- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Determine Your Dividend Tax Rate in the United States

Image Source: pexels

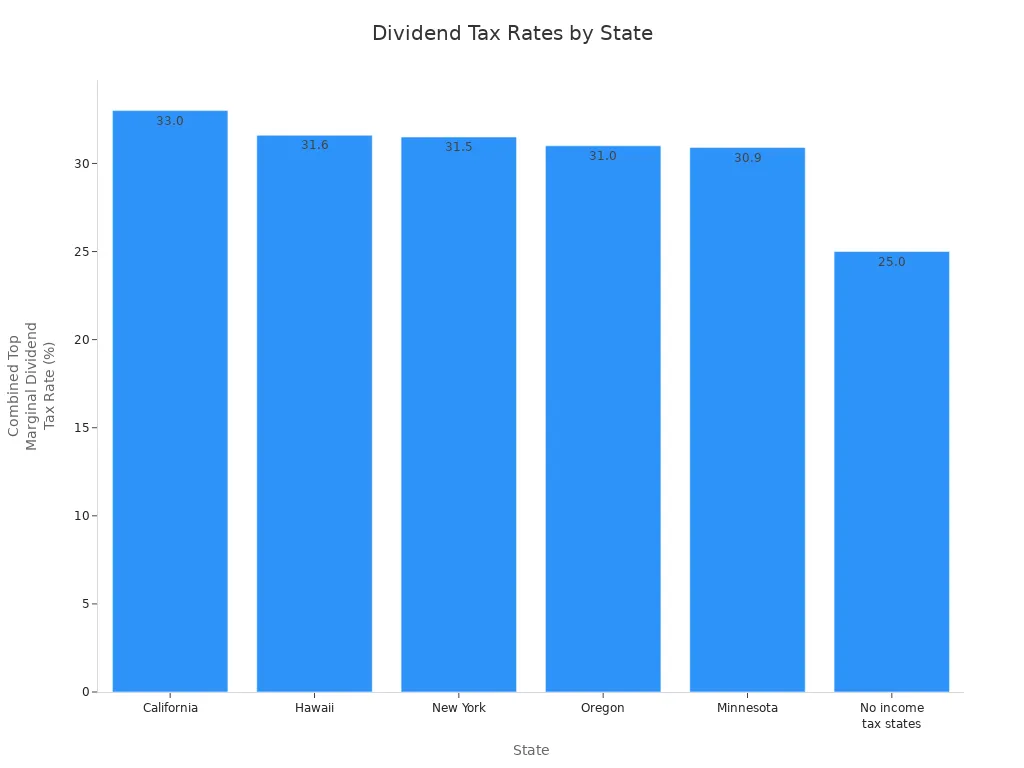

You can determine your dividend tax rate by following a few simple steps. First, identify if your dividends are qualified or ordinary. Then, check your income and filing status to see where you fit in the tax brackets. Next, apply the correct tax rate and remember to include any extra taxes. Both federal and state taxes affect your total rate. The table below shows how state rates can raise your total dividend tax:

| State | State Dividend Tax Rate | Combined Top Marginal Dividend Tax Rate |

|---|---|---|

| California | 13.3% | 33.0% |

| Hawaii | 11.0% | 31.6% |

| New York | 8.8% | 31.5% |

| Oregon | 9.9% | 31.0% |

| Minnesota | 9.9% | 30.9% |

| Average US | N/A | 28.6% |

| States with no personal income tax (e.g., Alaska, Florida, Nevada) | 0% | 25.0% |

If you understand how Dividends Taxed and us dividends work, you can avoid common mistakes and better plan for u.s. taxes.

Key Takeaways

- Identify whether your dividends are qualified or ordinary to know which tax rates apply.

- Check your taxable income and filing status to find your correct federal and state dividend tax rates.

- Use Form 1099-DIV to separate qualified and ordinary dividends and report them accurately on your tax return.

- Consider using tax-advantaged accounts like IRAs or 401(k)s to reduce or defer taxes on dividend income.

