- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

5 best Wise alternatives for users in the US this year

Image Source: pexels

Looking for the best alternatives to wise? Here are five top picks for you this year:

- Remitly lets you send money fast with flexible delivery options.

- OFX offers low-cost transfers and strong customer support.

- Revolut gives you multi-currency accounts and easy budgeting tools.

- Xe Money Transfer stands out for its simple app and wide currency coverage.

- PayPal brings trusted security and global reach for your transfers.

These alternatives to wise reflect the latest choices available for US users. You can compare each on cost, speed, and user experience to find the right fit.

Key Takeaways

- You have many good options besides Wise to send money internationally, each with unique strengths like speed, cost, or extra features.

- Check key factors before choosing: cost, security, speed, exchange rates, and customer support to find the best fit for your needs.

- Remitly is great for fast transfers and flexible delivery, OFX works well for large amounts, Revolut offers extra tools, Xe covers many countries, and PayPal is easy and trusted.

- Compare fees and transfer speed carefully because costs and delivery times vary a lot between services.

- Try small transfers first and pick the service that matches how often and how much you send, plus what your recipient prefers.

Selection Criteria

Key Factors

When you look for a Wise alternative, you want to know what really matters. Here are the main things you should check before you choose a money transfer service:

- Cost: Always look at the total cost. This includes sending fees, transfer fees, exchange rates, and any fees the person receiving the money might pay. Even a small difference in the exchange rate can change how much your recipient gets in USD.

- Security: You want your money and information to stay safe. Good services use strong encryption, multi-factor authentication, and follow strict rules to protect your data.

- Speed: Sometimes you need your transfer to arrive fast. Some services can send money in minutes, while others take a few days. Tracking features help you know where your money is at all times.

- Exchange Rates: A better exchange rate means more money for your recipient. Some services offer better rates for larger amounts or show you the real rate up front.

- Customer Support and Experience: If you have a problem, you want help right away. Look for services with helpful support teams and easy-to-use apps or websites.

Tip: Always check for hidden fees or unclear charges. Transparency helps you avoid surprises.

Why Criteria Matter

You want to get the most value when you send money abroad. Fees can add up quickly, especially if you send money often. Some services charge a flat fee, while others take a percentage or add a markup to the exchange rate. If you need to send money fast, speed becomes your top priority. Businesses often need quick transfers to keep things running smoothly.

Security is not just a buzzword. You trust these companies with your money and personal details. Features like encryption and multi-factor authentication keep your transfers safe. Reliable customer support can save you time and stress if something goes wrong.

Here’s a quick look at how these factors compare between popular services:

| Criterion | Wise | Payoneer |

|---|---|---|

| Fees | Low, transparent, real rate | Transparent, no hidden fees |

| Speed | Fast, but some delays | Quick access to funds |

| Security | Strong encryption, MFA | High-level encryption |

| Customer Support | Good, responsive | Multiple support channels |

| Extra Features | Multi-currency, batch pay | Freelance platform links |

Choosing the right service means thinking about what matters most to you—cost, speed, security, or support. When you know what to look for, you can pick the best Wise alternative for your needs.

Top Wise Alternatives

Image Source: unsplash

You have a lot of choices when you want to send money abroad. Here are the five best alternatives to wise for US users this year. Each one stands out for different reasons, so you can find the right fit for your needs.

Remitly

Remitly helps you send money fast and gives you more ways to deliver funds, like cash pickup and mobile wallets. You can pick between Express (fast, higher cost) and Economy (slower, lower cost) transfers. Remitly’s app is easy to use, and many US customers say it’s secure and convenient.

