- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Your Complete Handbook for USPS Money Orders

Image Source: pexels

A usps money order gives you a safe way to send or receive money without needing a bank account. You can buy a usps money order at any usps location, using cash or a debit card. Many people trust this method for rent payments, bills, or sending funds to family. The us postal service issues about 58.5 million money orders each year, showing just how popular this service remains. Each usps money order has built-in security features to help protect your money from theft or fraud.

Key Takeaways

- USPS money orders offer a safe, low-cost way to send money without a bank account, protecting your personal information.

- You can buy USPS money orders at any post office using cash, debit cards, or traveler’s checks, with a maximum limit of $1,000 per order.

- Always fill out the recipient’s name immediately and keep your receipt and tracking number to prevent fraud and track your money order.

- USPS money orders include strong security features like watermarks and QR codes, making them hard to counterfeit.

- You can cash USPS money orders for free at post offices or deposit them at banks, making them a convenient payment option.

USPS Money Order Basics

Image Source: unsplash

What Is a USPS Money Order

A usps money order gives you a simple way to send money safely. You do not need a bank account to use this service. You can buy a usps money order at any usps location. Many people use it to pay rent, send money to family, or handle bills. This payment tool works well for those who want a secure payment method without sharing bank details.

You will find that a usps money order stands out from other payment options for several reasons:

- You can buy one at any usps branch, making it easy to access.

- You pay with cash, a debit card, or a traveler’s check. Credit cards are not accepted.

- Each usps money order has a purchase limit of $1,000, which helps you control spending.

- You must fill in the recipient’s name at the time of purchase. This step lowers the risk of theft or fraud.

- You get a receipt and tracking number. This lets you check if the money order was cashed.

- The money order does not show your bank account information, so your personal data stays safe.

- The funds are prepaid. The money order cannot bounce like a personal check.

- The cost is low, usually $1.75 for up to $500 and $2.65 for up to $1,000.

- Many people use usps money orders for small payments, such as rent or utility bills.

Security Features

USPS has added many features to keep your money safe. The latest usps money order design, introduced in 2025, includes several tools to stop fraud and counterfeiting.

- Watermarks and a security thread make it hard to copy or alter the money order.

- A QR code links to the usps website for quick verification.

- The new design uses a red, white, and blue color scheme and a new bank routing number.

- You can use the Money Order Verification System by phone or online to check if your usps money order is real.

- If you think someone has tried to scam you, contact the U.S. Postal Inspection Service for help.

Tip: Always keep your receipt and tracking number. These details help you track your usps money order and prove your purchase if you need to report a problem.

How It Works

You can use a usps money order in a few easy steps:

- Go to a usps location and ask for a money order.

- Pay the amount you want to send, plus the small fee.

- Fill in the recipient’s name and your own details.

- Keep your receipt and tracking number.

- Give or mail the usps money order to the person you want to pay.

The recipient can cash the usps money order at any usps branch or deposit it at a bank. Because the funds are prepaid, the recipient does not have to worry about the money order bouncing. You can track the status using the tracking number on your receipt.

A usps money order gives you a reliable and secure way to send money. You do not need a bank account, and you can avoid sharing sensitive information. Many people choose this option for its safety, low cost, and ease of use.

