- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Complete guide to Remitly fees and transfer costs to India in 2025

Image Source: pexels

If you want to send money to India in 2025, Remitly fees depend on how much you transfer and the speed you choose. For transfers under $1,000, you pay a $3.99 fee plus an exchange rate markup from 0.4% to 1.4%. Larger amounts only include the exchange rate markup. The table below shows these details:

| Fee Component | Details |

|---|---|

| Transaction Fee | $3.99 for under $1,000; no fee for over $1,000 |

| Exchange Rate Markup | 0.4%–1.4% above mid-market rate |

| Transfer Types | Economy (up to 5 days), Express (instant, higher exchange rate markup) |

| Promotional Offer | No fee and lower markup for first-time customers up to $2,999 (limited time) |

You need to check both the exchange rate and Remitly fees before using the service. Some services, like Wise, use the mid-market exchange rate and show all costs up front. When you compare Remitly to Wise, you see that Remitly’s exchange rate markup means you get less INR for the same USD amount. Real-life examples and tables help you see the total cost of your remittances. Always look for the best money transfer service based on how much you want to send, the exchange rate, and how fast you need the money to arrive. This way, you make the most of global remittances.

Key Takeaways

- Remitly charges a $3.99 fee for transfers under $1,000 and adds an exchange rate markup between 0.4% and 1.4%, while transfers over $1,000 avoid the fee but still include the markup.

- You can choose Economy transfers for lower fees and slower delivery (3-5 days) or Express transfers for faster delivery with higher costs due to a bigger exchange rate markup.

- New Remitly users in the US can get special promotions with no fees and better exchange rates on their first transfer up to $10,000 during limited periods.

- Remitly shows all fees upfront with no hidden charges, but using a credit card may add a 3% fee, so always check total costs before sending money.

- Compared to Wise, Remitly offers faster transfers and more payout options but usually costs more due to exchange rate markups; Wise provides better value with transparent fees and mid-market rates.

Remitly Fees Overview

Image Source: pexels

Transaction Fees

When you send money to India with Remitly, you pay a transaction fee based on your transfer amount and payment method. For most transfers under $1,000, Remitly charges a $3.99 transaction fee. If you send $1,000 or more, Remitly waives this fee. You also avoid the transaction fee on your first transfer as a new customer. If you use a credit card in the United States, you pay an extra 3% card fee. This fee adds to your total transfer fees and can make your transfer more expensive.

Here is a table that shows the different types of Remitly fees you may encounter:

| Fee Type | Description & Cost Details |

|---|---|

| Transaction Fee | $3.99 per transfer to India; waived for first transfer or transfers over $1,000. |

| Card Fees | 3% credit card fee in the US, depending on payment method. |

| Service Options | Express and Economy services affect fees and transfer speed. |

You should always check the total transfer fees before sending money. The payment method and transfer speed can change the final cost.

Exchange Rate Markup

Remitly uses an exchange rate markup when you send money to India. This means the exchange rate you see is not the mid-market rate. Remitly adds a percentage to the real exchange rate, which can range from 0.5% to 3.0%. The exact markup depends on the transfer type you choose—Express or Economy. Express transfers use credit or debit cards and usually have a higher exchange rate markup. Economy transfers use bank accounts and often have a lower markup.

For example, if the mid-market exchange rate is ₹83 per $1, Remitly may offer you a rate like ₹82.83 per $1. The difference comes from the exchange rate markup. This markup directly affects how much money your recipient gets in India. If you use a credit card, you may also pay a 3% fee, which changes the effective exchange rate even more.

You should compare the exchange rate Remitly offers with the mid-market rate. This helps you see how much you lose to the markup. The exchange rate markup is a key part of Remitly fees and can make a big difference in the total amount received.

Tip: Always check the exchange rate before you send money. Even a small change in the exchange rate can mean a big difference in the amount your recipient gets.

Promotional Offers

Remitly sometimes gives special deals to new customers. In 2025, if you are a first-time user in the United States, you can send up to $10,000 to India at a special exchange rate during a limited promotion. This offer runs from June 16, 2025, to July 7, 2025. The special exchange rate applies only to your first transfer and only up to $10,000. If you send more than $10,000, the normal exchange rate applies to the extra amount.

- The promotion is only for new Remitly customers in the US.

- You get a special exchange rate for your first transfer up to $10,000.

- The offer is valid only during the promotion period.

