- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Deep Dive into Bank of America Services and Features

Image Source: unsplash

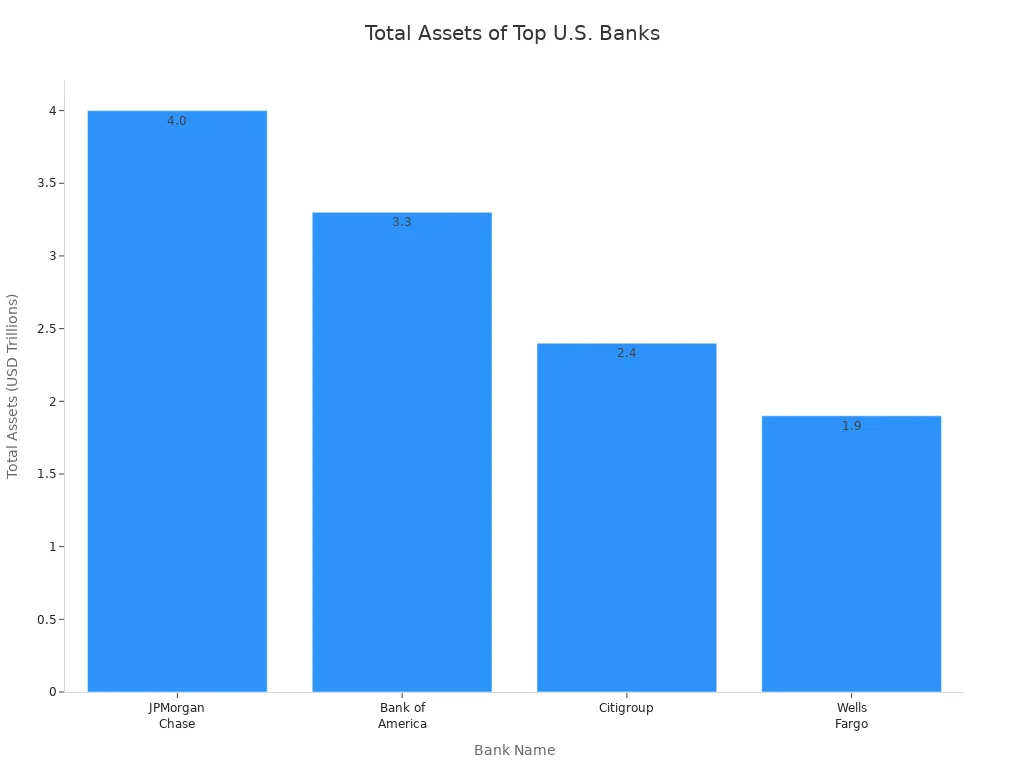

Is Bank of America a good choice for your banking needs? Many people rate Bank of America with 4 out of 5 stars, showing strong trust in this bank. You see Bank of America ranked second among U.S. banks, holding $3.3 trillion in total assets.

| Rank | Bank Name | Total Assets (USD Trillions) |

|---|---|---|

| 1 | JPMorgan Chase | 4.0 |

| 2 | Bank of America | 3.3 |

| 3 | Citigroup | 2.4 |

| 4 | Wells Fargo | 1.9 |

Bank of America stands out for its digital banking tools, strong security, and broad branch network. Many people also praise its mortgage lending. However, some customers report issues with customer service, low savings rates, and fees. When you read this Bank of America Review, think about what matters most to you in a bank.

Key Takeaways

- Bank of America offers strong digital tools, a large branch and ATM network, and solid security to make banking easy and safe.

- You can choose from various checking and savings accounts, but watch out for monthly fees and low interest rates compared to online banks.

- The mobile app is highly rated and includes Erica, an AI assistant that helps manage your money and provides quick support.

- Customer service can be slow or hard to reach, so using digital tools and monitoring your accounts helps avoid problems and fees.

- Bank of America provides many credit card and loan options, plus investment services through Merrill, but always compare rates and terms before deciding.

Bank of America Review

Bank of America stands as one of the largest and most stable banks in the United States. You see it rated 4 out of 5 stars on major financial review platforms. This high rating comes from its strong financial stability, wide range of services, and large customer base. The bank holds high ratings from agencies like Moody’s, S&P, and Fitch, which shows its solid reputation and trustworthiness.

| Rating Category | Moody’s Rating | S&P Rating | Fitch Rating |

|---|---|---|---|

| Bank of America Corp | |||

| Long-term senior | A1 | A- | AA- |

| Outlook | Stable | Stable | Stable |

| Short-term | P-1 | A-2 | F1+ |

| Bank of America, N.A. | |||

| Deposits | Aa2 | A+ | AA+ |

| Long-term senior | Aa2 | A+ | AA |

| Outlook | Stable | Stable | Stable |

Strengths

You benefit from several strengths when you choose Bank of America. The bank’s digital banking experience stands out. Over 57 million people use its digital tools, and more than 35 million customers get digital alerts. In 2023, users logged in 12.8 billion times, showing high engagement. The mobile app is highly rated, with 4.8 stars on the Apple Store and 4.6 on Google Play. The bank also uses a virtual assistant called Erica, which handled 673 million interactions last year. This focus on digital innovation makes your banking easier and more secure.

