- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What You Need to Know About Western Union Fees and Savings

Image Source: pexels

When you transfer money with western union, you want your loved ones to get as much as possible. Western union fees can take a real bite out of your transfer, especially since the company handles more payments than any other provider in the world. You might not notice at first, but exchange rate markups and extra charges often mean your recipient gets less than expected. Small fees add up, and even a difference of $11 on a single transfer can make a big impact over time. Take a closer look at your money transfer habits—sometimes, a few small changes can help you save more than you think.

Key Takeaways

- Western Union charges fees and exchange rate markups that can reduce the amount your recipient gets, so always check the total cost before sending money.

- Paying with a debit card or bank transfer usually costs less than using a credit card or cash, which often have higher fees and extra charges.

- Sending money online or through the app often offers lower fees and special promotions compared to in-person transfers.

- Use Western Union’s online fee estimator and look for promotions or coupons to save money on transfer fees.

- Compare fees and exchange rates from different providers to find the best deal and keep more money in your and your recipient’s hands.

Western Union Fees Overview

Image Source: unsplash

What Are Western Union Fees

When you send money with Western Union, you pay more than just the amount you want to transfer. Western union fees are the extra costs you pay for using their service. These money transfer fees can change based on where you send money, how you pay, and how your recipient gets the funds. You might notice that sending money for cash pickup costs more than sending it to a bank account. If you use a credit card, you may see even higher fees because your card company can charge extra for a cash advance.

Western Union sets different fees for each type of transaction. For example, if you send money online, you might pay less than if you go to a store. The company also adds a small markup to the exchange rate when you send money to another country. This means you pay a little more than the real exchange rate, and Western Union keeps the difference. These hidden costs can add up, so it’s smart to check the total cost before you finish your transaction.

Tip: Always use Western Union’s online fee estimator before you send money. This tool helps you see the exact money transfer fees and exchange rates for your transaction.

Here’s a quick look at the main types of fees you might see:

| Fee Type | Description | Fee Range / Notes |

|---|---|---|

| Outgoing Wire Transfer | Charged for sending money within the US or to another country | $20-$35 (US), $35-$50 (international) |

| Incoming Wire Transfer | Charged for receiving money | $0-$16 |

| Intermediary Transfer Fee | Extra fee from third-party banks helping with the transaction | Varies |

| Exchange Rate Markup | Extra cost added to the currency exchange rate | Varies; can be high for large transfers |

| Additional Fees | Fees for online vs. in-person, cancellation, or other services | Varies; check before you send |

Western union fees can also change if you are a loyalty program member or if there is a special promotion. Sometimes, you can get a better deal if you send money during a promotional period.

