- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to send money from Wise to Wise

Image Source: pexels

If you want to send money with Wise, you have several easy ways. You can use the recipient’s email, phone number, or pay a Wise request. Wise to Wise transfer is fast and secure, often finishing in just minutes. Most same-currency transfers are free, and you usually see the money in the Wise account almost right away. Wise uses strong security, like two-factor authentication and bank-level encryption, to keep your Wise account safe. If you need to know how to use Wise to transfer money internationally or how does Wise work, you will find Wise simple for sending money to any Wise account.

Key Takeaways

- Wise lets you send money quickly and safely using a phone number, email, or payment request.

- Most same-currency transfers between Wise accounts are free and arrive instantly.

- If the recipient does not have a Wise account, they can sign up or receive money directly to their bank.

- Always double-check recipient details before sending to avoid mistakes and lost money.

- Wise shows all fees and exchange rates upfront, so you know the exact cost before confirming.

Wise to Wise Transfer

Image Source: unsplash

When you want to send money between Wise accounts, you have three main options. You can use the recipient’s phone number, their email address, or pay a Wise payment request. Each method makes it simple to transfer money, whether you want to send to other Wise accounts or help someone receive money for the first time. Here’s a quick look at how these methods compare:

| Method | Description | User Experience Differences |

|---|---|---|

| Sending via Phone Number | Enter the recipient’s phone number in the Wise app or website, choose the currency and amount, add a note if you want, and confirm the transfer. | Fast and easy. If the recipient has a Wise account, the transfer is instant and free for same-currency transfers. You see the price before you confirm. |

| Sending via Email Address | Works like the phone number method. If the recipient does not have a Wise account, they get an email invite to sign up. Wise holds the money until they join or returns it after a week. | Smooth if the recipient already uses Wise. If not, you might wait for them to sign up. Once they do, the money goes straight into their Wise account. |

| Wise Payment Requests | The recipient creates a payment request link and sends it to you. You approve and pay through Wise or by bank transfer. | Adds a step for approval. No fee for same-currency payments. Low fees for currency conversion. Recipient must approve and pay. |

Wise always aims for speed, transparency, and low fees. Most same-currency transfers between Wise accounts are free and show up instantly. If you need to transfer money in a different currency, Wise uses real exchange rates and charges a small fee, usually starting from 0.41% of the amount.

Send Money by Phone

You can send money to any Wise account using just a phone number. Here’s how you do it:

- Open your Wise app or log in on the website.

- Tap “Send Money.”

- Enter the recipient’s phone number.

- Choose the amount and the currency.

- Add a reference or note if you want.

- Review the details and confirm the transfer.

If the recipient already has a Wise account linked to that phone number, they receive money instantly. If they do not have a Wise account, Wise sends them a message with instructions on how to receive money. They can sign up and claim the funds. If they do not sign up within a week, Wise returns the money to your Wise account.

Tip: Always double-check the phone number before you transfer money. If you enter the wrong number, the money might go to someone else’s Wise account.

Transfer Money by Email

You can also transfer money using the recipient’s email address. This method works almost the same as sending by phone:

- Log in to your Wise account.

- Click “Send Money.”

- Enter the recipient’s email address.

- Choose the amount and currency.

- Add a note if you want.

- Review everything and confirm.

If the recipient has a Wise account with that email, they receive money right away. If not, Wise sends them an email with a link to sign up. Once they join, the money appears in their Wise account. If they do not sign up within seven days, Wise returns the money to you.

Note: If the recipient does not want to open a Wise account, they can still receive money. Wise lets them provide their regular bank account details. Wise then transfers the money to their bank, just like a normal international money transfer.

Pay a Wise Request

Sometimes, the person you want to pay will send you a Wise payment request. This is a link they create in their Wise account. Here’s how you pay it:

- Open the payment request link you received.

- Check the amount and any message from the recipient.

- Log in to your Wise account or sign up if you do not have one.

- Choose how you want to pay (Wise balance, bank transfer, or card).

- Confirm the payment.

