- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding ACH Meaning and How the Process Works in 2025

Image Source: pexels

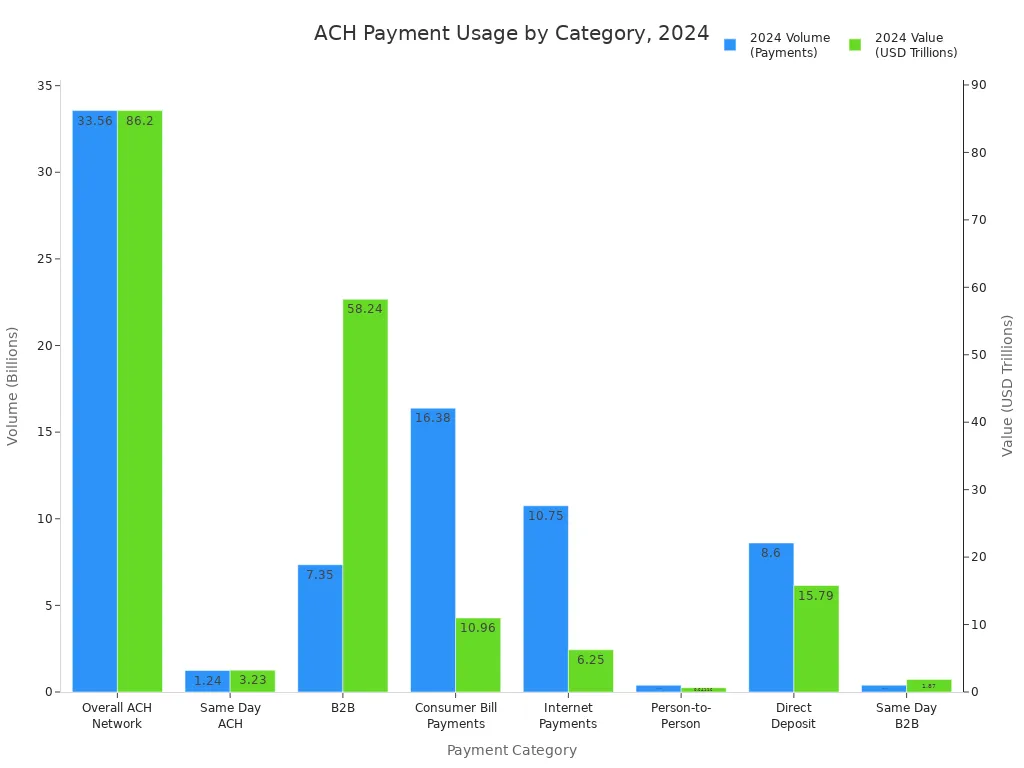

ACH stands for automated clearing house. You use the ACH network when you send or receive electronic payments in the United States, such as paying bills online or getting your paycheck through direct deposit. This network helps move money between banks quickly and securely. In 2024, the ACH network processed over 33.6 billion payments worth $86.2 trillion, showing how vital it is for both consumers and businesses. The steady rise in ACH payments highlights why understanding ACH meaning matters today.

Key Takeaways

- ACH stands for Automated Clearing House, a secure network that moves money electronically between U.S. banks for payments like payroll and bills.

- Nacha manages the ACH network by setting rules that keep payments safe, reliable, and low-cost for consumers and businesses.

- ACH payments usually take 1 to 3 business days to process, but same-day options exist for faster transfers when needed.

- There are two main ACH transaction types: credits (you send money) and debits (businesses pull money with your permission).

- ACH transfers cost less than wire transfers and credit cards, making them a smart choice for regular payments despite being slower.

ACH Meaning

Image Source: pexels

What Is ACH?

You may wonder what ACH meaning is and why it matters for your payments. ACH stands for Automated Clearing House. This system acts as a financial network that lets you move money electronically between banks in the United States. When you pay your bills online, receive your paycheck through direct deposit, or send money to someone else’s bank account, you use the ACH network.

The Code of Federal Regulations describes the Automated Clearing House as a funds transfer system governed by specific rules. These rules help banks clear electronic entries between each other. Nacha, the organization that manages the ACH network, publishes these rules to make sure every payment follows the same standards. This structure keeps your payments safe and reliable.

Note: The ACH network does not move physical cash. Instead, it sends payment instructions between banks, making your transactions fast and secure.

