- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Money order locations you can trust in 2025

Image Source: pexels

If you want to know where to get a money order in 2025, you have plenty of trusted options. You can choose a usps money order from the United States Postal Service, visit your local bank or credit union, or pick up a walmart money order at retail stores. Western Union and MoneyGram agents, grocery stores, pharmacies, and convenience stores also make it easy to purchase a money order. According to the United States Postal Service, 58.5 million money orders were issued in 2024, showing millions trust these locations every year. You can rely on these places for low fees, easy steps, and peace of mind.

Key Takeaways

- You can buy money orders at many trusted places like USPS, banks, Walmart, grocery stores, and convenience stores, each with different fees and limits.

- USPS and Walmart usually offer the lowest fees and allow money orders up to $1,000, while banks may charge more but provide extra security.

- Always bring cash or a debit card and a photo ID when buying a money order, and fill out all the details carefully before leaving the counter.

- Keep your receipt after purchase to track or cancel your money order if needed, which helps protect your money.

- If you need to send more than the limit, buy multiple money orders or consider alternatives like electronic payments or cashier’s checks for larger amounts.

Where to Get a Money Order

Image Source: pexels

You have many choices when you wonder where to get a money order in 2025. Each place offers different benefits, so you can pick what works best for you. Let’s look at the most trusted locations and what you can expect at each one.

USPS

You can always count on the post office for a usps money order. USPS locations are everywhere, and you do not need a bank account to buy a money order here. The process is simple:

- Go to any USPS branch.

- Ask for a money order at the counter.

- Fill in the recipient’s name, your name, and your address.

- Pay the amount plus a small fee. For amounts up to $500, the fee is $2.55. For amounts up to $1,000, the fee is $3.60.

- If you buy $3,000 or more in one day, you must show a valid photo ID and fill out a special form.

- Sign the money order and keep your receipt.

USPS money orders never expire and keep their value. You can trust the post office for security and reliability.

| Money Order Amount Range | Fee (USD) |

|---|---|

| $0.01 to $500.00 | $2.55 |

| $500.01 to $1,000.00 | $3.60 |

Tip: Always keep your receipt in case you need to track or cancel your money order.

Banks and Credit Unions

If you have an account, your bank or credit union is a great place to get a money order. These places offer high security because they link the money order to your account. You may pay a small fee, but some banks and credit unions offer money orders for free to account holders.

| Institution | Fee per Money Order | Maximum Limit per Transaction |

|---|---|---|

| Citizens Bank | Up to $5 | $1,000 |

| RTP Federal Credit Union | $1.00 | N/A |

| Valley Strong Credit Union | $0 (no fee) | N/A |

You can ask at the teller window for a money order. You will need to provide the recipient’s name and your details. Some banks may require ID, especially for larger amounts. If you do not have an account, you might pay a higher fee or not be able to buy a money order at all.

Walmart & Retailers

Retail stores like Walmart make it easy to get a money order. You can visit the MoneyCenter or customer service desk. Here’s how it works:

- Go to the MoneyCenter or customer service desk at Walmart or another large retailer.

- Tell the clerk the amount you need, up to $1,000 per money order.

- Give the payee’s name, your name, and your address.

- Pay with cash or a debit card. Credit cards are not accepted.

- Get your walmart money order and a receipt.

- Fill out the payee information and sign before you leave.

Walmart partners with MoneyGram, so you get a trusted service. Fees are low, usually $1.00 to $1.25 per money order. Many other retail stores, like Kroger and Meijer, offer similar services with small fees.

