- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

QuickBooks Explained for Beginners and How It Works

Image Source: unsplash

QuickBooks helps you manage your business finances with ease. You use it as accounting software designed for small businesses, especially if you want to save time and reduce errors. QuickBooks holds a strong presence in the United States, with about 62% of small businesses choosing it as their main tool. Many owners with 1-50 employees trust QuickBooks for its simple setup and clear reports. You can start with a free trial to explore its features. QuickBooks automates tasks, gives real-time insights, and connects with other tools. If you need to keep your finances organized, QuickBooks offers another trial so you can see how it fits your business.

Key Takeaways

- QuickBooks is easy-to-use accounting software that helps small businesses manage finances, save time, and reduce errors.

- The software offers automation, real-time insights, and mobile access, making it simple to track income, expenses, invoices, and payroll.

- Different QuickBooks versions fit various business needs, from freelancers to larger companies, with options for cloud or desktop use.

- QuickBooks connects with many apps and banks, automating tasks and improving accuracy to help your business grow smoothly.

- Starting with a free trial lets you explore features and find the right plan to keep your finances organized and support your success.

What Is QuickBooks?

Image Source: unsplash

Overview

QuickBooks is a popular accounting software package that helps you manage your business finances. Intuit, the company behind QuickBooks, defines it as a tool designed for small and medium-sized businesses. You can use QuickBooks accounting software to handle tasks like invoicing, payroll, inventory, and financial reporting. The software comes in different versions, so you can pick the one that fits your needs best. QuickBooks stands out because it offers scalability and works well with many other business tools.

When you use QuickBooks accounting software, you get more than just a digital ledger. You gain access to features that make your daily work easier. For example, you can send invoices, track expenses, run payroll, and generate reports with just a few clicks. QuickBooks also supports real-time updates and automatic backups, so you always have the latest information. If you run a small business, you will find that QuickBooks helps you stay organized and saves you time.

QuickBooks accounting software gives you a clear view of your business finances. You can see where your money goes and how your business performs at any time.

Here are some core functionalities that set QuickBooks apart from other accounting software:

- QuickBooks Online lets you manage your finances in the cloud, so you can work from anywhere.

- QuickBooks Solopreneur offers tools for invoicing, expense tracking, and tax filing, perfect for solo business owners.

- QuickBooks Enterprise supports larger businesses with advanced inventory tracking and custom pricing.

- QuickBooks Accountant Desktop and QuickBooks Online Accountant help financial professionals manage multiple clients.

- QuickBooks Ledger focuses on year-end reporting for tax-only clients.

- You can add extra features and connect QuickBooks with over 750 third-party apps.

QuickBooks has a mature feature set. You can handle complex tasks like job costing, inventory management, and multi-location operations. The software also offers industry-specific versions for fields like construction, manufacturing, and nonprofits. Many accountants and bookkeepers use QuickBooks, so you can easily find professional support.

Who Uses It

You will find that QuickBooks serves a wide range of users. Small businesses, freelancers, and small to medium business owners often choose QuickBooks accounting software because it is easy to use and powerful. If you run a micro-business, work as a contractor, or manage rental properties, QuickBooks can help you track income and expenses. Many hairstylists, salon owners, auto repair shops, daycare businesses, Airbnb hosts, and Uber drivers rely on QuickBooks to keep their finances in order.

Financial professionals also use QuickBooks. Accountants and bookkeepers like the specialized versions that let them manage multiple clients and run detailed reports. You can use QuickBooks to automate tasks, simplify payroll, and process payments. The software makes it easy to collaborate with your accountant or team members.

Some reasons why people choose QuickBooks include:

- A user-friendly interface that does not require an accounting degree.

- Automation features that save time and reduce errors.

- Mobile access, so you can manage your business on the go.

- Payroll tools that handle direct deposits and tax forms.

- Custom financial reports to help you understand your business performance.

- Easy collaboration with others.

If you want to track income, expenses, invoices, payments, payroll, and tax deductions, QuickBooks gives you the tools you need. The software fits many industries and business sizes, making it a top choice for small businesses and professionals.

QuickBooks Accounting Software

Key Features

QuickBooks gives you a wide range of tools to manage your business finances. You can track income and expenses, create invoices, and handle payroll with ease. Many users value the automation in quickbooks accounting software. This automation helps you save time and reduce mistakes. You can connect your bank accounts and credit cards, so transactions appear automatically. Quickbooks features like customizable invoices and payment reminders help you get paid faster.

