- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What is MoneyGram? Everything you need to know

Image Source: unsplash

MoneyGram is a money transfer service that helps people send money across the world. Based in the United States, MoneyGram supports transfers in more than 200 countries and territories. This money transfer service connects people in over 200 locations and serves more than 50 million users each year. MoneyGram processes over $200 billion USD in transaction volume annually. Many people trust MoneyGram to send money quickly and securely to friends and family worldwide.

Key Takeaways

- MoneyGram helps people send money quickly and safely to over 200 countries using online, app, or agent locations.

- Users can send money for cash pickup, bank deposits, or mobile wallets with easy steps and secure ID verification.

- Fees and exchange rates vary by location, amount, and payment method; users can check costs before sending.

- MoneyGram offers fast transfers, often within minutes, and supports many currencies and payment options.

- The service is best for sending money where cash pickup is needed, but users should avoid scams by sending only to trusted people.

What is MoneyGram?

Image Source: unsplash

Money Transfer Service Overview

MoneyGram stands as a leading money transfer company based in the United States. The company helps people send money worldwide through a network that covers more than 200 countries and territories. MoneyGram services include international and local money transfers, money orders, and bill payments. People use MoneyGram to send money to family, pay bills, or make international payments for goods and services.

MoneyGram offers several ways to send and receive money. Customers can visit agent locations, use the website, or download the mobile app. The company supports transfers to bank accounts, mobile wallets, and for cash pickup. Many people choose MoneyGram because it provides fast and reliable money transfer services. The company also supports international payments in many currencies, making it easier for users to send money worldwide.

Note: MoneyGram services reach millions of people each year. The company processes billions of dollars in transfers and payments, helping families and businesses connect across borders.

Global Reach and Network

MoneyGram has built a strong global network over many years. The company started with a focus on the United States but quickly expanded to serve international customers. By 2006, MoneyGram had over 96,000 agents in regions like Asia-Pacific, Eastern Europe, and Central America. The company introduced new services such as bill payment and online transfers to meet growing demand.

The network grew even larger by 2014, with MoneyGram operating in more than 200 countries and territories. The company had about 400,000 agent offices worldwide, making it the second largest provider of money transfer services at that time. In 2015, MoneyGram expanded its African network to 25,000 locations and formed partnerships with organizations like the Mauritius Post Office. By 2020, MoneyGram partnered with Digital Financial Services LLC in the UAE, allowing real-time transfers to over 200 countries through mobile wallets, bank deposits, and more than 350,000 walk-in locations.

The table below compares MoneyGram’s global network with other major money transfer services:

| Company | Global Network Size Description | Number of Supported Currencies | Notes on Reach and Coverage |

|---|---|---|---|

| MoneyGram | Veteran company with wide global reach | 58 (online transfers) | More currencies supported for physical transfers; smaller network than Western Union |

| Western Union | Largest and unmatched global network of offices | 145 | Operates even in remote areas where others do not; most extensive coverage worldwide |

| Wise | Growing global coverage but smaller than Western Union | N/A | Expanding but not yet as wide as Western Union |

MoneyGram supports 58 currencies for online transfers and even more for physical transfers at agent locations. The company’s network is smaller than Western Union but still covers most countries and regions where people need to send or receive money. MoneyGram international transfer options help people reach family and friends almost anywhere in the world.

MoneyGram’s growth shows its commitment to making money transfer services accessible. The company continues to add new partners and locations, making it easier for people to send money worldwide. Many users trust MoneyGram for international payments because of its strong network and reliable service.

How MoneyGram Works

Image Source: unsplash

How to Send Money

MoneyGram makes it easy for people to send money to friends and family around the world. The company offers several ways to send money, including online, through the MoneyGram app, or by visiting an agent location. Each method follows clear steps to help users complete their transfer safely and quickly.

Sending Money Online or with the MoneyGram App:

- Register or log in to a MoneyGram account on the website or app.

- Enter the recipient’s details, including their full name and location.

- Specify the amount to send in USD.

- Choose a delivery method, such as bank deposit or cash pickup.

- Select a payment method, like a debit card or Apple Pay (for iOS users).

- Review all details, including fees and exchange rates, then confirm the transfer.

People who use the MoneyGram app can also save receiver details for future transfers, track the status of their transfer, and manage their transactions. The app allows users to pay with credit or debit cards and provides options for sending money to mobile phones, which can be deposited to Visa debit cards.

