- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Xoom vs PayPal A Side by Side Look at Transfer Fees

Image Source: unsplash

When you compare Xoom vs PayPal, you often find that Xoom charges higher fees for smaller international transfers, while PayPal’s costs climb with larger amounts. The table below shows typical fees for these money transfer services:

| Fee Type | Fee Range / Details |

|---|---|

| Bank account transaction fee | $0 to $10 depending on currency and amount |

| PayPal balance transaction fee | $0 to $10 depending on currency and amount |

| Credit or debit card fee | Minimum $1.99, can increase with currency and amount |

| Exchange rate markup | Approximately 4-6% markup on exchange rates |

You should also watch out for exchange rate markups. Both Xoom and PayPal add a margin, so the total cost of sending money internationally can be higher than you expect. Your choice between Xoom vs PayPal may depend on how fast you need the international money transfer, the destination, and your payment method.

Key Takeaways

- Xoom and PayPal both charge fees plus extra costs hidden in exchange rate markups, which reduce the money your recipient gets.

- For small transfers, PayPal usually costs less if you use a bank account, while Xoom can be cheaper if you avoid card payments.

- Xoom often offers better rates and lower fees for large transfers, making it a good choice for sending bigger amounts.

- Using a bank account to fund transfers lowers fees for both services; credit cards cost the most and add extra charges.

- Always check the total cost, including fees and exchange rates, before sending money to avoid surprises and get the best value.

Quick Comparison: Xoom vs PayPal

Image Source: unsplash

Main Differences

When you compare xoom vs paypal, you see that both offer international money transfer services, but their fee structures and costs differ. The table below highlights the main differences between these two money transfer services:

| Feature | Xoom | PayPal |

|---|---|---|

| Fee basis | Variable fees based on amount and payment method | Fixed 5% fee per transfer (min $0.99, max $4.99) + 4% currency conversion fee |

| Example fees (USD to EUR) | $200: $4.99; $500: $4.99-$8.99; $1,000: $0 or $17.99 (cash pickup) | Flat $4.99 for $500 transfer + currency conversion fees |

| Additional fees | Extra charges for debit/credit card payments | Fees for receiving international payments, instant withdrawals, and debit card withdrawals |

| Exchange rate markup | Competitive and more predictable with no hidden fees | Higher exchange rate markups, making transfers more expensive |

You notice that xoom fees change depending on the transfer amount and payment method. Paypal uses a more straightforward fee structure, but the total cost can be higher due to exchange rate markups and extra charges for certain payments.

Key Factors Affecting Fees

Several important factors influence the international transfer fees you pay with xoom vs paypal:

- Both xoom and paypal add a markup to the exchange rate, which lowers the amount your recipient gets.

- The funding source matters. Using a paypal balance or linked bank account usually means lower fees. Credit or debit card payments often cost more.

- Paypal charges a 5% transaction fee for international transfers between paypal accounts, with a minimum of $0.99 and a maximum of $4.99.

- Currency conversion fees for paypal range from about 3.4% to 4.5%, depending on the currency.

- Xoom also applies exchange rate markups and extra fees if you use a credit or debit card for your transfer.

- You may face additional costs from intermediary bank fees or dynamic currency conversion, which can increase the total cost of your cross-border payments.

- Verification levels set your transfer limits, but they do not directly affect your fees.

Tip: Always review the total cost, including all transfer fees and exchange rate markups, before you send international payments. This helps you make the best choice for your remittances and money transfers.

International Transfer Fees Overview

Image Source: pexels

When you send money internationally, understanding how transfer fees work can help you save money. Both Xoom and PayPal use a mix of flat fees, percentage-based charges, and exchange rate markups. These costs can change based on the amount you send, the country you send to, and your chosen payment method. You should always check the total cost before making international money transfers.

Xoom Fee Structure

Xoom uses a flexible fee system for international transfers. The amount you pay depends on several factors, such as the destination country, the transfer amount, and how you fund the transfer. Here is a breakdown of how Xoom fees work:

- Xoom usually charges a 1% fee for transfers up to $999 when you use a bank account.

