- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Can You Trust Stripe with Your Payment Security

Image Source: unsplash

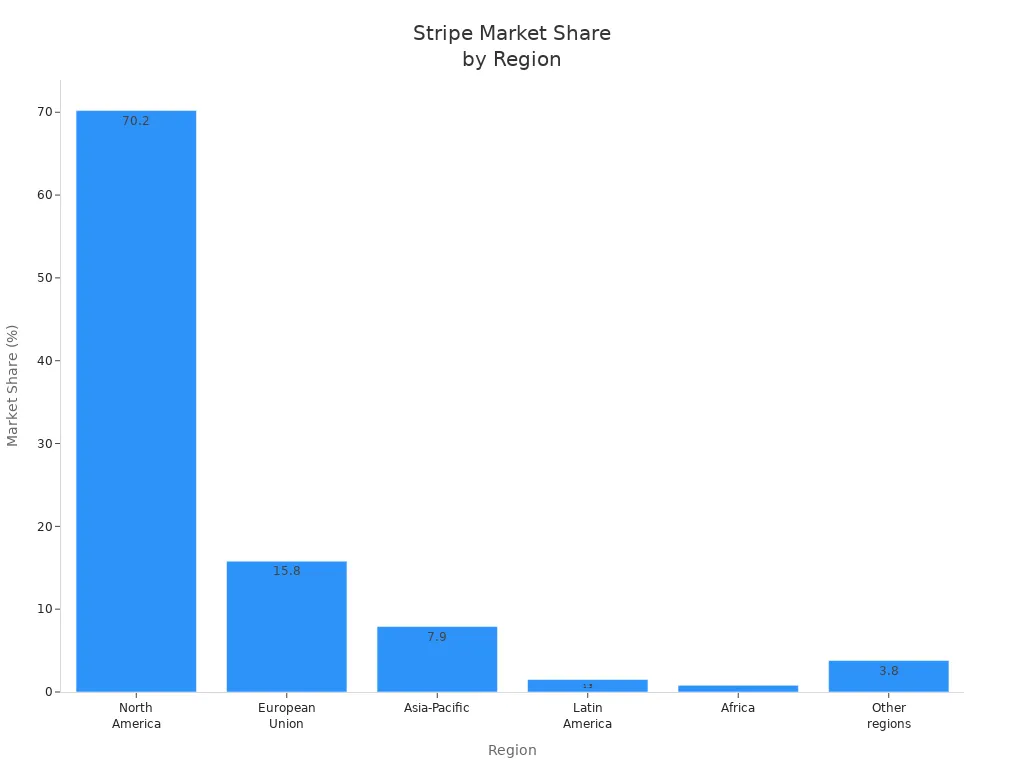

Stripe stands out as a highly secure and trustworthy payment processing platform, trusted by over 4 million websites worldwide and more than 5.3 million active business customers. The company’s commitment to stripe safety is evident through advanced security certifications, including PCI DSS Level 1, SOC 2, and ISO 27001. These standards ensure that stripe protects sensitive payment data at every stage. Stripe commands a 29% market share in global online payment processing, with a dominant presence in North America. The importance of payment security for businesses and the importance of online payment security cannot be overstated, especially as 92% of Fortune 100 companies rely on stripe for their transactions. Stripe safety, backed by industry-leading security, makes it a top choice for those prioritizing payment security for businesses.

Key Takeaways

- Stripe uses strong encryption, tokenization, and secure systems to protect payment data at every step.

- The platform holds top security certifications like PCI DSS Level 1 and follows strict global compliance standards.

- Stripe’s AI-powered fraud detection and two-factor authentication help prevent unauthorized access and fraud.

- Users should enable two-factor authentication, use strong passwords, and regularly review account security settings.

- Stripe offers FDIC insurance for settled funds and applies financial safeguards to protect user money.

Stripe Safety

Image Source: unsplash

Payment Security Overview

Stripe leads the industry in payment security by implementing a comprehensive set of security measures that protect both businesses and customers. Stripe safety begins with a secure payment gateway that uses advanced protocols to ensure secure payment processing at every step. The company enforces HTTPS connections using TLS (SSL) and HSTS, which creates encrypted data and communication channels. This approach prevents interception or tampering of payment data during transmission.

