- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Adding Money to Venmo Without a Bank Account Made Easy

Image Source: unsplash

Yes, you can add money to Venmo without a bank account. Many people in the United States use Venmo for daily payments, even if they do not have a traditional bank. If you want to add money or keep your balance topped up, you have plenty of options. Here are some of the most common ways:

- Use a Venmo Debit Card to add money instantly.

- Link a prepaid or credit card.

- Set up direct deposit for your income.

- Receive money from friends or family.

These tools make it easy for you to manage money, pay bills, or shop online. As more people look for how to use Venmo without a bank account, knowing the right steps helps you stay safe and avoid unwanted fees.

Key Takeaways

- You can add money to Venmo without a bank account using a Venmo Debit Card, prepaid cards, direct deposit, or by receiving money from others.

- The Venmo Debit Card lets you add cash at stores like Walmart, but fees and limits apply, so check them before you reload.

- Prepaid cards work for sending money and topping up your balance, but credit cards cannot add money directly and may charge fees.

- Direct deposit lets you receive paychecks or benefits straight to Venmo, but your employer must support this option.

- Keep your Venmo account safe by using strong passwords, multi-factor authentication, and secure WiFi, and always watch for fees and limits.

Add Money to Venmo Without a Bank Account

Image Source: unsplash

Venmo Debit Card

You can use a Venmo Debit Card to add money to your Venmo balance without a bank account. This card works like a regular debit card and lets you spend your Venmo balance anywhere Mastercard is accepted. You do not need a traditional bank account to get or use this card.

Eligibility requirements:

- You must be at least 18 years old.

- You need to live in the United States.

- You must have a U.S. cell phone number that can receive texts.

- Your Venmo app must be updated to version 7.38.2 or newer.

- You need to provide a valid government-issued photo ID.

- You must apply for the card in the Venmo app.

Once you meet these requirements, you can apply for the Venmo Debit Card right in the app. Approval usually takes just a few minutes, and your card arrives in about 10 business days.

How to add money with your Venmo Debit Card at a store:

- Go to a participating store like Walmart or CVS.

- Bring your Venmo Debit Card and the cash you want to add.

- Ask the cashier to reload your Venmo Debit Card.

- Hand your card to the cashier and pay the cash amount plus any reload fees.

- Wait for the money to show up in your Venmo balance, usually within minutes.

Tip: Always keep your receipt until you see the money in your Venmo balance.