- If you send $1,000 or more from your bank account, Xoom often charges a flat $10 fee.

- Using a credit or debit card increases the transfer fee. Card payments can cost between $2.99 and $8.99 or more, depending on the country and amount.

- Xoom applies a markup to the exchange rate, which means your recipient may get less money than the mid-market rate suggests.

- Faster transfer options, like Express, cost more. Economy transfers may be free or have lower fees.

- Fees can also change based on the country. For example, sending money to India or Mexico often costs less than sending to other countries.

| Fee Aspect | Details |

|---|---|

| Payment Method | Bank transfers have lower fees; credit/debit cards incur higher fees ($2.99 to $8.99) |

| Transfer Amount | $1,000 from U.S. to India via Express: about $3.99; Economy option may be free |

| Exchange Rate Margins | Xoom adds a margin to exchange rates, making them less favorable than mid-market rates |

| Additional Fees | Possible cash advance fees from card issuers; recipient bank fees may apply |

| Speed of Transfer | Express (faster) costs more; Economy (slower) can be free |

| Destination Variation | Fees vary by country; popular destinations like India or Mexico have lower fees |

You should know that Xoom fees can add up quickly, especially if you choose fast delivery or use a credit card. Always check the total cost, including the exchange rate, before you complete your transfer.

Note: Xoom generally charges higher fees for faster transfers and card payments. The exchange rate margin also affects the final amount your recipient gets.

PayPal Fee Structure

PayPal uses a more defined fee structure for international transfers. The main costs include a percentage-based transaction fee, a fixed fee, and an exchange rate markup. The total fee depends on the payment method and the recipient’s country.

- PayPal charges a 5% transaction fee for sending money to another PayPal account. The minimum fee is $0.99, and the maximum is $4.99.

- If you fund the transfer with a credit or debit card, PayPal adds a 2.9% funding fee plus a fixed fee based on the currency (for USD, this is usually $0.30).

- PayPal applies a currency conversion fee, which is usually 3% to 4% above the mid-market exchange rate.

- The fixed fee and exchange rate markup can change depending on the recipient’s country and the currency involved.

- For commercial payments, PayPal charges a 2.9% base fee, a 1.5% international fee, a fixed fee, and a 4% currency conversion fee if the payment is not in USD.

| Payment Method | Fee Components |

|---|---|

| PayPal balance or linked bank | Cross-border fee: 5% (min $0.99, max $4.99); Exchange rate markup: 3%-4% above wholesale rate |

| Credit or debit card | Cross-border fee: 5% (min $0.99, max $4.99) + 2.9% + fixed fee ($0.30 for USD); Exchange rate markup: 3%-4% above wholesale rate |

You should remember that PayPal’s international transfer fees can increase quickly if you use a credit or debit card. The exchange rate markup also reduces the amount your recipient receives. The total cost can vary by country, so always review the fees and exchange rates before sending money.

Tip: Both Xoom and PayPal combine flat fees, percentage-based charges, and exchange rate markups. The total cost of international transfers depends on your payment method, the amount you send, and the destination country.

Exchange Rate Markups

When you send money using Xoom or PayPal, you pay more than just the transfer fee. Both services add a margin to the exchange rate. This margin means your recipient gets less money than if you used the real mid-market rate. The exchange rate markup can make a big difference in the total cost of your international transfer.

