- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Wire Transfer Fees Work and What to Watch For

Image Source: unsplash

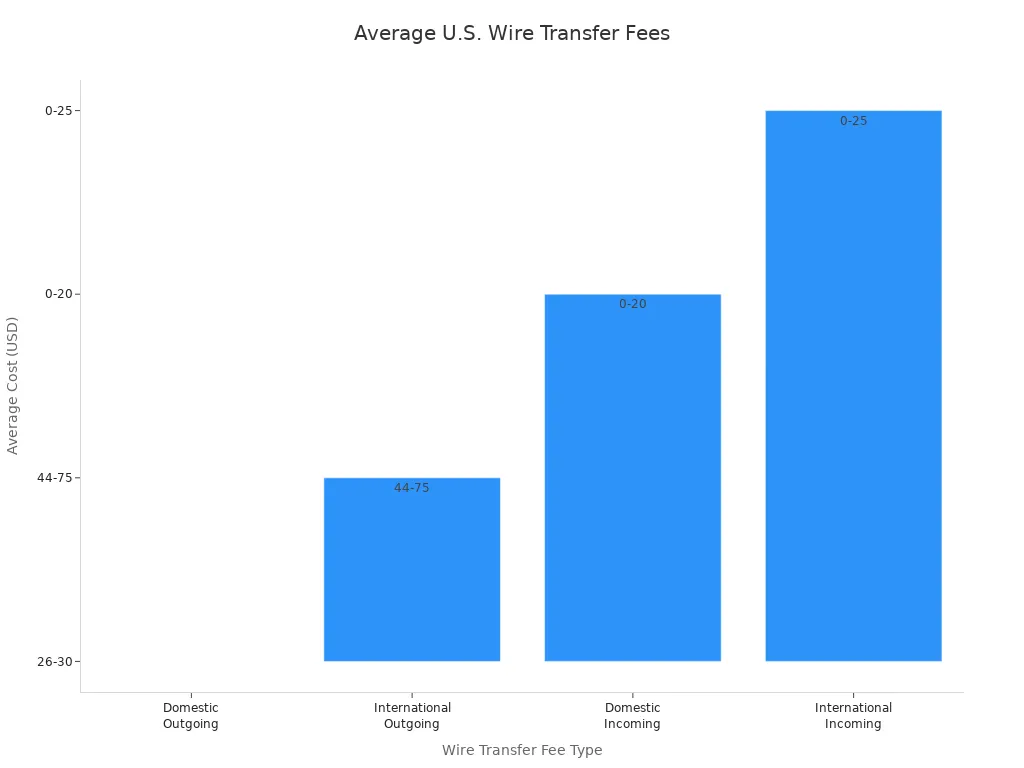

Wire transfer fees are charges that banks or financial institutions apply when you send or receive money electronically. You might pay these fees as a sender, but sometimes the person receiving the funds also pays. Knowing about the fees associated with wire transfers helps you avoid surprises and save money. In the United States, banks set different fees based on the type of wire transfer and the method you use. The table below shows recent average costs:

| Fee Type | Average Cost (USD) | Notes/Examples by Bank |

|---|---|---|

| Outgoing Wire (U.S.) | $26 - $30 | Bank of America $30; Chase $0-$35; State Employees’ CU $10. |

| Outgoing Wire (International) | $44 - $75 | Huntington up to $75; Truist $65; PNC $5-$50; Wells Fargo up to $40. |

| Incoming Wire (U.S.) | $0 - $20 | Fidelity $0; Bank of America $0-$15; U.S. Bank $20. |

| Incoming Wire (International) | $0 - $25 | U.S. Bank $25; Truist $20; Bank of America $15. |

When you understand wire transfer fees, you can make smarter choices and keep more of your money.

Key Takeaways

- Wire transfer fees vary by bank, transfer type, and method, with outgoing international wires costing the most.

- Both sender and recipient may pay fees, including extra charges from intermediary banks and currency conversion markups.

- Online wire transfers usually cost less than in-branch transfers and some banks offer fee waivers for certain accounts.

- Alternatives like ACH transfers and peer-to-peer apps can save money but may be slower or have limits.

- Always check fees, exchange rates, and who pays each charge before sending money to avoid surprises and save costs.

What Is a Wire Transfer?

