- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to make international transfers with First Convenience Bank

Image Source: unsplash

You can only start an international wire transfer with First Convenience Bank by visiting certain branches. Online or app options do not exist for international transfers. Before you begin the process, make sure you have all your documents ready. This step saves you time and helps you avoid mistakes when sending money overseas. Use this international transfer guide to understand what you need before you go. Bring your ID and double-check every detail for a smooth transfer.

Key Takeaways

- You must visit select First Convenience Bank branches in person to start an international transfer; online or app options are not available.

- Bring all required documents and accurate recipient details, including full name, bank info, and SWIFT code, to avoid delays or errors.

- International transfer fees vary by amount, with lower percentages for larger sums; ask the bank for the latest fee schedule before sending.

- Keep your confirmation receipt and Tracking ID to monitor your transfer and quickly resolve any issues with the bank.

- Stay alert to scams by verifying requests carefully and never rush a wire transfer; ask bank staff for help if you feel unsure.

International Transfer Guide

Image Source: pexels

Service Availability

You might wonder where you can start an international transfer guide with First Convenience Bank. The answer is simple. You can only use this service at select physical branches. The bank does not let you send money overseas through its website or mobile app. If you want to send funds abroad, you need to visit a branch in person. This rule helps keep your money safe and makes sure you get help from a staff member. When you walk into a branch, you can ask for the international transfer guide at the front desk. The staff will show you where to go and what to do next. This process makes things clear and easy for you.

Tip: Before you visit, call your local branch to check if they offer international transfers. Not every branch provides this service, so it is smart to confirm first.

Who Can Use This Service

The international transfer guide is for customers who have an account with First Convenience Bank. If you already have an account, you can use the international wire transfer service. You must bring a valid photo ID, like a driver’s license or passport, when you visit the branch. The staff will ask for your account details and help you with the process. If you are not a customer yet, you need to open an account before you can use the international transfer guide. The bank wants to make sure your information is correct and your money is safe. This step protects you and helps prevent fraud. The international transfer guide is designed to help you send money to family, friends, or businesses in other countries. You can trust the staff to walk you through each step and answer your questions.

International Wire Transfer Steps

Image Source: unsplash

Prepare Your Account

Before you start an international wire transfer, you need to make sure your account is ready. Check that your account is active and has enough funds to cover the transfer amount and any fees. If you are not sure about your balance, you can ask a teller at the bank or check your latest statement. You also need to bring a valid photo ID, like your driver’s license or passport. The bank staff will ask for this when you begin the wire transfer process. If you do not have your ID, the bank cannot start the transfer for you.

Tip: Double-check your account details before you go. This helps you avoid mistakes and saves time at the branch.

Gather Required Information

You need to collect all the details for the international wire transfer before you visit the branch. Missing or incorrect information can cause delays, extra fees, or even failed transfers. Here is what you must have:

- Recipient’s full name (no initials)

- Recipient’s address

- Recipient’s bank name

- Recipient bank’s SWIFT/BIC code

- Recipient’s account number or IBAN

- Your own account number and full name

If you are sending money to a bank in Hong Kong, make sure you have the correct SWIFT code for that bank. Always write names and numbers clearly. Even a small spelling mistake can slow down the process. If you leave out important details, the transfer might get rejected or sent to the wrong account. Fixing these problems can take days or even months, and sometimes you may need the recipient’s help to get your money back.

Note: Triple-check every detail. If you notice a mistake after submitting, contact the bank right away to fix it.

Visit a Branch

You cannot start an international wire transfer online or through the app. You must visit a branch in person. Not every branch offers this service, so call ahead to make sure. When you arrive, let the staff know you want to make an international wire transfer. They will direct you to a wire transfer specialist. This person knows the process well and can answer your questions.

Bring all your documents and information with you. The specialist will give you a wire transfer form to fill out. If you need help, just ask. The staff wants to make sure your transfer goes smoothly.

Confirm and Submit

The wire transfer process at the branch follows a few clear steps. Here is what you can expect:

1. Give the specialist all the beneficiary’s information, including full name, address, and SWIFT code.

2. Fill out the wire transfer form with the help of the specialist.

3. Review the fees for the transfer. Ask about the current exchange rate if you are sending money in a foreign currency.

4. Double-check every detail on the form. Make sure names, numbers, and codes are correct.

5. Pay the transfer fee and the amount you want to send.

6. The specialist will process your transfer and give you a confirmation receipt. This receipt has important details about your transaction.