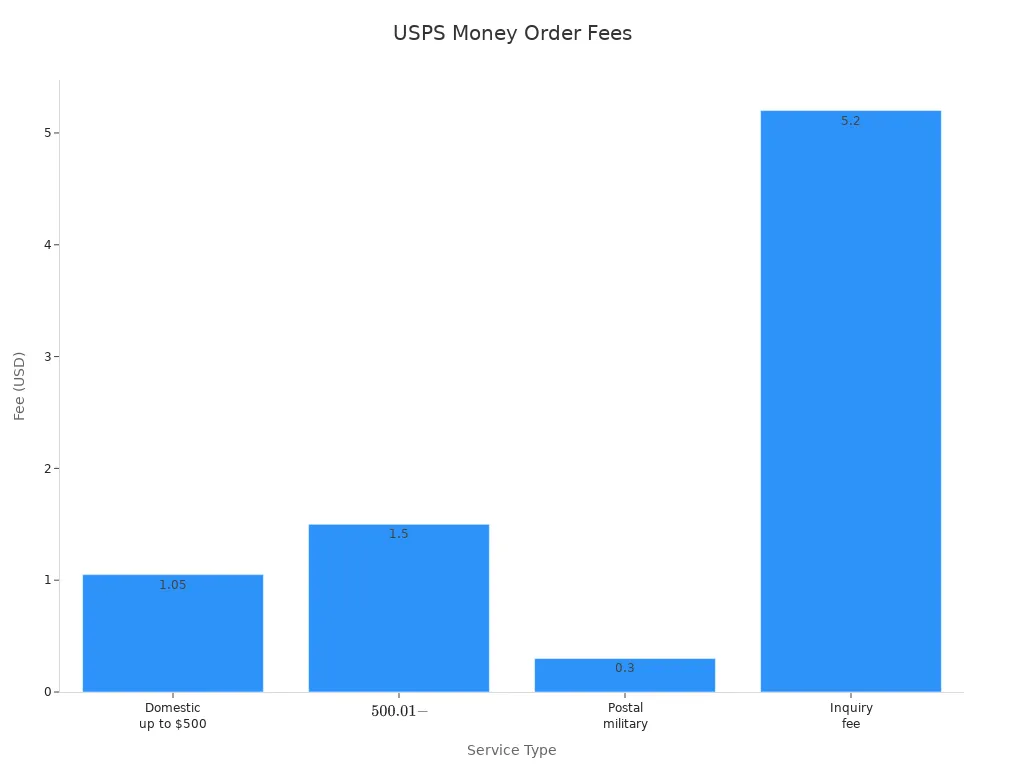

USPS Money Order Fees

Domestic Fees

You can find the money order cost for a USPS money order by checking the latest fee schedule. The price depends on the amount you want to send. If you buy a USPS money order for $500 or less, you pay $1.05. If you need to send more, up to $1,000, the fee is $1.50. If you are in the military and use a postal military money order, the fee drops to $0.30. If you ever need a copy of a paid money order, the inquiry fee is $5.20.

Here is a quick look at the current fees:

| Service Type | Fee |

|---|---|

| Domestic money order up to $500 | $1.05 |

| Domestic money order from $500.01 to $1,000 | $1.50 |

| Postal military money order | $0.30 |

| Inquiry fee (copy of paid money order) | $5.20 |

Note: Always keep your receipt. You may need it if you have questions about your USPS money order.

International Fees

If you want to send a USPS money order outside the United States, you need to check if the destination country accepts them. The fee for an international USPS money order is $10.25. Not all countries accept these money orders, so ask at your local post office before you buy. The maximum amount you can send with an international USPS money order is $700.

Limits

USPS sets limits to help protect your money. You can buy a single USPS money order for up to $1,000 within the United States. For international money orders, the limit is $700. If you need to send more than the limit, you can buy more than one money order. You must fill out each one separately. These limits help keep your transactions safe and easy to track.

Buy USPS Money Order

Where to Buy

You can buy a usps money order at any United States Postal Service location. Most post offices offer this service at the main counter. Some grocery stores and convenience stores may also sell money orders, but only those from the usps guarantee the same level of security and tracking. When you visit a post office, you can ask the clerk for a usps money order. You do not need a bank account to use this service.

Payment Methods

You can pay for a usps money order with cash, a debit card, or a traveler’s check. The post office does not accept credit cards for this purchase. If you use a debit card, make sure you know your daily spending limit. The clerk will ask for the total amount you want to send plus the small fee. You cannot use a personal check or credit card to buy a usps money order.