Stripe’s security measures extend beyond transmission. The platform encrypts all card numbers at rest using AES-256, a top-tier encryption standard. Decryption keys are stored on separate machines, so internal servers cannot access plaintext card data. Stripe’s infrastructure for storing, decrypting, and transmitting card numbers operates in a separate hosting environment. This environment does not share credentials with Stripe’s main services, such as the API and website. This architectural separation greatly reduces the risk of unauthorized access to sensitive payment information.

Stripe also stands out by offering FDIC-insured accounts with coverage up to $250,000, a feature not commonly found among competitors. The company holds extensive global licenses and registrations, ensuring compliance with financial regulations in 46 countries. Stripe’s continuous security testing, including a third-party bug bounty program, helps identify and address vulnerabilities quickly. These security measures build trust and demonstrate Stripe’s commitment to payment processor security.

Stripe’s approach to payment security means that businesses do not need to handle or store card details on their own servers. This reduces the compliance burden and lowers the risk of data breaches.

State-of-the-Art Encryption

Stripe uses state-of-the-art encryption to protect payment data both in transit and at rest. The platform enforces HTTPS for all connections, ensuring that data sent between users and Stripe remains confidential. TLS (SSL) protocols and HSTS policies guarantee that attackers cannot intercept or modify payment information during transmission. Stripe’s use of AES-256 encryption techniques ensures that card numbers and other sensitive data remain secure when stored.

Stripe’s security measures include storing decryption keys on separate machines from the encrypted data. This separation means that even if one part of the system is compromised, attackers cannot access both the encrypted data and the keys needed to decrypt it. Stripe’s infrastructure for handling sensitive data operates independently from its main services, further enhancing payment security.

Stripe’s commitment to state-of-the-art encryption and top-tier encryption standards meets the highest PCI Service Provider Level 1 certification. This level of security reassures businesses and customers that their payment information is safe during secure payment processing.

Tokenization Techniques

Tokenization techniques play a crucial role in Stripe safety and payment security. Stripe replaces sensitive payment data, such as credit card numbers, with unique tokens. These tokens have no value outside their specific transaction context, which prevents unauthorized retrieval of actual card details.

The process works as follows:

- When a user enters payment details, Stripe generates a token that represents the card.

- The business receives only the token, not the actual card data.

- Stripe stores the real card details securely, while the business holds only the token.

- If an attacker intercepts the token, it is useless outside its intended context.

- Stripe’s SDK ensures that payment data never touches the business’s servers, reducing exposure.

- Tokenization complies with PCI DSS Level 1, the highest industry standard for secure payment processing.

- Even if a business’s systems are compromised, attackers cannot access actual credit card information.

This approach to tokenization, combined with other security measures, ensures secure payment gateway operations and secure transactions. Stripe’s tokenization techniques support online payment security by minimizing the risk of data breaches and unauthorized access.

Tokenization acts like a coat check ticket: only the person with the right claim ticket can retrieve the coat, and the ticket is useless to anyone else.

Stripe’s layered security measures, including state-of-the-art encryption, tokenization, and a secure payment gateway, set a high standard for payment processor security. These features demonstrate the importance of online payment security and reinforce Stripe’s reputation for secure payment processing and data security.

PCI DSS and Compliance

PCI DSS Certification

Stripe holds the highest certification in the payment card industry data security standard, known as pci dss level 1. This status means Stripe meets the strictest pci dss compliance requirements for handling credit card transactions. Stripe processes over 300,000 credit card transactions each year, which qualifies it for this top tier. To maintain pci dss level 1, Stripe must complete several important security steps:

- Undergo an annual on-site assessment by a Qualified Security Assessor (QSA)

- Conduct quarterly network scans by an Approved Scanning Vendor (ASV)

- Submit an annual Report on Compliance (ROC) and Attestation of Compliance (AOC)

These pci dss compliance steps ensure Stripe’s security measures stay current and effective. Stripe’s regular audits and network scans help protect sensitive payment data and reduce the risk of breaches. By meeting pci dss level 1, Stripe shows a strong commitment to security and builds trust with businesses and customers.

