- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Exit Your Contract with a Timeshare and Protect Your Credit

Image Source: pexels

You might feel stuck in a timeshare, but you do have options to exit your contract and protect your credit. Many owners want to cancel, but only about 15% successfully exit their contracts during the rescission period, according to a 2017 study. Your right to cancel often depends on state laws and strict deadlines. Always review your paperwork, know your right to cancel, and keep all records. If you want to cancel outside the rescission period, persistence and good documentation help you avoid scams and increase your chances to exit your contract.

Key Takeaways

- Act quickly during the rescission period to cancel your timeshare contract without penalty by sending a formal cancellation letter and keeping proof.

- If you miss the rescission window, contact your resort about deed-back or surrender programs and keep detailed records of all communications.

- Avoid scams by never paying upfront fees and researching any timeshare exit company before trusting them with your money.

- Protect your credit by staying current on all payments while working to exit your contract and regularly checking your credit reports for errors.

- Seek legal help if needed, and stay organized and persistent to increase your chances of successfully exiting your timeshare.

Rescission Period

Cancel a Timeshare Within the Window

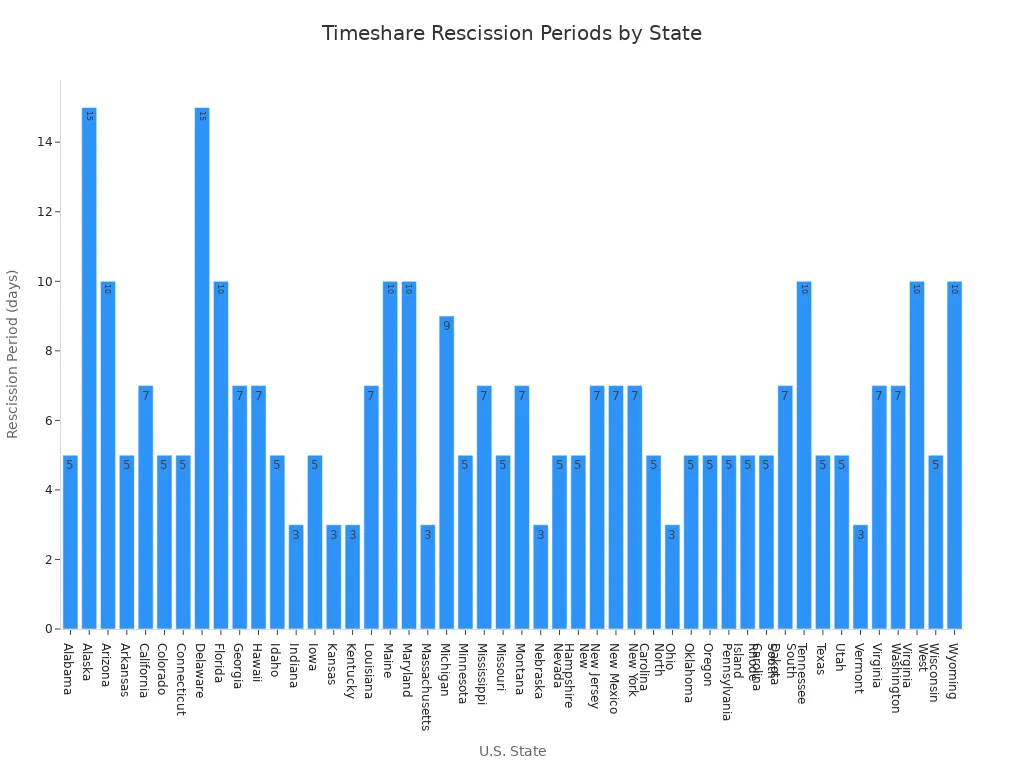

You have a short window called the rescission period to cancel a timeshare contract with no penalty. This period gives you the right to cancel if you change your mind soon after signing. Most states set the rescission period between 3 and 15 days. Some states count business days, while others use calendar days. The countdown usually starts on the day you sign the contract or get the required disclosure documents.

