- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What makes PayPal Credit different and how it works

Image Source: pexels

PayPal Credit gives you a new way to pay for your online shopping. You do not need to enter your credit card details at checkout. You only need your PayPal account to use PayPal Credit. This digital payment option keeps your personal and financial information secure and hidden. Many people choose PayPal Credit because it often offers special financing, like no payments and no interest for six months on certain purchases. You can experience faster, smoother online shopping when you use PayPal Credit. If you want to know how it works, you will find that it fits easily into your PayPal account.

Key Takeaways

- PayPal Credit lets you shop online without entering card details by using your PayPal account, keeping your information safe and secure.

- It offers special financing with no interest for six months on purchases over $99 if paid in full on time, but late payments can cause high interest and fees.

- You can manage your PayPal Credit easily within your PayPal account, tracking your balance, payments, and credit limit all in one place.

- Applying for PayPal Credit requires a credit check and meeting age and residency rules, with credit limits usually starting between $250 and $500.

- PayPal Credit works best for online shoppers who want flexible payment options and can pay on time to avoid extra costs and protect their credit score.

What Makes PayPal Credit Different

Image Source: pexels

Unique Features

PayPal Credit stands out as a digital line of credit designed for online shopping. You do not receive a physical card. Instead, you access your credit directly through your PayPal account. This makes it easy to manage and use for purchases at thousands of merchants that accept PayPal. Unlike traditional credit cards, PayPal Credit does not charge an annual fee. You can apply for PayPal Credit online, and approval depends on your creditworthiness. The service reports to credit bureaus, so your usage can impact your credit score.

Here is a table comparing PayPal Credit with other PayPal services:

| Feature | PayPal Credit | Other PayPal Services (e.g., PayPal Cash, PayPal Cash Plus) |

|---|---|---|

| Credit Approval | Requires application and credit approval | No credit check or approval required |

| Interest & Fees | No annual fee; 0% interest if paid in full within 6 months on $99+ purchases; 23.99% APR otherwise | Not credit products; no interest charged |

| Usage | Online purchases at merchants accepting PayPal only | Can be used for in-store purchases, cash withdrawals, international transfers |

| Physical Card | No physical card provided | Some services offer physical cards |

| Credit Impact | Involves credit checks and affects credit score | No impact on credit score |

| Availability | Only available in the United States | Available in multiple countries |

| Customer Support | Dedicated customer support and Resolution Center | Standard PayPal support |

PayPal Credit works best for people who want a simple, digital way to pay for online shopping. You can use paypal credit for purchases at any store that accepts PayPal, but you cannot use it for cash advances or in-store transactions. The credit limits often start lower than traditional credit cards, usually between $300 and $500. The standard APR is higher than many credit cards, at about 23.99%. PayPal Credit does not offer rewards like cashback or travel points, but it does provide strong buyer protection and fraud detection.

Note: PayPal Credit does not charge an annual fee, but you may face late fees or deferred interest if you do not pay your balance in full during promotional periods.

Integration with PayPal

You can use paypal credit directly from your PayPal account. This integration means you do not need to remember another card number or carry a physical card. When you check out online, you simply select PayPal Credit as your payment method. The process is fast and secure. Your financial information stays protected because you never share your card details with merchants.

PayPal Credit fits seamlessly into your existing PayPal wallet. You can view your available credit, track your purchases, and make payments all in one place. This digital approach makes it easy to manage your spending and stay organized. If you already use PayPal for online shopping, adding PayPal Credit gives you more flexibility without extra hassle.

Special Financing

One of the biggest advantages of PayPal Credit is its special financing offers. You can get 0% interest if you pay off purchases of $99 or more in full within six months. This means you get free credit for up to 6 months, as long as you pay the balance before the promotional period ends. If you do not pay in full, interest charges apply from the purchase date at a rate of 23.99% APR.

