- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Zelle vs Venmo A Side by Side Comparison for 2025

Image Source: pexels

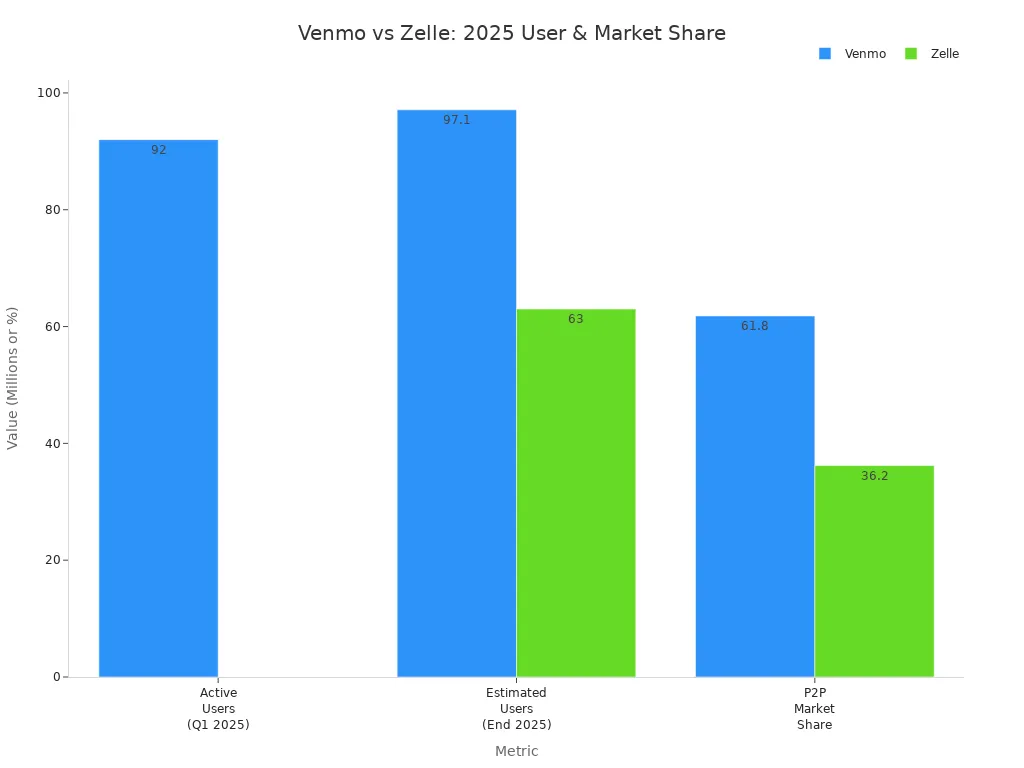

When you compare zelle vs venmo in 2025, you notice some clear key differences. Zelle works best if you want instant transfers between bank accounts with no fees. Venmo stands out if you like using a payment app with social features, a digital wallet, and flexible ways to pay. If you care about money transfer speed, security, or fees, both apps offer strong options, but each fits different needs. Check out the chart below to see how many people use each payment app:

Key Takeaways

- Zelle offers instant, fee-free bank-to-bank transfers and works inside many bank apps, making it ideal for fast, simple payments to trusted contacts.

- Venmo provides a digital wallet with social features, flexible payment options, and business profiles, perfect for sharing payments and small business use.

- Zelle payments are usually instant and final, so always double-check recipient details to avoid mistakes that cannot be reversed.

- Venmo charges fees for instant transfers and credit card payments but lets you send money for free with standard transfers that take 1-3 days.

- Choose Zelle for quick, private transfers with strong bank-level security; choose Venmo if you want social sharing, a digital wallet, and more payment flexibility.

