- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Explore the Top UK Credit Cards with No Fees for Overseas Purchases

Image Source: pexels

If you want to skip extra charges when spending abroad, you should check out the best credit cards with no foreign transaction fee. Top picks include Barclaycard Rewards, Halifax Clarity, NatWest Travel Reward, Santander All in One, and 118 118 Money Travel Credit Card. With no foreign transaction fee, you save money and earn travel rewards on every trip. These credit cards with no foreign transaction fees make travel simple and stress-free. Think about how often you travel and what you spend to find the right card for your needs.

Key Takeaways

- No foreign transaction fee credit cards save you money by avoiding extra charges on purchases abroad or in other currencies.

- Many top UK cards have no annual fee and offer perks like cashback, rewards, or no ATM withdrawal fees to make travel easier.

- Always pay in the local currency when using your card abroad to avoid hidden fees and poor exchange rates.

- Check card fees, rewards, and eligibility before applying to find the best card that fits your travel and spending habits.

- Use your card safely by notifying your bank of travel plans, setting alerts, and protecting your PIN and personal information.

No Foreign Transaction Fee Explained

Image Source: pexels

What Is a Foreign Transaction Fee?

When you use your credit card to buy something in another country or pay online in a different currency, your bank may charge you extra. This extra cost is called a foreign transaction fee. You usually see these fees when you travel or shop from international websites.

- UK credit card issuers often charge foreign transaction fees between 1% and 3% of your total purchase amount.

- These fees help banks cover the costs of currency conversion and processing payments through networks like Visa or Mastercard.

- The fee is simple to calculate. If you spend $100 and your card charges a 2% fee, you pay an extra $2.

- Banks add these fees because handling different currencies and international payments takes more work and comes with extra risk.

You might not notice these charges at first, but they can add up quickly. If you travel often or shop online from other countries, you could end up paying a lot more than you expect. That’s why many people look for no foreign transaction fee credit cards.

Why It Matters for Travelers

Foreign transaction fees can sneak up on you. Each time you use your card abroad, you pay a little extra. For example, if you buy something for $115, you might pay an extra $1.15 to $3.45 in fees. One fee may seem small, but after several purchases, the total can be surprising.

These fees usually come from both your card issuer and the payment network. Over a week-long trip, you could spend hundreds of dollars more just on foreign transaction fees. This makes your vacation or business trip more expensive than planned.

No foreign transaction fee credit cards help you avoid these extra costs. You get to keep more of your money for fun, food, or souvenirs. Plus, these cards often come with other perks, like rewards or fraud protection. If you want to save money and travel smarter, choosing a card with no foreign transaction fee is a smart move.

Tip: Always pay in the local currency when you use your card abroad. Some shops offer to convert the price to USD, but this can lead to worse exchange rates and even more fees.

No foreign transaction fee credit cards make travel and online shopping much easier. You don’t have to worry about hidden charges, and you can focus on enjoying your trip or finding great deals online.

Best No Foreign Transaction Fee Cards

Quick Comparison Table

You want to find the best no foreign transaction fee cards for your next trip. Here’s a quick look at some top choices. This table shows you the main details, so you can compare them easily:

| Credit Card Name | Annual Fee (USD) | Foreign Transaction Fees | ATM Withdrawal Fee | Rewards/Welcome Offer | Key Eligibility Requirements |

|---|---|---|---|---|---|

| Barclaycard Rewards | $0 | 0% | 0% | Cashback, no welcome offer | UK resident, credit check |

| Halifax Clarity | $0 | 0% | 0% | No rewards, no welcome offer | UK resident |

| NatWest Credit Card | $0 | 0% | 3% | No rewards, no welcome offer | Must be NatWest customer |

| Santander All in One | $42 | 0% | 3% | Cashback, welcome offer | UK resident, credit check |

| 118 118 Money Travel | $0 | 0% | 0% | No rewards, no welcome offer | UK resident, credit check |

| Capital One | $0 | 0% | 0% | No rewards, no welcome offer | UK resident, credit check |

| Monzo Credit Card | $0 | 0% | 0% | No rewards, no welcome offer | UK resident |

| Revolut Card | $0 | 0% | 0% | No rewards, no welcome offer | UK resident, verification |

| Virgin Money Travel Mastercard | $0 | 0% | 3% | 0% balance transfer, welcome offer | UK resident, age 18+ |

| Zopa Credit Card | $0 | 0% | $3 | No rewards, no welcome offer | UK resident, eligibility check |

Note: All fees are shown in USD. Exchange rates may apply when converting from GBP.