Image Source: pexels

A wire transfer lets you send money quickly and securely from one bank account to another. You can use this method to move funds across the country or to another part of the world. Many people and businesses choose a wire transfer when they need to send large amounts of money or want to make sure the payment arrives fast.

How Wire Transfers Work

When you start a wire transfer, you give your bank the details of where you want the money to go. This includes the recipient’s name, their bank account number, and the bank’s routing number or SWIFT code for international transfers. Your bank sends the payment instructions through a secure network. The recipient’s bank receives the information and deposits the money into the correct account. Most wire transfers complete within a few hours, but some may take up to one business day.

You pay a fee for each wire transfer. The recipient’s bank may also charge a fee. The process does not use physical cash. Instead, banks move the funds electronically, which makes the transaction safe and traceable.

Common Uses

You might use a wire transfer for many reasons. People often choose this method for important payments that need to arrive quickly. Businesses rely on wire transfers for large, secure, and reliable transactions. These include corporate payments, real estate settlements, international supplier payments, and high-value personal transfers. The speed and security of a wire transfer make it a top choice for urgent business operations and for sending money across borders.

Some of the most common uses for a wire transfer include:

- Paying for international trade, such as sending money to suppliers overseas using IBAN and SWIFT codes

- Completing mergers and acquisitions, where large sums must move quickly

- Settling real estate transactions, especially for commercial properties

- Paying for services, like a marketing firm sending money to a software developer in another country

- Subscribing to enterprise-level or annual services, such as cloud storage or software licenses

- Settling invoices that need immediate payment

- Making capital investments, such as funding a joint venture

- Purchasing equipment, especially expensive machinery from overseas suppliers

A wire transfer gives you a fast, secure way to move money when timing and reliability matter most.

Types of Wire Transfer Fees

When you use a wire transfer, you may see several types of fees. These charges can come from your bank, the recipient’s bank, or even other banks that help move your money. Understanding each fee helps you avoid surprises and manage your costs.

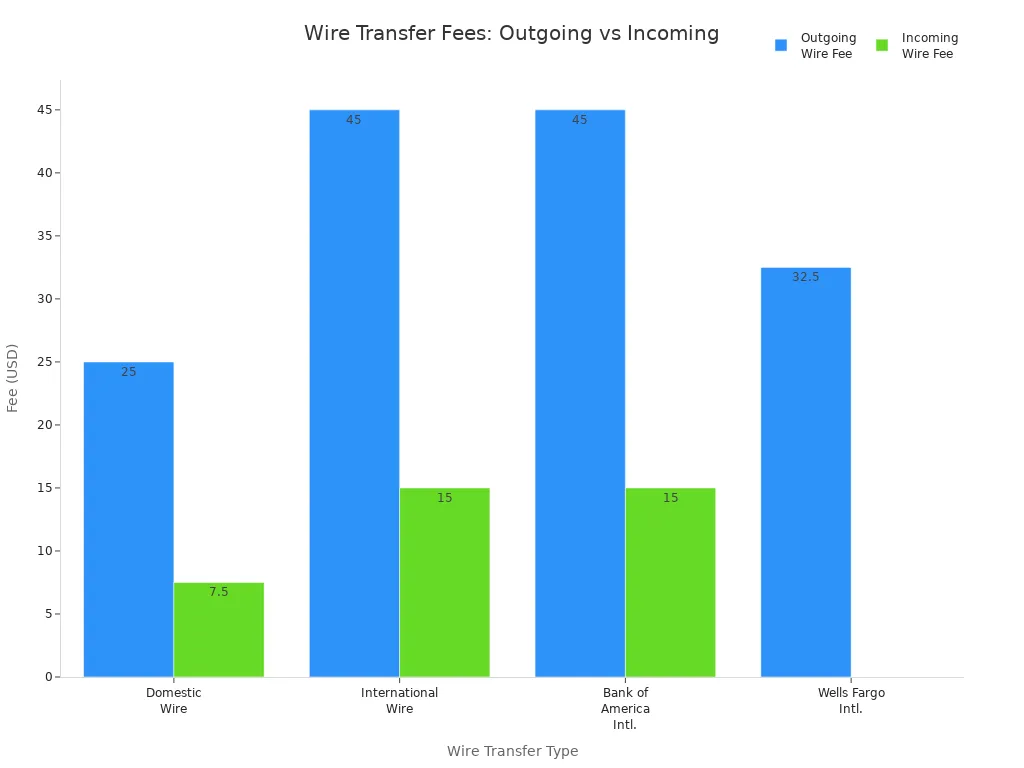

Outgoing and Incoming Fees

Banks usually charge you a fee when you send money, called an outgoing wire transfer fee. The person who receives the money may also pay an incoming wire transfer fee. Outgoing fees are often higher than incoming wire fees. For example, if you send money from your account, your bank might charge $15 to $30 for a domestic transfer and $35 to $50 for an international wire transfer. The recipient’s bank may charge $0 to $15 for incoming domestic wires and up to $30 for incoming international wires.