Xoom Exchange Rates

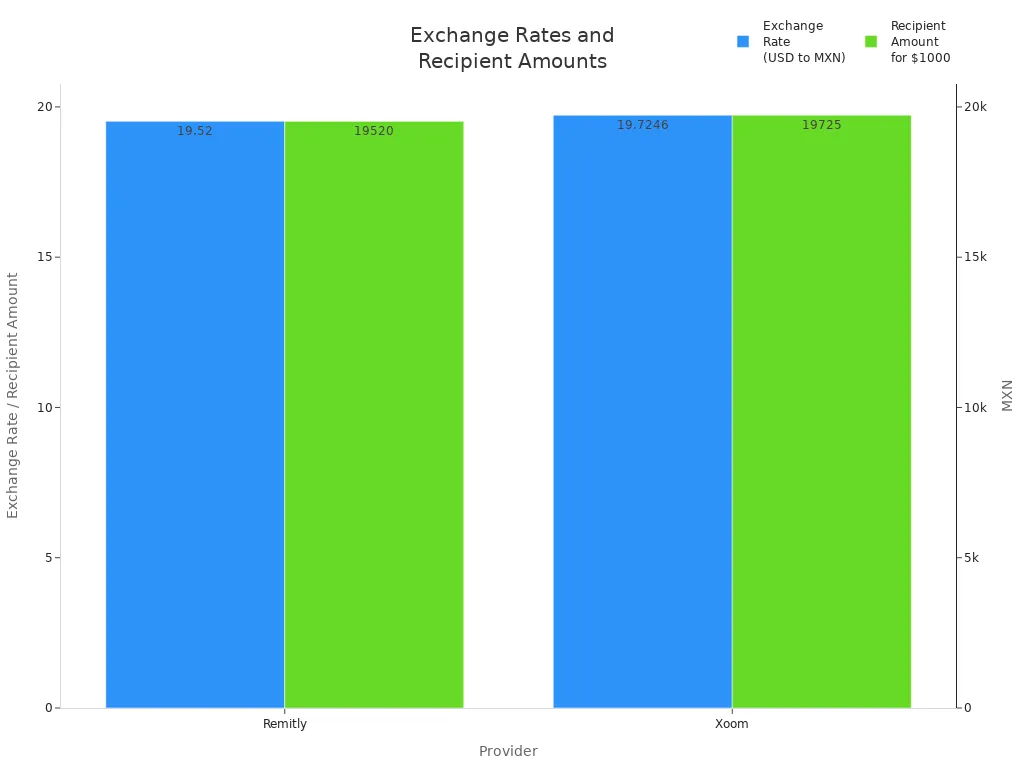

Xoom includes a fee within its exchange rate. This means the rate you see is not the same as the mid-market rate you find on financial news sites. The margin changes based on how much you send and which payment method you use. For example, if you send $1,000 from the United States to Mexico, Xoom may offer an exchange rate of 19.7246 for USD to MXN. This rate is higher than some competitors, so your recipient gets more pesos, but you still pay a markup compared to the real market rate.

| Provider | Transfer Fee | Exchange Rate (USD to MXN) | Recipient Amount for $1,000 USD Transfer |

|---|---|---|---|

| Remitly | $0 | 19.52 | 19,520 MXN |

| Xoom | $0 | 19.7246 | 19,725 MXN |

Xoom makes it easy for you to see these costs before you send money. You can use their online calculator to check the exchange rate and the total amount your recipient will get. This tool helps you understand the real cost of your international transfer.

Note: Xoom states that it earns money from currency conversion, not just from transfer fees. Always check the exchange rate before you confirm your transfer.

PayPal Exchange Rates

PayPal also adds a margin to the exchange rate for international transfers. The markup is usually between 3% and 4% above the mid-market rate. This extra cost is not always clear when you start your transfer. Unlike Xoom, PayPal does not offer a special calculator to show you the exchange rate markup before you send money. You see the final rate only when you reach the payment step.

PayPal’s exchange rate margin depends on the currency and the country you send money to. The total cost can be higher than you expect, especially if you use a credit or debit card. You should always compare the exchange rate PayPal offers with the current mid-market rate to see how much you are paying in hidden fees.

Tip: Always review the exchange rate and the total recipient amount before you complete your international transfer with PayPal.