- Hold stocks long enough to qualify for lower tax rates on dividends and avoid common reporting mistakes.

Types of Dividend Income

Image Source: pexels

Understanding the types of dividend income helps you know how much tax you might owe. The IRS separates dividends into three main categories: qualified dividends, ordinary (nonqualified) dividends, and special dividends such as those from REITs. Each type has different rules and tax rates.

Qualified Dividends

A qualified dividend meets specific IRS rules. You must receive the dividend from a U.S. or certain foreign corporation. You also need to hold the stock for a set period—at least 61 days for common stock or 91 days for preferred stock. The IRS does not count dividends from REITs, master limited partnerships, or tax-exempt companies as qualified dividends. If you meet these rules, your qualified dividends get taxed at lower long-term capital gains rates: 0%, 15%, or 20%, depending on your income. You will see qualified dividend income reported in Box 1b of Form 1099-DIV.

Note: Qualified dividends encourage you to hold stocks longer. This can help you pay less tax on your dividend income.

Ordinary (Nonqualified) Dividends

Ordinary dividends, also called nonqualified dividends, do not meet the IRS rules for qualified status. Most nonqualified dividends come from sources like banks, Hong Kong banks, money market funds, REITs, master limited partnerships, employee stock ownership plans, and some foreign corporations. You do not need to meet a holding period for these. The IRS taxes ordinary dividends at your regular income tax rate, which can be as high as 37%. You will find ordinary dividends in Box 1a of Form 1099-DIV.

- Common sources of nonqualified dividend income include:

- Dividends from REITs

- Payments from banks and money market funds

- Dividends from master limited partnerships

- Employee stock ownership plans

- Special one-time dividend payments

Special Dividends and REITs

Special dividends and dividends from Real Estate Investment Trusts (REITs) have unique tax rules. Most REIT dividends count as nonqualified dividends and get taxed as ordinary income. Sometimes, REITs pay capital gains dividends or return of capital. Capital gains dividends get taxed at capital gains rates. Return of capital is not taxed right away but lowers your cost basis. When you sell your shares, you may pay tax on the gain. The IRS requires REITs to report these amounts separately on Form 1099-DIV.

| Dividend Type | IRS Criteria & Examples | Tax Rate Implication | 1099-DIV Box |

|---|---|---|---|

| Qualified Dividends | Paid by U.S. or certain foreign corporations; meet holding period; not from REITs/MLPs | 0%, 15%, or 20% (capital gains rates) | Box 1b |

| Ordinary Dividends | Do not meet qualified criteria; includes REITs, MLPs, banks, money market funds | Up to 37% (ordinary income tax rates) | Box 1a |

| REIT/Special Dividends | Most REIT dividends; special one-time dividends; capital gains or return of capital | Ordinary income or capital gains rates | Box 1a |

How Are Dividends Taxed?

When you receive dividends, you need to know how the IRS and your state tax them. The way dividends taxed depends on the type of dividend, your income, and where you live. Let’s look at how federal and state taxes work for dividend income and what extra taxes might apply.

