- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Simple Guide to What Proof of Address Is and How to Get One

Image Source: unsplash

Proof of address means a document that shows where you live. You need proof of address in many parts of life. Banks often ask for proof of address when you want to open an account. Government offices request proof of address for things like driver’s licenses or voter registration. Utility companies check your proof of address to start services such as electricity or water. Landlords want proof of address before renting you a place. Some jobs also require proof of address to confirm your identity. Proof of address helps protect you and stops fraud.

- Banking: Needed to open accounts.

- Government Services: Used for licenses, benefits, and voter registration.

- Utilities Setup: Required for electricity, water, or internet.

- Rental Agreements: Asked for by landlords.

- Employment Verification: Sometimes required by employers.

Key Takeaways

- Proof of address is an official document that shows where you live and is needed for banks, government services, utilities, rentals, and jobs.

- Accepted proof of address documents include recent utility bills, bank statements, rental agreements, and government letters that show your full name and current address.

- Make sure your documents are recent (usually within three months), clear, original or certified, and match your ID exactly to avoid rejection.

- If you lack standard documents, you can use alternatives like employer letters, change-of-address confirmations, or official government letters after checking acceptance.

- Digital copies of proof of address are often accepted if they are clear and official, but always confirm requirements with the organization before submitting.

What Is Proof of Address?

Definition

Proof of address is an official document that confirms where you live. You use this document to show your full name and your current residential address. The document must come from a trusted source, such as a government agency, a bank, or a utility company. It must be recent, usually dated within the last three months. Banks, including those in Hong Kong, and government offices use this definition to meet legal rules. These rules help prevent money laundering and keep your identity safe. A document that confirms where you live can be a utility bill, a bank statement, a rental agreement, or a letter from a government office. The document must match your name as shown on your ID.

Note: Not all documents count as proof of address. For example, mobile phone bills, personal letters, or anything with only a P.O. Box do not meet the requirements.

Main Uses

You need proof of address in many parts of life. Banks ask for it when you open an account or apply for a loan. Government offices require it for services like getting a driver’s license or registering to vote. In the private sector, you use proof of address for business registration and to receive important mail, such as tax documents. The common uses of proof of address include:

- Opening a bank account

- Applying for loans or credit cards

- Sending money abroad

- Registering for government services

- Setting up utilities like water or electricity

Each time, the document must be current, show your full name, and come from a recognized authority. This helps prove your identity and gives evidence that you reside at your stated address.

Proof of Address vs. Proof of Residency

Proof of address and proof of residency sound similar, but they have different meanings in some situations. Proof of address is any document that shows your current address. Proof of residency often has stricter rules. For example:

- Proof of residency for a driver’s license in California requires a document with your address that matches your application.

- Acceptable documents include rental agreements, utility bills, school or medical records, government letters, tax returns, and insurance papers.

- Some people, like minors or family members, can use relationship documents to show where they live.

- The law focuses on proof of residency and does not always define proof of address separately.

You may see both terms used, but proof of residency is usually a legal requirement for things like getting a license or enrolling in school. Proof of address is more common for banking and everyday identity checks. Both types of documents must show your name and address, but proof of residency may need extra steps or special documents.

Proof of Address Documents

Image Source: pexels

Accepted Documents

You have many options when you need to show valid proof of address. Most organizations accept a range of documents, but some are more common than others. The table below shows the most widely accepted proof of address documents in the United States, Canada, and the United Kingdom. You will notice that utility bills, bank statements, rental agreements, and government letters appear in every country.

| Country | Commonly Accepted Proof of Address Documents |

|---|---|

| United States | Driver’s license, utility bills (water, electricity, internet, phone), bank statements, rental agreements, mortgage statements, academic records, insurance policies, tax forms, posted mail |

| Canada | Driver’s license, utility bills, bank or credit card statements, rental agreements, T4 slips, tax returns, government-issued photo ID, car registration, academic records, insurance policies, notice of assessment |

| United Kingdom | Letters from university/college/school, employer letters confirming address, letters from known bank customers, rental agreements, insurance policies, credit card statements, utility bills |

You can use the following proof of address documents in most situations:

- Utility bills (water, electricity, gas, internet, or landline phone)

- Bank statements or credit card statements

- Lease agreements or rental contracts

- Mortgage statements

- Government letters, such as tax bills or voting notices

- Insurance policies (home, health, auto)

- Vehicle registration papers

- Voter cards or electoral register entries

- School records (for minors)

- Official government correspondence

Some banks in Hong Kong may also accept a bank statement or a utility bill as valid proof of address. Always check with the organization to confirm which documents they accept.

