- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Much Do Accountants Charge for Small Business Tax Filing

Image Source: pexels

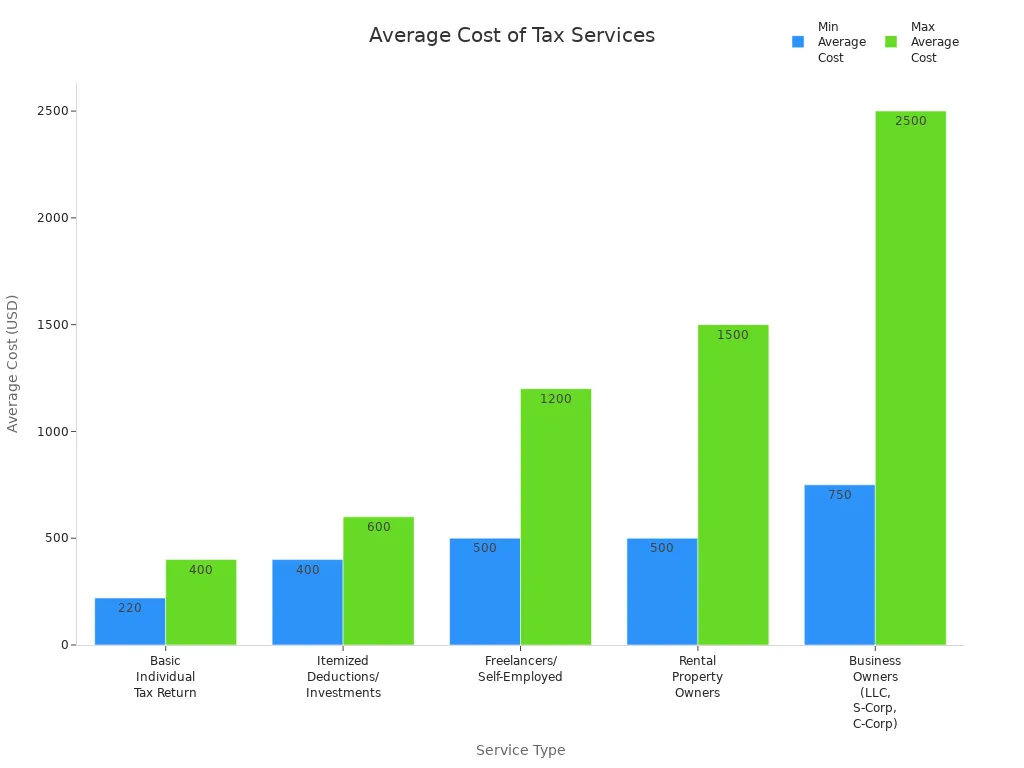

You can expect the cost of an accountant for small business tax filing to range from $500 to $2,500 per return. The average rate for a CPA falls between $150 and $500 per hour, while monthly fees often range from $300 to $2,500. The cost of hiring a tax accountant depends on your business complexity, the accountant’s credentials, and the scope of tax preparation services you need. Fees may increase if your records are disorganized or your business has complex transactions.

| Service Type | Typical Cost or Rate |

|---|---|

| Tax Preparation & Filing (per return) | $500 – $2,000 |

| CPA Hourly Rate | $150 – $500+ |

| Monthly Accounting Fees | $300 – $2,500 |

Key Takeaways

- Small business tax filing costs usually range from $500 to $2,500 per return, depending on business complexity and accountant experience.

- Accountants charge either hourly rates ($150 to $450 for CPAs) or flat fees, with flat rates offering more predictable costs.

- Organized records and early hiring can lower your accountant fees by reducing the time needed for tax preparation.

- You can choose from basic to premium tax service packages, with add-ons like bookkeeping, payroll, and audit support to fit your needs.

- Outsourcing accounting services can save money and provide expert help with monthly fees typically between $500 and $2,500.

Cost of an Accountant for Small Business

Image Source: unsplash

Average Fees and Ranges

When you look at the cost of an accountant for your small business, you will see a wide range of fees. The average cost of an accountant for business tax return preparation depends on your business type and the complexity of your finances. Most small businesses pay between $1,000 and $5,000 per year for accounting and tax services. If you only need business tax return preparation, you can expect to pay between $500 and $2,500 per return.

The average cost of tax preparation for an unincorporated business return usually falls between $200 and $500. Incorporated business returns, such as S Corporations or C Corporations, often cost between $800 and $1,800 per return. For example, preparing an S Corporation tax return (Form 1120-S) averages around $903, while partnership returns (Form 1065) average about $733. These numbers come from recent surveys by the National Society of Accountants.

