- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Top 10 Bank Accounts Anyone Can Open Online in 2025

Image Source: unsplash

Here are the 10 easiest bank accounts you can open online in 2025: Chime, Capital One 360, SoFi, Ally, Varo, Discover, Chase, Wells Fargo, US Bank, and Bank of America. You get fast online applications, low deposit requirements, and easy approval—even if you need the best for bad or no credit.

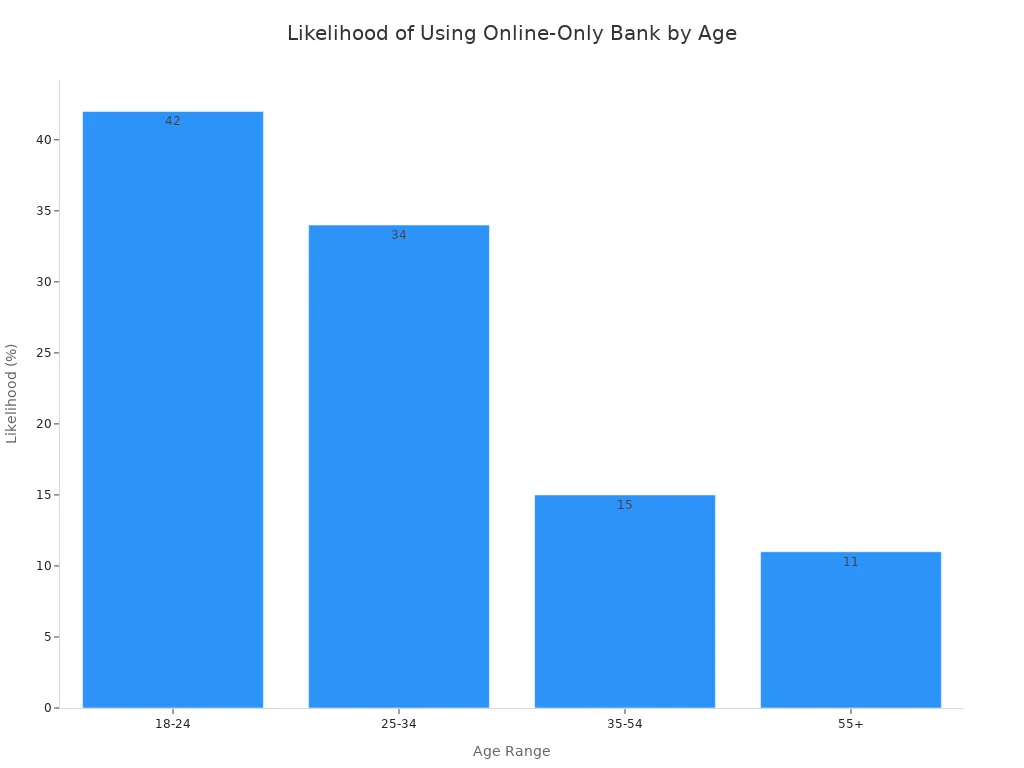

| Age Range | Likelihood to Use Online-Only Bank as Primary Account |

|---|---|

| 18-24 | 42% |

| 25-34 | 34% |

| 35-54 | 15% |

| 55+ | 11% |

Key Takeaways

- Many banks let you open accounts online quickly with no minimum deposit or monthly fees, saving you time and money.

- Banks like Chime, Varo, and Capital One 360 offer easy approval even if you have bad credit or no Social Security number.

- You can start using your new account right away with fast approval and simple online steps, making banking more accessible than ever.

Selection Criteria

When you want to open one of the easiest bank accounts online, you need to know what makes an account stand out. Here’s how you can spot the best for simple account opening and easy approval with low requirements.

Application Process

You want an online application that feels easy from start to finish. Banks work hard to make sure you don’t get lost or confused. They use clear steps, simple language, and even auto-fill features to help you move fast. If you ever stopped filling out a form because it felt too hard, you know why banks now focus on making things easy. The best for fast applications will guide you with clear instructions and quick feedback.