| Fee Type | Typical Fee Range (USD) | Charged To |

|---|---|---|

| Outgoing (domestic) | $15 - $30 | Sender |

| Incoming (domestic) | $0 - $15 | Recipient |

| Outgoing (international) | $35 - $50 | Sender |

| Incoming (international) | $0 - $30 | Recipient |

Tip: Some banks waive incoming wire fees for certain account types or online transfers.

Domestic vs. International

Wire transfer fees change depending on where you send the money. Domestic wire transfers usually cost less than international wire transfers. Outgoing international wire fees can reach up to $65, while domestic outgoing fees rarely go above $35. Incoming fees also follow this pattern, with international incoming fees sometimes reaching $25. Banks like Bank of America and Chase often charge more for international wires because they involve extra steps, such as currency conversion and more complex routing.

| Fee Type | Domestic Wire Transfer Fees (Outgoing) | Domestic Wire Transfer Fees (Incoming) | International Wire Transfer Fees (Outgoing) | International Wire Transfer Fees (Incoming) |

|---|---|---|---|---|

| Average Fee Range | $0 to $35 | Up to $15 | $35 to $65 | Up to $25 |

Intermediary Bank Fees

When you send money overseas, your transfer may pass through one or more intermediary banks. These banks help move your money if your bank and the recipient’s bank do not have a direct connection. Each intermediary bank can add its own wire transfer service fee, which increases the total cost. These fees are often not shown upfront, so you may not know the exact amount until the transfer is complete. If several intermediary banks are involved, the fees can add up quickly and reduce the amount the recipient gets.

Note: Payment instructions like OUR, SHA, or BEN decide who pays these extra fees. Sometimes you pay all, sometimes you share, and sometimes the recipient pays.

Exchange Rate Markups

If you send money in a different currency, banks use an exchange rate to convert your funds. Most banks add a markup to the exchange rate, usually between 1% and 6% above the mid-market rate. For example, if the market rate is 1 USD = 0.90 EUR, your bank might use 1 USD = 0.85 EUR. This difference is another way banks earn money from international wire transfers. The markup can make international wire fees much higher than you expect.

Always check the exchange rate your bank offers before you send money. A small difference in the rate can mean a big change in the total cost.

By knowing about all the fees associated with wire transfers, you can plan better and avoid paying more than you need.

How Much Does It Cost to Wire Money?

Understanding how much does it cost to wire money helps you plan your finances and avoid surprises. The cost of wire transfer fees depends on several factors, such as where you send the money, how you send it, and which banks you use. Both the sender and the recipient may pay fees, so it is important to look at the total costs of wire transfers before you start.

