- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Online Payment Stats and Real-World Cons in 2025

Image Source: pexels

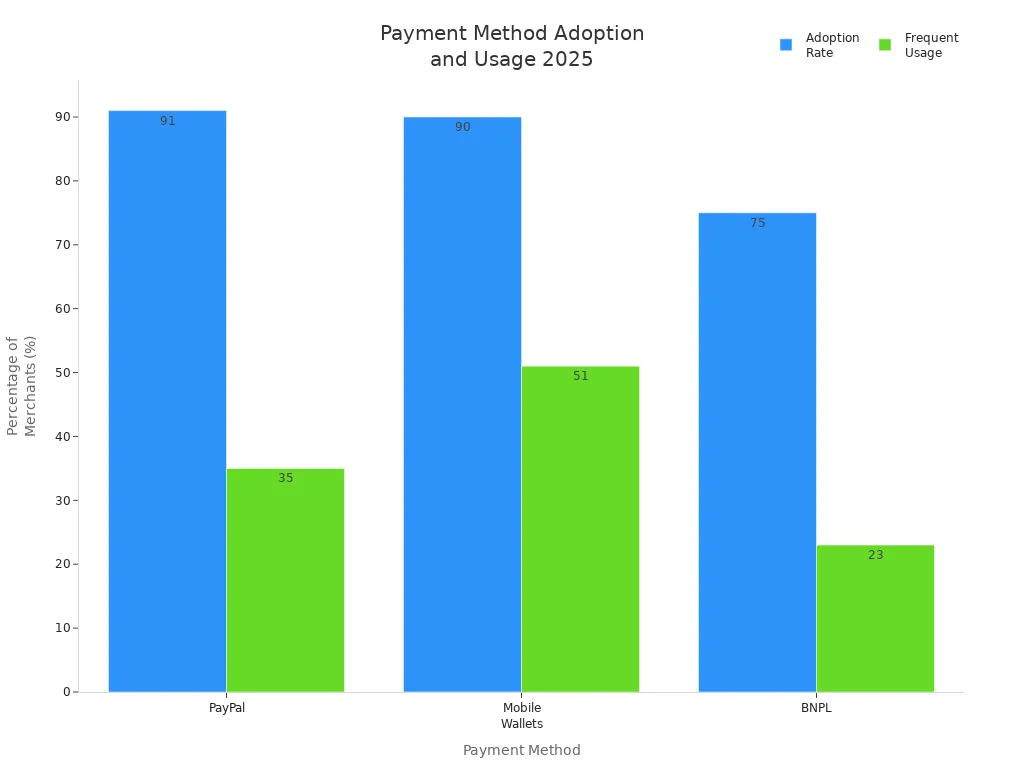

You want the best online payment experience for your business, right? In 2025, PayPal, Stripe, and Square top the list of payment service provider choices, thanks to their massive payment volumes and positive reviews from users. Stripe leads with 80.1% integration among IT companies, while PayPal is a favorite for 64% of US solo entrepreneurs. Check out the latest numbers:

| Provider | Total Payment Volume (USD) | Active Users/Businesses | Integration Rate |

|---|---|---|---|

| PayPal | $1.92 trillion | 435 million | 60% (e-commerce) |

| Stripe | $1.14 trillion | 5.3 million | 80.1% (IT firms) |

| Square | N/A | N/A | 17% |

You see these payment service provider solutions everywhere in online payments. Merchants praise their security, easy integration, and wide payment options, but reviews also point to fees and payout delays as real-world cons. Choosing the best online payment service means weighing these facts for your payments strategy.

Key Takeaways

- PayPal, Stripe, and Square lead the online payment market in 2025, each serving different business needs with strong security and wide payment options.

- High fees, account holds, and slow support are common drawbacks across many payment providers, so check fees and service quality before choosing.

- Stripe suits tech-savvy businesses with flexible APIs, while Square and Shopify Payments offer easy setups for small shops and Shopify users.

- Global sellers benefit from providers like Adyen and Worldpay that support many currencies and payment methods but may have complex pricing.

- Always test payment systems, compare fees, and read real user reviews to find a payment provider that fits your business size, location, and customer preferences.

Best Online Payment Comparison

Image Source: pexels

Key Stats Overview

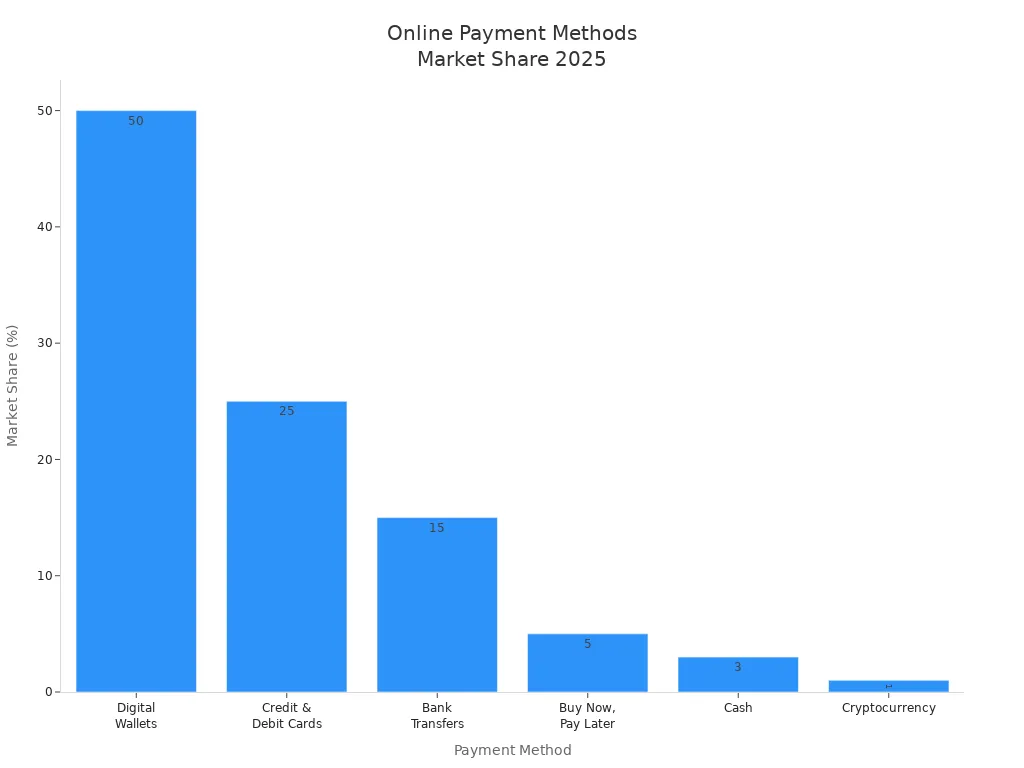

When you look for the best online payment provider, you want clear facts. Here’s a quick table to help you compare the top payment service provider options for 2025. You can see how each payment gateway stacks up for market share, transaction fees, payment methods, and pricing.

