- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Credit Card for Starters in the Philippines for 2025

Image Source: pexels

If you want the best credit card for beginners in the Philippines for 2025, the PNB Ze-Lo Mastercard stands out. This card offers low fees, easy approval, and perks that help you start your credit journey with confidence. You join a growing group—over 11 million cardholders in the country—where young Filipinos, especially Gen Z, now make up one-third of new users. Picking the right credit card for Filipinos means you learn to manage payments, avoid debt, and even get rewards for travel or everyday spending. Many banks in the Philippines now use digital tools that guide you through your first credit card steps. With the best credit card in the Philippines, you can unlock travel deals, enjoy flexible payment options, and build strong money habits. The right credit card Philippines choice sets you up for smart spending—whether you travel for fun, family, or business.

Key Takeaways

- Choose a beginner credit card with low or no annual fees and easy approval to start building your credit safely.

- Match your credit card choice to your lifestyle, like picking travel perks if you travel often or cashback if you spend on daily needs.

- Always pay your credit card bills on time to avoid fees, interest, and damage to your credit score.

- Prepare your documents and check your credit score before applying to improve your chances of approval.

- Avoid overspending and using cash advances to keep your finances healthy and build good credit habits.

Best Credit Cards for Beginners

Image Source: unsplash

Top Picks

Choosing your first credit card in the Philippines can feel overwhelming, but you have many great options. The best credit cards for beginners offer simple approval, low fees, and helpful perks. You want a card that matches your lifestyle, whether you love to travel, shop, or save on daily expenses. Here are some of the best credit cards you should consider for 2025:

- PNB Ze-Lo Mastercard: This card stands out as the best credit card for beginners. You get no annual fee, easy approval, and a low minimum income requirement. It is perfect if you want to start building your credit history in the Philippines.

- BPI Amore Cashback Credit Card: If you want to earn cashback on your daily spending, this card gives you rewards for groceries, bills, and shopping. It is one of the best cashback credit cards for those who want to save money while spending.

- RCBC Classic Mastercard: This card offers flexible payment options and simple requirements. You can use it for travel, shopping, or emergencies. It is a good choice if you want a reliable credit card Philippines option.

- UnionBank Rewards Visa Platinum Credit Card: You get bonus points for dining and shopping. This card is great for people who love to eat out or shop online. It is also one of the best credit cards for low-income earners.

- Citi Simplicity+ Card: You pay no annual fee and enjoy no late payment fees. This card is easy to manage and helps you avoid extra charges.

- Metrobank Titanium Mastercard: You earn bonus points for every purchase and can redeem them for travel or shopping. This card is one of the best travel credit card choices for beginners.

- RCBC Flex Visa: You can choose your bonus categories, get free travel insurance, and enjoy airport lounge access. If you want the best credit card for travel, this card gives you flexibility and perks.

- AUB Easy Mastercard: You pay no annual fee and get flexible payment terms. This card is good if you want to control your spending and avoid high fees.

- BDO ShopMore Mastercard: You receive welcome points, earn rewards for every purchase, and enjoy interest-free installments. This card is popular among shoppers in the Philippines.

Tip: Always check the latest requirements and benefits with your chosen bank. Some cards update their perks and eligibility each year.

Quick Comparison

You want to see how these best credit cards compare side by side. Here is a table that highlights the key features, fees, rewards, and perks for each card. All fees are shown in USD, using an exchange rate of 1 USD = 56 PHP.

| Credit Card Name | Annual Fee (USD) | Rewards & Perks | Minimum Income (USD/year) | Approval Ease | Special Beginner Benefits |

|---|---|---|---|---|---|

| PNB Ze-Lo Mastercard | $0 | No annual fee, easy approval, basic rewards | $2,143 | High | No annual fee, low income needed |

| BPI Amore Cashback Credit Card | $28 (first year free) | Cashback on groceries, bills, shopping | Not disclosed | Medium | Cashback, flexible payments |

| RCBC Classic Mastercard | $27 | Flexible payments, basic rewards | Not disclosed | High | Simple requirements |

| UnionBank Rewards Visa Platinum | $45 | Bonus points for dining/shopping | Not disclosed | Medium | Extra points for spending |

| Citi Simplicity+ Card | $0 | No annual fee, no late fees | Not disclosed | High | No penalty fees |

| Metrobank Titanium Mastercard | $45 | Bonus points, travel rewards | $2,143 (existing), $5,208 (new) | Medium | Points for every purchase |

| RCBC Flex Visa | $27 (first year free) | Choose bonus categories, travel insurance, lounge access | $2,143 | Medium | Free travel insurance |

| AUB Easy Mastercard | $0 | No annual fee, flexible payments, rewards | $893 | High | Flexible payment terms |

| BDO ShopMore Mastercard | $32 (first year free) | Welcome points, rewards, installments | $2,143 | Medium | Welcome bonus, easy installments |