A recent survey of 2,000 accountants in the United States shows that automation, cloud access, and third-party integrations are some of the most widely used quickbooks features. These tools help you work more efficiently every day. Quickbooks accounting software also offers advanced features such as inventory monitoring and real-time reporting. You can use the cloud to access your data from any device, which makes it easy to collaborate with your team or accountant.

Here is a table showing some of the most important quickbooks features:

| Feature | Description |

|---|---|

| Income and Expense Tracking | Tracks all money inflows and outflows, including sales, invoices, bills, and payroll. |

| Invoicing | Create, customize, and send invoices; automate payment reminders. |

| Payroll Management | Automates payroll processing and tax filings. |

| Bank Reconciliations | Matches bank transactions with your records for accuracy. |

| Inventory Monitoring | Tracks stock levels and sales; sets reorder reminders. |

| Cloud Accounting | Access your finances from anywhere, anytime. |

| Automation & Workflow | Automates billing and accounting tasks. |

| Reporting & Analytics | Generates real-time financial reports and dashboards. |

| Apps & Integrations | Connects with over 1,000 third-party apps. |

Benefits

Quickbooks accounting software brings many benefits to your business. You can automate invoicing and payments, which speeds up your cash flow. The software syncs with your bank accounts, so you always have accurate financial data. You can set budgets and spending limits to control your cash flow better. These quickbooks features help you make smarter decisions and focus on growing your business.

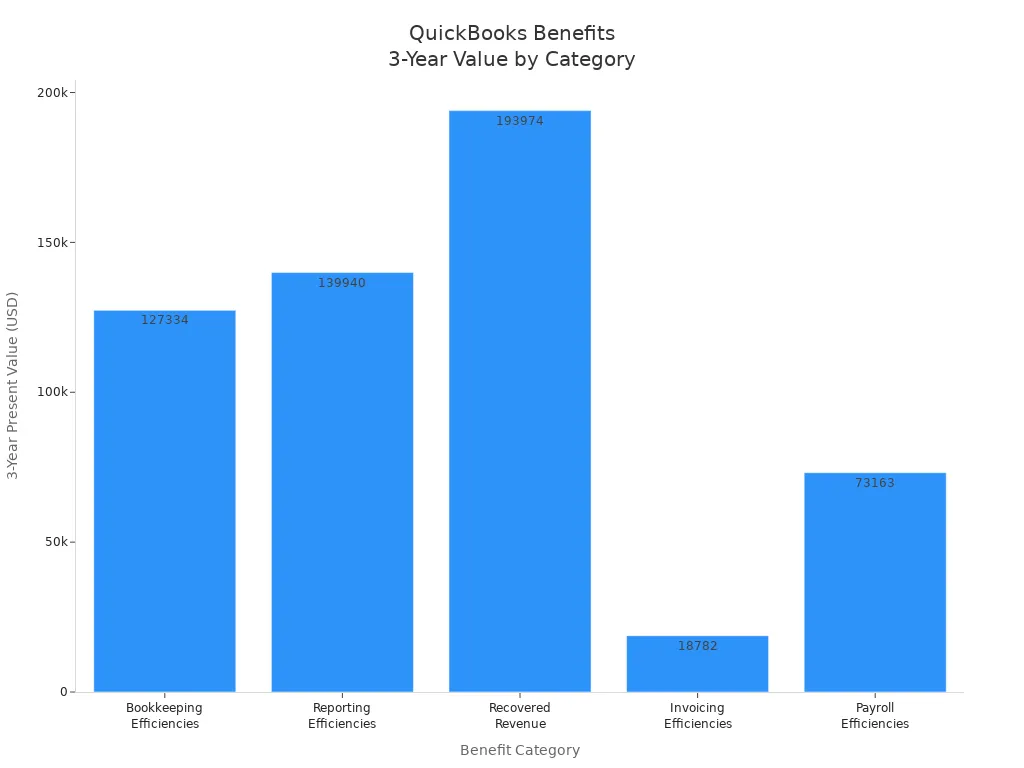

Many businesses report big improvements after switching to quickbooks. You get 24/7 cloud access, which means you can check your finances from anywhere. Real-time updates let you review your data and work with your accountant at any time. Quickbooks features like advanced reporting and payroll management save you hours each week. You can see the impact in this chart:

“The investment in Intuit Enterprise Suite is something that we needed to do to supply a ‘win-win’ to both our customers and our internal organization. If we can simplify and make our bookkeeping more seamless, it means we can spend more time doing the real work.” — CFO, Landscaping/Construction

With quickbooks, you gain efficiency, reduce errors, and get valuable insights. The advanced features and automation in quickbooks accounting software help you stay organized and ready for growth.