Approval Speed

Nobody likes to wait. The best for easy approval with low requirements will let you open an account and get a decision quickly. Some banks approve you in minutes, while others may take a few days. Most online banks use smart tools to check your info and give you easy approval. You can often open an account without requiring a minimum deposit and start using it right away.

Deposit Requirements

You want to open an account with no initial deposit or no minimum balance requirements. Many of the easiest bank accounts let you open with no money at all. Here’s a quick look at what major banks ask for:

| Bank | SSN/ITIN Requirement | Initial Deposit Requirement | Monthly Fees | Processing Time |

|---|---|---|---|---|

| Capital One | Accepts ITIN, SSN not required | No initial deposit required | No monthly fees | 5–7 business days |

| Chase | SSN required (strict) | $25 or more | No fees with balance | 7–10 business days |

| CitiBank | SSN not strictly required | $100 | Conditional fees | Around 10 business days |

| Mercury | Accepts ITIN, SSN not required | No initial deposit required | No monthly fees | 3–5 business days |

| Wise | Accepts ITIN, SSN not required | $20 | Low transaction fees | 1–3 business days |

You can see that many banks now offer no minimum balance requirements and no initial deposit.

Accessibility

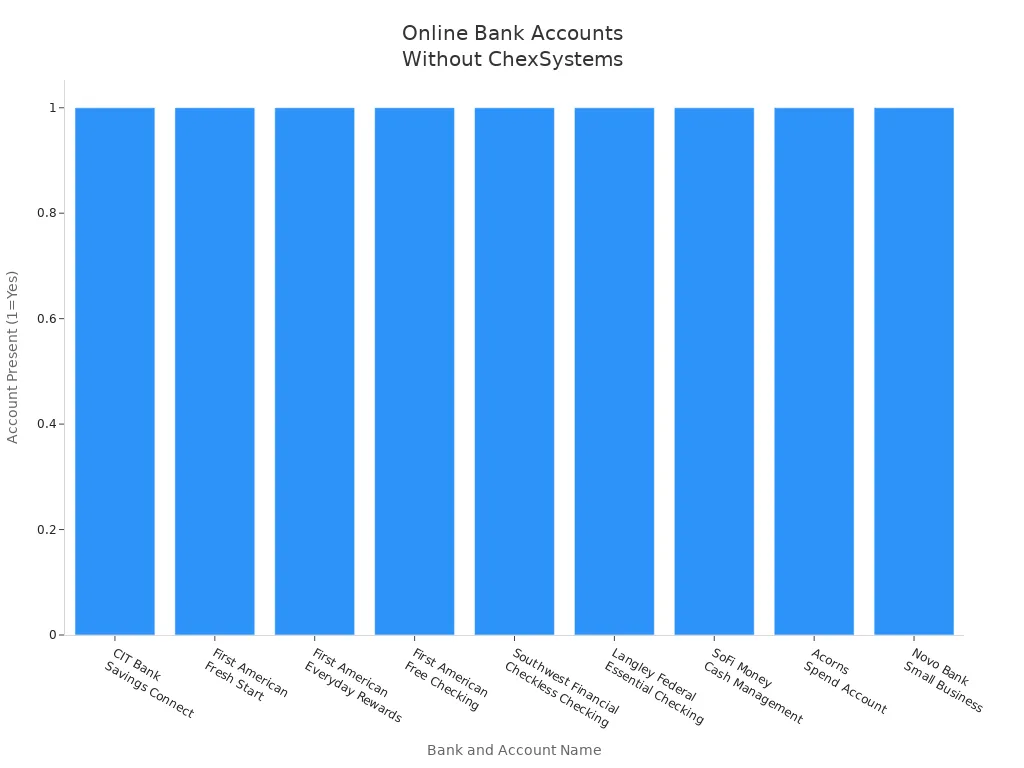

You want to open an account even if you have bad credit or you are not a U.S. resident. In 2025, this is not always easy. Some banks still let you open an account with an ITIN instead of an SSN, but most want a U.S. address. If you need the best for simple account opening or the best for fast applications, look for banks that do not use ChexSystems or have flexible ID rules. While options for nonresidents are limited, you can still find easy approval if you meet the basic requirements.