Zelle vs Venmo: Key Differences

Image Source: unsplash

Comparison Table

When you look at zelle vs venmo, you see some clear key differences. Both apps help you send money, but they work in different ways. Here’s a quick table to help you compare the main features:

| Feature | Zelle | Venmo |

|---|---|---|

| Money Transfer Speed | Instant between enrolled users; 1-3 days for others | Instant with a fee; 1-3 days for free standard transfers |

| Fees | No fees from Zelle; some banks may charge | Free standard transfers; 1.75% fee for instant transfers |

| Digital Wallet | No digital wallet; no balance to hold | Full digital wallet; keep a balance; buy/sell cryptocurrency; Venmo Mastercard Debit Card |

| Bank Integration | Built into 2,200+ banking apps; direct bank-to-bank transfers | Standalone app; links to bank accounts and cards |

| Social Features | None | Social feed with notes, emojis, and comments |

| Payment Options | Send and receive with US bank accounts only | Pay with balance, bank, or card; supports QR codes and online checkout |

| Business Use | Limited; some banks allow business payments | Venmo for Business profiles; easy for small businesses and side gigs |

Note: Neither zelle nor venmo supports international transfers. You can only use them within the United States.

Let’s break down the key differences for 2025 so you can decide which app fits your needs.

- Speed: Zelle sends money instantly if both you and the other person use a bank that supports it. If not, it can take up to three days. Venmo money transfer speed is fast if you pay a fee, but free transfers take one to three days.

- Fees: Zelle does not charge fees, but your bank might. Venmo lets you send money for free if you wait, but charges 1.75% for instant transfers.

- Digital Wallet: Zelle does not let you keep a balance. Money goes straight to your bank. Venmo acts like a digital wallet. You can keep money in your account, use a Venmo card, or even buy cryptocurrency.

- Bank Integration: Zelle works inside many banking apps, including some Hong Kong banks that operate in the US. You do not need a separate app if your bank supports Zelle. Venmo is a standalone app. You link your bank or card to use it.

- Social Features: Zelle keeps things private. Venmo adds a social feed. You can add notes, emojis, and see what your friends are paying for (if they share it).

- Payment Options: Zelle only works with US bank accounts. Venmo gives you more ways to pay, like using your balance, bank, or card. You can also pay businesses with QR codes.

- Business Use: Zelle is mostly for personal payments. Some banks let small businesses use it, but features are limited. Venmo offers business profiles. It is popular for side gigs, small shops, and freelancers.

If you want fast, free transfers straight to your bank, Zelle is a strong choice. If you like holding a balance, using a digital wallet, or sharing payments with friends, Venmo stands out. The key differences come down to how you want to send money, what features you need, and if you care about social sharing.

Zelle Overview

How Zelle Works

If you want to send money fast, Zelle makes it simple. In 2025, you can only use Zelle through your bank or credit union’s app or online banking. The standalone Zelle app is gone, so you need to check if your bank supports Zelle. Over 2,200 banks and credit unions, including many Hong Kong banks with U.S. branches, support Zelle. You can check your bank’s website or visit Zelle’s enrollment page to see if you’re covered.

Here’s how you use Zelle for p2p payment and peer-to-peer transactions:

- Enroll in Zelle through your bank’s app or online banking.

- Add your email or U.S. mobile number.

- Choose the account you want to use for Zelle transfers.

- Send money to someone you trust by entering their email or mobile number.

- Double-check the recipient’s info before you hit send. Zelle payments are instant and can’t be reversed.

Zelle works best for peer-to-peer payments between people who already know each other. You can use Zelle for splitting bills, paying rent, or sending money to family. Since Zelle is built into your bank’s app, you don’t need to download another payment app. Zelle is a top choice for p2p transfers if you want speed and simplicity.

Note: Zelle only works with U.S. bank accounts and U.S. dollars. You can’t use Zelle for international transfers or with credit/debit cards.