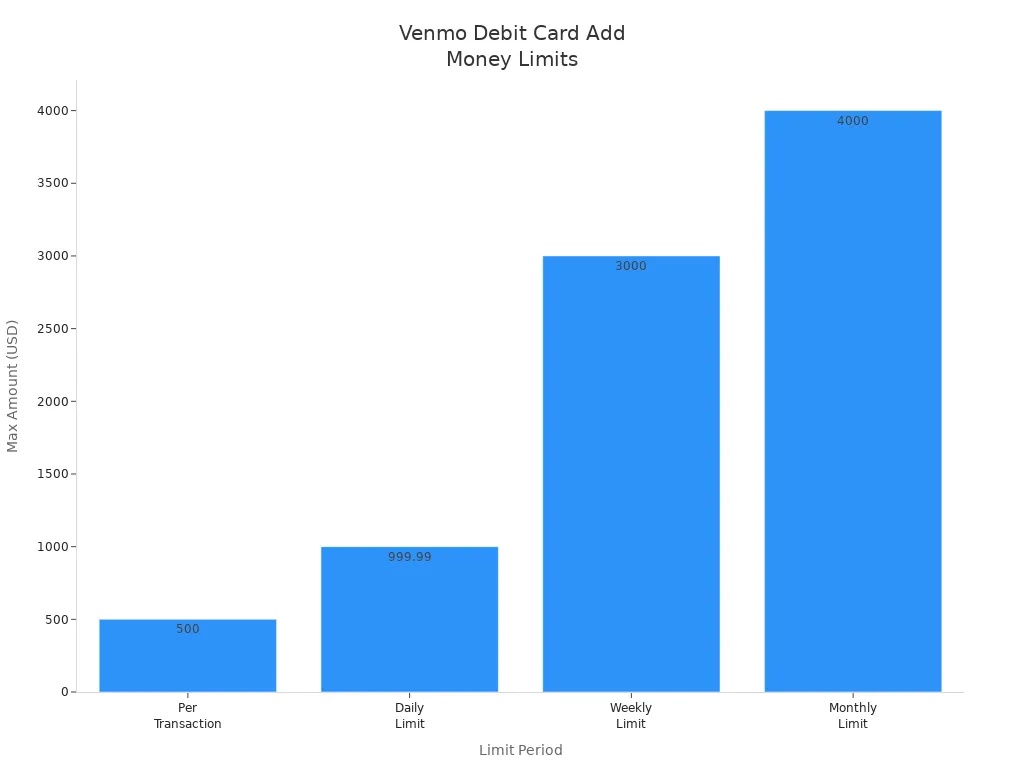

| Aspect | Details |

|---|---|

| Fee per cash add | $3.74 per transaction at Walmart stores |

| Transaction amount limit | $20 to $500 per transaction |

| Daily transaction limit | Up to 3 transactions totaling $999.99 per rolling 24 hours |

| Weekly transaction limit | Up to 7 transactions totaling $3,000 per rolling 7 days |

| Monthly transaction limit | Up to 20 transactions totaling $4,000 per calendar month |

You can use the Venmo Debit Card for ATM withdrawals, but fees may apply. There are no monthly maintenance fees for the card.

Prepaid and Credit Cards

If you do not have a bank account, you can still add money to your Venmo balance by linking prepaid or credit cards. Venmo accepts most prepaid and gift cards from major brands, including American Express, Discover, MasterCard, and Visa. Some prepaid cards may not work due to restrictions from the card issuer.

How to add a prepaid card or add a credit card:

- Open the Venmo app and go to Payment Methods.

- Tap to add a new card.

- Enter your card details manually or use your phone’s camera.

- If you add a prepaid card, enter your own zip code, since many prepaid cards do not have a registered address.

Once you add a prepaid card or add a credit card, you can use it to send money to others or pay for purchases. You cannot use a credit card to add money directly to your Venmo balance, but you can use it to make payments.

Fees and limits:

| Transaction Type | Fee | Transaction Limit |

|---|---|---|

| Instant Transfer (Debit Card) | 1.75% fee | Up to $5,000 per transfer |

| Credit Card Payment | 3% fee | Varies by account |

| Adding Money via Credit Card | Not allowed | N/A |

- Sending money with a credit card costs 3% of the amount.

- Instant transfers from a debit card have a 1.75% fee.

- You cannot add money to Venmo balance with a credit card, but you can use a prepaid card for some transactions.

Note: Not all prepaid cards work with Venmo. If your card does not work, try another one from a different brand.

Direct Deposit

Direct deposit is a great way to add money to Venmo without a bank account. You can have your paycheck or government benefits sent straight to your Venmo balance.

How to set up direct deposit:

- Open the Venmo app and go to the Me tab.

- Tap the Settings gear icon.

- Select Direct Deposit.

- Tap Show Account Number to see your Venmo account and routing numbers.

- Give these numbers to your employer or benefits provider.

- If asked, use Venmo’s partner bank details: The Bancorp Bank, 6100 S Old Village Pl, Sioux Falls, SD 57108.

- Wait up to two pay cycles for the direct deposit to start.

You do not need a traditional bank account for this. Once your money arrives, you can use your Venmo Debit Card to spend it or withdraw cash.

Direct deposit limits:

| Limit Type | Amount |

|---|---|

| Minimum Direct Deposit | N/A |

| Maximum Per Transaction | $5,000 |

| Maximum Weekly Limit | $20,000 |

Note: Not all employers or benefits providers support direct deposit to Venmo. Check with them before setting it up.

