- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Wire Transfer vs Bank Transfer Your Guide to Making the Right Choice

Image Source: pexels

When you compare a wire transfer to a bank transfer, the main difference is speed and cost. You often choose a wire transfer for sending money quickly or when handling large amounts, especially across borders. Recent data shows wire transfers in the United States reached over $1.13 trillion in 2024, with fast and secure service. Bank transfers work well for routine payments and offer a safe, cost-effective way for sending money within the country. Knowing which money transfer method fits your needs helps you avoid delays and manage costs.

Key Takeaways

- Wire transfers move money fast, often the same day, and work well for large or international payments but usually cost more.

- Bank transfers are cheaper and easier for everyday payments, like bills or payroll, but can take a few days to complete.

- Wire transfers cannot be canceled once sent, so always double-check recipient details to avoid mistakes.

- Choose wire transfers for urgent or big cross-border payments; use bank transfers for routine, smaller, or recurring payments.

- Consider speed, cost, transfer limits, and security when deciding which transfer method fits your needs best.

Wire Transfer

Image Source: unsplash

How Wire Transfers Work

A wire transfer lets you move money quickly and securely between banks. You can use this electronic method of sending funds for both local and international transfers. Here is how you usually complete a wire transfer through a major bank:

- Check if your account allows wire transfers. Some banks have different rules for personal and business accounts.

- Choose how you want to send the money. You can use online money transfer services, call your bank, or visit a branch for international wire transfer requests.

- Give the recipient’s details. You need their name, address, bank account number, and the correct routing code (ABA for the United States, SWIFT BIC for international transfers).

- Make sure you send the request before the bank’s cutoff time. Many banks process same-day transfers if you act before 2 pm Eastern Time.

- Review the fees. Sending money by wire transfer often costs between $10 and $45 USD, depending on the bank and destination.

- Authenticate your request, usually with your mobile phone.

- Remember, once you submit a wire transfer, you cannot cancel it. International transfers may allow a short cancellation window.

Pros and Cons

Wire transfers offer many benefits, but you should also know the drawbacks. Here is a quick look:

| Advantages | Disadvantages |

|---|---|

| Fast and reliable instant money transfer | High fees per transaction ($10–$45 USD) |

| Secure and traceable | Cannot reverse if sent to wrong person |

| Good for large or urgent payments | Prone to scams if codes are stolen |

| Works for international transfers | Poor exchange rates and hidden fees |

Tip: Always double-check recipient details before sending funds. Wire transfers are final and cannot be reversed.

Common Uses

You often use wire transfers for large, one-time payments. Businesses rely on this electronic funds transfer for real estate deals, mergers, and paying suppliers. You might choose a wire transfer for sending money overseas or when you need an online money transfer that arrives the same day. This method is not ideal for small or recurring payments because of the higher costs. Many people and companies prefer wire transfers for international transfers, emergency situations, and when credibility and speed matter most.

Bank Transfer

Image Source: pexels

How Bank Transfers Work

You can use a bank transfer to move funds between accounts at the same bank or different banks. This process works well for both personal and business needs. Most banks, including those in Hong Kong, offer online money transfer services that make the process simple and secure. Here is how you usually complete a bank transfer:

- Log into your bank’s website or mobile app.

- Select the transfer option or tab.

- Enter the recipient’s routing and account numbers. Some services let you use a phone number or email.

- Choose the amount and decide if the transfer is one-time or recurring.

- Review all details for accuracy and check for scam warnings.

- Authenticate your identity with a password or two-factor authentication.

- Confirm and authorize the transfer.

- Monitor your account to see when the transfer completes. Most transfers finish in 1–3 business days, especially for ACH transfers.

Note: Bank transfers can use different methods, such as ACH, wire, or third-party apps. Each method has its own speed and cost.

Pros and Cons

Bank transfers offer many benefits, but you should also know the drawbacks. Here is a quick overview:

- Pros:

- Enhanced security for sending money.

- Lower fees for most transfers, especially ACH.

- Easy to use for online money transfer and electronic funds transfer.

- Good for consolidating payments and managing recurring bills.

- Cons:

- Some types, like wire transfers, may have fees.

- ACH transfers can take longer to process.

