- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Which Travel Card Should You Choose in Singapore This Year

Image Source: unsplash

If you want the best travel card in Singapore this year, the Citi PremierMiles Visa Card stands out. You get flexible rewards, strong air miles, and great value when you travel often. Many Singapore residents now use cards for travel, food, and shopping, with spending on travel expected to grow past $120 billion in 2024. Other top choices like the DBS Altitude Visa Signature Card and UOB PRVI Miles Card fit different needs. The best travel cards depend on how you travel and where you spend. Think about your travel goals and pick a card that matches your habits for the most rewards.

Key Takeaways

- Choose a travel card that fits your travel habits and spending style to get the most rewards and benefits.

- Miles cards suit frequent travelers and high spenders, while cashback cards work better for low spenders wanting instant savings.

- Multi-currency cards like Wise and YouTrip help you save on foreign transaction fees and offer easy currency management.

- Look for cards with good air miles rates, travel insurance, and lounge access to enhance your travel experience.

- Compare fees, rewards, and perks carefully before applying to find the best card for your needs and budget.

Choosing a Card

Image Source: unsplash

Key Factors

When you choose a travel card in Singapore, you want to focus on what matters most for your travel lifestyle. Look at these main factors:

- Air miles earning rate

- Cashback rewards

- Travel insurance coverage

- Multi-currency support

- Overseas spending fees

Travel credit cards and multi-currency cards both help you save on travel, but they work differently. Travel credit cards reward you with miles or cashback for every dollar you spend, while multi-currency cards let you hold and spend in different currencies, often with lower fees. Your travel habits—how often you fly, where you go, and how much you spend—should guide your choice.

Air Miles vs. Cashback

You need to decide if you want to earn miles or get cashback. Here’s a quick comparison for Singapore travelers:

| Feature | Miles Cards | Cashback Cards |

|---|---|---|

| Minimum Spend | None | Usually $370–$590 per month |

| Earning Cap | No cap | Capped at $18–$92 per month |

| Rewards | Free flights, upgrades, lounge access | Instant rebates credited monthly |

| Best For | Frequent travelers, high spenders | Low spenders, instant rewards |

| Redemption | Accumulate and redeem for travel | Automatic monthly statement credit |

Miles cards suit you if you travel often or spend a lot. You can enjoy luxury perks and earn from every dollar. Cashback cards work better if you want quick savings and spend less each month, but caps limit your rewards.

Tip: If you spend over $5,200 a month, miles cards usually give you more value than cashback cards in Singapore.

Travel Insurance

Most leading travel credit cards in Singapore offer basic travel insurance. You get trip cancellation, travel delay, and rental car coverage. However, these cards rarely cover high medical expenses or emergency evacuation. If you want full protection, you should buy a separate travel insurance plan. Always pay for your trip with your card to activate the included insurance.