Easiest Bank Accounts to Open Online

Image Source: pexels

Chime Online Checking

You can open a Chime Online Checking account in just a few minutes. The application is simple and does not require a credit check. Chime does not use ChexSystems, so you have a good chance of easy approval, even if you have had problems with checking accounts before. There is no initial deposit needed, and you do not pay monthly fees. Chime gives you early access to your paycheck and a large ATM network. You can manage everything from your phone, making this one of the easiest bank accounts to open online.

Capital One 360 Checking

Capital One 360 Checking stands out for its fast and easy online application. You can open your account in about five minutes, according to Capital One’s website. The process is clear and quick, so you do not have to wait long for approval. There is no initial deposit required, and you do not pay monthly fees. Capital One does not rely heavily on ChexSystems, so you have a good chance of easy approval. You get access to a large ATM network and strong mobile banking features, making this one of the best online checking account options for easy setup.

SoFi Checking and Savings

SoFi makes it easy to open both checking and savings accounts online. You do not need a minimum deposit, and there are no account or maintenance fees. The application is quick, and you can manage your money with a user-friendly app. SoFi does not use ChexSystems, so you have a better chance of easy approval. You can earn interest on your balance with no minimum required. Here is a quick look at the main features:

| Feature | Details |

|---|---|

| Minimum Deposit | No minimum deposit required to open SoFi Checking and Savings accounts online. |

| Account Fees | No account, service, or maintenance fees charged. |

| Outgoing Wire Transfer Fee | Transaction fee applies for each outgoing wire transfer. |

| Incoming Wire Transfer Fee | No fee charged by SoFi; however, the sending bank may charge a fee. |

| Minimum Balance for Interest | No minimum balance required to earn interest. |

| Overdraft Coverage | Offered under certain conditions. |

You can open your account quickly and start using it right away, making SoFi a top choice for an easy-to-open savings account and one of the best online checking account options.

Ally Interest Checking

Ally Interest Checking is one of the easiest bank accounts to open online. You do not need a minimum deposit, and there are no monthly maintenance fees. Ally does not mention credit checks or restrictions for people with bad credit, so you have a good chance of easy approval. Here are some reasons why Ally is a great choice:

- No minimum deposit required, which makes it more accessible than some other banks.

- No monthly service fees, so you save money.

- Large ATM network with some ATM fee reimbursements.

- Fully online banking with a strong mobile app.

- Overdraft protection with no overdraft fees.

- Free access to your credit score and report.

- FDIC insured for your security.

You can open your account online in just a few steps, making Ally a strong option for easy bank accounts.

Varo Bank Account

Varo Bank makes it easy to open an account online. You do not need a minimum balance, and there are no monthly maintenance fees. Varo does not use ChexSystems, so you have a good chance of easy approval. You can get your paycheck up to two days early and use over 55,000 fee-free ATMs. Varo offers unique features like Varo Cash Advance, which lets you borrow small amounts without a credit check. Repayment is automatic from your next direct deposit, and fees are lower than payday loans. You also get automatic savings tools and strong security. You can open your account quickly and manage everything from your phone, making Varo one of the best online checking account choices for easy access.

Discover Cashback Debit

You can open a Discover Cashback Debit account online with a simple application. Discover does not require a credit check, so applying will not affect your credit score. The bank does not say if it uses ChexSystems, but many people with past banking issues have success opening accounts here. There is no initial deposit required, and you do not pay monthly fees. You earn 1% cashback on up to $3,000 in debit card purchases each month. Discover gives you access to a large ATM network and a strong mobile app, making it one of the easiest bank accounts to open online.