| Provider | Market Share (2025) | Transaction Fees (USD) | Supported Payment Methods | Main Cons |

|---|---|---|---|---|

| PayPal | 45% | 2.99% + fixed fee (domestic); 3.49% + fixed fee (checkout); +1.5% (international) | Credit/debit cards, PayPal, Apple Pay, Google Pay, bank transfers, BNPL, crypto (niche) | High fees, account holds |

| Stripe | 18% | 2.9% + $0.30 | Credit/debit cards, Apple Pay, Google Pay, ACH, BNPL | Developer-focused, support wait |

| Square | 12% | 2.6% + $0.10 | Credit/debit cards, Apple Pay, Google Pay | Limited global reach |

| Shopify Payments | 8% | 2.9% + $0.30 | Credit/debit cards, Apple Pay, Google Pay, Shop Pay | Only for Shopify stores |

| Clover | 4% | 2.6% + $0.10 | Credit/debit cards, Apple Pay, Google Pay | Hardware required |

| Authorize.net | 3% | 2.9% + $0.30 + $25/mo | Credit/debit cards, e-checks | Monthly fee, setup complexity |

| Helcim | 2% | 1.92% + $0.08 (avg) | Credit/debit cards, ACH, Apple Pay, Google Pay | Not for high-risk businesses |

| Adyen | 2% | 2.9% + $0.12 | Credit/debit cards, Apple Pay, Google Pay, local methods | Complex pricing |

| Amazon Pay | 2% | 2.9% + $0.30 | Credit/debit cards, Amazon Pay | Amazon account required |

| Worldpay | 2% | Custom | Credit/debit cards, Apple Pay, Google Pay, ACH | Opaque pricing |

| Google Pay | 1% | Varies by provider | Google Pay, credit/debit cards | Not all banks supported |

| Apple Pay | 1% | Varies by provider | Apple Pay, credit/debit cards | Apple device required |

| Payline | 1% | 0.2%–1.0% + $0.10 | Credit/debit cards, ACH | Monthly fee, limited features |

| Verifone | 1% | Custom | Credit/debit cards, Apple Pay, Google Pay | Hardware focus |

| Braintree | 1% | 2.89% + $0.29 | Credit/debit cards, PayPal, PayPal Credit, bank transfers, local methods | Developer setup needed |

Note: Digital wallets like Apple Pay and Google Pay now make up about 50% of global online payments. Credit and debit cards hold 25%, while bank transfers and BNPL are growing fast.

Main Cons Overview

You want the best online payment gateway for your e-commerce business, but every payment service provider has drawbacks. Some providers charge higher payment processing fees or have complex pricing. Others limit payment processing options or require special hardware. You might face account holds, slow support, or tough integration with your payment gateway. Always check the payment processing rates and transaction fees before you choose a provider. Look for payment solutions that fit your business and offer strong security for your payments.

Payment Service Provider Stats

PayPal

You see PayPal everywhere in online payments. In 2025, PayPal holds a 45% market share, making it the top payment service provider worldwide. This provider stands out for its strong user base growth and high transaction volume. You can use PayPal in over 200 countries, and it supports many payment processing options, including credit cards, debit cards, and digital wallets.

Here’s a quick look at PayPal’s transaction fees and pricing:

| Transaction Type | Fee Rate (USD) | Notes |

|---|---|---|

| Standard US Commercial Digital Payments | 2.99% to 3.49% + $0.49 fixed fee | Includes PayPal Checkout, Venmo, PayPal Credit; American Express may vary |

| Send/Receive Money for Goods & Services | 2.99% + $0.49 fixed fee | Lower end of commercial transaction fees |

| In-Person QR Code Transactions | 2.29% + $0.09 fixed fee | Applies to PayPal QR and third-party integrators |

| Card Present (PayPal Zettle) | 2.29% + $0.09 fixed fee | Chip or tap payments using card reader |

| Manual Card Entry | 3.49% + $0.09 fixed fee | Higher rate for manual entry |

| Standard Card Payments (Guest Checkout) | 2.99% + $0.49 fixed fee | Debit/credit card payments without PayPal login |

| Advanced Credit/Debit Card Payments | 2.89% + $0.29 fixed fee | Lower rates for confirmed charities (2.19% + $0.29) |

| Virtual Terminal | 3.39% + $0.29 fixed fee + $30/month | Manual card entry terminal with monthly fee |

| International Commercial Transactions | +1.50% cross-border fee | Added on top of domestic rates |

| Currency Conversion Fees | 3.0% to 4.0% markup | Applied as a spread on exchange rates |

| US Domestic Payouts (Mass Payments) | 2% capped at $1.00 per transaction | Without Payouts API; with API flat $0.25 per transaction |

| International Payouts | 2% capped at $20.00 per transaction | For USD payouts |

| Chargeback Fee | $20 USD | Charged if dispute lost; may be waived under Seller Protection |

| Dispute Fees | $15 to $30 USD | Standard and high volume dispute fees |

| Instant Transfer (Merchant) | 1.50% (min $0.50) | For faster access to funds |

| Instant Transfer (Consumer) | 1.75% (min $0.25, max $25) | For consumers withdrawing funds instantly |

PayPal’s pricing can feel high, but you get wide acceptance and strong security. You can trust this payment gateway for e-commerce, subscriptions, and even in-person sales.