Sending Money In Person at an Agent Location:

- Visit a nearby MoneyGram agent location with a valid government-issued ID and the cash amount to send.

- Provide the recipient’s full name and location.

- If sending to a bank account, give the recipient’s bank name and account number.

- If sending to a mobile wallet, provide the recipient’s mobile number with the international dial code.

- Complete any required forms and pay the transaction fees.

- Save the receipt and share the reference number with the recipient.

MoneyGram uses Mobile Verify™ technology to check the authenticity of identity documents. Customers can take a picture of their passport or other ID using a mobile device. This process helps meet anti-money laundering rules and speeds up verification.

Tip: Always make sure the recipient’s name matches their ID exactly to avoid delays in receiving money.

How to Receive Money

MoneyGram gives people several ways to receive money, depending on their country and local regulations. The most common methods include:

- Cash pickup at one of over 430,000 agent locations worldwide.

- Direct deposit to a bank account, where funds arrive automatically.

- Deposit to a debit card, which requires the receiver’s debit card details.

- Transfer to a mobile wallet in select countries.

- Receiving money through the MoneyGram app, which can deposit funds to a bank account or debit card.

To receive money at an agent location, the recipient must present a valid photo ID that matches the name on the transfer record. Acceptable IDs include passports, driving licenses, or national identity cards. Requirements may vary by country and agent, so it is important to check with the local MoneyGram agent for specific procedures.

The sender should provide the recipient with the reference number from the transfer receipt. This number is needed for cash pickup. For bank deposits and mobile wallets, the money usually arrives directly, and the recipient may get a notification.

Note: Not all receive money services are available in every country. Users should check which options are offered in their location.

Digital Platform and Agent Locations

MoneyGram supports both digital and physical ways to send and receive money. The company operates over 430,000 agent locations in more than 200 countries and territories as of 2024. These locations help people who prefer to handle money transfers in person.

The MoneyGram app and website offer a digital platform for users who want to send and receive money online. The app lets users:

- Send money by entering receiver and payment details.

- Save receiver information for future transfers.

- Pay using credit or debit cards and Apple Pay (on iOS).

- Track, edit, or cancel transfers.

- Send money to mobile phones for deposit to Visa debit cards.

- Manage transactions and view transfer status.

- Access extra services like bill pay, mobile top-ups, money orders, and loyalty rewards.

The app is available in many countries, but not all. Google Pay is not yet supported as a payment method. The digital platform gives users flexibility and control over their money transfers, making it easier to send and receive money anytime.

MoneyGram’s global network and digital services make it a reliable choice for people who need to send and receive money across borders. The company’s wide range of options, strong security, and user-friendly tools help millions of people manage their money transfers every year.

MoneyGram Fees and Speed

Transfer Fees

MoneyGram fees depend on several factors. The company calculates transfer fees based on the sender’s and receiver’s locations, the amount sent, the payment method, and the delivery option. The following list shows what affects the total cost:

- Sender and receiver locations

- Amount of money sent

- Payment method (credit cards often cost more than bank transfers or cash)

- Delivery speed (faster options usually have higher fees)

- Receiving method (cash pickup, bank deposit, or mobile wallet)

- Recipient’s location

MoneyGram payment options also influence the final fee. For example, using a credit card may trigger extra charges, such as cash advance fees. The company provides a transparent fee structure online, so users can estimate costs before sending money. Comparing transfer fees and exchange rates with other services helps users find the best deal.

The table below shows a sample fee structure for sending money from the US to India:

| Transfer Amount Range (USD) | Transfer Fee (USD) |

|---|---|

| $1 - $10,000 | $0 |

| $10,001 - $15,000 | $49.99 |

Exchange Rates

MoneyGram sets exchange rates by looking at market conditions, currency availability, and operational costs. The company adds a small markup to the mid-market rate. For example, if the mid-market rate for USD to EUR is 1 USD = 0.91085 EUR, MoneyGram may offer 1 USD = 0.9067 EUR. This markup is about 0.4% to 0.5%. Exchange rates can change daily or even hourly. MoneyGram includes fees in the final rate shown to customers. Users should check the online currency converter for the latest rates before making a transfer.

Transfer Speed

MoneyGram offers fast transfer times for most countries. Many transfers to bank accounts arrive within a few hours. Some may take until the next day. Several factors can delay a transfer:

- Incorrect recipient information

- Country regulations or local holidays

- Bank closures or technical issues

- Compliance checks

Transfers to remote areas may take longer than those to major cities. MoneyGram provides tracking tools and customer support to help with delays. Choosing faster service options can reduce waiting times. For example, the “Money in Minutes” service delivers funds quickly when speed matters most.

