- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding PNC ATM Withdrawal Limits

Image Source: pexels

You need to know your PNC ATM withdrawal limit before you try to withdraw cash. The PNC ATM withdrawal limit depends on your account and card type. For example, standard accounts often allow a daily ATM withdrawal limit between $500 and $1,500. If you have a PNC Virtual Wallet, the daily withdrawal limit usually sits at $500. These limits can change based on the ATM you use and the operator’s own restrictions. PNC withdrawal limits match industry standards, with most banks setting daily ATM withdrawal limits from $500 to $1,000. You should always check your ATM withdrawal limits to avoid surprises, especially in emergencies.

Key Takeaways

- PNC ATM withdrawal limits vary by account and card type, usually ranging from $500 to $1,500 daily.

- You can check your current withdrawal limit using PNC’s online app, customer service, or your cardholder agreement.

- PNC allows temporary or permanent increases to your withdrawal limit if you need more cash.

- Using PNC ATMs is free, but non-PNC or international ATMs may charge fees depending on your account.

- For larger cash needs, visit a PNC branch or use cash back at stores, which have higher or different limits.

PNC ATM Withdrawal Limit

Image Source: pexels

Standard Limits

You need to know the standard limits before you use your PNC card at an ATM. The pnc atm withdrawal limit depends on your account type and the card you use. Many PNC Virtual Wallet accounts have a daily atm withdrawal limit of $500. Other standard accounts may allow you to withdraw between $500 and $1,500 each day. Some accounts have different limits, so you should always check your specific details.

Here is a table that shows the typical daily atm withdrawal limits for different PNC account types:

| Account/Card Type | Standard Daily ATM Withdrawal Limit | Notes |

|---|---|---|

| Many PNC Virtual Wallets | $500 | Standard daily limit; may vary by personal circumstances and ATM type |

| Other PNC Accounts | Varies | Limits depend on specific account and card type; no detailed standard limits provided |

| ATM Type | Varies | Regular ATMs and video banking ATMs may have different limits |

| Limit Reset | End of each day | Reset time may vary depending on ATM time zone |

You can see that the atm withdrawal limits are not the same for every account. The limit resets at the end of each day, but the exact time may depend on the ATM’s time zone. If you need to check or adjust your limit, you can use online banking or contact customer service.