ACH meaning goes beyond just moving money. It creates a trusted way for you to handle payments, whether you are a consumer or a business. The ACH network supports millions of payments every day, making it a backbone of the U.S. financial system.

ACH Network and Nacha

You might ask who makes sure the ACH network works smoothly. Nacha serves as the official administrator of the ACH network in the United States. This group sets the rules and checks that all banks and payment providers follow them. Nacha’s work ensures that your payments stay secure, low-cost, and efficient.

Here are some key responsibilities of Nacha:

- Nacha sets and enforces the operating rules for all ACH network participants.

- It drives the growth and improvement of the ACH system.

- Nacha educates banks and payment providers about their roles in the ACH process.

- The organization oversees compliance for more than 10,000 banks and payment companies.

- Nacha manages risk by providing tools and guidance to prevent fraud and errors.

Nacha’s rules cover important areas like customer verification, payment authorization, and fraud detection. These standards help protect your money and keep the ACH network trustworthy. Nacha also brings together banks, fintech companies, and other stakeholders to discuss new ideas and solve problems in the payments industry.

Tip: When you use ACH for payments, you benefit from Nacha’s strict security and compliance standards. This helps keep your transactions safe from fraud and mistakes.

ACH meaning includes both the technology and the rules that make electronic payments possible. By understanding how the ACH network and Nacha work together, you can trust that your payments will reach the right place quickly and safely.

How ACH Payments Work

Image Source: pexels

Understanding how ACH payments work helps you manage your money and business more efficiently. The ACH system uses a batch processing method to move funds between accounts. This process involves several key players and follows a clear set of steps from start to finish.

Step-by-Step Process

You can follow these steps to see how ACH transfers move from initiation to settlement:

- You, as the originator, start the ACH transfer by providing payment instructions to your bank or payment provider. This step includes getting permission from the person or business receiving the funds.

- Your bank, known as the Originating Depository Financial Institution (ODFI), collects your ACH transactions and groups them into batches. The ODFI sends these batches to the ACH operator at scheduled times during the day.

- The ACH operator, such as the Federal Reserve or The Clearing House, sorts the batches and sends each ACH transfer to the correct Receiving Depository Financial Institution (RDFI).

- The RDFI receives the ACH transfer and posts the funds to the receiver’s account. The receiver could be a person, a business, or another organization.

- The entire process usually takes 24 to 48 hours. If you submit your payment before the cut-off time, you may use same-day ACH options for faster settlement.

- Banks and payment processors use risk assessment tools to check for fraud or errors. They may apply hold times, sometimes lasting 3-5 days, to make sure the funds are available and to reduce the risk of returns.

- Payment processors may hold reserves to cover possible chargebacks or returned payments. They also communicate hold times and cut-off schedules to help you understand when your funds will be available.

- You can monitor the status of your ACH transactions through your bank’s online portal or your payment processor’s dashboard.

Tip: If you want to know how to accept ACH payments, you need to set up an account with a bank or payment processor that supports ACH transfers. Make sure you follow their onboarding steps, including account verification and compliance with Nacha rules.

Key Players

Several important roles work together to complete ACH payments for businesses and individuals. Each player has specific responsibilities in the ACH transfer process.

| Key Player | Roles and Responsibilities |

|---|---|

| Originator | Starts the ACH transfer by giving payment instructions to the ODFI. This can be you, your business, or another organization. You must get authorization from the receiver. |

| ODFI | Your bank or payment provider. It collects ACH transactions, checks for compliance, and sends them to the ACH operator. The ODFI also ensures data security and follows Nacha rules. |

| ACH Operator | Acts as the central hub. It receives batches from ODFIs, sorts them, and sends each ACH transfer to the right RDFI. The operator also handles settlement between banks. |

| RDFI | The receiver’s bank. It accepts ACH transfers from the operator and credits or debits the receiver’s account. The RDFI must process entries quickly and notify the originator if there is a problem. |

| Receiver | The person or business receiving the funds. The receiver must authorize the ACH transfer and monitor their account for incoming payments. |

You play a key role as either the originator or the receiver. If you run a business, accepting ACH payments can help you save on fees and speed up your cash flow. ACH payments for businesses often mean fewer paper checks and less manual work.

Note: Both ODFI and RDFI must follow strict Nacha rules. They use security checks and compliance tools to protect your ACH transactions and reduce fraud.