Stripe

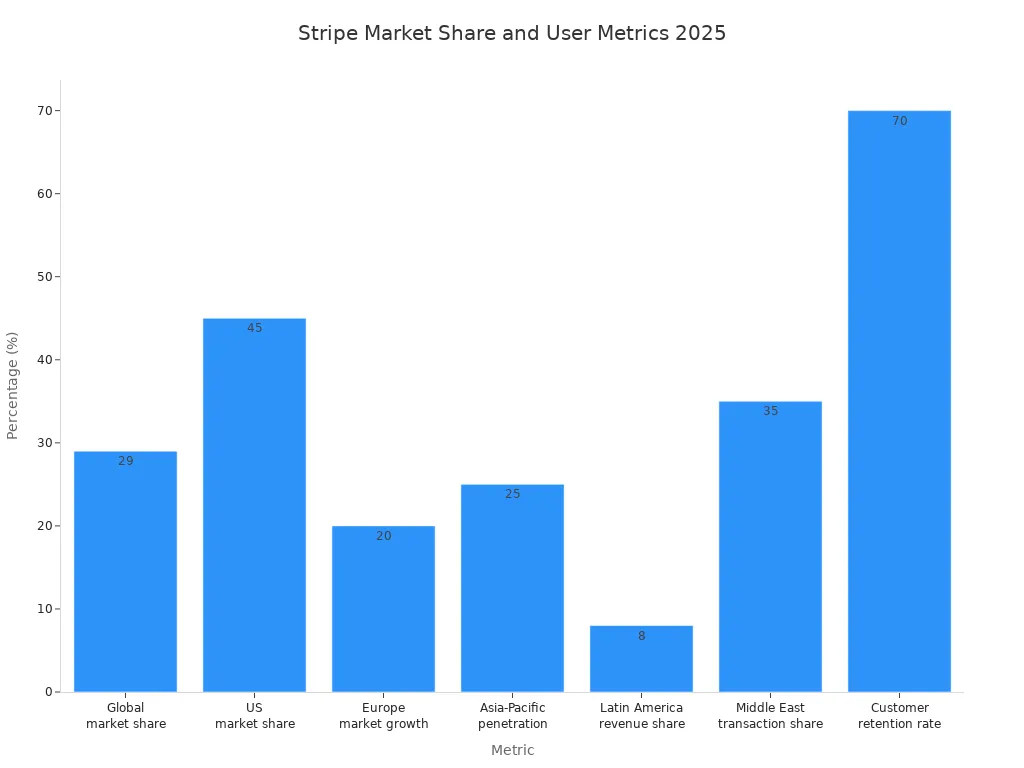

Stripe is a favorite payment service provider for tech-savvy businesses. You find Stripe on over 1.3 million active websites in 2025. Stripe’s global market share is 29%, and it holds 45% in the US. You get developer-friendly APIs, fast onboarding, and a wide range of payment processing options.

| Metric | Value | Notes |

|---|---|---|

| Global market share | 29% | Online payment processing |

| US market share | 45% | US market dominance |

| Active websites using Stripe | 1.31 million | Globally as of mid-2025 |

| Europe market growth | 20% growth | Germany, France, UK |

| Asia-Pacific penetration | 25% increase | India, Japan |

| Customer retention rate | 70% | Global |

Stripe’s pricing is simple for most businesses:

| Aspect | Details |

|---|---|

| Standard Online Transaction Fees | 2.90% + $0.30 per transaction (credit and debit cards) |

| In-Person Payments (Terminal) | 2.7% + $0.05 per transaction |

| ACH Direct Debit | 0.8% of transaction amount, capped at $5 |

| Wire Transfers | $8 per transaction |

| International Card Transactions | Additional 1.5% fee |

| Currency Conversion Fees | 1% to 2% depending on conversion requirements |

Stripe’s payment gateway gives you global reach, strong security, and flexible pricing. You can scale your online business quickly with Stripe.

Square

Square is a payment service provider that makes payment processing easy for small businesses and retailers. You get transparent pricing and no monthly fees for basic plans. Square’s payment gateway supports both in-person and online payments.

| Square Plan | Subscription Fee (per location) | Transaction Fees Range | Key Benefits |

|---|---|---|---|

| Square for Retail | Free: $0; Plus: $89; Premium: Custom | 2.6% + $0.10 to 2.9% + $0.30 per transaction | Advanced inventory, loyalty programs, COGS tracking |

| Square for Restaurants | Free: $0; Plus: $69; Premium: $165 | 2.6% + $0.10 to 2.9% + $0.30 per transaction | Menu management, auto-gratuity, seat tracking |

| Square Appointments | Free: $0; Plus: $29; Premium: $69 | 2.6% + $0.10 to 2.9% + $0.30 per transaction | Appointment reminders, no-show protection, multi-staff booking |

| Additional Costs | Payroll: $35; Loyalty: $45 | 3.5% + $0.15 for manually keyed transactions | Employee permissions, payroll integration, marketing |

You pay 2.6% + $0.15 for in-person transactions and 2.9% + $0.30 for online payments. If you key in a card manually, the fee is 3.5% + $0.15. Square’s payment gateway is popular for its easy setup and clear pricing.

- Cash App, owned by Square, generated $16.2 billion in revenue in 2024.

- 57 million people use Cash App monthly.

- Card inflows to Cash App reached $283 billion in 2024.

Shopify Payments

Shopify Payments is the built-in payment service provider for Shopify stores. You get seamless integration and fast payouts. Shopify Payments only works if you use Shopify as your e-commerce platform.

| Shopify Plan | Online Credit Card Processing Fee | In-Person Debit/Credit Card Fee |

|---|---|---|

| Basic | 2.9% + $0.30 | 2.7% + $0.30 |

| Shopify | 2.6% + $0.30 | 2.5% + $0.30 |

| Advanced | 2.4% + $0.30 | 2.4% + $0.30 |

You avoid extra transaction fees if you use Shopify Payments. This payment gateway is best for Shopify users who want simple pricing and easy payment processing.

Clover

Clover is a payment service provider that focuses on retail, restaurants, and service businesses. You get a mix of hardware and software payment solutions. Clover’s payment gateway supports both card-present and card-not-present transactions.

| Business Category | Plan Tier | Monthly Fee (USD) | Card-Present Transaction Fee | Card-Not-Present Transaction Fee |

|---|---|---|---|---|

| Retail Shops | Starter | $60 | 2.6% + $0.10 | 3.5% + $0.10 |

| Retail Shops | Standard | $135 | 2.3% + $0.10 | 3.5% + $0.10 |

| Retail Shops | Advanced | $185 | 2.3% + $0.10 | 3.5% + $0.10 |

| Professional Services | Starter | $14.95 | N/A (all card-not-present) | 3.5% + $0.10 |

| Professional Services | Standard | $50 | 2.6% + $0.10 | 3.5% + $0.10 |

| Professional Services | Advanced | $125 | 2.3% + $0.10 | 3.5% + $0.10 |

| Home and Field Services | Starter | $14.95 | N/A (all card-not-present) | 3.5% + $0.10 |

| Home and Field Services | Standard | $49 + $14.95 | 2.6% + $0.10 | 3.5% + $0.10 |

| Home and Field Services | Advanced | $50 | 2.6% + $0.10 | 3.5% + $0.10 |

Clover’s pricing is tiered, and you pay more for advanced features. You get strong integration with online food ordering and delivery platforms.