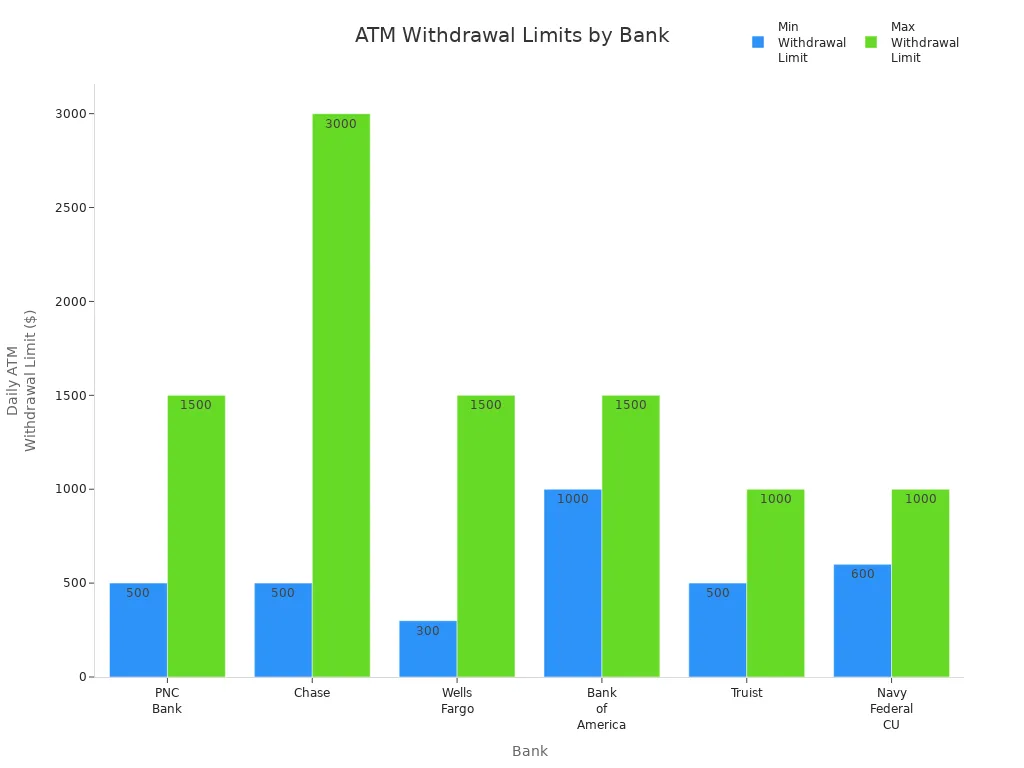

When you compare pnc atm withdrawal limits to other major banks, you will find that PNC’s limits are similar to the industry average. Here is a table that shows how PNC compares to other banks in the United States:

| Bank or Provider | Typical Daily ATM Withdrawal Limit | Increase Possible? |

|---|---|---|

| PNC Bank | $500 to $1,500 | Yes |

| Chase | $500 to $3,000 | Yes |

| Wells Fargo | $300 to $1,500 | Yes |

| Bank of America | $1,000 to $1,500 | Yes |

| Truist | $500 to $1,000 | Yes |

| Navy Federal Credit Union | $600 to $1,000 | Yes |

You can also view this comparison in the chart below:

The average daily atm withdrawal limits at PNC fall within the range of other large banks. You can request a higher limit if you need more cash access.

Note: In February 2024, PNC Bank increased atm withdrawal limits on several products. This change came after feedback from clients and employees. You may notice higher limits than before if you have used PNC for a long time.

PaySource and Other Cards

If you have a PaySource card, you can withdraw up to $2,500 each day at the atm. This is much higher than the standard limit for most accounts. PaySource cards are designed for people who need larger cash withdrawals, such as for payroll or business needs. Other special cards may also have different cash withdrawal limits, so you should check your cardholder agreement or ask customer service for details.

Some ATMs may have their own per-transaction limits. Even if your card allows a higher withdrawal, the atm may only let you take out a smaller amount at one time. You may need to make several transactions to reach your daily limit.

Factors Affecting Limits

Several factors can affect your pnc atm withdrawal limit:

- Account Type: Your account type sets the base limit. Virtual Wallet accounts usually have lower limits than business or premium accounts.

- Card Type: Some cards, like PaySource, have higher withdrawal limits.

- ATM Type: Some ATMs, especially those not owned by PNC, may set lower per-transaction limits.

- Location: Limits may change if you use your card outside the United States.

- Account History: If you have a new account or a history of overdrafts, your limit may be lower.

- Recent Policy Updates: PNC reviews and updates withdrawal limits based on customer feedback and security needs.

PNC has also upgraded many of its ATMs to dispense $1 and $5 bills. This makes it easier for you to withdraw the exact amount you need, even if it is less than $20.

You should always know your atm withdrawal limits before you need cash. This helps you plan for daily spending and emergencies. If you need to withdraw more than your current limit, you can ask PNC for a temporary or permanent increase.

How to Check ATM Withdrawal Limits

Image Source: pexels

Knowing your atm withdrawal limit helps you plan your cash needs. You have several ways to find out your current limits. Each method gives you quick access to the information you need.

Online and Mobile App

You can use PNC’s online banking or mobile app to check your limits. Log in to your account and look for your card details. Most users find the withdrawal limit listed under card settings or account services. If you do not see it, you can use the secure message feature to ask about your atm withdrawal limit. Many people prefer this method because it is fast and available 24/7.

Tip: Set up account alerts in the app. These alerts notify you if you reach your daily withdrawal limit.

Customer Service

If you want to speak with someone, call PNC customer service. The phone number appears on the back of your card and on the PNC website. When you call, have your card and account information ready. The representative can tell you your current withdrawal limit and answer questions about your atm usage. You can also visit a PNC branch and ask a banker to help you check your limits in person.