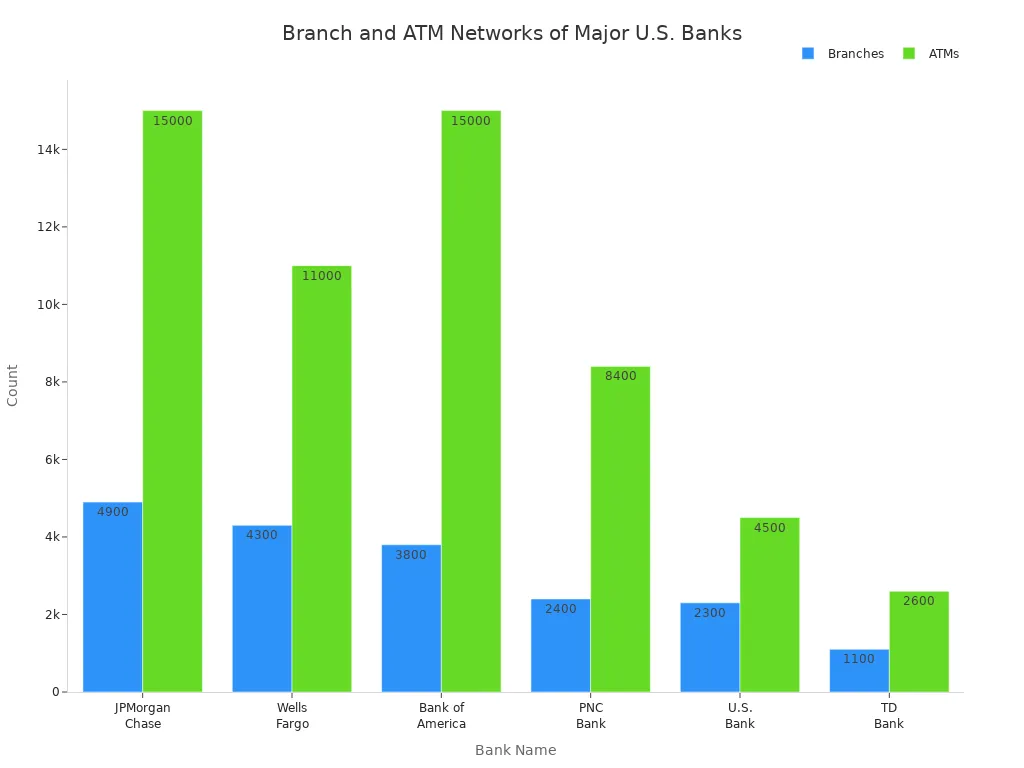

Bank of America also offers a large branch and ATM network. You have access to over 3,800 financial centers and 15,000 ATMs across 38 states and Washington, D.C. This makes it easy for you to find a location or ATM almost anywhere in the country.

| Bank Name | Branches (approx.) | States Covered | ATMs (approx.) | Rank by Branch Count |

|---|---|---|---|---|

| JPMorgan Chase | 4,900 | 48 states + D.C. | 15,000+ | 1 |

| Wells Fargo | 4,300 | 37 states + D.C. | 11,000+ | 2 |

| Bank of America | 3,800 | 38 states + D.C. | 15,000 | 3 |

| PNC Bank | 2,400 | 28 states + D.C. | 8,400+ | 4 |

| U.S. Bank | 2,300 | 27 states | 4,500+ | 5 |

| TD Bank | 1,100 | 16 states | 2,600 | N/A |

You also get strong security features. The bank invests in advanced technology to protect your accounts and personal information. Customer support is available with extended hours for bank accounts and 24/7 for credit cards. This helps you get help when you need it.

Note: Many reviews highlight the convenience of Bank of America’s digital tools and the wide access to branches and ATMs. These features make it a top choice for people who want both in-person and online banking options.

Weaknesses

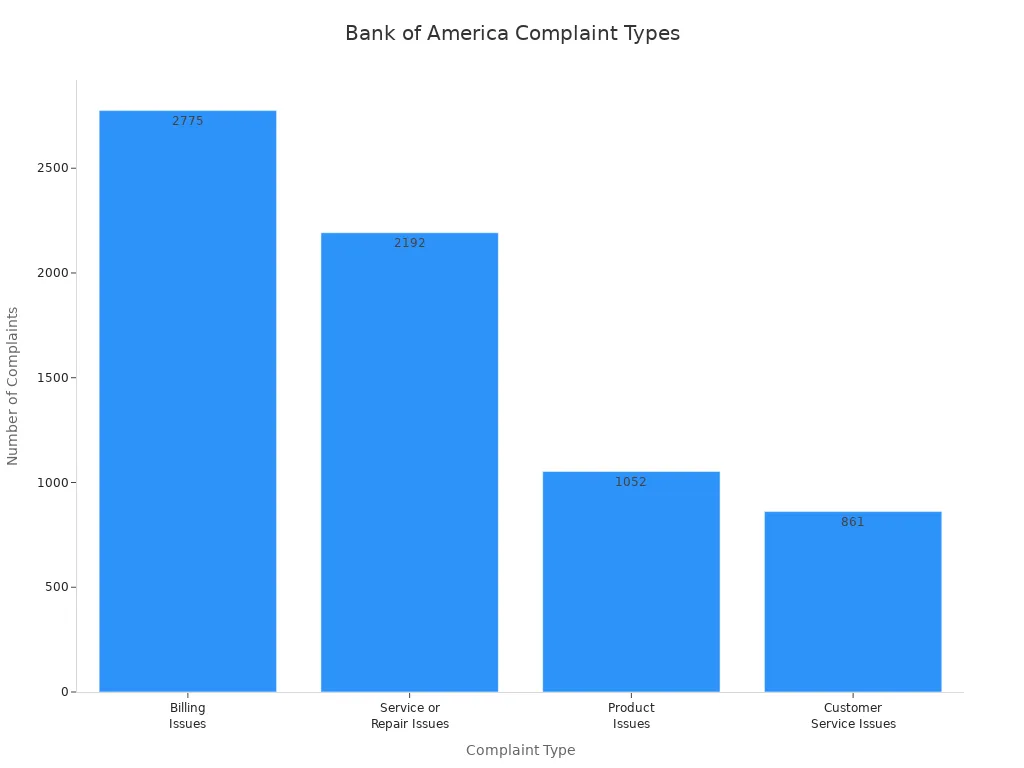

You should also know about the weaknesses in this bank of america review. Many customers report issues with customer service. Some say it is hard to reach helpful staff or supervisors. Others mention long wait times and poor communication. In the past year, Bank of America received 7,658 complaints. Most complaints were about billing, service delays, product issues, and customer service problems.

| Complaint Type | Number of Complaints | Common Issues Reported | Complaint Statuses |

|---|---|---|---|

| Billing Issues | 2,775 | Unexpected fees, disputed charges | Answered, Resolved, Unresolved, Unanswered |

| Service or Repair Issues | 2,192 | Delays in funds availability, problems with card security codes, unresolved disputes | Answered, Resolved, Unresolved, Unanswered |

| Product Issues | 1,052 | Account fees, product functionality issues | Answered, Resolved, Unresolved, Unanswered |

| Customer Service Issues | 861 | Poor communication, difficulty reaching supervisors, unhelpful staff | Answered, Resolved, Unresolved, Unanswered |

Another weakness is the low interest rates on savings accounts and certificates of deposit. Most reviews mention that you can find higher rates at online banks. The bank also charges monthly maintenance fees on many accounts. You can avoid some fees if you meet certain conditions, but many customers still pay more than they would at other banks.