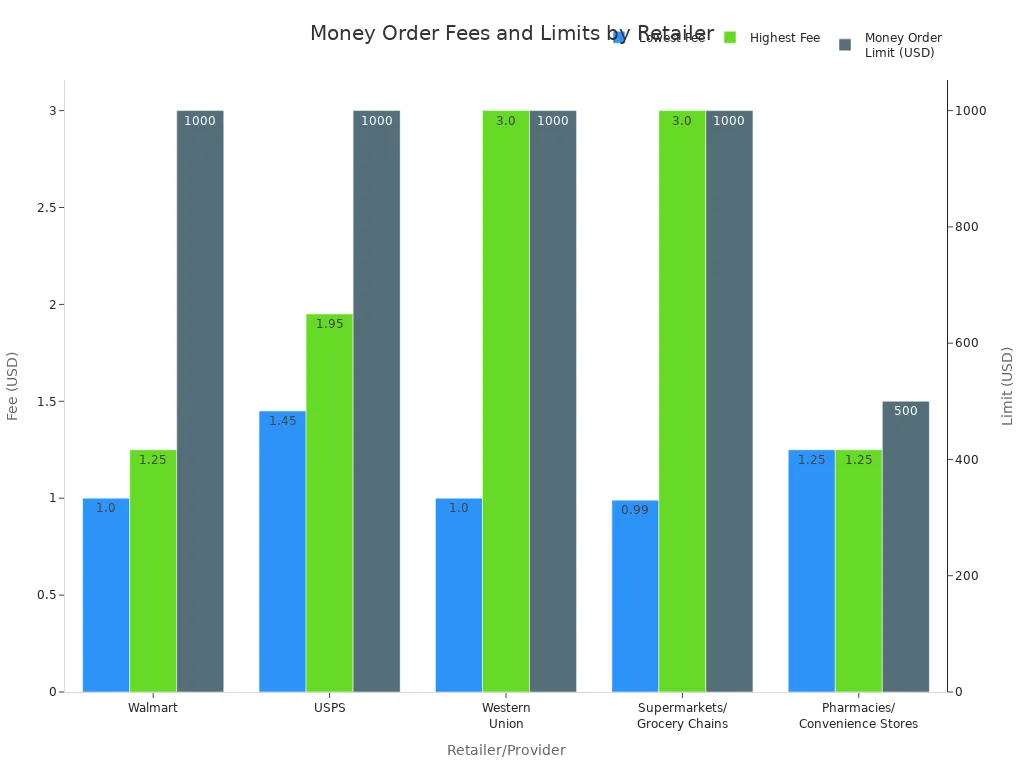

| Retailer/Provider | Fee Range (USD) | Money Order Limit (USD) | Payment Methods | Notes/Additional Info |

|---|---|---|---|---|

| Walmart | $1.00 - $1.25 | Up to $1,000 | Cash, Debit Card | Affordable; cashing available at Walmart |

| Kroger | $0.69 - $1.00 | $500 - $1,000 | Cash, Debit Card | Fees and limits vary by location |

| Meijer | $0.65 | $500 | Cash, Debit Card | Does not cash money orders |

Pharmacies & Grocery Stores

Many grocery stores and some pharmacies let you buy a money order while you shop. Stores like 7-Eleven, Publix, and Kroger offer this service. You can usually find the money order counter near the customer service area.

| Store | Money Order Limit | Fee Range | Provider(s) | Notes on Requirements/Services |

|---|---|---|---|---|

| 7-Eleven | $500 | $0.65 min, 1-3% | MoneyGram / Western Union | Over 9,000 locations nationwide |

| CVS | $500 | $1.25 | MoneyGram | Over 9,400 locations; good customer service |

| Meijer | $500 | $0.65 | Western Union | 266 stores; does not cash money orders |

| Publix | $500 | $0.85 | Western Union | 1,400+ stores; does not cash money orders |

| Kroger | $500 - $1,000 | $0.69 - $1.00 | Western Union | 2,900+ stores; fees and limits vary |

Fees range from $0.65 to $1.25, and limits are often $500 per money order. You will need to show ID for larger amounts. Always fill out the recipient’s name and keep your receipt.

Convenience Stores

You can also get a money order at many convenience stores, such as 7-Eleven and Circle K. Look for signs for Western Union or MoneyGram. The process is quick:

- Ask for a money order at the counter.

- Tell the clerk the amount you need.