Zelle Pros & Cons

Let’s look at the main advantages and disadvantages of using Zelle for p2p and business payments:

| Pros | Cons |

|---|---|

| Instant transfers between bank accounts | Only works with U.S. bank accounts |

| No fees from Zelle itself | No international payments |

| Easy to use inside your bank’s app | Can’t use credit or debit cards |

| No need to keep a balance or use a separate payment app | Payments are final and can’t be canceled or reversed |

| Great for peer-to-peer payments and splitting bills | No purchase protection or dispute resolution |

| Detailed digital records for tracking peer-to-peer payments | Transaction limits set by your bank |

| Improves cash flow for small businesses | Some banks may not support Zelle for business |

| Contactless, quick, and convenient | Security risks like phishing and scams require extra caution |

Zelle gives you fast, easy p2p payments, but you need to use it carefully. Always send money to people you trust, since Zelle payments are instant and final. If you run a small business, Zelle can help with quick payments, but you won’t get features like invoicing or purchase protection. For most peer-to-peer needs, Zelle is a strong choice if you want speed and no extra fees.

Venmo Overview

Image Source: unsplash

How Venmo Works

Venmo makes sending and receiving money simple and quick. You just open the Venmo app, log in, and enter the username of the person you want to pay. Type in the amount, add a note if you want, and hit send. Transfers often finish in seconds, but you can also schedule them for later. Venmo supports p2p payment and peer-to-peer transactions, so you can split bills, pay friends, or even shop online.

In 2025, Venmo connects with over 2 million merchants in the United States. You can pay for rides with Uber or order food from Grubhub right in the app. Venmo also gives you a debit card linked to your Venmo balance. You can use this card anywhere Mastercard is accepted, which means you can shop in stores or withdraw cash from ATMs. Venmo focuses on security, using encryption, multi-factor authentication, and even fingerprint or face ID to keep your money safe. You should always double-check the recipient’s details before sending money. Venmo is a payment app that works best for people who want fast, easy, and secure p2p payments.

Note: Venmo only works in the United States. It is not a full replacement for a bank account, but it is great for peer-to-peer payments and shopping with trusted merchants.

Venmo Pros & Cons

Venmo has many features that make it popular for both personal and business use. Here’s a quick look at the main advantages and disadvantages:

| Pros for Personal Use | Cons for Personal Use |

|---|---|

| Free for peer-to-peer payments | Payments can’t be canceled once sent |

| Fast and convenient for p2p transfers | No international transactions |

| Security backed by PayPal | Social feed may expose your transactions |

| Easy to split bills and share costs | Using for business can risk account termination |

| Pros for Business Use | Cons for Business Use |

|---|---|

| Contactless payments with QR codes | Customers must have Venmo accounts |

| Low fees (1.9% + $0.10 per transaction) | No built-in gratuity or business tools |

| Appeals to younger, tech-savvy customers | Transfer limits restrict high-volume transactions |

| Simple account switching | Limited branding and customization |

Venmo stands out for its social features and ease of use. You can see what your friends are paying for, add emojis, and make p2p payments feel fun. For small businesses, Venmo offers a simple way to accept payments, but it works best for low-volume sales. If you want a flexible, social, and secure way to handle peer-to-peer payments, Venmo is a top choice.

Money Transfer Speed

Zelle Speed

When you use Zelle, you get one of the fastest ways to move money between bank accounts. Zelle transfers usually arrive in your bank account within minutes. This quick money transfer speed happens because Zelle connects directly with over 2,200 banks, including many Hong Kong banks that operate in the United States. If both you and the person you are paying have accounts at banks that support Zelle, the transaction speed is almost instant.

Here are some things you should know about Zelle speed:

- Zelle transfers are typically instant, so you do not have to wait for your money.

- The exact timing depends on your bank’s policies, but most users see funds in their account within minutes.

- You do not need to keep a balance in a separate app. Zelle sends money straight to your bank account.

- Zelle does not charge fees for instant transfers, which makes it a great choice if you want to avoid extra costs.

Tip: Always double-check the recipient’s details before sending money with Zelle. Once you send it, you cannot reverse the payment.