Cardholder Agreement

Your cardholder agreement explains your withdrawal limits. You receive this document when you open your account or get a new card. Look for the section about atm transactions and daily limits. If you cannot find your agreement, you can request a copy from PNC. Reading this document helps you understand all the rules about atm withdrawals.

Note: Always check your limits before you travel or plan a large withdrawal. This step helps you avoid declined transactions and surprises at the atm.

Increase Daily ATM Withdrawal Limits

Temporary Increase

Sometimes you need more cash than your usual withdrawal limit allows. You can request a temporary increase to your PNC ATM withdrawal limit if you plan a large purchase or need extra funds for travel. To start this process, contact PNC Bank using one of these methods:

- Call PNC Bank’s customer service.

- Visit a local PNC branch.

- Use secure messaging through your online banking account.

When you speak with a representative, explain that you want a temporary increase. Make sure to mention the reason for your request. PNC can adjust your daily withdrawal limits for a short period, often to help with special situations. The bank usually reviews your account before approving the change.

Tip: Always request a temporary increase before you need the extra cash. This helps you avoid declined transactions at the ATM.

Permanent Increase

If you find that your current withdrawal limit does not meet your regular needs, you can ask for a permanent increase. You should contact PNC Bank by phone or visit a branch to make this request. The bank will review your account type, card type, and payment history. Good account management, such as no overdrafts and a positive balance, can improve your chances of approval. PNC does not require special documents for this process, but the decision depends on your account details.

A permanent increase can help if you often need more cash or want to increase your debit purchase limit for larger transactions.

Approval Factors

PNC Bank looks at several factors before approving any increase to your withdrawal limits. These include:

- Your account type and card type.

- Your account history, including overdrafts or negative balances.

- Any recent fraudulent activity.

- The reason for your request.

If you have a strong account history and manage your money well, you are more likely to receive an increase. Frequent overdrafts or negative balances may make approval harder. Always keep your account in good standing to improve your chances.

ATM Withdrawal Fees

PNC ATMs

You can use any PNC ATM without paying withdrawal fees. PNC has thousands of ATMs across the United States. When you use your PNC card at these machines, you do not pay extra charges for cash withdrawal. This makes it easy to access your money without worrying about extra costs.

Note: Always look for the PNC logo on the ATM to make sure you avoid unnecessary fees.

Non-PNC ATMs

If you use an ATM that does not belong to PNC, you may face withdrawal fees. The amount you pay depends on your account type. Some accounts, like Virtual Wallet with Performance Spend, give you a few fee reimbursements each month. Others, such as the basic Virtual Wallet, do not offer any reimbursement. Here is a table to help you understand the fees for different accounts:

| Account Type | Fee for Non-PNC ATM Use | Reimbursement Details |

|---|---|---|

| Virtual Wallet® with Performance Spend | $3 per transaction | First two fees reimbursed; up to $5 for surcharge fees per statement cycle |

| Virtual Wallet® with Performance Select | No PNC fees | Up to $10 reimbursed monthly for other banks’ ATM fees |

| Basic Virtual Wallet® | $3 per transaction | No reimbursement |

You may also pay a surcharge from the ATM operator, which is separate from PNC’s fees. Some accounts help cover these extra charges, but not all do.

International Fees

When you travel outside the United States, you may need to use your PNC card at foreign ATMs. PNC charges withdrawal fees for these transactions. The fee amount depends on the country and your account type. Here is a table that shows the typical fees:

| Location | ATM Withdrawal Fee (USD) |

|---|---|

| Canada, Puerto Rico, US Virgin Islands | $3 |

| All other countries | $5 |

| Performance Select Checking Account | $0 (ATM fees waived) |

Most accounts also have a 3% foreign transaction fee on top of the withdrawal fees. PNC adds a currency conversion markup, so you may get a less favorable exchange rate. Some foreign ATMs may charge their own fees, which are not controlled by PNC. If you see an option for Dynamic Currency Conversion, choose to be charged in the local currency to avoid extra costs.

Tip: Check your account type before you travel. Some accounts waive international withdrawal fees and can save you money.