Chase Secure Banking

Chase Secure Banking is a good option if you want a second-chance checking account. You can open your account online with no minimum deposit. The monthly service fee is $4.95, but you can avoid it by making electronic deposits of $250 or more each month. New accounts do not pay the fee for the first two statement periods. Chase does not allow overdraft fees on this account. The application is simple, and you get access to a large ATM network and mobile banking. This account is a strong choice if you want easy approval and need a second-chance checking option.

- Monthly service fee: $4.95 (waived with $250+ in electronic deposits)

- No minimum deposit required

- No overdraft fees

- Good for second-chance checking

Wells Fargo Clear Access Banking

You can open a Wells Fargo Clear Access Banking account online in just a few minutes. The application is step-by-step and easy to follow. Once your account is open, you get access to all features right away. There is no minimum deposit required, and the monthly fee is $5, but it is waived for account holders ages 13 to 24. This account does not allow overdrafts, so you avoid extra fees. Wells Fargo offers a large ATM network and a strong mobile app. This account is a good choice if you want easy bank accounts with fast online setup.

US Bank Smartly Checking

US Bank Smartly Checking is one of the easiest bank accounts to open online. You can apply in minutes, and there is no minimum deposit required. The monthly fee is $6.95, but you can avoid it by meeting certain requirements, like having direct deposits or keeping a minimum balance. US Bank offers a large ATM network and a user-friendly mobile app. This account is a good option if you want a second-chance checking account with easy approval and flexible fee waivers.

Bank of America Advantage SafeBalance

Bank of America Advantage SafeBalance is easy to open online if you are already a Bank of America customer. You need to log in to your online banking account, which makes the process fast and simple. There is no paper check writing, so everything is digital. If you are under 25, you do not pay a monthly maintenance fee. There are no overdraft item fees, which helps you avoid extra charges. This account is a good fit if you want a second-chance checking account with easy approval and a fully digital experience.

Tip: If you already have a Bank of America account, you can open Advantage SafeBalance online in just a few steps. This makes it one of the best online checking account options for quick setup.

Comparison Table: Easy Bank Accounts

Image Source: pexels

You want to compare the easiest checking accounts you can open online. This table helps you see which banks offer no minimum balance requirements, no monthly fees, and fast approval. You can spot which accounts do not use ChexSystems, so you have a better chance if you had issues before. Many of these banks let you open your account with no money at all.

| Bank/Account Name | Approval Speed | ChexSystems Used? | Minimum Deposit | Monthly Fees | No Minimum Balance Requirements | Unique Benefits |

|---|---|---|---|---|---|---|

| Chime Checking | Minutes | No | None | None | Yes | Early direct deposit, 60,000+ ATMs |

| Capital One 360 Checking | Minutes | No | None | None | Yes | Large ATM network, strong mobile app |

| SoFi Checking and Savings | Minutes | No | None | None | Yes | Earn interest, no overdraft fees |

| Ally Interest Checking | Minutes | No | None | None | Yes | ATM fee reimbursements, overdraft help |

| Varo Bank Account | Minutes | No | None | None | Yes | Early pay, cash advance |

| Discover Cashback Debit | Minutes | No | None | None | Yes | 1% cashback, large ATM network |

| Chase Secure Banking | Same day | Yes | $0 | $4.95 (waivable) | Yes | No overdraft fees, second-chance |

| Wells Fargo Clear Access Banking | Minutes | No | None | $5 (waivable) | Yes | No overdraft, strong mobile app |

| US Bank Smartly Checking | Minutes | No | None | $6.95 (waivable) | Yes | Fee waivers, large ATM network |

| Bank of America SafeBalance | Minutes | No | None | $4.95 (waivable) | Yes | Digital banking, no overdraft fees |

Note: Most accounts in this list do not use ChexSystems, so you can open an account even if you have bad credit. You also get no monthly fees with many of these banks, especially if you meet simple requirements.