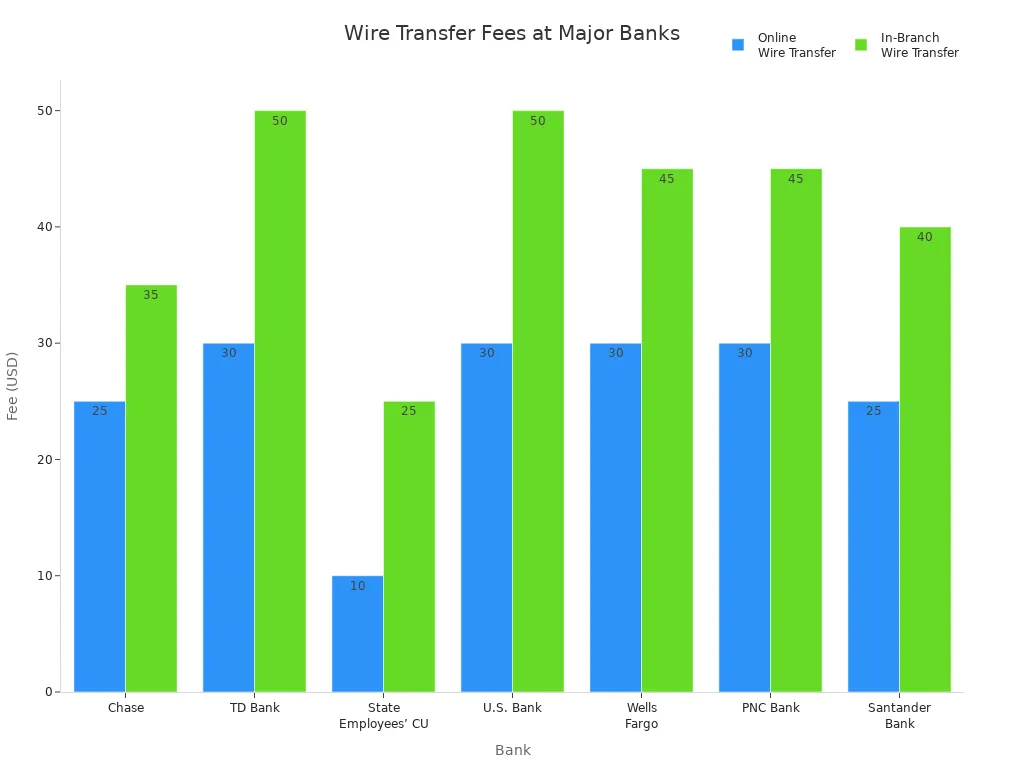

Domestic Wire Transfer Fees

When you send money within the United States, you pay domestic wire transfer fees. The average wire transfer fees for sending money from your account are about $29, while incoming wire fees are around $13. Some banks, like Capital One, may charge up to $40 for outgoing transfers. Others, such as Regions Bank, BMO Harris Bank, and TD Bank, charge closer to $25. Many banks, including BMO Harris and Discover, do not charge for incoming wires. Some banks, like Santander, Bank of America, and Citibank, waive incoming fees for certain account types.

You can save money by choosing online wire transfers. Many banks charge less for online wires than for in-branch transfers. The table below shows how online and in-branch fees compare at leading banks:

| Bank | Online Wire Transfer Fee (Domestic) | In-Branch Wire Transfer Fee (Domestic) |

|---|---|---|

| Chase | $25 | $35 |

| TD Bank | $30 | $50 |

| State Employees’ CU | $10 | $25 |

| U.S. Bank | $30 | $50 |

| Wells Fargo | $30 | $45 |

| PNC Bank | $30 (free for Performance Select) | $45 |

| Santander Bank | $25 (free in foreign currency) | $40 (free in foreign currency) |

Online transfers usually cost between $10 and $30. In-branch transfers often cost $25 to $50 or more. Some banks offer free wires for premium accounts or for wires sent in foreign currency.

International Wire Transfer Fees

International wire transfers cost more than domestic transfers. Outgoing international wire transfer fees usually range from $40 to $50. Incoming international wire fees are about $15 to $20. Some banks may charge even higher fees, especially if the transfer involves currency conversion or intermediary banks.

When you send money overseas, you may pay extra charges. These can include exchange rate markups and fees from intermediary banks. The sender’s bank may charge $15 to $50, and the recipient’s bank may charge $10 to $30. The total cost of wire transfer fees for international wires can reach $80 or more, depending on the banks and the countries involved.

Note: International wire transfers may also include hidden costs, such as currency conversion fees and charges from banks that help move the money between countries.

Cost of Wire Transfer Fees: Ranges

The cost of wire transfer fees can add up quickly. You should always check both the sending and receiving bank fees before you start a transfer. The table below shows typical fee ranges for different types of wire transfers:

| Wire Transfer Type | Typical Fee Range (USD) |

|---|---|

| Incoming Domestic Wire | Around $15 |

| Incoming International Wire | Around $15 |

| Outgoing Domestic Wire | Around $30 |

| Outgoing International Wire | Around $45 |

Sending a wire transfer means you may pay fees at both ends. The sender’s bank usually charges between $15 and $50. The receiver’s bank may charge $10 to $30. For international wire transfers, you may also pay for currency conversion and intermediary bank services. The total cost of wire transfers can range from $25 to $80 or more.

You can lower the cost of wire transfer fees by using online banking, choosing banks with lower fees, or asking about fee waivers. Always compare the average wire payment fees at different banks before you send money. Knowing how much does it cost to wire money helps you make smart choices and keep more of your money.

