- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How EBITA Differs from Other Metrics and What That Means for Startups

Image Source: pexels

Imagine you run a startup and you see so many financial numbers—net income, cash flow, EBITA. You wonder which one really shows how your business is doing. Here’s the thing: when you understand ebita, you see how much money your core business makes before interest, taxes, and amortization. This helps you focus on true operational profit. If you want to make smart decisions and catch the eye of investors, you need to understand ebita. For any startup, knowing ebita can clear up confusion and guide your next move.

When you understand ebita, you can spot strengths and weaknesses in your financial results faster than with other metrics.

Key Takeaways

- EBITA shows your startup’s true operational profit by excluding interest, taxes, and amortization, helping you focus on core business performance.

- Understanding EBITA helps you compare your startup fairly with others, even if they have different tax rates or financing structures.

- EBITA differs from EBITDA, EBIT, net income, and cash flow by focusing on operational earnings and excluding certain costs, making it especially useful for tech startups.

- Using EBITA alongside other metrics like cash flow and customer data gives a complete picture of your startup’s financial health and growth potential.

- Following best practices for tracking and reporting EBITA helps you make smarter decisions, attract investors, and build confidence in your startup’s future.

Understand EBITA

Image Source: unsplash

What Is EBITA?

When you look at your startup’s profit and loss statements, you might see a lot of numbers. EBITA stands for Earnings Before Interest, Taxes, and Amortization. This income statement metric helps you understand ebita by showing how much profit your core business makes before you pay interest, taxes, or account for amortization. You can think of ebita as a way to focus on your startup’s true operational profitability, without the noise from financial or accounting decisions.

EBITA strips away costs that don’t come from your main business activities. By leaving out interest and taxes, you get a clearer view of your earnings from operations. Amortization, which spreads out the cost of intangible assets, also gets excluded. This makes ebita a powerful tool for measuring financial performance and profit in a way that’s easy to compare across startups.

How to Calculate EBITA

You don’t need to be a finance expert to calculate ebita. Here’s a simple way to do it:

- Start with your net income from your profit and loss statements.

- Add back interest expenses. These are costs from loans or other financing.

- Add back taxes paid.

- Add back amortization, which is a non-cash expense.

The formula looks like this:

EBITA = Net Income + Interest + Taxes + Amortization

If you already know your EBITDA, you can calculate ebita by subtracting depreciation:

EBITA = EBITDA - Depreciation

Let’s say your startup has a net income of $200,000, interest of $50,000, taxes of $30,000, depreciation of $40,000, and amortization of $20,000. First, you calculate ebitda: $200,000 + $50,000 + $30,000 + $40,000 + $20,000 = $340,000. Then, subtract depreciation to get ebita: $340,000 - $40,000 = $300,000. This formula helps you see your operational profit before non-operating costs.

Why EBITA Matters for Startups

You want to know if your startup’s core business is working. EBITA gives you that answer. By focusing on operational earnings, you can spot trends in profitability and financial performance early. Investors often look at ebita because it shows how well your startup manages costs and generates profit from revenue. Understanding ebita helps you compare your results with other startups, even if they have different tax rates or financing structures.

EBITA also helps you track your financial health as you grow. If your ebita margin is high, you’re running your business efficiently. This metric is key for startup finance because it highlights operational strengths and weaknesses. When you understand ebita, you can make better decisions, improve profitability, and attract investors who care about strong financial performance.

Tip: Use ebita alongside other metrics like ebitda margin and cash flow to get a full picture of your startup’s financial performance.

EBITA vs. Other Metrics

When you look at your startup’s numbers, you might see EBITA, EBITDA, EBIT, net income, and cash flow. Each one tells a different story about your business. Let’s break down what makes each metric unique and why understanding these differences matters for your startup’s financial health.

EBITA vs. EBITDA

You might hear people talk about EBITDA for startups all the time. Both EBITA and EBITDA help you focus on your company’s core profit, but they are not the same. The main difference is how they treat depreciation and amortization.