- Existing customers do not get this deal.

- The promotion cannot be combined with other offers.

- Remitly may cancel or change the promotion at any time.

These promotional offers help you save money on your first transfer. However, regular users do not get ongoing discounts. Most of the time, you pay the standard Remitly fees and exchange rate markup after your first transfer. Other services may offer lower transfer fees for all users, so you should compare options if you send money often.

Transfer Costs to India: Breakdown

Image Source: unsplash

Economy vs Express

When you send money to India with Remitly, you choose between Economy and Express transfers. Each option has different costs and delivery times. Economy transfers usually take three to five business days. You pay a lower transaction fee and get a better exchange rate. Express transfers focus on speed. You can send an instant transfer, and the money often arrives within minutes. However, you pay more because the exchange rate is less favorable.

Here is a table to help you compare the two options:

| Feature | Economy Transfer | Express Transfer |

|---|---|---|

| Delivery Time | 3 to 5 business days | Immediate or within minutes |

| Transaction Fee | About $0.99 for under $1,000; no fee over $1,000 | About $0.99 for under $1,000; no fee over $1,000 |

| Exchange Rate | Lower markup (0.4% to 1.4%) | Higher markup (premium for speed) |

| Additional Costs | Credit card surcharges and exchange rate markups may apply | Same as Economy, but higher due to speed |

| Transfer Limit | Up to $30,000 per transfer | Up to $30,000 per transfer |

You get a better deal with Economy if you do not need the money to arrive right away. Express works best when you need speed, but you pay more through the exchange rate.

Fee Structure by Amount

Remitly’s transfer costs to India change based on how much you send. The transaction fee and exchange rate both affect the total cost. Here is a breakdown for different transfer amounts:

- Transfers under $200:

You pay a transaction fee of about $0.99. The exchange rate markup ranges from 0.4% to 1.4% for Economy. Express transfers use a higher markup, so your recipient gets less money in India. - Transfers between $200 and $999:

The transaction fee stays at about $0.99. The exchange rate markup still applies. For Express, you pay more because the exchange rate is less favorable. - Transfers of $1,000 or more:

Remitly waives the transaction fee. You only pay the exchange rate markup. Both Economy and Express options apply the markup, but Express uses a higher one.

Let’s look at some real-world examples:

- You send $150 using Economy:

- Transaction fee: $0.99

- Exchange rate: If the mid-market rate is ₹83 per $1, Remitly may offer ₹82.70 per $1.

- Your recipient gets: $150 x ₹82.70 = ₹12,405

- You send $500 using Express:

- Transaction fee: $0.99

- Exchange rate: Remitly may offer ₹82.20 per $1 (higher markup for speed).

- Your recipient gets: $500 x ₹82.20 = ₹41,100

- You send $2,000 using Economy:

- Transaction fee: $0

- Exchange rate: Remitly may offer ₹82.90 per $1.

- Your recipient gets: $2,000 x ₹82.90 = ₹165,800

You see how the exchange rate changes the amount your recipient gets. Even a small difference in the exchange rate can mean a lot of money lost or gained.

Note: Always check the exchange rate before you send money. The rate can change daily.

No Hidden Fees

Remitly does not charge hidden fees when you send money to India. You see the transaction fee and the exchange rate before you confirm your transfer. However, you should watch out for extra costs. If you use a credit card, you may pay a surcharge. The exchange rate markup is not always clear, but it affects the total amount your recipient gets.

You can avoid surprises by reviewing all costs before you send money. Remitly shows you the total transfer costs to India, including the transaction fee and the exchange rate. You do not pay any hidden fees after you complete your transfer.

Tip: Compare the total amount your recipient gets, not just the fees. The exchange rate can make a big difference.

Send Money to India: Comparison with Wise

Fee and Rate Comparison

When you send money to india, you want to know how much each service charges. Remitly and Wise use different fee structures. Wise uses the mid-market exchange rate with no markup. You pay a low, transparent fee, usually around 1.16%. Remitly may add a markup to the exchange rate and charges variable fees based on the amount, payment method, and speed. Wise only supports bank deposits in India, while Remitly offers more payout options like UPI and cash pickup.

| Aspect | Wise | Remitly |

|---|---|---|

| Exchange Rate | Mid-market, no markup | Markup added |

| Transaction Fees | ~1.16%, transparent | Varies by amount, method, and speed |

| Payout Options in India | Bank deposit only | Bank, UPI, cash pickup |

| Transfer Speed | Standard | Express (minutes) or Economy (days) |

| Fee Transparency | All fees shown before confirmation | Fees and rates may include markups |

Note: Wise always shows you the real exchange rate. Remitly’s rate may be lower because of the markup.