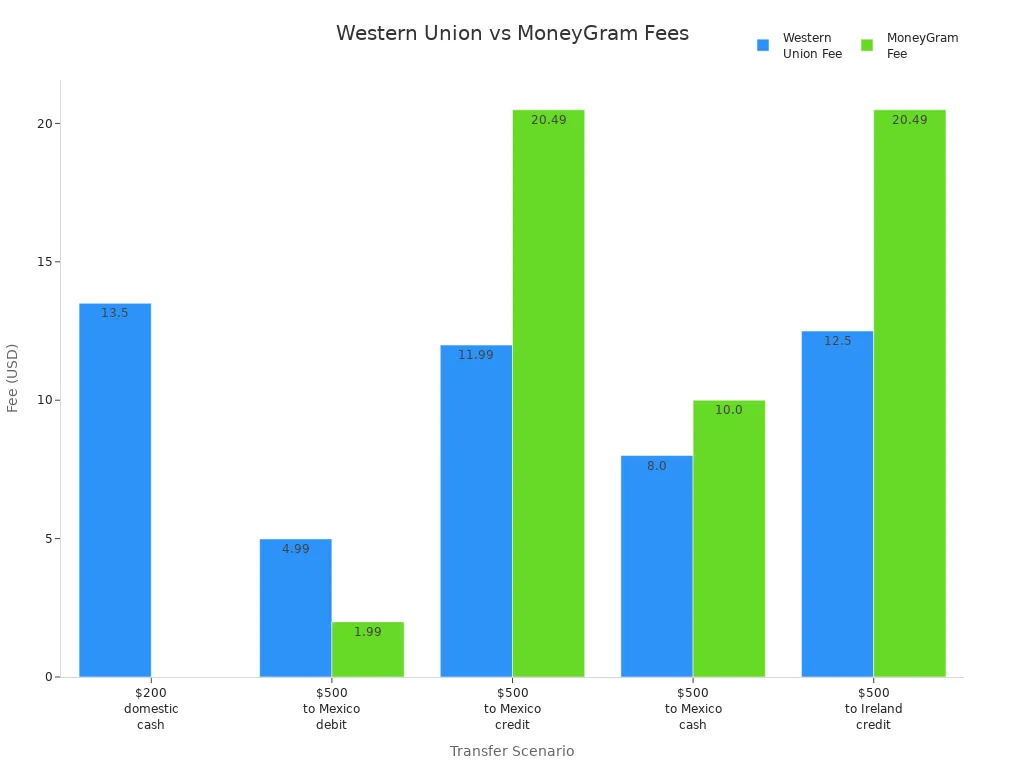

You might wonder how Western Union compares to other services. Take a look at this chart to see how their fees stack up against MoneyGram for different transaction types:

As you can see, western union fees are often higher than some other services, especially for cash-funded or online debit card transactions. Always compare both the money transfer fees and the exchange rate before you choose a service.

Why Fees Are Charged

You might ask, “Why do I have to pay so many fees when I just want to send money?” Western Union charges money transfer fees for several reasons. First, these fees help cover the cost of moving your money quickly and safely. Western Union has a huge network that lets you send money almost anywhere in the world. They need to pay for staff, technology, and security to keep your transaction safe.

The company also needs to follow strict rules from financial regulators, like the New York State Department of Financial Services. These rules help protect your money, but they also add to the cost of each transaction. Western Union says their fees are clear and easy to understand. They want you to know exactly what you will pay before you finish your transaction. You can use their online calculator to see all the costs, including the exchange rate and any extra fees.

Note: Western Union says their money transfer fees are often lower and more transparent than traditional banks. Banks sometimes hide fees or use confusing exchange rates, but Western Union tries to show you all the costs up front.

Here are some reasons why you pay fees when you use Western Union:

- You pay for convenience and speed. Some transfers arrive in minutes.

- You pay for security. Western Union uses strong systems to protect your transaction.

- You pay for global reach. You can send money to many countries and pick from different delivery options.

- You pay for transparency. Western Union shows you the total cost before you send money.

Every transaction is different. The amount you pay depends on how much you send, where you send it, and how you pay. Always check the total money transfer fees and the exchange rate before you complete your transaction. This way, you can make sure your recipient gets as much money as possible.

Types of Money Transfer Fees

Transfer Fees

When you send money with Western Union, you pay money transfer fees for each transaction. These fees depend on how much you send, where you send it, and how you pay. For international money transfer fees, you usually pay between 0.5% and 4% of the amount sent. If you send $100, you might pay anywhere from $0.65 to $3.76 in fees. The total cost changes if you use a credit card, pay in cash, or send money online. Western Union also gives you a fee estimate before you finish your transaction. If you join their loyalty program, you can sometimes get lower money transfer fees.

Tip: Always check the fee estimate before you send money. This helps you avoid surprises and hidden charges.

Exchange Rate Markups

You might think you only pay the listed fees, but currency conversion can add extra costs. Western Union uses its own exchange rates, not the mid-market rates you see online. This means you get less foreign currency for your money. The markup depends on the amount, the country, and the payment method. Larger transactions often have bigger markups. Sometimes, banks in the middle of the transaction add their own rates, which can make the total cost higher. Exchange rates change all the time, so it helps to watch them if you want to save on international money transfer fees.

- Western Union sets its own exchange rates for each transaction.

- Markups can be higher for large transactions or certain countries.

- Intermediary banks may add more charges for currency conversion.

Receiving Fees

Some transactions come with receiving fees. If your recipient picks up cash or gets the money in their bank account, the receiving bank might charge a fee. These charges can range from $0 to $16, depending on the bank and country. Always ask your recipient to check with their bank before you send money. This way, you both know the total money transfer fees for the transaction.

Other Charges

You might see other charges with your money transfer. These can include fees for canceling a transaction, changing the delivery method, or using special services. Sometimes, hidden charges show up if you use a credit card, because your card company might treat the transaction as a cash advance. Always read the fine print before you finish your transaction. If you use a Hong Kong bank, check if they add extra fees for currency conversion or international transfers.