Other Compliance Standards

Stripe goes beyond pci dss compliance by following many other global compliance standards. Stripe adheres to GDPR, which protects the privacy of EU citizens and gives them control over their personal data. Stripe also meets SOC 2 requirements, which cover security, availability, processing integrity, confidentiality, and privacy. These compliance standards show that Stripe uses strong security controls for financial data.

Stripe’s compliance standards include ISO 27001, which sets rules for information security management. Stripe also follows region-specific rules like PSD2 and VAT in Europe, CCPA in the US, and PDPA in Asia-Pacific countries. Stripe uses AWS’s secure infrastructure to meet these international compliance standards and deliver secure payment processing worldwide.

Stripe’s broad compliance standards help protect user data and support safe international payments. These certifications prove that Stripe’s security measures meet the highest industry expectations. Businesses and customers can trust Stripe to keep their payment information safe and follow all required pci dss compliance rules.

Stripe’s strong compliance standards and security certifications build trust, reduce risks, and show a clear commitment to protecting user data.

Data Protection

Encryption in Transit and at Rest

Stripe places a strong focus on payment security by using advanced encryption methods to protect sensitive information. The platform uses TLS 1.2 to encrypt all inbound and outbound data connections. This ensures that payment security remains intact during every transaction. Stripe also secures internal production network communications with mutual TLS (mTLS), which adds another layer of security between systems.

Stripe protects data at rest with AES-256 encryption. This standard is recognized as one of the most secure options available for data security. Payment card and bank account information receive additional AES-256 encryption at the data level. Stripe stores this information in a highly restricted, separate data vault. Decryption keys for sensitive data are kept on separate machines, which prevents unauthorized access even if one system is compromised.

Stripe’s approach to encryption in transit and at rest demonstrates a commitment to payment security and data security at every stage of the process.

Privacy and User Rights

Stripe maintains strict privacy standards to protect user information and support payment security. The company complies with legal and regulatory obligations, including fraud monitoring, tax, accounting, and financial reporting. Stripe aligns personal data retention with applicable laws and limitation periods.

Stripe manages international data transfers using recognized mechanisms such as EU Standard Contractual Clauses and the EU-U.S. Data Privacy Framework. The company requires service providers to maintain the security and confidentiality of personal data. Stripe processes personal data based on legal grounds, such as contractual necessity, legal compliance, and legitimate interests like fraud prevention and security.

Stripe shares personal data only with affiliates, service providers, financial partners, or in response to lawful requests. Identity verification and fraud detection use biometric technology and cross-verification with multiple data sources. Stripe honors Global Privacy Control signals and provides users with options to limit data sharing.

Stripe regularly updates privacy policies to reflect changes in services, laws, or practices. Jurisdiction-specific provisions ensure compliance with local privacy laws, such as Australia’s Privacy Act. The company offers dispute resolution options and maintains transparency about data transfer certifications.

Stripe’s privacy measures and user rights protections reinforce its reputation for payment security and strong security practices.

Fraud Prevention

Image Source: pexels

Machine Learning Tools

Stripe uses advanced machine learning tools to fight payment fraud and protect users. Stripe Radar, the company’s AI-powered fraud detection and prevention system, analyzes over 1,000 characteristics for each transaction. This system checks buyer behavior, transaction history, and many other signals to spot suspicious activity. Stripe Radar can assess fraud risk in less than 100 milliseconds, making it fast and reliable.

Stripe’s machine learning models have evolved over time. The company started with simple models and now uses deep neural networks. These networks help Stripe adapt quickly to new fraud patterns and improve accuracy. Stripe Radar learns from billions of transactions worldwide. This global data helps the system recognize new threats and reduce false declines for real customers.

Stripe Radar saved over $400 million in payment fraud last year. Businesses can use customizable rules to set their own risk levels and block or allow certain transactions.