Here is a comparison of special financing features:

| Feature | PayPal Credit | Affirm |

|---|---|---|

| Special Financing Offer | 6 months special financing on purchases $99+ with deferred interest if not paid in full within promotional period | Some loans 0% APR; others have interest; total cost disclosed upfront |

| Credit Check | Hard inquiry on application, affects credit score | Soft check for prequalification; hard inquiry if loan accepted |

| Credit Type | Revolving credit line linked to PayPal wallet | Fixed installment loans per purchase |

| Interest Transparency | Deferred interest charged from purchase date if balance unpaid after promo | Interest and total cost shown upfront |

| Repayment Flexibility | Minimum payments due, ongoing credit line | Fixed payments, predictable budgeting |

| Acceptance Network | Usable wherever PayPal is accepted | Growing acceptance, including virtual card options |

| Risk Considerations | Potential for high interest if promo not paid; risk of debt cycle | Generally more transparent; easier budgeting |

You can use paypal credit for flexible payments, but you must pay attention to the terms. If you miss a payment or do not pay the full amount within the promotional period, you may face high interest charges. PayPal Credit gives you the freedom to buy now and pay later, but you need to manage your account carefully to avoid extra costs.

PayPal Credit also offers other installment options, such as “Pay in 4” and “Pay Monthly.” These plans let you split your payments over several weeks or months. Some merchants even offer 0% APR promotions to encourage you to use these options. These features make PayPal Credit a strong choice for online shopping, especially if you want to spread out payments without paying extra interest.

How Does PayPal Credit Work

Use PayPal Credit Online

You can use paypal credit when you shop at stores that accept PayPal. To start, you need to apply for paypal credit through your PayPal account. The application asks for some basic information and checks your credit. If you get approved, you will see paypal credit as a payment option in your PayPal wallet.

When you want to make a purchase, choose paypal credit at checkout. You must log in to your PayPal account to complete the payment. This step adds security because you do not share your card details with the store. PayPal stores your information safely and uses encryption to protect your data. This makes online shopping safer and more private.

Here is a table that shows how using paypal credit compares to using a standard credit card for online purchases:

| Step/Feature | PayPal Credit | Standard Credit Card |

|---|---|---|

| Account Requirement | Must log in or create a PayPal account | No account needed; just enter card details |

| Payment Method | Uses PayPal as a digital wallet | Direct card network processing |

| Security | Details stored securely by PayPal | Card details entered directly |

| Checkout Experience | Smoother for PayPal users; extra step for new users | Simple entry of card details |

| Financing Options | Special financing and reusable digital credit | Standard credit card borrowing |

| Settlement Time | Funds land in PayPal account; transfer to bank takes 1-5 business days | Settlement 1-3 business days |

| Fees | Higher fees, especially for international transactions | Lower processing fees |

| Potential Friction | Extra login or account creation step | No extra login step |

You can use paypal credit for many types of online shopping. The process is quick if you already have a PayPal account. If you are new, you may need to create an account, which adds a step. This extra step helps keep your payments secure.

Payment Process

When you use paypal credit, your payment goes through PayPal’s system. PayPal acts as a middleman between you and the store. This means your card details stay hidden. After you make a purchase, PayPal sends the payment to the merchant. The funds usually settle in the merchant’s PayPal account within one to three business days. Sometimes, weekends or holidays can cause a delay.

You receive a monthly statement from paypal credit. This statement shows your purchases, minimum payment due, and the due date. You can pay the full balance or make the minimum payment. If you pay the full amount during a special financing period, you avoid interest charges. If you do not, interest starts from the purchase date. PayPal credit gives you a reusable digital line of credit, so you can use it again as you pay down your balance.

After you make a payment, your available credit may not update right away. PayPal and its partner bank need time to verify your payment. This process can take up to 21 days. The delay helps prevent fraud and errors. Once the payment clears, your available credit returns to the full limit. This process is normal and does not hurt your credit score.

Tip: Always check your statement and pay on time to avoid late fees and interest charges.

Account Management

Managing your paypal credit account is simple. You can see your balance, available credit, and payment history in your PayPal account. PayPal gives you tools to help you stay on track with your payments and spending.

- You can make payments directly through your PayPal account. This makes it easy to pay on time.

- You can review your statements and track your spending. This helps you know how much you owe and when payments are due.

- You can set up reminders or automatic payments. This helps you avoid late fees and keeps your credit in good shape.