Tip: If you want to avoid fees and get higher savings rates, you may want to compare Bank of America with online banks before making your choice.

Bank of America Overview

Image Source: pexels

History

You can trace the roots of Bank of America back to 1904. Amadeo Peter Giannini started the Bank of Italy in San Francisco. This bank helped many people who could not use traditional banks. In 1927, new rules in California allowed banks to open more branches. Giannini then created Bank of America of California by joining his banks together.

Bank of America grew quickly after World War II. By 1945, it became the largest bank in the world with $5 billion in assets. In 1958, Bank of America launched BankAmericard. This card became the first successful general-use credit card and later turned into Visa. The bank kept growing by merging with other banks. In 1992, it joined with Security Pacific Corporation. In 1998, Bank of America merged with NationsBank. This move made it the first bank to serve customers across the entire United States.

In 2009, Bank of America bought Merrill Lynch. This step made the bank stronger in investment banking and wealth management. Over the last decade, you have seen Bank of America invest in digital banking. The bank created mobile apps and Erica, an AI-powered assistant. Today, Bank of America operates in over 35 countries and supports many social responsibility programs.

Bank of America’s history shows how it has shaped the modern banking industry through innovation and growth.

Reputation

You will find that Bank of America has built a strong reputation in the banking world. Many people trust this bank because of its long history and large size. The bank holds high ratings from agencies like Moody’s, S&P, and Fitch. These ratings show its trustworthiness and financial strength. Bank of America serves millions of customers and offers a wide range of banking services. You can rely on its strong branch network, digital tools, and security features. Many people see Bank of America as a leader in both personal and business banking.

Checking Accounts

Options

You have several checking account choices at bank of america. Each account fits different needs and lifestyles. The main options include Advantage SafeBalance Banking, Advantage Plus Banking, and Advantage Relationship Banking. You can see the key features and requirements in the table below:

| Checking Account Type | Minimum Opening Deposit | Monthly Fee | Fee Waiver Conditions | Eligibility Requirements / Notes |

|---|---|---|---|---|

| Advantage SafeBalance Banking | $25 | $4.95 | Waived if under 25, enrolled in Preferred Rewards, or $500+ balance | No checks; use debit card, Zelle, digital banking; overdraft transactions declined to avoid penalty |

| Advantage Plus Banking | $100 | $12 | Waived with $1,500 daily balance, $250+ direct deposit, or Preferred Rewards membership | Standard checking features; includes checks, debit card, mobile and online banking |

| Advantage Relationship Banking | $100 | $25 | Waived with $20,000 combined balance or Preferred Rewards membership | Higher-tier account; earns interest (0.01%-0.02% APY); extra benefits for strong relationship with bank |

You can open an account with as little as $25 for SafeBalance. If you want more features, you may choose Plus or Relationship Banking. Each account has different ways to avoid monthly fees. You can qualify for a waiver by meeting balance requirements, setting up direct deposit, or joining the Preferred Rewards program.

Note: SafeBalance Banking does not allow checks. This account helps you avoid overdraft penalty fees by declining transactions that would overdraw your balance.

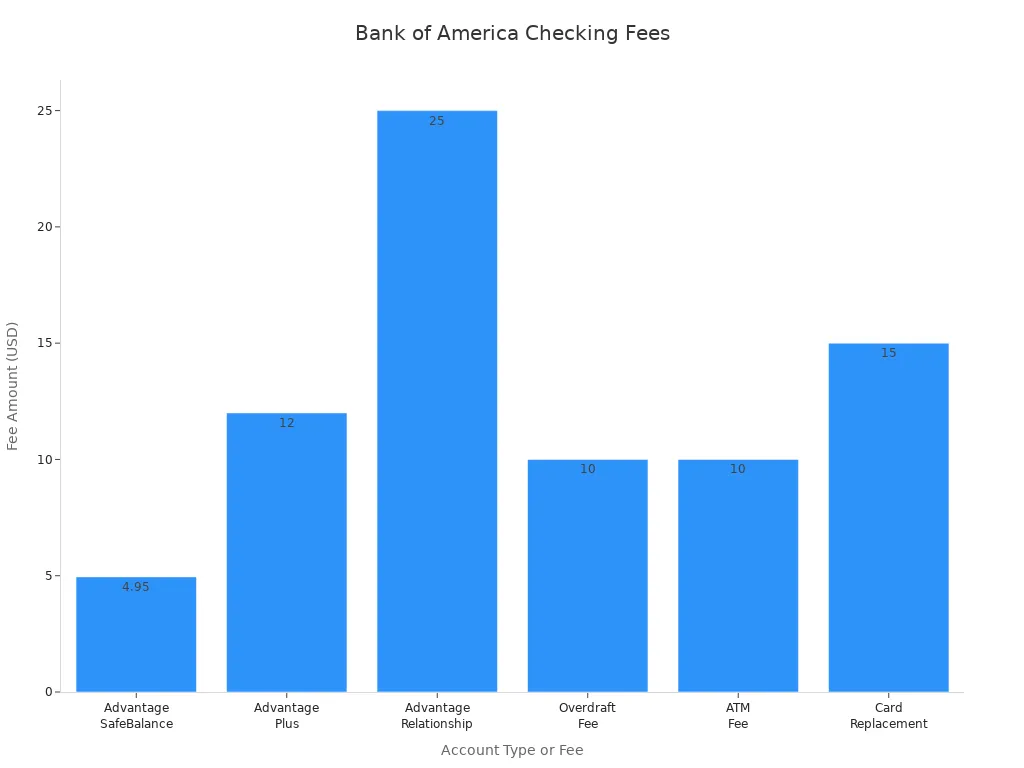

Fees

Bank of america charges monthly maintenance fees for most checking accounts. You can avoid these fees if you meet certain conditions. The table below shows the main fees and how you can waive them:

| Checking Account Type | Minimum Opening Deposit | Monthly Maintenance Fee | Fee Waiver Conditions |

|---|---|---|---|

| Advantage SafeBalance Banking | $25 | $4.95 | Under 25 years old, $500+ daily balance, or Preferred Rewards enrollment |

| Advantage Plus Banking | $100 | $12 | $1,500+ daily balance, $250+ direct deposit, or Preferred Rewards (Gold tier or higher) |

| Advantage Relationship Banking | $100 | $25 | $20,000+ combined balance or Preferred Rewards enrollment |

You may also face other fees. Overdraft fees can reach up to $10 per transaction. If you use an ATM outside the bank of america network, you may pay up to $10 per withdrawal. Card replacement fees can go up to $15. These charges can add up if you do not manage your account carefully.