You may also see different fees from popular service providers:

| Service Provider | Small Business Tax Preparation Cost (USD) |

|---|---|

| Intuit TurboTax | $739 to $1,749 (+ $64 per state filed) |

| TaxAct | $149 to $249 per return; bundles $945 to $2,095 |

| Pilot | Starting at $2,450/year (unprofitable businesses); $5,400/year (profitable businesses) + bookkeeping fees |

| H&R Block | $115 to $203 for sole proprietors; starting at $279 for corporations |

The accountant hourly rate also varies. Most CPAs charge between $150 and $450 per hour. Bookkeepers usually charge $30 to $90 per hour. If you choose a monthly package, you may pay $500 to $2,500 per month, which often covers more than just tax filing.

Several factors affect the cost of an accountant:

- Business Size: A sole proprietorship with simple finances pays less than a corporation with many employees.

- Business Complexity: More transactions, multiple locations, or special industry needs increase the average cost of tax preparation.

- Accountant Credentials: A CPA or tax specialist with more experience charges higher fees but can handle complex returns and provide audit support.

- Location: Accountants in urban areas often charge higher rates than those in rural areas.

Here is a summary table of average fees:

| Fee Type | Average Cost Range (USD) |

|---|---|

| Tax Return (Unincorporated) | $200 to $500 per return |

| Tax Return (Incorporated) | $800 to $1,800 per return |

| Bookkeeper Hourly Rate | $30 to $90 per hour |

| CPA Hourly Rate | $150 to $450 per hour |

| Financial Statement Service | $1,000 to $2,500 per engagement |

| Audit Service | $2,000 to $5,000 per engagement |

Note: The cost of an accountant can change based on how organized your records are and how early you hire help. If you wait until tax season, you may pay higher fees.

Hourly vs. Flat Rates

You will find two main pricing models for business tax return preparation: hourly rates and flat rates. Each model has its own pros and cons.

Hourly Rates

With hourly billing, you pay for the actual time your accountant spends on your work. The accountant hourly rate for a CPA ranges from $150 to $450 per hour. Bookkeepers charge less, usually $30 to $90 per hour. This model works well if you have a small project or need occasional advice. However, your total cost can be hard to predict if your business tax return preparation becomes more complex.

Flat Rates

Flat-rate pricing gives you a set fee for a specific service, such as preparing your business tax return. This model makes it easier to budget because you know the total cost upfront. Many small businesses prefer flat rates for the predictability. However, if your business needs change or you add more services, you may need to renegotiate the fee.

Here is a comparison table:

| Aspect | Flat-Rate Pricing Model | Hourly Pricing Model |

|---|---|---|

| Cost Calculation | Fixed price set upfront. | Based on actual hours worked × hourly rate. |

| Predictability | Predictable cost for you. | Cost can change if more hours are needed. |

| Risk | Accountant takes risk if work takes longer. | You take risk if project takes more time. |

| Administrative Burden | Lower, since only total project cost is tracked. | Higher, requires detailed time tracking. |

| Productivity Impact | Encourages efficiency. | May reduce productivity if paid by the hour. |

| Flexibility | Less flexible if project scope changes. | More flexible for changes in work. |

| Client Perception | Seen as simple and transparent. | Seen as fair, paying only for work done. |

Tip: If you want to control your budget, ask your accountant if they offer flat-rate packages for business tax return preparation.

The cost of an accountant for your small business depends on your needs, the complexity of your finances, and the pricing model you choose. By understanding the average cost of tax preparation and the different ways accountants charge, you can make a smart choice for your business.

Tax Preparation Services Breakdown

What’s Included

When you hire an accountant for business tax return preparation, you receive a set of standard tax preparation services. These services help you stay compliant and organized throughout the year. Most packages for small business tax preparation include:

- Business tax preparation and filing for federal, state, and local returns

- Form completion and submission for required tax documents

- Record keeping and profit and loss statement preparation

- Basic bookkeeping support

- Payroll services for employee payments and tax filings

- Quarterly estimated tax calculations

- Year-round tax planning and advisory

- Tax savings analysis to help you keep more of your earnings

- Audit defense and support if you face an IRS review

- Access to live tax professionals and AI tax assistance

- 100% accuracy and satisfaction guarantees

You can work with your accountant in person or remotely. Many providers offer unlimited business returns with premium software, which is helpful if you operate in multiple states or need sales tax filings. Some packages also include business and personal tax prep together, making it easier to manage all your tax needs in one place.