PayPal also lets you connect with apps that track your expenses. You can see all your transactions in one place, even if you use other cards or wallets. These tools help you understand your spending habits and find ways to save money.

If you want to know how does paypal credit work for restoring your credit after a payment, remember that the system needs time to verify your payment. Your available credit will update after this process. This helps keep your account safe.

PayPal credit makes it easy to manage your payments and spending. You get control over your account, and you can use paypal credit for many types of online shopping. If you use the tools PayPal offers, you can avoid extra fees and keep your finances healthy.

Applying for PayPal Credit

Image Source: pexels

Eligibility

You must meet several requirements before you can apply for paypal credit. You need to be at least 18 years old and a U.S. citizen. You also need a U.S. residential address, not a P.O. box. When you apply, you must provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Your income must meet the product’s requirements, and you need a qualifying credit score.

Here is a table comparing eligibility for paypal credit and other cards:

| Card Type | Minimum Credit Score Required | Additional Eligibility Factors | Availability Status |

|---|---|---|---|

| PayPal Cashback Mastercard® | Fair credit (640+) | Income, debt, number of open accounts, hard pull | Currently available |

| Traditional Credit Cards | Good to excellent (700+) | Income, debt, credit history | Widely available |

You may find it easier to qualify for paypal credit than for some traditional credit cards. Both options check your credit and look at your income and debts.

Application Steps

You can apply for paypal credit online through your PayPal account. The process is simple and quick. Here are the main steps:

- Log in to your PayPal account.

- Select the option to apply for paypal credit.

- Enter your personal information, including your SSN or ITIN.

- Provide your income details.

- Review and submit your application.

Sometimes, you may need to upload extra documents, such as paystubs or bank statements. Most people get a decision right away, but some applications take a few days if more review is needed. If you receive approval, you will get instructions on how to use your new credit line.

Tip: Before you apply for paypal credit, check your credit score and make sure your income and debts are in good shape. Using your PayPal account responsibly can also help your chances.

Credit Limits

When you apply for paypal credit, the company reviews your credit score, income, and payment history. Your starting limit usually ranges from $250 to $500. If you have excellent credit, your limit could reach $5,000 or more. PayPal looks at your overall financial situation, including your debt-to-income ratio and how much credit you already have. Responsible use of paypal credit can help you build your credit over time.

If you want a higher limit, keep your payments on time and avoid carrying high balances. PayPal may increase your limit as you show good financial habits.

Fees and Payment Terms

Interest and Charges

When you use PayPal Credit, you need to understand how interest and fees work. PayPal Credit offers a variable interest rate of 21.9% per year after a 0% interest period for four months on certain purchases. This rate is similar to or sometimes higher than what you see with major credit cards, which usually have rates between 15% and 25%. You do not pay an annual fee, which makes PayPal Credit different from some credit cards. The 0% interest period gives you a chance to pay off your balance without extra cost if you act quickly. If you do not pay the full amount during the promotional period, interest starts from the date you made the purchase. You should always check your statement for any paypal credit fees, such as late payment charges or fees for sending money to friends.

Payment Options

You have two main ways to pay your PayPal Credit balance. You can pay the full amount each month or spread your payments over time. Each option has its own benefits and drawbacks.

| Payment Option | Advantages | Disadvantages |

|---|---|---|

| Pay full balance within billing cycle | Avoids interest charges; simple and clear | May be hard to pay large amounts at once |

| Spread payments over time | Special financing for $99+ purchases; flexible payments | High interest if not paid in promo period; deferred interest; paypal credit fees for transfers |

If you pay your full balance within the billing cycle, you avoid interest and keep things simple. Spreading payments gives you more time and flexibility, especially with special financing on purchases of $99 or more. However, if you do not pay off the balance in time, you face high interest rates and possible deferred interest charges. PayPal Credit also charges fees for sending money to others, which you should consider when planning your payments. Always review your account for any paypal credit fees to avoid surprises.

