- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Curated List of the Best Online Banks in Europe

Image Source: unsplash

If you want to find the best online banks in Europe, you are not alone. Many people now turn to the best digital banks in Europe because they want simple, fast, and secure ways to manage money. Digital banks in Europe have seen a huge rise in popularity, thanks to new technology and a focus on what customers need. You might notice that the best digital banks in Europe offer lower fees, easy apps, and strong security. As you look at the leading digital banks, think about what matters most to you—maybe it’s multi-currency accounts, green banking, or smart tools for saving. The best online banks and best digital banks in Europe give you more options than ever before, making digital banking a smart choice for people across Europe.

Key Takeaways

- Digital banks in Europe offer easy, fast, and secure ways to manage money with lower fees and user-friendly apps.

- Look for banks with strong security, clear fees, good customer support, and features like multi-currency accounts or budgeting tools.

- Compare monthly fees and extra charges carefully to avoid surprises and find the best value for your needs.

- Choose a bank that matches your lifestyle, whether you want international transfers, sustainability, fast setup, or business tools.

- Test apps with free accounts and read user reviews to find a digital bank that feels right and keeps improving.

Best Online Banks: Quick List

Image Source: pexels

Overview Table

Here’s a quick look at some of the best online banks in Europe. This table helps you compare their main features at a glance. You can see which bank might fit your needs, whether you want a simple account, strong security, or easy international transfers.

| Bank | Founded | Headquarters | Main Features | Best For |

|---|---|---|---|---|

| Revolut | 2015 | UK | Multi-currency account, crypto, low fees | All-in-one banking |

| N26 | 2013 | Germany | Free account, instant notifications, easy app | Everyday spending |

| Bunq | 2012 | Netherlands | Sub-accounts, flexible payments, green banking | Budgeting, sustainability |

| Wise | 2011 | UK | Multi-currency, low-cost transfers | International transfers |

| Monese | 2015 | UK | Fast setup, no credit checks, mobile-first | Expats, travelers |

| Starling Bank | 2014 | UK | Fee-free account, strong app, good support | Personal & business use |

| Tomorrow | 2018 | Germany | Eco-friendly, transparent fees | Green banking |

Tip: The size of a bank can show trust, but smaller online banks sometimes offer more personal service and unique features. Think about what matters most to you before you open an account.

Key Features

When you look for the best online banks, you want to know what sets them apart. Here are the main things you should check:

- Security and privacy, like strong encryption and following GDPR rules

- Easy-to-use apps and websites that make banking simple

- A wide range of products, such as personal or business accounts, cards, and multi-currency options

- Clear and fair fees, so you know what you pay

- Good customer service with real people ready to help

- Money protection through deposit guarantee schemes

- Free or low-cost international transfers

- Interest on your account balance

You will find that the best online banks in Europe focus on these features. Some banks, like Revolut and N26, get high marks from experts for their all-in-one solutions and low fees. Others, like Bunq and Wise, stand out for flexible accounts and easy transfers. No matter what you need, you can find an account that matches your lifestyle.

Selection Criteria

When you look for the best digital banks in Europe, you want to know what makes them stand out. Here are the main things you should check before you open an account.