- You may face late or failed payments if details are wrong.

- Businesses may have less control and visibility over incoming payments.

Common Uses

You will find bank transfers useful in many everyday situations. Individuals often use them for paying bills, sending money to friends or family, and moving funds between accounts. Businesses rely on bank transfers for payroll, vendor payments, and settling invoices. You can also use bank transfers for tax payments, tuition, and donations to charities. ACH transfers work best for recurring payments, such as subscriptions or payroll, while wire transfers help with urgent or international transfers. Online money transfer options make it easy to handle these tasks from your computer or phone. Bank transfers remain a popular choice for both routine and high-value money transfers.

Differences Between Wire Transfers and Bank Transfers

Understanding the differences between wire transfers and bank transfers helps you choose the best way to move your money. Each method has unique features that affect speed, cost, security, and convenience. The table below gives you a quick side-by-side comparison.

| Feature | Wire Transfer | Bank Transfer (ACH/Other) |

|---|---|---|

| Processing Speed | Same day or next day for most; international payments take 1–5 business days | 1–3 business days; not available for all international payments |

| Cost | Higher fees ($20–$50+ per transfer); extra charges for international payments and currency exchange | Low or no fees for most transfers; some fees for international payments |

| Security | Highly secure but irreversible; strong verification needed | Secure; can be reversed or disputed in some cases |

| International Use | Supports international payments and cross-border transactions | Mostly for local transfers; limited international money transfer options |

| Convenience | Requires more details and steps; often needs in-branch visit for large or international payments | Easy to use online or with mobile apps; good for recurring payments |

| Transfer Limits | Higher limits, especially for business or in-branch transfers | Lower limits for personal accounts; higher for business accounts |

Speed

You want your money to arrive fast. Wire transfers usually process within the same business day if you send them before the bank’s cutoff time. For international payments, the speed of transfer can range from one to five business days because of extra checks and time zones. Bank transfers, such as ACH, take longer—usually two to three business days. Both methods slow down on weekends and holidays, as banks do not process transfers during these times. If you need urgent international transfers, wire transfer is the faster choice.

Note: Always check your bank’s cutoff times. Transfers made after these times will process the next business day.