If you want to avoid extra fees, keep an eye on your balance and use in-network ATMs. You can also join the Preferred Rewards program for more fee waivers. Bank of america does not charge a penalty for overdraft on SafeBalance accounts, but you may face a penalty on other accounts if you overdraw.

Tip: Review your account activity often. This helps you avoid unwanted fees and penalty charges.

Savings & CDs

Image Source: pexels

Savings Accounts

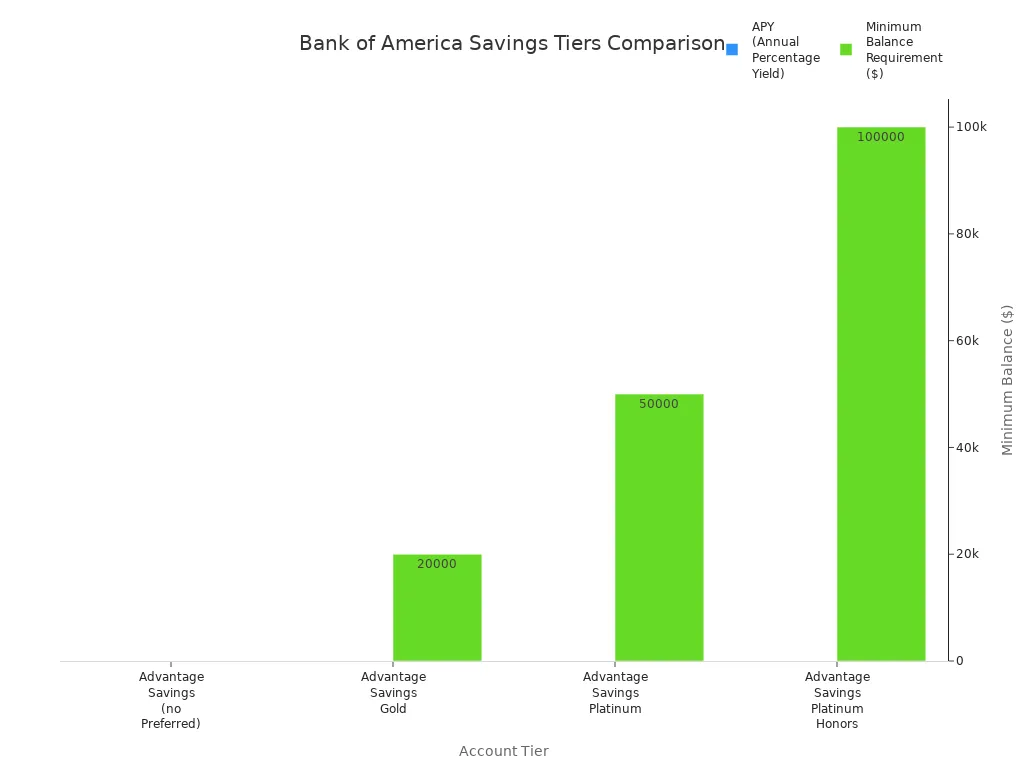

You can open a savings account at bank of america with a minimum deposit of $100. The main option is the Advantage Savings account. This account gives you different annual percentage yield (APY) rates based on your relationship tier. The base APY starts at 0.01%. If you qualify for Preferred Rewards, you can earn up to 0.04% APY. The higher your balance, the better your annual percentage yield. You pay an $8 monthly service fee unless you keep a daily balance of $500, link your account, join Preferred Rewards, or are under 25 years old.

| Account Tier | Annual Percentage Yield (APY) | Minimum Balance Requirement (3-month average across accounts) | Minimum Opening Deposit | Monthly Service Fee | Fee Waiver Conditions |

|---|---|---|---|---|---|

| Advantage Savings (no Preferred Rewards) | 0.01% | N/A | $100 | $8 | Waived if minimum daily balance $500, linked accounts, Preferred Rewards Gold tier or above, or under 25 |

| Advantage Savings Gold | 0.02% | $20,000 | $100 | $8 | Same as above |

| Advantage Savings Platinum | 0.03% | $50,000 | $100 | $8 | Same as above |

| Advantage Savings Platinum Honors | 0.04% | $100,000 | $100 | $8 | Same as above |

Interest compounds and pays monthly. You can see that the annual percentage yield remains low compared to online banks offering high apys.

Tip: If you want to avoid the monthly fee, keep at least $500 in your account or enroll in Preferred Rewards.