7. Keep the receipt in a safe place. You may need it if there are any questions or problems later.

If you provide incomplete or incorrect information, your transfer could get delayed, rejected, or even sent to the wrong account. Small errors, like a typo in the name, might only cause a delay. Big mistakes, such as a wrong account number or missing SWIFT code, can lead to your money going to the wrong place. Fixing these issues can take a long time and may require legal steps if the recipient does not agree to return the funds. To avoid these problems, always check your information carefully and ask the specialist if you are unsure about anything.

Reminder: Save your confirmation receipt. It is your proof that the transfer was made and includes all the details you might need for tracking or resolving issues.

Required Information

When you get ready for a wire transfer at First Convenience Bank, you need to bring the right details. This helps the bank process your request quickly and keeps your money safe. Let’s break down what you need for each part of the process.

Recipient Details

You must give the bank complete information about the person or business you want to send money to. Missing or wrong details can cause problems with your wire transfer. Here’s what you need:

- Recipient’s full name (no initials)

- Recipient’s address

- Recipient’s bank name and address

- Recipient’s bank account number or IBAN

- Recipient’s bank SWIFT code

Double-check every detail before you hand it to the bank. Even a small mistake can delay your wire transfer or send money to the wrong place.

Sender Details

The bank also needs your information to start the wire transfer. This helps the bank follow rules and keep your account safe. You should bring:

- Your full name

- Your address

- Your account number at First Convenience Bank

- A valid photo ID (like a driver’s license or passport)

If you plan to send a large amount, the bank may ask for extra documents. You might need to show where the money comes from or explain why you are sending it. The bank follows strict rules to stop money laundering and fraud. These rules protect you and everyone who uses the bank.

Bank Codes

A wire transfer needs special codes so the money goes to the right bank. The most important code is the SWIFT/BIC code. For First National Bank of Central Texas, the SWIFT/BIC code is FNCTUS44XXX. You need this code if you send money to or from this bank. The code helps banks talk to each other in the global network.

| Bank Name | SWIFT/BIC Code |

|---|---|

| First National Bank of Central Texas | FNCTUS44XXX |

Always ask the bank staff if you are not sure which code to use. The right code makes sure your wire transfer reaches the correct bank and branch.

The bank must follow U.S. laws for every wire transfer. If you send $10,000 or more, the bank will report it to the IRS. This is normal and helps stop illegal activity. The bank also checks your ID and may ask for more details to follow anti-money laundering rules.

International Bank Transfer Fees

When you send money overseas, you want to know exactly how much it will cost. Every international bank transfer at First Convenience Bank comes with its own fee. The bank lists these fees in its official fee schedule, so you can always ask for the latest rates before you start your transfer. You should also know that the total cost may include more than just the fee from your own bank.

Outgoing Transfer Fees

First Convenience Bank charges a separate fee for each international bank transfer. The fee depends on how much money you send. Instead of a flat fee, the bank uses a percentage based on your transfer amount. This can help if you plan to send a large sum. Here’s a table that shows how the fee changes as your transfer amount goes up:

| Transfer Amount Range | Fee Percentage |

|---|---|

| $10,000 to $24,999.99 | 1.65% |

| $25,000 to $49,999.99 | 1.40% |

| $50,000 to $99,999.99 | 1.05% |

| $100,000 to $149,999.99 | 0.78% |

| $150,000 to $249,999.99 | 0.47% |

| $250,000 and above | 0.36% |

You can see that the percentage drops as your transfer amount increases. For example, if you send $12,000, you pay a 1.65% fee. If you send $200,000, the fee drops to 0.47%. This system can save you money on larger transfers.