Additional Costs and Hidden Charges

Service Fees

When you send money with Xoom or PayPal, you may face more than just the basic transfer fees. Both services can add extra costs that you need to understand before you complete your transaction. Here is a table that shows the types of service fees you might see:

| Type of Fee | Description |

|---|---|

| Transaction Fees | These change based on the type of transaction, where you send money, how you pay, the amount, and the payout currency. |

| Reload Third-Party Service Fees | Some third-party companies charge extra for reload transactions. You will see these before you approve the payment. |

| Foreign Currency Exchange Rate | Both Xoom and PayPal make money by offering exchange rates that differ from the market rate. This margin is shown before you finish the transfer. |

| Local Taxes | Some countries add taxes to your transfer. These taxes appear before you confirm the transaction. |

| Financial Institution Fees | Your bank or card issuer may charge cash advance or non-sufficient funds fees. Xoom does not charge these, but you may still have to pay them. |

| Reimbursement for Failed Payments | If a payment fails, you must pay Xoom back for any fees they paid because of the failed transaction. |

You should always check the full list of fees and charges before you send money. Xoom and PayPal do not always show every cost upfront. For example, Xoom keeps many fees hidden, making it hard for you to know the total cost. PayPal also uses a fee structure that can be hard to understand, especially with exchange rate markups.

Note: Xoom and PayPal both have low transparency about all possible fees. You may not see the real cost until you reach the final step of your transfer.

Receiving and Third-Party Fees

When you send money internationally, you might wonder if the recipient will pay extra fees. With Xoom and PayPal, the sender usually decides who pays the cross-border fees. However, there is no clear evidence that banks in Hong Kong or other countries charge extra receiving fees for these transfers. Most of the time, the main costs come from the transfer fees, transaction fee, and exchange rate markups set by Xoom and PayPal.

You should also know that third-party companies may add their own fees, especially for reload transactions. These extra costs appear before you approve the payment. Always review all fees and charges before you send money. This helps you avoid surprises and makes sure your recipient gets the amount you expect.

Xoom and PayPal Costs: Real-World Comparison

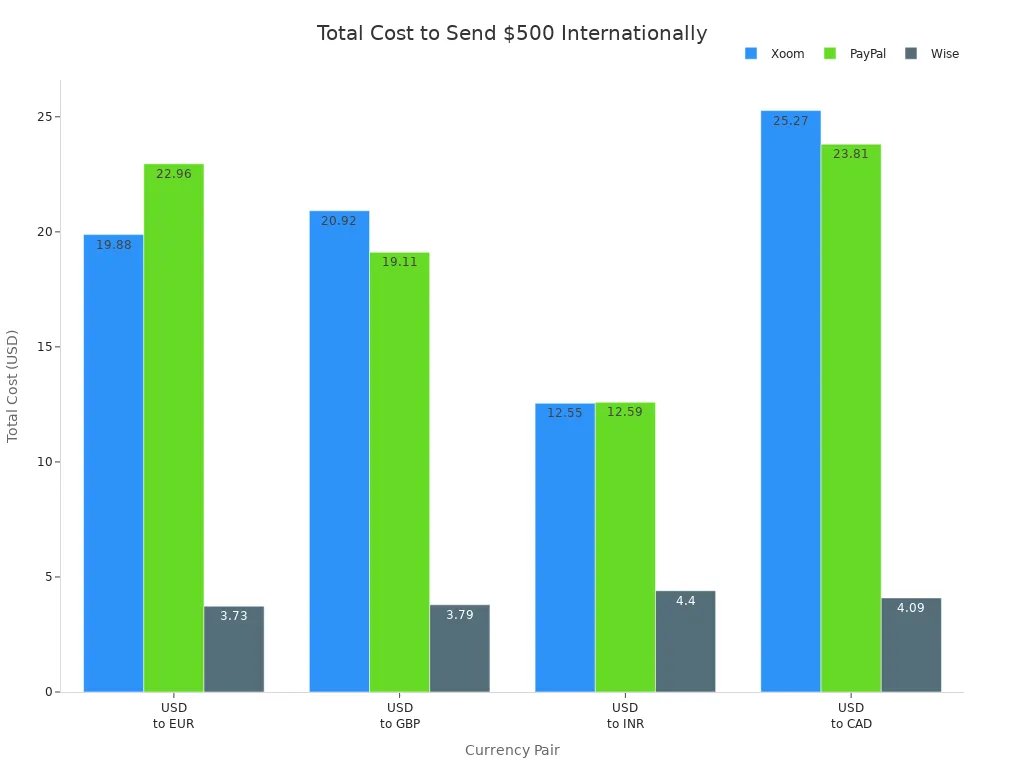

When you send money internationally, you want to know exactly how much it will cost. Xoom and PayPal both charge fees and add a markup to the exchange rate. These extra costs can make a big difference in how much your recipient gets. Let’s look at two common transfer amounts—$500 and $2,000—and see how the total costs compare.

