- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Bank of America's ATM Withdrawal Limits Affect Your Cash Access

Image Source: pexels

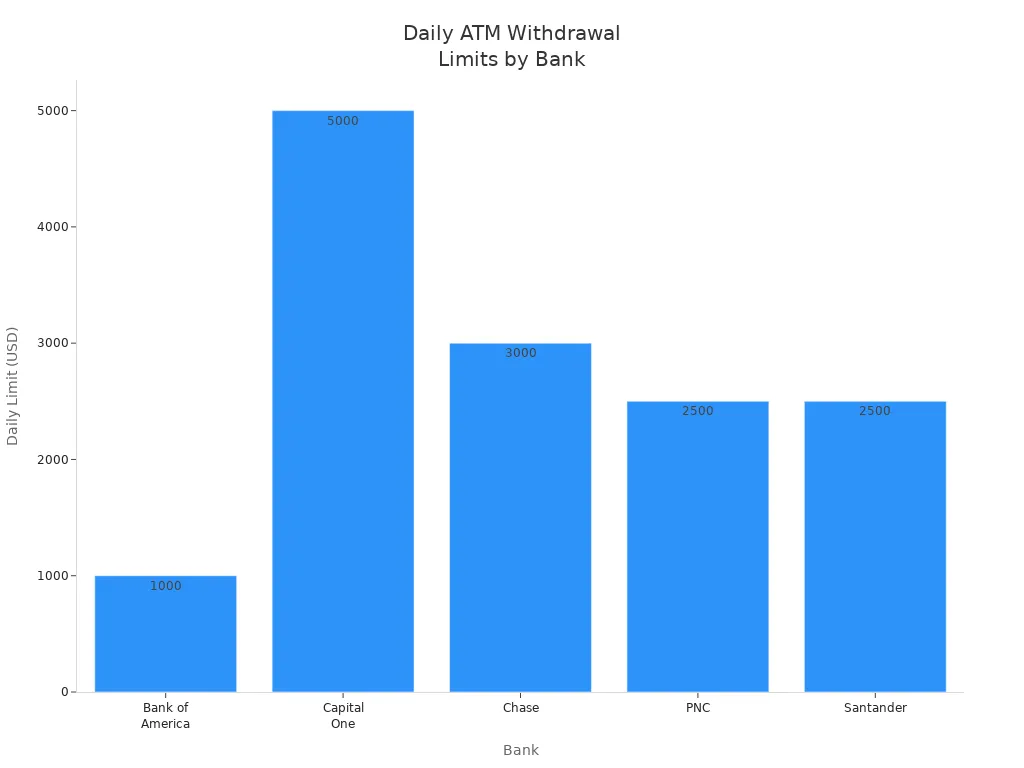

Bank of America sets a standard daily ATM withdrawal limit of $1,000 or up to 60 bills per transaction. This limit places Bank of America on the lower end compared to some other major banks, as shown below:

| Bank | Daily ATM Withdrawal Limit |

|---|---|

| Bank of America | $1,000 or 60 individual bills |

| Capital One | $5,000 |

| Chase | $500 - $3,000 |

| PNC | $2,500 |

| Santander | $2,500 |

Bank of America ATM withdrawal limits depend on your account type, card type, and the amount of money you have in your account. You may notice that your daily ATM limits differ from others. Knowing your withdrawal limits helps you plan for cash needs and avoid surprises at the ATM. You can adjust your daily limits if needed, making it easier to manage your money.

Key Takeaways

- Bank of America sets a daily ATM withdrawal limit of $1,000 or 60 bills per transaction to manage cash flow and security.

- Your withdrawal limit can vary based on your account and card type, so check your specific limit before making large withdrawals.

- You can view and adjust your ATM withdrawal limits through the mobile app, online banking, customer service, or by visiting a branch.

- If you need more cash than the ATM allows, use teller services at branches or get cash back at stores during purchases.

- ATM withdrawal limits protect your money from theft and help the bank keep enough cash available for all customers.

Bank of America Daily ATM Withdrawal Limit

Image Source: unsplash

Standard Limit Overview

You need to know how the bank of america atm withdrawal limit works before you visit an ATM. Bank of America sets a daily atm withdrawal limit of $1,000 or up to 60 bills per transaction. This means you cannot take out more than $1,000 in cash from an ATM in one day, even if you have more money in your account. The 60-bill cap also affects your withdrawal. If you try to withdraw an amount that would require more than 60 bills, the ATM will stop the transaction. For example, if the ATM only has $20 bills, you can take out up to $1,000, but if it only has $10 bills, you might not reach the full daily limit before hitting the 60-bill cap. This rule helps the bank manage cash flow and keeps the ATM running smoothly for everyone.

Tip: If you need more than the maximum daily withdrawal amount, you can visit a branch or make several ATM transactions, but you still cannot exceed your daily atm limits.

