- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding ABA Numbers and Easy Ways to Locate Them

Image Source: pexels

You might wonder, “What is an ABA number and how do I find an aba number?” An aba number, also known as an aba routing number or routing transit number, is a nine-digit number that helps identify U.S. financial institutions. You can spot your routing number on a check, use online banking, visit your bank’s website, or call customer service. The routing number is easy to locate and plays a key role in making sure your money goes to the right place.

Key Takeaways

- An ABA number is a unique nine-digit code that identifies U.S. banks and helps direct money to the right place.

- You can find your ABA number on the bottom-left of your checks, in your online banking account, on your bank’s website, or by calling customer service.

- Using the correct ABA number is crucial for safe and accurate payments like direct deposits, wire transfers, and bill payments.

- Banks may have different ABA numbers for various transaction types, so always verify the right number before sending money.

- Double-checking your ABA number helps prevent delays, errors, and lost funds, keeping your transactions smooth and secure.

ABA Number Basics

Image Source: unsplash

Definition

You may see the term ABA number when you open a bank account or write a check. The ABA number, also called the ABA routing number or routing transit number, is a unique nine-digit number assigned to each financial institution in the United States. The American Bankers Association created this system in 1910 to help banks identify each other during transactions. You can find the routing number printed on the bottom of your checks, usually on the left side. This number acts as an electronic address for your bank or credit union. It is different from your bank account number, which identifies your personal account.

Note: The ABA number is not the same as your bank account number. The routing number points to your bank, while your bank account number points to your specific account.

Purpose

The main purpose of the ABA routing number is to help banks process payments and direct deposits. When you send money, pay bills, or receive a paycheck, the routing number tells the system which bank should handle the transaction. You use the routing number for check payments, ACH transfers, and some wire transfers. The ABA number ensures that your money moves safely and reaches the correct bank. Both personal and business accounts use the ABA number in the same way. The routing number is essential for accurate and secure payments in the U.S. banking system.

Structure

The ABA number has a clear structure. It always has nine digits. The first four digits show the Federal Reserve Routing Symbol. The next four digits identify your financial institution. The last digit is a check digit. This check digit helps banks check if the routing number is valid. Banks use special tools to verify the routing number before processing a transaction. This process helps prevent errors and fraud. The routing number appears on the MICR line of your check, making it easy for machines to read and process.

Banks, customers, and government agencies all use the ABA number to verify accounts and reduce mistakes. This system helps keep your transactions safe and accurate.

ABA Routing Number vs. Routing Number

Differences

You may see both “ABA routing number” and “routing number” when you handle bank transactions. Many people wonder if there is a difference between these terms. In reality, there is no difference. Both terms refer to the same nine-digit code that identifies a U.S. financial institution. The American Bankers Association created this system in 1910. The routing number helps banks process checks, ACH payments, and wire transfers.

You use the routing number for many tasks:

- Setting up direct deposits

- Making automatic bill payments

- Sending wire transfers

- Completing ACH payments

- Ordering checks

The routing number aba format stays the same for all banks in the United States. You can find this number on your checks, in your online banking account, or by asking your bank.

Why the Terms Overlap

You may notice that banks use “ABA routing number,” “routing number,” and “Routing Transit Number (RTN)” in different places. These terms all mean the same thing. The American Bankers Association, or ABA, created the numbering system. Because of this, some people call it the ABA routing number. Others use “routing number” or “RTN.” No matter which term you see, they all point to the same nine-digit code.

Note: The terms are interchangeable. You do not need to worry about which one to use. When a form asks for your routing number, you can use the number found on your check or in your bank account details.

Banks, employers, and payment services all use the routing number to make sure your money goes to the right place. This system helps keep your transactions safe and accurate.

Find an ABA Number

Image Source: pexels

You have several reliable ways to find an aba number. Each method works well, whether you prefer paper checks, digital banking, or direct communication with your bank. Below, you will find step-by-step instructions for each approach.

