrawals carefully. Take out larger amounts less often instead of making many small withdrawals. This way, you pay fewer fees overall. Use Chase’s website or mobile app to find in-network ATMs. These tools help you locate ATMs in places like grocery stores or gas stations, which can save you money.

Note: Always check if your Chase account refunds ATM fees. Some premium accounts offer this foreign transaction fee benefit.

Here are some best practices for ATM use abroad:

- Withdraw larger sums to minimize the number of transactions.

- Use in-network ATMs whenever possible.

- Check the ATM screen for any extra fees before you confirm the withdrawal.

- Keep some cash as a backup, but avoid carrying too much for safety.

By planning your ATM use, you can avoid foreign transaction fees and keep more of your money for your trip.

Notify Chase Before Traveling

You want your card to work smoothly when you travel. In the past, you needed to notify Chase before leaving the country. Now, Chase uses advanced fraud detection to monitor your account. You do not have to set a travel notice anymore. However, you should make sure your contact information is up to date. If Chase sees unusual activity, they may try to reach you by phone or email.

Tip: Update your phone number and email address in your Chase online account before your trip.

If you still want to set a travel notice, you can do it online by entering your travel dates and destinations. This step is optional. Keeping your contact details current helps Chase contact you quickly if they spot suspicious activity. This way, you avoid card disruptions and can continue to avoid foreign transaction fees while traveling.

Here is a quick checklist to help you prepare:

- Update your phone number and email with Chase.

- Carry more than one credit card in case your main card does not work.

- Check if your card is accepted in the country you plan to visit.

- Review your card’s travel benefits, such as insurance or rewards on travel purchases.

By following these steps, you can avoid foreign transaction fees and enjoy a smoother travel experience.

Common Mistakes with Chase Foreign Transaction Fees

Dynamic Currency Conversion

Many travelers make the mistake of choosing to pay in U.S. dollars when shopping or dining abroad. Merchants may offer you the option to pay in your home currency, but this process is called dynamic currency conversion. It often leads to higher costs. When you accept dynamic currency conversion, the merchant or payment processor sets the exchange rate. This rate is usually worse than what Chase provides. For example, you might see a hotel bill in Mexico for 2,000 pesos or $126 USD. The real exchange rate values 2,000 pesos at about $106 USD. By paying in dollars, you pay $20 more, which is nearly 19% extra. On top of that, Chase may still charge a foreign transaction fee, which can increase your total cost even further. Always choose to pay in the local currency to avoid these extra charges.

Using Credit Cards for Cash Advances

Using your Chase credit card for cash advances while traveling can be very expensive. Cash advances are treated as short-term loans. They come with high interest rates and extra fees. Here is a table that shows the main costs:

| Fee Type | Description | Financial Impact Example |

|---|---|---|

| Foreign Transaction Fee | 3% fee on purchases made in foreign currency or through international merchants with Chase Freedom cards | $30 fee on $1,000 spent abroad, adding up significantly |

| Cash Advance Fee | Typically 5% of the transaction or a flat fee (e.g., $10) on cash advances | Adds substantial cost on cash withdrawals |

| Cash Advance Interest Rate | High APR often near 30%, interest accrues immediately without grace period | Increases cost rapidly if balance not paid quickly |

| Additional Fees | ATM fees or app transfer fees may apply on cash advances | Further increases total cost of accessing cash abroad |

Interest on cash advances starts right away, with no grace period. You also pay a cash advance fee, usually 5% of the amount or a flat fee like $10. If you withdraw cash from an ATM or buy foreign currency with your credit card, you trigger these fees. These costs can add up quickly and make your trip much more expensive.

Ignoring Card Terms

Failing to review your Chase card terms can lead to unexpected foreign transaction fees. Many travelers think that purchases made in the U.S. or on U.S.-based websites are always free from these fees. However, if the purchase is processed in a foreign currency or by a foreign retailer, you may still pay a foreign transaction fee. These fees are usually a percentage of the transaction, such as 3% on a $100 purchase, which means you pay an extra $3. If you do not read your credit card agreement, you might not know about these charges. This can cause surprise fees when you travel or shop online from foreign merchants. Always check your card’s fine print. Using a card that waives foreign transaction fees or an alternative payment method can help you avoid these extra costs.

Alternatives to Chase for International Spending

Multi-Currency Accounts

You can use multi-currency accounts to manage your money when you travel. Wise offers an account that lets you hold over 50 currencies. You get local banking details in several countries, which makes it easy to pay or receive money without extra charges. N26 is another option, especially if you want a simple mobile banking experience. Both Wise and N26 provide debit cards that work well for international spending and have low fees.