Account and Card Variations

Your account type and debit card can change your withdrawal limits. Most personal accounts follow the standard $1,000 daily atm withdrawal limit. However, business accounts work differently. If you have a business employee debit card, the account owner can set a custom limit, but the maximum is usually $700 per day. Some business deposit cards do not allow cash withdrawals at all. Bank of America does not publish specific limits for every card type, so you should check your account details or ask the bank if you have questions about your daily atm limits or debit purchase limits.

- Standard personal debit cards: $1,000 daily atm withdrawal limit

- Business employee debit cards: Up to $700 per day (customizable)

- Business deposit cards: No cash withdrawals allowed

You may also have different daily debit purchase limit and debit purchase limits, which control how much you can spend using your card each day. These limits are separate from your atm withdrawal limits.

Bill Denominations

The types of bills available at the ATM can affect how much cash you get in one transaction. Bank of America ATMs usually offer $20 and $50 bills, but some locations may have $10 or $100 bills. The mix of denominations changes how quickly you reach the 60-bill cap. If the ATM gives out smaller bills, you might not reach the full $1,000 limit before hitting the 60-bill maximum. If the ATM has larger bills, you can withdraw the maximum daily withdrawal amount more easily.

| Factor | Details |

|---|---|

| Daily Withdrawal Limit | Bank of America ATMs usually cap withdrawals at $1,000 per day. |

| Typical Denominations | Most ATMs stock $20 and $50 bills; some may have $10 or $100 bills. |

| Impact of Denominations | The mix of bills affects how many you get and how close you get to your daily atm limits. |

| Operational Efficiency | The bank chooses bill types to balance customer needs and ATM capacity. |

| Temporary Adjustments | You can ask for a temporary increase or make several withdrawals if you need more cash. |

Sometimes, mistakes happen. For example, a vendor once loaded $100 bills instead of $10 bills into a Bank of America ATM. This allowed customers to withdraw more money in fewer bills, making it easier to reach higher amounts without hitting the 60-bill cap. While this is rare, it shows how the denominations in the ATM can change your experience with withdrawal limits.

Knowing your bank of america atm withdrawal limit and how bill denominations work helps you plan your cash needs. Always check the ATM screen for available denominations before you start your withdrawal. If you need more cash than the ATM allows, you can visit a branch or use other options to access your money.

Why ATM Withdrawal Limits Exist

Security Reasons

You might wonder why Bank of America sets daily withdrawal limits at ATMs. The main reason is to protect your money. If someone steals your card or gets your PIN, the limit stops them from taking all your cash at once. This helps prevent large losses from theft or fraud.

Bank of America also gives you ways to report lost or stolen cards quickly. When you act fast, you lower the risk of someone making unauthorized withdrawals. The bank’s security team uses these limits to keep your account safe.

Note: If you notice any suspicious activity on your account, contact Bank of America right away. Quick action can help protect your funds.

Bank Policies

Bank of America uses ATM withdrawal limits to manage cash flow and make sure everyone has access to cash. If one person takes out too much, the ATM could run out of money. By setting a daily withdrawal limit, the bank ensures that more customers can get the cash they need.

Here are some reasons why these limits matter:

- They help the bank keep enough cash in each ATM for all customers.

- They protect both you and the bank from large losses due to fraud.

- They make it easier for the bank to track and manage cash reserves.

- They allow the bank to review and adjust limits if you need more cash for special reasons.

You can ask Bank of America to raise your daily withdrawal limits if you have a special need. The bank may suggest other ways to get more cash, such as visiting a branch. These policies balance your convenience with the bank’s need to keep ATMs running smoothly.

Check and Increase Your ATM Withdrawal Limits

How to Check Your Limit

You have several ways to check your current ATM withdrawal limit with Bank of America. Knowing your limit helps you avoid surprises when you need cash. Here are the most common methods:

- Log in to Bank of America’s online banking platform. Select your account, then go to the Information & Services tab. Choose ‘Manage Card Settings’ and select ‘Set daily purchase and ATM withdrawal limits’ to view your current limit.

- Use the Bank of America mobile app. Sign in, tap Menu, then select ‘Manage Debit/Credit Card.’ Make sure your debit card is unlocked to see or set your limit.

- Review the cardholder agreement that came with your debit card. This document lists your daily debit purchase limit and ATM withdrawal limit.

- Call Bank of America customer service for help. A representative can tell you your current withdrawal and debit purchase limits.

- Visit a local Bank of America branch. Staff can provide your limit details and answer questions face-to-face.

Tip: Checking your limit before making a large withdrawal can save you time and prevent declined transactions.

Requesting a Higher Limit

Sometimes you need more cash than your current ATM withdrawal limit allows. You can request a one-time extended limit or ask for a permanent increase. Here is how you can do it:

- Open the Bank of America mobile app. Go to Menu, tap Help & Support, then select Contact Us. Submit a request to increase your withdrawal limit.

- Call Bank of America customer service at 800.432.1000. Explain why you need a higher limit. The representative will verify your identity and process your request.

