- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Zelle Safety Checklist for Secure Transfers

Image Source: pexels

You might wonder if Zelle is safe for sending money. Zelle safety remains strong, with less than 0.1% of transactions reported as fraud or scams. However, a J.D. Power survey found that 3% of users have lost money to scammers. Before sending money, always check the recipient’s name and details. Only send funds to people you trust. Zelle payments cannot be reversed, so treat each transfer like cash. Stay alert for scams and follow zelle safety steps:

- Confirm recipient details

- Use strong passwords

- Enable two-factor authentication

Key Takeaways

- Always double-check the recipient’s email or phone number before sending money to avoid mistakes.

- Only send money to people you know and trust because Zelle payments cannot be reversed.

- Use strong passwords and enable two-factor authentication to protect your Zelle account from hackers.

- Stay alert for common scams like urgent payment requests, fake messages, and impersonation attempts.

- If you suspect fraud, contact your bank and Zelle support immediately to report the issue and protect your money.

Zelle Safety Basics

Is Zelle Safe?

You may ask, is Zelle safe for your money transfers? Zelle uses the same security technology as major banks. This means your transactions get protected by strong encryption and authentication. Zelle connects directly to your bank account, so you do not need to share sensitive information with anyone else. Many people trust Zelle because it works inside their bank’s app, which adds another layer of security.

Zelle also uses real-time fraud monitoring. If the system notices anything unusual, it can flag or stop the transaction. You may also use features like Face ID or Touch ID for extra protection. Still, is Zelle safe for every situation? You must remember that Zelle payments are instant and cannot be reversed. If you send money to the wrong person, you may not get it back. This is a key risk to using Zelle.

How Zelle Protects Your Info

Zelle safety depends on how well your information stays private. Zelle does not share your bank account number or other sensitive details with the person you pay. Instead, you use an email address or phone number. Zelle uses encryption to protect your data during each transfer. Your bank’s app may also offer privacy settings, letting you control what information you share.

You should keep your Zelle account details private. Never share your password or PIN. Always verify the recipient’s email or phone number before sending money. Zelle sends notifications to your phone or email, so you can track your transactions. These steps help lower the risk to using Zelle.

| Feature | Zelle | Venmo |

|---|---|---|

| Security Protocols | Bank-level encryption, fraud monitoring | Encryption, PIN code |

| Privacy | No public transaction feed | Public feed by default |

| Purchase Protection | None | Limited |

Why Zelle Safety Matters

Zelle safety matters because you face a higher risk to using Zelle if you do not follow best practices. Zelle does not offer purchase protection or chargebacks like credit cards. If you pay a scammer or make a mistake, you usually cannot get your money back. This makes it important to only send money to people you trust. Treat every Zelle payment like cash. If you lose it, you may not recover it.

Tip: Always double-check the recipient’s details before you send money. If you get an unexpected request, confirm it through another method.

Is Zelle safe? Yes, if you use it wisely and stay alert. Zelle safety depends on your actions. By following these tips, you can reduce the risk to using Zelle and keep your money secure.