Authorize.net

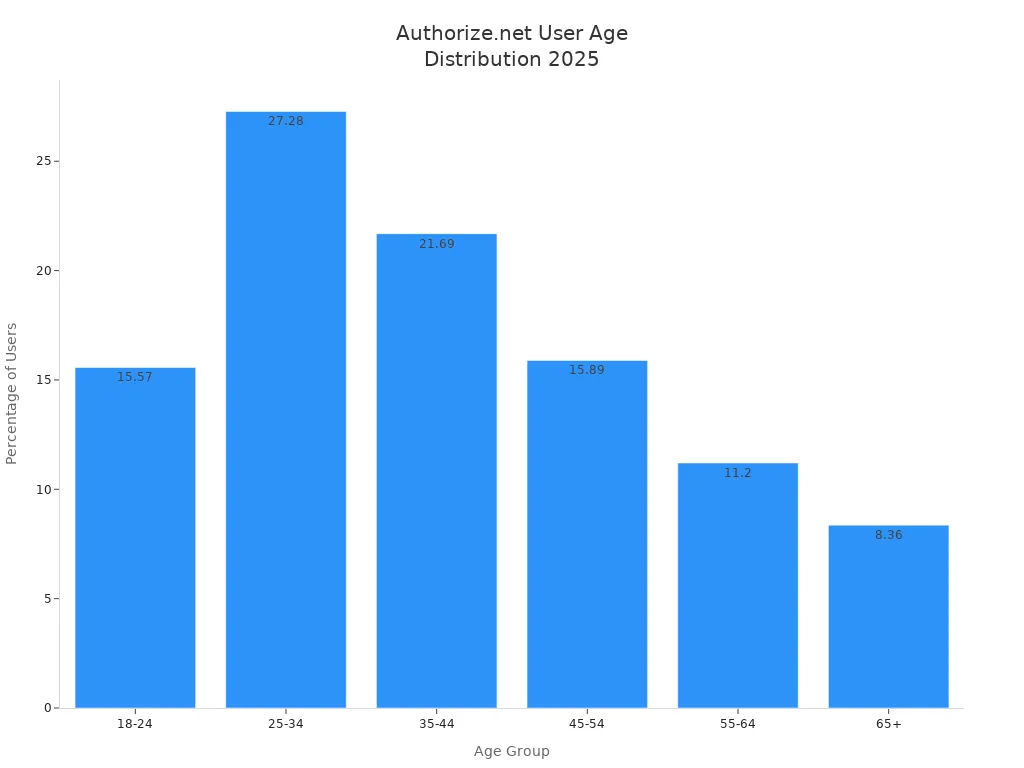

Authorize.net is a long-standing payment service provider. You find it used by many marketing and web design agencies. In 2025, about 3% of US users choose Authorize.net, and it holds a 1.5% market share in e-commerce payment gateways.

| Metric/Category | Value/Statistic |

|---|---|

| U.S. digital payment users aware | 17% |

| Positive opinion among aware users | 24% |

| Current U.S. users of service | 3% |

| User loyalty rate | 33% |

| Market share in eCommerce gateways | 1.5% |

| Monthly visits peak | 5.5 million in July 2025 |

| Device usage split | Mobile (46.2%), Desktop (53.8%) |

Authorize.net’s payment gateway offers strong security and supports many payment processing options, but you pay a monthly fee and setup can be complex.

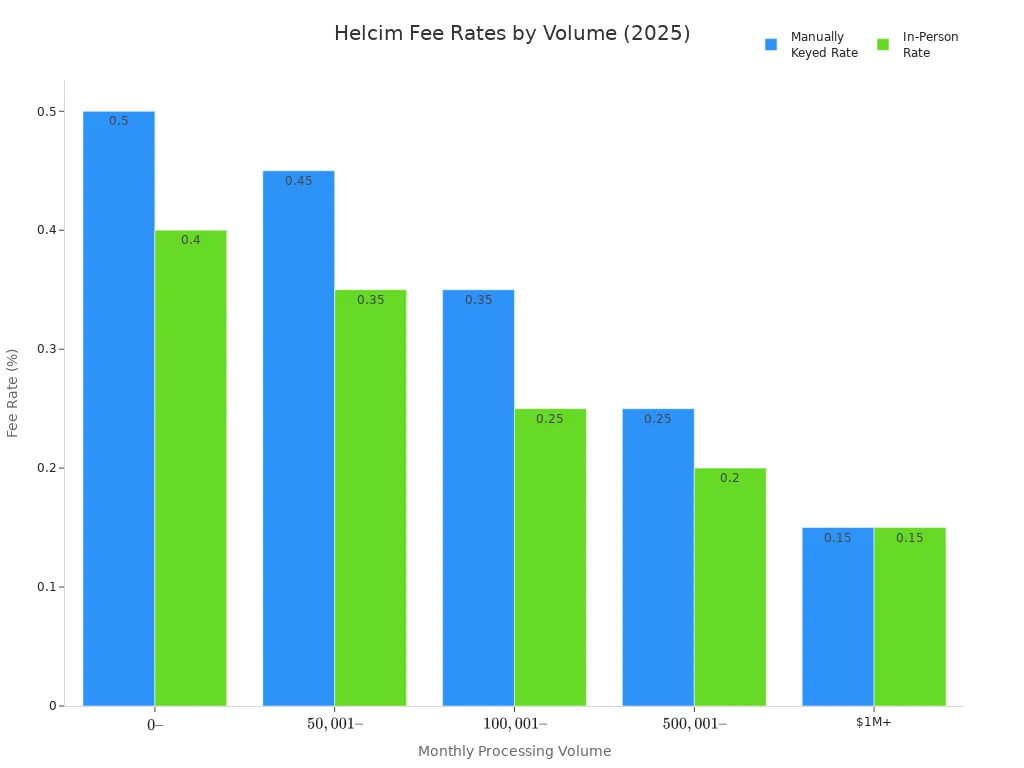

Helcim

Helcim is a payment service provider known for transparent pricing. You pay lower rates as your monthly processing volume grows. Helcim supports both online and in-person payments.

| Monthly Processing Volume | Manually Keyed Rate (plus Interchange) | In-Person Rate (plus Interchange) |

|---|---|---|

| $0 – $50,000 | 0.50% + $0.25 | 0.40% + $0.08 |

| $50,001 – $100,000 | 0.45% + $0.20 | 0.35% + $0.07 |

| $100,001 – $500,000 | 0.35% + $0.20 | 0.25% + $0.07 |

| $500,001 – $1,000,000 | 0.25% + $0.15 | 0.20% + $0.06 |

| $1,000,001+ | 0.15% + $0.15 | 0.15% + $0.06 |

Helcim’s payment gateway is a good fit if you want clear pricing and no hidden fees. You get access to ACH payments and strong payment processing options.