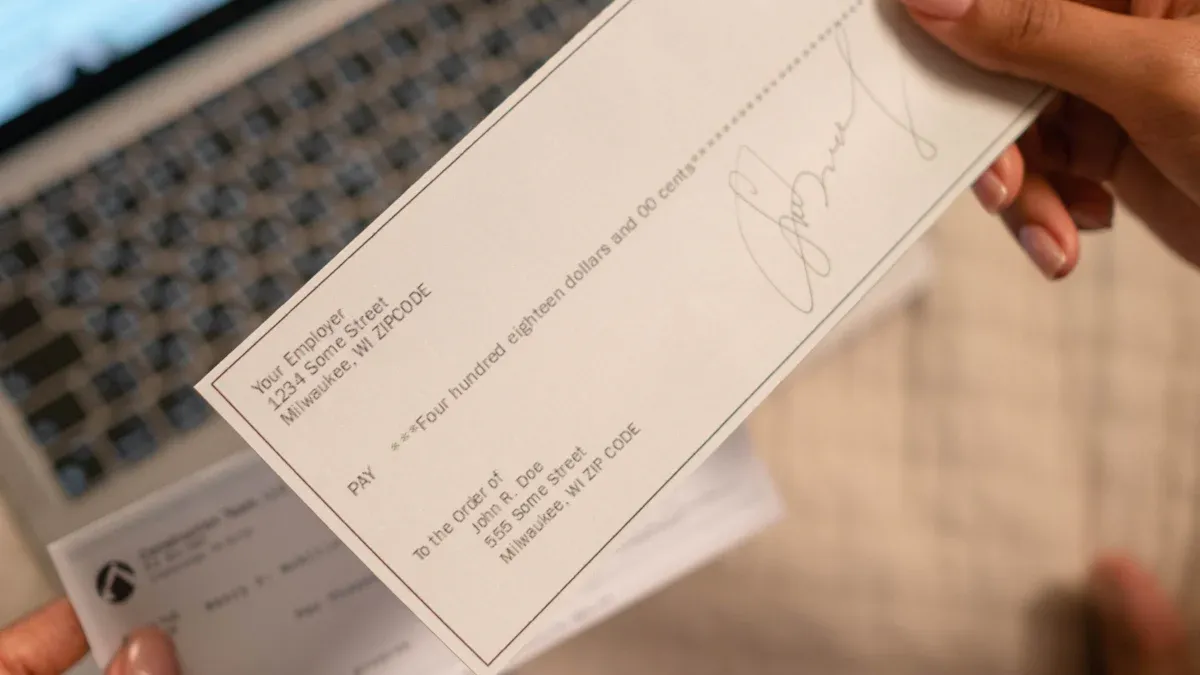

On a Check

A check provides one of the easiest ways to find an aba number. Every standard U.S. check displays the routing number in a specific location and format.

- Look at the bottom-left corner of your check.

- The first nine-digit number you see is the aba number.

- This number appears on both personal and business checks.

- It is printed in magnetic ink, which allows machines to read it quickly.

- Some checks may also show a fractional routing number near the top, but always use the nine-digit number at the bottom for transactions.

The aba routing number is the first set of nine digits in the MICR line at the bottom of your check. It comes before your account number and the check number. Special symbols surround the routing number, making it easy for banks to identify.

Online Banking

You can also find an aba number by logging into your online banking account or using your bank’s mobile app. Most banks display this information in your account details.

- Log in to your online banking portal or open your mobile banking app.

- Navigate to the section labeled “Account Information” or “Account Summary.”

- Look for the routing number listed with your account details.

- Some banks, such as Bank of America, provide state-specific routing numbers. The correct number depends on where you opened your account and the type of transaction you want to make.

- Do not assume the routing number based on your current location. Always check the details for your specific account.

Many major banks have multiple routing numbers. You may see different numbers for electronic payments, paper checks, and wire transfers. Always verify you have the right bank routing number for your transaction.

Bank Website

Bank websites offer helpful tools to help you find an aba number. Many banks provide routing number lookup features, and you can also use third-party resources.

- Visit your bank’s official website.

- Search for a section called “Routing Number Lookup” or “ABA Number Finder.”

- Enter your account information or select your state and account type to get the correct nine-digit number.

- Some banks list routing numbers on their FAQ or support pages.

- The American Bankers Association offers an official Routing Number Lookup service. You can use this tool to verify a routing number up to two times per day for free.

- Other websites, such as CHAX, allow you to search by routing number or bank name.

Always use official bank websites or trusted lookup tools to confirm your aba number. This helps prevent errors and ensures your transactions go through smoothly.

Customer Service

If you cannot find an aba number using the above methods, contacting your bank’s customer service is a good option. Bank representatives can provide the correct routing number for your account and transaction type.

- Call your bank’s customer service number or visit a local branch.

- Be ready to provide your name, account number, and the name of your bank.

- Explain the type of transaction you want to make, such as a wire transfer or ACH payment.

- The bank representative will confirm the correct aba number for your needs.

Banks may use different aba numbers based on location and transaction type. If you feel unsure about the number you found on a check or online, always double-check with customer service. This step helps you avoid transaction errors.

By following these steps, you can easily find an aba number using a check, online banking, your bank’s website, or customer service. Always verify the nine-digit number before making any transaction to ensure your money reaches the right place.

ABA Number for Transfers

Wire Transfers

When you send wire transfers within the United States, you need to provide the recipient’s ABA routing number. This nine-digit code helps the banking system send your money to the right place. The Federal Reserve Banks use ABA numbers in their Fedwire Funds Service. This system moves money between banks quickly and safely. Private systems like CHIPS also use ABA numbers for wire transfers.

You must give the recipient’s name, address, bank account number, and ABA routing number. The bank uses this information to make sure the wire transfer goes to the correct financial institution. Wire transfers usually finish on the same day. Once you start a wire transfer, you cannot cancel it. For this reason, you must check the ABA routing number before you send money. Using the correct ABA number keeps your funds safe and helps avoid mistakes.

Tip: Always double-check the ABA routing number before sending wire transfers. A small error can send your money to the wrong bank.