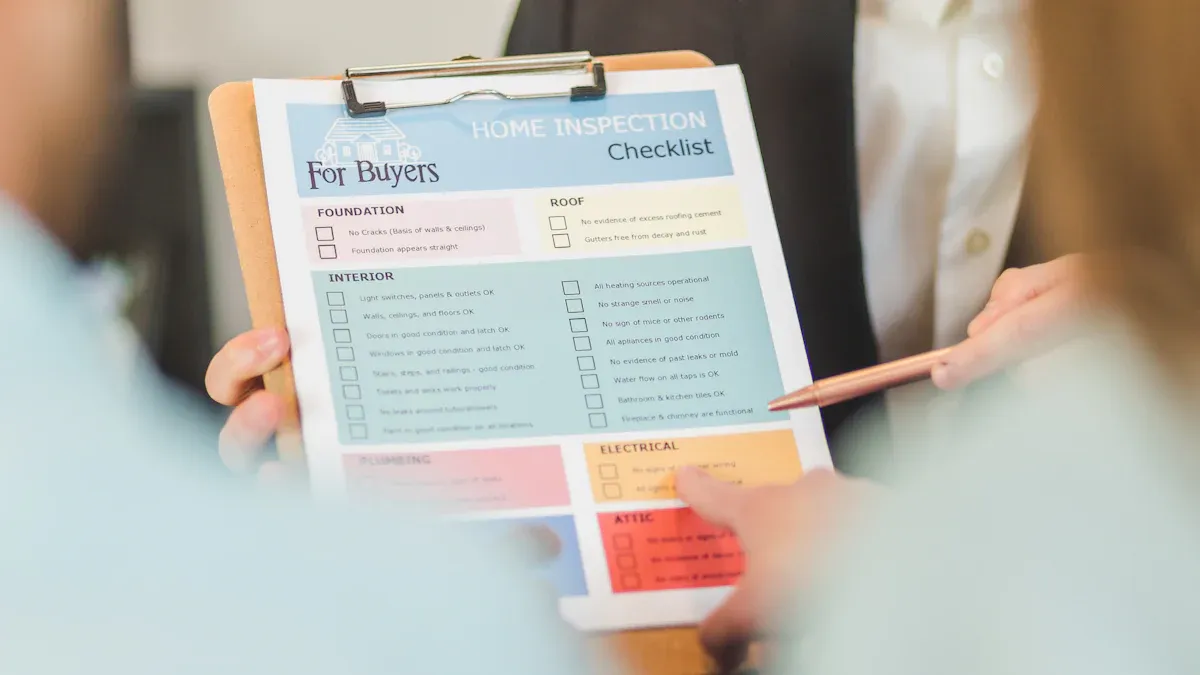

Zelle Safety Checklist

Image Source: pexels

Protect Yourself When Using Zelle

You can protect yourself when using Zelle by following a clear set of steps every time you send or receive money. Zelle and major banks recommend these actions to help you protect your money and avoid mistakes:

- Log into your bank’s online or mobile banking app.

- Select the option to send money with Zelle.

- Enroll your U.S. mobile number or email address.

- Verify your enrollment with a one-time code sent to your phone or email.

- Add the recipient’s email or U.S. mobile number, enter the amount, review all details, and send.

- Only send money to people you know and trust.

- Review payment limits and cancellation policies before sending.

- Edit scheduled or recurring payments if needed.

Note: Zelle payments cannot be canceled or reversed once the recipient enrolls. Always double-check before you send money.

Confirm Recipient Details

You should always confirm recipient details before sending money. Enter the recipient’s email or mobile number carefully. Double-check the spelling and numbers. If you send money to the wrong person, you may not get it back. Banks like Wells Fargo and Citizens Bank remind users to verify recipient information every time. This step helps you avoid sending money to a stranger or scammer. If you receive a request from someone you do not know, do not respond or send money.

Enable Two-Factor Authentication

Enabling two-factor authentication (2FA) adds a strong layer of security to your Zelle account. With 2FA, you need a second step to log in, such as a code sent to your phone. This makes it much harder for someone to access your account, even if they know your password. Experts say 2FA is a critical defense against unauthorized access. You can turn on 2FA in your bank’s security settings. Regularly check your transactions and report anything suspicious right away. Staying alert and using 2FA helps protect yourself when using Zelle.

- Two-factor authentication requires a unique code in addition to your password.

- This extra step greatly reduces the risk of someone breaking into your account.

- You can enable 2FA through your bank’s app or website.

Use Strong Passwords

Strong passwords are key to keeping your Zelle account safe. Cybersecurity experts recommend using a password that is at least 12 to 16 characters long. Mix uppercase and lowercase letters, numbers, and symbols. Do not use common words, personal information, or the same password for multiple accounts. A password manager can help you create and store strong passwords without having to remember them all. Update your passwords regularly and never share them with anyone. These steps help protect your money from hackers and scammers.

- Use a unique password for each account, including Zelle.

- Avoid using your name, birthday, or simple words.

- Consider a password manager for better security.

Keep App and Device Updated

Keeping your banking app and device updated is another important step. Updates often include security fixes that protect you from new threats. Set your phone and apps to update automatically if possible. If you use Zelle through your bank’s app, make sure you have the latest version. Also, use a secure Wi-Fi connection when sending money. Avoid public Wi-Fi for financial transactions. These habits help you stay ahead of scammers and keep your information safe.