You can open these checking accounts online in just a few minutes. Many banks now offer no minimum balance requirements and no monthly fees, so you keep more of your money. If you want to open an account fast, look for banks that skip ChexSystems and let you start with no deposit.

Best for Quick Online Setup

Fastest Approval Accounts

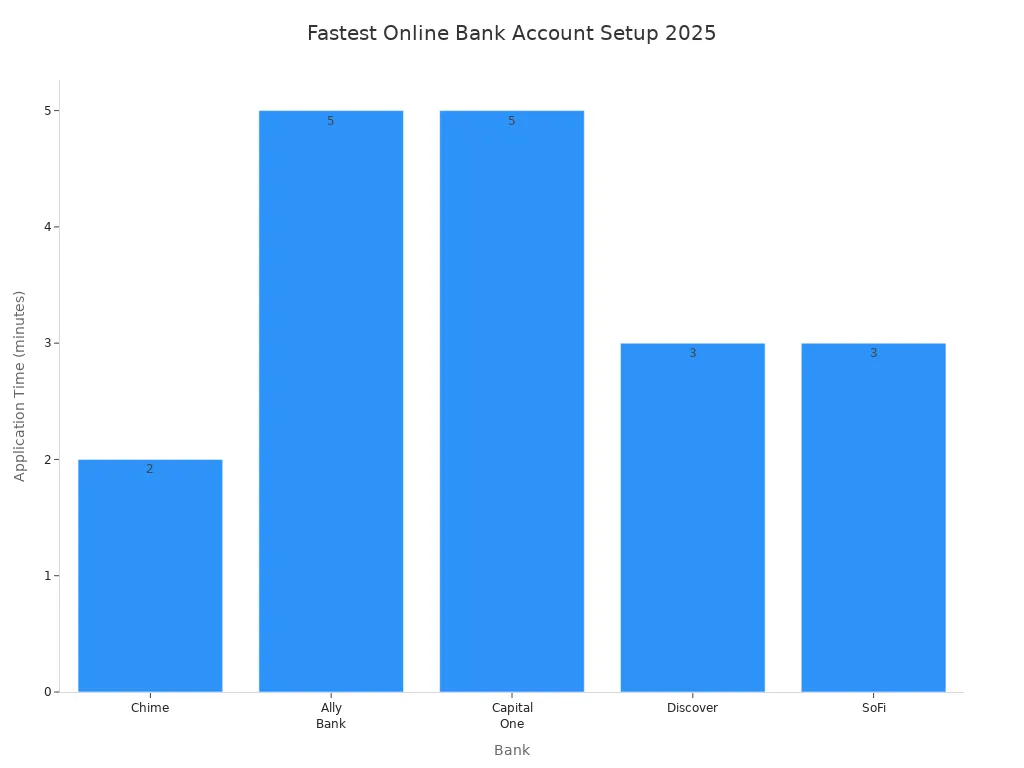

If you want a bank account asap, you probably care about the best for quick online setup. Some banks stand out for their faster average processing times and instant approval. Chime is easy and quick to open online. You can finish the application in under two minutes. Capital One and Ally Bank also let you get approved quickly, usually in about five minutes. SoFi and Discover are best for fast applications, too. You do not need to visit a branch or mail any forms. Everything happens online, so you can start banking right away.

Here’s a quick look at how long it takes to open an account with these banks:

| Bank | Typical Application Time | ChexSystems Used? | Minimum Deposit | Monthly Fees |

|---|---|---|---|---|

| Chime | Under 2 minutes | No | None | None |

| Ally Bank | Around 5 minutes | Yes | None | None |

| Capital One | Around 5 minutes | No | None | None |

| Discover | Few minutes | No | None | None |

| SoFi | Few minutes | No | None | None |

If you want the best for fast applications, these banks make it simple to get started.