QuickBooks Online

Automation

QuickBooks Online stands out as a cloud-based accounting software that helps you automate many daily tasks. When you use this cloud-based subscription service, you save time and reduce mistakes. QuickBooks Online connects with your bank accounts and downloads transactions automatically. You do not need to enter each transaction by hand. You can set up rules in QuickBooks Online to categorize your expenses and income. This feature keeps your records organized and accurate.

Here is how QuickBooks Online automates your work:

- QuickBooks Online integrates with payroll apps like Gusto. Payroll data imports automatically and follows your business rules.

- You can set up recurring invoices and schedule reminders for late payments. This keeps your cash flow steady.

- QuickBooks Online lets you customize reports and schedule them to send by email. You do not have to create reports every time.

QuickBooks Online uses AI to handle journal entries, prepaid expenses, and deferred revenue. This automation improves accuracy and lets you focus on growing your business. You can also connect QuickBooks Online with over 750 third-party apps. These integrations sync data and reduce manual entry. QuickBooks Online gives you real-time insights, so you always know how your business is doing.

QuickBooks Online helps you automate routine accounting tasks, so you can spend more time on important decisions.

Mobile App

The QuickBooks Online mobile app gives you the power to manage your business from anywhere. You can check your finances, send invoices, and track expenses on your phone or tablet. This cloud-based version of QuickBooks keeps your data updated across all devices.

With the QuickBooks Online mobile app, you can:

- Access your business information anytime, anywhere.

- Send invoices and estimates directly from your device.

- View, add, and edit transactions such as sales and expenses.

- Monitor cash flow and see real-time business reports.

- Snap photos of receipts and categorize expenses for tax season.

- Receive fast electronic payments.

- Get alerts for inventory, timesheets, and tasks.

- Enjoy secure data with 128-bit SSL encryption.

QuickBooks Online supports multiple users and syncs data across devices. This makes it easy for you and your team to stay on the same page. The mobile app is ideal for small business owners, freelancers, and accountants who need flexibility. Most tasks you do on the desktop version are available on the app, except for mileage tracking and receipt photo capture. QuickBooks Online makes it simple to keep your business running smoothly, even when you are on the go.

QuickBooks Versions

Online vs Desktop

When you choose between quickbooks online and quickbooks desktop, you need to think about your business needs and how you want to work. Quickbooks online uses a subscription model, with monthly fees from $30 to $200. This makes it flexible for small and medium businesses. Quickbooks desktop lets you pay once or use an annual subscription, which can save money over time if you do not need frequent updates.

Quickbooks online gives you a modern, easy-to-learn interface. You get automatic updates and can access your data from any device with internet. This helps if you work remotely or have a team in different places. Quickbooks desktop offers more advanced features, like detailed inventory tracking and industry-specific tools. You install it on your computer, so you control your data, but you must update it yourself.

Here is a table to help you compare these quickbooks products:

| Feature | QuickBooks Online | QuickBooks Desktop |

|---|---|---|

| Updates | Automatic | Manual |

| Access | Cloud, any device | Local computer only |

| Collaboration | Real-time, multi-user | Limited, needs refreshing |

| Inventory | Basic | Advanced |

| Industry Tools | General | Specialized editions |

| Automation | Strong | Less automation |

Quickbooks online works well if you want easy access, automation, and simple setup. Quickbooks desktop fits businesses that need advanced inventory or industry features. Quickbooks accountant desktop is a special version for accountants who manage many clients.

Tip: If you want to work from anywhere and need simple tools, quickbooks online is a good choice. If you need deep features and do not mind working on one computer, quickbooks desktop or quickbooks accountant desktop may suit you better.

Self-Employed

Quickbooks self-employed is one of the quickbooks products made for freelancers and independent contractors. You can use it to separate business and personal expenses, track your mileage, and find tax deductions. The software helps you organize your finances without needing accounting skills.

With quickbooks self-employed, you get:

- Automatic separation of business and personal expenses.

- Mileage tracking using GPS for business trips.