Supported Countries and Limits

Countries and Currencies

MoneyGram supports sending money to over 200 countries and territories. This wide network covers every continent, including Africa, Asia, Europe, Latin America, the Middle East, North America, and Oceania. People can use MoneyGram to send funds to family and friends almost anywhere in the world. The service offers a country selector on its website, which lists all supported destinations for international transfers. Currency availability depends on the destination country. Some countries allow transfers in their local currency, while others may only support major global currencies like USD or EUR. Fees and exchange rates can change based on the country and the type of international transfer.

Note: Not all MoneyGram services are available in every country. Some regions may not have access to instant transfer options or the MoneyGram app. Users should always check the MoneyGram website or contact customer support to confirm which services are available for their chosen destination.

Transfer Limits

MoneyGram sets transfer limits to follow financial regulations and keep transactions safe. For most countries, the maximum amount for an online international transfer is 10,000 USD per transaction. Users can also send up to 10,000 USD within any 30-day period. Some countries have lower limits. For example, Chile has a 5,000 USD limit for international transfers. These limits help MoneyGram meet anti-money laundering rules and other legal requirements.

- MoneyGram may ask for extra documents if someone sends a large amount.

- The sender might need to explain the source and purpose of the funds.

- Recipients may need to show more identification for large transfers.

- Transfers can take longer if they need extra security checks.

People who want to send more than the online limit can visit a MoneyGram agent location. Some agents allow higher transfer amounts, depending on the country and payment method. MoneyGram’s limits and rules help protect users and support safe international money movement.

Safety and Comparison

Security Features

MoneyGram uses several security features to protect customer transactions and data. The company applies advanced encryption technology, such as SSL encryption, to secure data during transfers. The mobile app includes strong security measures like data encryption, fraud prevention tools, and two-factor authentication. Users can track transactions in real time for extra peace of mind. MoneyGram also monitors transactions for suspicious activity and encourages customers to report anything unusual. The company offers a money-back guarantee if problems occur during a transfer. Customers can customize security settings, including enabling two-factor authentication and setting security questions. MoneyGram works with cybersecurity firms to improve its defenses and responds quickly to any security breaches. The company educates users about online safety and recommends using strong passwords and avoiding public Wi-Fi when sending money.

Note: In late September, MoneyGram experienced a cyberattack that exposed sensitive customer data. The company responded by notifying affected users and continues to update its security measures.