Stripe also offers Radar for Fraud Teams. This paid product gives companies more control over fraud detection and prevention. Teams can create custom rules, set risk thresholds, and use analytics to fine-tune their security measures. Stripe’s dynamic 3D Secure authentication adds extra security for high-risk transactions, keeping the process smooth for most users.

Two-Factor Authentication

Stripe strengthens security with two-factor authentication (2FA). This method requires users to provide two forms of identification before accessing their accounts. 2FA helps prevent payment fraud by making it harder for attackers to gain access, even if they know a password.

Stripe supports several 2FA options, such as SMS codes and authentication apps. Users receive a one-time code on their phone or app, which they must enter along with their password. This extra step adds a strong layer of security to every login.

Two-factor authentication is a simple but powerful tool for fraud detection and prevention. Stripe encourages all users to enable 2FA to protect their accounts and payment information.

Stripe’s focus on security measures, machine learning, and 2FA shows a strong commitment to fraud detection and prevention. These tools help businesses and customers stay safe from payment fraud and keep their information secure.

Account Security

Best Practices

Account security forms the backbone of any payment system. Stripe provides robust tools, but users must take active steps to maintain security. Following best practices helps protect sensitive data and ensures smooth payment processing. Stripe recommends several key actions for strong security:

- Use HTTPS with SSL certificates to encrypt data between users and your website. Obtain SSL certificates from trusted authorities and configure your server to enforce HTTPS.

- Regularly update WordPress core, themes, and plugins to patch vulnerabilities. Outdated software can create security gaps that attackers exploit.

- Conduct periodic security audits and penetration testing. These checks help identify and fix security weaknesses before they become problems.

- Enable Stripe fraud protections such as Stripe Radar and Block Rules. These features reduce fraudulent transactions and chargebacks.

- Use CAPTCHA on sign-up pages to prevent automated abuse. This step adds another layer of security against bots.

- Create strong, unique passwords for your stripe account. Combine uppercase, lowercase, numbers, and symbols for maximum security.

- Set up two-factor authentication (2FA), preferably using authenticator apps. This extra step makes unauthorized access much harder.

- Protect your API keys and monitor for suspicious activity. Stripe provides tools to help track and respond to unusual events.

- Maintain clear Terms of Service and Privacy Policy pages. These documents build trust with stripe and your customers.

- Avoid content that violates stripe’s prohibited or restricted business policies. Stripe may suspend accounts that do not follow these rules.

Regular monitoring and a clear response plan help maintain security if your stripe account faces any threats.

Phishing Awareness

Phishing attacks target users by tricking them into revealing sensitive information. Stripe users must stay alert to these threats to protect their accounts. Attackers often send emails or messages that look like official stripe communications. These messages may ask for passwords, API keys, or other security details.

Stripe never asks users to share passwords or sensitive information by email. Users should always check the sender’s address and look for signs of phishing, such as urgent language or suspicious links. When in doubt, log in to stripe directly through the official website rather than clicking on links in emails.

Stripe encourages users to report any suspicious messages. The company investigates and takes action to protect users. Staying informed about phishing tactics and following stripe’s security guidelines helps prevent account compromise.

Awareness and caution are essential for maintaining stripe account security in the face of phishing threats.

Stripe vs. Other Processors

Stripe vs. PayPal

Stripe and PayPal both lead the industry in secure payment processing. Each platform holds PCI DSS compliance and uses SSL encryption to protect payment data. Stripe stands out by using AES-256 encryption for credit card data and storing decryption keys on separate systems. This approach adds another layer of security. Stripe’s infrastructure keeps card data isolated from its main services, which reduces the risk of unauthorized access.

Stripe uses Stripe Radar, an AI-powered fraud detection tool. This system uses machine learning to score transactions in real time and adapts to new fraud patterns. Stripe allows developers to customize fraud rules and 3D Secure activation, giving businesses more control over security. PayPal also offers advanced fraud monitoring and seller protection. However, PayPal may freeze accounts or delay payments if it detects suspicious activity. Stripe’s fraud prevention tools provide more customization and sophistication.