Venmo Speed

Venmo gives you more options, but the venmo money transfer speed depends on how you move your funds. If you want instant transfers from your Venmo balance to your bank account or debit card, you can get your money in about 30 minutes. However, Venmo charges a 1.5% fee for this service (minimum $0.25, maximum $10 USD see exchange rates). If you choose the free option, standard bank transfers take one to three business days.

Let’s break down how Venmo works for money transfer speed:

- Standard transfers to your bank are free but take 1-3 business days.

- Instant transfers post right away or within 30 minutes, but you pay a small fee.

- Transfers made after hours, on weekends, or during holidays may take longer.

- Venmo acts as a digital wallet, so you can keep a balance and pay friends or businesses anytime.

If you need your money fast, Venmo’s instant transfers help you get funds quickly, but you pay for the speed. For most people, waiting a few days for a free transfer works fine. Venmo gives you flexibility, but Zelle still wins for pure transaction speed.

| Factor | Zelle | Venmo |

|---|---|---|

| Transfer Speed | Usually instant | Standard: 1-3 business days |

| Instant: within 30 minutes | ||

| Fees | Free | Standard: free |

| Instant: 1.5% fee (min $0.25, max $10) | ||

| Timing Impact | Usually instant, even after hours | Delays after hours, weekends, holidays |

| Account Requirements | Linked bank account, enrollment | Linked bank account, enrollment |

Fees

Zelle Fees

When you use zelle, you usually do not have to worry about extra fees. Most banks that support zelle let you send and receive money for free. You can send money to friends, family, or even some small businesses without paying any transaction fees. This makes zelle a great choice if you want to avoid extra costs. Some banks, including a few Hong Kong banks with U.S. branches, might have their own policies, so it is smart to check with your bank first. You will not find hidden fees from zelle itself, but always read your bank’s terms to make sure you know about any possible charges.

Here is a quick look at the current fees for zelle and venmo in 2025:

| Service | Sending Fee | Receiving Fee | Withdrawal Fee |

|---|---|---|---|

| Zelle | No fee (some banks may charge fees based on their policies) | No fee | N/A (not specified) |

| Venmo | No fee for personal transactions funded by bank account or Venmo balance; fees apply for credit card payments | No fee | Fees apply for instant transfers; standard withdrawal fees not detailed |

You do not pay payment reception fees when you get money through zelle. The money goes straight to your bank account. There are no transfer fees or hidden fees from zelle, so you can send money with peace of mind.

Venmo Fees

Venmo gives you more ways to pay, but you need to watch out for venmo fees. If you send money using your bank account or your venmo balance, you do not pay any fees. This keeps the cost low for most users. If you use a credit card, venmo charges a 3% fee for each payment. Instant transfers from your venmo balance to your bank account come with a 1.75% fee (minimum $0.25, maximum $10 USD see exchange rates). Standard withdrawals to your bank are free, but they take longer.

Venmo does not charge payment reception fees, so you get the full amount when someone sends you money. Still, you should always check for hidden fees, especially if you use features like instant transfer or pay with a credit card. Venmo fees can add up if you use these options often. Always review the venmo fees page in the app to stay updated on any changes.

Tip: If you want to avoid extra cost, use your bank account or venmo balance for payments and choose standard withdrawals.

Security

Zelle Security

You might wonder, is zelle safe? Zelle uses bank-level security to protect your money and personal information. When you use zelle through your bank, you get the same security measures that protect your regular bank account. Here’s what you can expect:

- Zelle uses strong encryption to keep your data private.

- You must verify your identity before sending money.

- Zelle investigates scams on a case-by-case basis and reimburses 100% for unauthorized transactions if you did not send the money.

- If someone pretends to be a trusted person or company, zelle will fully reimburse you for those scams.

- Your bank may add extra security steps, like two-factor authentication, especially for large transfers.

Even with these protections, you should always double-check the recipient’s details. Criminals sometimes trick people into sending money to the wrong account. Some thieves steal unlocked phones and change security settings to drain accounts quickly. Zelle’s instant transfers make it easy for scammers to move money fast. Some banks, including Hong Kong banks with U.S. branches, may not always notify you about transfers, which can make you more vulnerable. Always keep your device locked and never share your login details. Zelle safe practices mean sending money only to people you trust.