Step-by-Step Process

Buying a usps money order is simple if you follow these steps:

- Go to your local post office and ask for a money order at the counter.

- Tell the clerk the amount you want to send. The maximum for one money order is $1,000.

- Pay with cash, a debit card, or a traveler’s check.

- Fill out the money order form at the counter. The clerk can help you if you have questions.

- Write the recipient’s name and your own information on the money order.

- Keep your receipt and tracking number. These help you track your usps money order and prove your purchase.

If you plan to buy usps money orders totaling between $3,000 and $10,000 in one day, you must follow extra steps:

- You need to fill out Form 8105-A.

- You must show identification with your photo, name, and address.

- The daily purchase limit is $10,000 per customer.

- The ID rule only applies if your total purchase is $3,000 or more. Smaller purchases do not require ID.

- You can buy more than one money order to reach your total, but each one cannot be more than $1,000.

Tip: Always double-check the information you write on the money order. Mistakes can delay payment or cause the money order to be rejected.

Fill Out Money Order

Image Source: pexels

Recipient Information

When you fill out a money order, start with the recipient’s details. This step makes sure only the right person or business can cash it. Follow these steps:

- Write the recipient’s full legal name in the “Pay to” or “Pay to the order of” field. Use the exact name as shown on their ID.

- If you pay a business, write the full company name. Do not use abbreviations or nicknames.

- Add the recipient’s address if there is a line for it. This helps identify the right person or business.

Tip: Fill out the recipient’s name right after you buy the money order. If you leave it blank, someone else could cash it if it gets lost.

Purchaser Section

Next, complete your own information in the purchaser section. This part helps the recipient know who sent the money order.

- Write your full name and address in the spaces marked for the purchaser.

- Sign only in the area labeled “Purchaser’s signature.” Do not sign the back.

- Use a black or blue ballpoint pen. Avoid gel pens or markers, as their ink can fade or bleed.

Note: Always keep your receipt. It has a tracking number you can use to check the status or request a replacement if needed.

Common Mistakes

Many people make small errors that can cause delays or rejection. Here are common mistakes and how to avoid them:

- Not filling out the money order right away. Always complete it at the counter to prevent theft or misuse.

- Using nicknames or incorrect names for the recipient. Always use the legal name.

- Making corrections or crossing out mistakes. If you make an error, buy a new money order.

- Forgetting to include your own name, address, or signature.

- Using the wrong type of pen. Stick to black or blue ballpoint pens.

- Losing the receipt. Keep it safe as proof of payment.

Tip: Double-check all information before handing over or mailing the money order. This helps ensure the recipient can cash it without problems.

Send and Cash USPS Money Order

Sending Options

You can send a usps money order in several ways. After you buy the money order and fill it out, you can hand it to the recipient in person. Many people choose to mail the money order using a secure envelope. If you want extra safety, you can use certified mail or add tracking. Always keep your receipt and tracking number. These details help you check if the money order has been cashed.

Cashing Locations

You have many choices when you want to cash a usps money order. The most common places include:

- Post offices

- Banks and credit unions

- Some convenience stores

Post offices offer a secure place to cash your money order. Banks and credit unions also cash money orders, but you may need to have an account with them. Some convenience stores provide this service, but they may charge a fee. If you cash a large amount, such as $3,000 or more in one day, you must show a photo ID. The clerk may ask you to fill out a special form. These rules help prevent fraud and keep your money safe.

No-Fee Cashing

You can cash a usps money order for free at your local post office. This is the best option if you want to avoid extra charges. Many banks and credit unions also cash money orders without fees if you have an account there. If you do not have an account, the bank may charge a small fee. Retail stores and check-cashing services often charge extra fees. Always bring a valid photo ID when you cash your money order. The post office remains the most reliable place for no-fee cashing.

International USPS Money Order

Eligible Countries

You can send a usps money order to select countries outside the United States. Not every country accepts these money orders. Before you buy, ask the clerk at your local post office if your destination country is on the approved list. Some common countries that accept usps money orders include Canada, Jamaica, and several Caribbean nations. Many countries in Europe, Asia, and Africa do not accept them. Always check the latest list because countries can change their rules at any time.