- Show your photo ID.

- Pay with cash or sometimes a debit card.

- Fill out the form with the recipient’s name, your details, and your signature.

- Keep the receipt safe.

Fees at convenience stores are usually higher, often over $1.75, and the limit per money order is lower than at other places. These stores are open late, so they are handy if you need a money order outside regular business hours.

| Location Type | Typical Fee (up to $1,000) | Maximum Limit per Money Order | Notes |

|---|---|---|---|

| Convenience Stores | Higher fees (often > $1.75) | Lower limits | Fees and limits vary; generally less cost-effective and lower max amounts than others. |

Note: CVS does not offer money order services in 2025. For money orders, use other convenience stores or retail stores.

Western Union & MoneyGram

Western Union and MoneyGram are two of the biggest names for money orders. You can find their services at many banks, retail stores, grocery stores, and convenience stores. Here’s what you do:

- Write the recipient’s name in the “Pay to the order of” field.

- Fill in your name and address.

- Sign the money order.

- Pay the fee and the amount you want to send.

- Keep the receipt for tracking.

Western Union allows transfers up to $3,000 without extra ID and up to $50,000 with verification. MoneyGram lets you send up to $10,000 for most international transfers and $15,000 for some transactions. Both accept cash and debit cards, but credit cards usually cost more. For large amounts, you may need to show extra ID or documents.

Always double-check the recipient’s information and keep your receipt. This helps you track your money order if needed.

Money orders from Western Union and MoneyGram are accepted almost everywhere. They are a safe choice if you want to send money across the country or even to another country.

Money Order Fees and Limits

Image Source: pexels

Fee Comparison

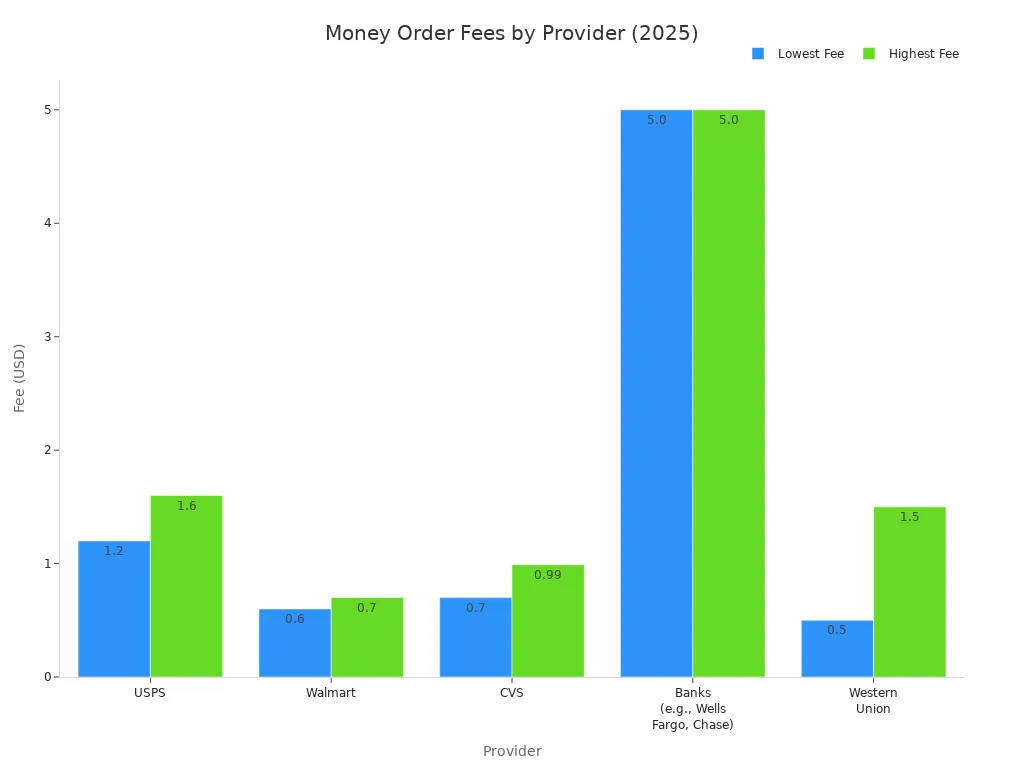

When you buy a money order, you want to know how much it will cost. The money order fee can change depending on where you go. Some places charge less, while others may cost more. Here’s a quick look at what you can expect in 2025:

| Provider | Fee Range | Maximum Money Order Amount | Notes |

|---|---|---|---|

| USPS | $1.20 (up to $500), $1.60 (up to $1,000) | $1,000 | International money orders cost $4.50; limited to $1,000 per order. |

| Walmart | Approximately $0.60 - $0.70 | $1,000 | One of the lowest fees; payment by cash or debit card only; no credit cards accepted. |

| CVS | $0.70 - $0.99 | $500 | Slightly higher fees than Walmart; lower maximum limit. |

| Banks (e.g., Wells Fargo, Chase, U.S. Bank) | Around $5 flat fee | $1,000 | Fees may be waived for premium account holders; fees vary by bank and location. |

| Western Union | $0.50 - $1.50 (varies by location) | $1,000 | Fees vary by branch; no account needed; open daily including weekends; cashing fees 1-3%. |

You can see that Walmart and USPS usually have the lowest money order cost. Banks and credit unions may charge more, sometimes up to $5, unless you have a special account. Grocery stores and pharmacies fall in the middle.

Tip: Always ask about the money order cost before you buy, so you don’t get surprised at the counter.

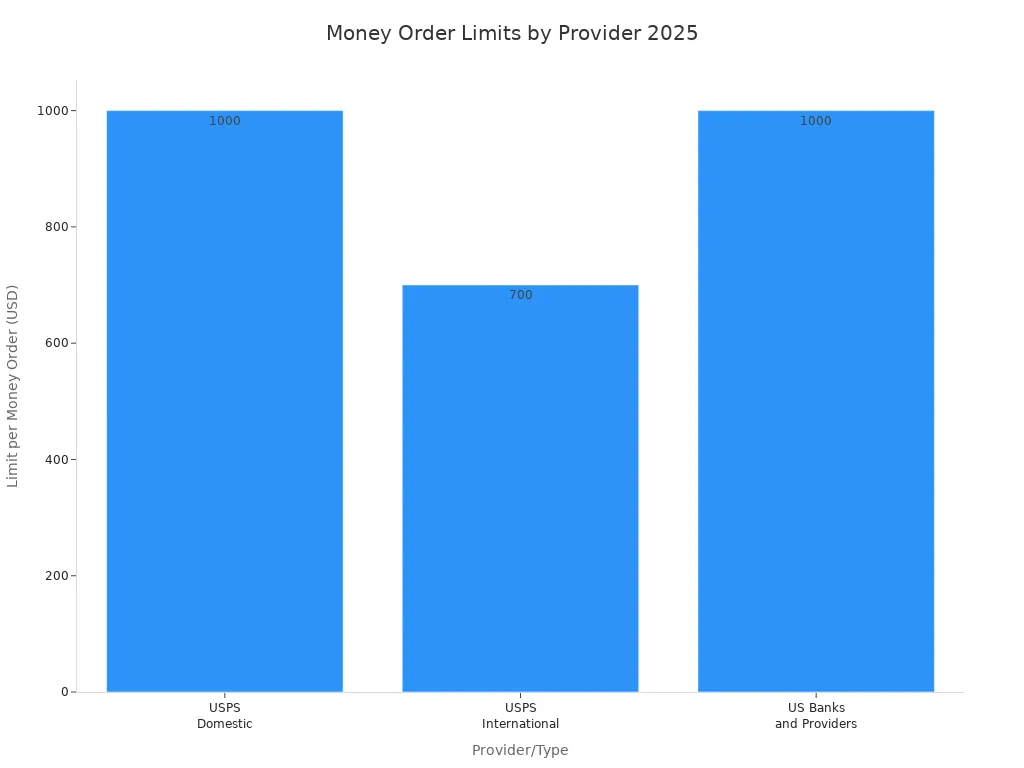

Limits and Requirements

Most places set a limit on how much you can send with one money order. The standard limit is $1,000 per money order at places like USPS, Walmart, and most banks. Some stores, such as CVS, have a lower limit of $500. If you need to send more, you can buy more than one money order, but you may need to show your ID if the total is high.