Venmo Security

You may ask, is venmo safe? Venmo also takes security seriously. The app uses several security measures to protect your account:

- Venmo uses 24/7 fraud monitoring and advanced encryption.

- The app uses machine learning to spot scams and block risky transactions.

- Venmo enforces a zero-tolerance policy for fraud.

- You get full reimbursement for unauthorized transactions.

- Venmo offers Purchase Protection for eligible payments, which covers some authorized fraudulent purchases.

Venmo safe habits include using fingerprint or face ID to lock your app. You should only send money to people you know and always check the recipient’s username. Some criminals use social engineering tricks, like pretending to be your friend or asking for your phone. There have been reports of thieves targeting venmo users, even robbing people to access their accounts. Large-scale data breaches have exposed user information in the past, so always update your passwords and watch for suspicious activity. Consumer Reports suggests using multi-factor authentication for big payments and recommends holding periods for large transfers. Venmo continues to improve its security, but you play a big part in keeping your money safe.

Reversibility

Canceling Payments

When you send money with zelle or venmo, you might wonder if you can cancel the payment. The answer depends on which app you use and the status of your transaction. Here’s a quick table to help you see the main differences:

| Aspect | Zelle | Venmo |

|---|---|---|

| Payment Finality | Instant and usually irreversible | Irreversible once accepted by recipient |

| Cancellation Policy | Only possible if recipient not enrolled in zelle | Only possible if payment is still pending |

| Reversibility | Rare, mostly in fraud cases | Limited, difficult, sometimes possible in disputes |

If you use zelle, your payment goes through almost instantly. You cannot cancel it once the other person is enrolled. If the person you sent money to has not signed up for zelle yet, you can cancel the payment before they enroll. With venmo, you can only cancel a payment if it is still pending. Once the recipient accepts the money, you cannot take it back. Both apps make it hard to reverse payments, so always double-check the details before you hit send.

Tip: Always confirm the recipient’s information before sending money with zelle or venmo. This helps you avoid mistakes that are hard to fix.

Handling Errors

Mistakes can happen when you send money. Maybe you typed the wrong amount or sent money to the wrong person. Each app has its own way of handling these errors.

- If you use venmo, you can file a dispute directly in the app. Venmo will look into your case and may reverse the transaction if they find a valid reason. If you paid with a card, you can also ask your bank for a chargeback. Venmo gives merchants a chance to respond and offers purchase protection for some payments.

- With zelle, things work differently. Once you send money to someone enrolled in zelle, you cannot dispute the payment. There is no chargeback process. You can only cancel if the recipient has not enrolled yet. If someone takes your money without permission, you might get help under Regulation E, which protects electronic transfers. Still, zelle’s user agreement says you cannot dispute payments you approved.

Both zelle and venmo offer limited ways to fix mistakes. You need to be careful and only send money to people you trust. If you make an error, contact your bank or the app’s support team right away.

Business Use

Zelle for Business

If you want to use zelle for business payments, you need to check if your bank supports this feature. Many banks, including some Hong Kong banks with U.S. branches, now let small businesses accept payments through zelle. You can send and receive money quickly, and the funds go straight to your business bank account. Zelle does not charge fees for standard transactions, but your bank might have its own rules. Always ask your bank about any possible charges.

Here are some important things to know about using zelle for business payments:

- Zelle only supports bank-to-bank transfers. You cannot use cards or digital wallets.

- Transaction limits depend on your bank. For example, Bank of America lets you send up to $15,000 per day, while Wells Fargo sets a $3,500 daily limit.

- Zelle does not issue 1099-K forms because it is not a payment settlement entity. However, you still need to report all taxable income to the IRS.

- You must classify payments correctly as personal or business to avoid tax problems.