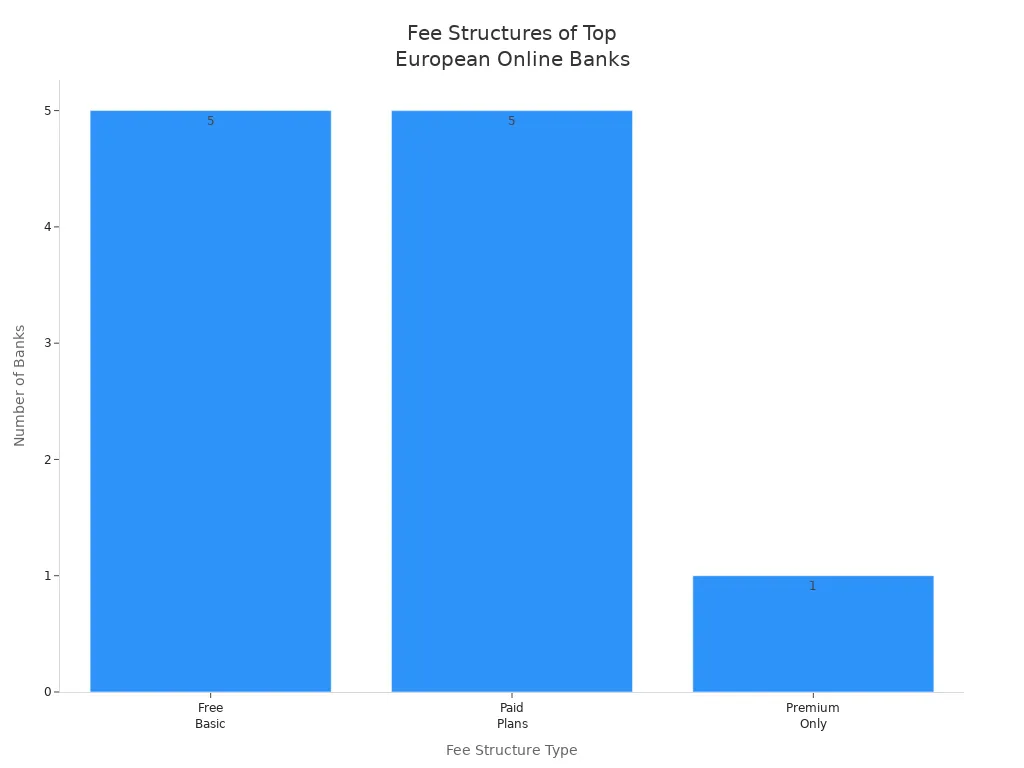

Fees

You probably want a bank that offers low fees and clear pricing. Most digital banks in Europe give you a free basic account, but some, like Bunq, only offer paid plans. Many banks have tiered premium plans with monthly fees, and you might see extra charges for things like international transfers or ATM withdrawals over certain limits. Currency conversion fees can also apply, often based on Mastercard rates with a small markup. The best banks show you all their pricing upfront, so you never get surprised by hidden costs.

| Bank | Monthly Fees (USD) | Transaction Fees and Notes |

|---|---|---|

| Revolut | Paid plans from $5 to $57/month | Some fees for exclusive features; free international transfers on paid plans. |

| N26 | Free basic; paid plans $6–$19/month | One-time $11 card fee; premium plans offer more free ATM withdrawals. |

| Monzo | Free basic; paid tiers available | No international payment fees; currency conversion at Mastercard rate plus possible markup; some ATM withdrawal fees depending on account. |

| Monese | Free basic; fees for some transactions | 1% fee on instant card top-ups; $1 per outgoing transfer; 2%+ currency exchange fee on international transfers. |

| Bunq | No free tier; premium plans only | Mastercard exchange rate plus 0.5% currency fluctuation fee; fees to upgrade account. |

| Starling | Free basic | Free transfers; own exchange rate with possible markup for international transfers; Mastercard rate for foreign purchases. |

Tip: Always check the bank’s website for the latest pricing and fee details, as these can change.

Features

You want your digital banking experience to be simple and convenient. The best digital banks focus on easy-to-use apps, instant notifications, and tools that help you manage your money. Many offer high-yield savings options, multi-currency accounts, and even AI-driven financial guidance. You might also find budgeting tools, sub-accounts, and features that support sustainability. People value trust, safety, and a seamless digital experience, so look for banks that make your life easier.

- Simplicity and convenience

- Value and safety

- Personalized financial guidance

- Accessibility and inclusivity

- Proactive notifications

Security

Security is a top concern for anyone using digital banks. In Europe, digital banks must follow strict rules like the Digital Operational Resilience Act (DORA), GDPR, and PSD2. These rules require banks to protect your data, use strong customer authentication, and report any major security incidents. Banks use multi-factor authentication, real-time fraud detection, and advanced encryption to keep your money safe. You can feel confident knowing that digital banks invest heavily in security and follow international standards.