Overseas Spending

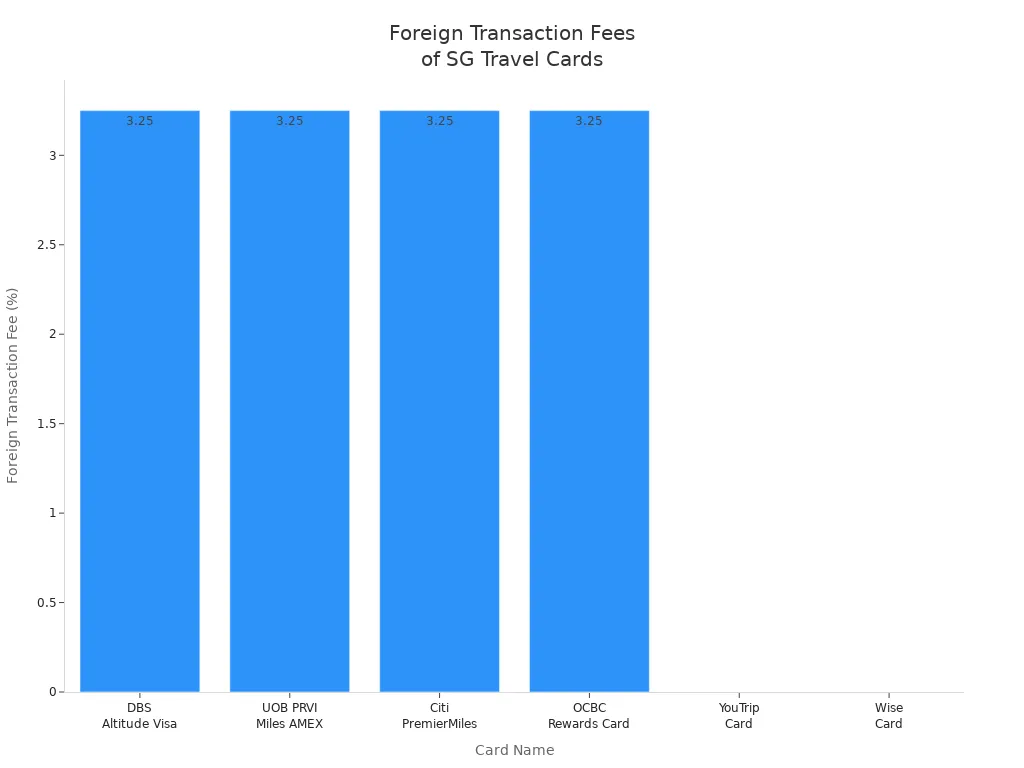

Overseas spending fees can eat into your travel savings. Many travel credit cards in Singapore charge up to 3.25% on foreign transactions. Multi-currency cards like YouTrip and Wise avoid these fees, making them the best for overseas spending. See how the fees compare:

Choose a card that matches your travel style. If you want to maximize rewards and minimize fees, compare both travel credit cards and multi-currency cards before your next trip.

Best Travel Cards Singapore 2024

Image Source: pexels

Singapore offers a wide range of travel credit cards and multi-currency cards. You want to choose the best travel cards that match your travel habits and spending style. The top five travel credit cards and multi-currency cards for 2024 stand out for their strong miles per s$1 rates, flexible rewards, and unique benefits. Here is a closer look at each option so you can find the right fit for your next trip.

Citi PremierMiles Visa Card

You want a card that gives you flexibility and strong rewards. The Citi PremierMiles Visa Card delivers on both. You earn 1.2 miles per s$1 on local spend and 2.2 miles per s$1 on foreign currency spend. When you book hotels or flights online, you can earn up to 10 miles per s$1. Your miles never expire, so you can save them for big trips. You also get 2 complimentary lounge visits each year, making your airport experience more comfortable. The annual fee is about USD 146, but the first year is often waived. You need a minimum income of USD 22,300 to apply.

You should choose this card if you travel often and want to maximize your miles. The card works well for both business and leisure travelers. You can redeem your miles with many airline and hotel partners, giving you more choices. The card also includes travel insurance and a renewal bonus of 10,000 miles each year. The main drawback is the 3.25% foreign transaction fee, but the high miles per s$1 rate can offset this cost if you spend a lot overseas.

If you want the best for currency conversion rates and broad airline partners, this card is a top pick among the best travel cards in Singapore.

DBS Altitude Visa Signature Card

You want a card that makes earning miles easy and flexible. The DBS Altitude Visa Signature Card gives you 1.3 miles per s$1 on local spend and 2.2 miles per s$1 on overseas spend. You can earn up to 4.3 miles per s$1 on Agoda bookings. Your miles never expire, so you can plan for future travel. The annual fee is about USD 146, with a first-year waiver. You need a minimum income of USD 22,300.

This card is great if you want to collect miles for flights and hotels. You get 2 complimentary lounge visits each year and can redeem your points for miles, shopping vouchers, or to offset bills. The card credits points quickly, usually the next day after your transaction posts. You also get a generous welcome bonus if you meet the minimum spend. The main downside is the annual fee after the first year unless you spend enough to get it waived. The card does not include complimentary travel insurance.

UOB PRVI Miles Card

You want to earn the most miles per s$1 when you travel or shop overseas. The UOB PRVI Miles Card gives you 1.4 miles per s$1 on local spend, 2.4 miles per s$1 on overseas spend, and 3 miles per s$1 on regional spend in Indonesia, Malaysia, Thailand, and Vietnam. You can earn up to 8 miles per s$1 on Agoda and Expedia bookings. The annual fee is about USD 195, waived for the first year. You need a minimum income of USD 22,300.

This card is best for big spenders who travel or shop overseas. You get 4 complimentary lounge visits each year and travel insurance coverage up to USD 375,000. You can redeem your UNI$ for miles, cash rebates, or vouchers. The card also offers exclusive benefits if you choose the American Express version, such as loyalty miles and airport transfers. The main drawback is the high annual fee and the 3.25% foreign transaction fee. The card works best if you use it for overseas spending and flight bookings.

If you book flights through Expedia or pay large recurring expenses, you can maximize your miles with this card.