Note: Even if you do not get a 1099-K from zelle, you must report all business payments to the IRS. The IRS can audit you if you do not report your income.

Venmo for Business

Venmo makes it easy for you to accept business payments, especially if you run a small shop or freelance. You can set up a Venmo for Business profile and start taking payments from customers right away. Venmo supports many payment methods, including bank accounts, cards, and Venmo balance. You can even use QR codes for quick checkouts.

Here is a table comparing key features for business payments:

| Aspect | Zelle | Venmo |

|---|---|---|

| Fees | No fees for standard transactions (bank may charge) | 1.9% + $0.10 per in-app transaction; 3.49% + $0.49 for online checkout; instant transfer fee 1.75% (see exchange rates) |

| Payment Methods | Bank-to-bank transfers only | Venmo balance, bank accounts, credit/debit/prepaid cards, QR codes |

| Transaction Limits | Bank-specific (e.g., $15,000/day at Bank of America) | Verified: up to $24,999.99 weekly; unverified: $2,499.99 weekly |

| Security | Bank-level security, FDIC-insured funds | PayPal-level security, seller protection |

Venmo must issue a 1099-K form if your business payments go over $2,500 in 2025. The IRS will get a copy, so you need to keep good records. If you use venmo for business, always mark your payments as business-related. This helps you avoid tax mistakes and possible penalties.

Tip: Always report all business payments you receive through venmo or zelle, even if you do not get a tax form. The IRS tracks these payments closely.

App Features

Usability

When you look at usability, you want an app that feels easy and quick. Zelle keeps things simple. You use it inside your bank’s app, so you do not need to download anything extra. Many Hong Kong banks in the United States support zelle, which makes it easy to find. You just log in, pick zelle, and send money. The design focuses on fast, fee-free transfers. You do not see extra buttons or features that might confuse you.

Venmo takes a different approach. The app looks and feels like a social media platform. You see a feed, big buttons, and a clean layout. Venmo works on both iOS and Android. You can use your balance, link cards, or even try out crypto transactions. Some users say group payments are hard to find. You might wish for a big “split a bill” button right on the home screen. Venmo has listened to feedback and keeps improving its design. If you need help, venmo offers live chat, an in-app help center, and email support.

Here’s a quick table to compare usability features:

| Feature | Zelle | Venmo |

|---|---|---|

| Interface Design | Inside many bank apps, no extra download needed | Simple, user-focused, with a social feed |

| Accessibility | Embedded in bank apps, easy to access | On iOS and Android, supports wallet, cards, crypto |

| Customer Support | Not detailed | Live chat, help center, email |

| Unique Features | Instant bank-to-bank transfers, often zero fees | Social feed, business profiles, group payments (some hidden) |

| Usability Focus | Seamless bank integration, fast transfers | Social and fintech features, user-friendly, supports freelancers and small sellers |

Social Features

Venmo stands out for its social features. When you pay someone, you can add a note, emoji, or even make the payment public. If you allow sharing, your friends can see your transactions in a feed. They can like or comment, which makes paying for pizza or splitting a ride feel fun. This social feed turns peer-to-peer payments into a shared experience. You can choose to keep things private, share with friends, or let everyone see.

Zelle does not offer any social features. You use zelle for fast, secure transfers. There is no feed, no comments, and no sharing. If you want privacy and speed, zelle fits your needs. If you enjoy seeing what your friends are up to or want to make p2p payments more interactive, venmo is the better choice.

Both services help you send money, but they feel very different. Zelle focuses on simple, secure transfers. Venmo adds a social layer that makes payments more engaging, especially for younger users who like to share.

Limitations

Sending & Receiving Limits

You might wonder how much money you can send or receive with zelle and venmo. Each app sets its own rules, and you need to know these before you start moving money. Zelle does not have one set limit for everyone. Your bank or credit union decides how much you can send or receive. Some banks, like those in Hong Kong with U.S. branches, may let you send thousands of dollars each day, while others set lower limits. Always check with your bank to see your exact numbers.