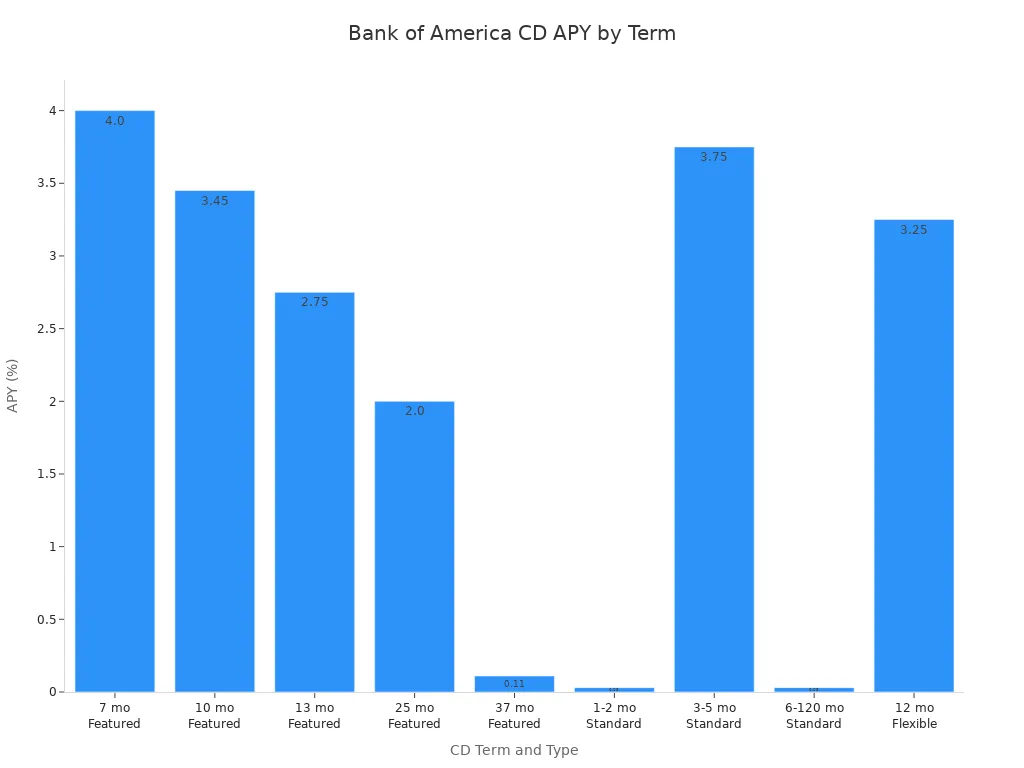

CD Options

Bank of america offers several certificate of deposit (CD) choices. You can pick from Featured CDs, Standard Term CDs, and Flexible CDs. Each CD requires a $1,000 minimum deposit. The annual percentage yield depends on the term and type. Featured CDs offer higher rates for short terms, but most APYs are lower than national averages. For example, a 7-month Featured CD gives you a 4.00% APY, while a 13-month CD drops to 2.75% APY. Standard Term CDs and Flexible CDs also have lower annual percentage yields compared to top national rates.

| CD Type | Term (months) | APY (%) | Minimum Deposit | Notes on Comparison to National Average |

|---|---|---|---|---|

| Featured CD | 7 | 4.00 | $1,000 | Below top national 6-month CD rate (4.55%) |

| Featured CD | 10 | 3.45 | $1,000 | Lower than some top yields nationally |

| Featured CD | 13 | 2.75 | $1,000 | Lower than national averages |

| Featured CD | 25 | 2.00 | $1,000 | Lower than national averages |

| Featured CD | 37 | 0.11 | $1,000 | Significantly below national averages |

| Standard Term CD | 1-2 | 0.03 | $1,000 | Much lower than national averages |

| Standard Term CD | 3-5 | 3.75 | $1,000 | Below top national 6-month CD rate |

| Standard Term CD | 6-120 | 0.03 | $1,000 | Much lower than national averages |

| Flexible CD | 12 | 3.25 | $1,000 | Below national average rates |

Note: You may want to compare CD rates at other banks if you want the highest annual percentage yield.

Rates

You will notice that both savings accounts and CDs at bank of america offer lower annual percentage yields than many online banks. The APY for savings accounts ranges from 0.01% to 0.04%. Most CDs provide an annual percentage yield between 0.03% and 4.00%. The highest APY comes from the 7-month Featured CD, but even this does not match the top national rates. As a customer, you should always check the current APY before opening an account. Bank of america updates rates often, so review them as part of your banking decisions.

If you want to grow your savings faster, look for banks with high apys and compare their annual percentage yield to what bank of america offers.

Credit Cards

Types

You can choose from many credit card options at bank of america. Each card fits different needs and spending habits. Here are the main types you will find:

- Travel rewards cards: These cards help you earn points for flights, hotels, and other travel expenses. Some cards, like the Bank of America® Premium Rewards® Elite, offer extra perks for travelers.

- Airline rewards cards: You can earn miles for airline purchases and get benefits like free checked bags or priority boarding.

- Cash back cards: These cards give you a percentage of your spending back as cash. You can use this cash for anything you want.

- Credit building cards: If you want to build or rebuild your credit, these cards can help. They often have lower limits and simple features.

- Student cards: These cards are made for students who are new to credit. They help you learn good banking habits.

- Low-interest cards: You can use these cards to save money on interest if you carry a balance.

The Bank of America® Premium Rewards® Elite card stands out. You earn 2 points per $1 on travel and dining, and 1.5 points per $1 on other purchases. You also get statement credits for airline fees, Global Entry or TSA PreCheck®, and lifestyle services. This card gives you access to VIP lounges and a 24/7 concierge.

Tip: Pick a card that matches your spending style and banking goals.

Rewards

Bank of america credit cards offer many rewards and benefits. You can see the main features in the table below:

| Card Name | Annual Fee | Welcome Bonus | Rewards Structure & Benefits | Preferred Rewards Bonus |

|---|---|---|---|---|

| Unlimited Cash Rewards | $0 | $200 cash back after $1,000 spent in 90 days | 1.5% cash back on all purchases; 0% intro APR for 15 billing cycles | Up to 75% more rewards |

| Premium Rewards® | $95 | 60,000 points after $4,000 spent in 90 days | 1.5 points per $1 on most purchases; strong travel benefits | 25%-75% bonus points |

| Customized Cash Rewards | N/A | $200 cash back after $1,000 spent in 90 days | 1% base cash back; 2% in select categories like groceries and wholesale clubs | Eligible for bonuses |

| Business Advantage Customized Cash Rewards | N/A | $300 after $3,000 spent in 90 days | Business rewards; similar bonus structure | Same as personal cards |

You can join the Preferred Rewards program to boost your rewards. Gold members get 25% more, Platinum gets 50% more, and Platinum Honors gets 75% more. You earn rewards on net purchases, and points do not expire while your account stays open. You can redeem points for travel, cash, gift cards, or statement credits.

Note: Many customers like the flexibility of redeeming rewards for travel or cash. The Preferred Rewards program can help you earn even more.

Loans & Mortgages

Personal Loans

You may notice that bank of america does not offer traditional personal loans. Instead, you can use the Balance Assist program if you need a small, short-term loan. This program lets you borrow up to $500. You must be at least 18 years old, have a bank or credit union account, and provide proof of income and identity. The bank prefers a credit score of 670 or higher, but some lenders may accept lower scores with higher interest rates. The average interest rate for personal loans across lenders is about 20.75%. Most loan terms last from 1 to 5 years. Longer terms mean lower monthly payments, but you pay more interest over time.

| Aspect | Details |

|---|---|

| Bank of America Offering | No traditional personal loans; offers Balance Assist short-term loan up to $500 |

| Eligibility Criteria | 18+ years, bank/credit union account, income and identity verification |

| Credit Score Preference | 670+ preferred; fair/poor credit accepted by some lenders at higher rates |

| Interest Rate Range | 6-7% (excellent credit) up to 35%+ (poor credit) |

| Average Interest Rate | 20.75% across lenders |

| Loan Terms | 1 to 5 years |

Note: If you need a larger personal loan, you may want to compare other banking options.