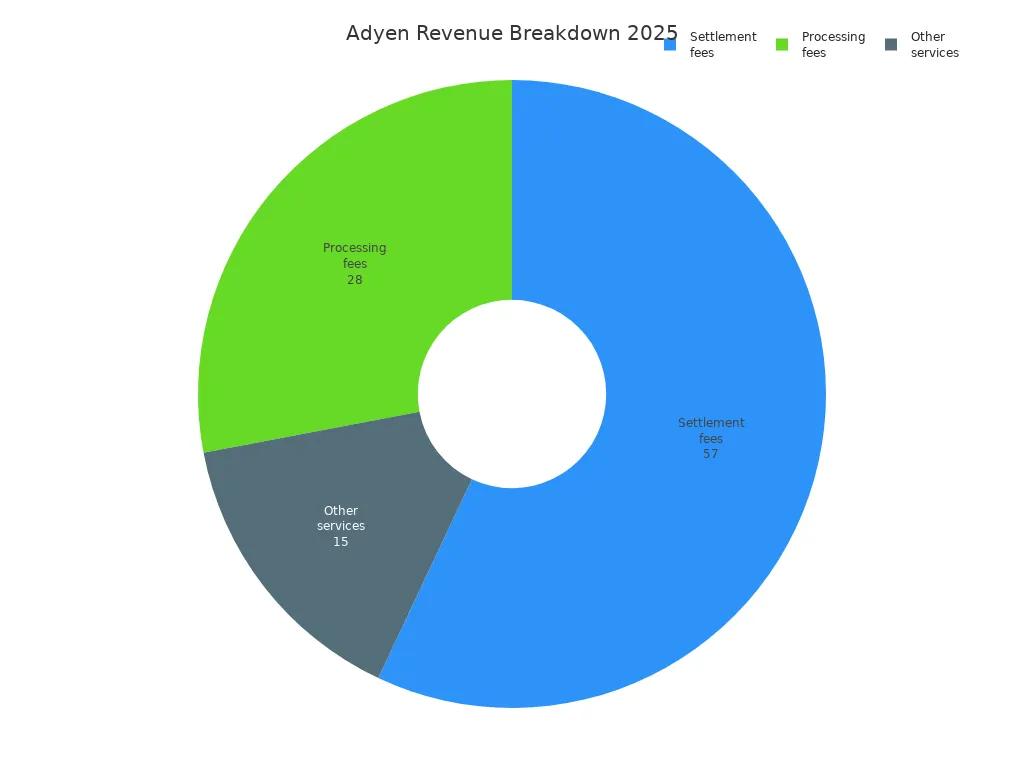

Adyen

Adyen is a global payment service provider that processes over $1.08 trillion in payments in 2025. You get access to more than 250 payment methods and 187 currencies. Adyen’s payment gateway is popular with large businesses and international e-commerce.

| Metric | Value/Description |

|---|---|

| Payment volume processed (2025) | Over $1.08 trillion, 17% YoY increase |

| Net revenue (2025) | €1.82 billion, 21% growth |

| EBITDA margin | 61% |

| Net income (2025) | €635 million, 12% YoY rise |

| Customer retention rate | 98.5% |

| Regional transaction distribution | 60% Europe, 30% North America, 10% Asia-Pacific |

| Cross-border payments | 55% of transaction volume |

| Payment methods supported | Over 250 |

| Currencies supported | 187 |

Adyen’s pricing is tiered and can be complex, but you get strong global reach and high security.

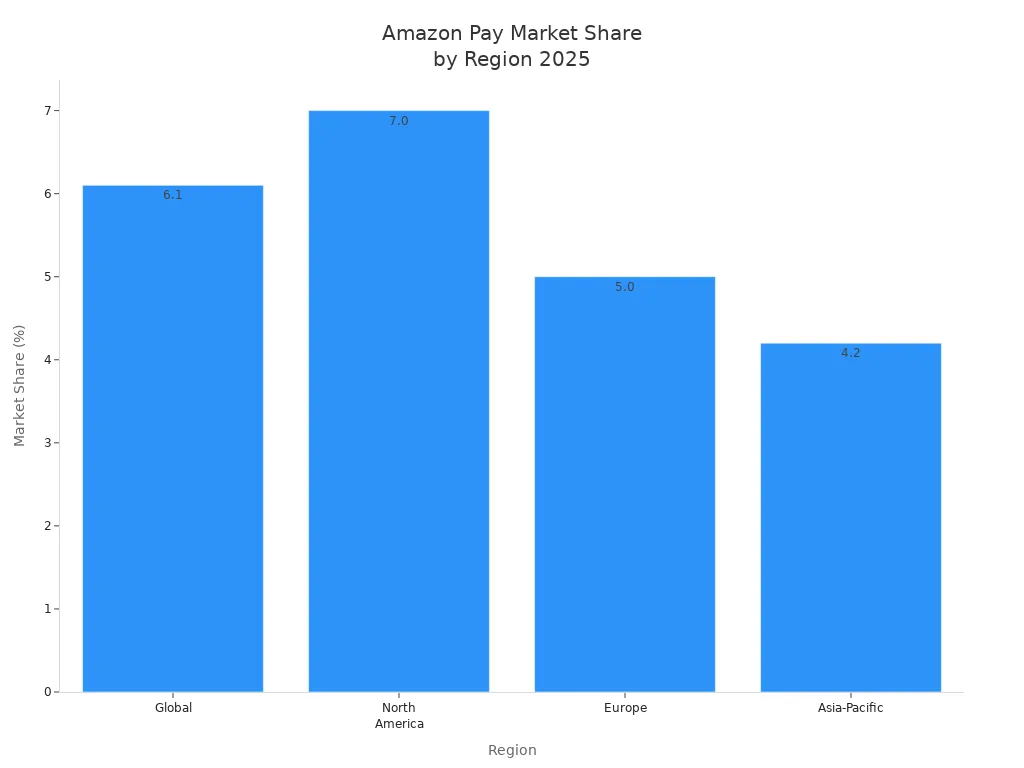

Amazon Pay

Amazon Pay is a payment service provider that lets your customers pay using their Amazon accounts. In 2025, Amazon Pay holds a 6.1% global market share and is the third most-used payment gateway in North America.

| Metric | Value (2025) | Notes/Comparison |

|---|---|---|

| Global Market Share | 6.1% | Projected by end of 2025 |

| North America Market Share | 7.0% | 3rd most used payment gateway |

| Europe Market Share | 5.0% | Up from 4.2% in 2023 |

| Asia-Pacific Market Share | 4.2% | Up from 3.5% in 2024 |

| Transaction Volume Growth | 13.3% increase | Compared to 2024 |

| Merchant Growth | 20% increase | Over 600,000 merchants worldwide |

| Revenue Projection | $2.1 billion | By end of 2025 |

| Cross-border Transaction Growth | 25% increase | Strengthening global reach |

| Mobile Transaction Growth | 18% increase | Mobile payments rising |

Amazon Pay’s payment gateway is easy to use for online payments, especially if your customers already shop on Amazon.

