- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Send Money via Courier and Avoid Common Pitfalls

Image Source: unsplash

You might wonder if you can send money to Mexico using a courier delivery. The truth is, most major services will not let you send money this way. Sending cash by courier delivery brings big risks. You could lose your money or face legal trouble. If you want to send money safely, you need to use trusted delivery methods that protect your funds and follow the law.

Key Takeaways

- Sending cash to Mexico by courier is risky and often illegal, with chances of loss or legal trouble.

- Both the US and Mexico require reporting cash transfers over $10,000 to avoid serious penalties.

- Courier services do not insure or track cash deliveries, making them unsafe for sending money.

- Use trusted money transfer services or bank transfers for secure, fast, and trackable payments.

- Always verify providers, check fees and transfer speeds, and protect yourself from scams when sending money.

Is It Legal to Send Money via Courier?

Image Source: pexels

US and Mexico Laws

You might think you can just send money to Mexico by putting cash in a package and using a courier service. The truth is, both the US and Mexico have strict rules about this kind of delivery. If you try to send more than $10,000 in cash or monetary instruments from the US, you must report it to US Customs and Border Protection. You need to fill out a special form called FinCEN Form 105. If you do not report it, you could face serious trouble.

Here are some important points you should know:

- You must report any transfer of cash or monetary instruments over $10,000 when you send money to Mexico.

- The law covers not just cash, but also things like traveler’s checks, bearer bonds, and some types of securities.

- If you try to hide money in a package or suitcase to avoid reporting, you could be charged with a crime under US law.

- Money exchange businesses near the US-Mexico border must check your ID for cash transactions between $200 and $10,000. They do this to stop money laundering and illegal transfers.

Mexico also has its own rules. If you send money into Mexico without following the law, you could face fines or even criminal charges there, too. Both countries want to stop illegal money transfers, so they watch these deliveries closely.

Note: There is no limit to the amount of money you can bring into or out of the US, but you must report amounts over $10,000. If you do not, you risk breaking the law.

Risks and Consequences

Sending money by courier delivery is risky. You could lose your money, or worse, get into legal trouble. Here are some of the main risks:

- Theft or Loss: Couriers do not insure cash. If your package gets lost or stolen, you will not get your money back.

- Legal Penalties: If you do not report large amounts, or if you try to hide the money, you could face criminal charges. US law makes it a crime to smuggle more than $10,000 in cash or monetary instruments to avoid reporting.

- Money Laundering Concerns: Both the US and Mexico have strict rules to stop illegal transfers. If you do not follow these rules, you could be investigated for money laundering.

- No Reliable Tracking: When you send money by courier, you cannot track it like you can with a bank transfer or a money transfer service. You have no way to know if your money arrives safely.

Trying to transfer money to Mexico by courier is not just unsafe. It can also put you at risk of breaking the law. You should always use legal and secure ways to send money. This keeps your funds safe and helps you avoid trouble with the authorities.

Why Sending Money by Courier Is Not Recommended

Security Risks

When you try to send money to mexico using a courier, you put your cash at risk. Couriers do not protect your money like banks or trusted transfer services do. If your delivery gets lost or stolen, you have no way to get your money back. You cannot track a cash delivery the same way you track a bank transfer. This makes it hard to know if your money ever reaches mexico.

Scams are common with cash delivery. Someone might promise to deliver your money, but they could disappear with it. You cannot trust just anyone with your cash. Even if you use a well-known courier, they do not insure cash deliveries. If something goes wrong, you lose everything.

Tip: Always use a secure transfer method that lets you track your money. This helps you avoid losing your funds.

Lack of Reliable Services

Most major companies that help you send money to mexico do not offer courier delivery. Services like Western Union, MoneyGram, and PayPal use electronic transfers or cash pickups. They do not let you send cash in a package. This is because delivery by courier is not safe or reliable for money transfers.

If you try to find a courier willing to handle your cash delivery, you might run into scams. Many fake companies promise to transfer your money to mexico, but they just take your cash. Real money transfer services use secure systems and follow the law. They protect your money and give you proof of delivery.

Here is a quick comparison:

| Method | Tracking | Insurance | Reliable? |

|---|---|---|---|

| Courier Delivery | No | No | No |

| Bank Transfer | Yes | Yes | Yes |

| Trusted Money Service | Yes | Yes | Yes |

If you want to send money to mexico, choose a method that keeps your funds safe. Courier delivery does not offer the protection you need.