Note: Money transfer fees can add up fast. Always review all charges before you send money to make sure your recipient gets the most from your transaction.

Fee Examples

Domestic Transfers

When you send money within the United States using Western Union, you pay domestic transfer fees that usually range from $20 to $35. The exact cost depends on how much you send and how you pay. If your recipient uses a Hong Kong bank, incoming wire transfer charges can be anywhere from $0 to $16. Always check with the receiving bank before you send money, so you know what to expect.

International Transfers

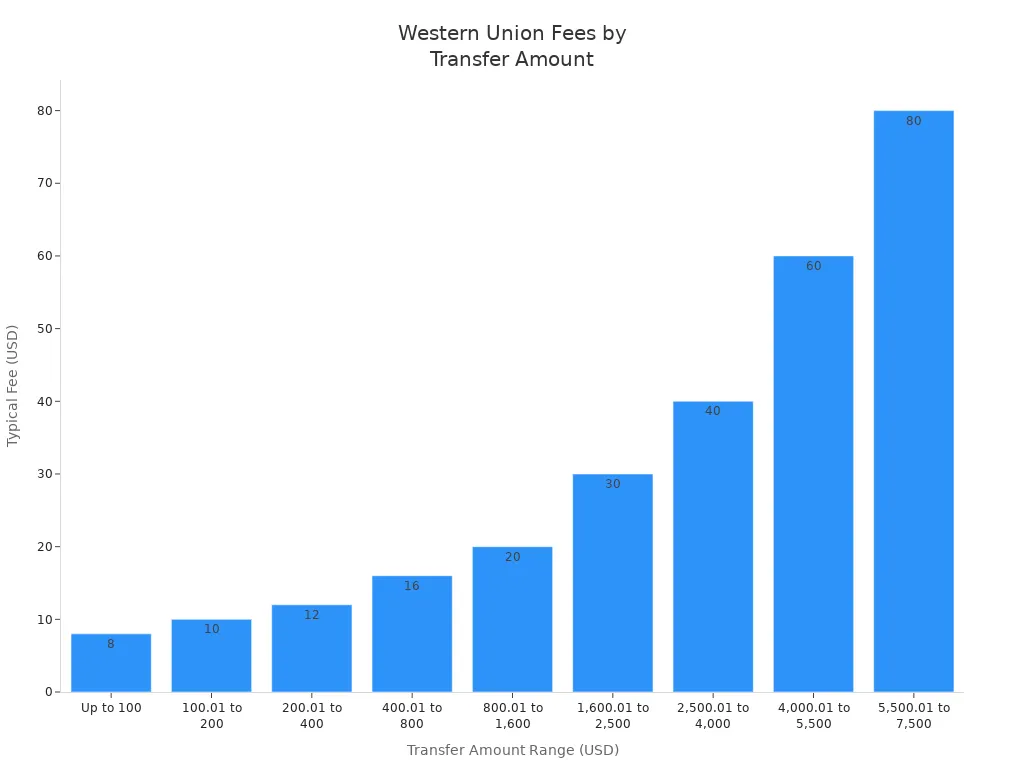

International money transfers often cost more than sending money within the US. The fee depends on the amount you send and the country you choose. For popular destinations like India and the Philippines, here’s a quick look at typical international transfer fees:

| Transfer Amount Range (USD) | Typical Transfer Fee (USD) |

|---|---|

| Up to 100 | 8 |

| 100.01 to 200 | 10 |

| 200.01 to 400 | 12 |

| 400.01 to 800 | 16 |

| 800.01 to 1,600 | 20 |

| 1,600.01 to 2,500 | 30 |

| 2,500.01 to 4,000 | 40 |

| 4,000.01 to 5,500 | 60 |

| 5,500.01 to 7,500 | 80 |

You can see that the cost goes up as you send more money. International charges also include exchange rate markups, which means you might pay more than just the listed fee.