| Package Type | Included Services and Features | Cost and Target Users |

|---|---|---|

| Basic | Simple business tax return preparation, basic income reporting, limited support, fewer features | Ideal for simple businesses, lower cost |

| Premium | Support for investors, self-employed, small business owners; unlimited live support; business tax forms; expense tracking; profit and loss statements; tax savings analysis; unlimited business returns; additional state filings; advanced tools like depreciation modules | Designed for growing businesses, higher cost, more features |

Note: CPAs often charge more for advanced tax preparation services, such as audit support or strategic planning. Their fees can be two to four times higher than standard tax preparers, but you gain access to deeper expertise and more comprehensive cpa services.

Optional Add-Ons

You may need more than basic business tax return preparation. Accountants offer optional add-ons to cover extra needs. These services help you manage your finances and grow your business.

| Optional Add-on Service | Description/Scope | Average Cost Range |

|---|---|---|

| Tax Planning Advice | Guidance to minimize tax liabilities and optimize tax outcomes | Included in some packages or additional fees apply |

| Bookkeeping Services | Maintaining financial records and bookkeeping systems | $200–$2,000+ per month |

| Payroll Services | Managing employee payroll and related tax filings | Often part of monthly accounting services |

| Audit Support | Assistance during audits and preparation of audited financial statements | $100–$400 per hour |

| Business Advice | Financial and operational advice to improve business efficiency | Bundled or hourly consulting fees |

| Tax Preparation for Various Forms | Preparation of specific tax forms (e.g., Form 1120, 1120S, 1065) | $282–$826 depending on complexity |

You can choose add-ons like bookkeeping, payroll, or advanced tax planning. Some cpa services include year-round support or help with complex business tax return preparation. If you need help with sales tax filings or want ongoing business and personal tax prep, ask your accountant about bundled packages. These options let you customize your tax preparation services to fit your business goals.

Monthly Accounting Cost and Service Options

Bookkeeper vs. CPA

When you look at the monthly accounting cost for your business, you will see big differences between hiring a bookkeeper and a CPA. Bookkeepers usually charge $30 to $90 per hour, or $300 to $1,000 per month for basic bookkeeping. If you need more help, such as monthly financial statements or payroll, the fees can reach $2,500 per month. CPAs charge higher rates, often $150 to $450 per hour. Monthly accounting cost for CPA services usually starts at $750 to $1,000 for core packages, but can go up to $3,000 if your business is complex or needs extra support.

| Service Type | Hourly Rate Range | Average Monthly Cost Range |

|---|---|---|

| Bookkeeper | $30 - $90 | $300 - $1,000 |

| CPA | $150 - $450 | $750 - $3,000 |

You should choose a bookkeeper if your business has simple finances, fewer than 200 transactions each month, or annual revenue under $500,000. Bookkeepers handle daily tasks like recording income and expenses, reconciling bank accounts, and preparing basic reports. If your business grows, or you need tax planning, audits, or strategic advice, a CPA is a better fit. CPAs provide advanced cpa services, including tax filings and financial analysis.

Tip: Many small businesses start with a CPA for setup and compliance, then hire an online accountant or bookkeeper for ongoing monthly accounting.