Best Ways to Send Money to Mexico

Image Source: pexels

When you want to send money to Mexico, you have many secure and reliable options. The best ways to send money include electronic transfers, cash pickup services, and bank deposits. These methods are safer than using a courier and are supported by major money transfer providers. You can use an app or an online platform to make the process fast and easy. Let’s look at each option so you can choose the best way to send money for your needs.

Electronic Transfers

Electronic transfers are one of the best ways to send money to Mexico. You can use an app or website to send money online from your phone or computer. Many people like this method because it is fast, secure, and easy to track. You can use services like Wise, PayPal, or Western Union. These money transfer apps let you move funds directly to a bank account or a digital wallet in Mexico.

Wise is a popular choice because about 45% of its transfers arrive instantly. The speed depends on how you pay. Debit card payments are usually faster than bank transfers. Some apps use QR codes or phone numbers to make transfers even easier. Digital wallets like Mercado Pago and BBVA Wallet are also growing in Mexico, especially among younger people.

Here is a table showing some of the most popular and secure ways to send money online to Mexico:

| Payment Method Type | Examples / Platforms | Key Features and Security Aspects |

|---|---|---|

| Bank Transfers | SPEI (Sistema de Pagos Electrónicos Interbancarios) | Instant, secure interbank transfers operated by Bank of Mexico; preferred for larger transactions and traceability. |

| Digital Wallets | Mercado Pago, PayPal, BBVA Wallet, Dimo | Convenient, widely used; Dimo enables instant transfers via phone numbers; strong security and mobile integration. |

| Cash-Based Options | OXXO | Allows cash payments for online purchases; important for unbanked population and cultural cash preference. |

| International Transfers | PayPal, Western Union | Trusted global services recommended for sending money internationally with secure transaction protocols. |

| Government Initiatives | CoDi (QR code payments), DiMo | Promote digital inclusion and secure transactions; CoDi uses QR codes, DiMo enables instant bank transfers. |

| Payment Gateways & Platforms | TransFi, PayU | Provide multi-currency support, strong security, integration capabilities, and comprehensive payment processing. |

| Emerging Trends | Biometric authentication, Cryptocurrency adoption | Enhance security and convenience; biometric methods reduce fraud; crypto gaining acceptance in some sectors. |

You can see that online transfers offer many choices. Each app has its own features, but all focus on security and speed. If you want to send money online, these are some of the best ways to send money to Mexico.

Cash Pickup Services

Cash pickup services are another top choice when you need to transfer money to Mexico. This method lets your recipient pick up cash at a local store or bank. You can use an app or visit a money transfer company like Western Union, MoneyGram, or Ria. These services are great if your recipient does not have a bank account.

Sending money for cash pickups is fast. In many cases, your recipient can get the cash within minutes. You just need to enter their name and location when you send money. The app or website will give you a tracking number. Your recipient shows this number and an ID to pick up the money.

Cash-based options like OXXO are very popular in Mexico. Many people use OXXO to pay bills or receive money. This is important because about 37% of people in Mexico do not have a bank account. Cash pickup services help everyone get the money they need, even if they do not use banks.

Here is a quick look at the most common ways people send money for cash pickups:

- Western Union: Offers instant cash pickup at thousands of locations in Mexico.

- MoneyGram: Lets you send money online or in person for fast pickup.

- Ria: Provides many pickup points and low fees.

- OXXO: Allows recipients to pick up cash at convenience stores across Mexico.

These money transfer providers use strong security checks to protect your funds. You can track your transfer online or in the app, so you always know where your money is.

Bank Deposits

Bank deposits are a secure way to transfer money to Mexico. You can send money directly to your recipient’s bank account using an app or a money transfer company. This method is safe and works well for larger amounts. Many people choose bank deposits because they offer good tracking and strong security.