Key Features Overview

You get a lot of value from credit cards with no foreign transaction fees. These cards help you avoid paying extra when you shop or travel outside the UK. Most of the best credit cards in this group have no annual fee, so you save money right away. Some cards, like Santander All in One, charge a small annual fee, but you might get a welcome offer or cashback to make up for it.

ATM withdrawal fees can be tricky. Some cards, such as Barclaycard Rewards and Halifax Clarity, let you take out cash abroad with no extra charge. Others, like NatWest and Virgin Money, charge a fee of about 3%. Always check this before you travel.

Rewards and welcome offers are important if you want to get more from your spending. Many no foreign transaction fee credit cards do not have a welcome offer, but a few, like Santander All in One and Virgin Money, do. You might also earn cashback or points on your purchases.

To get one of these cards, you usually need to be a UK resident and at least 18 years old. Most banks will check your credit score. Some cards, like NatWest, require you to already have an account with them. Typical credit limits depend on your income and credit history, but many people get limits around $5,000.

If you travel often or shop online in other currencies, the best no foreign transaction fee cards can save you a lot. You avoid foreign transaction fees, enjoy simple spending, and sometimes get extra perks like a welcome offer or cashback.

Best Credit Cards for Overseas Purchases

Image Source: pexels

Barclaycard Rewards Credit Card

You want a card that makes travel easy. The Barclaycard Rewards Credit Card stands out for travelers who want to avoid foreign transaction fees. You pay no annual fee and no extra charges when you use your card abroad. This card uses a unique community-driven approach. Cardholders can vote on changes, like removing foreign transaction fees. You also get a profit-sharing program instead of traditional rewards. There is no fixed cashback or points, but you may receive a share of profits.

Here’s a quick look at the main features:

| Feature / Rating Category | Details / Rating |

|---|---|

| No Foreign Transaction Fees | Card charges no foreign transaction fees, unlike most cards that charge ~3% abroad. |

| Unique Community-Driven Development | Cardholders can vote on product changes, e.g., removal of foreign transaction fees. |

| Giveback Program | Profit-sharing program instead of traditional rewards; no fixed reward rates or points. |

| Complimentary FICO Credit Score | Free monthly access to FICO credit score included. |

| APR and Fees | Regular APR: 14.24% variable; low cash advance APR; $3 cash advance fee; no annual fee. |

| Customer Satisfaction (J.D. Power) | Score of 796 in 2020; 80% of issuers ranked higher, indicating moderate satisfaction. |

| Mobile App Ratings | 4.1/5 on both Google Play and Apple Store. |

| Overseas Use Recommendation | Particularly useful for travelers due to no foreign transaction fees; avoid dynamic currency conversion to save more. |

| Rewards Program | Lacks traditional rewards points or cash back, which may be a downside for some users. |

Pros:

- No foreign transaction fees

- No annual fee

- Community-driven features

- Free FICO credit score

Cons:

- No traditional rewards or cashback

- Moderate customer satisfaction

- No welcome offer

Best for:

You should pick this card if you want to avoid foreign transaction fees and like the idea of a community-driven card. If you want a travel rewards card with a welcome offer or fixed cashback, you may want to look elsewhere.

Halifax Clarity Credit Card

The Halifax Clarity Credit Card is a favorite among travel credit cards. You pay no foreign transaction fee on purchases or cash withdrawals abroad. There is no annual fee. You can withdraw up to $650 per day from ATMs overseas with no extra charge from Halifax, but interest starts right away on cash withdrawals.

Key Features Table:

| Feature | Halifax Clarity Credit Card |

|---|---|

| Foreign Transaction Fee | 0% (no fees on purchases or cash withdrawals abroad) |

| Cash Withdrawal Fee | 0% (interest starts immediately) |

| Daily ATM Withdrawal Limit | $650 abroad |

| Annual/Monthly Fee | $0 |

| Interest Rate on Cash Withdrawals | 23.9% variable |

| Late Payment Fee | $15 |

| Balance Transfer Option | Not available |

| User Ratings | 66% 5-star reviews, recent increase in 1-star reviews |

Pros:

- No foreign transaction fees

- No annual fee

- No ATM withdrawal fees (but interest applies)

- Favorable exchange rates

- Easy to manage with the mobile app

Cons:

- Interest on cash withdrawals starts immediately

- No balance transfer option

- No welcome offer

- Credit limits and APR vary

Best for:

You should choose this card if you want to avoid foreign transaction fees and plan to use your card for purchases and cash withdrawals abroad. If you want a travel rewards card with a welcome offer or balance transfer, this may not be the best fit.