Pros, Cons, and Alternatives

Advantages

PayPal Credit gives you a flexible way to pay for online purchases. You can shop at thousands of stores that accept PayPal. Many users report high satisfaction with PayPal Credit. According to CivicScience, PayPal Credit stands out as the most positively rated digital credit service. About 73% of people who use online payment plans feel satisfied, and PayPal Credit leads in this group. You do not pay an annual fee. You can take advantage of special financing offers, such as no interest if you pay off purchases of $99 or more within six months. You also keep your financial information secure because you never share your card details with merchants.

Drawbacks

PayPal Credit has some downsides. The interest rate is high if you do not pay your balance in full during the promotional period. You may face late fees if you miss a payment. You cannot use PayPal Credit for in-store purchases or cash advances. The credit limit often starts lower than traditional credit cards. You do not earn rewards like cashback or travel points. If you do not manage your payments well, you may pay more in interest and fees.

Who Should Use PayPal Credit

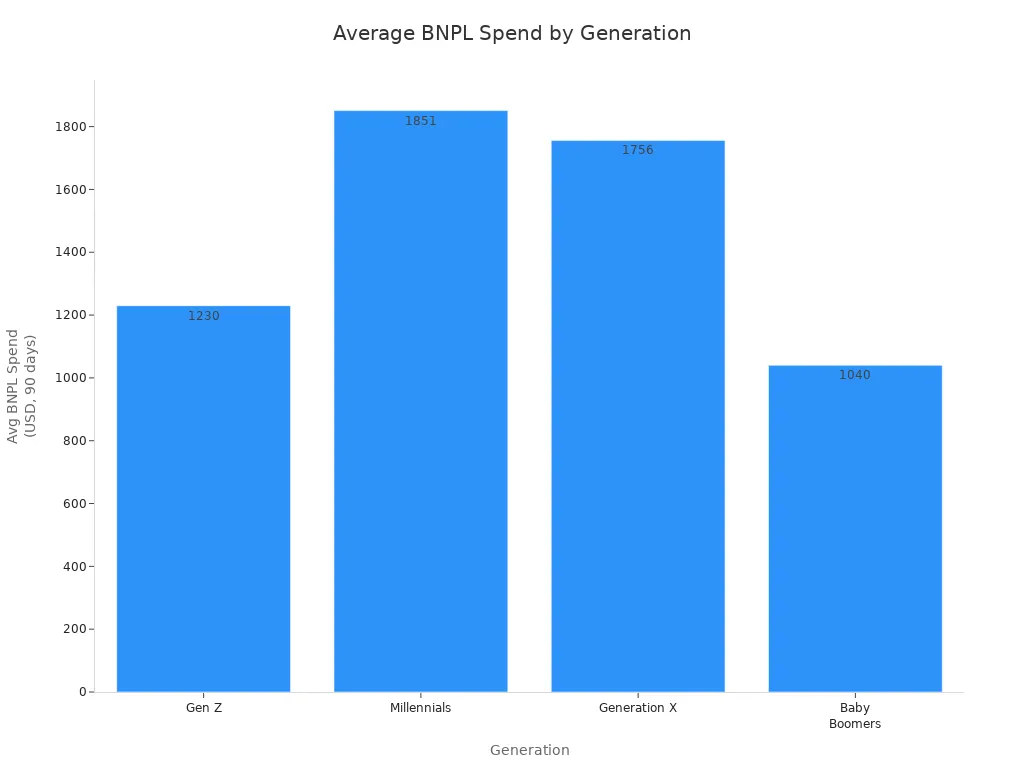

You may wonder who is paypal credit best for. People who want to spread out payments on online purchases find it helpful. Younger shoppers, such as Gen Z and Millennials, use PayPal Credit for smaller, frequent purchases like clothing and electronics. Older shoppers, such as Generation X and Baby Boomers, use it for larger items like furniture. The table below shows how different generations use PayPal Credit and what they buy:

| Generation | Average BNPL Spend (90 days) | Typical Purchase Types | Financial Needs and Benefits from PayPal Credit |

|---|---|---|---|

| Gen Z | $1,230 | Smaller, practical items (clothing, electronics) | Benefit from flexible, interest-free payments for frequent smaller purchases |

| Millennials | $1,851 | Mixed purchases (groceries, clothing, furniture, electronics) | Benefit from spreading payments on diverse purchases, increasing order value |

| Generation X | $1,756 | Mixed purchases (groceries, clothing, furniture, electronics) | Similar benefits as Millennials, managing both practical and larger expenses |

| Baby Boomers | $1,040 | Big-ticket items (furniture) | Benefit from managing larger expenses with flexible installment options |

If you want to know who is paypal credit best for, look at your spending habits. If you shop online often and want flexible payments, PayPal Credit can help you manage your budget.