Factors Affecting Wire Transfer Fees

Many factors can change the amount you pay for a wire transfer. Knowing these factors helps you plan and avoid extra costs.

Bank and Account Type

The bank you choose and your account type both affect the fees you pay. Some banks charge higher processing fees than others. Your account status matters, too. Premium or business accounts may get lower fees or even free transfers. Here are some ways banks and account types influence fees:

- Banks set their own fee schedules, so costs differ from one bank to another.

- Some banks offer flat fees, while others charge a percentage of the transfer amount.

- Certain account types, like premium or high-balance accounts, may qualify for fee waivers.

- Intermediary banks can add extra charges, especially for international transfers.

- Receiving banks may deduct fees from the amount you receive or bill you separately.

You should always check your bank’s fee schedule and ask if your account qualifies for discounts.

Transfer Method

How you send your wire transfer also affects the cost. Online transfers usually cost less than those done in person at a branch. Many banks encourage you to use online or mobile banking by offering lower fees. Some banks may even waive fees for online transfers if you meet certain requirements. In-person transfers often come with higher service charges because they require more staff time.

Amount and Frequency

The amount you send and how often you transfer money can impact your fees. Some banks charge a flat fee, but others may use a sliding scale based on the transfer amount. If you send large sums, you might pay more. Frequent transfers could help you qualify for special rates or fee waivers, especially if you have a business or premium account. Always ask your bank if they offer discounts for regular or high-value transfers.

Currency Conversion

If your wire transfer involves different currencies, you will face currency conversion fees. Banks add a markup to the exchange rate, which increases your total cost. The table below shows the main fee components:

| Fee Component | Description |

|---|---|

| Sending Bank Fee | Fixed fee charged by your bank for processing the transfer. |

| Receiving Bank Fee | Fixed fee charged by the recipient’s bank for receiving the transfer. |

| Exchange Rate Markup | Percentage added to the mid-market exchange rate during currency conversion. |

Note: The exchange rate markup can make a big difference in the final amount received. For example, if you send $1,000 with a $20 sending fee, a $15 receiving fee, and a 2% exchange rate markup, your total fee becomes $55. Always compare exchange rates and ask about markups before sending money.

How to Minimize Fees Associated with Wire Transfers

You can take several steps to reduce wire transfer fees and keep more of your money. Here are some tips to help you minimize wire transfer fees and make smarter choices.

Use Online Banking

You can make wire transfers online to save money. Many banks charge lower fees for online transfers than for those done in person. Some banks even offer free wires if you use their online platforms or meet certain account requirements. Online money transfer services, such as Wise, also help you reduce wire transfer fees, especially for international payments. You can often find banks that offer free wire transfers for premium or student accounts.

Tip: Always check if your bank has a mobile app or website that lets you send wires at a lower cost.