- Simple invoicing for clients.

- Quarterly tax calculation and reminders.

- Integration with TurboTax for easy tax filing.

- Mobile access so you can manage your money on the go.

Quickbooks self-employed helps you import transactions, snap photos of receipts, and match expenses automatically. You can focus on your work while the software keeps your records ready for tax time. This version does not have all the features of quickbooks online or quickbooks desktop, but it covers what freelancers need most. Quickbooks accountant desktop can also help tax professionals support self-employed clients.

QuickBooks Functionality

QuickBooks functionality gives you powerful tools to manage your business finances. You can automate many tasks, such as invoicing, tracking income and expenses, payroll, and reporting. These features help you save time, reduce errors, and gain better control over your financial management.

Invoicing

You can create and send professional invoices with QuickBooks. The system lets your customers pay directly from the invoice using credit cards, ACH transfers, or mobile payments. QuickBooks payments make it easy for your clients to pay you quickly. Automated reminders help you collect payments on time and reduce overdue invoices. When you use QuickBooks invoicing with integrated payment solutions, you speed up payment collection and improve your cash flow. Automation features like real-time syncing of payments, reminders, and faster dispute resolution reduce manual errors and delays. This process helps you get paid faster and improves your customer service. Automating invoicing in QuickBooks increases efficiency and enables quick and accurate invoice reconciliation.

Expense Tracking

QuickBooks makes tracking income and expenses simple. You can link your bank accounts and credit cards, which allows automatic importing of transactions. This automation helps you categorize expenses and attach receipts, so your records stay organized and current. QuickBooks enhances expense tracking by scanning barcodes on receipts and extracting key data, such as date, amount, and vendor. You do not need to enter this information by hand. You can upload receipts quickly using the mobile app, which prevents loss of important records. Expenses are grouped and categorized, helping you control spending, set budgets, and analyze your costs. These features support better tax deductions and improve your overall profitability. Income and expense tracking is a core part of QuickBooks functionality.

Payroll

QuickBooks payroll gives you a complete solution for paying your employees. You can calculate wages, taxes, and deductions automatically. The system handles direct deposits and files federal and state payroll taxes for you. QuickBooks payroll includes built-in time tracking, so you can pay your team accurately. You can generate payroll summaries and other reports that connect directly with your accounting data. Automated payroll processing saves you time and reduces errors. QuickBooks payroll integrates with over 750 business apps, making it easy to manage your workforce. If you need to pay employees in more than one state, QuickBooks payroll supports multi-state payroll, though higher-tier plans may be required. The integration with accounting software means you do not need to transfer data manually, which lowers the risk of mistakes.

| Feature / Aspect | QuickBooks Online with Payroll | Standalone Payroll Services (e.g., Gusto) |

|---|---|---|

| Integration | Fully integrated with QuickBooks accounting software, automates data flow, reduces errors | Requires separate accounting software, manual data transfer needed |

| Payroll Automation | Calculates wages, taxes, deductions; handles direct deposits; automatic federal and state filings | Automates payroll but may lack integrated tax filing with accounting |

| Time Tracking | Built-in time tracking tool feeding directly into payroll calculations | Often requires separate time tracking software |

| Reporting and Analytics | Offers profit & loss, balance sheets, payroll summaries integrated with accounting data | Reporting may be payroll-only, less integrated with accounting |

| Third-Party Integrations | Integrates with over 750 business apps | Varies by provider, generally fewer integrations |

| Multi-State Payroll | Supports multi-state payroll but may require higher-tier plans and incur additional fees | Often better multi-state support, depending on provider |

| User Experience | User-friendly but can be challenging for complex payroll setups; mixed customer support reviews | Generally user-friendly; support quality varies |

| Cost | Higher base cost; additional fees for state filings and advanced features | Lower base price; separate costs for accounting software and data handling |

| Suitability | Best for small to medium businesses with straightforward payroll needs | Suitable for various sizes; may be better for complex or multi-state payroll |

| Long-term Benefits | Integration saves time, reduces errors, and avoids migration costs as business grows | May require switching or additional software as business scales |

Reporting

QuickBooks offers strong reporting tools that help you understand your business performance. You can generate essential financial reports, such as Profit and Loss, Balance Sheet, and Cash Flow Statements. These reports help you monitor income, expenses, profitability, and financial stability. Sales reports show revenue, sales trends, and customer buying patterns. Inventory reports track stock levels and shortages. Payroll reports help you manage employee payments and labor costs. QuickBooks reporting tools transform raw accounting data into actionable information. You can customize reports, automate report generation, and export data to Excel for deeper analysis. These tools provide real-time financial insights and support data-driven decisions. Regular use of reporting helps you identify growth opportunities, control costs, and communicate with stakeholders.