- Multi-factor authentication and strong customer authentication

- Real-time transaction monitoring with AI

- Regular security testing and risk management

- Compliance with EU regulations and global standards

Customer Satisfaction

Customer satisfaction sets the best digital banks apart from traditional banks. More people now choose digital banks as their main financial provider because they want better digital services. Surveys show that customers rate digital banks higher for user experience, trust, and innovation. Many people switch from traditional banks because they want more personalized and intuitive digital banking. If you want a bank that listens to you and keeps improving, digital banks lead the way.

Note: Digital banks often update their apps and services based on customer feedback, so you get new features and better support over time.

Reviews of Top Digital Banks in Europe

If you want to know which digital-only bank fits your needs, these in-depth reviews will help you decide. Each review covers what makes these leading digital banks special, so you can compare them side by side.

Revolut

| Attribute | Details |

|---|---|

| Founding Year | 2015 |

| Headquarters | 7 Westferry Circus, Canary Wharf, London, England, United Kingdom |

| Geographic Coverage | Global operations; serves customers in Europe, Australia, Canada, Japan, Singapore, Switzerland, UK, USA; supports multi-currency accounts in over 40 countries. |

Revolut stands out as one of the most popular digital banks in Europe. You get a choice of three main account types: Standard (free), Premium ($9.99/month), and Metal ($16.99/month). The Standard account gives you a prepaid debit card, disposable virtual cards, access to 55,000+ ATMs, and budgeting tools. If you want more, Premium and Metal accounts add higher savings rates, travel insurance, and lounge passes.

You can open a Joint Account to manage money with someone else. Both users get their own debit cards, and you can hold and exchange over 30 currencies. Revolut’s app lets you set up “Pockets” for budgeting and saving, and you get real-time notifications for every transaction.

Pros:

- Multi-currency support

- Strong budgeting tools

- Early direct deposit

- No monthly fee for Standard account

Cons:

- No overdraft

- Fees for ATM withdrawals over limits

- Customer support can be slow

Best for:

If you travel often, share expenses, or want a digital-only bank with lots of features, Revolut is a top pick.

N26

| Attribute | Details |

|---|---|

| Founding Year | 2013 |

| Headquarters | Berlin, Germany |

| Geographic Coverage | Europe, presence in 24 markets; focus on Germany, France, Spain, Italy |

N26 is one of the leading digital banks in Europe, known for its simple app and clear pricing. You can choose from four account types: Standard (free), Smart ($5.30/month), Go ($10.70/month), and Metal ($18.30/month). The Standard account gives you a Mastercard debit card, two free ATM withdrawals per month, and real-time notifications. Premium accounts add more free withdrawals, travel insurance, and cashback.

You can create up to 10 sub-accounts called “Spaces” to help you save for different goals. N26 also offers strong security, with biometric login and instant card locking. You get instant push notifications for every transaction, so you always know what’s happening.

Pros:

- Free basic account

- No foreign transaction fees

- Easy-to-use app

- Sub-accounts for budgeting

Cons:

- Limited cash deposit options

- Some features only in premium plans

Best for:

If you want a digital-only bank for everyday spending and saving, N26 is a great choice.

Monzo

| Attribute | Details |

|---|---|

| Founding Year | 2015 |

| Headquarters | London, United Kingdom |

| Geographic Coverage | Global; card accepted in 132 countries |

Monzo is a digital-only bank that focuses on making banking easy and transparent. You can open a personal account, business account, or even an account for kids and teens. Monzo offers real-time notifications, budgeting tools, and savings pots. You can use your card in over 130 countries without extra fees.

Monzo Plus and Monzo Premium accounts give you extra perks like travel insurance and exclusive card designs. Kids and teens can use Monzo’s special accounts to learn about money, with parental controls and educational tools.