OCBC 90°N Card

You want a card with flexible rewards and low fees. The OCBC 90°N Card lets you earn Travel$ points, which you can convert to miles or cashback. You earn 1.2 miles per s$1 on local spend, 2.1 to 4 miles per s$1 on foreign currency spend, and up to 8 miles per s$1 on accommodation bookings through Agoda, Expedia, or Airbnb. Your miles never expire, so you can save them for future travel. The annual fee is about USD 40, one of the lowest among the best travel credit cards, and is often waived with a minimum spend.

This card is ideal if you want flexibility in how you use your rewards. You can redeem Travel$ for flights, cashback, or shopping. The card gives you access to the Mastercard LoungeKey program, but you pay USD 32 per lounge visit. You also get discounts on hotels, flights, and fuel. The main downside is the lack of complimentary lounge visits and travel insurance. The card is easy to qualify for, with a minimum income of USD 22,300.

HSBC TravelOne Credit Card

You want instant rewards and strong travel perks. The HSBC TravelOne Credit Card gives you 1.2 miles per s$1 on local spend and 2.4 miles per s$1 on foreign currency spend. You get 4 complimentary lounge visits each year and instant points transfer to over 12 airline and hotel partners. The card includes complimentary travel insurance, even for COVID-19, and access to the ENTERTAINER app with over 1,000 deals. The annual fee is about USD 146, with a minimum income requirement of USD 22,300.

This card is best for occasional travelers and HSBC customers who want easy redemption and strong travel benefits. You can redeem your points instantly through the mobile app. The main drawback is the high annual fee unless you qualify for a waiver.

YouTrip Card

You want a multi-currency card with no annual fee and low foreign exchange costs. The YouTrip Card lets you convert and spend in up to 10 supported currencies and pay in over 150 currencies worldwide. You get close to mid-market exchange rates with almost zero spread, making it one of the best travel cards for overseas spending. You can use the card for online shopping and in-store payments during travel. The card does not charge foreign exchange fees, but you pay a USD 3.70 fee for each ATM withdrawal overseas.

This card is perfect if you want to avoid high foreign transaction fees and spend in multiple currencies. You can load up to USD 3,700 and spend up to USD 22,300 per year. The main drawback is the ATM withdrawal fee and the lack of rewards or miles. YouTrip is best for travelers who want to save on currency conversion and do not need travel credit card perks.

Wise Card

You want to hold and spend in over 40 currencies with no annual fee. The Wise Card uses the real mid-market exchange rate and charges low fees starting from 0.33%. You pay no foreign transaction fees and get up to USD 260 in free ATM withdrawals each month. The card supports virtual cards and offers strong security features. You can use the card in over 150 countries, making it one of the best travel cards for frequent travelers.

Wise is best for travelers who visit many countries and want to save on currency conversion. You can manage your money easily through the app and freeze your card if needed. The main drawback is the USD 6.60 card ordering fee and the limit on free ATM withdrawals. Wise works well for expatriates, freelancers, and business users who need flexible, low-cost international payments.

Revolut Card

You want a card with flexible plans and strong multi-currency support. The Revolut Card lets you hold and exchange over 35 currencies at interbank rates. You can choose from different plans, including Standard, Plus, Premium, Metal, and Ultra. Premium and Metal plans include travel insurance and complimentary lounge visits. You get free ATM withdrawals up to USD 260 per month, with a 2% fee after that. The card supports instant peer-to-peer transfers, budgeting tools, and virtual cards for added security.

Revolut is best for travelers who want to manage money across currencies and enjoy extra perks. You can spend in over 140 currencies and access airport lounges with higher-tier plans. The main drawback is the fee structure, which can get complex if you exceed plan limits. Revolut is a strong choice if you want to combine travel, spending, and money management in one app.

Choose the best travel cards in Singapore based on your travel needs, spending habits, and the rewards or benefits you value most. Each card offers unique strengths, from high miles per s$1 rates to flexible redemption and complimentary lounge visits.