Third-Party Reload Services

Some stores and services let you add money to Venmo using third-party reload options. These services often work with cash and do not require a bank account. You can visit a participating retailer, give them cash, and ask them to reload your Venmo account.

The process is similar to reloading your Venmo Debit Card:

- Bring your Venmo Debit Card and cash to the store.

- Ask the cashier to reload your card.

- Pay the cash plus any service fees.

- The money usually appears in your Venmo balance within minutes.

Tip: Always check the fees and limits before using a third-party reload service. Fees can vary by location and provider.

Comparison Table: Advantages and Disadvantages

| Method | Advantages | Disadvantages |

|---|---|---|

| Debit Card | Easy to set up and use; can add up to $2,000 per week | Lower weekly limits compared to bank ($2,000 vs $10,000); not all debit cards accepted |

| Credit or Prepaid Card | Alternative to bank linking; can be added via Venmo app; usable for topping up | Card compatibility issues; not all card types accepted; may have limits on adding funds |

| Direct Deposit | Can receive salary or payments directly; easy to set up if employer supports | Employer must offer Venmo direct deposit option; not universally available; may have restrictions |

You have several ways to add money to Venmo without a bank account. Each method has its own steps, fees, and limits. Choose the one that fits your needs best and always keep an eye on your Venmo balance.

Using Venmo Without a Bank Account

Receive Money from Others

You do not need a bank account to receive money on Venmo. If you want to use Venmo without a bank account, ask your friends or family to send money directly to your Venmo balance. This is one of the easiest ways to keep your balance topped up. When someone sends you money, it goes straight into your Venmo balance. You can see the amount in your app right away.

Many people use Venmo for splitting bills, paying for rides, or sharing costs with friends. If you do not have a bank account, you can still collect money for chores, babysitting, or even selling items. Your Venmo balance grows every time someone sends you money. You can then use this balance for other payments or purchases.

Tip: Always check your Venmo balance after someone sends you money. This helps you keep track of your funds and avoid mistakes.

Make Payments and Transfers

You can send money to others, pay at stores, or transfer money to your Venmo card—all without a bank account. Venmo lets you use your Venmo balance to pay friends, shop online, or buy things in stores that accept Venmo QR codes. You can also use your Venmo Mastercard Debit Card to spend your balance at any place that takes Mastercard.

Here are some things you can do:

- Send money to friends or family from your Venmo balance.

- Pay at authorized merchants using your Venmo balance.

- Transfer Venmo funds to your Venmo Debit Card for cash withdrawals.

Venmo does set some limits if you use Venmo without a bank account. If you have not verified your identity, you can only send up to $299.99 per week. Once you verify your identity, your limit increases to $60,000 per week. You cannot transfer money out of Venmo to a bank account unless you link one. This means you need to use your Venmo balance for payments or spend it with your Venmo card.

Note: Payments from your Venmo balance are free. If you use a credit card, Venmo charges a 3% fee. Always check your limits before you send money or transfer money.

Venmo makes it simple to manage your money, even without a bank account. You can send money, receive money, and pay for things—all from your Venmo balance.

Safety and Fees When You Add Money

Image Source: unsplash

Security Tips

Keeping your Venmo account safe matters, especially if you do not use a bank account. You want to make sure your money stays protected. Here are some smart steps you can take:

- Create a strong password. Use at least 12 characters with a mix of letters, numbers, and symbols. Avoid using your name or easy words. A password manager can help you remember it.

- Turn on Multi-Factor Authentication (MFA). This adds another layer of security. Try using an authenticator app instead of just text messages.

- Set up a PIN or use your phone’s fingerprint or FaceID for the Venmo app. This keeps others from opening your app if they get your phone.

- Only use secure WiFi or a VPN when you log in to Venmo. Public WiFi can put your information at risk.

- Watch for security alerts from Venmo. If you see something strange, act fast.