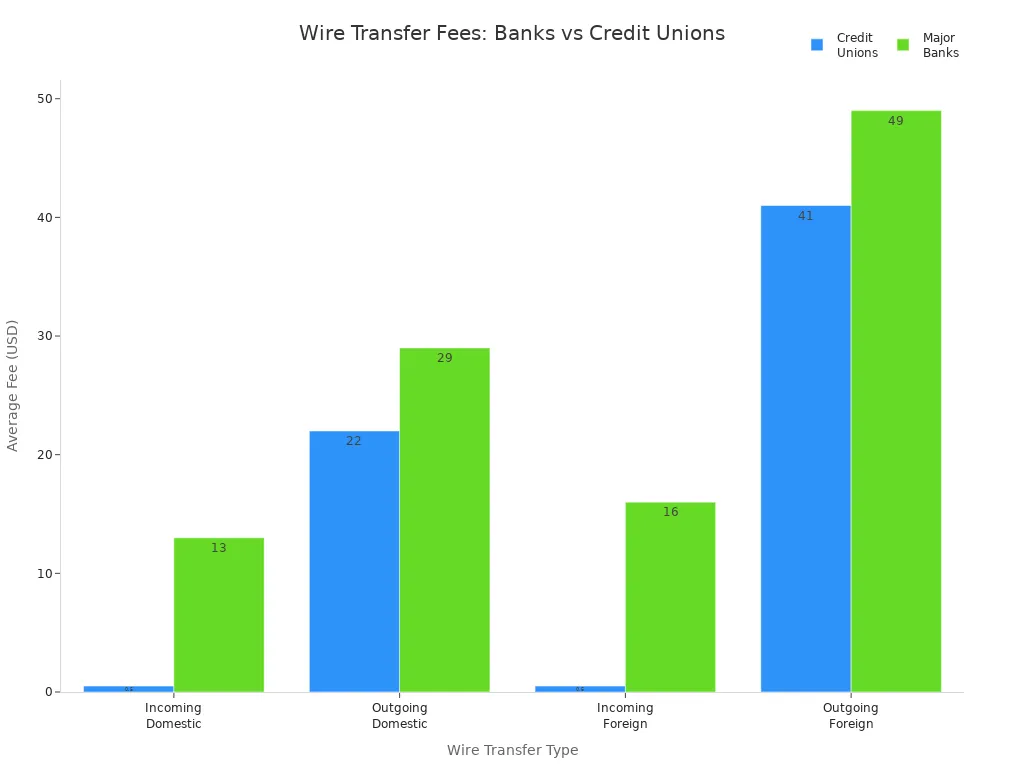

Compare Banks

Not all banks charge the same fees. You should compare fee schedules before choosing where to send your money. Credit unions often have lower fees than major banks. The table below shows how fees differ:

| Institution Type | Incoming Wire Fee (USD) | Outgoing Wire Fee (USD) |

|---|---|---|

| Credit Unions | $0.50 | $22 (domestic), $41 (foreign) |

| Major Banks | $13 (domestic), $16 (foreign) | $29 (domestic), $49 (foreign) |

You can reduce wire transfer fees by choosing a credit union or a bank with lower charges. Always review the latest fee schedule and look for special offers.

Consider Alternatives

You do not always need to use a wire transfer. Alternative transfer methods, such as ACH payments or peer-to-peer apps like Zelle, Venmo, or PayPal, often cost less. ACH transfers usually have low or no fees, but they may take a few days. Peer-to-peer apps can send money quickly with little or no cost for smaller amounts. For international payments, services like Wise or Remitly can help you reduce wire transfer fees and avoid high exchange rate markups.

| Feature | ACH Payments | Wire Transfers |

|---|---|---|

| Speed | 1-3 days | Same day (US); up to 10 days (international) |

| Fees | Low or none | $0-$15 (incoming), $25-$50 (outgoing) |

| Security | Payments reversible | Irreversible |

| Limits | Lower | Higher |

You can choose the best method based on your needs and the amount you want to send.

Ask About Waivers

Many banks offer fee waivers or discounts if you have a certain account type or keep a high balance. Some banks waive fees for premium accounts, students, or long-term customers. You should always ask your bank if you qualify for any discounts or free wires. Some banks refund accidental fees or offer special deals for business accounts.

Note: Banks like Wells Fargo, Bank of America, and Citibank provide free wires for certain account holders. Always check with your bank for the latest offers.

By following these tips to reduce wire transfer fees, you can save money and make your transfers more efficient.

Domestic vs. International Wire Transfer Fees

Key Differences

You will notice some clear differences between sending money within your country and sending it to another country. International wire transfer fees are usually higher than those for local transfers. This happens because more banks and extra steps get involved. You often pay for currency conversion and extra checks. The process can also take longer.

Here is a table to help you compare:

| Aspect | Domestic Wire Transfers | International Wire Transfers |

|---|---|---|

| Processing Time | Often same day or within hours | 1 to 5 business days, sometimes longer |

| Cost | Lower fees, no currency conversion | Higher fees, currency conversion, more intermediaries |

| Complexity | Simple, fewer steps | More complex, extra checks and regulations |

| Intermediary Banks | Rarely involved | Often involved, adding to cost and time |

| Currency Conversion | Not required | Required, adds to total cost |

You can see that sending money to another country costs more and takes longer. The process also involves more checks and steps.

Who Pays the Fees

Both you and the person receiving the money may pay wire transfer fees. When you send a wire transfer, your bank charges you a fee. The recipient’s bank may also charge a fee when the money arrives. For international wire transfer, extra banks may help move the money. Each of these banks can take a fee from the amount sent. Sometimes, you and the recipient share the total cost. Always ask your bank who pays each fee before you send money.

Note: Large transfers may get reported to authorities for safety and legal reasons. This helps prevent fraud and money laundering.