Instant Account Access

You want to use your new account as soon as possible. The best for quick online setup banks help you do just that. After you finish the online application, you can often access your account right away. Most banks ask for a valid photo ID, your Social Security number or ITIN, and proof of address. You can upload these documents during the application. Once you finish, you can deposit money and start using your account features.

| Requirement Step | Details |

|---|---|

| Identity Verification | Valid government-issued photo ID, Social Security card or ITIN, passport, birth certificate |

| Proof of Address | Lease, mortgage, utility bill, bank or credit card statement |

| Opening Deposit | Transfer, check, money order, or cash deposit at branch |

| Debit Card Activation | Activate online, phone, or ATM before use |

| Account Usage | Ready for deposits, withdrawals, and other features after setup |

If you want instant approval and need to use your account right away, choose a bank with best for fast applications and easy online steps. You can open your account, upload your documents, and start banking—all in one day.

Important Considerations

Fees and Charges

You want to avoid surprises when it comes to fees. Many online banks advertise no monthly fees, but you should always check the details. Here’s a quick look at the most common charges you might see:

| Fee Type | Description | Typical Cost Range |

|---|---|---|

| Monthly Maintenance | Charged for account upkeep, sometimes avoidable with a minimum balance | $5 - $25 per month |

| Overdraft Fees | Charged if you spend more than your balance | Around $35 per overdraft |

| ATM Fees (Out-of-Network) | Using ATMs outside your bank’s network | A few dollars per use |

| Paper Statement Fees | For paper statements instead of digital | $2 - $5 per statement |

| Early Account Closure | Closing your account too soon | $24 - $50 |

You should look for accounts with no monthly fees and low extra charges. This helps you keep more of your money.

Deposit and Balance Rules

Some banks require a minimum deposit or balance, but many of the best for easy account management options do not. Here’s what you might see:

| Bank Account | Minimum Opening Deposit | Minimum Daily Balance | Monthly Fee | Fee Waiver Conditions |

|---|---|---|---|---|

| Wells Fargo Everyday Checking | $25 | None | $10 | $500 daily balance or qualifying deposits |

| Citizens Bank One Deposit | Any amount | None | $9.99 | One deposit per statement period |

| U.S. Bank Smartly Checking | Not stated | N/A | N/A | Focus on overdraft protection and benefits |

You want an account with no monthly fees and no strict deposit rules for the best for easy account management.

Approval and Documentation

You need to prepare some documents before you apply. Most banks ask for two forms of ID, like a driver’s license and a Social Security card. You also need proof of address, such as a utility bill. If you are under 18, you need a parent or guardian to help. Some banks may ask for more, but these are the basics.

Account Access and Usability

You want your account to be easy to use. Online banks now support screen readers, keyboard navigation, and clear headings. Many banks offer large touch targets and voice commands. Some even provide language options for users who do not speak English well. These features make online banking the best for easy account management, especially if you have special needs or want a simple experience.

You have great options for easy online banking. If you want no credit check, Chime and Varo work well. For nonresidents, Capital One 360 and Bank of America make setup simple. Use the table above to compare features. Pick your favorite and start your application today.

FAQ

Can you open a bank account online if you live outside the United States?

Yes, you can. Some banks, like HSBC Hong Kong, let you apply online. You may need a valid passport and proof of address.

Do you need a minimum deposit to open these accounts?

Most accounts on this list do not need a minimum deposit. You can start with $0. Always check the latest requirements before you apply.

What if you have bad credit or a closed account in the past?

You still have options. Many banks, like Chime and Varo, do not use ChexSystems. You can get approved even with past banking issues.

Opening an online bank account in 2025 is simple — but most banks still fall short when it comes to international transfers, transparent exchange rates, and low fees. If you need a solution that goes beyond just holding money, BiyaPay is built for the global economy.

With BiyaPay, you can convert multiple currencies and crypto at real-time exchange rates, enjoy transfer fees as low as 0.5%, and send money to most countries worldwide with same-day delivery. Whether you are a freelancer, student, or business owner, registration only takes minutes — giving you instant access to smarter money movement.

Take control of your finances today. Start your global journey with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.