Starting January 8, 2025, zelle will stop accepting new users. If you already use zelle, you can keep sending and receiving money until March 31, 2025. After that, you will need to find another way to transfer money. This change affects all banks and apps that use zelle.

Venmo uses rolling weekly limits. If you have not verified your identity, you can send up to about $299.99 per week. Once you verify your account, your limit jumps to $4,999.99 for person-to-person payments. If you use venmo for business or with the venmo card, your combined limit is $6,999.99 per week. You can also add up to $1,500 from your bank account each week. These limits reset one week after each transaction.

Tip: Always check your app or bank for the latest limits. Rules can change, and you do not want your payment to get blocked.

Supported Banks & Cards

Zelle works by moving money straight from one bank account to another. You need a bank account or debit card linked to a bank or credit union that supports zelle. Most prepaid cards do not work with zelle. Only a few, like the Wells Fargo EasyPay Card or the Access 360° card from Fifth Third Bank, are accepted. If you try to use a prepaid card from a non-partner bank, like Netspend, Chime, Green Dot, or Cash App, you will get an error. Zelle does not work with most prepaid cards because they often lack the security and account checks banks require.

Venmo lets you link many types of accounts, but the details about which banks or cards work best are not always clear. You can usually connect your bank account, debit card, or credit card to venmo. Some users find that certain prepaid cards do not work, so you may need to try a few options. Venmo does not require your bank to be part of a special network, which gives you more flexibility.

Note: If you use a Hong Kong bank with a U.S. branch, check if it supports zelle. Venmo usually works with most U.S. banks, but always test your card or account first.

Zelle vs Venmo: Transfers Between Apps

Direct Transfers

You might wonder if you can send money straight from zelle to venmo or the other way around. Right now, you cannot transfer funds directly between these two apps. Zelle and venmo work on separate networks. Zelle sends money from one bank account to another, while venmo lets you move money between venmo accounts or from your venmo balance to your bank. These systems do not connect, so you cannot just type in a venmo username in zelle or vice versa.

If you try to send money from zelle to someone’s venmo account, the payment will not go through. Both apps require the sender and receiver to use the same platform. Zelle needs both people to have bank accounts that support zelle. Venmo needs both users to have venmo accounts. This setup keeps things simple but also means you cannot move money directly between the two.

Workarounds

Even though you cannot make direct transfers, you do have a few options if you need to move money between zelle and venmo. Here is how you can do it:

- Bank Account Bridge:

- First, send money from zelle to your own bank account.

- Next, link that same bank account to your venmo account.

- Then, transfer the money from your bank to venmo.

- Ask a Friend:

- If you trust someone, you can send them money with zelle.

- They can then send you the same amount back using venmo.

Note: These workarounds take extra steps and time. You may face delays, especially if your bank holds funds before releasing them to venmo. Also, moving money this way can get confusing if you do not keep track of each step.

Here is a quick table to show the main points:

| Method | Possible? | Risks or Limits |

|---|---|---|

| Direct Transfer | No | Not supported by either app |

| Bank Account Bridge | Yes | Takes extra time; possible bank transfer delays |

| Friend as Middleman | Yes | Trust needed; risk of mistakes or miscommunication |

Neither zelle nor venmo offers a built-in way to move money between the two. You should also know that using these apps for business payments can bring risks, like payment errors or policy violations. Always double-check your steps and only use these workarounds with people you trust.

Best Use Cases

Instant Transfers

If you need your money to move fast, you want instant transfers. Zelle is your best choice here. When you send money with zelle, it usually lands in the other person’s bank account within minutes. You do not have to wait or pay extra fees. This works well if you and the other person both use banks that support zelle. Venmo can also send money quickly, but you might have to pay a fee for instant transfers. If you do not mind waiting a day or two, venmo offers free standard transfers.

| Feature | Zelle | Venmo |

|---|---|---|

| Speed | Instant (bank-to-bank) | Instant (with fee) or 1-3 days (free) |

| Fees | No fees (usually) | 1.75% fee for instant transfers |

| Best For | Trusted contacts, emergencies | Social payments, flexibility |

Tip: Use zelle for instant transfers when you need money to arrive right away and want to avoid fees.