NatWest Travel Reward Credit Card

The NatWest Travel Reward Credit Card is a strong choice for travel credit cards. You pay no foreign transaction fees on purchases abroad. You earn 0.1% cashback on all spending and 1% cashback on travel purchases like flights, hotels, and car rentals. You also get up to 15% cashback with selected partners. There is no annual fee, but cash withdrawals abroad cost 3% with a $4 minimum.

| Feature | Details |

|---|---|

| Cashback on all spending | 0.1% cashback |

| Cashback on eligible travel | 1% cashback on flights, car rentals, hotels, travel agents, cruises, and more |

| Rewards with partner retailers | 1% to 15% cashback with selected NatWest partners like Booking, National Express, etc. |

| Foreign transaction fees | None on purchases abroad |

| Cash withdrawals abroad | 3% fee with a $4 minimum |

| Annual/monthly fees | None |

| Representative APR | 27.9% |

Pros:

- No foreign transaction fees on purchases

- Cashback on all spending

- Extra cashback on travel and with partners

- No annual fee

- Good for earning travel rewards

Cons:

- 3% fee on cash withdrawals abroad

- No welcome offer

- High APR

Best for:

You should consider this card if you want to earn travel rewards and cashback on your overseas spending. If you need to withdraw cash abroad, watch out for the fees.

Santander All in One Credit Card

The Santander All in One Credit Card is another popular travel credit card. You pay no foreign transaction fee on purchases abroad. There is a $42 annual fee. ATM withdrawals abroad cost 3% with a $4 minimum, and interest starts right away on cash withdrawals. This card does not offer special travel perks, but you may get a welcome offer and cashback.

| Feature | Details |

|---|---|

| Foreign Transaction Fee | 0% on purchases abroad |

| ATM Withdrawal Fee | 3% with a $4 minimum |

| Annual Fee | $42 |

| Interest on Cash | Starts immediately |

| Travel Perks | None specified |

| Welcome Offer | Sometimes available |

| Cashback | Sometimes available |

Pros:

- No foreign transaction fees on purchases

- Possible welcome offer

- Possible cashback

- Widely accepted

Cons:

- $42 annual fee

- 3% ATM withdrawal fee abroad

- Interest on cash withdrawals starts immediately

- No special travel perks

Best for:

You should pick this card if you want a travel credit card with no foreign transaction fee and a chance for a welcome offer or cashback. If you plan to use ATMs abroad, the fees can add up.

118 118 Money Travel Credit Card

The 118 118 Money Travel Credit Card is simple and easy to use. You pay no annual fee and no foreign transaction fees. You also pay no ATM withdrawal fees, which makes it a good choice for travelers who need cash. This card does not offer a welcome offer or travel rewards, but it is easy to qualify for if you have a fair credit score.

Pros:

- No foreign transaction fees

- No annual fee

- No ATM withdrawal fees

- Easy to qualify for

Cons:

- No welcome offer

- No travel rewards

- No extra perks

Best for:

You should choose this card if you want a no foreign transaction fee credit card that is simple and has no hidden costs. If you want a travel rewards card or a welcome offer, you may want to look at other options.

Capital One Credit Cards

Capital One offers several travel credit cards that work well for overseas purchases. All Capital One cards have no foreign transaction fees. You save an average of 1.57% per purchase compared to cards that charge these fees. These cards work worldwide through Visa and Mastercard networks. You do not need to notify Capital One before traveling. Many cards offer travel protection benefits like trip cancellation insurance, baggage delay insurance, and rental car insurance. Popular options include Venture Rewards, Quicksilver Cash Rewards, and Savor Student Cash Rewards.

Pros:

- No foreign transaction fees

- Wide acceptance worldwide

- Travel protection benefits

- No need to notify before travel

- Some cards offer a welcome offer

Cons:

- Benefits vary by card

- Some cards have annual fees

- Not all cards offer travel rewards

Best for:

You should consider Capital One if you want a travel credit card with no foreign transaction fee and strong travel protection. If you want a travel rewards card with a welcome offer, check the details of each card.

Royal Bank of Scotland Reward Black Credit Card

The Royal Bank of Scotland Reward Black Credit Card is designed for frequent travelers. You pay no foreign transaction fees when you use your card abroad. You earn 1% back at supermarkets, 0.5% at gas stations, and up to 15% back at selected retailers, including travel partners. You also get personalized offers for travel. The card provides prioritized customer service all year. However, it does not include premium travel perks like airport lounge access or travel insurance.