Here’s a simple table to help you compare:

| Aspect | EBITA | EBITDA |

|---|---|---|

| Calculation | Net income + interest + taxes + amortization | Net income + interest + taxes + depreciation + amortization |

| Includes depreciation? | Yes | No |

| Includes amortization? | No | No |

| Focus | Operational profit, includes depreciation | Operational cash profit, excludes all non-cash charges |

| Use case | Best for tech startups with lots of intangible assets | Best for companies with big physical assets or lots of debt |

| Drawback | Can understate cash profit by including depreciation | Can overstate profit by ignoring asset costs |

EBITA excludes amortization, which is the slow write-off of things like software or patents. This makes EBITA a better fit for technology startups, where intangible assets are a big part of your business. EBITDA, on the other hand, ignores both depreciation and amortization. That can make your profit look higher than it really is, especially if you have a lot of assets that lose value over time.

If you want to calculate EBITDA, you add back both depreciation and amortization to your net income. Calculating EBITDA is common when you want to see how much cash your business generates from its main operations. But if you want a clearer view of your core earnings, especially in tech, EBITA gives you a better picture.

Note: Understanding EBITDA and EBITA helps you see how different accounting choices affect your reported profit.

EBITA vs. EBIT

Now, let’s look at EBITA and EBIT. Both focus on your operating profit before interest and taxes, but EBITA goes one step further by excluding amortization.

- EBIT includes both depreciation and amortization. This means it shows how your business handles the cost of using up both physical and intangible assets.

- EBITA removes amortization, so you see your profit before the cost of intangible assets is counted.

For startups, this difference matters. If your company relies on software, patents, or other intangibles, amortization can make your profit look smaller. EBITA helps you see past that, giving you a clearer view of your true operating earnings.

Investors often use EBITA to compare startups in the tech space, where amortization policies can vary a lot. EBIT is more conservative, showing the full cost of using your assets. If you want to show off your operational strength, EBITA can help you highlight your core profit.

EBITA vs. Net Income

Net income is the “bottom line” on your financial statement. It includes every expense—interest, taxes, depreciation, amortization, and more. EBITA, in contrast, strips out interest, taxes, and amortization. This makes EBITA a more focused measure of your startup’s operational profit.

Here’s why this matters for you:

- Net income can swing up or down because of things like loan payments, tax changes, or big one-time expenses.

- EBITA lets you see how well your business runs, no matter how you finance it or what your tax rate is.

If you’re growing fast and reinvesting in your business, your net income might be negative. That doesn’t always mean trouble. Investors often look at EBITA to judge your operational performance, especially when you’re in a high-growth phase. Using EBITA vs. net income helps you and your investors focus on the parts of your business you can control—like revenue and costs—rather than outside factors.

Tip: Calculating EBITDA and EBITA can help you explain your financial performance to investors, even if your net income is negative.

EBITA vs. Cash Flow

Cash flow shows the real money moving in and out of your business. EBITA, on the other hand, is an accounting measure of profit that doesn’t always match your cash position.

| Aspect | EBITA | Cash Flow |

|---|---|---|

| Non-Cash Items | Excludes amortization, includes depreciation | Includes all cash transactions |

| Capital Expenditures | Does not consider capital expenditures | Includes capital expenditures |

| Debt and Interest | Ignores interest payments on debt | Includes debt servicing payments |

| Tax Implications | Adds back taxes, ignores cash paid for taxes | Reflects tax payments |

| Purpose | Measures operational profit | Measures liquidity and solvency |

| Importance for Startups | Useful for comparing operational performance | Essential for managing cash and avoiding shortfalls |

You need to know both your EBITA and your cash flow. EBITA tells you if your core business is profitable. Cash flow tells you if you have enough money to pay your bills and invest in growth. Calculating EBITDA and EBITA helps you track profit, but only cash flow shows if you can keep the lights on.

Financial professionals recommend using EBITA and cash flow together. This way, you can see both your operational strength and your real cash position. If you only look at EBITA, you might miss warning signs about running out of cash.

Note: Always check your cash flow after calculating EBITDA or EBITA. Profit on paper doesn’t always mean cash in the bank.

Startup Insights with EBITA

Image Source: unsplash

Operational Performance

You want to know if your startup’s core business is working. EBITA helps you see this clearly. By removing interest, taxes, and amortization, you focus only on earnings from your main operations. This makes it easier to spot strengths and weaknesses in your financial performance. For example, a mid-sized equipment company changed its business model to include buy-back programs and subscription services. They saw $11.5 million EBITDA growth in 18 months, a 20% jump in customer retention, and a 40% drop in warranty costs. This shows how EBITA can highlight improvements that other metrics might miss.