Stripe’s combination of advanced encryption, isolated data handling, and customizable fraud prevention makes it a strong choice for secure payment processing.

| Feature | Stripe | PayPal |

|---|---|---|

| PCI DSS Compliance | Yes, Level 1 | Yes |

| Encryption | AES-256, HTTPS, TLS (SSL), HSTS | Advanced encryption, SSL |

| Data Handling | Isolated infrastructure | Secure networks, access controls |

| Fraud Prevention | Stripe Radar, AI, machine learning, real-time scoring, customizable | 24/7 monitoring, seller protection, account freezes |

| Customization | High, developer-focused | Limited |

Stripe vs. Square

Stripe and Square both focus on security and secure payment processing. Square uses PCI-compliant hardware and encrypts payment information end-to-end. Square’s EMV-compliant card readers help reduce fraud. Square also uses machine learning to detect suspicious transactions. Stripe encrypts payment data through HTTPS and supports advanced tokenization. Stripe allows merchants to verify cardholder identities at the point of sale, which adds another layer of security.

Stripe offers more advanced identity verification tools, including support for local ID verification in over 30 countries. Square provides HIPAA compliance and signs Business Associate Agreements with healthcare providers, which Stripe does not offer. Both platforms use machine learning and 3D Secure for fraud prevention, but Stripe gives businesses more options to customize fraud detection and security settings.

Stripe’s advanced identity verification and customizable fraud prevention tools give businesses greater control over security.

| Aspect | Square | Stripe |

|---|---|---|

| PCI Compliance | Yes, built into hardware | Yes, reduces merchant PCI scope |

| Encryption & Tokenization | End-to-end encryption, tokenization at point of sale | HTTPS encryption, advanced tokenization |

| Fraud Prevention | Machine learning, 3D Secure, Risk Manager | Machine learning, 3D Secure, customizable fraud detection, ID tools |

| HIPAA Compliance | Yes, with BAAs | Not offered |

| Identity Verification | Standard | Advanced, supports local ID verification in 30+ countries |

Stripe, PayPal, and Square all prioritize security, but Stripe’s approach to secure payment processing includes more advanced encryption, customizable fraud prevention, and enhanced identity verification. These features help businesses protect customer data and reduce fraud risks.

Fund Protection

FDIC Insurance

Stripe provides an extra layer of protection for user funds through its relationship with FDIC-insured banks. Stripe holds funds in a Payouts Custodial Account, which is expected to qualify for pass-through FDIC insurance up to the standard limit per depositor. The FDIC insurance limit is currently $250,000 per eligible account. This coverage applies only to funds that have fully settled in the Payouts Financial Account. Pending or provisionally credited funds do not receive FDIC insurance until settlement completes. Stripe’s approach aligns with other leading payment processors that partner with FDIC-member banks to offer similar protections. For example, some processors use deposit sweep programs to extend FDIC coverage across multiple banks, potentially increasing the insured amount. Stripe’s FDIC insurance eligibility depends on determinations made by the FDIC at the time of any bank insolvency. Users should understand that FDIC insurance protects against bank failure, not fraud or unauthorized transactions.

Note: FDIC insurance covers only settled funds in Stripe’s Payouts Financial Account. Pending funds or those in transit remain uninsured until settlement.

Financial Safeguards

Stripe implements several financial safeguards to protect user funds from risks such as fraud or insolvency. Stripe establishes Reserves, which are pooled accounts held under Stripe’s name. Users cannot access these Reserves, and they do not form part of a user’s insolvency estate. Stripe may fund Reserves using user-provided funds, amounts owed to users, or by debiting user bank accounts. Stripe also holds Safeguarded Funds separately, but may use these funds to cover Reserves if needed. Stripe has the right to delay or withhold payouts, reverse transactions, or suspend services if it detects risks like fraud or insolvency. Stripe requires users to provide security interests or credit support, such as guarantees or letters of credit, to secure payment obligations when necessary. Stripe employs advanced fraud detection tools, including fraud signals and third-party data, to prevent financial loss. Stripe complies with PCI-DSS standards and maintains strict administrative, technical, and physical controls to prevent unauthorized access. Stripe may refuse or delay refunds if it detects insolvency or risk of non-payment. Stripe can also set off liabilities owed by users against amounts Stripe owes to users, reducing financial risk.