Tip: Visit the official usps website or call customer service to confirm if your destination country accepts international money orders.

International Limits

You can send up to $700 per usps money order to eligible countries. This limit helps protect your funds and makes tracking easier. If you need to send more than $700, you can buy more than one money order. Each one must stay within the $700 limit. You must fill out each money order separately. The fee for each international usps money order is $10.25. You pay this fee at the time of purchase.

| Country Example | Maximum Amount (USD) | Fee (USD) |

|---|---|---|

| Canada | $700 | $10.25 |

| Jamaica | $700 | $10.25 |

Note: Exchange rates may affect the final amount the recipient receives. Ask the post office for current rates.

Delivery Times

Delivery times for international usps money orders depend on the destination country. Most money orders arrive within 7 to 14 business days. Some countries may take longer due to local mail systems or customs checks. You should keep your receipt and tracking number. These details help you check the status of your money order if there is a delay. If your money order does not arrive after a reasonable time, contact usps for help.

Always plan ahead when sending money internationally. Delivery can take longer than sending money within the United States.

Track or Cancel USPS Money Order

Tracking Tools

You can track your USPS money order using several helpful tools. Start by keeping your receipt safe. The receipt shows the money order’s serial number, the dollar amount, and the post office number where you bought it. You need these details to check the status.

- Visit your local post office and ask to fill out a Money Order Inquiry form.

- Use the USPS website to check the status online. Enter the serial number and other details from your receipt.

- Call the post office inquiry line for updates. You may not get instant results, but you can ask about the process.

- If you lose your receipt, you must fill out USPS Form 6401 to start an inquiry. This form asks for as much information as you remember.

If you submit a formal Money Order Research Request with Form 6401, USPS may take 30 to 60 days to process it. When finished, you receive a copy of the cashed money order if it has been processed.

Tip: Always keep your receipt. It makes tracking much easier and faster.

Cancel or Replace

If you need to cancel or replace a USPS money order, act quickly. You cannot stop payment on a money order like you can with a check. Instead, you must request a replacement or refund.

- Go to your local post office and ask for Form 6401.

- Fill out the form with the money order’s serial number, amount, and purchase location.

- Pay the processing fee, which is usually $6.95.

- USPS will investigate and, if the money order has not been cashed, issue a replacement or refund.

The process may take several weeks. If someone already cashed the money order, USPS will send you a copy for your records.

Report Issues

If you suspect fraud or have problems with your money order, report it right away. Contact the U.S. Postal Inspection Service for help. You can also visit your post office and explain the issue. Bring your receipt and any forms you have filled out. The staff will guide you through the next steps. Always act quickly to protect your money and resolve any problems.

Alternatives to USPS Money Orders

Bank Money Orders

You can choose a bank-issued money order if you want another secure way to send money. Banks and credit unions offer these at their branches. If you already have an account, you may find this option convenient. Bank money orders work much like USPS money orders, but the fees are often higher. Some banks give discounts to account holders. You can use both types at banks, credit unions, post offices, and some retail stores. The table below shows how they compare:

| Aspect | USPS Money Orders | Bank-Issued Money Orders |

|---|---|---|

| Cost | $2.35 for $0.01-$500; $3.40 for $500.01-$1,000 | Generally slightly higher fees; possible discounts for account holders |

| Acceptance Locations | Banks, credit unions, post offices, some retail stores | Banks, credit unions, post offices, some retail stores |

| Convenience | Widely available at USPS locations | Convenient for account holders at their bank branches |

| Reputation | Known for low cost and broad acceptance | Reliable but less cost-effective than USPS |

Note: USPS money orders usually cost less and have broad acceptance. Bank money orders may suit you if you prefer to handle everything at your bank.