If you already have a Wise account, the system matches the payment to your account. If you do not, Wise asks you to sign up or lets you pay directly from your bank account. Wise holds the money until the recipient claims it. If they do not claim it within a week, Wise returns the money to you.

Wise recommends you only pay requests from people you know. Always check the reason for the payment and the identity of the person requesting money.

What Happens If the Recipient Does Not Have a Wise Account?

If you send money to someone who does not have a Wise account, Wise helps them receive money in a few ways. They can sign up for a Wise account and claim the funds. If they do not want to join, they can give their regular bank account details. Wise then processes the transfer as a normal bank transfer, so they receive money in their bank account. This makes Wise flexible for both Wise to Wise transfer and for sending money to people who do not use Wise yet.

Security and Compliance

Wise takes your safety seriously. Wise follows strict rules in every country where it operates. Wise uses strong security, like two-factor authentication and bank-level encryption, to protect your Wise account. Wise also follows rules set by the Financial Conduct Authority in the UK and similar agencies in the United States, Hong Kong, and other countries. Wise checks the identity of everyone who sends or receives money. Wise asks for your name, address, date of birth, and sometimes more details, especially for large transfers. Wise does this to stop fraud and keep your money safe.

Fees and Speed

Most Wise to Wise transfers in the same currency are free and instant. If you transfer money in a different currency, Wise charges a small fee and uses the real exchange rate. You always see the fee and the rate before you confirm. Wise makes it easy to compare prices and know exactly how much money the recipient will receive.

If you want to know how to use Wise for international money transfer, just follow the same steps. Wise supports many currencies and countries, including Hong Kong banks. Wise always shows you the exchange rate in USD and the total cost before you send money.

Common Questions

People often ask about how to send money, how to receive money, and how to use Wise for different types of transfers. You can check the status of your transfer, see when the money arrives, and get notifications in your Wise account. If you make a mistake, like sending to the wrong person, Wise can help you cancel or refund the transfer. Wise also lets you manage your recipients, set up repeating transfers, and send money from your Wise balance.

If you ever wonder how does Wise work or how to receive money, Wise makes it simple. You can send money, transfer money, and receive money all in one place. Wise keeps your transfers fast, safe, and low-cost.

Transfer Steps and Requirements

Image Source: unsplash

Choose Recipient

When you want to send money with Wise, you start by choosing who will receive money. Wise makes this step easy. You only need the recipient’s email address or phone number linked to their Wise account. You do not need to ask for full bank details if you are sending to another Wise account.

- You can pick a contact from your list if you have synced your phone contacts.

- If you want to send money to someone new, just type in their email or phone number.

Tip: If you send money to someone who does not have a Wise account yet, Wise will invite them to join so they can receive money.

Enter Amount and Currency

Next, you decide how much money you want to send and which currency you want to use. Wise supports many currencies, but some have special rules. Here is a quick look at some options:

| Currency | Can Send to Business? | Can Receive as Business? | Notes |

|---|---|---|---|

| USD | Yes | Yes | Verification needed |

| AUD | Yes | Yes | Rules depend on country |

| MYR | No | Yes | Only for Malaysia residents |

| CNY | Yes | Yes | Some limits for China |

| INR | No | Yes | Daily limit applies |

You can hold and convert over 40 currencies in your Wise account. Wise always shows you the real exchange rate in USD before you confirm.

Select Payment Method

Now, you choose how to pay for your transfer. Wise gives you several options:

| Payment Method | Pros | Cons |

|---|---|---|

| Wise Balance | Fast and easy | Must have enough funds |

| Bank Transfer | Good for large amounts, lower cost | May take 1-2 business days |

| Credit Card/Apple Pay | Instant, very convenient | Higher fees, possible card charges |

Pick the method that fits your needs. If you want speed, Wise balance or card works best. If you want to save on fees, bank transfer is a good choice.

Review and Confirm

Before you finish, always review your transfer details. This helps you avoid mistakes. Here is what you should check:

- Make sure the recipient’s email or phone number is correct.

- Double-check the amount and currency.

- Look at the payment method and fees.