Pros:

- No fees for spending abroad

- Accounts for all ages

- Great budgeting and savings tools

- Fast customer support

Cons:

- Some features only in paid plans

- Limited to UK for full banking services

Best for:

If you want a digital bank that helps you manage money and teaches kids about finance, Monzo is a strong option.

Starling Bank

Starling Bank started in London and now has offices in other UK cities. It launched its app in 2017 and focuses on the UK and Europe. You can open a personal or business account, all managed through a mobile app.

Starling gives you budgeting tools like “Spaces” for saving, instant spending alerts, and the ability to connect accounts from other banks. You can deposit checks through the app and add cash at the Post Office. Starling’s card works overseas with no extra fees. The bank is fully regulated and your money is protected up to $108,000.

Starling also offers a “Connected Card” for trusted helpers, and an AI chatbot called “Spending Intelligence” to help you understand your spending.

Pros:

- Fee-free card use abroad

- High customer satisfaction

- Strong budgeting tools

- Secure and regulated

Cons:

- Only available in the UK

- No physical branches

Best for:

If you want a secure, easy-to-use digital bank for personal or business use in the UK, Starling is a top pick.

Monese

| Attribute | Details |

|---|---|

| Founding Year | 2015 |

| Headquarters | London, United Kingdom |

| Geographic Coverage | UK and Europe; supports multiple currencies |

Monese is designed for people who move between countries or need fast account setup. You can open an instant account, joint account, or business account. Monese supports GBP, EUR, and RON, and you can transfer money internationally with ease.

The app is available in 12 languages and works with Google Pay and Apple Pay. Monese offers instant transfers between Monese users, personal loans, and a Credit Builder service. You also get insurance options and integration with PayPal and Avios.

Pros:

- Fast account opening

- Multi-currency support

- No credit checks

- Multilingual app

Cons:

- Some features only for premium users

- Limited physical services

Best for:

If you are an expat, traveler, or need a flexible digital bank across Europe, Monese is a smart choice.

Bunq

- Founded in 2012 by Ali Niknam

- Headquarters: Amsterdam, Netherlands

- Coverage: European Economic Area, expanding to the UK and US

Bunq is one of the most innovative digital banks in Europe. You can pick from several account types: Easy Bank ($4.30/month), Easy Money ($10.80/month), Easy Green ($20.50/month), Premium, Joint, and Business accounts. Bunq lets you create up to 25 sub-accounts, get local IBANs for 22 currencies, and use three free cards.

Bunq stands out for its eco-friendly approach. With the Easy Green account, Bunq plants a tree for every $108 you spend. The app is mobile-first, with real-time payments, strong budgeting tools, and competitive interest rates.

Pros:

- Eco-friendly features

- Multiple sub-accounts

- Local IBANs for many countries

- 24/7 customer support

Cons:

- No free account

- Some features only in higher plans

Best for:

If you care about sustainability and want flexible banking across Europe, Bunq is a great digital-only bank.

Wise

| Attribute | Details |

|---|---|

| Founding Year | 2011 |

| Headquarters | London, United Kingdom |

| Geographic Coverage | Global; serves 16 million users worldwide |

Wise is famous for low-cost international transfers and multi-currency accounts. You can open a personal or business account. Wise lets you hold, send, and receive money in over 40 currencies. You always get the real exchange rate, with no hidden markups.

The Wise card works in over 50 currencies, and you can earn interest on your balance in GBP, USD, or EUR. Business users get extra tools like batch payments, invoicing, and accounting software integration. Wise is a top choice for freelancers, expats, and anyone who needs to move money across borders.

Pros:

- Real exchange rates

- Low, transparent fees

- Fast transfers

- Supports over 40 currencies

Cons:

- No cash deposits

- Limited lending options

Best for:

If you need a digital-only bank for international payments or business in Europe, Wise is hard to beat.

Tomorrow

| Attribute | Details |

|---|---|

| Founding Year | 2020 |

| Headquarters | Berlin, Germany |

| Geographic Coverage | Europe and the United States (expanding) |

Tomorrow is a digital bank focused on sustainability. You can choose from three account types: Now ($3.20/month), Change ($7.50/month), and Zero ($16.10/month). The Change account gives you a free Visa debit card, up to 15 sub-accounts called “Pockets,” and a user-friendly app in English and German.