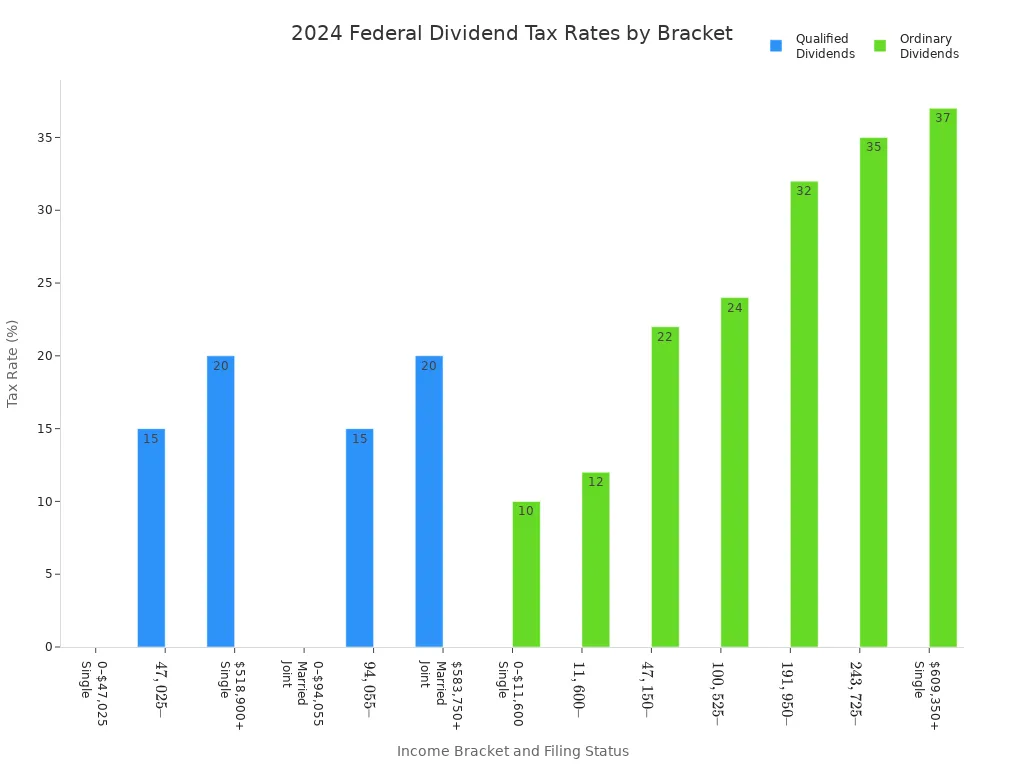

Federal Dividend Tax Rates

The IRS taxes qualified dividends at lower rates than ordinary dividends. Qualified dividends get the same rates as long-term capital gains. Ordinary dividends are taxed at your regular income tax rates. The tables below show the 2024 federal dividend tax rates by filing status and income bracket:

2024 Federal Tax Rates for Qualified Dividends

| Tax Rate | Single Filers (Taxable Income) | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 0% | $0 – $47,025 | $0 – $94,055 | $0 – $47,025 | $0 – $63,000 |

| 15% | $47,025 – $518,900 | $94,055 – $583,750 | $47,025 – $291,850 | $63,000 – $551,350 |

| 20% | $518,900+ | $583,750+ | $291,850+ | $551,350+ |

2024 Federal Tax Rates for Ordinary Dividends

| Tax Rate | Single Filers (Taxable Income) | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 – $11,600 | $0 – $23,200 | $0 – $11,600 | $0 – $15,700 |

| 12% | $11,600 – $47,150 | $23,200 – $94,300 | $11,600 – $47,150 | $11,600 – $47,150 |

| 22% | $47,150 – $100,525 | $94,300 – $201,050 | $47,150 – $100,525 | $47,150 – $100,525 |

| 24% | $100,525 – $191,950 | $201,050 – $383,900 | $100,525 – $191,950 | $100,525 – $191,950 |

| 32% | $191,950 – $243,725 | $383,900 – $487,450 | $191,951 – $243,725 | $191,950 – $243,700 |

| 35% | $243,725 – $609,350 | $487,450 – $731,200 | $243,726 – $365,600 | $243,700 – $609,350 |

| 37% | $609,350+ | $731,200+ | $365,600+ | $609,350+ |

You can see that qualified dividends are taxed at lower rates than ordinary dividends. This makes a big difference in how much tax you pay on your dividend income.

State Taxes on Dividend Income

Most states tax dividends as part of your regular income. State tax rates can range from 0% to over 13%. Some states offer credits or deductions that lower the taxes on dividend income. A few states do not tax dividends at all. Your total dividend tax rate is the sum of your federal and state rates. For example, if you live in California, your combined top marginal tax rate on dividends can reach 33%. Always check your state’s rules because they can change how much tax you owe.

Tip: Some states let you exclude part of your dividend income or offer special credits. This can lower your overall tax bill.