Auto Loans

You can apply for an auto loan through bank of america if you want to buy a new or used car, refinance, or buy out a lease. The bank offers loan terms of 48, 60, or 72 months. You can discuss longer terms after you apply. The lowest advertised APR is about 5.11% for customers with excellent credit. Your actual rate depends on your credit score, loan amount, term, and state. You must be at least 18 years old and live in the United States. The bank usually requires a credit score of 661 or higher. You can prequalify online with a soft credit pull, which does not affect your score.

- No loan documentation fees, but you may pay title or state fees.

- No prepayment penalties, so you can pay off your loan early.

- You must buy your car from an approved dealer, such as CarMax or Carvana.

- The car must be 10 years old or newer, have less than 125,000 miles, and be worth at least $6,000.

- Preferred Rewards members get interest rate discounts.

Tip: Use the online banking tools to check your rate and see if you qualify for discounts.

Mortgages

Bank of america is a top mortgage lender in the United States. You can get help from home loan specialists who guide you through the process. The bank uses digital tools to let you prequalify, apply, and track your mortgage online. You can also find educational resources on the Better Money Habits platform. If you are a first-time homebuyer, you may qualify for the Community Affordable Loan Solution. This grant program helps you with no down payment and no closing costs. To qualify, you need a minimum credit score (often around 620), a steady job, and a reasonable debt-to-income ratio. You may also need to complete a homebuyer education course.

Bank of america has helped over two million mortgage customers avoid foreclosure by providing more than $27 billion in relief. Many customers say they like the support and guidance they receive during the mortgage process.

Note: If you want to buy your first home, ask about grants and educational programs that can lower your costs.

Investment Services

Merrill

You can access a wide range of investment services through Merrill, the investment arm of bank of america. Merrill gives you many ways to invest and manage your money. You can choose from self-directed trading, guided investing, or work with a dedicated advisor. This flexibility helps you match your investment style and goals.

Merrill offers many investment products:

- Stocks, mutual funds, and exchange-traded funds (ETFs)

- Fixed income and bonds

- Money market mutual funds and certificates of deposit (CDs)

- Options trading

- Insurance and annuity products through Merrill Lynch Life Agency Inc.

You can also find trust and fiduciary services through bank of america subsidiaries. Merrill makes it easy to link your banking and investment accounts. This integration lets you manage your finances in one place. If you join the Preferred Rewards program, you get extra benefits by combining your bank of america deposit accounts with Merrill investment accounts.

Merrill provides digital tools like Idea Builder and Merrill Edge MarketPro®. These tools help you research investments and track your portfolio. You can also open education accounts for college savings.

Note: Merrill Edge targets investors with up to $250,000 in liquid assets. It combines Merrill Lynch’s investment expertise with the convenience of bank of america’s banking services.

Planning Tools

Bank of america gives you access to many financial planning tools through Merrill Lynch and Merrill Edge. You can get personalized financial planning, investment management, and even robo-advisor services. These tools help you set goals, track progress, and adjust your plan as your needs change.

You can use Merrill Edge for a simple, low-cost way to start investing. This platform is designed for new investors and those who want to manage their own accounts. If you want more guidance, you can work with a Merrill advisor for a custom plan. Bank of america aims to be a one-stop-shop, letting you handle both banking and investing together.

Other banks like Charles Schwab and Morgan Stanley also offer strong planning tools. Schwab leads in automated investment management, while Morgan Stanley and Wells Fargo focus on wealth management and estate planning. Bank of america competes closely by offering a broad suite of planning tools and digital platforms. You get the benefit of both personal advice and easy-to-use online resources.

Tip: Use the planning tools to set clear goals and review your progress often. This helps you stay on track with your investments and savings.

Business Banking

Accounts

You can choose from several business accounts at bank of america. Each account fits different business needs. The bank offers digital banking tools, fraud protection, and integration with QuickBooks and Zelle. You also get access to a large branch and ATM network. The table below shows the main business account options, their fees, and features:

| Business Account Type | Monthly Fee (Typical) | Fee Waivers / Conditions | Features & Limits |

|---|---|---|---|

| Business Advantage Fundamentals | Monthly fee applies | Waived with minimum balance or qualifying activity | Basic business checking, digital banking, debit card, good for small businesses |

| Business Advantage Relationship | Higher monthly fee | Waived with higher balance or combined balances | For higher transaction volume, relationship benefits |

| Business Interest Checking | Monthly fee applies | Waived with minimum balance | Earns interest, good for businesses wanting interest on balances |

| Business Economy Checking (Legacy) | Monthly fee applies | Waived with minimum balance | Legacy account, fewer features, limited transactions |

| Business Advantage Savings | Monthly fee applies | Waived with minimum balance | Business savings, earns interest, supports cash deposits |

You can avoid most monthly fees by keeping a certain balance or meeting activity requirements. Each account includes digital banking, which lets you manage your money online or on your phone. You also get customer service designed for business needs.

Tip: Review your business needs before choosing an account. Some accounts work better for high transaction volumes, while others help you earn interest on your balance.

Lending

Bank of america gives you many lending options for your business. You can apply for loans to buy real estate, purchase equipment, or manage cash flow. The bank offers both secured and unsecured loans, as well as lines of credit. Some loans require you to meet certain business age and revenue requirements. For example, most products need your business to operate under current ownership for at least two years and have at least $250,000 in annual revenue.