Cost

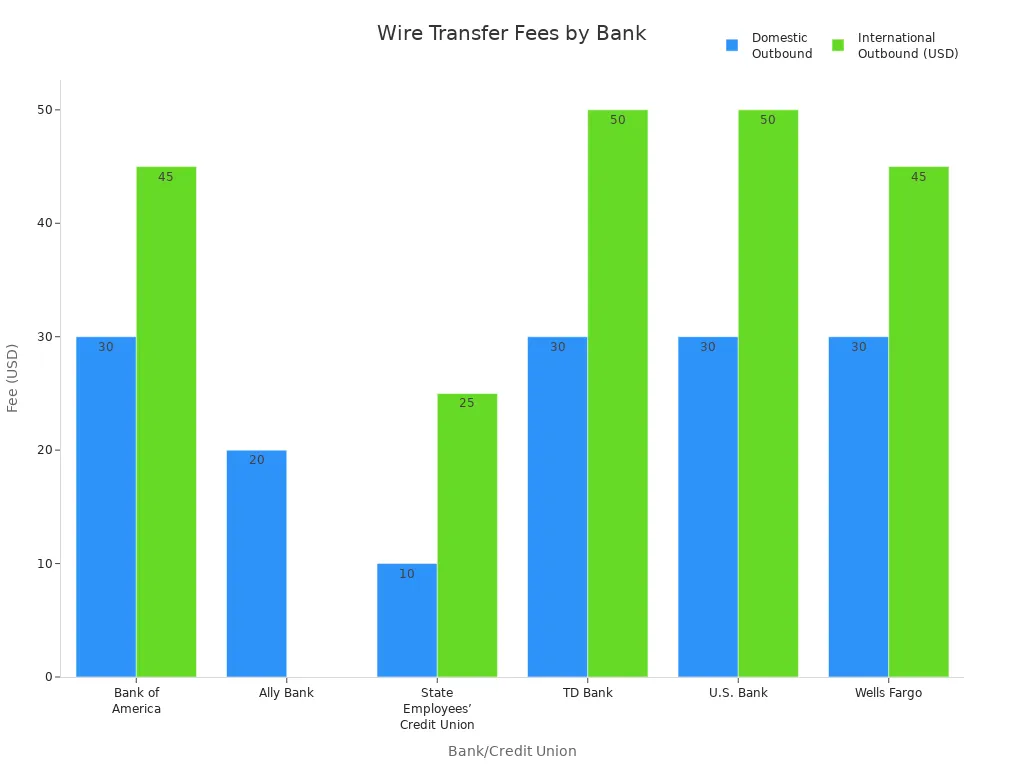

The cost differences between wire transfers and bank transfers can be significant. Wire transfers charge higher fees, especially for international payments. For example, sending a wire transfer from a major bank in Hong Kong or the United States can cost $20–$50 or more. Incoming wires may have lower fees or be free, depending on your account type. Bank transfers, like ACH, are much cheaper. Many banks offer free or low-cost transfers for local payments. International money transfer services may charge extra fees or use less favorable exchange rates.

Tip: Always review transfer fees before sending large amounts, especially for cross-border transactions.

Security

Both wire transfers and bank transfers use strong security measures, such as encryption and multi-factor authentication. You can trust these systems for secure transfers. However, wire transfers are usually irreversible. If you send money to the wrong person, you cannot get it back easily. Bank transfers, especially ACH, sometimes allow you to dispute or reverse a payment if there is an error. Most fraud risks come from human mistakes, like entering the wrong account number or falling for scams. Always double-check details and use secure communication with your bank.

- Wire transfers are as secure as the people and processes managing them.

- Bank transfers offer more flexibility for reversing errors, but you still need to be careful.

International vs Domestic

Wire transfers work well for international payments and cross-border transactions. They use global networks like SWIFT, which allow you to send money almost anywhere in the world. These transfers require more information, such as SWIFT codes or IBANs, and may involve extra checks for anti-money laundering. Bank transfers, such as ACH, are best for local payments. Some banks offer international money transfer services, but these often have lower limits and may not reach every country.

| Aspect | International Wire Transfers | Bank Transfers (ACH/Other) |

|---|---|---|

| Regulations | Stricter, with more checks and documentation | Simpler, fewer checks |

| Processing Times | 1–5 business days | 1–3 business days (limited international options) |

| Fees | Higher, with extra charges for currency exchange | Lower, but may have hidden costs |

| Required Information | SWIFT/IBAN, recipient details | Routing/account numbers |

Note: Sending money internationally often costs more and takes longer due to extra regulations and checks.

Convenience

You want transfer convenience, especially for routine payments. Bank transfers are easy to set up online or with mobile apps. You can schedule recurring payments, pay bills, or send money to friends with just a few clicks. Wire transfers require more steps. For large or international payments, you may need to visit a branch or provide extra documents. Some banks in Hong Kong and the United States let you start wire transfers online, but limits may apply.

- Bank transfers are best for regular, small payments.

- Wire transfers are better for one-time, large, or urgent international payments.

Transfer Limits

Transfer limits vary by bank and account type. Wire transfers usually have higher limits, especially for business accounts or in-branch requests. For example, some banks allow up to $100,000 or more per day for international wire transfers. Bank transfers, such as ACH, have lower limits for personal accounts—often $1,000 to $5,000 per transfer. If you need to send a large amount, wire transfer is the better option.

| Institution/Provider | Wire Transfer Limit Details | Bank Transfer Limit Details |

|---|---|---|

| Bank of America | Up to $5,000 online; higher in-branch | $1,000 per transfer (personal) |

| Charles Schwab | $100,000 per day (international) | Varies by account |

| HSBC | $200,000 per day online | Varies by account |

Tip: Transfers of $10,000 or more must be reported to the IRS. Your bank handles this automatically, but you may need to provide extra documents.

By understanding the differences between wire transfers and bank transfers, you can make better choices for your international payments, secure transfers, and everyday banking needs.