If you want to learn how to accept ACH payments, start by contacting your bank or payment provider. They will guide you through the setup process, including account verification and compliance checks. Once you complete onboarding, you can send and receive ACH transfers with confidence.

ACH transfers offer a reliable way to move money between accounts. By understanding how ACH payments work and the roles of each player, you can make better decisions for your personal finances or your business.

ACH Transaction Types

ACH transactions come in two main types: credits and debits. Each type serves a different purpose in the payment system. Understanding how these work helps you choose the right method for your needs.

ACH Credits

ACH credits let you send money from your account to someone else’s account. You start the transfer, so you control when the funds leave your account. This process is often called a “push” payment. You use ACH credits for direct deposit payroll, vendor payments, and refunds. When your employer sends your salary through direct deposit, they use an ACH credit. Many businesses use ACH credits to pay suppliers or issue refunds to customers.

Common uses for ACH credits include:

- Direct deposit payroll for employees

- Vendor and supplier payments

- Bill payments you initiate, such as mortgages or credit cards

- Government benefits like Social Security or unemployment

- Refunds and customer-initiated payments

You benefit from ACH credits because you decide when to send the money. This gives you more control over your deposits and payments.

ACH Debits

ACH debits allow a business or organization to pull money from your account. You give permission for this to happen, usually by signing an ACH debit authorization form. This process is known as a “pull” payment. ACH debits work well for recurring expenses, such as subscriptions, loan repayments, or utility bills. When you set up automatic bill pay, the company uses an ACH debit to collect the funds.

Common uses for ACH debits include:

- Recurring payments for utilities, subscriptions, or gym memberships

- Online payments you authorize for eCommerce

- Installment or subscription payments collected by businesses

- Telephone or internet-authorized debits

- Retry of bounced checks

You must trust the business to withdraw the correct amount. ACH debits help you avoid missing payments, but you have less control over the timing.

Here is a table that shows the main differences between ACH credits and ACH debits:

| Aspect | ACH Credit | ACH Debit |

|---|---|---|

| Initiation | Initiated by the payer (sender) | Initiated by the recipient (receiver) |

| Process | Payer ‘pushes’ funds to recipient | Recipient ‘pulls’ funds from payer |

| Authorization | Payer authorizes the transfer (usually via an ACH credit authorization form) | Recipient obtains explicit authorization from payer (often a signed ACH debit authorization form) |

| Control & Security | More control for payer; payer initiates and authorizes the transaction | Requires payer’s consent; less control over timing as recipient initiates withdrawal |

ACH direct deposit and ACH direct payment both use these transaction types. Direct deposits, such as payroll and government benefits, use ACH credits. Direct payments, like bill pay and subscriptions, use ACH debits. You can use both ACH direct deposit and ACH direct payment to manage your finances and make deposits or payments easier.

ACH Transfer Timing and Costs

Processing Times

When you send or receive ACH transfers, you want to know how long it takes for the money to move. Most ACH transfers settle in one to three business days. The timing depends on the type of ACH transfer you choose and when you submit your payment. You can see the main options in the table below:

| ACH Transfer Type | Cutoff Times (PT) | Processing Time | Settlement Timeframe | Transaction Limits |

|---|---|---|---|---|

| Standard ACH | 2:00 PM, 5:00 PM | Batch processing during the day | 1-3 business days | Up to $99,999,999.99 |

| Same-Day ACH | 9:00 AM, 12:00 PM | Expedited, same-day processing | Same business day | Up to $1,000,000 |

You can also use next-day ACH for some debit transfers. If you submit before 4:00 PM, the funds arrive the next business day. Same-day ACH transfers help when you need to move money quickly, but you must meet the cutoff times. Standard ACH credits, like payroll, often reach accounts as early as the next business day.

Several factors affect how fast your ACH transfer settles:

- Bank cutoff times decide when your payment enters the system.

- ACH transfers process in batches. Missing a batch window can delay your transfer by up to three days.

- ACH transfers do not process on weekends or U.S. bank holidays.

- Errors in payment details can cause delays or rejections.

- Submitting early in the day increases your chance for faster settlement.

Fees and Costs

You may wonder how much ACH transfers cost. For most consumers, ACH transfers are free or come with very low fees. Many banks do not charge you for sending or receiving these transfers. Some even offer discounts for using ACH.