Payment Methods

The way you pay for your transfer changes the total cost. Here’s a quick guide:

| Payment Method | Cost Impact | Notes |

|---|---|---|

| Credit Card | Higher fees + immediate interest charges | Extra fees and interest increase total cost significantly. |

| Debit Card | Generally lower fees | Recommended to avoid overdraft and debt-related fees. |

| Bank Transfer (POLi) | Usually cheaper than credit card payments | May have transfer amount limits and longer processing times. |

| Cash Payment | Fees and exchange rate markups apply | Cash pickup is fast (minutes), but fees and exchange rate margins still add to cost. |

If you use a credit card, you pay higher fees and interest starts right away. Debit cards and bank transfers usually cost less. Cash payments are quick, but you still pay extra charges. No matter which method you choose, Western Union adds exchange rate markups to all international transfers, so always check the total cost before you send money.

Factors Affecting Fees

Amount Sent

The amount you send plays a big role in how much you pay in fees. Western Union uses a flat fee system that changes based on the amount you transfer and where you want the money to go. If you send a small amount, you might see a lower fee. When you send a larger amount, the fee usually goes up. This fee structure means you pay more as your transaction amount increases. If you use a credit card, you may notice even higher fees added to your transaction. Always check the fee chart before you send money abroad, so you know exactly what you will pay for each transaction.

Tip: Try sending larger amounts less often instead of many small transactions. This can sometimes help you save on total fees.

Destination Country

Where you send money also affects your fees. Some countries have higher non-sterling transaction fees because of local banking rules or extra charges from the receiving bank. If you send money abroad to places like China or the Philippines, you may see different fees compared to sending to Europe or the United States. International transfers often come with extra costs, including exchange rate markups and currency conversion. Always ask your recipient to check with their Hong Kong bank about any incoming charges. This way, you both know the full cost of the transaction before you send money.

Transfer Channel

How you send your money changes the fees you pay. Western Union lets you choose between online, in-person, or mobile app transfers. Each channel has its own fee structure:

- Online transfers often have lower or special promotional fees. Sometimes, your first online transaction comes with a $0 fee.

- In-person transfers at agent locations may cost more than online options.

- Mobile app transfers are easy to use and usually have fees similar to online transfers.

- Exchange rate markups and non-sterling transaction fees can change depending on the channel and location.

- The Western Union website and app let you see fee estimates before you finish your transaction.

Choosing the right channel can help you save money, especially if you want to avoid extra non-sterling transaction fees. Always compare the total cost, including international fees and exchange rates, before you send money abroad.

How to Avoid Non-Sterling Transaction Fees

You probably want to keep more of your money when you send funds with Western Union. Non-sterling transaction fees can sneak up on you and eat into the amount your recipient gets. The good news is, you have several ways to avoid non-sterling transaction fees or at least lower them. Let’s look at some smart moves you can make.

Choose Payment Methods

The way you pay for your transfer makes a big difference. Some payment methods help you avoid non-sterling transaction fees, while others can add extra costs. Here are some steps you can take:

- Use a multicurrency debit card. This card lets you hold and spend in different currencies. When you use it, you avoid non-sterling transaction fees because the card uses the local currency for your transfer.

- Exchange your money before you send it. If you convert your funds to the local currency ahead of time, you skip the extra charges that come with currency conversion during the transaction.

- Pay in pounds sterling whenever possible. If you make payments online, choose to pay in your home currency. This helps you avoid non-sterling transaction fees that banks or card issuers might charge.

- Talk to your bank or card provider. Ask if they offer a fee waiver for foreign transaction fee charges or if they have cards that do not charge non-sterling transaction fees.

Tip: Credit card payments often cost more. Western Union charges higher transfer fees for credit card payments. Your card issuer may treat the payment as a cash advance, which means you could pay an extra 3% to 5% of the transaction amount plus higher interest rates. You also face exchange rate markups, which increase the total cost. If you want to avoid non-sterling transaction fees, try to use a debit card or bank transfer instead.

Use Electronic Transfers

Electronic transfers can help you avoid non-sterling transaction fees and keep your costs down. When you send money online or through the Western Union app, you often get lower fees and better exchange rates. Here’s why electronic transfers work well:

- You see the total cost before you send money. Western Union shows you all the fees, including any non-sterling transaction fees, so you know what to expect.

- Online transfers sometimes come with special offers or lower fees for first-time users.

- You can use a multicurrency debit card or a bank transfer, both of which help you avoid non-sterling transaction fees.

- Electronic transfers are fast and secure. You don’t need to visit a store or handle cash.