Here are the main lending products and their features:

| Business Lending Product | Loan Amount | Interest Rate (Starting) | Loan Terms | Typical Approval Requirements |

|---|---|---|---|---|

| Commercial Real Estate Loans | From $25,000 | As low as 6.00% | Up to 10 years (balloon); up to 15 years (amortized) | 2+ years in business, $250,000+ annual revenue |

| Equipment Loans | From $25,000 | As low as 6.50% | Up to 5 years (secured by assets) | 2+ years in business, $250,000+ annual revenue |

| Secured Business Line of Credit | From $25,000 | As low as 8.50% | Revolving, annual renewal | 2+ years in business, $250,000+ annual revenue |

| Secured Business Loans | From $25,000 | As low as 6.50% | Up to 4 years (assets); up to 5 years (CDs) | 2+ years in business, $250,000+ annual revenue |

| SBA Loans | Varies | Varies | Longer terms, lower down payments | Available for newer businesses |

| Unsecured Business Loans | From $10,000 | Varies | Varies | Credit approval, no collateral |

| Unsecured Business Lines of Credit | From $10,000 | Varies | Revolving | Credit approval, no collateral |

To apply, you need to provide business identification, financial documents, and personal credit history. You can apply online for unsecured loans if you have a Small Business Online Banking login. For other loans, you may need to meet with a business lending specialist. The bank reviews your business age, revenue, and creditworthiness before approval.

Note: Prepare your business and personal financial documents before applying. This helps speed up the approval process and increases your chances of success.

Digital Experience

Mobile App

You can manage your money easily with the Bank of America highly rated app. Many users praise this mobile banking app for its convenient features and simple design. You get access to Erica, an AI-powered assistant that gives you personalized financial tips. The app lets you pay bills, deposit checks, and set financial goals. You can also see spending insights and track your progress.

Many people choose this highly rated app because it saves time and makes banking convenient. The app has won awards from J.D. Power and Global Finance for its strong security and user experience. You can use fingerprint or facial recognition to log in. Real-time alerts help you spot any problems quickly.

The Bank of America highly rated app stands out for its quick transactions, easy navigation, and strong customer support. You can link other financial tools for a complete banking experience.

Online Banking

Bank of America gives you a convenient online banking platform. You can check balances, transfer money, and pay bills from your computer. The website has a clear layout, so you find what you need fast. You can set up account alerts and manage your cards online.

The online banking tools help you stay organized. You can download statements, view spending reports, and plan your budget. Many people like the convenience of handling their banking without visiting a branch. The platform works well with the mobile banking app, so you get a seamless experience across devices.

Security

Bank of America takes your security seriously. The bank uses many layers of protection to keep your accounts safe. You get multi-factor authentication and biometric login options. The bank trains employees to protect your information and limits access to only those who need it.

You benefit from physical, electronic, and procedural safeguards. The bank offers IBM Trusteer Rapport software for free to help guard against malware. You receive alerts if there is suspicious activity on your account. The bank contacts you quickly if it detects a risk.

You should keep your contact details up to date and check your account activity often. Bank of America encourages you to use secure ATMs and shred sensitive documents to protect your information offline.

Fees & Rates

Common Fees

When you use bank of america, you will notice several common fees. These fees can affect your banking experience if you do not pay attention. The most frequent bank fees include monthly maintenance fees for checking and savings accounts. You may pay $4.95 to $25 each month, depending on your account type. If you use an ATM outside the bank of america network, you might pay up to $10 per withdrawal. Overdraft fees can reach $10 for each transaction. If you lose your debit card, a replacement can cost up to $15. Some accounts also charge a penalty if your balance drops below the required minimum.

You should also watch for fees on certificates of deposit. If you withdraw money before the term ends, you pay an early withdrawal penalty. This penalty can reduce your annual percentage yield. Bank of america savings accounts offer a low apy, usually between 0.01% and 0.04%. CDs may offer a higher annual percentage yield, but you must keep your money in the account for the full term to avoid a penalty.

| Fee Type | Typical Amount (USD) | When It Applies |

|---|---|---|

| Monthly Maintenance | $4.95 – $25 | If you do not meet waiver requirements |

| Out-of-Network ATM | Up to $10 | Using non-bank of america ATMs |

| Overdraft | Up to $10 | Spending more than your balance |

| Card Replacement | Up to $15 | Lost or damaged debit card |

| Early CD Withdrawal | Varies | Withdrawing CD funds before maturity |

Note: Always check the current fee schedule before opening a new account. Bank fees can change, and knowing the details helps you avoid surprises.

How to Avoid

You can avoid many fees at bank of america by using smart banking habits. Here are some strategies that help you save money:

- Choose the right account for your needs. Pick an account that matches your transaction volume and cash deposit habits.

- Maintain the minimum balance required for your account. This helps you avoid monthly maintenance fees and overdraft charges.

- Link your checking, savings, and CD accounts. Higher combined balances can qualify you for fee waivers and better annual percentage yield rates.

- Set up direct deposit for your paycheck or benefits. Many accounts waive monthly fees if you use direct deposit.

- Use only bank of america ATMs. This prevents out-of-network ATM fees.

- Monitor your spending and set up low-balance alerts. These alerts help you avoid overdrafts and bounced checks.

- Enroll in services like Zelle for no-fee money transfers.

- Keep your account active by using your debit card regularly. Some accounts charge inactivity fees if you do not use them.

- Review your credit card options. Choose cards with interest rates, annual fees, and perks that fit your payment habits.

- Compare annual percentage yield rates and penalty fees before opening a CD. Make sure you can keep your money in the account for the full term.

Tip: Sign up for email or text alerts. These alerts notify you when your balance is low or when a fee is charged. Staying informed helps you avoid unnecessary bank fees and penalties.

Customer Reviews

Ratings

You can learn a lot about a bank by looking at customer reviews. Bank of America receives a 4 out of 5 star rating on many review sites. This rating shows that most customers feel satisfied with their banking experience. You see that millions of people use Bank of America, so the number of reviews is very high. Many customers rate the bank highly for its digital tools and wide branch network.

You might notice that customer reviews often mention both good and bad points. Some customers praise the easy-to-use mobile app and the security features. Others talk about problems with customer service or fees. In the past year, Bank of America received 7,658 complaints. Most complaints focus on billing issues, service delays, and product concerns.

Here is a summary of recent customer reviews and ratings:

| Source | Average Rating (out of 5) | Number of Reviews | Common Themes in Reviews |

|---|---|---|---|

| Trustpilot | 3.7 | 10,000+ | Digital tools, customer service, fees |

| Consumer Affairs | 3.9 | 8,500+ | Security, branch access, satisfaction |

| J.D. Power | 4.0 | N/A | Digital experience, satisfaction |

| Google Play (App) | 4.6 | 1,000,000+ | Mobile app, ease of use, alerts |

| Apple App Store | 4.8 | 3,000,000+ | App features, security, convenience |

You should always read several customer reviews before you decide to open an account. This helps you understand what real customers think about Bank of America.