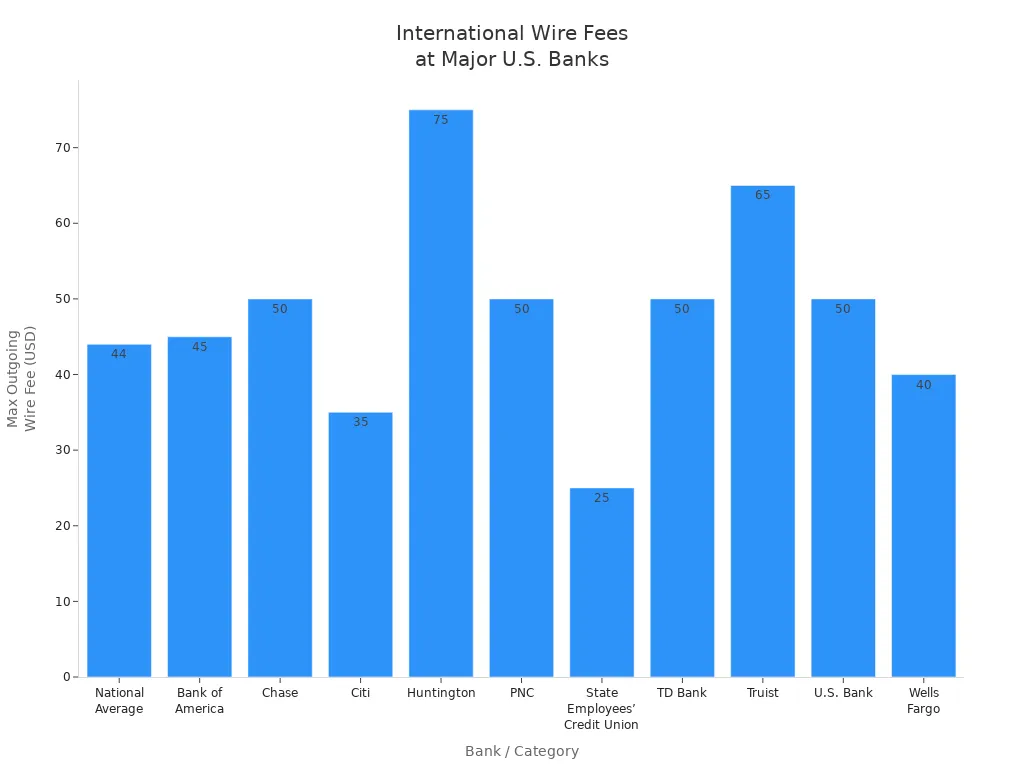

How does this compare to other banks? Many U.S. banks charge a flat fee for each international bank transfer. The national average is about $44 per transfer. Some banks, like Huntington, charge as much as $75, while others, like Citi, may charge as little as $35. Here’s a quick look at how First Convenience Bank’s fees stack up:

| Bank / Category | Outgoing International Wire Fee |

|---|---|

| National Average | $44 (flat fee) |

| Bank of America | $0-$45 |

| Chase | $0-$50 |

| Citi | $0-$35 |

| Huntington | $75 |

| PNC | $5-$50 |

| State Employees’ Credit Union | $25 |

| TD Bank | $50 |

| Truist | $65 |

| U.S. Bank | $50 |

| Wells Fargo | $0-$40 |

Tip: Always ask the bank staff for the most up-to-date fee schedule before you start your transfer.

Additional Charges

You might think the fee from your own bank is the only cost, but that’s not always true. When you make an international bank transfer, other banks may get involved. These are called intermediary or receiving banks. Each one can charge its own fee for handling your transfer. Sometimes, the recipient’s bank in another country, like a Hong Kong bank, will also take a fee before the money arrives.

These extra charges can lower the final amount your recipient gets. You may not see these fees until after the transfer is complete. If you want to avoid surprises, ask your bank if they know about possible extra charges. You can also talk to the person receiving the money and ask them to check with their bank.

Note: Intermediary and receiving bank fees are common with international bank transfers. Plan ahead so your recipient gets the right amount.

Transfer Time and Tracking

Processing Time

When you send an international transfer at First Convenience Bank, you probably want to know how long the process will take. Most international transfers take between 3 to 5 business days to reach the recipient. Sometimes, the process can be faster, but it depends on several things. If your transfer involves multiple banks, like when sending money to a Hong Kong bank, the process may take longer. Time zone differences and bank holidays can also slow things down. If you start your transfer after the bank’s daily cutoff time or on a weekend, the process will begin on the next business day. Currency conversion and extra checks for security or regulations can add more time.