- Read any notes or references you added.

If you spot an error, fix it before you confirm. Wise lets you track your transfer in your Wise account. If you need to know how to receive money or how to use Wise for different transfers, Wise has clear steps and support.

Always check for unexpected requests. If something looks wrong, stop and ask Wise support for help.

Fees and Processing Time

Same Currency Transfers

When you send money between Wise accounts in the same currency, you usually pay no fee. Wise makes these transfers free and instant for most users. If you use an email or phone number to send money, you do not pay anything extra. Wise also lets you receive money using local bank details for many currencies without a fee. There are a few exceptions, especially if you receive USD by wire transfer. In that case, Wise charges a $4.14 USD fee. If you use ACH to receive USD, you pay nothing.

| Transfer Method | Currency Condition | Fee Description |

|---|---|---|

| Using identifiers (email/phone) | Same currency | No fee; transfers are free |

| Using local bank details | Most currencies | Free to receive |

| Using local bank details | USD by wire transfer | $4.14 USD fee for recipient |

| Using local bank details | USD by ACH transfer | No fee to receive |

Most Wise to Wise transfers in the same currency arrive in seconds. You can check your Wise app to see the money almost right away.

Tip: Always check the transfer method and currency before you send money. This helps you avoid surprise fees.

Currency Conversion

If you need to send money in a different currency, Wise charges a small fee. The fee starts at 0.57% of the amount and can change based on the currency. Wise always shows you the real exchange rate with no hidden markup. Sometimes, you may see a fixed fee, like $7 USD, if you use a wire payment. If you receive a wire into your Wise balance, you might pay a $6.11 USD fee.

| Fee Type | Amount or Range | Notes |

|---|---|---|

| Variable conversion fee | From 0.57% | Depends on currency |

| Fixed fee (wire) | About $7 USD | For some wire payments |

| Receiving wire | About $6.11 USD | For receiving into Wise balance |

You might wonder, how long does a wise to wise transfer take when you convert currencies? Wise uses smart technology to move money fast. About 64% of transfers finish in under 20 seconds. Most transfers (95%) complete in less than 24 hours. The speed depends on the payment method, the amount, and the country.