Safety and Limits

Banks use strong safety measures to protect your money. You may see daily limits on how much you can send. Many banks set a maximum of $5 million for local wires and $1 million for international wire transfers. Banks use two-factor authentication, biometric checks, and callback verification for large transfers. You will get alerts for any suspicious activity. Banks also follow strict rules to check for fraud and illegal activity, especially for international transfers. You must give clear approval for each transfer, including the amount and who will receive the money.

Tip: Always double-check the details before you send a wire transfer. This helps keep your money safe.

Alternatives to Wire Transfer

Image Source: unsplash

When you need to move money, you do not always have to use a wire transfer. You can choose from several alternative transfer methods that may save you money or offer more convenience. Here are three popular options:

ACH Transfers

ACH transfers use the Automated Clearing House network to move money between banks. You might use this method to pay bills, receive your paycheck, or send money to friends. ACH transfers usually cost less than wire transfers. Many banks offer them for free or charge a small fee, often less than 1% of the transaction. You can expect your money to arrive in one to three business days. ACH transfers are also very secure. The network allows you to reverse a payment if there is an error or fraud.

| Feature | ACH Transfers | Wire Transfers |

|---|---|---|

| Processing Speed | Up to 3 days for funds to be received | Usually same business day processing |

| Cost | Typically free or low fees (~1% of transaction) | Fees can range from $0 to nearly $100 |

| Security | More secure; allows reversals | Less secure for senders; irreversible |

ACH transfers work best for routine payments that do not need to arrive instantly.

Peer-to-Peer Apps

Peer-to-peer (P2P) apps like PayPal, Venmo, Zelle, and Cash App let you send money using just a phone number or email. These apps make it easy to split bills, pay friends, or send small amounts quickly. Basic transfers are often free. Some apps charge a fee for instant transfers or currency conversion. Each app sets its own transfer limits, so you should check before sending large amounts. P2P apps move money fast, but you may have less protection if something goes wrong. PayPal offers some purchase protection, but most P2P payments are similar to cash.

- P2P apps are great for quick, small payments.

- You can use them without needing bank account details.

- Fees may apply for instant transfers or sending money in another currency.

Online Banks

Online banks and third-party money transfer services give you more ways to send money. Many online banks, such as Ally or Discover, offer free incoming transfers and lower fees for outgoing transfers. Some third-party money transfer services, like Wise, provide low-cost international transfers with clear pricing. These services often use the real exchange rate, so you avoid hidden costs. Online banks may also offer features like crypto transfers or free wires if you meet certain account requirements.

You should consider online banks or third-party money transfer services if you want lower fees, transparent pricing, or need to send money overseas. These options can be more cost-effective than traditional banks.

Note: ACH transfers and P2P apps are often cheaper than wire transfers, but they may be slower or have lower transfer limits. Always choose the method that fits your needs best.

You need to understand all the fees associated with wire transfers before you send money. Always ask both banks for clear details about the fees associated with wire transfers. Compare your options and choose a method that balances cost, speed, and security. Pick a reputable bank or service that uses strong security, like encryption and multi-factor authentication. Stay informed and ask questions so you can avoid surprises and make sure your money arrives safely.

FAQ

What information do you need to send a wire transfer?

You need the recipient’s full name, their bank account number, and the bank’s routing number or SWIFT code. For transfers to Hong Kong banks, you also need the bank’s address and the recipient’s contact details.

Can you cancel a wire transfer after sending it?

You usually cannot cancel a wire transfer once your bank processes it. If you notice a mistake, contact your bank immediately. Some banks may help if the funds have not reached the recipient’s account.

Why do international wire transfers cost more?

International wire transfers cost more because banks use extra steps, such as currency conversion and intermediary banks. These steps add fees and increase the total cost. Always check the exchange rate and all fees before sending money.

How long does a wire transfer take to arrive?

Wire transfers within the same country often arrive the same day. International transfers, including those to Hong Kong banks, may take one to five business days. Delays can happen if banks need extra checks or if you send money on weekends.

Wire transfers are fast and secure, but their fees and hidden costs can quickly add up—especially for international transfers. Instead of losing money to banks and intermediaries, you can choose a smarter alternative.

With BiyaPay, you get transparent real-time exchange rates, fees as low as 0.5%, and same-day settlement across most countries. Whether you’re paying suppliers, sending funds to family, or managing international expenses, BiyaPay makes cross-border transfers faster, safer, and more affordable.

Stop overpaying on wire transfer fees. Start saving today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.