Tomorrow invests in renewable energy, social housing, and rainforest protection. For every $1 you spend, Tomorrow protects a square meter of rainforest. The app offers spending analytics and strong security, including two-factor authentication and $108,000 fund protection.

Pros:

- Strong focus on sustainability

- Free metal Visa card

- No exchange fees on card payments (up to 40 currencies)

- Fast account opening

Cons:

- No free account

- Limited banking services (no loans or credit cards)

Best for:

If you want a digital bank that helps the planet and offers easy banking in Europe, Tomorrow is a smart pick.

Note: These reviews give you a clear look at the leading digital banks in Europe. Each digital-only bank has its own strengths, so think about what matters most to you before you choose an account.

Comparing the Best Digital Banks

Features Comparison

When you look at digital banks in Europe, you will notice that each one offers something unique. Some focus on multi-currency accounts, while others give you extra tools for saving or spending. Here’s a table to help you compare the main features side by side:

| Feature | Wise | Revolut | N26 | Monese | Bunq |

|---|---|---|---|---|---|

| Account Types | Multi-currency account (40+ currencies) | 3 plans, supports 25+ currencies | EUR accounts with various plans | Multi-currency, varies by location | Multiple plans, varies by account |

| Local Account Details | USD, EUR, GBP, RON, HUF and others | Not specified | German IBAN for EUR payments | EUR, GBP, RON, multi-currency IBAN | Receive payments from many European countries (upgrade needed) |

| Supported European Currencies | Most European currencies including CHF, DKK, BGN | Around 13 European currencies including USD, EUR, GBP | EUR only | Depends on location | Varies by plan |

| Debit Card Availability | Yes, usable in 150+ countries | Yes, usable in 150+ countries | Yes, multi-currency spending | Yes, multi-currency spending | Yes, multi-currency spending |

| Account Fees | No ongoing fees; currency exchange from 0.43% | From $0 to $16.99/month | From $0 to $16.90/month | From $0 to $14.95/month, varies by location | From $0 to $18.99/month, varies by plan |

| Exchange Rates | Mid-market exchange rate | Mid-market to plan limit, then fees | Network rate for card payments, mid-market for transfers | 2% fee on transfers and unsupported currency spending | Depends on plan; sometimes network rate with no extra fee |

You can see that Wise and Revolut stand out if you want to manage money in different currencies. Bunq and N26 offer strong budgeting tools and flexible plans. Monese is a good pick if you move between countries often.

Tip: If you want a convenient mobile app, most digital banks now offer easy-to-use apps that help you track spending and manage your account on the go.

Fees Comparison

Fees can make a big difference in your banking experience. Some banks keep things simple with no monthly charges, while others have premium plans with extra perks. Here are some key points about fees:

- Juni keeps foreign exchange fees low or capped.

- Revolut gives you competitive rates for transfers.

- Monzo lets you send money instantly in your country for free.

- Wise charges low conversion fees and a one-time card cost.

- Starling Bank offers business accounts with no monthly fees.

Always check the latest fee details before you open an account. Some banks may charge for ATM withdrawals, currency exchanges, or special features.