Certified Checks

Certified checks, sometimes called cashier’s checks, offer another safe payment method. Banks and credit unions issue these checks, often for larger amounts. The bank fills out the payee’s name and guarantees the funds. You may pay between $5 and $15 for a certified check. These checks work best for big purchases, such as cars or homes. The table below highlights the main differences:

| Feature | Certified Checks (like Cashier’s Checks) | USPS Money Orders |

|---|---|---|

| Cost | Typically $5 to $15 | Typically less than $5 |

| Availability | Banks and credit unions; sometimes only to customers | Banks, post offices, supermarkets, retail stores |

| Security | Bank guarantees funds; “pay to” field filled by bank; no risk of bouncing | No risk of bouncing; “pay to” field filled by purchaser |

| Restrictions | Usually no limit on amount | Usually limited to $1,000 or less |

| Best Use | Large transactions needing extra security (e.g., home, car) | Smaller transactions or when bank check not an option |

| Usage Notes | Funds withdrawn immediately; cannot be stopped once issued | Prepaid; recipient guaranteed funds; easier to obtain without bank account |

Tip: Choose a certified check for large payments that need extra security. Use a USPS money order for smaller amounts or if you do not have a bank account.

Electronic Payments

Electronic payment services give you a fast way to send money. You can use wire transfers or online payment apps. These services move funds instantly or on the same day. You must have a bank account to use most electronic payments. Fees can reach up to $50 for each transfer, much higher than USPS money orders, which cost between $1.20 and $1.60 for amounts up to $1,000. Electronic payments allow you to send up to $100,000 at once, while USPS money orders limit you to $1,000 per order. Electronic payments are secure and hard to reverse, but you must trust the recipient. USPS money orders do not need a bank account and work well for people who want a paper record or need to send smaller amounts.

Note: Electronic payments offer speed and high limits, but USPS money orders remain a good choice if you want low fees or do not have a bank account.

USPS money orders give you a secure way to send funds without a bank account. You protect your privacy, avoid revealing banking details, and use a service that never expires.

- You can cash money orders for free at any post office.

- You deposit them at banks without extra fees.

USPS money orders are less prone to digital fraud than cashier’s checks, making them a smart choice for everyday payments. For quick answers, check the FAQs at the end of this guide.

FAQ

How long does a USPS money order stay valid?

A USPS money order never expires. You can cash it at any time. You do not need to worry about losing value or paying extra fees if you wait.

What should you do if you lose your USPS money order?

Go to your local post office and fill out Form 6401. Bring your receipt if you have it. USPS will investigate and may issue a replacement. You must pay a $6.95 processing fee.

Can you deposit a USPS money order into your bank account?

Yes, you can deposit a USPS money order at most banks, including Hong Kong banks. Endorse the back and fill out a deposit slip. The bank may place a hold until the funds clear.

What happens if you make a mistake on a money order?

You cannot correct mistakes on a USPS money order. Buy a new one if you make an error. The post office will not accept altered money orders.

Tip: Always double-check all information before leaving the post office. This helps you avoid costly errors.

This article highlights the convenience and security of USPS money orders for domestic payments, especially for those without a bank account. However, when it comes to international payments, money orders are slow, limited to a few countries, and come with a low maximum transfer limit. These limitations can be a major hurdle for anyone needing to send money abroad efficiently. This is where a modern, digital solution like BiyaPay offers a seamless alternative. Our platform provides real-time exchange rate queries and conversions for various fiat and digital currencies, with remittance fees as low as 0.5%, giving you the speed and flexibility money orders simply can’t.

Whether you’re sending money to family, paying international suppliers, or managing a global business, BiyaPay makes the process easy, secure, and cost-effective. We support transfers to most countries and regions worldwide, ensuring your funds get where they need to go quickly—often on the same day. Don’t let a slow, limited service hold you back from your financial goals. Open an account with BiyaPay in minutes and experience a new level of financial freedom. Register now to start your global financial journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.