Choosing the Right Transfer Method

When to Use a Wire Transfer

You should choose a wire transfer when you need to move large sums quickly or when sending money across borders. This method works best if you face a tight deadline, such as paying for a property or settling an urgent invoice. Many banks, including those in Hong Kong, allow you to send up to $1 million per day with a wire transfer. You may also need this option if the recipient’s bank does not support other types of transfers. Remember, wire transfers often come with higher fees, but they offer fast delivery and strong security.

Tip: Always double-check the recipient’s details before you send a wire transfer. Once you send the money, you cannot reverse the payment.

When to Use a Bank Transfer

A bank transfer fits best for routine payments, such as paying bills, sending money to friends, or handling payroll. You can use your bank’s website or mobile app to set up these transfers. Most bank transfers, like ACH or EFT, cost little or nothing and finish in one to three business days. This method works well for smaller amounts and recurring payments. You can also cancel or reverse a bank transfer if you make a mistake, which adds peace of mind.

Decision Guide

Financial advisors suggest you look at several factors before you choose a transfer method:

- Timing: Do you need the money to arrive today, or can you wait a few days?

- Fees: Are you willing to pay more for speed, or do you want to save on costs?

- Transfer Limits: Are you sending a small amount or a large sum?

- Security: Do you need extra protection for your transaction?

- Ability to Reverse: Will you need to cancel or change the payment if something goes wrong?

Here is a quick comparison to help you decide:

| Factor | Wire Transfer | Bank Transfer (ACH/EFT) |

|---|---|---|

| Speed | Same-day if before cutoff | 1–3 business days |

| Fees | Higher, often $20–$50 | Low or no fees |

| Limits | Up to $1 million per day | Lower, varies by bank |

| Security | Strong, but cannot reverse | Strong, can reverse in some cases |

| Best Use | Urgent, large, or cross-border needs | Routine, local, or recurring |

Note: If you need to send a large amount quickly, a wire transfer is your best choice. For everyday payments, a bank transfer offers more convenience and lower costs.

You can see clear differences between wire transfers and bank transfers. The table below highlights key points from recent studies:

| Aspect | Wire Transfers | ACH/Bank Transfers |

|---|---|---|

| Speed | Same day or minutes | 1–3 business days |

| Cost | $15–$50 per transfer | $0.5–$1.5 per transfer |

| Best Use | Urgent, large, global | Routine, recurring |

Think about your needs for speed, cost, and security before you choose. Many banks offer online tools and alerts to help you pick the best option for your next payment.

FAQ

What is the main difference between a wire transfer and a bank transfer?

You will notice the main differences between wire transfers and bank transfers in speed, cost, and security. Wire transfers offer instant money transfer and higher transfer fees. Bank transfers, such as ACH, provide lower cost and better transfer convenience for routine payments.

Can I use a wire transfer for international money transfer?

Yes, you can use a wire transfer for international money transfer. This electronic method of sending funds works well for cross-border transactions. Hong Kong banks often support international wire transfer requests, but you should check processing times and cost differences before sending funds.

How secure are electronic funds transfers?

Electronic funds transfer methods, including wire transfers and ACH, use strong security features. You get secure transfers with encryption and authentication. Always double-check recipient details to avoid errors. Wire transfers cannot be reversed, so accuracy is important when sending funds.

What affects the speed of transfer for sending money internationally?

The speed of transfer for sending money internationally depends on the method you choose. Wire transfers usually process faster than other options. Processing times may vary based on the bank, time zones, and extra checks for international payments.

Navigating the complexities of wire transfers versus bank transfers can be a challenge, especially when dealing with international payments where costs and speed are critical. This article highlights a key pain point for users: traditional financial methods are often slow, expensive, and require a lot of manual work. This is where a modern, streamlined solution like BiyaPay offers a clear advantage. Our platform provides a more efficient way to manage your global finances, offering real-time exchange rate queries and conversions for various fiat and digital currencies with remittance fees as low as 0.5%.

Whether you’re sending large sums for business or routine payments to family abroad, BiyaPay makes the process easy and secure. Our service supports money transfers to most countries and regions worldwide, ensuring your funds get where they need to go quickly—often on the same day. Don’t let high fees and slow transfers hold you back. Register now to see how much you can save, and get started with a single app that meets all your international financial needs. You can open an account with BiyaPay in minutes and experience a new level of financial freedom.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.