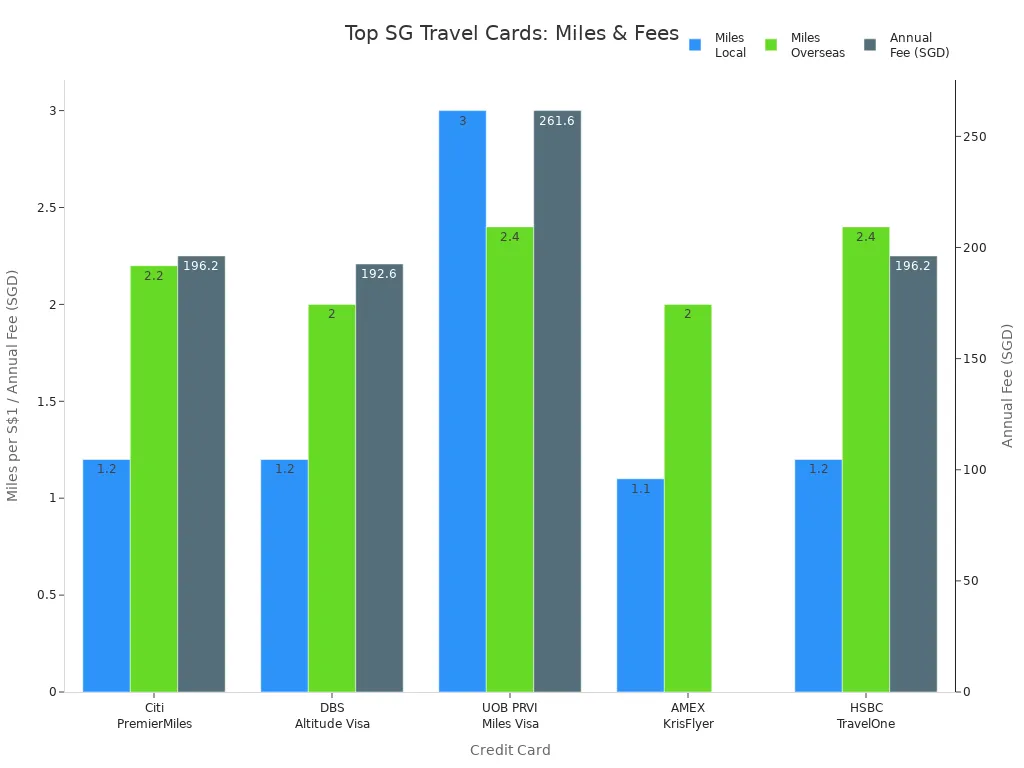

Travel Credit Cards Comparison

You want to make the smartest choice for your travel in Singapore. Comparing the top travel credit cards and multi-currency cards helps you see which card fits your needs. The table below shows the key features of the best cards in Singapore for 2024. You can quickly spot the miles per s$1 rates, annual fees, and travel perks.

| Credit Card | Miles Earning Rates (Local) | Miles Earning Rates (Overseas) | Annual Fee (USD) | Travel Perks |

|---|---|---|---|---|

| Citi PremierMiles Card | 1.2 miles per s$1 | 2.2 miles per s$1 | $146 (waivable) | 2 lounge visits/year, up to 10 miles per s$1 on select bookings |

| DBS Altitude Visa Signature | 1.2 miles per s$1 | 2 miles per s$1 | $143 (waived for high spenders) | Travel insurance, double miles on online bookings, flexible redemption |

| UOB PRVI Miles Visa Card | 3 miles per s$1 (regional) | 2.4 miles per s$1 | $195 | 4 lounge visits/year, accident coverage, up to 6.6 miles per s$1 on select bookings |

| AMEX KrisFlyer Credit Card | 1.1 miles per s$1 | 2 miles per s$1 (SIA/Scoot) | N/A | Travel benefits, no conversion fee for KrisFlyer miles |

| HSBC TravelOne Card | 1.2 miles per s$1 | 2.4 miles per s$1 | $146 (waivable) | 4 lounge visits/year, travel insurance, ENTERTAINER app deals |

You see that Singapore offers cards with competitive earn rates and strong travel benefits. Some cards give you more miles per s$1 when you spend overseas. Others reward you for booking flights or hotels online. You can enjoy perks like airport lounge access, travel insurance, and bonus miles.

When you look at multi-currency cards in Singapore, you notice a few differences:

- You need travel documents like your passport and visa to apply for these cards.

- You can apply online or at a bank branch, even if you are not a bank customer.

- These cards charge fees for issuing, reloading, and spending, but some offer real-time exchange rates.

- Travel credit cards often require a minimum income and a credit check.

- You get more rewards and lifestyle benefits with travel credit cards, while multi-currency cards focus on easy currency management.

You should pick a card that matches your travel style. If you want to earn more miles and enjoy travel perks, choose a travel credit card. If you want to save on currency conversion and spend in many countries, a multi-currency card works better. Singapore gives you many choices, so you can find the right fit for your next trip.

Which Card Fits Your Travel?