Splitting Bills

Venmo shines when you want to split bills with friends. You can add notes, emojis, and even see a feed of who paid for what. This makes it easy to keep track of shared expenses, like dinner or rent. Zelle can also help you split bills, but it does not have social features. You just send money to someone’s email or phone number. If you like seeing payment details and sharing with friends, venmo is the better pick.

- Venmo lets you:

- Split bills with groups

- Add fun notes and emojis

- See a social feed of payments

- Zelle keeps things simple:

- No social feed

- Direct transfers to bank accounts

Business Payments

If you run a small business or do freelance work, venmo gives you more options. You can set up a business profile, accept payments with QR codes, and even use your venmo balance with a debit card. Venmo’s social feed can help you get noticed by new customers. Zelle supports business payments at some banks, but you do not get marketing tools or a business profile. When to use zelle for business? Choose it if you want fast, fee-free transfers straight to your bank and do not need extra features.

| Aspect | Zelle | Venmo |

|---|---|---|

| Business Profiles | Not available | Available |

| Marketing Tools | None | Social feed, QR codes |

| Fees | Usually free | 1.9% + $0.10 per transaction |

Security & Privacy

You want your money and information to stay safe. Zelle uses your bank’s security, so your transfers get strong protection. Your details stay private because zelle does not have a social feed. Venmo uses encryption and offers PINs and biometric locks, but your payments can show up in a public feed unless you change your privacy settings. If you care about privacy, zelle is the safer pick. If you use venmo, remember to set your payments to private.

- Zelle:

- Bank-level security

- No public transaction feed

- Good for large, trusted transfers

- Venmo:

- Encryption, PINs, biometrics

- Social feed (adjust privacy settings)

- Good for social payments and small business

Choosing between zelle and venmo depends on what you want most. If you need fast, fee-free bank transfers, zelle fits you best. Many users trust zelle for its strong security and simple bank integration. If you enjoy sharing payments with friends or want more ways to pay, venmo stands out. Venmo’s social feed and balance features attract younger users, but you should watch for privacy settings and fees. Think about your habits and pick the app that matches your style.

FAQ

Can you use Zelle or Venmo outside the United States?

No, you cannot use Zelle or Venmo for international transfers. Both apps only work with U.S. bank accounts. If you need to send money abroad, you should look for other services.

What happens if you send money to the wrong person?

If you use Zelle, you usually cannot get your money back. Venmo lets you request a return, but the other person must agree. Always double-check the recipient’s details before sending any payment.

Do Zelle or Venmo offer buyer protection?

Venmo offers limited purchase protection for eligible transactions. Zelle does not provide buyer protection. You should only use these apps to pay people you trust.

Can you use a Hong Kong bank account with Zelle or Venmo?

You can use Zelle if your Hong Kong bank has a U.S. branch that supports Zelle. Venmo works with most U.S. banks, but not with international accounts. Always check with your bank for compatibility.

Are there limits on how much money you can send?

Yes, both apps have limits. Zelle limits depend on your bank. Venmo sets weekly limits based on your account verification status. You can check the latest limits in each app’s settings.

While Zelle and Venmo are great for domestic payments in the U.S., neither helps when you need to send money abroad. For freelancers working cross-border, students supporting family overseas, or businesses paying partners globally, the gap is clear: you need a smarter solution.

That’s where BiyaPay comes in. With BiyaPay, you get real-time exchange rates, transfer fees as low as 0.5%, and seamless fiat-to-crypto conversions. Even better, BiyaPay supports same-day settlement in most countries worldwide, so your money reaches where it’s needed without the delays or high costs of traditional apps.

Don’t limit yourself to U.S.-only transfers. Register with BiyaPay today and unlock truly global payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.