Tracking Your Transfer

You do not have to wonder where your money is during the process. First Convenience Bank lets you track your international transfer using the Online Activity section under the Payments & Transfer Menu. Here, you can see every transfer you have started, approved, or completed. Each transfer has a unique Tracking ID. This ID helps you and the bank staff find your transfer quickly if you have questions. If you need help, you can call the bank and give them your Tracking ID. The staff can check the status and explain where your transfer is in the process.

Tip: Always keep your confirmation receipt and Tracking ID. These details make it much easier to get updates or solve any problems with your transfer.

Handling Delays

Sometimes, your transfer might not arrive as fast as you expect. Many things can slow down the process:

- Several banks may handle your transfer, which adds extra steps.

- Time zone differences mean banks in other countries may not work the same hours.

- Currency conversion can take longer if your bank does not deal in the needed currency.

- Incorrect or missing information, like a wrong account number or SWIFT code, can stop your transfer.

- Transfers started outside business hours or after cutoff times wait until the next business day.

- Security checks and rules for international transfers can hold up the process.

If your transfer is delayed, check the Online Activity section first. If you still have questions, call First Convenience Bank. The staff can look up your transfer and help you understand what is happening. They can also tell you if you need to fix any information to complete the process.

Wire Transfer Safety

Security Measures

You want your money to reach the right person, so First Convenience Bank puts strong security steps in place for every wire transfer. The bank uses encryption technology to keep your data safe while it moves between banks. Only people with permission can see your information. When you start a wire transfer, you must use two-factor authentication. This means you need more than just a password to send money, which stops others from making transfers without your approval.

The bank also checks all recipient details before sending your wire transfer. If something looks wrong, the staff will ask you to confirm the information. You get alerts by email or text if there is any unusual activity on your account. These alerts help you spot problems fast. First Convenience Bank follows strict international security rules to protect your wire transfer, no matter where you send it—even if you are sending money to a Hong Kong bank.

If you ever feel unsure, talk to a bank employee before you start your wire transfer. They can answer your questions and help you follow all security steps.

Avoiding Scams

Wire transfer scams can happen to anyone, but you can avoid them by staying alert. Scammers often pretend to be someone you trust, like a business partner or a family member. They might send you an email or call you, asking for money right away. Sometimes, they change payment instructions or use fake email addresses that look real.

Here are some ways to keep your wire transfer safe:

- Always double-check wire transfer requests by calling the person using a phone number you already know.

- Never send money to someone you do not know well or have not met in person.

- Watch out for urgent or strange requests, especially if they come from overseas or mention Hong Kong banks.

- Do not cash checks and then send a wire transfer to someone you do not trust.

- Look for red flags like poor grammar, odd payment details, or requests for confirmation codes.

If you think you have been tricked, contact First Convenience Bank right away. The bank can freeze your account and help you stop the wire transfer if possible. You should also report the scam to the police and the Federal Trade Commission. Taking quick action can help protect your money and improve your security.

Remember, wire transfers are hard to reverse. Always take your time and check every detail before you send money. Your safety comes first.