Stripe safeguards your money by combining FDIC insurance for settled funds with robust internal controls and risk management practices. These measures help ensure that user funds remain protected, even in challenging situations.

User Responsibilities

Account Security Steps

Users play a vital role in maintaining payment security on stripe. While stripe provides advanced security features, users must follow specific steps to maximize protection. Strong security habits help prevent unauthorized access and reduce risks. The following steps outline payment security best practices for every stripe account:

- Enable two-factor authentication (2FA) to add an extra layer of security beyond passwords.

- Use strong, unique passwords for each account to make it harder for attackers to guess or reuse credentials.

- Keep all software and plugins updated to close known security gaps.

- Limit access permissions to only those who need them, reducing the chance of accidental or malicious actions.

- Turn on alerts for suspicious activities to detect potential breaches quickly.

- Choose payment platforms that offer end-to-end encryption, ensuring transaction data remains secure.

- Regularly review security settings to stay aligned with the latest industry standards.

- Educate all users about safe login practices and the importance of protecting authentication devices.

Following these steps helps users support stripe’s security efforts and maintain strong payment security for every transaction.

Regular Reviews

Ongoing vigilance is essential for payment security. Users should not assume that initial setup alone will keep their stripe accounts safe. Regular reviews of account activity and security settings help identify new threats and ensure compliance with current standards. Stripe recommends that users check access logs, review permissions, and update passwords at set intervals. Monitoring for unusual transactions or login attempts can reveal early signs of security issues.

Stripe also advises users to stay informed about new security features and updates. Reading stripe’s official communications and security bulletins keeps users aware of changes that may affect payment security. By making regular reviews part of their routine, users help stripe maintain a secure environment for all payment processing.

Consistent attention to security details strengthens payment security and builds trust between users and stripe.

Stripe continues to set the standard for payment security.

- The platform uses advanced security measures like AES-256 encryption, tokenization, and HTTPS to protect every transaction.

- Stripe holds PCI DSS Level 1 certification, runs a bug bounty program, and maintains licenses in 46 countries.

- Merchants benefit from strong authentication, FDIC insurance, and regular third-party audits.

- Stripe Radar uses machine learning for fraud detection, while continuous updates and education keep security strong.

Users should follow best practices to maximize security. Stripe’s ongoing commitment ensures payment security remains a top priority.

FAQ

How does Stripe keep payment information safe?

Stripe uses strong encryption, tokenization, and secure servers. The company separates sensitive data from its main systems. Stripe also runs regular security checks and follows strict industry standards.

Is Stripe PCI DSS compliant?

Stripe holds PCI DSS Level 1 certification. This status means Stripe meets the highest security requirements for handling credit card transactions. Stripe completes annual audits and regular network scans to maintain compliance.

What should users do if they suspect fraud on their Stripe account?

Users should contact Stripe support immediately. They should change passwords and enable two-factor authentication. Stripe investigates all reports and helps secure affected accounts.

Does Stripe offer FDIC insurance for user funds?

Stripe provides FDIC insurance for settled funds in its Payouts Financial Account, up to $250,000 per eligible account. Pending or in-transit funds do not receive FDIC coverage until settlement completes.

While Stripe’s security certifications make it a reliable choice for online payment processing, many businesses still face challenges when it comes to cross-border payments—high remittance fees, slow settlement times, and limited support for multi-currency transactions. That’s where BiyaPay provides an essential complement.

BiyaPay offers real-time foreign exchange rates, transparent and low remittance fees starting at just 0.5%, and supports both fiat and digital currency conversions. With fast onboarding and the ability to send or receive funds across most countries and regions, BiyaPay ensures that global transfers are as secure as they are efficient. Best of all, with same-day settlement, you no longer need to wait days for your funds to arrive.

For business owners and entrepreneurs who value both security and speed, BiyaPay makes global transactions simple, reliable, and cost-effective. Register with BiyaPay today and experience a smarter way to move your money.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.