| Provider/Type | Limit per Money Order | Additional Conditions/Notes |

|---|---|---|

| USPS | Up to $1,000 | Purchases totaling $3,000 or more in one day require ID and a special form. |

| Walmart | $1,000 | Cash or debit card only; no credit cards. |

| CVS | $500 | Lower limit than other providers. |

| Banks | $1,000 | Some banks may have different limits; ID often required for large amounts. |

| Western Union | $1,000 | Higher limits possible with extra ID; varies by location. |

You usually need to pay with cash or a debit card. Credit cards are not accepted at most places. Always bring your photo ID, especially if you plan to buy several money orders or send a large amount. This helps keep your money order safe and secure.

How to Buy a Money Order

What to Bring

Before you head out to buy a money order, make sure you have everything you need. Most places want you to pay with cash or a debit card. Credit cards are usually not accepted because of higher fees. You should also bring a valid photo ID, especially if you plan to send a large amount. Some places may not ask for ID for small amounts, but it is always good to have it just in case. You will need the exact name of the person or business you want to pay.

Here’s a quick table to help you get ready:

| What to Bring | Details |

|---|---|

| Payment | Cash or debit card (credit cards not accepted in person) |

| Photo ID | Required for large amounts or if requested by the provider |

| Recipient Info | Full name and address of the person or business receiving the money order |

| Your Info | Your name and address |

Tip: Always keep your receipt after you purchase a money order. It helps you track or cancel it if needed.

Filling Out the Form

When you get to the counter, ask to buy a money order. The clerk will give you a form to fill out. Here’s how you do it:

- Write the name of the person or business you want to pay on the “Pay to the order of” line. Double-check the spelling.

- Add your name and address in the purchaser section. Some forms may also ask for the payee’s address.

- Use the memo line if you want to add a note, like an account number or reason for payment.

- Sign your name in the purchaser’s area on the front. Do not sign the back; that is for the person who gets the money order.

- Detach and keep the receipt for your records.

You can purchase a money order at many places, such as the post office, banks, or big stores. Always pay the full amount plus the fee upfront. If you make a mistake, ask for help before you finish. This way, you avoid problems later.

Note: Fill out every part of the money order before you leave the counter. This keeps your money safe and makes sure only the right person can cash it.

Money Order Alternatives

You have more ways to send money in 2025 than ever before. If you want something other than a money order, you can try electronic payments or cashier’s checks. Each option has its own benefits and works best in different situations.