Here’s a quick look at how long the rescission period lasts in different states:

| State | Typical Rescission Period |

|---|---|

| Alabama | 5 days (excluding Sundays) after contract signing |

| Alaska | 15 days after receipt of statutory disclosure |

| Arizona | 10 days after contract execution |

| California | 7 days after signing or receipt of disclosures |

| Florida | 10 days after contract execution or disclosure |

| Georgia | 7 days excluding holidays and Sundays after disclosure |

| Indiana | 72 hours after contract execution |

| Kansas | 3 business days after contract signing |

| Nevada | 5 days after contract execution |

| New York | 7 business days after contract signing |

| Tennessee | 10 days after signing with inspection; 15 days without |

| West Virginia | 10 days after signing and 10 days after disclosure |

| Wyoming | 10 days after signing (Home Solicitation) |

Your right to cancel depends on your state’s law and the details in your contract. Always check your paperwork for the exact rescission period.

Steps to Exit Your Contract Early

If you want to cancel a timeshare contract during the rescission period, you need to act fast. Follow these steps to make sure your cancellation is valid:

- Write a formal cancellation letter. Include the current date, your full name, address, phone number, email, the name of the timeshare company, a description of the timeshare, the date of purchase, and a clear statement that you want to cancel the contract.

- Send the letter by certified mail. Make sure it is postmarked before the rescission period ends.

- Keep copies of your letter and all related documents.

- Save proof of mailing and delivery.

- Follow up with the timeshare company by email or fax to confirm they received your cancellation.

- Ask for written confirmation that your timeshare cancellation is complete.

Tip: The sooner you send your cancellation notice, the better your chance to exit your contract without problems. Missing the rescission period deadline can make it much harder to get out of a timeshare.

After the Rescission Period

How to Get Out of a Timeshare with the Resort

If you missed the rescission period, you still have ways to get out of a timeshare. The first step is to contact your resort directly. Many resorts have owner support teams that handle requests from people who want to exit their contract. You can call or email them and ask about your options for getting rid of a timeshare.

Most resorts will ask if you are current on your fees and if you have paid off your loan. Resorts rarely help owners who owe money or have missed payments. If you meet these requirements, you can ask about deed-back or surrender programs. Sometimes, the resort may offer a way to give a timeshare back, but they do not have to accept your request.

You should know that only about 15% of owners succeed in negotiating an exit with the resort after the rescission period. Resorts often make it hard to exit a timeshare because they want to keep collecting fees. If you want to exit your contract, you need to be persistent and keep good records of every conversation.

Note: Always get everything in writing. Save emails, letters, and notes from phone calls. This helps protect you if the resort changes its story later.

Deed-Back and Surrender Options

Many major timeshare companies offer deed-back or surrender programs. These programs let you give a timeshare back to the resort if you meet certain rules. Here are the most common requirements:

- You must have paid off your timeshare in full. No loans or liens can be active.

- Your account must be in good standing. You cannot owe maintenance fees or other charges.

- You need to contact the resort or the homeowners association (HOA) directly to ask about deed-back options.

- You should provide a valid reason, like financial hardship or a major life event. Just saying you do not want the timeshare is not enough.

- Write a formal letter explaining your situation. This shows you are serious.

- Be ready to try more than once. Resorts do not have to accept your request, and they may say no at first.

- Some resorts charge a fee to process the deed-back. This fee can range from a few hundred to several thousand USD.

Major companies like Diamond, Wyndham, Worldmark, Welk, Westgate, and Holiday Inn Club Vacations have official deed-back programs. If you qualify, this can be one of the best solutions for getting rid of a timeshare without hurting your credit.

Tip: If the resort says no, do not give up. Try again, and keep all your paperwork. Sometimes, a different person or a new reason can change the answer.