If you want to avoid non-sterling transaction fees, electronic transfers are usually your best bet. Always check the payment options before you send money. Pick the one that keeps your fees as low as possible.

Promotions and Coupons

Western Union often runs promotions and offers coupons that help you avoid non-sterling transaction fees or cut your costs. These deals can make a big difference, especially if you send money often. Here’s a look at some common promotions and how much you can save:

| Promotion Type | Description | Fee Reduction Impact |

|---|---|---|

| New User Offer | First online transfer with $0 fees for new users | Up to 100% fee reduction (first transfer free) |

| Percentage Discounts | Promo codes offering 10%, 26%, and up to 50% off transfer fees | Up to 50% off transfer fees |

| Flat Fee Discounts | Coupons such as $5 off transfer fees applicable on any transfer amount | Fixed $5 off transfer fees |

| Referral Program | Earn Amazon e-gift codes ($15 per friend, up to 20 friends) by referring new users | Indirect savings via gift cards |

| Rewards Program | Earn points per transfer (100 points) redeemable for transfer fee discounts | Variable discounts based on points |

| Seasonal/Holiday Promotions | Special deals during events like Black Friday with up to 50% off transfer fees | Up to 50% off transfer fees |

| Region-Specific Coupons | Examples include 50% off transfer fees in certain European countries and €5 mobile top-up codes | Up to 50% off or fixed amount discounts |

| Usage Tips | Use mobile app or online platform to access promotions and apply promo codes during transfer | Enables access to all discounts |

You can find these promotions on the Western Union website or app. Sometimes, you get up to 50% off transfer fees during seasonal sales or holidays. New users often get their first transfer free. If you send money to certain countries, you might find region-specific coupons that help you avoid non-sterling transaction fees. Don’t forget to check for promo codes before you send money. Using these deals can help you save a lot over time.

Note: Always read the terms of each promotion. Some offers only work for online transfers or for certain countries. Make sure you apply the code before you finish your transaction.

If you want to avoid non-sterling transaction fees, combine these tips. Choose the right payment method, use electronic transfers, and look for promotions or coupons. These steps help you keep more of your money and make sure your recipient gets the most from every transfer.

Save When You Transfer Money with Western Union

Image Source: unsplash

Compare Fees and Exchange Rates

You want to keep more of your money when you send money abroad. One of the best ways to do this is to compare fees and exchange rates before you choose a provider. Many companies, including Western Union, add extra costs that are not always clear. Some providers say their transfers are “free,” but they hide costs in poor exchange rates. If you only look at the fee, you might miss how much you lose on the exchange rate.

- Western Union often has higher fees and less favorable exchange rates than some online services.

- Wise uses the real mid-market rate, which is the same rate you see on Google, and charges a low, upfront fee.

- TransferGo gives you clear pricing and lets you pick how fast you want your money to arrive.

- Checking both the fee and the exchange rate helps you see how much your recipient will actually get.

Tip: Always check the total cost, not just the fee. This helps you avoid hidden charges and find the best value when you send money abroad.

Time Your Transfers

You might wonder if there is a best time to send money abroad for lower fees or better exchange rates. Western Union does not offer special rates during certain months or seasons. Exchange rates change all the time, sometimes even during the same day. These changes depend on the market and world news. The best thing you can do is watch the rates and pick a time when the rate looks good. If you want to save more, you can also exchange your money beforehand when the rate is in your favor.

Note: There are no special days or months for better rates. Keep an eye on the rates and act when you see a good one.

Avoid Unclaimed Transfer Charges

You do not want your money to go unclaimed. If your recipient does not pick up the transfer, Western Union gives you a full refund. You do not lose money, but it is still best to make sure your recipient collects the funds quickly. If you send money to the wrong person, contact Western Union Customer Care right away to cancel the transfer. Refunds may not be possible after the money is picked up or deposited, so act fast.

- Make sure your recipient knows the transfer details.

- Remind them to collect the money as soon as possible.

- If you make a mistake, contact customer care immediately.

Tip: Quick action helps you avoid problems and keeps your money safe.

Alternatives to Western Union

Other Money Transfer Services

You have many choices when you want to send money across borders. Some services offer lower fees and better exchange rates than Western Union. Wise stands out because it uses the mid-market exchange rate with no markup. You see exactly how much you pay and how much your recipient gets. Wise’s pricing calculator helps you avoid hidden costs. Vance also keeps things simple with a flat $3 transfer fee and no hidden charges. It uses Google exchange rates, so you know you are getting a fair deal.