$500 Transfer Example

If you want to send $500 to another country, you might think the fee is the only thing you pay. However, both Xoom and PayPal add a hidden cost through the exchange rate. This means your recipient gets less money than you expect.

For a $500 transfer, Xoom usually charges a flat fee. PayPal charges a percentage plus a fixed fee. Both services also add a markup to the exchange rate. The total cost for each service depends on the country you send money to and the payment method you use.

Here is a table that shows the total cost for sending $500 from the United States to four different countries. The table includes all fees and exchange rate markups.

| Currency Pair | Xoom Total Cost (USD) | PayPal Total Cost (USD) | Wise Total Cost (USD) |

|---|---|---|---|

| USD to EUR | 19.88 | 22.96 | 3.73 |

| USD to GBP | 20.92 | 19.11 | 3.79 |

| USD to INR | 12.55 | 12.59 | 4.40 |

| USD to CAD | 25.27 | 23.81 | 4.09 |

You can see that Xoom and PayPal both charge between $12 and $25 for a $500 transfer, depending on the currency. Wise, another provider, charges much less for the same transfers.

Note: Even if Xoom or PayPal advertises “no fee” transfers, you still pay through a less favorable exchange rate. This hidden cost can be just as high as an upfront fee.

Many users report that Xoom and PayPal look cheap at first, but the final amount your recipient gets is lower because of the exchange rate markup. For example, if you send $500 to India, both services charge about $12 to $13 in total costs, but the recipient gets less than if you used a service with a better exchange rate.

$2,000 Transfer Example

When you send a larger amount, like $2,000, the way Xoom and PayPal calculate fees changes. Xoom often uses a flat fee for transfers over $1,000, while PayPal keeps its percentage-based fee but caps the maximum charge. Both services still add a markup to the exchange rate.

Let’s look at a real-world example. Suppose you want to send $2,000 from the United States to Europe, the United Kingdom, India, or Canada. Here is how the total costs compare:

| Currency Pair | Xoom Total Cost (USD) | PayPal Total Cost (USD) | Wise Total Cost (USD) |

|---|---|---|---|

| USD to EUR | 40.00 | 45.00 | 7.00 |

| USD to GBP | 42.00 | 38.00 | 7.20 |

| USD to INR | 25.00 | 25.20 | 8.80 |

| USD to CAD | 50.00 | 47.00 | 8.10 |

Note: These numbers are estimates based on typical fee structures and exchange rate markups as of late 2023. Actual costs may vary depending on the day and payment method.

You notice that as the transfer amount increases, the total cost also rises. Xoom and PayPal both charge higher fees for larger transfers, and the exchange rate markup becomes more important. For a $2,000 transfer, you might pay $25 to $50 in total costs with Xoom or PayPal, while Wise charges much less.

Tip: Always check the total cost before you send money. Look at both the fee and the exchange rate. Some services hide costs in the exchange rate, so your recipient gets less money.

Many users share that Xoom and PayPal costs can be confusing. You might see a “no fee” offer, but the exchange rate is worse than the real market rate. This means you pay more than you think. For example, a user sending $1,000 to India found that Xoom offered no upfront fee, but the recipient got less money because of the poor exchange rate. PayPal works the same way. Even if you pay no fee, the exchange rate markup reduces the amount your recipient receives.

Key Takeaways

- Both Xoom and PayPal charge a mix of upfront fees and hidden costs in the exchange rate.

- For a $500 transfer, you usually pay about $12 to $25 in total costs.

- For a $2,000 transfer, the total cost can reach $50 or more.

- Always compare the total cost, not just the fee, before you choose a service.

If you want to save money, use the fee calculators on Xoom and PayPal before you send your transfer. This helps you see the real cost and avoid surprises.