- Financial reports help you monitor income, expenses, and profitability.

- Sales reports analyze revenue and customer trends.

- Inventory reports improve stock management.

- Payroll reports track labor costs and ensure compliance.

- Customizable reports and real-time insights support better decision-making.

Tax Tools

QuickBooks includes tax tools that make tax season easier. You can use companion apps like Payroll, Self-Employed, and TurboTax Integration to automate payroll tax calculations and track contractor payments for 1099 forms. The system auto-categorizes transactions, sends reminders for tax documents, and schedules reporting and reconciliation. You can track mileage, home office deductions, equipment depreciation, and contractor expenses to maximize deductions. QuickBooks separates business and personal transactions and classifies account types for tax categorization. Regular reconciliation keeps your books clean. QuickBooks Live Expert Tax services give you access to tax professionals who can help you prepare and file taxes. You can choose full-service tax filing or get expert help as you prepare your own taxes. These services ensure accuracy and help you get the most deductions and credits.

- Payroll, Self-Employed, and TurboTax Integration automate tax calculations and reporting.

- Auto-categorization and reminders streamline tax preparation.

- Expense tracking covers mileage, home office, and equipment for better deductions.

- QuickBooks Live Expert Tax services provide professional support.

Integrations

QuickBooks connects with over 750 third-party applications, expanding its financial management capabilities. You can integrate with CRM tools, payment platforms, e-commerce solutions, and more. These integrations automate workflows, sync data, and reduce manual entry. For example, you can use Method CRM or Salesforce for customer management, Square for payments, Fundbox for lending, and Expensify for expense management. QuickBooks checking allows you to manage payments, sync transactions, and improve cash flow. You can also use Gusto for payroll, Melio for bill payments, and Zapier to connect QuickBooks with hundreds of other apps. These integrations help you streamline your business processes and keep your financial data accurate.

| Application | Type/Category | Additional Functionality Provided with QuickBooks Integration |

|---|---|---|

| Method CRM | CRM | Two-way sync, custom reporting, workflow automation, payment portals |

| Salesforce | CRM | Customer data management, marketing automation, customer service tools |

| Square | Payment & POS | Contactless payments, vendor management, sync transactions and inventory |

| Fundbox | Lending | Short-term credit lines, automatic syncing, faster funding decisions |

| Synder | E-commerce Integration | Automated reporting, smart invoicing, accounts reconciliation |

| Expensify | Expense Management | Receipt scanning, mobile app, corporate card reconciliation |

| Gusto | Payroll | Payroll processing, onboarding tools, simplifies workflows |

| Melio | Payment Platform | Online bill payments, bank transfers, recurring payments |

| Collbox | Accounts Receivable | Automated collections, cash flow improvement, invoice follow-ups |

| Zapier | Automation Tool | Connects QuickBooks with hundreds of apps, automates workflows |

| Insightly | CRM | Syncs contacts, tasks, projects, automatic sales sync |

Electronic Payments, Bank Connections, and Real-Time Insights

QuickBooks checking and QuickBooks payments let you accept credit cards, debit cards, ACH bank transfers, and mobile payments. You can send invoices with a “Pay Now” button, automate payment reminders, and schedule payments to vendors. Transactions sync automatically, reducing manual entry and errors. QuickBooks checking gives you real-time tracking of payments and cash flow visibility up to 90 days in advance. Integration with QuickBooks Online or Desktop ensures your records stay accurate. You can offer discounts for early payments, manage disputes, and set customizable payment terms. Over 95% of accountants say QuickBooks Online Payments saves time, and 89% of users report better cash flow planning. The system uses encrypted transactions and fraud prevention to keep your data safe.

Limitations of QuickBooks Functionality

QuickBooks functionality has some limits. The software lacks industry-specific features, such as detailed project costing for construction or advanced inventory management for manufacturing. Reporting options may not be customizable enough for some businesses. You may face file size and user number constraints as your business grows. Some users report system crashes and data loss. QuickBooks checking and integrations can require manual data entry if not set up correctly. The system does not always provide strong audit trails or advanced controls for compliance. Inventory control remains basic, which may not suit businesses with complex needs. QuickBooks ledger and QuickBooks checking help with year-end reporting, but may not cover all specialized requirements.