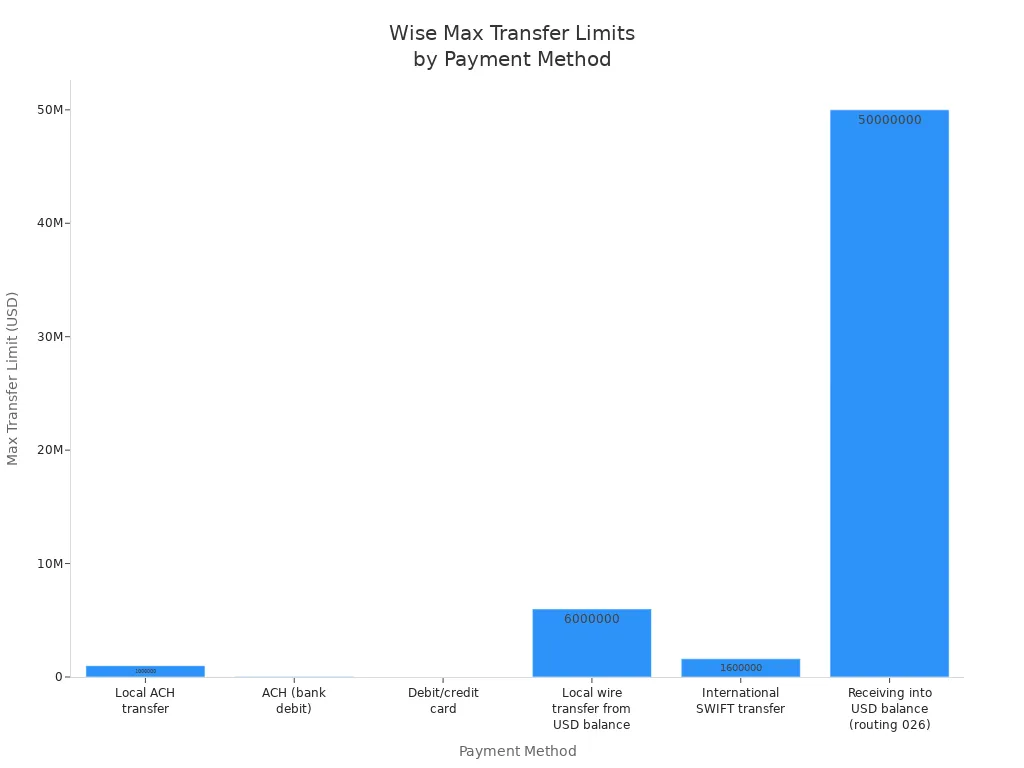

Transfer Limits

Wise sets limits on how much money you can send or receive in one go. The limits depend on your payment method and account type. Here is a quick look at some of the main limits:

| Payment Method / Account Type | Maximum Transfer Limit |

|---|---|

| Local ACH transfer | $1,000,000 USD per transfer |

| ACH (bank debit) | $50,000 USD per 24 hours |

| Debit/credit card | $2,000 USD per 24 hours |

| Local wire transfer from USD balance | $6,000,000 USD per transfer |

| International SWIFT transfer | $1,600,000 USD per transfer |

| Receiving into USD balance (routing 026) | $50,000,000 USD per transfer |

| Receiving into USD balance (routing 084) | No limits |

If you want to send more than the allowed limit, you have a few options:

- Visit your bank in person to request a larger transfer.

- Call your bank to ask for a temporary limit increase.

- Add smaller amounts to your Wise balance over several days, then send the full amount.

- Split your transfer into smaller payments and follow Wise’s instructions.

Note: If you pay in smaller amounts over several days, the exchange rate Wise offers may change before you finish your transfer.

Sending money from your wise account to another wise account is quick and easy. You just pick the recipient, enter the amount, and confirm the details. Wise gives you fast transfers, often within minutes, and you pay no hidden fees for same-currency moves. Wise uses the real exchange rate, so you always know what you pay. To keep your wise account safe, double-check recipient details and make sure you have enough funds. Wise also helps you avoid mistakes by showing clear steps and reminders. If you ever have trouble with your wise account or a wise transfer, you can reach wise support any time. Wise stands out for its transparent fees, strong security, and user-friendly wise account features. Choose the wise method that fits your needs, and enjoy reliable, low-cost transfers every time you use your wise account.

FAQ

How fast does a Wise to Wise transfer arrive?

You usually see the money in your Wise account within seconds. Most transfers finish instantly. Sometimes, it can take a few minutes if Wise needs to check details or if you send a large amount.

Can you cancel a Wise transfer after sending?

You can cancel a Wise transfer if the recipient has not received the money yet. Go to your Wise account, find the transfer, and select “Cancel.” If the money already arrived, you cannot reverse it.

What happens if you send money to the wrong Wise account?

If you send money to the wrong Wise account, contact Wise support right away. Wise may help you recover the funds if the recipient has not withdrawn them. Always double-check recipient details before you send money.

Are there any hidden fees with Wise to Wise transfers?

Wise shows you all fees upfront. Same-currency transfers between Wise accounts are free. If you convert currency, Wise charges a small fee and uses the real exchange rate. You always see the total cost before you confirm.

Can you use Wise to send money to someone without a Wise account?

Yes, you can send money to someone who does not have a Wise account. Wise will invite them to join and claim the funds. If they do not want to join, they can provide their bank details, and Wise will send the money to their bank account.

Sending money between Wise accounts is simple — but what if you need to move funds across borders or between currencies? That’s where BiyaPay gives you the edge. With real-time transparent FX rates, multi-fiat & crypto conversions, and fees starting from just 0.5%, you keep more of your money instead of losing it to hidden markups.

BiyaPay also supports same-day transfers in most countries worldwide, so whether you’re paying overseas vendors, supporting family abroad, or converting crypto into cash, your funds arrive faster and cheaper.

Upgrade your transfer experience today — register now at BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.