You can see that many of the best credit cards for beginners in the Philippines offer no annual fee or waive it for the first year. Cards like the PNB Ze-Lo Mastercard, Citi Simplicity+ Card, and AUB Easy Mastercard help you avoid extra costs. If you want to earn cashback, the BPI Amore Cashback Credit Card and BDO ShopMore Mastercard are among the best cashback credit cards. For travel lovers, the Metrobank Titanium Mastercard and RCBC Flex Visa stand out as the best travel credit card options, giving you travel insurance, lounge access, and points you can use for flights or hotels.

If you want to maximize your rewards, look for cards that give you bonus points for shopping, dining, or travel. The UnionBank Rewards Visa Platinum Credit Card and Metrobank Titanium Mastercard both offer extra points for every purchase. If you want the best airmiles credit cards, focus on cards that let you convert points to airline miles or give you travel perks.

Note: Most banks in the Philippines require you to show proof of income and may check your credit history. Always prepare your documents before you apply for a credit card for Filipinos.

When you choose the best credit card, think about your spending habits. If you travel often, pick a travel credit card with insurance and lounge access. If you want to save on daily expenses, go for the best cashback credit cards. The right card helps you build your credit, enjoy rewards, and unlock travel opportunities in the Philippines and beyond.

Key Features to Consider

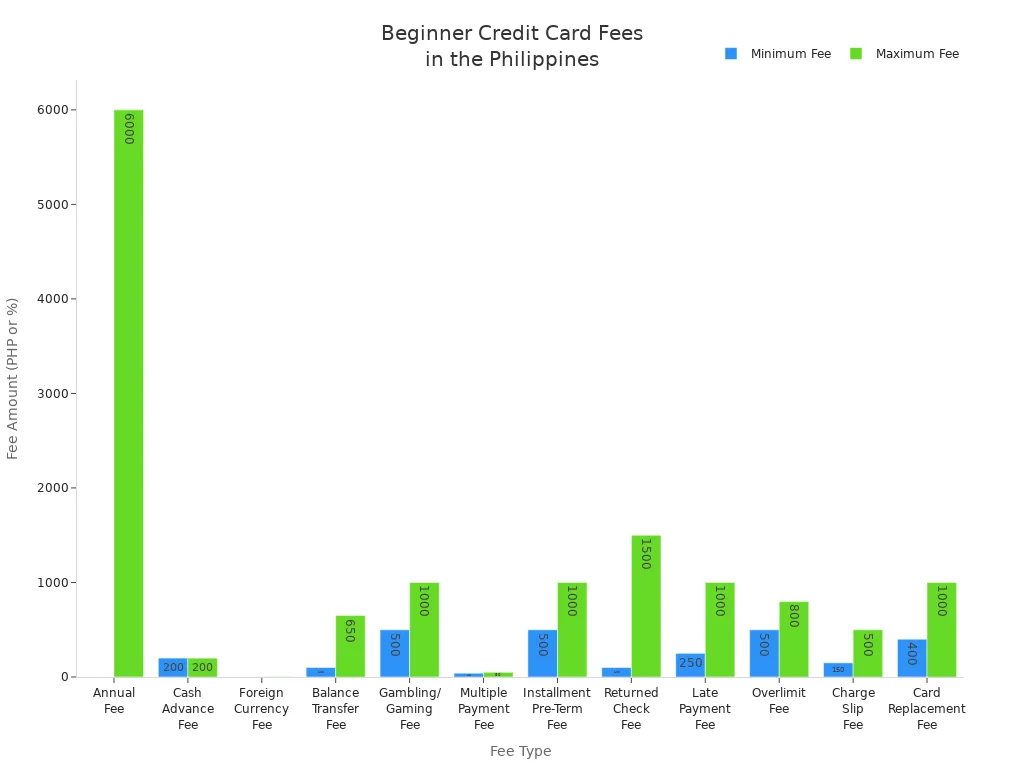

Fees and Charges

When you pick your first credit card in the Philippines, you want to avoid surprise costs. Low fees and clear charges help you manage your money and keep your travel plans on track. Many of the best credit cards for beginners offer no annual fee or waive it for the first year. You should also watch out for other charges, like cash advance fees or late payment penalties. Here’s a quick look at typical fees you might see:

| Fee Type | Typical Range / Amount (USD) | Notes / Examples from Banks |

|---|---|---|

| Annual Fee | $0 (some cards) to $107 | Some cards offer free-for-life; others charge $21 to $107 |

| Cash Advance Fee | $3.57 per transaction | Charged when withdrawing cash via credit card ATM |

| Foreign Currency Transaction Fee | 1% to 3.5% of transaction amount | Varies by bank |

| Balance Transfer Fee | $1.78 to $11.60 per transaction | Depends on bank |

| Late Payment Fee | $4.46 to $17.86 or unpaid minimum amount due | Penalty for late payment |

You can avoid most fees by paying your bill on time and choosing cards with no annual fee. This helps you keep more money for travel and enjoy more rewards.

Interest Rates

Interest rates matter because they affect how much you pay if you carry a balance. Most beginner cards in the Philippines have rates around 2% per month. If you pay your full balance each month, you avoid interest and keep your travel budget safe. Always check the interest rate before you apply, especially if you plan to use your card for travel expenses.

Rewards and Perks

Rewards make using your card fun. The best credit cards for beginners offer points, cashback, or travel perks. You can earn rewards for every purchase, and some cards give extra points for travel, shopping, or dining. Look for cards with a high rewards rate and flexible rewards programs. Cashback rewards help you save on daily spending, while travel credit card perks like lounge access or free insurance make your trips smoother. Some cards even let you convert points to miles, making them the best travel credit card or best credit card for travel if you love to explore new places.

Approval Requirements

Getting approved for your first card in the Philippines is easier if you know what banks want. Most require a minimum annual income of about $2,678. You need to submit documents like an application form, ID, and proof of income. Some banks use your e-wallet or bill payment history to help you qualify, even if you have no credit history. This makes it easier for you to start earning rewards and enjoying benefits.

Virtual Card Options

Virtual cards are great if you shop or book travel online. Some banks in the Philippines, like UNO Digital Bank and Tonik, offer virtual cards you can use right away. These cards give you instant access to rewards, cashback, and travel benefits without waiting for a physical card. You can manage your card through an app, making it easy to track your rewards rate and spending.

Tip: Always check if your card offers security features like OTPs, chip technology, and instant card freeze. These keep your travel and online purchases safe.

How to Choose the Best Credit Card

Assess Your Needs

Before you pick your first credit card, take a close look at your financial situation. Ask yourself how you plan to use your card. Do you want to use it for travel, shopping, or emergencies? Think about your income and job stability. Banks in the Philippines often check your income and employment history to see if you can handle payments. Your credit score also matters. If you pay bills on time and keep your debt low, you have a better chance of getting approved.

Here are some things you should consider:

- Your credit score and payment history

- Your monthly income and job stability

- How much debt you already have compared to your income

- Your living situation and how long you have stayed at your current address

- Your savings and ability to handle emergencies

If you want to build your credit, start with a card that matches your current financial status. Some cards in the Philippines offer easier approval for beginners. Always use your card for what you can afford to repay. This helps you avoid debt and keeps your credit healthy for future travel plans.

Match Features to Lifestyle

You want a card that fits your daily habits and goals. If you love to travel, look for cards that offer travel rewards, free insurance, or no foreign transaction fees. Some cards give you points for every travel booking or even airport lounge access. If you spend more on groceries or dining, choose a card that gives cashback or extra points for those categories.

Think about these points:

- Do you travel often for work or fun?

- Do you want to save on travel costs with rewards or discounts?

- Are you looking for perks like travel insurance or purchase protection?

- Does the card offer a good rewards rate for your favorite spending categories?

Compare the annual fee with the benefits. Sometimes, a card with a small fee gives you more value if you use the travel perks. Always check if the rewards match your lifestyle in the Philippines.