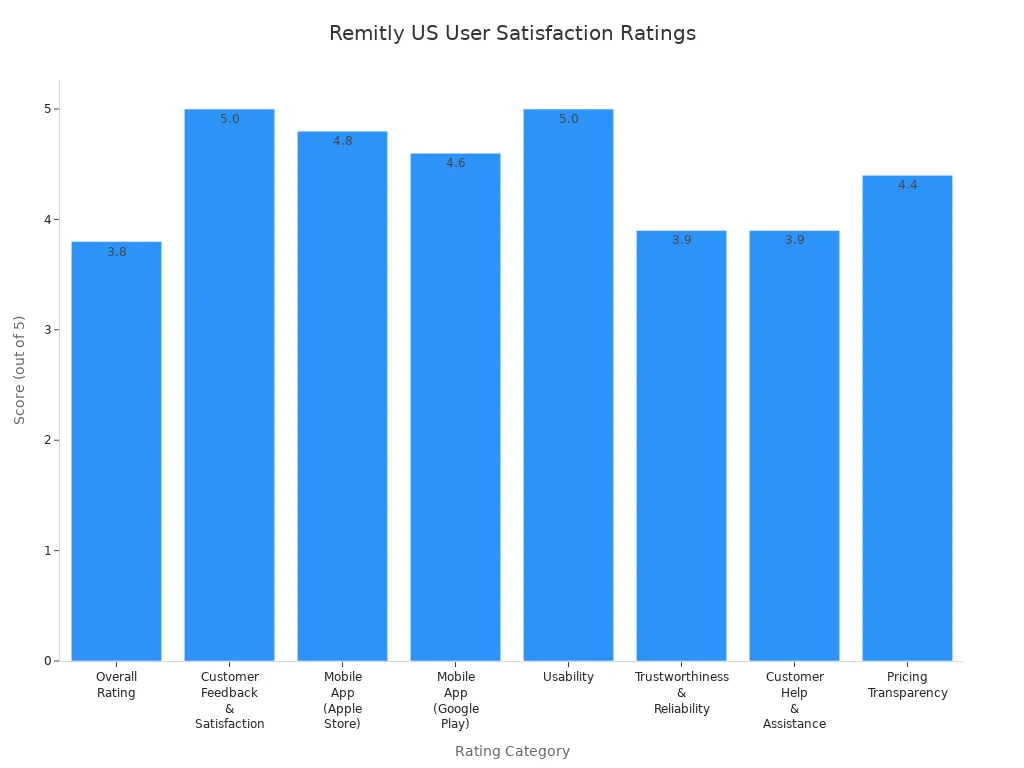

| Rating Category | Score (out of 5) | Summary |

|---|---|---|

| Overall Rating | 3.8 | Very Good |

| Customer Feedback & Satisfaction | 5.0 | Very high satisfaction |

| Mobile App (Apple Store) | 4.8 | Highly rated, easy to use, secure, convenient |

| Mobile App (Google Play) | 4.6 | Highly rated, easy to use, secure, convenient |

| Usability | 5.0 | Excellent usability |

| Trustworthiness & Reliability | 3.9 | Good reliability |

| Customer Help & Assistance | 3.9 | Good support |

| Pricing Transparency | 4.4 | Transparent pricing, no hidden fees |

Key Features:

- Express and Economy transfer options

- Cash pickup, bank deposit, and mobile wallet delivery

- User-friendly app with high ratings

- Transparent pricing, but exchange rate markups apply

Pros:

- Fast transfers with Express

- Many payout options

- High customer satisfaction for app usability

Cons:

- Exchange rate markup (0.5% to 3.0%)

- Fees can be unclear until you start a transfer

- Economy transfers take 3-5 days

How Remitly compares to Wise:

Wise uses the real mid-market exchange rate and charges a low, upfront fee. Remitly adds a markup to the exchange rate and charges fixed fees, which can make it more expensive. Wise is more transparent about costs, but Remitly gives you more ways to deliver money, like cash pickup.

Best for:

You want to send money quickly and need flexible delivery options, especially if your recipient prefers cash pickup or mobile wallets.

OFX

OFX is a strong choice if you want to transfer larger amounts and need business support. It offers competitive exchange rates and no transfer fees, but you must send at least $1,000 per transfer. US users like OFX for its helpful customer service and broad currency support.

Key Features:

- No transfer fees

- Minimum transfer amount: $1,000

- 50+ supported currencies

- 24/7 customer support

- Business-focused services

Pros:

- Good for large transfers

- Helpful support team

- Strong regulatory compliance

Cons:

- Exchange rate markup (0.4% to 1.2%)

- Minimum transfer amount is high

- Some users report slow transfers and compliance delays

| Feature | OFX | Wise |

|---|---|---|

| Exchange Rate | Markup above mid-market (0.4%-1.2%) | Real mid-market rate, no markup |

| Transfer Fees | No transfer fee, but margin in rate | Transparent fee starting at 0.43% |

| Minimum Transfer | $1,000 | No minimum |

How OFX compares to Wise:

Wise is usually cheaper for smaller transfers because it uses the real exchange rate and has no minimum. OFX works better for big transfers and business needs, but you pay more due to the exchange rate margin.