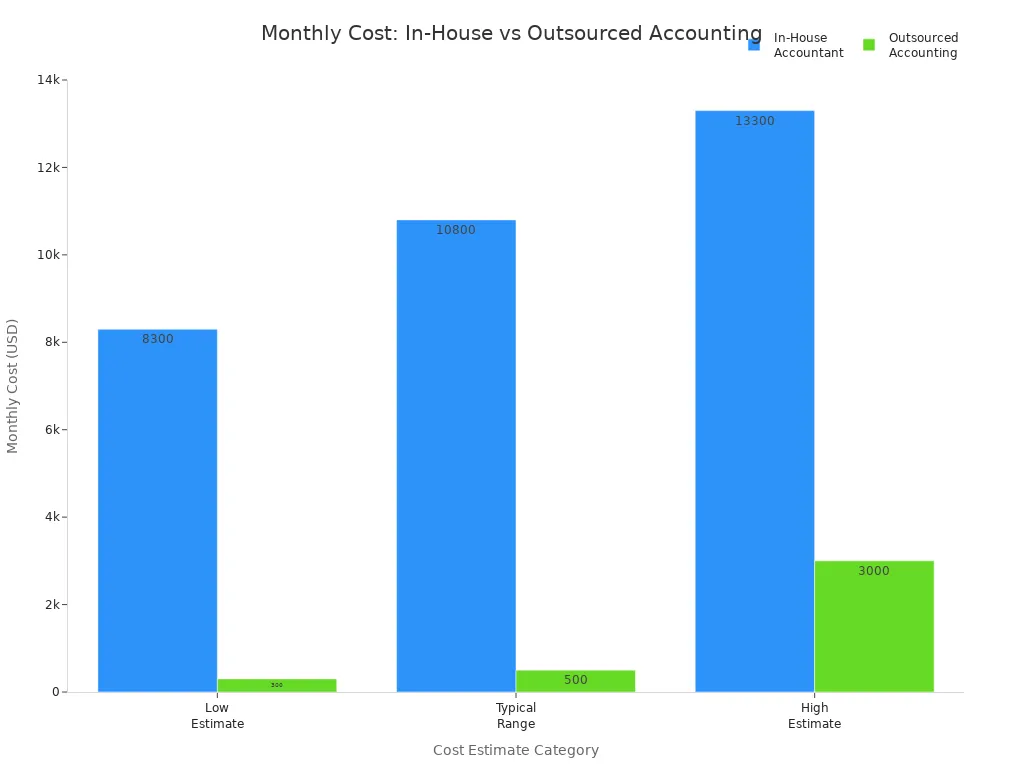

Outsourced Accounting

Outsourced accounting services offer another way to manage your monthly accounting cost. These services bundle bookkeeping, tax preparation, and consulting into flat monthly accounting fees. Most small businesses pay between $500 and $2,500 per month for outsourced accounting, depending on the complexity of their needs. Some providers charge as little as $300 per month for basic packages, while more advanced services can reach $5,000 or more.

| Service Type | Average Monthly Cost Range |

|---|---|

| Outsourced Bookkeeping | $300 - $1,000 |

| Outsourced Accounting (CPA) | $750 - $3,000 |

| Full-Service Outsourcing | $500 - $5,000+ |

Outsourcing can save you money compared to hiring an in-house accountant. You avoid costs like salaries, benefits, office space, and software. Outsourced accounting services often include access to a team of specialists who handle everything from bookkeeping to tax planning. This approach works well for small business accounting if you want predictable flat monthly accounting fees and need help with monthly financial statements.

If you want to hire an online accountant, you can find flexible plans that match your business size and needs. Outsourcing fits best if you want to control costs, need expert support, or prefer not to manage accounting staff. You can focus on running your business while professionals handle your accounting services.

Factors Affecting Small Business Tax Preparation Fees

Business Complexity

You will notice that the complexity of your business has a big impact on small business accountant fees. The type of entity you choose—sole proprietorship, partnership, LLC, or corporation—changes the forms and schedules your accountant must prepare. For example, a sole proprietorship files a simple Schedule C, but a corporation needs Form 1120 or 1120S, which takes more time and skill. If your business has many owners, employees, or revenue streams, your accountant will spend more hours on your small business tax preparation. Industry-specific rules, such as those for real estate or healthcare, also add to the workload. More complex businesses pay higher fees because they require extra forms, calculations, and expertise.

| Business Complexity Factor | Description | Impact on Tax Preparation Fees |

|---|---|---|

| Entity Type | Different forms for each entity | More complex entities increase fees |

| Number of Transactions | High transaction volume | More transactions raise fees |

| Employees | Payroll and W-2 forms | More employees increase fees |

| Revenue Streams | Multiple income sources | Diverse income raises fees |

| Multi-state Operations | Filing in several states | Multi-state filings increase fees |

| Industry-specific Rules | Unique industry requirements | Special rules add to fees |

Record Organization

The way you organize your records can lower or raise your accountant fees. Well-organized and accurate records help your accountant finish your small business taxes faster, which reduces the cost. If your records are messy or missing, your accountant must spend extra time sorting them out. This increases your fees. You can save money by keeping business and personal finances separate, tracking expenses, and using accounting software. Good record-keeping can save you about 13 hours each year on tax preparation. The IRS also says that organized records help you avoid extra charges.

- Organized records reduce the time and cost of small business tax preparation.

- Disorganized records increase fees because your accountant must clean up errors.

- Using software and keeping receipts in order helps lower your overall cost.

- Hiring a bookkeeper for routine tasks can reduce what you pay your accountant.