Requirements for Documents

Not every document with your address will count as valid proof of address. You need to make sure your documents meet certain requirements. Here is what you should look for:

- The document must show your full legal name exactly as it appears on your government-issued ID.

- Your current residential address must be clear and complete. A post office box does not count as a valid proof of address.

- The document must come from a trusted source, such as a bank, utility company, or government agency.

- Most organizations require the document to be recent, usually issued within the last three months.

- The document must be original or a clear digital copy. Handwritten or edited documents are not accepted.

- The name and address must be easy to read and in a standard format.

Tip: Always double-check the requirements with the organization before you submit your proof of address documents. Some places may ask for two different documents.

Here is a quick list of what you should check before using a document:

- Make sure the document is recent (within three months).

- Confirm your full name and address match your ID.

- Check that the document comes from a reputable source.

- Avoid using documents with only a P.O. Box address.

- Do not use handwritten, black and white, or edited documents.

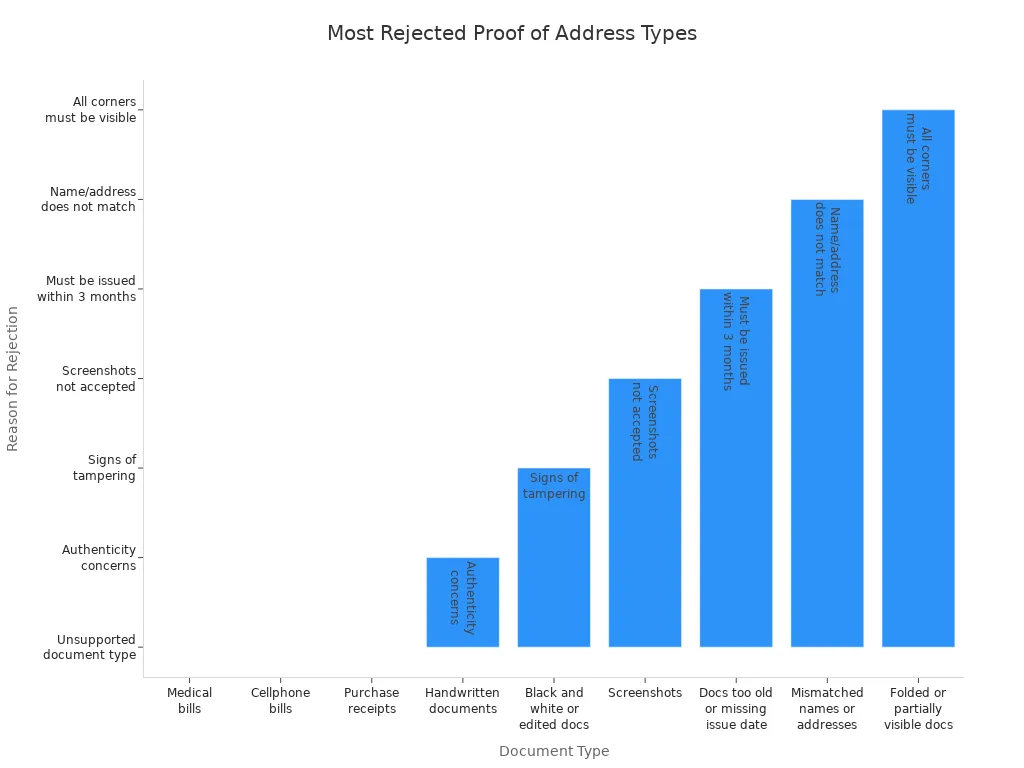

Many organizations reject documents that do not meet these standards. The chart below shows the types of documents most often rejected and the reasons why:

Common reasons for rejection include missing information, old dates, mismatched names, or unclear addresses. Always use a valid proof of address to avoid delays.