Application Tips

Getting approved for your first credit card in the Philippines can feel tricky, but you can boost your chances with a few smart moves:

- Check your credit score before you apply. Many banks let you do this for free.

- Fix any errors on your credit report. Even small mistakes can hurt your approval odds.

- Keep your debt-to-income ratio below 36%. This shows banks you can handle more credit.

- Pay all your bills on time. Good payment history is key for approval and future travel plans.

- Don’t apply for many cards at once. Wait a few months between applications.

- Look for cards that offer preapproval checks. This helps you avoid hard inquiries.

- If you have no credit history, try a secured card or one designed for beginners.

Tip: Always prepare your documents, like proof of income and ID, before you apply. This makes the process smoother and gets you closer to your next travel adventure.

Common Mistakes for Beginners

Image Source: pexels

Starting your credit card journey can feel exciting, but it’s easy to make mistakes if you’re not careful. Many first-time users in the Philippines fall into common traps that can hurt their finances and credit score. Let’s look at the biggest mistakes you should avoid.

Overspending

You might feel tempted to use your credit card when your salary runs short. Many beginners see their card as extra cash, but this can lead to trouble. If you spend more than you can pay back, your balance grows fast. Some people even take cash advances, which come with high daily interest rates and extra fees. This habit can trap you in debt and make it hard to recover.

Tip: Only use your credit card for things you can afford to pay off each month. Treat your card as a tool, not a backup wallet.

Here are some common overspending mistakes:

- Using the card for wants, not needs

- Taking cash advances for quick money

- Relying on the card when your salary is low

Ignoring Fees

Many beginners ignore the small print about fees. You might think the annual fee or late payment fee is not a big deal, but these charges add up. Some cards charge for cash advances, foreign transactions, or balance transfers. If you only pay the minimum balance, interest and penalties can pile up quickly.

| Fee Type | What to Watch Out For |

|---|---|

| Annual Fee | Some cards offer $0, others charge up to $107 |

| Cash Advance | High fees and daily interest |

| Late Payment | Penalties and higher interest |

Note: Always read your statement and check for hidden charges. Paying attention to fees helps you save money and avoid surprises.

Missing Payments

Missing a payment can hurt your credit score, especially if you’re new to credit cards in the Philippines. Even one late payment can get reported to credit bureaus. This makes it harder for you to get loans or better cards in the future. Late fees and higher interest rates also make your debt grow faster. If you keep missing payments, your card issuer might lower your credit limit or even close your account.

You can avoid these problems by:

- Setting up automatic payments

- Paying more than the minimum due

- Using reminders for due dates

Paying on time helps you build a strong credit history. Good habits now set you up for better financial options later.

You have great beginner credit card options that make life easier. These cards stand out because they offer simple applications, low or zero annual fees, and rewards for everyday spending. Many even give you travel perks and easy online approval. Before you apply, think about your habits and what you need most.

Check if you meet the age and income requirements, prepare your documents, and choose the best way to apply.

Starting with the right card helps you build good credit, enjoy rewards, and set yourself up for financial success.

FAQ

What documents do you need to apply for a beginner credit card?

You usually need a valid ID, proof of income, and a completed application form. Some banks may ask for proof of billing or employment. Always check the bank’s website for the latest requirements.

Can you get approved if you have no credit history?

Yes, you can. Many banks offer beginner cards for people with no credit history. You can also try secured cards or cards that accept e-wallet or bill payment records as proof.

How long does approval take for your first credit card?

Most banks process applications within 5 to 10 business days. Some digital banks may approve you faster. You can track your application online or through the bank’s app.

What happens if you miss a payment?

If you miss a payment, you pay a late fee and interest. Your credit score may drop. Set reminders or use automatic payments to avoid missing due dates.

Getting your first credit card in the Philippines is a big step, but many beginners face hidden costs, high interest, and limited international flexibility. If you want a smarter way to manage money locally and abroad, BiyaPay offers a modern solution. You can check real-time exchange rates, instantly convert between multiple fiat and digital currencies, and send funds worldwide with remittance fees as low as 0.5%. Whether you’re paying tuition, supporting family, or traveling, BiyaPay gives you transparency, speed, and security that starter credit cards often lack.

Take control of your financial journey today — register with BiyaPay and experience a better way to manage money globally.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.