Here is a comparison of Wise with Chase cards:

| Feature | Chase Freedom Unlimited | Chase Sapphire Cards | Wise Multi-Currency Card |

|---|---|---|---|

| Foreign Transaction Fee | 3% | None | None |

| Annual Fee | $0 | Varies | $0 (one-time card fee applies) |

| Exchange Rate | Marked up by issuer | Marked up by issuer | Real mid-market rate |

| ATM Withdrawals | Fees apply | Fees apply | Up to $250 every 30 days free |

| Convenience | Widely accepted | Widely accepted | Global use, transparent fees |

Multi-currency accounts like Wise help you avoid hidden fees and get better exchange rates. You can spend in different countries without worrying about extra charges.

Prepaid Travel Cards

Prepaid travel cards let you load money before your trip. These cards help you control your budget and protect you from overspending. You can use them at stores and ATMs worldwide. Some cards, like Netspend or PayPal Prepaid, work on major networks such as Visa or Mastercard.

Advantages:

- You limit spending to the amount you load.

- Fraud protection keeps your money safe.

- Some cards offer chip and PIN security.

Disadvantages:

- Many prepaid cards charge activation, monthly, and ATM fees.

- Foreign transaction fees can reach 3% or more.

- Some cards have poor exchange rates and limited acceptance.

- You do not earn rewards or travel perks.

Prepaid travel cards work best if you want strict control over your spending. However, Chase travel cards often give you better rates and more benefits.

Digital Wallets

Digital wallets like Apple Pay, Google Pay, and Samsung Pay make paying abroad easier. You can add your credit or debit card to your phone and pay with a tap. These wallets process payments locally, which helps you avoid extra fees. They also use tokenization to protect your card details.

Digital wallets support many currencies and often have lower processing fees than traditional cards. You get real-time notifications for each purchase, which helps you track your spending. Contactless payments also add convenience and security when you travel. Digital wallets can be a smart choice if you want fast, secure, and cost-effective payments in other countries.

You can avoid most Chase foreign transaction fees by choosing cards like Chase Sapphire Preferred or Chase Sapphire Reserve. Review your card’s terms before you travel. Set travel notifications with Chase to help prevent fraud alerts. Always pay in local currency and use travel rewards cards for extra value. Use the Chase Travel Portal to redeem points for flights and hotels. Report lost cards right away to get protection. Planning ahead helps you save money and avoid stress.

FAQ

What is the current Chase foreign transaction fee for debit cards?

You pay a 3% fee on each purchase or withdrawal made in a foreign currency. You also pay a $5 fee for each ATM withdrawal outside the United States. Always check the latest rates before you travel.

How can you check if your Chase card charges foreign transaction fees?

You can review your card’s terms online or call Chase customer service. Look for the “Pricing & Terms” section. The table below shows where to find this information:

| Method | Where to Check |

|---|---|

| Online Account | Card Benefits or Terms Page |

| Customer Service Call | Ask About Foreign Fees |

| Card Agreement | “Fees” or “Rates” Section |

Will Chase refund foreign ATM fees?

Most Chase accounts do not refund foreign ATM fees. Some premium accounts, such as Chase Sapphire Checking, may offer refunds. Always review your account benefits before you travel to see if you qualify for fee refunds.

Can you avoid foreign transaction fees by using a digital wallet?

No. If your linked Chase card charges foreign transaction fees, you still pay the fee when using a digital wallet like Apple Pay or Google Pay. The fee depends on your card, not the payment method.

While this guide helps you minimize Chase foreign transaction fees, the core challenge of managing money across borders remains. The hidden costs and unfavorable exchange rates often associated with traditional banking can significantly impact your finances. This is where BiyaPay offers a powerful and flexible solution for seamless international payments. We provide real-time exchange rates and incredibly low remittance fees, starting from just 0.5%, allowing you to move your money internationally with confidence and efficiency.

Whether you’re paying an international supplier, managing funds across different countries, or simply sending money to a family member abroad, BiyaPay supports the free conversion of various fiat and digital currencies. Our platform ensures your funds get where they need to go quickly and securely with a fast registration process and same-day delivery feature. Don’t let high fees and poor exchange rates hinder your financial freedom. Use our Real-time Exchange Rate Calculator to see how much you can save, and get started with a global financial solution that supports your lifestyle. Register now to simplify your international money transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.