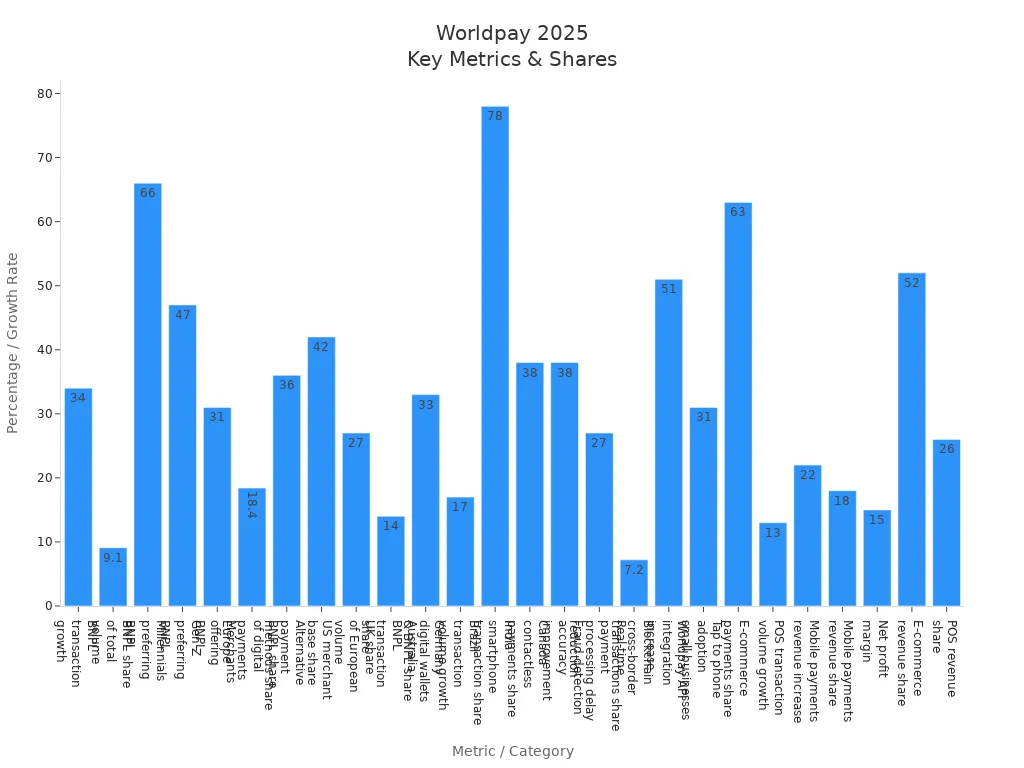

Worldpay

Worldpay is a payment service provider with a strong presence in e-commerce and point-of-sale payments. You get access to many payment processing options, including BNPL, digital wallets, and contactless payments.

| Metric / Category | 2025 Data / Statistic |

|---|---|

| BNPL transaction growth | 34% increase in 2025 |

| BNPL share of total transaction volume | 9.1% |

| Merchants offering BNPL | 31% |

| E-commerce payments share of total transactions | 63% |

| Total e-commerce transaction value | $278 billion |

| Annual revenue | $5.8 billion (8% increase from previous year) |

| Net profit margin | 15% |

| Number of merchants served | Over 1.3 million |

| Daily transactions processed | Over 110 million |

Worldpay’s payment gateway is known for high transaction volume and strong fraud detection.

Google Pay

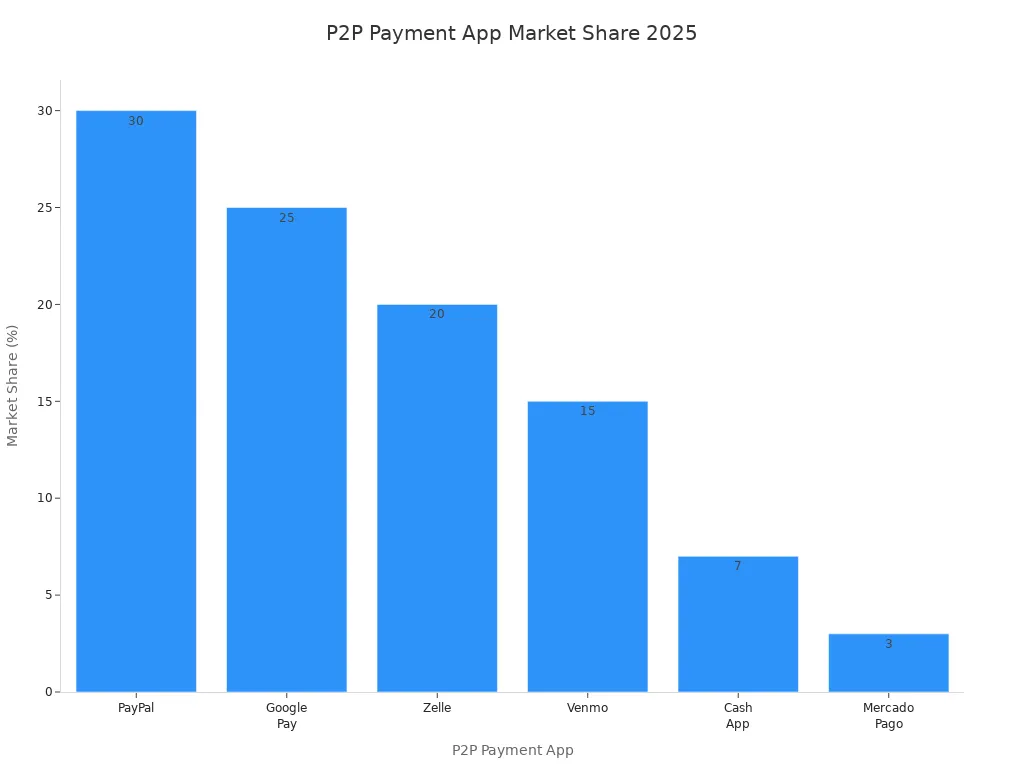

Google Pay is a popular payment service provider for peer-to-peer and online payments. In 2025, Google Pay holds a 25% market share among P2P payment apps, making it the second most-used after PayPal.

| P2P Payment App | Market Share 2025 |

|---|---|

| PayPal | 30% |

| Google Pay | 25% |

| Zelle | 20% |

| Venmo | 15% |

| Cash App | 7% |

| Mercado Pago | 3% |

Google Pay’s payment gateway is easy to use for online and mobile payments, but transaction fees depend on your bank or payment service provider.

Apple Pay

Apple Pay is a leading payment service provider for mobile and contactless payments. In 2025, Apple Pay has about 659 million active users and processes up to $8.7 trillion in payments worldwide.

| Metric | 2025 Statistic/Detail |

|---|---|

| User Base | Approximately 659 million active users worldwide |

| Annual Transaction Volume | $7.6 trillion to $8.7 trillion globally |

| US Market Share | 45% share of US mobile payment market |

| Global Mobile Wallet Share | 35% of global mobile wallet transactions |

| Transaction Fee | 0.15% fee on each credit card transaction via Apple Pay |

| Merchant Acceptance | Over 10 million merchants worldwide |

| Daily Usage | 30% of active users use Apple Pay daily |

| E-commerce Market Share | 14.3% of global e-commerce sales |

- Apple Pay processed $8.7 trillion in global transactions in 2025.