User Experience

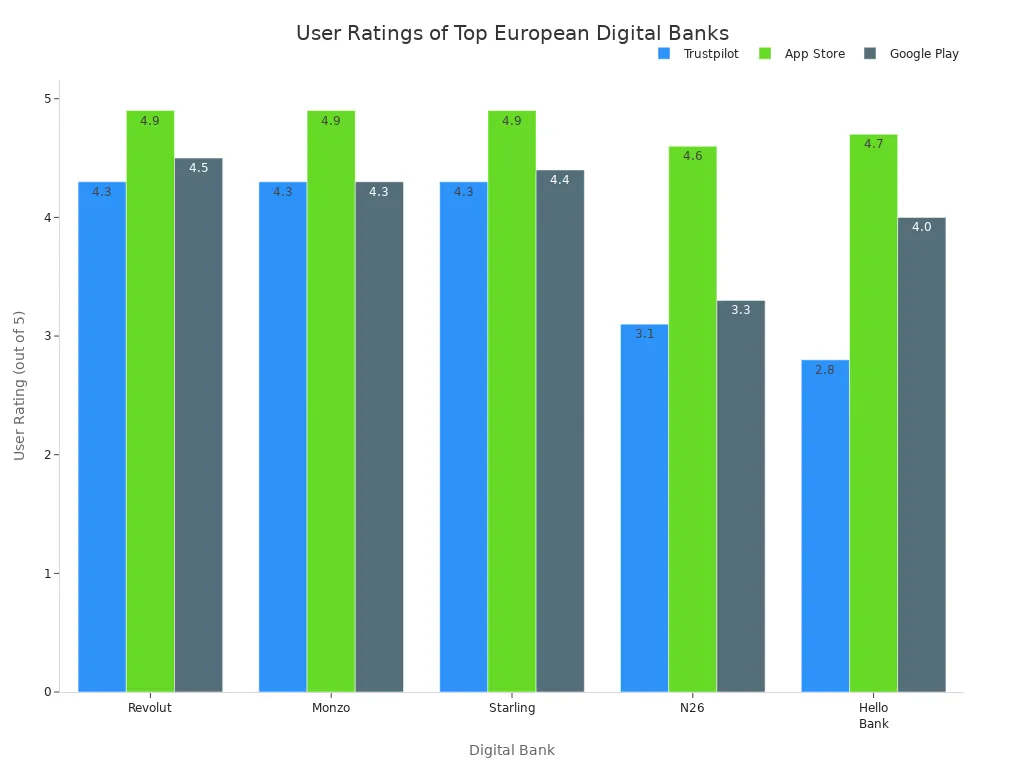

You want your banking experience to be smooth and stress-free. Most digital banks focus on making their apps simple and helpful. Ratings from users can show you which banks do this best.

| Digital Bank | Number of Users | Trustpilot Rating (out of 5) | App Store Rating (out of 5) | Google Play Rating (out of 5) |

|---|---|---|---|---|

| Revolut | 25 million+ | 4.3 | 4.9 | 4.5 |

| Monzo | 7.2 million | 4.3 | 4.9 | 4.3 |

| Starling | 2.7 million | 4.3 | 4.9 | 4.4 |

| N26 | 8 million | 3.1 | 4.6 | 3.3 |

| Hello Bank | 390,000 | 2.8 | 4.7 | 4.0 |

Revolut, Monzo, and Starling get high marks for their user experience. Their apps are easy to use, and people trust them. N26 and Hello Bank have lower ratings on some platforms, so you might want to read reviews before you decide. If you want a great experience, look for a bank with strong ratings and a helpful support team.

Key Considerations in Europe

Image Source: unsplash

Deposit Protection

When you open bank accounts for individuals or businesses in Europe, you want to know your money is safe. Every country in the European Union has a Deposit Guarantee Scheme. This scheme protects your savings up to $108,000 (about €100,000) per person, per bank. If your bank fails, you can get your money back up to this limit. These protections are funded by banks, not taxpayers. The European Banking Authority checks that all banks follow these rules. Some countries, like Germany, even offer extra protection through private funds. You can expect faster payouts too, with most claims paid within seven working days.

Tip: Always check if your online bank is covered by a national Deposit Guarantee Scheme before you open an account.

Customer Support

Good customer support makes a big difference in your banking experience. You want answers fast, especially if you have questions about international transactions or mobile banking. Many digital banks in Europe offer 24/7 chat, phone, or email support. Some banks use AI chatbots for quick help, while others give you access to real people. Look for banks that listen to feedback and update their mobile banking services often. Trust and transparency help build long-term loyalty, so choose a bank that values your needs.