Frequent Flyers

If you fly often from Singapore, you want a card that gives you the most value for every trip. Choose a card with strong airline transfer partners and no foreign transaction fees. The Chase Sapphire Preferred card stands out for frequent travelers. You earn flexible points, enjoy a large welcome bonus, and pay no extra fees when you spend overseas. You can transfer your points to airlines like Singapore Airlines and United. The Amex EveryDay Preferred card also works well, letting you earn bonus points for many transactions and transfer them to top airlines. However, it charges a 2.7% foreign transaction fee. Both cards help you collect miles quickly and redeem them for flights, hotels, or upgrades.

| Credit Card | Key Benefits | Airline Partners | Annual Fee | Foreign Transaction Fee |

|---|---|---|---|---|

| Chase Sapphire Preferred | Flexible points, no foreign fee, big welcome bonus | Singapore Airlines, United, more | $95 | None |

| Amex EveryDay Preferred | Bonus points for frequent use, many transfer partners | 17 airlines including Singapore | $95 | 2.7% |

Tip: Pick a card that matches your travel style and helps you earn miles on every purchase in Singapore and abroad.

Occasional Travelers

If you travel a few times a year, you want a card that gives you good rewards without a high annual fee. The Chase Sapphire Preferred card fits this need. You earn 3 points per dollar on travel, hotels, and supermarkets. You also get a 25% bonus when you redeem points through the travel portal. The Chase Sapphire Reserve card offers more perks, like airport lounge access and travel insurance, but it comes with a higher fee. Both cards let you transfer points to airline and hotel partners, making your travel in Singapore and beyond more rewarding.

Business Travelers

If you travel for work, you need a card that gives you premium benefits and helps you save on business expenses. The American Express Business Platinum Card is a top choice for business travelers in Singapore. You earn 5X points on flights, prepaid hotels, and short-term rentals booked through AmexTravel.com. You also get over $2,000 in annual statement credits, airport lounge access, and up to $200 in airline fee credits. This card helps you earn miles fast and enjoy comfort during your travel. The high annual fee pays off if you travel often for business.

Budget Travelers

If you want to save money on travel, pick a card with no annual fee and simple rewards. The Discover Card gives you 1.5 miles per dollar on all purchases and matches your miles in the first year. You pay no annual fee and get a 0% intro APR for 14 months. You can redeem your miles for travel or cash. This card works well for budget-conscious users in Singapore who want to earn rewards without extra costs.

Note: Always compare the rewards, fees, and perks before you choose a travel card in Singapore. The right card helps you earn more miles, save on fees, and enjoy your trips.

You have many strong travel card options in singapore for 2024. Wise stands out for low-cost multi-currency management, letting you spend in over 40 currencies with minimal fees. If you want travel rewards, cards like Citi PremierMiles and UOB PRVI Miles offer high miles earning rates and lounge access.

- Wise works best for frequent travel, backpackers, and digital nomads who want transparent fees.

- Travel credit cards suit you if you want perks, rewards, and flexible redemption.

To choose the right travel card:

- Check your eligibility and prepare your documents.

- Compare travel perks, fees, and currency support.

- Apply for the card that matches your travel style.

Review your travel needs and compare features before you apply. The right travel card helps you save, earn rewards, and enjoy every trip.

FAQ

What is the best travel card for earning air miles in Singapore?

You should choose the Citi PremierMiles Visa Card. You earn high miles per USD spent and enjoy flexible redemption options. This card works well for frequent travelers who want strong rewards and easy airline transfers.

Do multi-currency cards save you money on overseas spending?

Yes, you save money with multi-currency cards like Wise and YouTrip. These cards use real exchange rates and charge low fees. You avoid the 3.25% foreign transaction fee that most travel credit cards charge.

Can you get travel insurance with a travel card?

Most travel credit cards in Singapore include basic travel insurance. You get coverage for trip delays, cancellations, and lost luggage. For full protection, you should buy a separate travel insurance plan.

How do you qualify for a travel credit card in Singapore?

You need to meet the minimum income requirement, usually around USD 22,300 per year. You must provide proof of income and identification. Banks in Hong Kong may have different requirements, so always check before you apply.

A proforma invoice helps you preview costs, terms, and risks before committing to a deal. But once it’s time to make the actual payment, you need the same level of transparency and efficiency in your money transfers. That’s where BiyaPay stands out.

With BiyaPay, you benefit from multi-fiat and cryptocurrency conversions, real-time transparent exchange rates, and fees as low as 0.5%. The platform also supports same-day settlement and operates in most countries and regions worldwide, giving your business a faster, safer, and more predictable way to handle cross-border payments.

Take the next step toward smarter international trade — register with BiyaPay and experience payments as clear as your proforma invoice.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.