ACH Payments

ACH transactions use ABA routing numbers to move money between banks. When you set up direct deposits, pay bills, or transfer money online, the ABA number acts like an address for your bank. This number works with your bank account number to make sure your money goes to the right place.

ACH transactions include things like payroll, utility payments, and online transfers. The ABA number helps prevent errors and delays. If you use the wrong routing number, your payment might not go through. Organizations like Nacha and LexisNexis Risk Solutions help keep routing number data up to date. This makes sure ACH transactions stay accurate and secure.

Note: You need the correct ABA routing number for direct deposits, recurring payments, and other ACH transactions.

International Transfers

ABA numbers work for international transfers only when you send money into the United States. If you want to send money from another country to a U.S. bank, you need the ABA number to identify the U.S. bank. However, ABA numbers do not work for sending money out of the United States. For international wire transfers, you must use codes like SWIFT/BIC or IBAN.

| Code Type | Usage | Region | Purpose |

|---|---|---|---|

| ABA Number | U.S. transfers | USA | Identifies U.S. banks |

| SWIFT/BIC | International transfers | Global | Identifies banks worldwide |

| IBAN | International transfers | Europe and others | Identifies specific bank accounts |

ABA numbers work for international transfers only when you receive money in the U.S. For sending money out, you need a SWIFT/BIC or IBAN code. When you receive international wire transfers, your bank may ask for both the ABA number and a SWIFT code. This helps route the funds correctly.

Remember: ABA numbers are for U.S. banks. For international wire transfers, always check if you need a SWIFT/BIC or IBAN code.

Importance

Transaction Accuracy

You need to use the correct aba number for every transaction. This nine-digit code helps banks identify where to send your money. When you enter the wrong routing number, several problems can happen:

- Delays in funds reaching the recipient.

- Money sent to the wrong bank account.

- Transactions rejected if the routing number does not match other bank details.

- Extra fees or penalties, even if the transaction fails.

- Businesses may face late payroll or vendor payments.

The aba number is essential for electronic funds transfers, including direct deposits, bill payments, and wire transfers. If you use an incorrect or invalid aba number, your payment may not go through. You might see delays or even lose money if funds go to the wrong place. Always check the routing number before you start a transfer. This step helps you avoid mistakes and keeps your money safe.

Tip: The aba number acts like an address for your bank. Using the right number ensures your payment arrives on time and in the right account.

Double-Check with Your Bank

Banks recommend that you always verify the aba number before making a payment. You can follow these steps to double-check your routing number:

- Look at the bottom-left corner of your check for the nine-digit aba number.

- If you do not have checks, log in to your bank’s online portal or mobile app to find the routing number.

- Check your bank account statements for the routing number.

- If you still feel unsure, ask a banker at your local branch to confirm the number.

These steps help prevent errors, delays, or lost funds. Verifying the aba number is especially important for direct deposits and wire transfers. If you ever have doubts, contact your bank before sending money. Taking a few minutes to double-check can save you from costly mistakes.

Knowing your aba number helps you keep your money safe and your payments accurate. When you use the correct routing number, you make sure your funds reach the right bank. The routing number includes a special check digit that helps prevent mistakes and fraud. Always follow the steps in this guide to find your aba number and double-check with your bank if you feel unsure. This simple habit protects your transactions and gives you peace of mind.

FAQ

What if my bank has more than one ABA routing number?

Banks often use different ABA numbers for various account types or regions. Always check your account details or contact customer service to confirm the correct number for your transaction.

Can I use the same ABA number for wire transfers and ACH payments?

Not always. Some banks assign separate ABA numbers for wire transfers and ACH payments. You should verify which number to use by checking your bank’s website or asking customer service.

Where can I find the ABA number on my check?

You will see the ABA number as the first nine digits at the bottom left of your check. This number appears before your account number and check number.

What is the difference between an ABA number and a SWIFT code?

| ABA Number | SWIFT Code |

|---|---|

| Used in the U.S. | Used worldwide |

| 9 digits | 8–11 characters |

| For U.S. banks | For global banks |

You use an ABA number for U.S. transfers. You use a SWIFT code for international transfers.

While this guide helps you understand and find your ABA number for domestic U.S. transfers, the complexity of international payments is a different story. When you need to send money abroad, relying on traditional banking with its high fees, unfavorable exchange rates, and slow processes can be a major challenge. This is where BiyaPay offers a powerful and flexible solution for seamless global money transfers. We provide real-time exchange rates and incredibly low remittance fees, starting from just 0.5%, allowing you to send money internationally with confidence and efficiency.

Our platform supports the free conversion of various fiat and digital currencies, so you can easily pay international suppliers, send money to family, or handle any cross-border financial need without the typical hidden costs. The fast registration process and same-day delivery feature ensure your funds get where they need to go quickly and securely. Don’t let the complexities of international finance slow you down. Use our Real-time Exchange Rate Calculator to see how much you can save, and get started with a secure, global financial solution. Register now to simplify your international money transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.