Best for:

You need to send large amounts or want business services, and you don’t mind a higher minimum transfer.

Revolut

Revolut gives you a lot more than just money transfers. You get multi-currency support, budgeting tools, and even investment options. You can trade stocks, buy insurance, and use a prepaid debit card. Revolut has different account tiers, so you can pick the plan that fits your needs.

Key Features:

- Multi-currency accounts and prepaid debit card

- Budgeting tools (Vaults)

- Stock and crypto trading

- Insurance products (device and medical)

- Four subscription plans (Standard, Plus, Premium, Metal)

Pros:

- Many extra features beyond transfers

- Fee-free currency conversion up to $1,000/month

- Priority support for premium users

Cons:

- Fees after free transfer limits

- 1% fee on weekends for currency conversion

- Paid plans needed for more benefits

| Fee Type | Revolut (US Users) | Wise (US Users) |

|---|---|---|

| Monthly Fee | No fee for Standard; $30+/month for higher tiers | No monthly fees |

| Currency Conversion | $1,000/month free, then 0.6% fee; 1% fee on weekends | 0.5% to 1.5% upfront fee, always mid-market rate, no hidden markups |

| International Transfers | 5 free transfers (Grow plan: 5 free, Scale plan: 25 free), then $5 per transfer | Transparent low upfront fee, varies by country/payment method, generally cheaper and clearer |

| Exchange Rate | Interbank rate weekdays; 1% markup on weekends | Mid-market exchange rate (real rate) |

| Account Requirements | Tiered plans with fees and limits | No minimum balance or subscription fees |

How Revolut compares to Wise:

Wise is more straightforward and cost-effective for most users. Revolut gives you more features, but its fee structure is more complex. Wise always uses the real exchange rate and shows all fees upfront.

Best for:

You want an all-in-one app for spending, saving, investing, and sending money, and you like having extra features.

Xe Money Transfer

Xe Money Transfer is known for its wide coverage and simple app. You can send money to over 220 countries in more than 139 currencies. US users give Xe high marks for reliability and ease of use, though some mention occasional fees and transfer limits.

| Feature | XE Money Transfer | Wise |

|---|---|---|

| Supported currencies | Over 139 currencies | 50+ currencies |

| Supported countries | More than 220 countries and territories | 80+ countries |

| Payment methods (USD) | Bank transfer, credit or debit card | Bank transfer, credit or debit card |

| Transfer speed | Card payments ~24 hours; bank transfers 1-3 days | 50% instant, 90% within 24 hours |

Key Features:

- Send money to 220+ countries

- Supports 139+ currencies

- Simple, easy-to-use app

- Bank transfer and card payment options

Pros:

- Very broad coverage

- High user satisfaction

- Accurate exchange rates

Cons:

- Some fees and transfer limits

- Transfers can take 1-3 days

How Xe compares to Wise:

Xe covers more countries and currencies, making it a good choice if you need to send money somewhere Wise doesn’t support. Wise is faster for most transfers and has more transparent fees.

Best for:

You need to send money to less common countries or want a simple, reliable app.

PayPal

PayPal is one of the most popular alternatives to wise. You can send money almost anywhere, and transfers within the PayPal network are instant. PayPal is easy to use and keeps your bank details private, but it charges higher fees and adds a markup to exchange rates.

Key Features:

- Instant transfers within PayPal accounts

- Strong security and buyer/seller protection

- Widely accepted for online payments

- Mobile app for easy management

Pros:

- Free to sign up

- Fast transfers within PayPal

- No need to share bank details

Cons:

- High international fees and exchange rate markups (up to 5%)

- Recipient may need a PayPal account

- Transfer limits and possible account holds

| Aspect | Wise (for US users) | PayPal (for US users) |

|---|---|---|

| Exchange Rates | Uses mid-market exchange rate without markups, ensuring fair and transparent rates | Adds a margin to the exchange rate, potentially increasing costs by up to 5% |

| Transfer Fees | Transparent, upfront fees starting around 0.43%, varying by currency and amount | Less transparent fee structure; fees and currency conversion charges vary and can be higher |

| Transfer Times | Generally fast, often within minutes; can range up to 4 business days depending on factors | Often instant for recipients with PayPal accounts; may vary due to currency conversion and destination |

| Customer Satisfaction | Higher satisfaction (Trustpilot 4.2/5) due to transparency and cost-effectiveness | Lower satisfaction (Trustpilot 1.3/5) mainly due to fee transparency and cost concerns |

| Security | Licensed and regulated (e.g., UK FCA), uses encryption and multi-factor authentication | Also regulated globally (e.g., NY DFS, UK FCA), with fraud prevention and identity verification |

How PayPal compares to Wise:

Wise is better if you want low, transparent fees and the real exchange rate. PayPal is more versatile for online payments and instant transfers, but you pay more in fees and exchange rate markups.