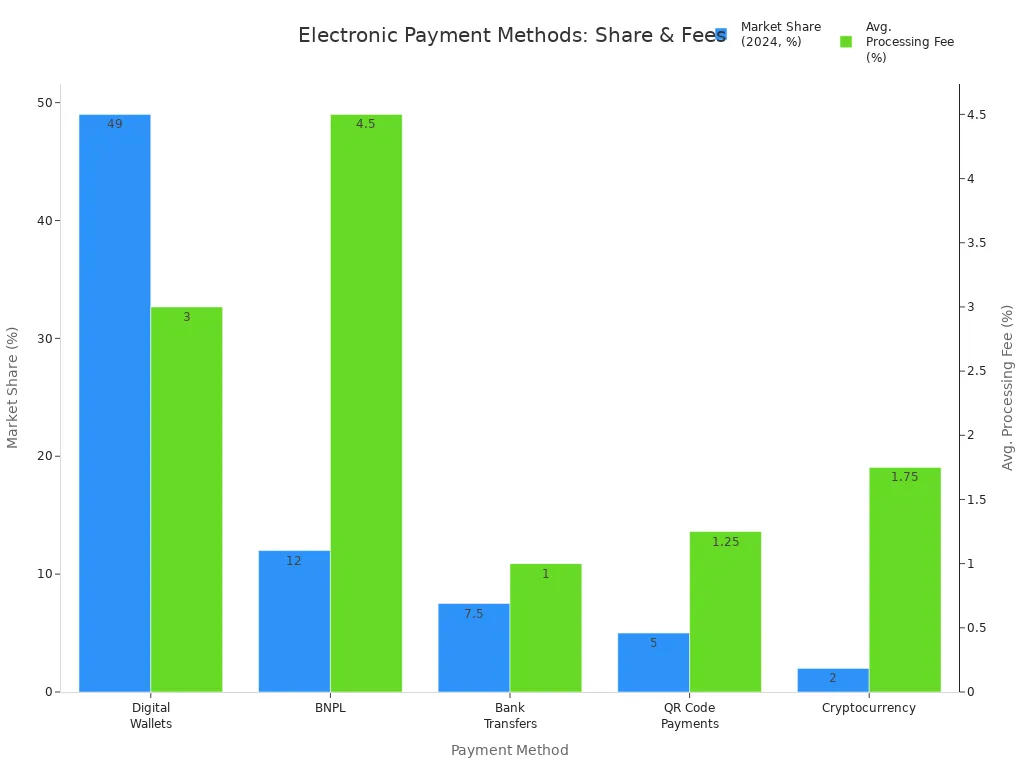

Electronic Payments

Electronic payments are now very popular. You can use digital wallets, bank transfers, QR code payments, or even cryptocurrency. These methods let you send money quickly and safely, often right from your phone or computer. Many people use services like PayPal, Stripe, or Square. These companies offer strong security and easy ways to pay.

Here’s a quick look at how electronic payment methods compare:

| Payment Method | Market Share (2024) | Avg. Processing Fee | Transaction Speed | Security Level |

|---|---|---|---|---|

| Digital Wallets | ~49% of global ecommerce | 2.5–3.5% | Instant | High |

| Buy Now Pay Later (BNPL) | ~12% of global ecommerce | 3–6% | Instant approval | Medium–High |

| Bank Transfers | ~7–8% of global ecommerce | 0.5–1.5% | Same day to 3 days | Very High |

| QR Code Payments | ~15% in APAC; <5% globally | 0.5–2% | Instant | High |

| Cryptocurrency | ~2% globally | 0.5–3% | 10 min – 1 hour | Variable |

Most electronic payments cost a small fee, usually between 0.5% and 3.5%. Bank transfers are often the cheapest and safest, but they can take longer. Digital wallets and QR codes are fast and easy, but you might pay a bit more. These options work well if you and the person you pay both have access to the same app or service.

Cashier’s Checks

Cashier’s checks are another safe way to pay, especially for large amounts. You get a cashier’s check from your bank, and the bank guarantees the money. This makes them very secure and hard to fake. People often use cashier’s checks for big purchases, like cars or homes.

Here’s how cashier’s checks compare to money orders:

| Aspect | Money Orders | Cashier’s Checks |

|---|---|---|

| Cost | Low cost (a couple of dollars) | Higher cost ($10-$20, sometimes waived for premium accounts) |

| Transaction Limit | Typically capped at $1,000 per order | Can be issued for tens of thousands of dollars or more |

| Security | Basic security features; more vulnerable to fraud | Advanced security features (watermarks, security threads); harder to forge |

| Acceptance | Widely accepted for smaller payments, rent, court fees, international transfers | Preferred for large transactions like real estate, vehicle purchases |

| Accessibility | Can be purchased without a bank account at USPS, retail stores, Western Union | Requires bank account and visit during banking hours |

| Replacement | Difficult and slow to replace if lost or stolen | Also difficult and slow to replace if lost or stolen |

You need a bank account to get a cashier’s check, and you must visit the bank during business hours. The fee is higher than a money order, but you can use it for much larger payments.