- Visit a Bank of America branch. Bring a valid ID and speak with a staff member about raising your ATM withdrawal limit.

Bank of America reviews your account standing, balance, and client level before approving a higher limit. If you only need more cash for a short time, you can request a one-time extended limit. For ongoing needs, ask about a permanent increase. The bank may not approve every request, but staff will explain your options.

Note: Always plan ahead if you expect to need more cash than your usual limit. This helps you avoid delays and ensures you have access to your funds when you need them.

Options When You Need More Cash

Image Source: pexels

Branch Withdrawals

You can visit a Bank of America branch if you need more cash than the ATM allows. Teller withdrawals at branches do not have a fixed limit. The amount you can take out depends on your account balance, account type, and how much cash the branch has on hand. You may withdraw the maximum amount of cash available in your account. Sometimes, large withdrawals require advance notice or a special order, which can take up to a week. If you want to close your account and take all your money, you might need to make an appointment with a banking specialist.

- No set withdrawal limit at teller counters

- Withdrawals depend on your account balance and branch cash availability

- Large amounts may need advance notice or ordering funds

- You can withdraw more than the ATM limit, even your entire balance

Cash Back at Stores

You can also get cash back at many retail stores when you make a purchase with your Bank of America debit card. This option gives you quick access to cash without visiting an ATM. The process is simple: make a small purchase, enter your PIN, and choose a cash back amount at checkout. Limits and fees depend on the store.

| Store | Max Cash Back | Typical Fee (USD) |

|---|---|---|

| Walmart | $100 | $0 |

| Target | $40 | $0 |

| Walgreens | $20 | $0 |

| CVS | $35 | $0 |

| Kroger brands | $200-$300 | $0.50-$3.50 |

| Dollar General | $40 | $1-$2.50 |

| Dollar Tree | $50 | $1-$1.50 |

Cash back at stores offers several benefits. You get cash instantly, avoid ATM fees, and often find better security than at some ATMs. However, stores set their own limits, so you may need to visit more than one location if you need a larger amount.

Emergency Access

If you reach your daily ATM withdrawal limit and still need more cash, you have other options. You can request a temporary increase to your ATM limit by contacting Bank of America. You may also:

- Get cash back at checkout with your debit card

- Use a credit card for a cash advance (note: high fees and interest apply)

- Write a personal check to cash at the bank

- Transfer funds from savings to checking before withdrawing

Bank of America has over 15,000 ATMs and 3,900 branches, so you have many ways to access your money. If you need more than your usual limit, contact the bank early to discuss your options.

Understanding your daily ATM withdrawal limit helps you avoid surprises when you need cash.

- Check your limit before planning large withdrawals.

- Use teller services or cash back at stores if you need more than the ATM allows.

- Scheduled ATM withdrawals in the mobile app may have lower limits, so plan ahead.

Tip: Use your debit card every few months to keep it active and explore digital banking tools for easy account management.

FAQ

How can you find out your current ATM withdrawal limit?

You can check your current limit by logging into your online banking account or mobile app. You may also call customer service or visit a branch for help. Always confirm your limit before planning a large cash withdrawal.

What should you do if you need more cash than your ATM allows?

You can visit a branch to withdraw a larger amount. You may also request a temporary increase to your limit by contacting customer service. Some stores offer cash back with debit card purchases, which can help you access more funds.

Are there fees for withdrawing cash at non-Bank of America ATMs?

Yes, you may pay a fee when using an ATM outside your bank’s network. The ATM owner may also charge a separate fee. Check your account terms or ask your bank for details about these charges.

Can you change your daily ATM withdrawal limit permanently?

You can request a permanent change by contacting your bank. Approval depends on your account history and balance. The bank may review your request and let you know if they can increase your limit.

What happens if you reach your daily ATM withdrawal limit?

If you reach your limit, you cannot withdraw more cash from an ATM until the next day. You can still use other options, such as teller withdrawals or cash back at stores, to access more money.

This guide shows you that even with a major bank like Bank of America, accessing your own cash can be a frustrating exercise in navigating limits and restrictions. You’re forced to choose between the inconvenience of visiting a branch, the low limits of a store’s cash back program, or the hassle of calling customer service for a temporary increase. These experiences highlight a broader truth in today’s financial world: traditional banking systems often lack the flexibility and speed you need. The problem becomes even more pronounced with international transactions, where you face high fees, unfavorable exchange rates, and slow transfers. This is where BiyaPay offers a modern, transparent solution, providing a new level of financial freedom without the traditional constraints. Our platform enables real-time exchange rate queries and conversions for a wide range of fiat and digital currencies, with remittance fees as low as 0.5%.

With BiyaPay, you can move money across borders with the speed and efficiency you expect. Our fast registration and support for same-day delivery to most countries and regions worldwide help you avoid the delays and high costs of traditional banking. You get to control your money, not be controlled by it. Don’t let domestic or international limits hold you back. Open a secure account with BiyaPay in minutes and experience a new standard for global finance. Register now to streamline your international transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.