Tip: Check for app updates at least once a week. Updated apps and devices help block hackers and keep your account secure.

Zelle Scam Signs

Image Source: pexels

Common Signs of a Zelle Scam

You can spot common signs of a Zelle scam if you know what to look for. Scammers often use high-pressure tactics and ask for urgent payments. They may send you unsolicited payment requests or claim you need to pay a fee to unlock funds. Overpayment scams are also common. In these cases, someone pretends to buy something from you, sends a fake payment, and then asks you to send money back for a supposed upgrade fee. If someone refuses to verify their identity or insists you act quickly, you should pause and double-check. These are common signs of a Zelle scam.

Tip: Always verify the sender’s identity before sending money. Never respond to unexpected payment requests.

Phishing and Fake Requests

Phishing scams use fake emails, texts, or websites to trick you into sharing your information or sending money. Scammers may pretend to be from your bank or Zelle. They might send you a message about a suspicious login or payment, asking you to click a link or call a number. In one case, a person in Illinois lost $3,500 after scammers spoofed a caller ID and Zelle account. Another victim in California lost $1,000 after replying to a fake Wells Fargo text. These phishing scams can also include fake invoices or lottery winnings. If you get scammed on Zelle through a phishing attack, it is hard to recover your money.

| Scam Type | Description | Amount Lost (USD) |

|---|---|---|

| Spoofing/Phishing | Fake caller ID and Zelle account | $3,500 |

| Phishing Email | Fake payment request, gift card payment | $4,200 |

| Smishing | Fake bank text message, spoofed Zelle account | $1,000 |

Impersonation Scams

Imposter scams are a major risk when using Zelle. Scammers may pretend to be customer service agents, family members, or friends. They often create urgent situations, like saying a loved one is in trouble and needs money fast. They may use fake customer service numbers or support pages. Imposter scams can also involve follow-up calls or emails that seem official. Warning signs include requests for secrecy, urgent payment demands, and poor grammar or spelling. Zelle will never ask you for money by email or phone call. If you get scammed on Zelle by someone pretending to be a trusted contact, contact your bank right away.

- Always verify requests through official channels.

- Be cautious of urgent or secretive messages.

- Never share sensitive information with unknown contacts.

Too-Good-To-Be-True Offers

Some Zelle scams promise big rewards or deals that sound too good to be true. Scammers may offer fake jobs, lottery winnings, or cheap goods. They ask for payment up front but never deliver what they promise. Payment scams like these often appear on resale sites or social media. If someone asks you to pay with Zelle for a prize, job, or item you have not seen, it is likely a scam. Imposter scams also use these tactics to trick you into sending money. Always research offers and never send money to strangers.

Note: Zelle partners with the Better Business Bureau to warn users about scam red flags. Stay alert and use in-app alerts to verify recipients before sending money.

If You Suspect Fraud

Immediate Steps

If you think you might get scammed on Zelle, act quickly. Take these steps right away:

- Contact your bank or credit union where you use Zelle. Report the suspicious activity as soon as possible.

- Use Zelle’s official scam reporting form or call their support number at 1-844-428-8542.

- Know the difference between scams and unauthorized transactions. Scams happen when you send money willingly but get tricked. Unauthorized transactions happen when someone uses your account without your permission.

- Report any unauthorized transactions right away. Quick action can help your bank investigate and may improve your chances for a refund.

- Also, report scams and identity theft to the Federal Trade Commission (FTC) and the Internet Crime Complaint Center.

Tip: The faster you report, the better your chance to stop more losses and possibly get a refund.

Reporting to Your Bank and Zelle

When you report fraud to your bank or Zelle, you start an investigation. Many banks now use automation tools to speed up this process. Some banks can review your case in just a few minutes. You may get a phone call from the fraud department. They will ask about the details and send notes to a special team. Even though banks work fast, some investigations may not look at every detail. Always give clear information about what happened. Ask your bank about their refund policy and what you can expect.

Contacting the FTC

You should also report the fraud to the FTC. When you contact the FTC, provide:

- Your account number.

- Details about the unauthorized transactions, such as the type, amount, date, and transaction number.

- A timeline of your dispute, including when you saw the charge and when you told your bank.