- Stay alert for phishing scams. Never share your login details or click on links from unknown sources.

Tip: Always log out of Venmo if you use someone else’s device. This helps keep your account safe.

Common Fees and Limits

You should know about the fees and limits before you add money to Venmo. Different methods have different costs. Here is a quick look at what you might pay:

| Method of Adding Money Without Bank Account | Fee Structure |

|---|---|

| Cash-a-check (payroll and government checks, faster deposits) | 1.00% fee, minimum $5 |

| Cash-a-check (other accepted check types, faster deposits) | 5.00% fee, minimum $5 |

| Other non-bank methods (e.g., debit card) | No fees for adding money (fees apply only when sending money with credit card, 3%) |

Venmo does not charge you to add money with a debit card or most prepaid cards. If you use a credit card to send money, you pay a 3% fee. When you cash a check, the fee depends on the type of check. Always check the latest fees in the Venmo app before you add money.

Venmo also sets limits on how much you can add or send. These limits help protect your account. If you reach a limit, you may need to wait before adding more money to your Venmo balance.

Note: If you ever feel unsure about a fee or limit, check Venmo’s help center or contact support for help.

You have several ways to add money to Venmo without a bank account. You can use a Venmo debit card, prepaid cards, direct deposit, or even receive funds from friends who send money. Each option has its own fees, limits, and steps. Check the table below for key factors to consider:

| Factor | Details |

|---|---|

| Card Type | Use activated prepaid or Venmo debit cards for online transfers. |

| Fees | Reload fees range from $1–$5; Venmo charges $3.74 at stores. |

| Limits | Most cash reloads allow $20–$500 per transaction. |

| Security | Always buy reload cards from trusted stores. |

Stay alert for common mistakes like using an outdated Venmo app or having insufficient funds. Pick the method that fits your lifestyle, keep your Venmo app updated, and always double-check your details. With the right steps, you can send money, pay bills, and manage your Venmo balance with confidence.

FAQ

Can you use Venmo if you do not have a bank account?

Yes, you can use Venmo without a bank account. You can add money with a Venmo Debit Card, prepaid cards, direct deposit, or by receiving payments from others. You can spend your balance with the Venmo app or card.

What prepaid cards work with Venmo?

Venmo accepts most prepaid cards from major brands like Visa, MasterCard, American Express, and Discover. Some cards may not work due to issuer restrictions. If your card does not work, try another brand or check with the card provider.

How long does it take for money to show up in your Venmo balance?

Most cash reloads and direct deposits appear in your Venmo balance within minutes. Sometimes, direct deposits may take up to two pay cycles to start. Always check your balance after adding money to confirm the funds arrived.

Are there fees for adding money to Venmo without a bank account?

Yes, some methods have fees. Here is a quick look:

| Method | Typical Fee (USD) |

|---|---|

| Venmo Debit Card reload | $3.74 per transaction |

| Prepaid card | Usually free |

| Credit card payment | 3% of amount |

| Direct deposit | Free |

Tip: Always check the Venmo app for the latest fee details before adding money.

This guide shows you that even without a traditional bank account, you have multiple ways to use Venmo for your daily financial needs. But for many, digital wallets like Venmo are just the first step. The real challenge comes when you need to use those digital funds for international transactions, like sending money back home or paying a global supplier. These tasks often involve frustratingly high fees and unreliable exchange rates. This is where BiyaPay offers a modern solution. Our platform provides real-time exchange rate queries and conversions for a variety of fiat and digital currencies, and our remittance fees are as low as 0.5%.

Whether you’re a digital nomad, an international student, or simply need to make a cross-border payment, BiyaPay simplifies the process. We support fast transfers to most countries and regions worldwide, with many transactions completed on the same day. Say goodbye to the high costs and slow speeds of traditional remittance. You can open a secure account with BiyaPay in minutes and start your global financial journey. Register now and experience seamless, affordable international payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.