Alternatives

You have many choices if you want a digital payment solution. Some options focus on payment processing, while others offer expense management or digital wallets. The table below compares PayPal Credit to other popular services:

| Alternative | Key Features | Cost Structure / Fees | Comparison to PayPal Credit |

|---|---|---|---|

| Brex | High credit limits, expense management, tailored for startups | Not explicitly stated, but designed for high-growth startups | Focuses on credit line and expense management, similar to PayPal Credit but startup-focused |

| Stripe | Customizable payment processing, APIs, financial services, tax accounting, risk management | 2.9% + $0.30 per transaction; +1.5% international cards; +1% currency conversion; +0.5% manual entry cards | More payment processing oriented, no reusable credit line like PayPal Credit |

| Skrill | Personal and business accounts, supports 40+ currencies, free Skrill-to-Skrill transfers | Up to 4.99% currency exchange fee; inactivity fee; fees on international transactions | Focuses on payments and currency exchange, not credit lines |

| Google Pay | Digital wallet, supports linked cards, available on Android and Apple phones | No fees for payments; limited to US, Singapore, India | Limited international reach compared to PayPal Credit |

| Venmo | Social payment features, instant transfers | Instant transfer fee 1.75% (min $0.25, max $25); no regular fees | Payment app with social features, no credit line |

| Apple Pay | Built into Apple devices, widely accepted in US | No fees charged by Apple | Payment method, no credit line |

| Payment Depot | Membership model, wholesale credit card rates, supports multiple industries | $79 monthly membership fee; no per-transaction fees | Payment processing focus, no credit line |

| Shopify | Online store platform with integrated payment processing | Fees vary by plan; integrated payment processing fees | E-commerce platform with payment processing, no credit line |

Most alternatives do not offer a reusable credit line or special financing. They focus on payment processing, digital wallets, or business tools. You should compare features and fees to find the best fit for your needs.

PayPal Credit gives you flexible online payment options and special financing, but it does not offer rewards like many credit cards. You should consider these factors before applying:

- You must meet age, residency, and credit requirements.

- Applying can affect your credit score.

- Late payments may lead to fees and negative credit impact.

- Interest-free periods help if you pay on time.

| Feature | PayPal Credit | Traditional Credit Card |

|---|---|---|

| Rewards | None | Cashback, travel, points |

| Interest Model | Deferred, retroactive | Grace period, no retroactive |

| Best For | Short-term flexibility | Long-term benefits |

Choose PayPal Credit if you want short-term financing and can manage payments well.

FAQ

How do you check your PayPal Credit balance?

You can log in to your PayPal account. Go to your Wallet. Click on PayPal Credit. You will see your current balance, available credit, and recent transactions.

Can you use PayPal Credit for in-store purchases?

No, you cannot use PayPal Credit in physical stores. You can only use it for online purchases at merchants that accept PayPal as a payment method.

What happens if you miss a PayPal Credit payment?

If you miss a payment, you may pay a late fee. Your credit score can drop. Interest charges may apply. Always pay on time to avoid extra costs.

Does PayPal Credit affect your credit score?

Yes, PayPal Credit checks your credit when you apply. Your account activity, such as on-time payments or missed payments, can impact your credit score.

While PayPal Credit helps with flexible online shopping, many users still face hidden costs such as high APRs and limited international support. If you’re looking for a smarter way to manage your money globally, BiyaPay gives you more control. With real-time exchange rate checks, instant fiat and digital currency conversions, and remittance fees as low as 0.5%, you can send and receive funds securely across most countries and regions. Whether you’re paying bills abroad or managing income from different currencies, BiyaPay makes the process transparent and efficient.

Don’t let high fees or limited options restrict your finances. Register with BiyaPay today and experience faster, safer, and more cost-effective global transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.