Location and Experience

Where you run your business and the experience level of your accountant both affect your fees. Accountants in cities with higher living costs, like New York or San Francisco, usually charge more than those in rural areas. For example, average fees in the Midwest range from $300 to $400, while in the Pacific region, fees often go over $500. More experienced accountants charge higher fees, but they bring more value. They know how to find deductions, follow tax laws, and give you advice that can save you money on small business taxes. Hiring early in the year can also help you secure better rates and avoid last-minute rush fees.

Saving on Small Business Taxes and Choosing the Right Accountant

Image Source: pexels

Preparation Tips

You can lower your accountant fees and make tax season easier by staying organized all year. Start by keeping your business and personal finances separate. Open a business bank account and use a business credit card. Track your income and expenses with accounting software like QuickBooks or Xero. Save digital copies of receipts and invoices. Set aside time each month to update your records and reconcile your accounts. This helps you catch mistakes early and ensures you do not miss any deductions.

Here are some ways to reduce your tax preparation costs and ensure accuracy for tax obligations:

- Use accounting software to automate tracking of income, expenses, and invoices.

- Reconcile your bank and credit card statements every month.

- Save digital copies of all receipts and contracts.

- Keep a clear filing system with labels and categories.

- Back up your financial data regularly.

- Educate your team about proper record-keeping.

You can also save on small business taxes by choosing a tax-efficient business structure, such as an S corporation. Maximize deductions for home office, vehicle use, health insurance, and retirement contributions. Plan your estimated tax payments to avoid penalties. Consult a CPA to tailor strategies for your business.

Evaluating Value

When you compare tax preparation services, do not focus only on the lowest fees. Look for affordable accounting services that offer more than just filing forms. Ask these questions to find the right accountant:

- What experience do you have with businesses like mine?

- How do you help me maximize deductions and credits?

- What is your process for keeping my data secure?

- How do you communicate during the tax preparation process?

- What extra services do you offer, such as payroll or financial planning?

A good accountant provides advice, helps you grow your business, and uses technology to add value. Some offer value-based pricing, which can include bookkeeping, payroll, and advisory services. Ongoing communication and support help you make better business decisions. By balancing cost and value, you get the most from your tax preparation services and keep your fees under control.

You will see that small business tax preparation fees usually range from $400 to $1,000, but complex needs can push fees higher. The table below shows how service type and business complexity affect cost:

| Service Type | Typical Fees or Cost Range |

|---|---|

| Basic Tax Preparation | $400 – $1,000 |

| Bookkeeping | $300 – $2,500/month |

| Payroll Processing | $20 – $100/employee/month |

When you choose a provider, look at both cost and value. Qualified professionals may charge higher fees, but they help you avoid errors and maximize savings. To minimize fees, gather your records, compare service options, and ask about experience and support.

FAQ

How can you estimate your small business tax preparation cost?

You can estimate your cost by considering your business type, number of transactions, and service needs. Ask for a quote from several accountants. Compare flat-rate packages and hourly rates. Organized records help you keep costs lower.

What documents should you prepare before meeting your accountant?

Gather these items:

- Income statements

- Expense receipts

- Bank statements

- Payroll records

- Last year’s tax return

Having these ready helps your accountant work faster and more accurately.

Can you negotiate accounting fees for tax filing?

Yes, you can negotiate fees. Ask about flat-rate packages or bundled services. If you have organized records, mention this to request a discount. Always compare offers from different accountants before you decide.

Do you need a CPA for small business tax filing?

You do not always need a CPA. For simple businesses, a bookkeeper or enrolled agent may handle your taxes. If your finances are complex or you want advanced advice, a CPA provides more expertise and support.

This guide shows you that for small businesses, controlling costs and maintaining organized records are the keys to a healthy financial life. You’ve learned how to choose the right accountant and how to save money on tax preparation. But your financial strategy shouldn’t end there. In today’s global market, a major hidden cost for many small businesses comes from international payments—whether you’re paying overseas suppliers or receiving funds from global clients. Traditional wire transfers can eat into your profits with high fees, unfavorable exchange rates, and slow processing times. This is where BiyaPay provides a modern, transparent solution for your global financial needs. Our platform offers real-time exchange rate queries and conversions for a wide range of fiat and digital currencies, with remittance fees as low as 0.5%.

Just as a smart tax strategy helps you keep more of your revenue, a smart payment solution helps you keep more of your profits. BiyaPay streamlines your international transactions with fast registration and support for same-day delivery to most countries and regions worldwide. You can focus on growing your business while we handle the complexities and costs of cross-border finance. Don’t let confusing fees erode your hard-earned money. Open a secure account with BiyaPay in minutes and experience a new standard for global business payments. Register now to streamline your international transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.