- The type of refund or resolution you want.

You can file your report online at ReportFraud.ftc.gov or call 1-877-FTC-HELP.

Monitor Your Accounts

After you report the problem, keep watching your accounts for more suspicious activity. Stay alert for signs of identity theft or new unauthorized transactions. Contact your bank’s customer service if you see anything unusual. You can also use identity theft protection services to help track your accounts. These services watch for strange activity and alert you if something looks wrong. Staying vigilant helps you catch problems early and improves your chances for a refund.

More Zelle Safety Resources

Official Zelle Safety Page

You can find helpful information on the official Zelle safety page. Zelle explains how to keep your money safe and avoid scams. The page lists common scam types, such as impersonation, refund scams, prize scams, and phishing. Zelle also shares prevention tips that you can use every day. These include using only the official Zelle app, verifying recipient details, and enabling security features like strong passwords and two-factor authentication. Zelle recommends that you report any suspicious activity right away to your bank, Zelle, the Consumer Financial Protection Bureau (CFPB), the Federal Trade Commission (FTC), or local law enforcement.

Here are some key tips from Zelle’s official safety resources:

- Treat Zelle like cash because payments are fast and cannot be reversed.

- Only send money to people you know and trust.

- Double-check the recipient’s email or phone number before sending money.

- Use security features such as strong passwords and two-factor authentication.

- Watch out for scams that use urgency or impersonation.

Note: Zelle’s education pages link to more resources if you want to learn about security and fraud prevention.

FTC Scam Advice

The Federal Trade Commission (FTC) gives you clear advice to avoid Zelle scams. The FTC says you should only send money to people you know and trust. Always confirm the recipient’s contact information before sending money. The FTC warns you to be careful with offers that seem too good to be true. Zelle does not provide protection for authorized payments, so you cannot get your money back if you make a mistake. The FTC suggests using credit cards for purchases with unknown parties because credit cards offer buyer protection. You can also report scams through Zelle’s support page and find more tips on the FTC website.

Bank Security Tips

Major banks want you to stay safe when using Zelle. They recommend these steps:

- Send money only to friends, family, or people you trust.

- Treat Zelle payments like cash. Once you send money, you cannot get it back.

- Confirm the recipient’s mobile number or email address before sending money.

- Never share your online or mobile banking credentials with anyone.

- Avoid using Zelle for purchases from online sales sites or with strangers.

Many banks also suggest sending a small test payment to new recipients. This helps you make sure you have the correct contact. Some banks offer real-time alerts to help you spot suspicious activity. If you have questions, you can contact your bank’s support team for help.

You can keep your Zelle transfers secure by following these essential steps:

- Only send money to people you trust, such as friends or family.

- Treat every Zelle payment like cash, since you cannot reverse it.

- Always double-check the recipient’s contact information before sending.

- Enable two-factor authentication and use strong passwords.

- Stay alert for new scams and review safety tips often.

Staying informed and practicing these habits helps you protect your money and gives you confidence when using Zelle.

FAQ

How fast do Zelle transfers happen?

You usually see Zelle transfers complete within minutes. If you or the recipient use a bank that does not support Zelle, the transfer may take one to three business days.

Can you cancel a Zelle payment after sending?

You cannot cancel a Zelle payment if the recipient already enrolled with Zelle. Always double-check the recipient’s details before sending money. Treat every payment as final.

Does Zelle charge any fees for sending money?

Zelle does not charge fees for sending or receiving money. Some banks, such as HSBC Hong Kong, may have their own fees. Always check your bank’s fee schedule before using Zelle.

What should you do if you sent money to the wrong person?

Contact your bank and Zelle support right away. Provide transaction details and ask for help. You should also notify the recipient if possible. Quick action gives you the best chance to recover your money.

Zelle is convenient for trusted transfers within the U.S., but when it comes to sending money globally, you need a solution that goes further.

With BiyaPay, you enjoy real-time exchange rates with fees as low as 0.5%, plus the flexibility to freely convert between multiple fiat currencies and cryptocurrencies. BiyaPay supports transfers to most countries and regions worldwide and ensures same-day delivery for faster access to your funds.

Make your international transfers smarter, safer, and more affordable. Start today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.