Digital and Paper Options

You can use both digital and paper documents as proof of address, as long as they meet the requirements. Many banks and government offices now accept digital documents, such as a PDF bank statement or a utility bill downloaded from your provider’s website. Make sure the digital copy is clear, complete, and unedited.

Paper documents remain widely accepted. If you use a paper document, keep it in good condition. Do not fold or damage it, and make sure all corners are visible when you scan or photograph it.

Note: For your safety, store your proof of address documents in a secure place. Use a locked cabinet for paper documents. For digital files, use password protection and back up your files in a secure cloud service.

You should always protect your personal information. Only share your proof of address with trusted organizations. If you need to send a digital copy, use a secure method, such as encrypted email or a secure upload link.

By following these tips, you can make sure your proof of address documents are accepted and your information stays safe.

How to Get Proof of Address

Image Source: unsplash

Standard Methods

You can get proof of address using documents you already have. Many organizations accept utility bills, bank statements, lease agreements, or government letters. These documents must show your name and current address. They also need to be recent, usually from the last three months.

Here is how you can use utility bills or bank statements as proof of address:

- Collect a recent utility bill, such as electricity, water, or internet. Make sure it is not older than 90 days.

- Check that your name and address appear clearly on the bill.

- Submit the bill to the organization that needs proof of address. Many banks and agencies use real-time verification systems to check the document’s authenticity.

- The system will compare your bill with official records to confirm your address. This process follows rules to prevent fraud and keep your information safe.

- If you use a bank statement, gather a recent one that shows your name and address. Electronic or certified copies from your bank work best.

- Double-check that all details match your ID. Keep your documents organized for future use.

You can also use a lease agreement, mortgage statement, or official government letters. Always make sure your documents are up-to-date and come from a trusted source.

Tip: Some banks in Hong Kong and other agencies may ask for two different documents. Always check their requirements before you submit your proof of address.

Alternatives if You Lack Standard Documents

If you do not have utility bills or bank statements, you still have options. Many organizations accept other documents as proof of address. Here are some alternatives you can use:

- Official letters from government agencies

- Employer verification letters or pay stubs with your address

- Rental agreements or landlord letters confirming where you live

- Voter registration cards showing your address

- Postal service documents that confirm a change of address

- Notarized Affidavit of Residency

- Letters from social service agencies or public authorities

- School or church records with your address

- Medical records that list your current address

- Letters from shelters, housing organizations, or student housing offices

- Digital records like online bank statements or e-bills that include your name, address, and date

You can also ask your landlord or roommate to write a letter confirming your residence. Some organizations accept these letters if they include contact details and a signature.

Note: Always check if the organization accepts your alternative document. Some places may require the document to be pre-printed or computer-generated.

How to Get a Proof of Address Quickly

You may need proof of address fast. Here are steps you can take to speed up the process:

- Download a recent utility bill or bank statement from your provider’s website. Many companies let you access these documents online right away.

- Request a letter from your bank or a government agency. Some banks in Hong Kong can provide a certified statement within one business day.

- Use a change-of-address confirmation from the postal service. You can often print this document as soon as your address update is processed.

- Ask your landlord or employer for a letter confirming your address. Many can provide this on the same day.

- If you sign a new lease, you can request a copy of the agreement immediately. Some services, like VirtualPostMail’s TruLease, can provide a utility bill or lease agreement within 1-2 business days after your address is secured.

Tip: Always use documents that are recent and show your full name and address. Digital copies are often accepted if they are clear and unedited.

You may need to provide two documents for some applications. Make sure both are current and from different sources. Always keep your proof of address documents safe and ready for future use.

What Is Not Accepted

Common Mistakes

When you submit documents for proof of address, you need to avoid common mistakes that can lead to rejection. Many people think any document with their name and address will work, but this is not true. Agencies and banks, including those in Hong Kong, have strict rules. If you do not follow these rules, your application may face delays or rejection.

Here are the most common reasons your proof of address might get rejected:

- You use unsupported document types, such as an ID card, passport, mobile phone bill, or handwritten receipt.

- Your document has incomplete or unclear information, like a missing name or address, or the scan is blurry.