Pros:

- No foreign transaction fees

- High rewards at supermarkets and travel partners

- Personalized travel offers

- Prioritized customer service

- Good for frequent travelers

Cons:

- No airport lounge access

- No travel insurance

- No welcome offer

- May have an annual fee

Best for:

You should pick this card if you travel often and want to earn rewards on your spending. If you want premium travel perks or a welcome offer, you may want to compare other travel credit cards.

Best Travel Credit Cards: Pros and Cons

Strengths of Top Cards

When you look for the best travel credit cards, you want to know what makes them stand out. Many users say these cards help you save money and make your trips easier. Here are some of the top strengths you can expect:

- You avoid foreign transaction fees, which means you keep more of your money when you spend in other countries.

- Most cards use exchange rates close to those set by Visa and Mastercard, so you get a fair deal when you pay in another currency.

- You get automatic purchase protection under UK law (Section 75) for purchases over $125, which gives you peace of mind when shopping abroad.

- You can use these cards almost anywhere—shops, restaurants, and ATMs—without worrying about extra charges.

- Some of the best travel credit cards even waive ATM withdrawal fees, so you can get cash without paying more.

- Many cards offer eligibility tools that help you see if you are likely to be accepted, which protects your credit score.

- You also get extra security from protection schemes like Section 75 and Chargeback, making your overseas purchases safer.

Note: These features make the best travel credit cards a smart choice for anyone who travels often or shops online in different currencies.

Drawbacks to Consider

Even the best travel credit cards have some downsides. You should know about these before you apply:

- Some cards may still have hidden fees, like ATM withdrawal charges or less favorable exchange rates, which can add up during your trip.

- If you do not pay off your balance each month, you might face high interest rates and extra charges, which can lead to debt.

- There is always a risk of fraud or identity theft when you use your card abroad. If your bank sees something unusual, they might block your card, which can be a hassle while traveling.

- Managing different currencies and fees can get confusing, especially if you visit several countries on one trip.

- Prepaid cards, like the Travelex Money Card, require manual top-ups and support only a limited number of currencies. They may also charge inactivity fees, making them less convenient than modern travel credit cards.

Tip: Always check the terms and conditions of your card before you travel. This helps you avoid surprises and get the most out of your best travel credit cards.

How to Choose the Best No Foreign Transaction Fee Credit Cards

Assess Your Travel and Spending

Start by thinking about how you travel and spend. If you travel often or make lots of purchases in other currencies, you want a card that helps you save the most. Some cards work best for people who spend a lot on travel or dining. Others give you simple, flat-rate rewards on everything. If you only travel once or twice a year, you might prefer a card with no annual fee. Frequent travelers may find that paying a higher annual fee is worth it for perks like airport lounge access, travel credits, or travel insurance. Your spending habits help you decide if you want a card with a big welcome offer or one that gives steady rewards.

Tip: Think about where you spend the most. If you love eating out or booking hotels, look for cards that reward those categories.