Best for:

You want a trusted, easy way to send money online, especially if speed and convenience matter more than cost.

Note: Other highly rated alternatives for US users include Mural Pay, Rippling, Airbase, Amazon Pay for Business, and Payoneer. These platforms focus on business payments and cost-saving payment platforms, so you might want to check them out if you run a business or need more advanced features.

Comparing Wise Alternatives

Image Source: pexels

You want to know how these alternatives stack up against Wise. Here’s a quick table to help you see the differences for fees, speed, security, user experience, and coverage:

| Provider | Fees & Cost Structure | Speed | Security & Certifications | User Experience | Coverage (Countries/Currencies) |

|---|---|---|---|---|---|

| Wise | Low, transparent, real exchange rate; small percentage fee; no hidden cross-border fees | 50% instant, most within 24 hours | Licensed, strong encryption, SOC 1/2, PCI DSS, ISO 27001, FDIC pass-through | Highly rated apps, clear interface | 80+ countries, 50+ currencies |

| Remitly | Fixed fees, exchange rate markup (0.5%-3%) | Express: minutes; Economy: 3-5 days | Licensed, encryption, fraud prevention | Easy app, high satisfaction | 100+ countries, many payout options |

| OFX | No transfer fee, exchange rate margin (0.4%-1.2%), $1,000 minimum | 1-3 days | Licensed, strong compliance | Good support, business focus | 50+ currencies, global reach |

| Revolut | Free up to $1,000/month, then 0.8%+; 1% on weekends | Instant for some transfers, others 1-2 days | Licensed, encryption, account monitoring | Mobile-first, budgeting tools | 30+ currencies, growing coverage |

| Xe Money Transfer | Small fees, exchange rate margin, varies by method | Card: ~24 hours; Bank: 1-3 days | Licensed, encryption | Simple app, reliable | 220+ countries, 139+ currencies |

| PayPal | High fees (up to 5%), exchange rate markup | Instant within PayPal, slower for banks | Licensed, global fraud protection | Easy to use, lower satisfaction | 200+ countries, many currencies |

Fees

You care about cost. Wise keeps things simple with low, upfront fees and no hidden cross-border fees. Remitly and Xe add a markup to the exchange rate, so the total cost can be higher, especially for small transfers. OFX works best for large amounts because it has no transfer fee but does add a margin to the rate. Revolut gives you free transfers up to $1,000 each month, but charges more after that or on weekends. PayPal charges the most, with fees and exchange rate markups that can reach 5%. If you want low-cost international transfers, Wise and Revolut (within limits) are your best bets.

Speed

Speed matters for cross-border transfers. Wise sends over half of transfers instantly, and most arrive within a day. Remitly’s Express option delivers money in minutes, but Economy takes longer. OFX and Xe usually take 1-3 days. Revolut can be instant for some transfers, but not all. PayPal is fast within its network, but slower for bank payouts. If you need money to arrive fast, Wise and Remitly stand out.

Security

You want your money safe. Wise, Remitly, OFX, Revolut, Xe, and PayPal all use strong encryption and follow strict rules. Wise stands out with certifications like SOC 1/2, PCI DSS, and ISO 27001, plus FDIC pass-through insurance for eligible users. All these alternatives keep your funds secure and use fraud prevention tools.

User Experience

You want an app that’s easy to use. Wise and Revolut both have highly rated mobile apps. Remitly’s app is simple and works well for everyone, even if you’re not tech-savvy. OFX focuses on business users but still offers good support. Xe is reliable and easy to use. PayPal is familiar, but some users find the fees confusing.

Coverage

Coverage is key for international payments. Xe and PayPal reach the most countries and currencies. Remitly and Wise also cover many places, but Xe leads for less common destinations. Revolut’s coverage is growing, but still smaller. If you need to send money almost anywhere, Xe and PayPal are strong alternatives.

Tip: Think about what matters most to you—cost, speed, security, or coverage—before you choose a service for your next transfer.