- In the US, Apple Pay transactions reached $2.9 trillion.

- Apple Pay charges a 0.15% fee on each credit card transaction.

- Apple Pay accounted for 32% of all US contactless POS payments in 2025.

Apple Pay’s payment gateway is fast, secure, and widely accepted for online and in-person payments.

Payline

Payline is a payment service provider that offers flexible pricing for businesses of all sizes. You get lower rates if you process more payments each month.

| Monthly Processing Volume | Transaction Fee (plus Interchange) |

|---|---|

| $0 – $50,000 | 0.2%–1.0% + $0.10 |

Payline’s payment gateway supports credit cards and ACH payments. You pay a monthly fee, but you get transparent pricing and strong payment processing options.

Verifone

Verifone is a payment service provider that focuses on usage-based pricing. You pay based on how much you use the service, with lower rates for higher volumes.

- Merchants can apply surcharges to customers to recover processing costs, but this depends on local financial regulations.

- Only Merchant Admin and Merchant Supervisor roles can set up surcharges in Verifone Central.

- Surcharges are shown to customers at checkout and on receipts, so pricing is transparent.

- Verifone supports API, Checkout, Virtual Terminal, and Pay-by-Link integrations.

Verifone’s payment gateway is a good fit if you want flexible pricing and strong integration options.

Braintree

Braintree is a payment service provider owned by PayPal. You get a simple pricing model and strong support for online payments.

| Fee Type | Description | Fee Structure |

|---|---|---|

| Standard Transaction Fee | Fee per transaction | 2.9% + $0.30 |

| Chargeback Fee | Fee charged per chargeback | $15 |

| International Transaction | Additional fee for international transactions | 1% |

| Chargeback Protection | Optional service fee for chargeback protection | Starting at 0.4% per transaction |

| Fraud Maintenance Tools | Optional fraud protection inquiry fee | $0.05 per inquiry |

Braintree’s payment gateway is easy to set up for online businesses. You get strong security, but you pay extra for international transactions and chargeback protection.

Online Payment Service Cons

Image Source: unsplash

PayPal Cons

You might love PayPal for its reach, but you can run into some real headaches. Many users complain about high fees, especially when you deal with international payments or currency conversions. You may also face sudden account holds or frozen funds, which can disrupt your cash flow. Some business owners say PayPal’s customer support feels slow and unhelpful when you need urgent answers. If you process a lot of refunds or disputes, you might notice extra charges and long resolution times. Reviews often mention that PayPal’s payment gateway can be tricky to integrate with some e-commerce platforms, and you may find the interface less intuitive than newer solutions.

Stripe Cons

Stripe stands out for developers, but you should watch for these common issues:

- Fees can add up, especially the 1% cross-border and 1% currency conversion charges. If you sell internationally, these costs can eat into your profits.

- Many merchants feel frustrated with chargeback handling. You might upload evidence, but Stripe sometimes closes disputes without clear explanations.

- Stripe Radar, the fraud prevention tool, gets mixed reviews. Some users find it too strict, causing false positives, while others think it lets too much slip through. Adjusting the settings can be confusing.

- Customer support is inconsistent. If you run a small business, you may get slow or generic replies. Limited phone support is a frequent complaint.

- Stripe’s account approval process is strict. Sudden holds or frozen funds can happen, and communication about these issues often lacks detail.

- Non-technical users find Stripe’s payment gateway complex. If you want a simple online payment service, Stripe may feel overwhelming.

You should weigh these drawbacks before choosing Stripe as your payment service provider.

Square Cons

Square makes payments easy, but you need to know the downsides:

- High transaction fees can shrink your profit margins, especially if you process many small payments.

- Customer support often gets poor reviews. You might wait a long time for help, and some users say support is not always available when you need it.

- Some business owners report unexpected account holds or even sudden deactivations. This can disrupt your operations and cause stress.

If you rely on fast, reliable payment processing, these issues could impact your business.

Shopify Payments Cons

Shopify Payments works well for Shopify stores, but you should consider these real-world cons:

- You can only use Shopify Payments if you run your store on Shopify. If you switch platforms, you lose saved customer payment data and checkout optimizations.

- Accounts may get flagged for risk if you have sudden sales spikes, high refund rates, or sell digital or high-risk products. This can lead to payout delays.

- Refunds are deducted from future payouts or directly from your bank account, which can cause cash flow problems.

- You get limited options to customize billing descriptors.

- Point of sale updates sometimes happen during business hours, causing downtime and lost sales.

- Reviews mention expensive premium plans and high fees for some features.

A Shopify user shared that a point of sale update once ran during trading hours, blocking card payments and resulting in lost sales. You should plan for these risks if you choose this payment gateway.

Clover Cons

Clover offers flexible payment solutions, but you may face several challenges:

- Customer service often gets negative reviews. You might wait on hold for a long time, and it can be hard to escalate problems or get after-hours support.

- Many users report unexpected and unclear fees, such as monthly terminal charges, higher processing rates than promised, and costly early termination fees. Equipment leases can also be expensive.

- Technical problems are common. You could experience buggy software, hardware failures during busy times, or card readers freezing, which disrupts your business.

- Sales practices can be aggressive. Clover relies on independent resellers, so contract terms and transparency vary. Some merchants feel misled or stuck in bad agreements.

- Some users call Clover a “scam” or “ripoff” due to high costs and unmet expectations.

If you want a payment gateway with clear pricing and reliable support, Clover may not be the best fit.

Authorize.net Cons

Authorize.net has a long history, but you should know about these drawbacks:

- You cannot request refunds directly. Disputes on held charges can hurt your account and even your credit.

- Transaction limits frustrate many users, especially if you process large payments.

- Customer support often feels unfriendly or unhelpful. Some users say they would avoid working with clients who use Authorize.net.

- The platform can be hard to navigate, especially on mobile devices.

- Some users report that the system fails to notify them about fraudulent transactions.

- Reviews mention that refund policies and dispute handling are problematic, with some users saying they would not use this payment service provider again.

Helcim Cons

Helcim is known for transparency, but it is not perfect. Here’s a quick look at the main cons:

| Con Aspect | Explanation |

|---|---|

| No acceptance of high-risk merchants | Helcim restricts businesses in high-risk sectors such as adult entertainment, gambling, and certain financial services. |

| Fees add up for low-volume businesses | If you process low transaction volumes, Helcim’s fees can become a disadvantage. |

| Limited POS hardware features | The basic Helcim Card Reader lacks advanced features needed for operational efficiency. |

| Expensive advanced POS hardware | The Helcim Smart Terminal costs $349, which may be high for some businesses. |

| Not suitable for enterprise-level | Larger businesses with complex needs may need more advanced solutions. |

| Settlement period 1-3 business days | Funds are deposited within 1-3 business days, with no same-day deposits available. |

You may also find limited third-party software integrations. If you process less than $5,000 per month, Helcim may not be cost-effective. Customer support lacks live chat, and email replies can take several hours. If you need fast deposits or advanced hardware, you might want to look at other payment gateways.