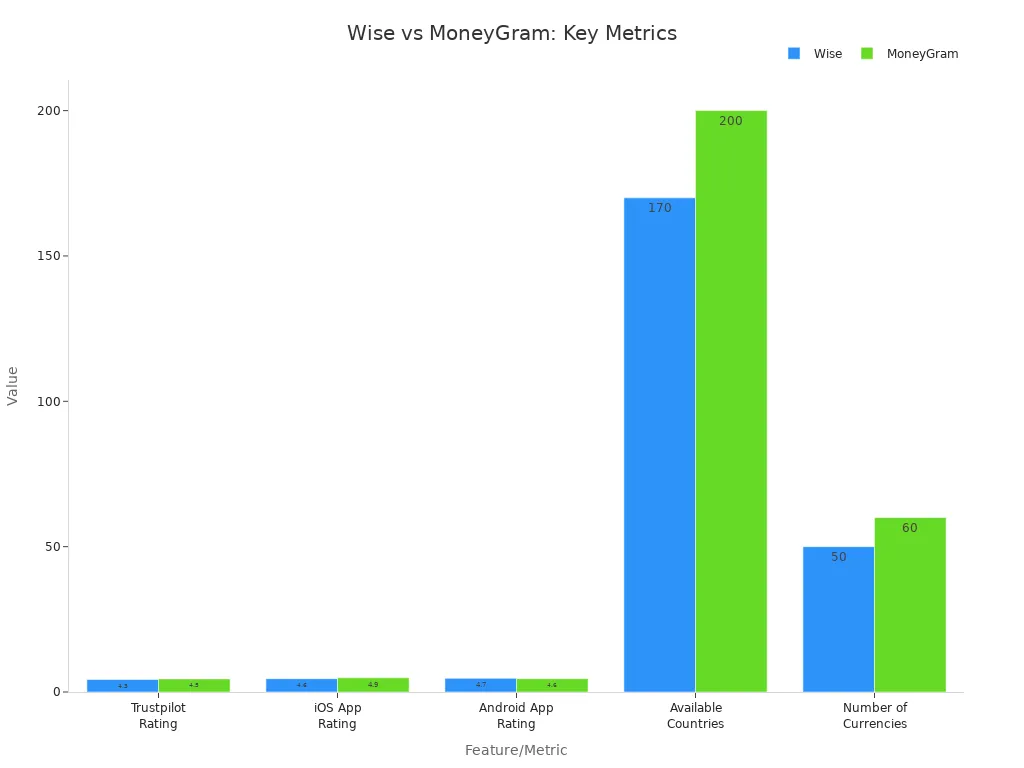

MoneyGram vs Other Money Transfer Services

MoneyGram competes with Western Union and Wise in the global money transfer market. The table below compares key features:

| Aspect | Western Union | MoneyGram | Wise (TransferWise) |

|---|---|---|---|

| Fees | Often high, especially for fast cash transfers | Variable, sometimes more competitive | Low and transparent |

| Speed | Minutes for cash, up to 7 days for bank deposit | Minutes for cash, 1-3 days for bank transfer | 0-2 days, often minutes |

| Global Reach | 500,000+ agent locations, 200+ countries | 430,000+ agent locations, 200+ countries | 170 countries, no physical agents |

| Exchange Rate | Adds margin | Adds margin | Uses mid-market rate |

| Cash Pickup | Yes | Yes | No |

MoneyGram stands out for its large agent network and cash pickup options. Wise offers better exchange rates and a digital-first experience, but does not support cash pickup. Western Union has the largest global reach, especially in remote areas.

When to Use MoneyGram

MoneyGram works best for people who need to send money quickly to locations where banking services are limited. The service is helpful when recipients need to collect cash in person. MoneyGram’s wide network supports users in over 200 countries. The table below summarizes the main pros and cons:

| Pros | Cons |

|---|---|

| Large global presence and many agent locations | Fees and exchange rates can be high |

| Multiple sending and receiving options | Cash pickup limited to agent working hours |

| Supports cash pickup, bank deposit, and mobile wallet | Not always the cheapest or fastest for bank transfers |

| Fast cash transfers for emergencies | Risk of scams if sending to unknown recipients |

People should use MoneyGram when speed and cash pickup matter most. Users must stay alert to scams and only send money to trusted recipients.

MoneyGram offers a wide network, fast transfers, and flexible ways to send money. The company supports over 200 countries and provides cash pickup, bank, and card options. Many users rate MoneyGram highly for reliability and ease of use, as shown below:

| Aspect | Details |

|---|---|

| Trustpilot Rating | 4.5/5 |

| Global Coverage | 200+ countries, 58 currencies |

| Fast Transfers | Minutes for most cash pickups |

People often choose MoneyGram to send money quickly, especially where cash pickup is needed. Before choosing a service, users should compare fees, speed, and customer support to find the best way to send money.

FAQ

How long does a MoneyGram transfer take?

Most MoneyGram transfers arrive within minutes. Some bank deposits may take up to one business day. Delays can happen due to holidays, incorrect details, or extra security checks.

What documents does MoneyGram require to send money?

MoneyGram asks for a valid government-issued photo ID, such as a passport or driver’s license. Some transfers may need extra documents, especially for large amounts or certain countries.

Can someone cancel a MoneyGram transfer?

Yes. MoneyGram allows cancellations if the money has not been picked up or deposited. The sender can request a refund online, by phone, or at an agent location.

What should a recipient do if they do not receive money?

The recipient should check the transfer status using the reference number. If there is a problem, contact MoneyGram customer support for help. Always confirm the recipient’s name and details match the transfer record.

MoneyGram is a trusted name for global money transfers, but users often face high fees, exchange rate markups, and delays tied to agent hours. If you want the same global reach with greater transparency and lower costs, there’s a better option.

With BiyaPay, you enjoy real-time exchange rates, transfer fees as low as 0.5%, and support for both fiat and digital currencies. Unlike traditional providers, BiyaPay ensures that your money moves fast — often delivered the same day across most countries. Whether you’re sending funds to family, managing overseas bills, or paying globally, BiyaPay gives you speed, savings, and reliability in one platform.

Start sending smarter today — register with BiyaPay and experience a new era of international transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.