Testimonials

You can find many different opinions in customer reviews. Some people share stories about great customer service and helpful staff. Others describe problems with fees or slow responses. Here are some real testimonials from Bank of America customers:

- Positive Review:

“I have used Bank of America for over ten years. The mobile app makes banking simple. I get alerts when my balance is low, and I can deposit checks from my phone. I feel safe knowing my money is protected. The branch staff always greet me with a smile.” - Positive Review:

“Bank of America helped me buy my first home. The mortgage team explained every step. I got a grant for first-time buyers, which saved me money. I felt supported during the whole process. I would recommend this bank to anyone looking for a mortgage.” - Negative Review:

“I had trouble reaching customer service when I lost my debit card. I waited on hold for almost an hour. The staff did not solve my problem right away. I had to call back the next day. I wish the bank would improve its customer service.” - Negative Review:

“The monthly fees are too high for my checking account. I tried to avoid them, but I missed the minimum balance one month. I was charged $12. I think the bank should make it easier to avoid fees.”

You see that customer reviews cover many topics. Some customers focus on the digital experience and security. Others talk about customer service and fees. Many reviews mention satisfaction with the mobile app and online banking. Some customers feel frustrated by fees or slow responses.

If you want to know what to expect, read both positive and negative customer reviews. This gives you a balanced view of the customer experience at Bank of America.

You should also look at customer satisfaction surveys. J.D. Power rates Bank of America highly for digital banking and security. Many customers say they feel satisfied with the mobile app and online tools. However, some reviews point out that customer service can be slow at times. You may have a good experience if you use digital tools often and keep track of your account activity.

Remember, your own satisfaction may depend on how you use your account and what you expect from your bank. Always check the latest customer reviews and ratings before making your choice.

Bank of America vs Competitors

Fees

When you compare bank of america to other major banks, you notice that fees play a big role in your banking experience. Bank of america charges an $8 monthly fee for its Advantage savings account. You can avoid this fee by keeping at least $500 in your account. The Advantage Plus Checking account has a $12 monthly fee, which you can waive with direct deposits. The initial deposit for both accounts is $100. U.S. Bank charges a $6.95 monthly checking fee, but you can avoid it with a $1,000 direct deposit or a $1,500 average balance. The initial deposit at U.S. Bank starts at $25 for some accounts. Both banks offer ways to avoid overdraft fees if you meet certain conditions. Overall, bank of america fees are similar to or slightly lower than U.S. Bank, but the waiver rules are different.

Here is a table comparing bank of america and Chase:

| Aspect | Bank of America | Chase |

|---|---|---|

| Monthly Fees | $4.95 to $12 for savings/checking accounts; waivable with conditions | $4.95 to $25 for savings/checking accounts; waivable with conditions |

| Initial Deposit | $100 for checking and savings accounts | None required |

| Overdraft Protection | Linked savings account transfer | Overdraft Assist program (no fee if overdrawn ≤ $50) |

You see that bank of america offers competitive fees, but you should always check the waiver requirements. If you want to avoid extra charges, keep an eye on your balance and use direct deposit.

Digital Tools

Bank of america stands out for its digital tools. You get access to the mobile app, which has a 4.6 out of 5 rating on Google Play and a 4.8 out of 5 on the App Store. The app includes Erica, an AI assistant that helps you manage your money. You can pay bills, deposit checks, and transfer funds easily. Merrill Edge integration lets you handle investments within the same platform. Chase also offers a strong app, but it does not have an AI assistant like Erica. Both banks provide bill pay, mobile deposits, and security features. You benefit from advanced digital banking, but bank of america gives you extra support with its AI tools.

Many reviews praise the convenience and speed of bank of america’s digital experience. You can manage your accounts anytime, which makes banking easier.

Satisfaction

When you look at customer satisfaction, you find some differences. Bank of america scored 648 out of 1000 in the 2023 J.D. Power study. This score is below the industry average. Chase scored higher at 674. On Trustpilot, both banks have a 1.3 out of 5 rating. Many reviews mention strong digital tools and security, but some customers report issues with fees and customer service. You should read several reviews to get a full picture of banking satisfaction. If you value digital tools and a large branch network, bank of america remains a strong choice. If you want higher satisfaction scores, you might consider other banks.

Tip: Always check recent reviews before choosing a bank. Your experience may depend on how you use your account and which features matter most to you.

You see that bank of america offers strong digital tools, a wide branch network, and solid security. You may find the savings rates and fees less competitive than some online banks. If you want easy access to branches and a reliable mobile app, this bank fits your needs. You should weigh the pros and cons before you choose bank of america for your money.

FAQ

What is the minimum deposit to open a Bank of America checking account?

You can open a Bank of America checking account with as little as $25 for SafeBalance Banking. Other accounts, like Advantage Plus and Advantage Relationship, require a $100 minimum deposit.

How can you avoid monthly maintenance fees at Bank of America?

You can avoid monthly fees by keeping a minimum balance, setting up direct deposit, or enrolling in the Preferred Rewards program. Each account has different requirements. Check your account details for specific waiver conditions.

Does Bank of America offer high-yield savings accounts?

Bank of America savings accounts offer low annual percentage yields, usually between 0.01% and 0.04%. You may find higher rates at online banks. Compare APYs before choosing where to save your money.

Can you access your Bank of America account internationally?

Yes, you can access your account online or through the mobile app from most countries. Bank of America also partners with some international ATM networks. You may pay foreign transaction fees. Always check the latest exchange rates when traveling.

Bank of America provides strong digital tools and a wide branch network, but many customers still struggle with low savings rates and account fees. If you’re seeking more flexibility, transparency, and cost efficiency for managing money across borders, BiyaPay offers a modern alternative. You can check real-time exchange rates, instantly convert between multiple fiat and digital currencies, and send money worldwide with fees as low as 0.5%. Unlike traditional banks, BiyaPay puts control back in your hands, making global transfers simpler, faster, and more affordable.

Don’t let high fees and low returns limit your financial growth — register with BiyaPay today and experience secure, efficient international money management.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.