Businesses usually pay between $0.20 and $1.50 per ACH transfer. The average fee is about $0.40 per transaction. If a payment fails or is returned, you might see a return fee of $2 to $5. Same-day ACH transfers cost more, with fees from $1 to $10 per transfer. Some banks charge setup fees (up to $50) or monthly fees (from $5 to $35), but these depend on your provider and how many transfers you make.

ACH transfers are much cheaper than wire transfers, which can cost $15 to $35 for each payment. Credit card payments also have higher fees, often 2.5% to 3.2% of the amount. For a $5,000 payment, an ACH transfer might cost $37.50, while a credit card payment could cost nearly $150. This makes ACH transfers a smart choice for regular or high-value payments.

Note: ACH transfers offer a cost-effective way to move money, especially for businesses that handle many payments each month.

ACH vs Other Payment Methods

Wire Transfers

You may wonder how ACH compares to wire transfers. Wire transfers move money quickly, often within the same day in the United States or within a few days for international payments. They cost more, with fees ranging from $25 to $50 per transfer. ACH transfers, on the other hand, process in batches and usually take one to two business days, though same-day options exist. ACH is a secure way to move money for regular payments like payroll or bills. Wire transfers work best for large, urgent, or one-time payments such as real estate deals or sending money abroad. ACH payments can be reversed if there is an error, but wire transfers are usually final once sent.

| Feature | ACH Payments | Wire Transfers |

|---|---|---|

| Speed | 1-2 business days (same-day possible) | Same day (US), 1-5 days (international) |

| Cost | Low (often under $3) | High ($25-$50 per transfer) |

| Use Cases | Payroll, bills, recurring payments | Large, urgent, or international payments |

| Security | Can be reversed if needed | Usually irreversible |

| Availability | US-based, USD only | Global, supports many currencies |

Checks and EFTs

ACH payments offer more security than checks. Checks can be lost, stolen, or forged. ACH is an electronic money transfer, so you do not need to handle paper or visit a bank. You can schedule recurring payments, making it easier to pay bills or employees. Compared to other electronic money transfers, ACH is slower but costs less. Some electronic money transfers, like debit or credit card payments, happen instantly but have higher fees. ACH is a secure way to move money for bulk or scheduled payments.

| Feature | ACH Payments | Other EFTs | Checks |

|---|---|---|---|

| Security | High, regulated | Varies, often encrypted | Low, risk of theft |

| Convenience | Electronic, recurring | Instant, many options | Manual, slow |

| Speed | 1-3 days | Instant to same-day | Several days |

| Cost | Low | Higher | Printing, postage costs |

| Use Cases | Payroll, bills | Peer-to-peer, POS, global | Personal, rare business |

Security and Fraud Prevention

ACH payments use strong security measures. Banks use multi-factor authentication to verify your identity. They encrypt your data during transfers and when stored. Banks monitor accounts for unusual activity and train staff to spot fraud. Secure portals and file transfer protocols protect your information. Banks also check transaction details and block suspicious transfers. ACH follows strict rules set by Nacha and federal laws. These steps make ACH a secure way to move money.