Personal vs. Business Use

You might need different features depending on whether you want bank accounts for individuals or bank accounts for businesses. For personal use, you may want multicurrency accounts, easy money transfers, and personalised banking services. If you run a business, you need tools for invoicing, accounting, and bulk payments. Many digital banks in Europe offer both types of accounts. They also provide personalised banking services that match your goals. Make sure the bank you choose supports your needs, whether you want to save, spend, or grow your business.

International Access

If you travel or work across borders, international access is key. Many online banks in Europe let you open multicurrency accounts and make international transactions with low fees. You can send and receive money transfers in different currencies using just your phone. Some banks offer local account details in several countries, making it easier to get paid or pay others. Open banking and API integrations help you connect with third-party services for even more options. When you pick a bank, check how easy it is to use your card, app, and account for international transactions.

Best Digital Banks in Europe: Summary

Matching Needs to Banks

You have seen how the best digital banks in europe offer different features. Now, you might wonder which one fits your needs. If you travel a lot or send money abroad, Wise and Revolut stand out. They make international transfers easy and affordable. If you want strong budgeting tools, N26 and Bunq give you great options. Bunq also helps if you care about sustainability. Starling Bank and Monzo work well for people who want simple apps and strong customer support. Monese is a good choice if you move between countries in europe or need fast account setup.

Here is a quick table to help you match your needs to the best digital banks in europe:

| Your Priority | Best Digital Bank(s) |

|---|---|

| International Access | Wise, Revolut |

| Budgeting Tools | N26, Bunq |

| Sustainability | Bunq, Tomorrow |

| Fast Setup | Monese |

| Business Accounts | Starling Bank, Wise |

Tip: Think about what matters most to you. The best digital banks in europe have something for everyone.

Next Steps

You have learned about the best digital banks in europe and what makes each one special. Now, you can take the next step. Start by listing your top priorities. Do you want the best bank accounts for travel, saving, or business? Visit the official websites of the banks you like. Read user reviews to see what real people say. Many banks let you open a free or trial account, so you can test the app before you decide.

- Make a list of your must-have features.

- Compare fees and services in USD.

- Try out the app with a free account if possible.

- Contact customer support with any questions.

Choosing from the best digital banks in europe helps you manage your money with confidence. You get more control, better tools, and a banking experience that fits your life.

You now have a clear guide to the best online banks in europe. Use the reviews and tables to compare your options. Think about what matters most to you—maybe low fees, sustainability, or easy international access.

Take action:

- Visit official bank websites

- Read user reviews

- Try a free account if possible

Making a smart choice helps you manage your money better in europe.

FAQ

What do you need to open an online bank account in Europe?

You usually need a valid ID, proof of address, and a smartphone. Some banks may ask for a selfie or a short video. You can often finish the process in less than 10 minutes.

Are online banks in Europe safe?

Yes, most online banks follow strict security rules. They use strong encryption and two-factor authentication. Your money is protected up to $108,000 by deposit guarantee schemes in Europe.

Can you use these banks if you live outside Europe?

Some banks let you open an account from outside Europe. Wise and Revolut work in many countries. Check the bank’s website for a list of supported countries.

How do fees compare between online banks?

Here’s a quick look at monthly fees for basic accounts:

| Bank | Monthly Fee (USD) |

|---|---|

| Revolut | $0 |

| N26 | $0 |

| Bunq | $4.30 |

| Wise | $0 |

| Monese | $0 |

Tip: Always check for extra fees, like ATM withdrawals or currency exchange, before you sign up.

While Europe’s best online banks offer powerful tools for everyday finance, many still charge extra for international transfers and currency conversions. If you need a faster and more transparent way to move money globally, BiyaPay is designed to fill that gap.

With BiyaPay, you get multi-fiat and cryptocurrency conversions, real-time transparent exchange rates, and fees as low as 0.5%. The platform also supports same-day settlement and works in most countries and regions worldwide, giving you the clarity and speed that traditional digital banks can’t always match.

Register with BiyaPay today and complement your digital bank account with a truly global payment solution.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.