Note: QuickBooks works best for small to medium businesses with general accounting needs. If you need advanced features or industry-specific tools, you may need to look for additional solutions or integrations.

Getting Started

Image Source: pexels

Getting started with quickbooks is simple if you follow a few clear steps. You can set up your account, organize your business information, and customize your dashboard to fit your needs.

Sign Up

To begin, you need to create a quickbooks account. Here is a step-by-step guide:

- Visit the quickbooks website and select the plan that fits your business.

- Enter your email address, name, and mobile number. Set a secure password.

- Choose your subscription plan and enter your payment details.

- Add your company information, such as business name, address, and tax ID.

- Complete the setup checklist. You can take a quick tour if you want.

Tip: Prepare your business details and bank account information before you start. This will make the process faster.

Set Up Accounts

After signing up, you need to set up your accounts in quickbooks. This step helps you track your money accurately. Use the Chart of Accounts to organize your finances. Here is a table showing common account types:

| Account Type | Description | Examples |

|---|---|---|

| Asset Accounts | What your business owns | Bank accounts, inventory |

| Liability Accounts | What your business owes | Loans, credit card balances |

| Income Accounts | Money your business earns | Sales income, rental income |

| Expense Accounts | Money your business spends | Advertising, salaries |

You can customize these accounts to match your business needs. Review your accounts with an accountant if possible.

Connect Bank Data

Connecting your bank and credit card accounts to quickbooks saves time and reduces errors. The software imports transactions automatically. You can set up rules to categorize expenses and income. This automation helps you keep your records accurate and up to date. Regularly check your bank connections and review transactions to catch any mistakes early.

Customize Dashboard

You can personalize your quickbooks dashboard to show the information you use most. Drag and drop widgets to reorder them. Resize widgets to fit your preferences. Add bookmarks for features like invoices or bills. Each user can set up their own dashboard without affecting others. You can also update your company name and logo from the dashboard.

Note: If you need help, quickbooks offers setup guides, videos, and customer support to answer your questions.

Pricing

Plans

When you look at QuickBooks, you see several pricing plans. Each plan fits a different business size and need. You can start with a free 30-day trial to test the features before you pay. QuickBooks offers four main plans. The Simple Start plan costs $35 per month and supports one user. The Essentials plan is $65 per month and allows up to three users. The Plus plan costs $99 per month and supports five users. The Advanced plan is $235 per month and works for up to 25 users. Each plan gives you a trial, so you can try the software and see if it matches your needs.

Here is a table that shows the main QuickBooks plans:

| Plan Name | Monthly Price | User Limit | Best For |

|---|---|---|---|

| Simple Start | $35 | 1 | Freelancers, sole proprietors |

| Essentials | $65 | 3 | Small teams, growing businesses |

| Plus | $99 | 5 | Inventory, project tracking |

| Advanced | $235 | 25 | Larger businesses |

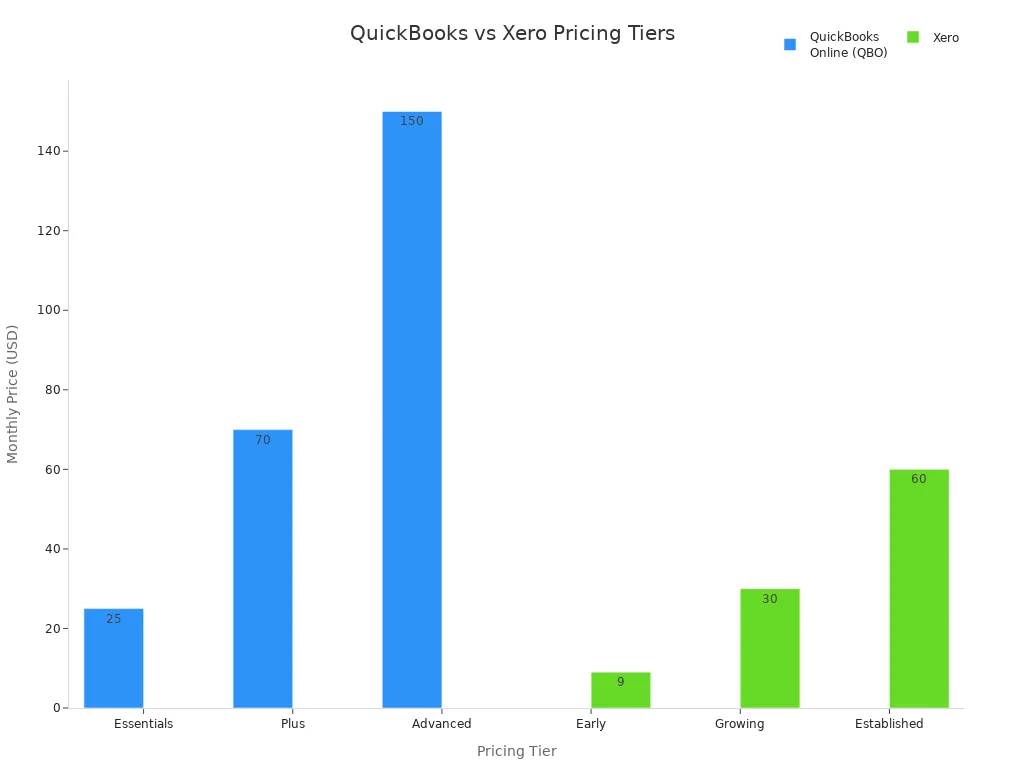

You can compare QuickBooks with Xero, another popular accounting software. Xero offers lower prices and unlimited users, but QuickBooks gives you more advanced features. The chart below shows how the monthly prices compare:

Note: QuickBooks often provides discounts for the first few months. You can use a trial to explore all features before you decide.

What’s Included

Each QuickBooks plan includes different features. The Simple Start plan gives you basic invoicing, expense tracking, and financial reports. Essentials adds bill management and better reporting. Plus includes inventory tracking and project management. Advanced gives you custom reports, advanced analytics, and priority support. You can add payroll to any plan for an extra fee. Every plan comes with a trial, so you can see what works best for your business.

Here is a table that breaks down what you get with each plan:

| Plan Name | Key Features | Business Size Targeted |

|---|---|---|

| Simple Start | Basic invoicing, expense tracking, financial reports | Freelancers, sole proprietors |

| Essentials | All Simple Start features + bill management, enhanced reporting | Growing small businesses |

| Plus | All Essentials features + inventory tracking, project management | Businesses with inventory or projects |

| Advanced | All Plus features + custom reports, advanced analytics, priority support | Larger businesses with complex needs |

You can use a trial for each plan. This helps you find the right fit. If you want to test features like inventory or advanced reporting, you can switch plans during your trial. QuickBooks also lets you try payroll as an add-on. Many users start with a trial to see how QuickBooks meets their needs.

You gain many advantages when you choose QuickBooks as a beginner.

- The software offers a user-friendly interface, flexible pricing, and automated features that reduce manual work.

- You save up to 15 hours each week on bookkeeping, invoicing, and expense tracking.

- QuickBooks helps you stay organized, supports business growth, and gives you real-time insights.

Many business owners report faster growth and better focus on strategy after switching to QuickBooks. Try it to simplify your finances and set your business up for success.

FAQ

How do you choose the right QuickBooks plan for your business?

You should look at your business size, number of users, and needed features. Start with a free trial. Compare plans using a table or QuickBooks’ website. Upgrade as your business grows.

Can you use QuickBooks if you are not an accountant?

Yes, you can use QuickBooks without accounting experience. The software uses simple menus and guides. You can also find tutorials and customer support to help you learn.

Does QuickBooks work with banks outside the United States?

QuickBooks connects with many banks worldwide, including Hong Kong banks. You can link your accounts to import transactions. Check the QuickBooks website for a list of supported banks.

How secure is your financial data in QuickBooks?

QuickBooks uses encryption and security tools to protect your data. You get secure logins and regular backups. Always use strong passwords and enable two-factor authentication for extra safety.

QuickBooks keeps your books in order, but when it comes to moving money across borders, you need a solution that’s just as efficient.

BiyaPay empowers small businesses and entrepreneurs with multi-currency and crypto-to-fiat conversions, real-time exchange rates, and fees as low as 0.5%. Whether you’re paying overseas staff or receiving client payments, BiyaPay ensures same-day transfers across most countries worldwide — at a fraction of traditional bank costs.

Track your finances with QuickBooks, move your money with BiyaPay, and keep your business running smarter.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.