Debit Purchase Limits and Alternatives

Debit Purchase Limits

You use your PNC debit card for more than just ATM withdrawals. Debit purchase limits set the maximum amount you can spend on purchases each day. These limits are usually higher than ATM withdrawal limits. You can use your card for shopping, paying bills, or getting cash back at stores. The daily debit purchase limits for PNC debit cards range from $2,000 to $5,000, depending on your account type. This range gives you flexibility for larger purchases.

Here is a table that shows the difference between ATM withdrawal and debit purchase limits:

| Limit Type | Amount for PNC Debit Cards |

|---|---|

| Daily ATM Withdrawal Limit | $2,500 |

| Daily Debit Purchase Limit | $2,000 to $5,000 |

Debit purchase limits help protect your account from fraud. If you need to spend more, you can ask PNC to review your limit. Remember, these limits include all debit card transactions, such as in-store and online purchases.

Note: Debit purchase limits may change based on your account history or if you request an increase.

In-Branch Withdrawals

If you need more cash than your ATM or debit card allows, you can visit a PNC branch. Teller withdrawals let you take out much larger amounts. While the ATM withdrawal limit is $2,500 per day, you can usually withdraw up to $20,000 in cash at a branch. Bank staff will ask for your ID and may ask about your withdrawal. This process keeps your money safe and helps prevent fraud.

| Withdrawal Method | Maximum Daily Limit at PNC |

|---|---|

| ATM Withdrawal | $2,500 |

| Branch Teller | Up to $20,000 |

You should plan ahead if you need a large sum. Some branches may need extra time to prepare large amounts of cash.

Cash Back at Stores

You can also get cash back when you make a purchase at many grocery stores or retailers. This option lets you access cash without visiting an ATM. The cash back amount counts toward your daily debit purchase limits. Most stores set their own cash back limits, often between $20 and $100 per transaction. You do not pay a fee for cash back at most stores, so this method can save you money.

Tip: Always check your available balance and daily debit purchase limits before requesting cash back. This step helps you avoid declined transactions.

Knowing your PNC ATM withdrawal limit helps you manage your cash needs. You avoid surprises when you check your limit before making withdrawals. Always review your account for possible fees. If you need more cash, you can request a higher limit or use in-branch services.

Staying informed about your withdrawal options gives you more control over your money and helps you plan for emergencies.

FAQ

What should you do if your ATM withdrawal is declined?

Check your account balance first. Make sure you have not reached your daily withdrawal limit. If the problem continues, contact PNC customer service. You can also visit a branch for help.

Can you change your ATM withdrawal limit online?

You cannot change your ATM withdrawal limit directly online. You must contact PNC customer service or visit a branch. Use secure messaging in online banking to request a review of your limit.

How do ATM withdrawal limits differ from debit purchase limits?

ATM withdrawal limits control how much cash you can take out each day. Debit purchase limits set the maximum you can spend with your card. Here is a quick comparison:

| Limit Type | Typical Range |

|---|---|

| ATM Withdrawal | $500–$2,500 |

| Debit Purchase | $2,000–$5,000 |

Are there extra fees for using a non-PNC ATM?

Yes, you may pay a fee to PNC and a surcharge from the ATM operator. Some accounts offer fee reimbursements. Always check your account details before using a non-PNC ATM.

While this guide helps you understand PNC’s ATM withdrawal limits, the core challenge of managing money across borders remains. High fees and unfavorable exchange rates often associated with traditional banking can significantly impact your finances, especially when you need to access cash abroad. This is where BiyaPay offers a powerful and flexible solution for seamless global money transfers. We provide real-time exchange rates and incredibly low remittance fees, starting from just 0.5%, allowing you to move your money internationally with confidence and efficiency.

Whether you’re paying an international supplier, managing funds across different countries, or simply sending money to a family member abroad, BiyaPay supports the free conversion of various fiat and digital currencies. Our platform ensures your funds get where they need to go quickly and securely with a fast registration process and same-day delivery feature. Don’t let high fees and poor exchange rates hinder your financial freedom. Use our Real-time Exchange Rate Calculator to see how much you can save, and get started with a global financial solution that supports your lifestyle. Register now to simplify your international money transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.