Recommendations

Best for Small Transfers

When you want to send a small amount of money overseas, you should look for low-cost ways to transfer money. PayPal often gives you the best deal for small remittances, especially if you use your bank account as the funding source. PayPal charges a 5% fee for international payments, but this fee is capped at $4.99. You also pay a 3% to 4% currency conversion spread. If you send money from your bank account, you avoid extra charges that come with card payments.

Xoom can also be a good choice for small transfers if you avoid using debit or credit cards. Xoom sometimes offers no fees when you send from your bank account or PayPal balance. However, Xoom’s exchange rates are usually less favorable than some other services, so your recipient may get less money.

Here is a table to help you compare the costs for small remittance payments:

| Transfer Method | PayPal Fees | Xoom Fees |

|---|---|---|

| International transfer (e.g., $100 from U.S. to Mexico) | 5% fee capped at $4.99 (minimum $0.99), plus 3%-4% currency conversion spread | Fees range from free to $4.49 depending on payment method; no fees when sending from bank account or PayPal balance, fees apply for debit/credit cards |

Tip: For small remittances, PayPal is usually more cost-effective if you use your bank account. Xoom is also a good option if you avoid card payments.

Best for Large Transfers

If you need to send a large amount of money, Xoom often gives you better rates and lower fees than PayPal. Xoom charges about 3.93% of the amount sent for large transfers, which is much lower than the average fee of 7.45% charged by many traditional services. Xoom also lets you send up to $10,000 USD to some countries, and you get improved exchange rates for high-value remittances.

You can use Xoom for large remittance payments to countries like India, the United Kingdom, or Mexico. Xoom offers quick transfer speeds, especially if you choose cash pickup or bank deposit. You may need to provide extra documents for large transfers, but you get better value for your money.

Note: Xoom is the better choice for large remittances because you pay lower fees and get better exchange rates than with PayPal.

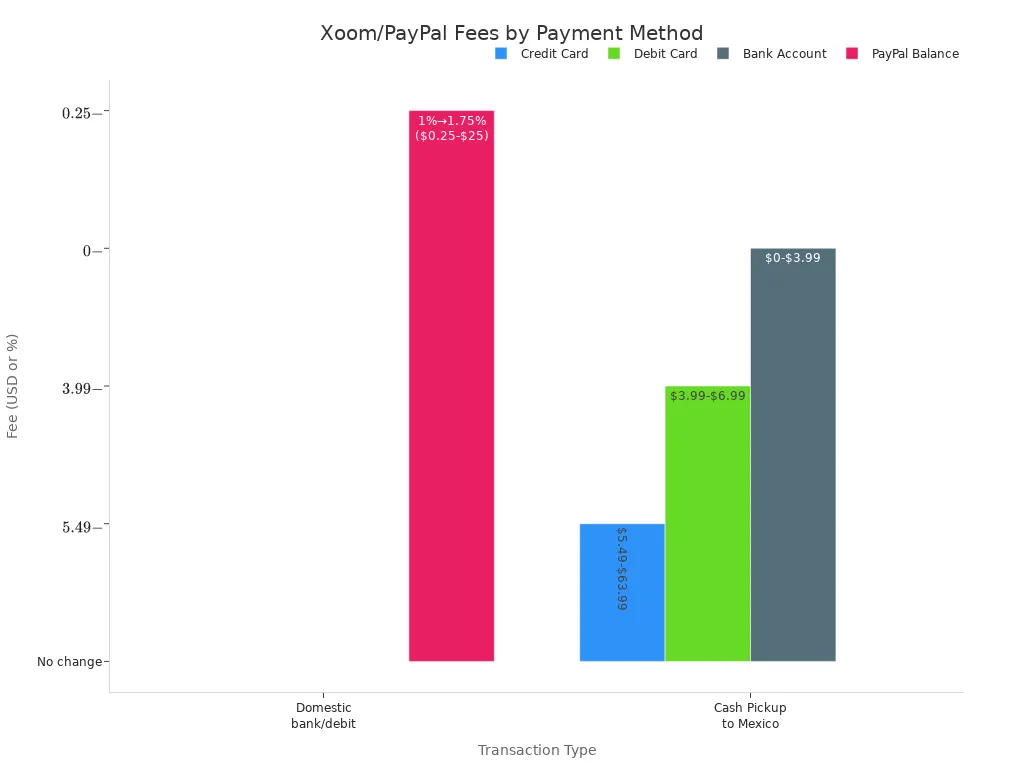

Payment Method Considerations

The payment method you choose can change the total cost of your transfer. Bank account payments usually have the lowest fees for both Xoom and PayPal. Debit card payments cost a bit more, but they are still cheaper than credit cards. Credit card payments have the highest fees and may include extra charges from your card issuer.