Value for Different Amounts

The value you get depends on how much you send money to india. Wise gives you better value for both small and large transfers. You pay less in fees and get the best exchange rate. Remitly can be competitive for medium to large transfers if you use a bank account and send over $500, since the transaction fee may be waived. For small transfers, Remitly’s higher markup and extra fees mean you get less INR.

- Wise works best for small transfers because of low fees and no exchange rate margin.

- For medium transfers, Remitly sometimes waives the fee, but the exchange rate markup still applies.

- Large transfers save you the most with Wise, since you avoid hidden costs and get the mid-market rate.

Pros and Cons

You should look at the strengths and weaknesses before you send money to india.

Pros of Wise:

- Transparent pricing and mid-market exchange rate

- Lower fees for all transfer sizes

- Simple process for bank deposits

Cons of Wise: - Only supports bank deposits in India

- Customer support hours are limited

Pros of Remitly: - Fast express transfers, sometimes within minutes

- Multiple payout options, including UPI and cash pickup

- 24/7 customer support

Cons of Remitly: - Higher costs for small transfers due to markup and fees

- Exchange rate is not as favorable as Wise

- Transfer limits, such as $30,000 to India

When you compare both services, Wise gives you better value if you want to save money. Remitly offers more speed and flexibility if you need instant delivery or cash pickup when you send money to india.

Limits and Supported Banks

Transfer Limits

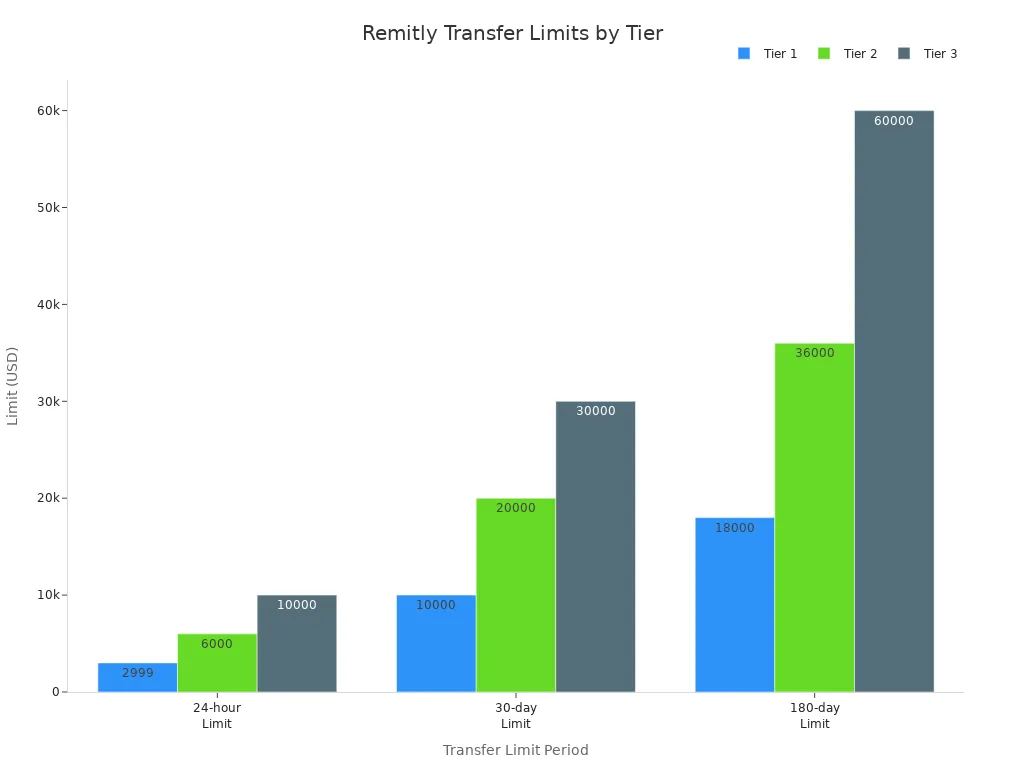

When you send money to India with Remitly, you need to know the transfer limits for your account. Remitly uses a tiered system. Each tier has its own daily, monthly, and half-yearly limits. You can see these limits in the table below:

| Account Tier | 24-hour Limit (USD) | 30-day Limit (USD) | 180-day Limit (USD) |

|---|---|---|---|

| Tier 1 | 2,999 | 10,000 | 18,000 |

| Tier 2 | 6,000 | 20,000 | 36,000 |

| Tier 3 | 10,000 | 30,000 | 60,000 |

Remitly may allow you to send up to $25,000 in a single transaction, depending on your country and delivery method. The minimum transfer amount is not clearly stated, so you should check the Remitly app or website for the latest details.