Alternatives and Tips

Other Transfer Options

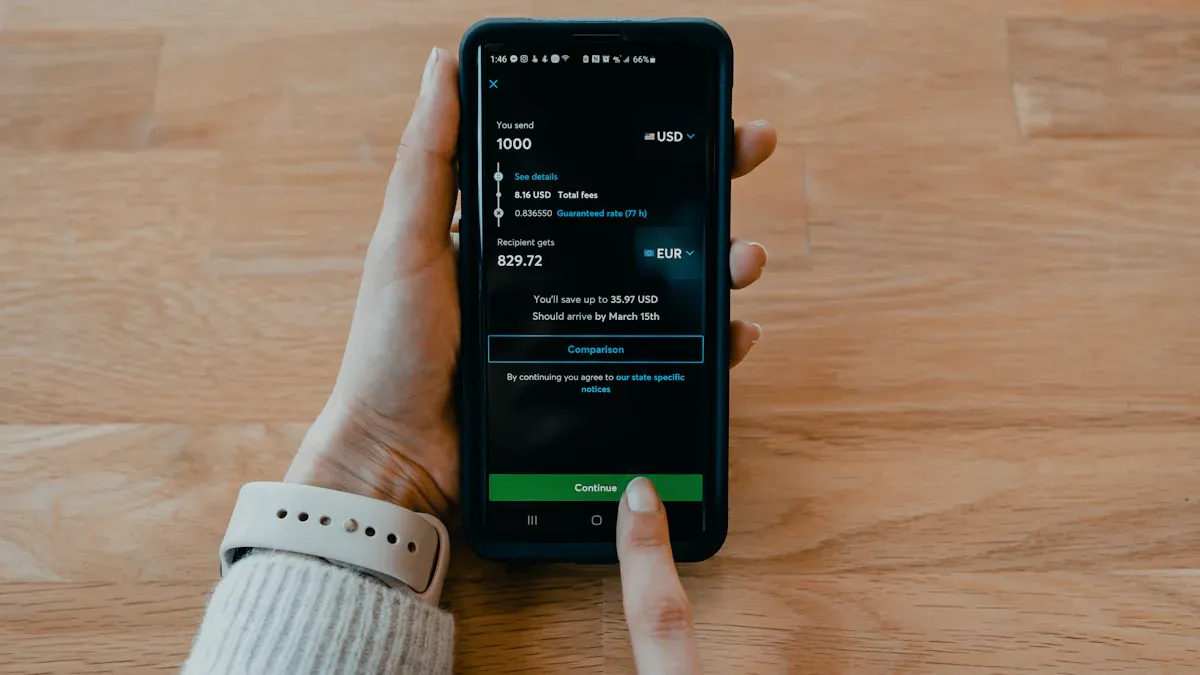

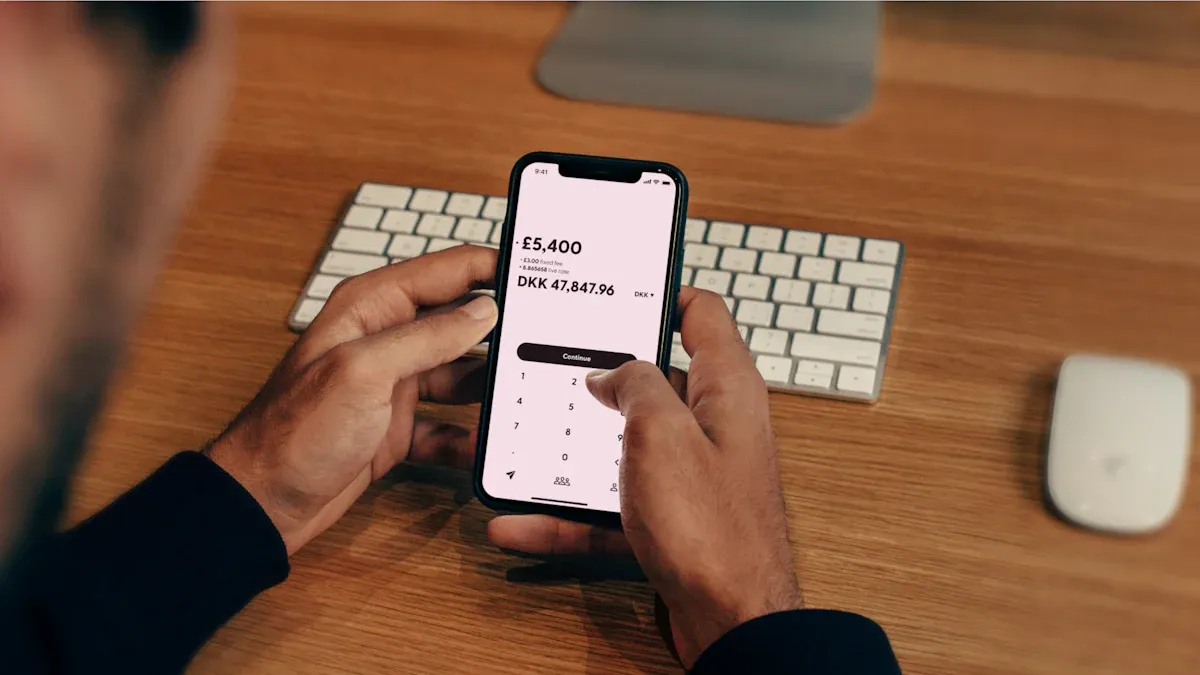

You have more choices than just using First Convenience Bank for sending money abroad. Many people now look for services that offer lower fees, faster transfers, and better exchange rates. Some companies let you send money online or through an app, which can save you a trip to the bank. These services often show you all the fees up front, so you know exactly what you will pay.