- The document is expired, usually older than three months.

- The address on your document does not match your registered information, even if the difference is small.

- Your address is in a region that the agency does not support.

You should also check for missing titles, names, or signatures. Sometimes, people forget to include all required details, such as marital status or mailing address. These small errors can cause big problems.

Tip: Always double-check your documents before you submit them. Make sure your name, address, and date are clear and match your proof of id.

Unacceptable Documents

Not every document counts as proof of address. You need to know which documents agencies and banks will not accept. If you use the wrong document, you will have to start over.

Unacceptable documents include:

- Passports, national ID cards, or any proof of id that does not show your address.

- Mobile phone bills, handwritten receipts, or personal letters.

- Documents with only a P.O. Box address.

- Expired documents or those with unclear scans.

- Documents missing required signatures or legal descriptions.

If you try to use a fake or altered document, you risk serious legal trouble. Forgery means creating or using false documents to trick others. If you submit a forged proof of address or proof of id, you could face criminal charges. Penalties can include fines up to $250,000 or prison time up to five years under federal law. Courts look for intent to deceive, so honest mistakes are not crimes, but deliberate fraud is.

You should always use acceptable forms of id, such as a driver’s licence, bank statement, or utility bill. These documents must be current and show your full name and address. If you are not sure, ask the agency for a list of acceptable forms of id before you apply.

Special Situations

Recent Movers

If you have just moved, you might not have many documents that show your new address. You can still get proof of address by using a few simple steps. Start by updating your address with your bank, utility companies, and government agencies. Many organizations accept a change-of-address confirmation from the postal service. You can also use a new lease agreement or a letter from your landlord. Some banks, including those in Hong Kong, may accept a letter from your employer if it lists your new address. Always check if the document is recent and shows your full name and new address. If you need proof quickly, download a digital statement from your bank or utility provider after you update your address.

Non-Residents and International Students

If you are a non-resident or an international student, you may face extra challenges when proving your address. Many banks and agencies want documents from local sources. You can use a letter from your school or university that shows your address. Some places accept a letter from your student housing office or a rental agreement. If you live with someone else, ask them to write a letter confirming your address and include a copy of their proof of address. Always bring your student ID and passport when you visit a bank or government office. Some banks in Hong Kong may ask for extra documents, so check their list before you apply.