Compare Rewards and Fees

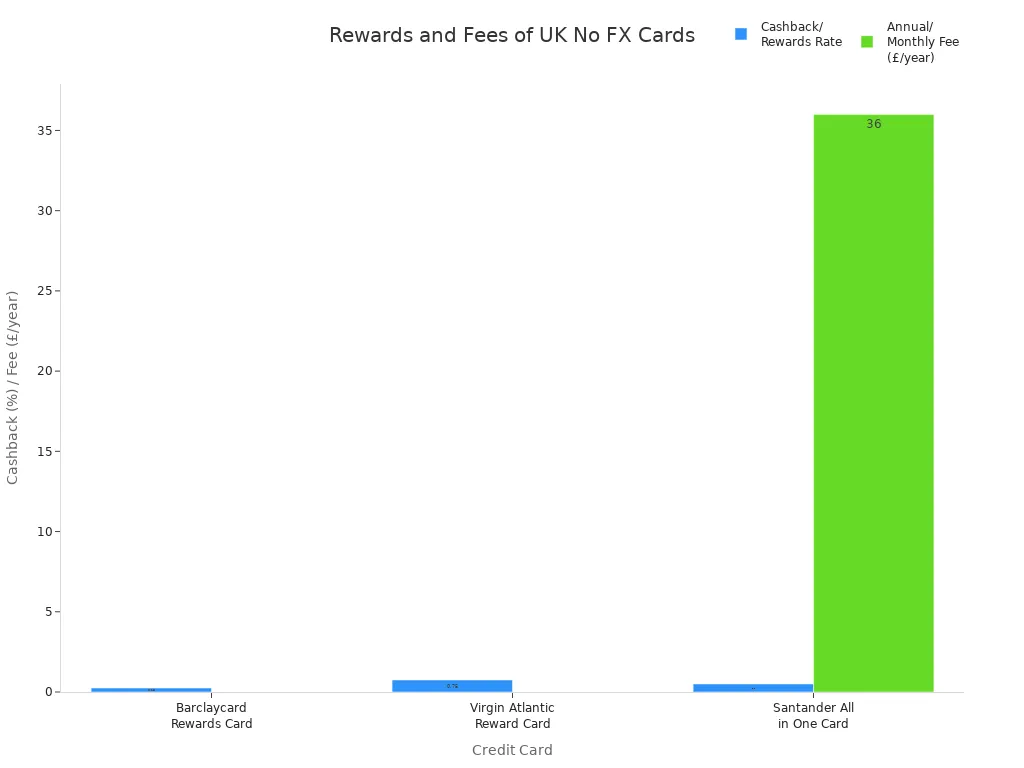

You should always compare the rewards and fees before you pick a card. Some of the best no foreign transaction fee credit cards offer cashback or points on every purchase. Others focus on travel perks. Take a look at this table to see how rewards and fees can differ:

| Credit Card | Rewards / Cashback | Fees (Annual/Monthly) | Foreign Transaction Fees | Interest Rate (APR) | Other Notes / Features |

|---|---|---|---|---|---|

| Barclaycard Rewards Card | 0.25% cashback on all spending | $0 | None on purchases and cash withdrawals (ATM operator fees may apply) | 27.9% variable | Visa exchange rate; purchase protection; free Apple subscriptions |

| Halifax Clarity Credit Card | None specified | $0 | None on purchases and overseas ATM withdrawals (ATM fees may apply) | Variable | Mastercard exchange rate; eligibility checker available |

| Virgin Atlantic Reward Credit Card | 0.75 Virgin Points/$1 on everyday; 1.5 points/$1 on Virgin purchases | $0 | No fees on payments in certain EEA currencies; 5% fee on cash withdrawals | 26.9% variable | Mastercard exchange rate; upgrade benefits after $25,000 spend; cash withdrawal interest applies |

| RBS Credit Card | None specified | $0 | None on purchases; fees on cash withdrawals | 12.9% variable | Mastercard exchange rate; low APR; no balance transfer fee |

| NatWest Credit Card | None specified | $0 | None on purchases; small fee on cash withdrawals | 12.9% variable | Mastercard exchange rate; instalment plan available |

| Santander All in One Credit Card | 0.5% cashback on all purchases | $36/year | None on purchases; 3% fee on cash withdrawals (min $4) | 21.9% variable | Mastercard exchange rate; 0% interest on balance transfers and purchases for 15 months |

| Bip (Digital Cardless Credit) | None specified | $0 | None on purchases and cash withdrawals | 29.9% variable | Mastercard exchange rate; requires cardless ATM; interest on cash advances starts immediately |

| Zopa Credit Card | None specified | $0 | None on purchases; $3 flat fee on cash withdrawals | From 24.9% variable | Visa exchange rate; includes credit management features in app |

| Metro Bank Credit Card | None specified | $0 | No fees in most European countries; 2.99% fee outside Europe; $2 cash withdrawal fee | 14.9% variable | Mastercard exchange rate; branch application required |

Look for cards that combine no foreign transaction fee with good rewards and low annual fees. Some cards offer a welcome offer, which can give you extra value in your first year. Always check if the rewards are easy to use and if the card is accepted in the countries you visit.

Check Eligibility and Application Tips

Before you apply, make sure you meet the card’s requirements. Most travel credit cards need you to be a UK resident and pass a credit check. Some cards, like NatWest or RBS, may ask you to already have an account with them. Use eligibility checkers to see if you are likely to get approved without hurting your credit score. When you compare credit card offers, look for cards with strong customer service. This can help if you lose your card or have problems while traveling. Also, check if the card has a welcome offer or extra perks like travel insurance.

Note: Many cards charge foreign transaction fees up to 2.99% and fees on cash withdrawals abroad. Choosing a card with no foreign transaction fee and a good welcome offer can save you money and make your trips easier.