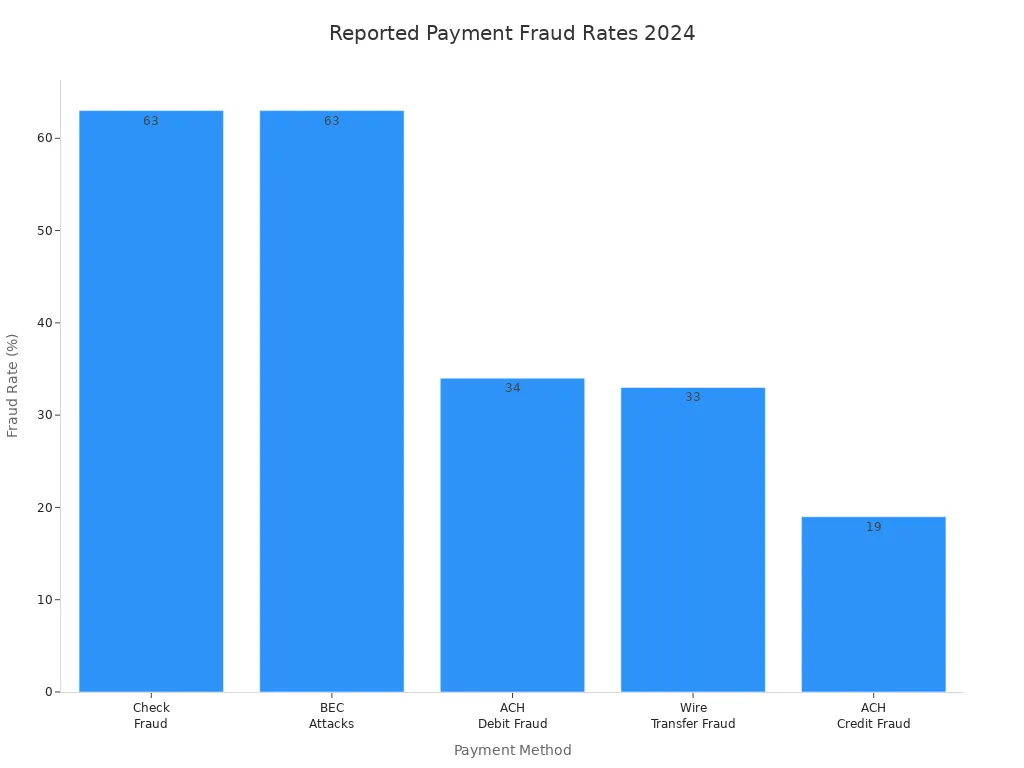

ACH debit fraud affects about 34% of organizations, while check fraud is even higher at 63%. Wire transfer fraud is also common, especially in business email scams. ACH credit fraud is lower but still targeted by scammers. ACH security features help reduce these risks.

Pros and Cons

ACH payments have many advantages:

| Advantage | Explanation |

|---|---|

| Lower Cost | Fees are much less than checks or credit cards |

| Security | Encryption and rules protect your money |

| Convenience | Easy setup, supports recurring payments |

| Time Savings | No need to write or mail checks |

| Environmental | Reduces paper use and carbon footprint |

You should also know the drawbacks:

- ACH transfers can take 1-3 days to clear, which may delay payments.

- Banks may limit how much you can send each day.

- Handling disputes is more complex than with credit cards.

- ACH is mostly for US payments and does not support many international transfers.

- Fraud risks exist, such as phishing or account takeovers, but strong security helps reduce them.

ACH remains a secure way to move money for regular, bulk, or scheduled payments. For urgent or international needs, you may prefer other electronic money transfers.

You now know ACH payments move money between bank accounts for things like bill pay and payroll.

- ACH offers low fees (about $0.29 per transaction), strong security, and works well for recurring payments such as direct deposit.

- Most transfers finish in one to three business days, but same-day options exist for urgent needs.

- Drawbacks include slower speed than wire transfers, limits on large payments, and rare delays from errors.

| Benefit | Drawback |

|---|---|

| Low cost | Slower than wires |

| Secure process | Limited global use |

| Easy for bills | Amount limits |

In 2025, you will see faster payments, better fraud protection, and more real-time options. Review your payment needs to decide if ACH fits your routine.

FAQ

What information do you need to send an ACH payment?

You need the recipient’s name, bank name, routing number, and account number. Always double-check these details before you send money. Your bank or payment provider may also ask for your authorization.

Can you cancel an ACH transfer after sending it?

You can cancel an ACH transfer if you act quickly. Contact your bank or payment provider before the payment processes. Once the funds settle, you cannot reverse the transfer.

Are ACH payments available for international transfers?

ACH payments work only within the United States. For international transfers, you can use wire transfers or services like SWIFT. Some Hong Kong banks offer international wire transfers in USD.

How safe are ACH payments compared to checks?

ACH payments use encryption and strict rules to protect your money. Banks monitor for fraud and errors. Checks can be lost or stolen, so ACH offers a safer way to move funds.

While ACH remains a secure and low-cost option for U.S. domestic payments, it simply wasn’t built for today’s global economy. If you need to send or receive money across borders, waiting 1–3 business days and facing regional limitations can slow you down.

That’s why more professionals and businesses choose BiyaPay. With real-time exchange rates, global coverage across most countries and regions, and transfer fees as low as 0.5%, BiyaPay makes international payments faster, easier, and far more affordable than wire transfers or card payments. Best of all, most transactions arrive the same day.

Upgrade from ACH to a truly global payment solution. Start with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.