Adyen Cons

Adyen gives you global reach, but you should be aware of these issues:

- Many users find Adyen’s platform complicated and frustrating to use.

- The user interface is complex and hard to navigate, especially for new users.

- Reporting tools often get poor reviews from business owners.

- High fees and hidden charges are common complaints.

- Contacting support can be difficult, and response times are slow.

- Developers mention small annoyances with the platform’s design and usability.

If you want a simple payment gateway with strong support, Adyen may not meet your needs.

Amazon Pay Cons

Amazon Pay makes checkout easy, but you may face some drawbacks. You need an Amazon account to use it, which can limit your customer base. Some users report that integration with non-Amazon platforms is tricky. Reviews mention that customer support can be slow to respond. If you sell internationally, you may find the payment processing fees higher than other providers. You also have limited control over the checkout experience, which can affect your brand.

Worldpay Cons

Worldpay supports many payment methods, but you should watch for these cons. Pricing can be opaque, making it hard to predict your costs. Some users report hidden fees and complicated contracts. Customer support sometimes gets poor reviews for slow or unhelpful responses. Integration with some e-commerce platforms can be challenging. If you want clear pricing and fast support, you may want to compare other payment gateways.

Google Pay Cons

Google Pay is popular for online and mobile payments, but it has some limits. Not all banks support Google Pay, so some customers cannot use it. Transaction fees vary depending on your payment service provider, which can make costs unpredictable. Reviews mention that customer support is not always easy to reach. If you want to offer a wide range of payment processing options, you may need to pair Google Pay with other solutions.

Apple Pay Cons

Apple Pay is fast and secure, but you need an Apple device to use it. This requirement can exclude some customers. Transaction fees depend on your payment gateway, and some merchants find them higher than expected. Reviews mention that integration with some online platforms can be tricky. If you want to reach all customers, you may need to offer other payment methods alongside Apple Pay.

Payline Cons

Payline offers flexible pricing, but you should know the drawbacks. You pay a monthly fee, which may not suit small businesses. Some users report limited features compared to larger providers. If you process low payment volumes, fees can add up. Reviews mention that customer support is not always responsive. You may also find fewer integration options with e-commerce platforms.

Verifone Cons

Verifone focuses on usage-based pricing, but you may face some challenges. The payment gateway is hardware-focused, so you may need to buy equipment. Some users report that advanced features require extra costs. Reviews mention that customer support can be slow. If you want a simple online payment service, Verifone may feel too complex.

Braintree Cons

Braintree is easy to set up, but you should consider these cons. You pay extra for international transactions and chargeback protection. Some users find the developer setup process challenging. Reviews mention that customer support can be slow to respond. If you want fast payouts and simple integration, you may want to compare other payment gateways.

Choosing a Payment Service Provider

Decision Checklist

Picking the right payment provider for your business can feel tough. You want to make sure your payments run smoothly every day. Here is a simple checklist to help you decide:

- What size is your business? Small shops may need easy payment processing. Large stores might want more features.

- Where do you sell? Some payment providers work better in certain countries or regions.

- What payment methods do your customers use? Look for a provider that supports cards, wallets, and bank transfers.

- How much do you pay in fees? Check the rates for each payment and see if there are extra charges.

- Do you need fast payouts? Some payment processing services hold your money longer than others.

- How easy is it to use? Make sure the payment system fits your e-commerce site and is simple for you and your customers.

Matching Provider to Business

You want a payment provider that matches your business needs. If you run a small e-commerce shop, Square or Shopify Payments can help you get started fast. Stripe works well for tech companies that want custom payment processing. PayPal is great if you want a trusted name and lots of payment options. Helcim offers clear rates for growing businesses. If you sell worldwide, Adyen or Worldpay can handle many currencies and payment types. Always check if the provider supports your e-commerce site and offers the payment methods your customers like.

Tips and Pitfalls

You can avoid common mistakes by following these tips:

Tip: Always read the fine print before you sign up. Some payment providers have hidden fees or tricky contracts.

- Compare payment processing rates and look for extra charges.

- Test the payment system on your site before you go live.

- Ask other business owners about their payment experiences.

- Watch out for slow support or payout delays.

- Make sure your payment provider keeps your payments safe and secure.

Choosing the right payment provider helps your business grow and keeps your payments running without trouble.

You want the best payment provider for your business. PayPal and Stripe work well if you need flexible payment options and strong payment security. Square helps small shops with easy payment tools. Shopify Payments fits if you run a Shopify store. Adyen and Worldpay support global payment needs. Always check payment fees, payment support, and payment speed. Ask other business owners about their payment experience. Test each payment system before you decide. Remember, the right payment choice helps your business grow.

Tip: Balance payment stats with real-world payment reviews to find the best payment service for you.

FAQ

What is the best online payment service for a new e-commerce site?

You want a payment service provider that is easy to set up and has low payment processing fees. Many new e-commerce businesses choose Stripe or Square. These solutions offer simple pricing, strong security, and lots of payment processing options for your online store.

How do I compare transaction fees between providers?

You should check each provider’s pricing page. Look for tables that show payment processing fees and extra charges. Some payment gateways have flat rates, while others use tiered pricing. Always read reviews to see if there are hidden fees or extra costs for certain payment methods.

Are online payment gateways safe for my business?

Most online payment service providers use strong security tools. You get fraud protection, encryption, and regular updates. Always choose a provider with good reviews about security. Make sure your payment gateway supports secure checkout and keeps your customers’ payments safe.

What should I do if my payment provider holds my funds?

If your payment service provider holds your funds, contact support right away. Ask for details and check your account for alerts. Read reviews to see if other users had the same issue. You may want to compare other solutions with faster payouts and better support.

Every payment provider in 2025 comes with trade-offs: PayPal’s wide reach but high fees, Stripe’s flexibility but complex setup, and Square’s simplicity but limited global scale. If you want a smarter way to move money for your business, BiyaPay gives you the edge. Beyond multi-currency support, real-time rates, and remittance fees as low as 0.5%, BiyaPay also offers same-day exchange and same-day arrival — meaning your funds reach destinations faster than traditional gateways. For businesses that can’t afford payout delays, this speed and transparency can make all the difference.

Choose a solution that matches the pace of your business. Register with BiyaPay today and experience secure, same-day global payments without the hidden costs.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.