When Should You Use a Money Order?

Sometimes, a money order is still your best choice. Here’s when you might pick one:

- You do not have a bank account.

- You need to pay less than $1,000.

- You want to pay bills, rent, or send money to someone who does not accept checks or electronic payments.

- You want a safe, prepaid way to send money with a receipt for tracking.

- You need to buy it with cash or a debit card at a store or post office.

A money order gives you security and convenience, especially if you do not use banks or apps. It is a trusted way to pay for everyday needs.

Comparison Table

You might feel overwhelmed by all the choices for buying a money order. This table helps you see the differences at a glance. You can quickly compare fees, limits, and where you can buy a money order. Use this guide to pick the best spot for your needs.

| Provider | Typical Fee (USD) | Limit per Money Order | Payment Methods | Convenience Level | Notes |

|---|---|---|---|---|---|

| USPS | $2.55 (up to $500)$3.60 (up to $1,000) | $1,000 | Cash, Debit Card | High (many locations) | No bank account needed; safe and reliable |

| Walmart | $1.00 – $1.25 | $1,000 | Cash, Debit Card | Very High | Low fees; MoneyGram partner; no credit cards |

| Publix (Western Union) | $0.85 – $0.99 | $500 | Cash, Debit Card | High | Multiple money orders needed for large amounts; international options |

| Banks/Credit Unions | Up to $5 (often less) | $1,000 | Cash, Debit Card, Account | Medium | May require account; higher security |

| 7-Eleven | $0.65 min, 1–3% | $500 | Cash, Debit Card | High (open late) | Fees vary; MoneyGram/Western Union; lower limits |

| CVS | $1.25 | $500 | Cash, Debit Card | High | Good customer service; lower limit |

| Western Union | $0.50 – $1.50 | $1,000+ (with ID) | Cash, Debit Card | Very High | Available at many locations; international money orders |

Tip: If you need to send more than the limit, you can buy more than one money order. For example, at Publix, you might need six money orders to send $3,000.

You can see that fees and limits change depending on where you go. Some places, like Walmart and Publix, keep costs low. Others, like banks, may charge more but offer extra security. Think about what matters most to you—price, convenience, or speed—before you choose where to buy your next money order.

You have many trusted options for getting a money order in 2025. Banks, post offices, and retail stores each offer unique benefits. When you choose a provider, think about:

- Fees and transaction limits (some charge $5, others up to $18)

- Speed of processing (most money orders are ready within hours)

- Convenience, like location hours and network reach

Before you visit, check current fees and limits on official provider websites. Always fill out your money order right away, keep your receipt, and avoid exchanging with strangers. If you need more help, provider customer service can answer your questions.

FAQ

How long does it take to get a money order?

You can get a money order in just a few minutes. Most places process your request right at the counter. You walk out with your money order and receipt almost instantly.

Can you buy a money order with a credit card?

Most locations do not accept credit cards for money orders. You need to use cash or a debit card. Always check with the provider before you go.

What happens if you lose your money order?

If you lose your money order, contact the place where you bought it. Bring your receipt. They can help you track or cancel it. You may pay a small fee for a replacement.

Where can you cash a money order?

You can cash a money order at many banks, check-cashing stores, and some retailers. For example, you can cash a money order at Walmart or a Hong Kong bank branch. Always bring your photo ID.

Tip: Always fill out your money order completely before leaving the counter. This helps keep your money safe.

While money orders remain a trusted option in 2025, their limits, hidden costs, and in-person requirements make them less practical for frequent or larger transfers. With BiyaPay, you can send funds globally with transfer fees starting as low as 0.5%, access real-time exchange rates, and convert between multiple fiat and digital currencies—all from your phone. No more waiting in line or worrying about receipt tracking. BiyaPay combines security with convenience, making cross-border payments simpler and more transparent. Experience the future of money movement today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.