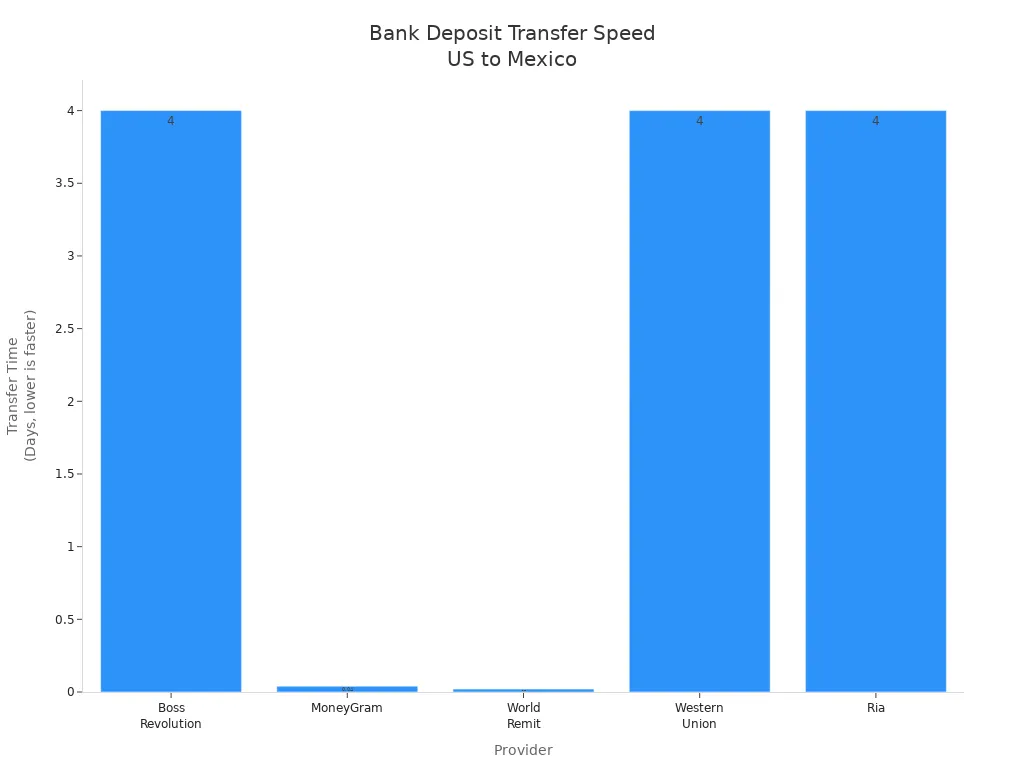

You will need your recipient’s full name, bank account number, and sometimes a BIC or SWIFT code. Most money transfer apps and companies support bank deposits to major banks in Mexico. Some services, like MoneyGram and Xoom, offer fast deposits that arrive within hours. Others, like Boss Revolution and Ria, may take up to four business days.

Here is a table comparing some popular bank deposit services for sending funds to Mexico:

| Provider | Transfer Method | Security Features | Transfer Speed | Fees (approx.) | Notes on Speed and Security |

|---|---|---|---|---|---|

| Boss Revolution | Bank Deposit | Requires recipient details; secure process | Up to 4 business days | Starts at $1.99 (debit) | Reliable and secure; slower than cash/mobile wallet options |

| MoneyGram | Bank Deposit | Standard bank transfer security | As fast as 1 hour | $1.99 | Faster bank deposits available; secure but fees vary |

| World Remit | Bank Transfer | Bank-specific transfers (e.g., Banorte) | Minutes to same day | $1.99 | Secure; speed varies by bank; limited to certain banks |

| Western Union | Bank Account | Data encryption, fraud monitoring | Up to 4 business days (bank acct) | $2.99 (debit card) | Secure; bank deposits slower than cash pickups |

| Ria | Bank Deposit | Standard bank transfer security | Up to 4 business days | $0 (bank to bank) | Secure; bank deposits slower than cash/mobile wallet |

Bank-to-bank transfers are very reliable. You get strong security features like data encryption and fraud monitoring. Xoom, a PayPal service, uses these tools to keep your money safe. Some bank deposits arrive in just a few hours, but others may take up to four days. If you want the best way to send money for larger amounts, bank deposits are a smart choice.

Tip: Always compare fees and transfer speeds before you send money. Some apps and money transfer providers offer instant transfers, while others take longer. Checking these details helps you pick the best way to send money to Mexico.

No matter which method you choose, using an app or an online service is safer than sending cash by courier. The best ways to send money are supported by trusted money transfer providers. You can track your transfer, get help if something goes wrong, and know your money is protected.

How to Transfer Money to Mexico Safely

Choosing a Trusted Provider

When you want to transfer money to Mexico, picking the right provider makes all the difference. You want your money to arrive quickly and safely. Start by looking for a provider with a strong reputation and clear fees. Many people use an app or an online service because these options are fast and easy to track.