Tips for Using Best No Foreign Transaction Fee Cards Abroad

Maximize Rewards

You want to get the most out of your fee-free spending when you travel. Here are some ways to boost your rewards:

- Pick travel credit cards that offer both rewards and no foreign transaction fees. This way, you earn points or cashback while saving money.

- Always pay in the local currency. If a shop or ATM asks if you want to pay in USD or another currency, choose the local one. This helps you avoid extra costs from dynamic currency conversion.

- Use your credit card for purchases instead of cash. Credit cards often give you better fraud protection and make it easier to track your spending.

- Look for cards that reward you for international transactions. Some cards give extra points or cashback when you spend abroad.

- Check if you are pre-approved for a card before you apply. This can make the process smoother and protect your credit score.

Tip: Using the right card for fee-free spending can help you save up to 3% on every purchase.

Avoid Common Pitfalls

Even with the best cards, you can run into problems if you are not careful. Watch out for these common mistakes:

- Do not let ATMs or shops convert your payment into sterling. Always pick the local currency to avoid hidden fees.

- Check your card’s terms before you travel. Some cards have withdrawal fees or other charges you might not expect.

- Pay attention to exchange rates and extra fees from ATMs or merchants. These can add up fast.

- Choose cards made for travel and learn about their fee structures.

- Always select the local currency when paying to keep costs low.

Note: Reading your card’s terms before your trip can help you avoid surprises.

Stay Safe While Traveling

Keeping your money and information safe is important when you use credit cards abroad. Try these safety tips:

- Tell your bank about your travel plans. This helps prevent your card from being blocked for suspicious activity.

- Set spending limits and turn on transaction alerts. You will get notified right away if something looks wrong.

- Use secure internet connections for online banking. Avoid public Wi-Fi and use two-factor authentication when possible.

- After your trip, turn off international transactions in your banking app.

- Carry only the cards you need and keep your cash, cards, and passport in a safe place.

- Memorize your PIN and cover the keypad when you enter it.

- Check ATMs for signs of tampering before you use them.

- Watch out for scams or distractions near ATMs.

Tip: Credit cards are safer than debit cards for purchases because they do not give direct access to your bank account.

You can save money and earn rewards when you use the best no foreign transaction fee credit cards for overseas purchases. These cards help you avoid extra costs, keep your spending secure, and make travel easier. Before your next trip, review your current card and compare features, fees, and rewards. Always check the latest offers and terms. Picking the right card lets you enjoy more perks and better value every time you travel.

FAQ

What is a foreign transaction fee?

A foreign transaction fee is an extra charge your bank adds when you use your credit card for purchases in another currency. Most UK cards charge between 1% and 3%. Cards with no foreign transaction fee help you avoid this cost.

Can I use these cards for online shopping in other currencies?

Yes, you can use these cards for online shopping on international websites. You will not pay extra fees for purchases in other currencies. This helps you save money when you shop from the United States, China, or anywhere else.

Do all no foreign transaction fee cards have ATM withdrawal fees?

Not all cards charge ATM withdrawal fees. Some let you take out cash abroad for free, while others add a fee. Check this table for a quick look:

| Card Name | ATM Withdrawal Fee |

|---|---|

| Barclaycard Rewards | $0 |

| Halifax Clarity | $0 (interest applies) |

| Santander All in One | 3% ($4 min) |

Will using a credit card abroad affect my credit score?

Using your card abroad does not hurt your credit score if you pay your bills on time. Missed payments or going over your limit can lower your score. Always pay at least the minimum amount each month to keep your credit healthy.

How do I choose the best card for my travel needs?

Think about how often you travel and what you spend. Compare rewards, fees, and perks. Use eligibility checkers before you apply. Pick a card that matches your habits and gives you the most value for your trips.

Choosing a credit card with no foreign transaction fee is a smart way to save money while traveling. But even the best cards can’t always protect you from hidden exchange rate costs or delays in settlement. That’s where BiyaPay goes further.

With BiyaPay, you get real-time exchange rates, remittance fees as low as 0.5%, and the flexibility to convert between multiple fiat and digital currencies. Unlike traditional banking cards, BiyaPay offers same-day settlement, quick registration, and global coverage across most countries and regions. Whether you’re shopping abroad, sending money home, or managing multi-currency balances, BiyaPay ensures your payments remain secure, transparent, and cost-efficient.

Travel with peace of mind and keep your overseas spending under control. Start today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.