Net Investment Income Tax

If your income is high, you may have to pay an extra tax called the Net Investment Income Tax (NIIT). The NIIT is 3.8% and applies to the lesser of your net investment income or the amount your modified adjusted gross income (MAGI) goes over a set threshold. This tax covers dividends, capital gains, and other investment income.

| Filing Status | NIIT Threshold Amount |

|---|---|

| Single | $200,000 |

| Married Filing Jointly | $250,000 |

| Married Filing Separately | $125,000 |

| Head of Household | $200,000 |

| Qualifying Widow(er) | $250,000 |

If your income is above these thresholds, your tax rate on dividends can go up. For example, the top rate on qualified dividends increases from 20% to 23.8% when you add the NIIT. This makes it important to know your total income and plan for possible extra taxes on dividend income.

Determining Your Dividend Tax Rate

Figuring out your dividend tax rate helps you plan for tax time and avoid surprises. You can follow three main steps: identify your dividend type, check your taxable income and filing status, and apply the correct tax rate on dividends. Each step matters because mistakes can lead to paying too much tax or facing penalties.

Identify Your Dividend Type

Start by finding out if your dividends are qualified or nonqualified. This step is important because the IRS taxes each type differently. Qualified dividends usually get lower tax rates. Nonqualified dividends, also called ordinary dividends, get taxed at your regular income tax rate.

You can use Form 1099-DIV to help you. This form shows the type and amount of dividends you received. Box 1a lists total ordinary dividends, and Box 1b shows qualified dividends. If you see amounts in Box 3, those are nondividend distributions, which are not taxed right away but affect your cost basis. Sometimes, you may get an updated 1099-DIV if the company changes how it classifies your dividends.

Tip: Always check your 1099-DIV carefully. Make sure you know which dividends are qualified and which are nonqualified. This helps you avoid misclassifying your income and paying the wrong tax.

Here are some common errors people make when identifying dividend types:

- Misunderstanding the basics of dividend tax and withholding tax.

- Misclassifying dividends as ordinary instead of qualified dividends.

- Not checking for updated 1099-DIV forms if the company changes the classification.

- Overlooking special rules for dividends from real estate investment trusts or regulated investment companies.

You can avoid these mistakes by reading your 1099-DIV, following IRS instructions, and asking a tax professional if you have questions.

Check Your Taxable Income and Filing Status

Your taxable income and filing status decide which dividend tax rates apply to you. The IRS uses your total income and whether you file as single, married, or head of household to set your tax brackets. Qualified dividends get taxed at 0%, 15%, or 20%, depending on your income and filing status. Nonqualified dividends get taxed at your regular income tax rate, which can range from 10% to 37%.

Here is how your income and filing status affect your dividend tax:

- If you have a lower income, you may pay no tax on qualified dividends.

- If you have a higher income, you may pay up to 20% on qualified dividends and up to 37% on nonqualified dividends.

- If you file jointly, your income thresholds for lower tax rates are higher than if you file as single or head of household.

- High earners may also pay a 3.8% Net Investment Income Tax on taxable dividends.

The IRS provides tables to help you match your income and filing status to the correct tax rate. For example:

| Filing Status | Income Threshold for Qualified Dividends |

|---|---|

| Single or Married Filing Separately | $44,625 |

| Married Filing Jointly or Qualifying Widow(er) | $89,250 |

| Head of Household | $59,750 |

If your income is below these thresholds, you may pay 0% on qualified dividends. If your income is above, you move to the next tax bracket.

Note: Always use the latest IRS tables and worksheets to check your tax implications. These resources help you avoid errors and make sure you pay the right amount.

Apply the Correct Tax Rate

Once you know your dividend type and your income bracket, you can apply the correct tax rate on dividends. Use the IRS tax rate schedules for your filing status. Qualified dividends get the lower rates, while nonqualified dividends get taxed at your regular income tax rate.

Here is a simple way to apply the correct rate:

- Find your total dividend income on your 1099-DIV.

- Separate the amount into qualified and nonqualified dividends.

- Check your taxable income and filing status.

- Use the IRS tables to find your tax rate for each type of dividend.