Tip: If you want to increase your limits, you may need to provide extra identification or proof of funds.

Supported Indian Banks

Remitly lets you send money to almost any bank in India. You can transfer funds to major banks like State Bank of India, ICICI Bank, and HDFC Bank. You can also send money to smaller regional banks. Remitly does not set special requirements or restrictions for specific banks. You only need to complete customer identification steps, such as providing a government-issued photo ID. Sometimes, Remitly may ask for proof of funds, like a bank statement or pay stub. These steps help Remitly follow anti-money laundering rules.

Note: You do not need to worry about bank-specific rules when sending money to India with Remitly.

Comparison with Wise

Remitly and Wise both support transfers to Indian banks, but they have some differences. Remitly covers over 140 banks in India and does not require the recipient to sign up. Wise connects directly with local bank accounts through a partner approved by the Reserve Bank of India. Wise requires the recipient to sign up, but allows much higher transfer limits—up to $1,000,000 USD.

| Feature | Remitly | Wise |

|---|---|---|

| Bank Coverage | Over 140 banks in India | Connects with local banks via approved partner |

| Recipient Sign-up Requirement | No sign-up needed; recipient notified by SMS | Recipient must sign up |

| Transfer Limits | Up to $10,000 USD monthly (higher with extra ID) | Up to $1,000,000 USD |

| Exchange Rate & Fees | Sender pays fees; recipient pays nothing; exchange rate includes markup | Real mid-market exchange rate; transparent fees |

| Regulatory Approval | Not specified | Approved by Reserve Bank of India |

| Technology | Traditional direct deposit network | Uses smart technology for cost efficiency |

You should choose the service that matches your needs for speed, coverage, and transfer size.

When you choose a money transfer service in 2025, you should compare fees, exchange rates, and delivery options. The table below highlights the main differences between Remitly and Wise:

| Factor | Remitly | Wise |

|---|---|---|

| Transfer Fee | Flat fee, flexible options | Transparent, slightly higher |

| Exchange Rate | Markup added | Mid-market, better rate |

| Speed | Minutes (Express) or days | Fast, depends on funding |

You can use online calculators like those from Wise or Vance.tech to check the latest rates before you send money to india. Both services offer strong security and high customer satisfaction. Always review your options to get the best value.

FAQ

How long does it take for Remitly to send money to India?

You can choose Express for instant delivery or Economy for delivery in three to five business days. The speed depends on your payment method and the option you select.

Are there any hidden fees when using Remitly for remittances to India?

You see all fees and exchange rates before you confirm your transfer. Remitly does not charge hidden fees. Always check the total cost to make sure your recipient gets the most money.

Can I cancel a Remitly transfer after sending it?

You can cancel your transfer if Remitly has not delivered the money yet. Log in to your account and check the transfer status. If the transfer is still processing, you can cancel it.

What payout options does Remitly offer for global remittances to India?

Remitly lets you send money to bank accounts, UPI, or cash pickup locations in India. You can choose the option that works best for your recipient.

Does Remitly support transfers to Hong Kong banks?

Remitly does not support sending money directly to Hong Kong banks for transfers to India. You can only send to Indian banks or payout locations within India.

Reading through Remitly’s fee breakdown makes one thing clear: small fees and exchange rate markups can quietly reduce the money your family actually receives in India. If you want to avoid this, BiyaPay provides a better way — with transparent real-time exchange rates, multi-fiat and crypto conversions, and transfer fees as low as 0.5%.

BiyaPay also supports same-day settlement across most countries and regions worldwide, so your funds reach loved ones quickly without hidden costs. Whether it’s a small monthly support or a large one-time transfer, BiyaPay ensures efficiency and trust.

Start today with BiyaPay and experience global remittances that are fast, fair, and reliable.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.