- EBITA lets you track operational efficiency.

- You can measure the success of new strategies.

- It acts as an early warning if something needs attention.

- EBITA helps you make decisions that support business growth and enhance revenue streams.

Investor Appeal

Investors care about operational profitability. They look at EBITA and EBITDA for startups to judge if your business can generate profit before outside costs. A strong EBITA makes your startup more attractive to investors and can help you secure funding. Many investors use the EBITDA multiple method for business valuation. This method focuses on operational efficiency and helps set fair values for your company.

| Metric | Role in Investor Decision-Making |

|---|---|

| EBITDA | Shows operational profitability and efficiency, boosts investor confidence. |

| Free Cash Flow | Complements EBITDA by showing cash after investments. |

| Net Profit Margin | Includes all expenses, gives a full picture of profitability. |

| EBITDA Margin | Helps compare operational profit to revenue, key for business valuation and funding discussions. |

Industry Comparisons

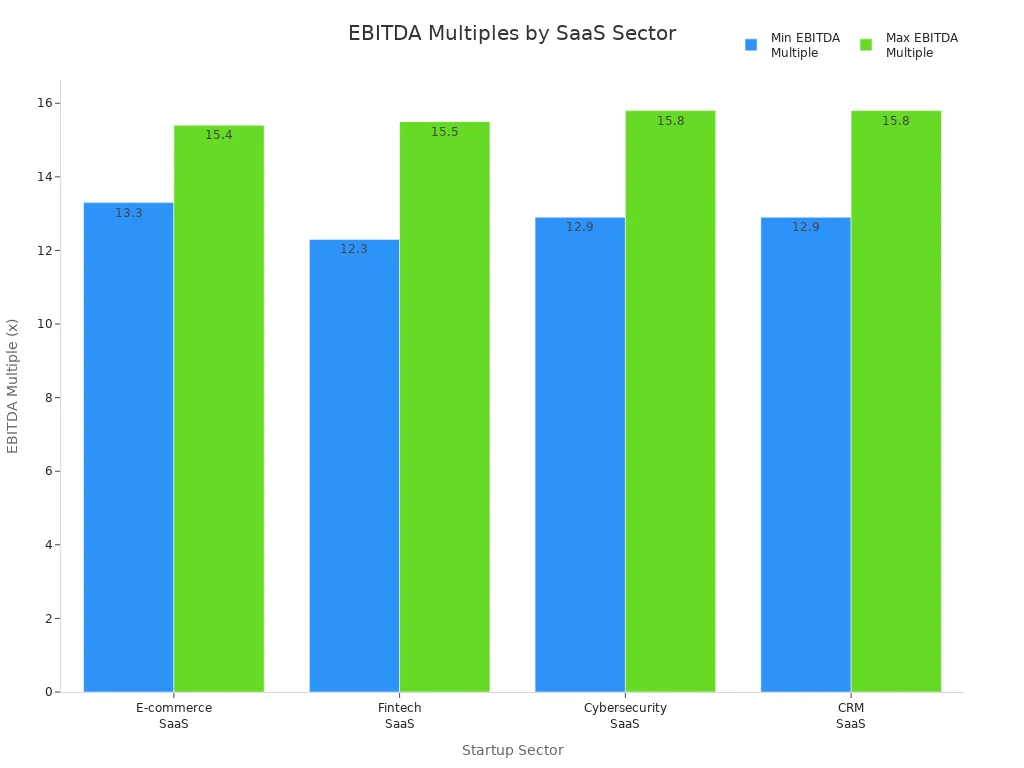

You can use EBITA to compare your startup with others in your industry. EBITA and EBITDA margin remove the effects of different tax rates and financing, so you get a fair comparison. Startups often benchmark EBITDA growth, EBITDA margin, and EBITDA multiples against similar companies. This helps you see if you are leading or lagging behind.

For SaaS startups, EBITDA multiples usually range from 10x to 19x. Fintech startups use revenue multiples when growing fast, but profitable ones use EBITDA multiples around 8x. By tracking your EBITA and EBITDA margin, you can build a strong story for investors and improve your business valuation.