Xoom’s fees depend on the payment method, the amount you send, and the country you send to. If you use a credit card, you pay the most in fees and exchange rate markups. Debit card payments are faster than bank transfers, and Xoom even lets you send money directly to eligible Visa debit cards in 25 countries. This gives your recipient faster access to funds, but you pay a moderate fee.

Here is a table that shows how fees change based on the payment method:

| Payment Method | Transaction Type | Fee Change / Range |

|---|---|---|

| Bank Account | Cash Pickup to Mexico | Fee increased from $0 to $3.99 for $500 and up send amount |

| Debit Card | Cash Pickup to Mexico | Fees increased from $3.99 to $6.99 for $300-$999.99 send amount |

| Credit Card | Cash Pickup to Mexico | Fees range from $5.49 to $63.99 depending on amount sent |

Always check the total cost, including both fees and exchange rate markups, before you send money. If you want low-cost ways to transfer money, use your bank account or PayPal balance as the funding source.

You usually find that Xoom is cheaper than PayPal for most users, especially when you compare both transfer fees and exchange rates. The table below shows that for a $500 USD to EUR transfer, Xoom gives your recipient about €5 more than PayPal.

| Provider | Transfer Fee (USD) | Exchange Rate | Amount Recipient Receives (EUR) |

|---|---|---|---|

| Xoom | $4.99 | 0.897225 | €444.14 |

| PayPal | $4.99 | 0.887387 | €439.27 |

Always check both the transfer fee and the exchange rate before you send money. Fees change based on payment method, country, and amount. Exchange rates often include markups. Reviewing both helps you avoid high costs. Use the fee calculators from Xoom and PayPal to get the most accurate, up-to-date costs. Choose the service that matches your transfer amount, destination, and payment method for the best value.

FAQ

How do Xoom and PayPal calculate their transfer fees?

You see fees based on the amount, payment method, and destination. Xoom uses flat or percentage fees. PayPal uses a percentage plus a fixed fee. Both add a markup to the exchange rate. Always check the total cost before sending money.

Can you avoid extra fees by using a bank account?

Yes. You pay lower fees when you use a bank account with Xoom or PayPal. Credit or debit cards cost more. Bank transfers usually take longer, but you save money on fees.

How fast do Xoom and PayPal transfers arrive?

Xoom often delivers funds within minutes to a few hours. PayPal transfers can take a few minutes if you send to another PayPal account. Bank deposits may take one to three business days.

Will the recipient pay any fees to receive money?

Usually, the recipient does not pay extra fees with Xoom or PayPal. However, some banks, especially in Hong Kong, may charge a receiving fee. Always ask the recipient to check with their bank.

Which service gives better exchange rates?

You get different rates from each service. Xoom and PayPal both add a margin to the exchange rate. Here is a quick comparison:

| Service | Typical Markup Above Mid-Market Rate |

|---|---|

| Xoom | 2%–4% |

| PayPal | 3%–4% |

Check the rate before you send money.

Comparing Xoom and PayPal highlights one issue most senders face: fees and hidden exchange rate markups eat away at your transfer. With BiyaPay, you avoid these surprises — enjoying transparent real-time exchange rates, multi-fiat and cryptocurrency conversions, and transfer fees as low as 0.5%.

BiyaPay also supports same-day settlement and operates in most countries and regions worldwide, giving you speed and security that legacy services can’t match. Whether you’re sending $500 or $5,000, you’ll keep more of your money where it belongs — with your recipient.

Start today with BiyaPay and make global transfers simple, low-cost, and reliable.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.