Here’s a quick comparison of how some modern money transfer services stack up against traditional banks:

| Feature | Wise | Traditional Banks (e.g., First Convenience Bank) |

|---|---|---|

| Transfer Fees | Transparent fees starting from 0.33% | Varies, often $10 - $35 per transfer |

| Intermediary Bank Fees | None | Yes, variable and often hidden |

| Exchange Rate Markup | None (mid-market rate used) | Yes, includes markup making transfers more expensive |

| Recipient Fees | Usually none | Varies, sometimes up to $9 |

| Transfer Speed | 60%+ instant, most within 24 hours | Typically 3-5 days via SWIFT |

| Countries Supported | 80+ countries | Varies, generally fewer than Wise or Western Union |

| Security | Regulated fintech with strong compliance | Established banks with traditional security measures |

Other services, like Vance and Remitly, also offer low fees and fast transfers. Western Union supports transfers to over 200 countries, which gives you more options if you need to send money to places like Hong Kong. Many of these providers use the real exchange rate, so you do not lose money on hidden markups.

If you want to save time and money, compare a few services before you send your next transfer.

Saving on Fees

You can take a few simple steps to keep more of your money when sending funds overseas:

- Compare fees and exchange rates from different banks and transfer services. Some providers use the mid-market rate, which is the fairest rate you can get.

- Look for special offers or discounts. Some banks waive fees for large transfers or for using their online services.

- Send money online or through an app when possible. Many banks and services charge less for online transfers than for in-person ones.

- Choose to send money in the recipient’s local currency. This helps you avoid extra conversion fees and inflated exchange rates.

- Use dedicated money transfer companies. These often have lower fixed fees and faster delivery than traditional banks.

- If you send money often, consider opening a foreign currency account. This can help you avoid repeated conversion charges.

Always check the total cost, not just the upfront fee. Hidden charges and poor exchange rates can add up quickly. By doing a little research, you can make sure your recipient gets the most from your transfer.

Getting ready for an international wire transfer at First Convenience Bank is simple if you follow the right steps. Here’s what you should do:

- Gather the recipient’s full name, account number, SWIFT/BIC code, and any extra details their country needs.

- Check that your account supports international transfers and that your branch offers this service.

- Visit the branch in person with your ID and all documents.

- Double-check every detail before you send money to avoid mistakes.

- Ask a wire transfer specialist for help if you have questions.

Always compare fees and watch for scams. Take your time, stay careful, and your transfer will go smoothly.

FAQ

How do I know if my branch offers international wire transfers?

Call your local branch before you visit. Not every branch can send money overseas. The staff will tell you if they offer this service and answer your questions.

What should I do if I make a mistake on the transfer form?

If you spot a mistake, tell the bank staff right away. They can help you fix it before sending your money. Quick action helps prevent delays or lost funds.

Can I track my international transfer after leaving the branch?

Yes, you can track your transfer. Use your confirmation receipt and Tracking ID. If you need help, call the bank. The staff can check the status for you.

Are there limits on how much money I can send overseas?

The bank may set limits based on your account type and the country you send money to. Ask the staff about any limits before you start your transfer.

Will the recipient pay any fees when receiving money in Hong Kong?

Some Hong Kong banks may charge a fee when your recipient gets the money. These fees depend on the bank’s policy. Ask your recipient to check with their bank for details.

Managing an international transfer through First Convenience Bank means branch visits, multiple forms, and days of waiting—plus fees that quickly add up. If you’re looking for a faster, simpler, and more affordable way to send money abroad, BiyaPay is built for you. With transfer fees as low as 0.5%, transparent real-time exchange rates, and support for both fiat and digital currencies, BiyaPay helps you send money to most countries and regions worldwide with ease. Even better, same-day transfers are available when initiated on the same day and cleared through compliance. Quick registration and intuitive features make cross-border transfers as smooth as local ones. Don’t let hidden charges or long wait times hold you back—take control of your international transfers with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.