How to Choose Alternatives

Assessing Needs

Start by thinking about what you need most from a money transfer service. Do you send money often or just once in a while? Are you sending small amounts or large sums? Some services work better for business users, while others fit personal transfers. Here are some important things to consider:

- Transfer fees can range from $5 to $50, depending on where you send money and how fast you want it to arrive.

- Exchange rate margins usually fall between 0.5% and 3% above the mid-market rate.

- Security features like encryption and two-factor authentication help keep your money safe.

- Some providers offer volume discounts, such as a 10% fee discount if you send over $50,000 each month.

- Transaction limits matter. Some services let you send up to $10,000 per transfer for business accounts.

- If you need fast delivery, you might pay extra—expedited transfer fees can be $20 to $50.

Note: If you run a business, look for options with multi-currency accounts, batch payments, or integration with accounting platforms.

Matching Features

Now, match your needs to what each provider offers. Use the table below to compare key features:

| Alternative | Best For | Key Features | Currency Support | Fees & Rewards | Integrations | Security |

|---|---|---|---|---|---|---|

| Payoneer | Businesses | Local receiving accounts, credit cards, cashback | 70+ currencies | 0.5% FX fee, free/paid plans | Xero, Quickbooks, marketplaces | Spending limits, virtual cards |

| PayPal | Personal & Business | Debit card, tiered pricing | Multiple currencies | Varies by tier | Ecommerce, accounting tools | Strong security |

| Skrill | Personal & Business | Digital payments, merchant accounts | 40+ currencies | Up to 4.99% markup | Payment gateway | Fast transfers, fees on conversion |

| Juni | Ecommerce | Multi-currency IBAN, virtual cards | USD, GBP, EUR, SEK, NOK | Low FX fees | Shopify, Amazon | Card controls |

| Stripe | Business | Payment processing, APIs | International cards | 2.9% + $0.3, +1.5% intl. | Custom API | Business only |

Think about which features matter most to you. If you want low fees, Payoneer and Juni stand out. If you need strong security, PayPal and Skrill offer robust protection.

Tips for Users

- Always check the total cost, including transfer fees, exchange rate margins, and any extra charges from banks.

- Look for promotional offers or discounts, especially if you send money often.

- Review transaction limits and make sure they fit your needs.

- Try the app or website before sending a large amount. A simple interface can save you time.

- For business users, consider subscription plans that offer discounted fees and extra features for $20 to $50 per month.

Tip: Compare at least two providers before you send money. This helps you find the best balance of cost, speed, and security for your situation.

You have great options when you want to send money outside the US. Each Wise alternative stands out for something different. Remitly sends money fast. OFX works well for big transfers. Revolut gives you multi-currency accounts and budgeting tools. Xe covers many countries. PayPal is easy and trusted.

Think about what matters most to you—fees, speed, security, or app experience.

- The best service depends on how often you send money, how much you send, and what your recipient needs.

- Remitly is great for urgent small transfers.

- Revolut fits regular small transfers with extra perks.

- Xe helps with large amounts and rate alerts.

Try a demo or a small transfer first. Compare your options before you send money internationally.

FAQ

What makes these alternatives to Wise good for cross-border transfers?

You get more ways to send money with these alternatives. Some offer fast delivery, others give you multi-currency support or lower cross-border fees. You can pick the best option for your needs and save on cost.

Can I use these Wise alternatives for business international payments?

Yes, you can. Many alternatives to Wise help you handle business payments. Some platforms offer cost-saving payment platforms, batch transfers, and tools for low-cost international transfers. You can manage cross-border transfers and keep your business running smoothly.

How do I know which alternative has the lowest cost?

You should always check the total cost before you send money. Look at transfer fees, exchange rates, and any extra cross-border fees. Some alternatives show all costs upfront, so you can compare and choose the best deal.

Do these alternatives offer multi-currency support?

Yes, most of these Wise alternatives offer multi-currency support. You can hold, send, or receive money in different currencies. This helps you save on exchange rates and makes international payments easier.

Looking for a money transfer service that’s more transparent and affordable than traditional Wise alternatives? BiyaPay gives you real-time exchange rate tracking, international transfers with fees as low as 0.5%, and flexible support for both fiat and digital currencies. You can also enjoy the convenience of same-day transfers when you send early. With a fast, secure platform, BiyaPay makes cross-border payments simpler for students, families, and businesses. Start exploring the benefits with BiyaPay today and discover how much you can save on your next transfer.

Get started now — it only takes minutes to register with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.