Here’s a quick comparison of popular money transfer options:

| Service | Key Fee Features | Exchange Rate Policy | Extra Notes |

|---|---|---|---|

| Vance | Flat $3 fee, no hidden charges | Google exchange rates, no markup | Supports USD, EUR, AED, INR; secure |

| Wise | Low, transparent fees, no hidden charges | Mid-market rate, no markup | Multi-currency accounts, clear pricing |

| Remitly | Transparent fees, new user discounts | Not specified | Express and economy transfer options |

| MoneyGram | Fast transfers, fees vary | Not specified | 24/7 support, wide service range |

| WorldRemit | Mobile-first, fees vary | Not specified | App optimized, many payout methods |

When you evaluate money transfer options, look at both the fees and the exchange rates. Some services may offer a low fee but use a poor exchange rate, which means your recipient gets less money.

Digital Wallets and Apps

You might find digital wallets and payment apps even more convenient for sending money. Apps like Venmo, Cash App, PayPal, and Apple Pay often let you send money with no extra fee if you use a linked bank account or debit card. These apps make it easy to split bills, pay friends, or shop online. You can send money quickly, and your recipient gets it almost right away.

- Many apps support contactless payments and multi-currency transfers.

- Security is strong, with features like passwords, fingerprint, or face recognition.

- You do not need to carry cash or cards.

- Western Union works with digital wallets like Apple Pay and Google Pay, making transfers easier.

Western Union still leads in global reach. It operates in over 200 countries and has more than 550,000 agent locations. This makes it a good choice if your recipient needs to pick up cash or does not have a bank account. Still, for fast, low-fee transfers within digital systems, money transfer options like digital wallets can save you time and money.

You can save a lot by making small changes to how you send money. Many people lower their costs by switching to digital transfers, comparing prices, and using special offers. Here are some habits that help you keep more of your money:

- Move from in-person to digital transfers for lower fees.

- Compare providers and switch when you find better deals.

- Use promotions and fee discounts when available.

By checking both transfer fees and exchange rates before you send money, you avoid hidden costs. Frequent senders who compare options can save tens to hundreds of dollars each year.

| Provider Type | Outgoing Transfer Fee (USD) | Incoming Transfer Fee (USD) |

|---|---|---|

| Large US Banks | $40–$65 | $16 |

| Credit Unions | $25–$50 | $0.50 |

Take a moment to review your transfer habits. Even small changes can help you save more every year.

FAQ

How can you check Western Union fees before sending money?

You can use the Western Union online fee estimator. This tool shows you the exact transfer fee and exchange rate for your transaction. Always check it before you send money so you know the total cost.

Do Hong Kong banks charge extra for receiving Western Union transfers?

Some Hong Kong banks may charge an incoming wire transfer fee. This fee usually ranges from $0 to $16 USD. Ask your recipient to check with their bank before you send money.

Can you cancel a Western Union transfer and get a refund?

Yes, you can cancel a transfer if your recipient has not picked up the money. Contact Western Union customer care right away. You will get a full refund, but act quickly to avoid problems.

What is the cheapest way to send money with Western Union?

Sending money online with a debit card or bank transfer often costs less than using a credit card or cash. Look for promotions or coupons on the Western Union website to save even more.

As this article explains, navigating the fees and exchange rates of traditional money transfer services like Western Union can be complex and costly. Hidden markups and variable fees, especially for international transactions, mean your recipient often receives less than you intended. This is where a modern financial solution like BiyaPay simplifies the entire process. We offer transparent, cost-effective global money transfers with remittance fees as low as 0.5% and provide real-time exchange rate queries and conversions for various fiat and digital currencies.

Whether you’re sending money to family, paying international suppliers, or managing a global business, BiyaPay makes it easy and secure. Our platform supports transfers to most countries and regions worldwide, ensuring your funds get where they need to go quickly—often on the same day. Don’t let hidden fees and unfavorable exchange rates diminish your hard-earned money. Use our Real-time Exchange Rate Calculator to see how much you can save, and get started with a single app that meets all your international financial needs. You can open an account with BiyaPay in minutes and experience a new level of financial freedom.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.