Here’s a table to help you compare what matters most when you choose a provider:

| Evaluation Criteria | Explanation |

|---|---|

| Transparent and Low Transfer Fees | You see all costs up front, so there are no surprises. |

| Competitive Real-Time Exchange Rates | You get more pesos for your dollars with better rates. |

| Rapid Transfer Speeds | Your money arrives fast, which is important for emergency transfers. |

| Robust Security Measures | Your information and funds stay safe with strong security. |

| User-Friendly Digital Platforms | The app or website is simple to use, even if you are new to online money transfers. |

| Excellent Customer Support | You can get help quickly if you have questions or problems. |

| Recipient’s Preferred Receiving Method | Your recipient can choose cash pickup, bank deposit, or a mobile wallet. |

| Potential Tax Implications | You know if there are any taxes for sending or receiving money. |

| Frequency of Transfers | Some apps offer deals if you send money often. |

| Reputation and Network Coverage | The provider has a good track record and many locations in Mexico. |

| Transfer Options | You can pick the best way to send money, like cash pickup or bank deposit. |

Always use licensed and regulated money transfer providers. Before you send money, double-check the recipient’s full name, account number, and bank details. Make sure you use a secure app or online platform. Enable two-factor authentication if the app offers it. Keep your login details private and never share them.

Avoiding Scams

Scams can happen to anyone, but you can protect yourself by staying alert. Many scams target people who want to transfer money to Mexico. Some scammers use fake ads, pretend to be charities, or claim to be a relative in trouble. They might ask you to send money through an app or online, then disappear.

Here are some common scams and how to avoid them:

| Scam Type | Warning Signs & How to Avoid |

|---|---|

| Newspaper Ads Scam | Don’t send money for deals that seem too good to be true. Always check if the seller is real. |

| Charity Scams | Only donate through trusted organizations. Look up the charity before you give. |

| Relative in Need Scam | If someone claims to be a family member in trouble, call them directly to check. |

| Lottery & Sweepstakes | Never pay to claim a prize. Real lotteries do not ask for money upfront. |

| Internet Purchase Scam | Use secure payment methods and avoid wiring money for online purchases unless you know the seller. |

You can stay safe by following these steps:

- Always verify the recipient’s identity before you transfer money.

- Use secure apps and online services for all money transfers.

- Turn on two-factor authentication for extra security.

- Keep your devices updated and use antivirus software.

- Watch your accounts for any strange activity.

- Never share personal or financial information with strangers.

- Keep all receipts and confirmation numbers from your transfers.

- If you get a request that feels odd, check with someone you trust before you send money.

If you follow these tips, you can send money with confidence. You will know your funds are safe and your transfer will reach the right person in Mexico.

Sending money to mexico by courier delivery puts your cash at risk. You could lose it, face scams, or even break the law if you skip important steps. Trusted money transfer services give you better security, real-time tracking, and support. Always declare large amounts, use licensed providers, and keep records of every delivery. Protect your money by choosing safe delivery options and following the rules for every delivery to mexico.

FAQ

Can you send cash to Mexico using a courier service?

You cannot send cash to Mexico by courier safely or legally. Most courier companies do not allow cash in packages. You risk losing your money or facing legal trouble if you try this method.

What is the safest way to send money to Mexico?

You should use a trusted money transfer service or a bank transfer. These options let you track your money and offer strong security. Services like Western Union, Wise, and PayPal are popular choices.

How long does it take for money to arrive in Mexico?

Transfer times depend on the method you choose. Here is a quick guide:

| Method | Typical Speed |

|---|---|

| Cash Pickup | Minutes to hours |

| Bank Deposit | 1 hour to 4 days |

| Digital Wallet | Instant to 1 day |

How much does it cost to send money to Mexico?

Fees vary by provider and method. Most services charge between $1.99 and $5.00 USD per transfer. Always check the latest exchange rates and fees before you send money.

Courier delivery may sound simple, but it puts your money at risk — from theft to legal penalties. The safer choice is using a regulated platform like BiyaPay. With BiyaPay, you get real-time transparent exchange rates, multi-fiat & crypto conversions, and fees starting at just 0.5%.

Better yet, BiyaPay supports same-day transfers across most countries and regions worldwide, so your family or business partners in Mexico receive funds quickly, securely, and without hidden losses.

Stay compliant and protect your money. Register now at BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.