- Add any extra taxes, such as the Net Investment Income Tax, if your income is high.

Many people make mistakes at this step. Here are some common errors and how to avoid them:

- Failing to use tax-advantaged accounts, such as IRAs or 401(k)s, to shield dividend income from immediate taxation.

- Neglecting to consider tax treaties and foreign tax credits, which can lower your tax bill.

- Not consulting with a tax professional for complex situations.

You can reduce your tax liability by:

- Using tax-advantaged accounts to defer or avoid tax on dividends.

- Investing in stocks that pay qualified dividends.

- Timing your investments to meet holding period requirements.

- Offsetting dividend income with eligible deductions.

Understanding the tax implications of each step helps you avoid costly mistakes. You can use these strategies to lower your dividend tax and keep more of your investment income.

Reporting US Dividends on Tax Forms

Image Source: pexels

Forms for Dividend Income

When you receive us dividends, you need to use the right tax forms to report dividend income. The IRS requires several forms, each with a specific purpose:

- Form 1099-DIV: Your bank or brokerage sends you this form if you receive at least $10 in dividend income. Box 1a shows your total ordinary dividends, and Box 1b lists your qualified dividends.

- Form 1040: You use this main tax form to report dividend income. Ordinary dividends go on line 3b, and qualified dividends go on line 3a.

- Schedule B (Form 1040): If your ordinary dividends are $1,500 or more, or if you receive dividends as a nominee, you must fill out Schedule B. This form helps you list each source of dividend income and totals the amounts. Schedule B also asks about foreign accounts.

- Form 1040-NR: If you are a nonresident alien, you use this form to report us dividends. The IRS applies special rules and withholding taxes for nonresident aliens.

- Special Forms for International Investments: If you own shares in foreign corporations, you may need to file extra forms like Form 5471 or Form 8621. These forms help the IRS track foreign investments and make sure you report dividend income correctly.

- REITs and Special Dividends: If you receive dividends from Real Estate Investment Trusts (REITs), you will see these on Form 1099-DIV. Sometimes, REITs also send Form 2439 if they pay tax on undistributed capital gains.

Note: Some payments from credit unions or Hong Kong banks may look like dividends but are reported as interest. Always check your forms to avoid confusion.

Common Reporting Mistakes

Many people make mistakes when they report dividend income. You can avoid problems by watching for these common errors:

- Forgetting to include all us dividends, especially if you have more than one account or receive forms late.

- Entering the wrong amounts from Form 1099-DIV, which can cause the IRS to question your return.

- Not filing Schedule B when your dividend income is $1,500 or more.

- Missing special forms for foreign investments, such as Form 5471 or Form 8621, which can lead to large penalties.

- Misclassifying dividends from REITs or not reporting capital gain distributions correctly.

- Failing to report dividend income as a nonresident alien, which can result in a 30% withholding tax unless a tax treaty lowers the rate.

| Mistake Type | What Happens | How to Avoid |

|---|---|---|

| Omitted dividend income | IRS penalties and interest | Double-check all accounts |

| Wrong amounts entered | IRS notices or audits | Match 1099-DIV to your return |

| Missing Schedule B | Incomplete reporting | File if over $1,500 |

| Ignoring foreign forms | Large penalties, audit risk | File required forms |

| Misclassifying REIT income | Back taxes, penalties | Use correct 1099-DIV boxes |

Tip: Always keep your tax documents and check each form before you file. Accurate reporting helps you avoid penalties and keeps your tax record clear.