Selling or Gifting Your Timeshare

If the resort will not take your timeshare back, you might look at selling or gifting it. Many owners want to know how to get out of a timeshare by selling it, but the resale market is tough. Here are some of the biggest obstacles you might face:

- Lack of market demand. Most people do not want to buy a timeshare because of high costs and yearly fees.

- Complicated contracts. Legal rules and resort policies can make it hard to transfer ownership.

- Resort restrictions. Some resorts limit how many timeshares can be resold or have the right to buy it back first.

- High maintenance fees. These fees keep going up, which scares off buyers.

- Weak resale market. Timeshares lose value fast, and you may not get any money back.

- Scams. Some companies promise to help you sell but only take your money and disappear.

If you want to sell, you can list your timeshare on websites that specialize in resales. You can also try to gift it to a friend or family member. Some charities accept timeshare donations, but most will only take them if you pay all the fees first.

Warning: Never pay a company upfront to sell your timeshare. Many scams target owners who want quick solutions for getting rid of a timeshare.

Selling or gifting a timeshare can be hard, but it is still a possible solution if you cannot use deed-back or surrender programs. Always check the rules in your contract and talk to the resort before you try to transfer ownership.

If you feel stuck, remember that you are not alone. Many people struggle with canceling a timeshare after the rescission period. You have several solutions, but each one takes time and patience. Keep asking questions, keep good records, and do not give up until you find the right way to exit a timeshare.

Canceling Your Timeshare Safely

Image Source: pexels

Avoiding Scams

When you start canceling your timeshare, you need to watch out for common scams to avoid. Many scammers target people who want to get out of a timeshare. They promise quick results, ask for large upfront fees, and then disappear. Here are some common scams to avoid:

- Resale and rental scams: Scammers pretend to have buyers or renters lined up, charge you fees, and never deliver.

- Exit and cancellation fraud: Fake companies promise to cancel your contract, take thousands of dollars, and do nothing.

- Upfront fee scams: Scammers demand payment before any service, then vanish or ask for more money.

- Cold calls or robocalls: Unsolicited calls claim a buyer is ready, but you must pay transfer fees first.

Tip: Never pay upfront fees. Always check if a company has a real business address and a good record with the Better Business Bureau.

Timeshare Exit Companies

Some people look for timeshare exit companies to help with canceling your timeshare. Not all of these companies are honest. You should know the warning signs before you trust anyone with your money. Here are some red flags:

- High upfront fees. Legitimate companies rarely ask for large payments before results.

- Promises of quick exits or guaranteed cancellation. Timeshare contracts are complex, and no one can promise fast results.

- Advice to stop paying maintenance fees. This can hurt your credit and lead to foreclosure.

- Vague contracts or poor communication. If you do not get clear answers, walk away.

- High-pressure sales tactics. If someone pushes you to sign right away, be careful.

You should always research timeshare exit companies. Check reviews, ask for a written contract, and talk to your timeshare company first. The Better Business Bureau has received many complaints about these companies, so do your homework.

Legal Help to Exit Your Contract

Sometimes, the best way to get out of a timeshare is to talk to a lawyer. Attorneys who know timeshare law can review your contract and explain your options. Many timeshare owners find legal solutions work better than risky exit companies. Attorney fees can range from $3,000 to $10,000, depending on your case. Some lawyers charge flat fees, while others bill by the hour.

You can also contact your timeshare developer or use platforms like ResponsibleExit.com. Many developers offer free or low-cost solutions if you are current on fees. The Coalition for Responsible Exit lists trusted resources and vetted resellers. Always check credentials and avoid anyone who is not a licensed attorney.

Note: If you feel unsure, talk to a lawyer before you sign anything. Legal help can protect you from scams and make canceling your timeshare safer.

Protecting Your Credit

Image Source: pexels

Risks of Walking Away

If you stop paying your timeshare, your credit score can take a big hit. When you miss payments on a timeshare loan, the developer usually reports it to the credit bureaus. This creates a negative mark on your credit report. If you bought your timeshare with a loan, defaulting can lower your score by at least 100 points. Unpaid maintenance fees can also hurt your credit if the debt goes to a collection agency. Foreclosure on a timeshare works like a home foreclosure. It stays on your credit report for seven years and makes it harder to get loans, rent a home, or even pass some job credit checks. Most timeshare defaults show up on credit reports, so you should always check your credit after missing payments.