Limitations and Best Practices

When Not to Use EBITA

You might think ebita always gives you the best view of your startup’s health, but that’s not true in every case. Ebita leaves out some important details. Here are some common limitations you should know:

- Ebita ignores capital expenditures (CAPEX), which can be a big deal for startups and affect your cash flow.

- Ebita overlooks changes in working capital. Even if your ebita looks good, cash flow can still be tight.

- Ebita leaves out financing costs and tax impacts, so you don’t get the full financial picture.

- Ebita can make your company look healthier than it is by ignoring debt and depreciation costs.

- Ebita is not GAAP-compliant, so it can be manipulated and may not always be reliable.

You should avoid using ebita as your main metric if your startup has limited operating history, uncertain profits, or high risk. Ebita also misses unique risks and growth potential. In these cases, experts suggest using other methods for business valuation, like the Scorecard Method or Monte Carlo Simulation, to get a better sense of your startup’s value.

Complementary Metrics

Ebita and ebitda are helpful, but you need more than just these numbers to understand your startup. Here are some other metrics you should track:

- Revenue multiples

- Customer Acquisition Cost (CAC)

- Lifetime Value (LTV)

- Monthly Recurring Revenue (MRR)

- Churn Rate

- Retention Rate

These metrics help you see how well you attract and keep customers, how much money you bring in each month, and how efficient your operations are. When you combine ebita with these numbers, you get a clearer view of your startup’s financial health and business valuation.

Tip: Ebita alone can give you a false sense of security. Always check your cash flow, balance sheet, and other key numbers to avoid surprises.

Best Practices for Startups

You want to use ebita and ebitda the right way in your startup’s financial reports. Here are some best practices:

- Standardize your data collection to keep your numbers accurate and consistent.

- Add non-GAAP metrics like adjusted ebitda to your regular reports for deeper insights.

- Change your financial reports as your startup grows. Early on, focus on simple metrics. As you mature, add more details.

- Use automated tools for real-time financial tracking and scenario planning.

- Show historical comparisons and budget differences to help everyone understand your progress.

- Use charts and graphs to make your reports easy to read.

- Share your financial reports with your board before meetings so they have time to review.

- Customize your presentations for your audience and update them based on feedback.

If you use ebita with other metrics and follow these steps, you can avoid common pitfalls. You will give investors a true picture of your startup and make better decisions for growth.

You now see how ebita stands apart from other metrics. Ebita focuses on your startup’s core profit, while metrics like ebitda, net income, and cash flow each tell a different story. To get the most out of ebita, start by collecting clear financial data, adjust for one-time costs, and compare your numbers with industry peers. Share ebita with investors during funding talks to highlight your operational strength. Use ebita with other metrics to show a full picture of your startup’s health. When you understand ebita, you make smarter decisions, attract investors, and set your startup up for success. Financial literacy gives you the confidence to lead your startup and secure funding.

FAQ

What does EBITA tell you about your startup?

EBITA shows how much profit your main business makes before you pay interest, taxes, or count amortization. You can use it to see if your core operations are strong and healthy.

How is EBITA different from EBITDA?

EBITDA removes both depreciation and amortization. EBITA only removes amortization. If your startup has big physical assets, EBITDA may look higher. EBITA gives you a closer look at profits when intangible assets matter more.

Should you use EBITA or net income for investor talks?

You should use both. EBITA highlights your operational strength. Net income shows your total profit after all costs. Investors often want to see EBITA to understand your business before outside costs affect the numbers.

Can EBITA help you compare your startup to others?

Yes. EBITA lets you compare your results with other startups, even if they have different tax rates or financing. You get a fairer view of operational performance across your industry.

For startups, understanding EBITA clarifies your operational strength — but managing cross-border cash flows and funding is just as critical. High transfer fees and hidden exchange markups can erode your runway faster than expected. With BiyaPay, you gain real-time transparent exchange rates, multi-currency (fiat & crypto) conversions, and transfer fees as low as 0.5%, so every dollar of investor capital goes further.

BiyaPay also supports same-day transfers across most countries worldwide, helping founders move funds quickly for payroll, product development, or market expansion. Just as EBITA gives clarity in your metrics, BiyaPay gives clarity and efficiency in your global transactions.

Scale smarter — register today at BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.