Digital Proof of Address

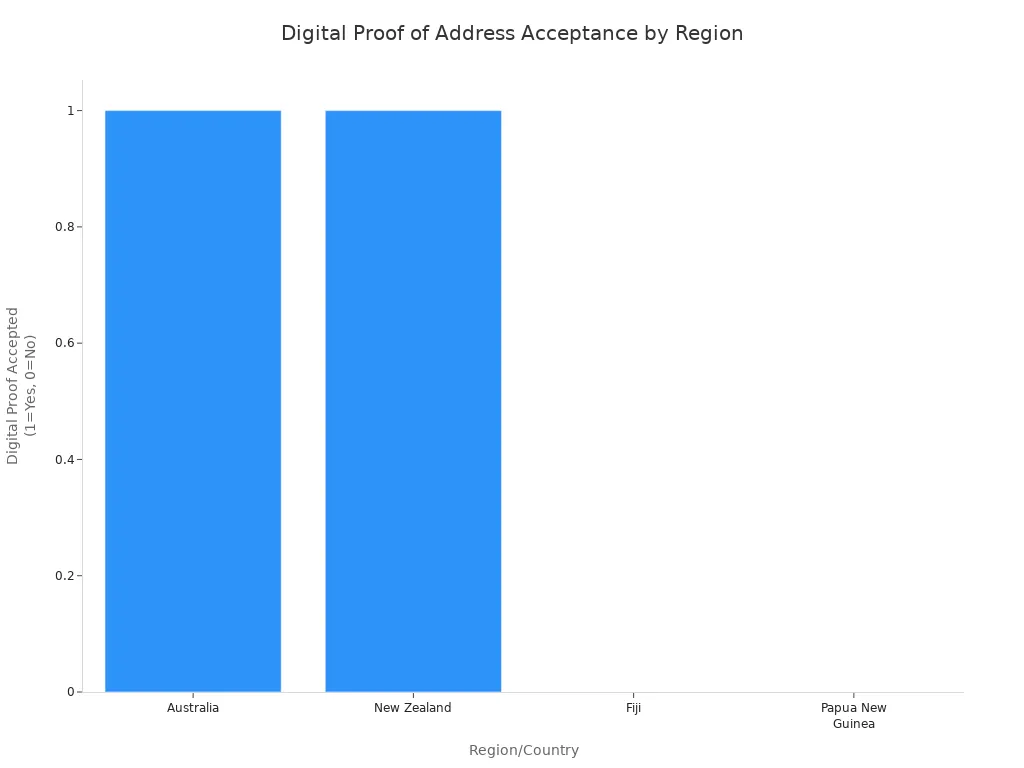

Digital proof of address is becoming more common. Many banks and government offices now accept digital documents, such as PDF bank statements or scanned utility bills. In regions with advanced digital infrastructure, you can upload these documents online. The table below shows how different countries accept digital proof of address:

| Region/Country | Commonly Accepted Documents | Digital Proof of Address Accepted |

|---|---|---|

| Australia | Utility Bills, Bank Statements | Yes (PDF uploads, secure links) |

| New Zealand | Rental Agreements, Insurance Policies | Yes (alternative digital options) |

| Fiji | Government Correspondence, Tax Notices | No digital acceptance |

| Papua New Guinea | Letters from Local Authorities | No digital acceptance |

Banks and financial institutions often have strict rules to prevent fraud. Some accept digital documents, but others want physical copies or multiple documents. Always check the requirements of the bank or agency before you submit your proof. Digital proof of address offers convenience and security. Many systems use encrypted platforms, real-time verification, and biometric checks to keep your information safe. This trend is growing, but acceptance still varies by country and institution. If you use digital proof, make sure your documents are clear, official, and easy to verify.

You now know how to prepare and submit address documents with confidence. Always use original or certified papers, check that your name and address match your ID, and make sure your documents are valid for at least 30 days.

- Bring extra supporting documents if needed, such as a secondary ID or proof of social security number.

- Update your address on all records before applying.

- Double-check that your documents are not expired.

- Confirm if you need a notary or authority stamp.

- Scan your documents clearly and match the address exactly.

If you do not have standard documents, you can use alternatives like employer letters or change-of-address confirmations. Careful review helps you avoid delays and makes the process smooth.

FAQ

What if you do not have any utility bills in your name?

You can use a bank statement, a government letter, or a rental agreement. Some banks in Hong Kong accept employer letters or a change-of-address notice. Always check with the organization for their accepted documents.

Can you use digital documents as proof of address?

Yes, many banks and agencies accept digital documents. You can download a PDF bank statement or utility bill from your provider’s website. Make sure the document is clear, official, and shows your name and address.

How recent must your proof of address be?

Most organizations require documents dated within the last three months. Some may accept documents up to six months old. Always check the specific date requirements before you submit your proof.

Which documents are never accepted as proof of address?

| Not Accepted | Reason |

|---|---|

| Passport | No address listed |

| Mobile phone bill | Not considered official |

| Handwritten letter/receipt | Not verifiable |

| P.O. Box address only | Not a physical address |

This guide shows you that proof of address is a crucial part of life, and getting it right is key to accessing essential services, from opening a bank account to setting up utilities.1 For those with international ties—whether you’re a recent mover, an international student, or a global freelancer—proving your address and managing your finances can be even more complex. You need a platform that understands these challenges. BiyaPay is designed for modern, global citizens. Our service helps you seamlessly manage international financial needs, with support for multiple fiat and digital currencies and remittance fees as low as 0.5%.

Whether you’re sending money home or receiving funds for a freelance gig, BiyaPay makes the process fast, secure, and affordable. Our platform supports money transfers to most countries and regions globally and often achieves same-day delivery. With our commitment to transparency, you can use our real-time exchange rate queries and conversions to get the best value for your money. Don’t let complicated financial hurdles slow you down. Sign up and open an account with BiyaPay in minutes to simplify your global finances. Register now and take the first step towards smarter international transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.