Note: If you stop paying your timeshare, the damage can last for years. Always look for other solutions before you walk away.

How to Protect Your Credit Score

You can protect your credit score by staying current on all timeshare payments while you work to exit your contract. Keep up with both loan payments and maintenance fees. If you fall behind, your credit score can drop fast. Always keep records of every payment and communication with the timeshare company. If you need help, talk to a lawyer who knows about timeshare contracts. Avoid companies that promise quick fixes or tell you to stop paying your timeshare. These can be scams that leave you with worse credit. Check your credit reports from all three bureaus often. If you see mistakes or negative marks, dispute them right away. Good credit habits, like paying bills on time and keeping debt low, help your score recover if you have any problems.

Step-by-Step Checklist

Here’s a simple checklist to help you exit your contract safely and protect your credit:

- Review your timeshare contract and know your cancellation deadlines.

- Stay current on all timeshare payments and fees.

- Gather all your documents, like your deed, loan info, and payment records.

- Contact the timeshare company to ask about exit programs or deed-back options.

- Document every call, email, and letter.

- Send all requests by certified mail and keep copies.

- Talk to a qualified timeshare attorney if you need legal help.

- Watch out for scams and never pay large upfront fees.

- Check your credit reports for any changes or errors.

- Dispute any mistakes you find on your credit report.

| Category | What You Need |

|---|---|

| Timeshare Documents | Deed, contract, payment records, loan info |

| Ownership Details | Points/weeks owned, maintenance fee amount, pay-off balance |

| Resort Info | Resort name, contact info, member number |

| Questions to Ask | Exit program options, loan balance, maintenance fee status, buyback or assistance programs |

Tip: Staying organized and proactive gives you the best chance to exit your contract without hurting your credit.

You can exit your timeshare if you stay persistent and follow the right steps. Many owners make mistakes like missing the cancellation window, not reading the contract, or falling for scams. The process to cancel a timeshare often takes months, so set realistic expectations. Always act within legal deadlines, keep up with payments, and protect your credit. If you feel stuck, seek help from a trusted professional. Canceling your timeshare brings relief from fees and stress, giving you more freedom and better financial health.

Remember: Never rush the cancellation process or ignore important details. Careful planning helps you avoid costly errors.

FAQ

How long does it take to exit a timeshare contract?

The process can take a few weeks to several months. If you act during the rescission period, it is quick. After that, it depends on the resort, your contract, and the method you choose.

Will canceling my timeshare hurt my credit score?

If you follow the right steps and stay current on payments, your credit score should stay safe. Missing payments or walking away can lower your score and lead to collections or foreclosure.

What documents do I need to start the exit process?

You should gather these documents:

| Document Type | Examples |

|---|---|

| Contract | Purchase agreement, deed |

| Payment Records | Loan statements, fee receipts |

| Resort Info | Member number, contact details |

Can I exit my timeshare if I still owe money?

You may find it harder to exit if you have a loan balance. Most resorts require you to pay off your loan first. Some exit companies or lawyers can help, but you should expect extra costs.

Exiting a timeshare can feel overwhelming, especially when you’re balancing deadlines, fees, and the risk of hurting your credit. The same challenges apply when managing international payments—high fees, unclear exchange rates, and delays can cost you both money and peace of mind. That’s where BiyaPay comes in. With transparent real-time currency conversion, fees as low as 0.5%, and support for both fiat and digital currencies, BiyaPay makes it easy to move money globally without hidden surprises. You can register quickly, send funds to most countries and regions, and even benefit from same-day transfers when requirements are met. Protecting your financial health doesn’t stop at exiting a timeshare—choose a smarter way to manage cross-border payments with BiyaPay. Start today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.