Reducing Taxes on Dividend Income

Tax-Advantaged Accounts

You can lower your tax on dividend income by using tax-advantaged accounts. These accounts help you keep more of your investment earnings. The most common options include IRAs and 401(k)s. When you put dividend-paying stocks in a Traditional IRA or 401(k), you do not pay tax on dividends right away. You pay tax when you withdraw the money, usually at your ordinary income rate. Roth IRAs work differently. You pay tax on your contributions, but your dividends grow tax-free. When you take money out in retirement, you do not pay tax on those withdrawals if you meet the rules. Health Savings Accounts (HSAs) also offer tax benefits, but you must use the money for medical expenses.

| Account Type | Contribution Type | Tax on Earnings | Tax on Withdrawals | Notes for Dividend Income |

|---|---|---|---|---|

| Traditional IRA/401(k) | Pretax or tax-deferred | Tax deferred | Ordinary income | Defers tax on dividends |

| Roth IRA/401(k) | After-tax | Tax-free growth | Tax-free | Dividends grow and withdraw tax-free |

| HSA | Pretax or tax-deferred | Tax deferred | Tax-free (medical) | Best for medical expenses |

You can also use tax-managed funds and ETFs to reduce taxable events. Municipal bonds and Treasury products offer tax-exempt interest, which can help balance your overall tax plan.

Holding Period Strategies

The length of time you hold a stock affects how much tax you pay on dividends. If you want your dividends to count as qualified, you must hold the stock for more than 60 days during a 121-day window that starts 60 days before the ex-dividend date. Qualified dividends get taxed at lower rates—0%, 15%, or 20%. If you sell too soon, your dividends become nonqualified and get taxed at higher ordinary income rates.

Here is how the holding period works:

- Buy the stock before the ex-dividend date.

- Hold the stock for at least 61 days within the 121-day window.

- Check your holding period if you own mutual funds or preferred stocks, as rules may differ.

If you meet the holding period, you pay less tax on your dividends. Missing the window means you pay more.

Tip: Always track your purchase and sale dates. This helps you know if your dividends qualify for lower tax rates.

Other Tax Planning Tips

You can use several strategies to reduce your tax on dividend income. Tax-loss harvesting lets you sell investments at a loss to offset gains and lower your tax bill. Roth IRA conversions allow you to pay tax now and enjoy tax-free withdrawals later, which helps if you expect higher tax rates in the future. Charitable giving, such as donating appreciated stocks, helps you avoid capital gains tax and may give you a deduction. You can also spread your investments across taxable, tax-deferred, and tax-free accounts. This approach, called tax diversification, gives you more control over your tax situation each year.

Note: Using tax-advantaged accounts and timing your income can help you manage your tax burden and keep more of your dividend income.

To determine your dividend tax rate, you need to know the type of dividends you receive, your income level, and the account holding your investments. Qualified dividends often get lower tax rates, while ordinary dividends are taxed at your regular rate. High earners may pay an extra tax. Tax laws can change, so review your situation each year and use trusted resources for updates. For quick reference, use the tables and checklist below.

Checklist:

- Identify your dividend type

- Check your taxable income

- Find your tax rate

- Review for law changes

- Ask a tax professional if needed

FAQ

What is the difference between qualified and ordinary dividends?

Qualified dividends meet IRS rules and get taxed at lower rates. Ordinary dividends do not meet these rules and get taxed at your regular income tax rate. You can check your Form 1099-DIV to see which type you received.

Do I pay state taxes on dividend income?

Most states tax dividend income as part of your regular income. Some states do not tax dividends. Always check your state’s tax rules. Your total tax rate combines federal and state rates.

How do I know if I owe the Net Investment Income Tax?

You owe the Net Investment Income Tax if your modified adjusted gross income goes over the IRS threshold. For example, single filers pay this tax if income exceeds $200,000. Use the IRS table to check your filing status and income.

What should I do if I receive dividends from a Hong Kong bank?

You must report all dividend income from Hong Kong banks on your U.S. tax return. You may also need to file extra forms for foreign accounts. Check the latest USD exchange rates when converting amounts for your tax forms.

Knowing your dividend tax rate helps you plan smarter for IRS season — but don’t let hidden fees and poor exchange rates eat into your returns when moving dividend income across borders. With BiyaPay, you get transparent real-time FX rates, fees as low as 0.5%, and same-day transfers to most countries, so more of your dividend income stays in your pocket.

Just as tax planning saves you thousands, BiyaPay ensures your global transactions are efficient, fast, and transparent.

Optimize your dividend strategy today — register now at BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.