- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How the Chase Withdrawal Limit Works for Your Account

Image Source: pexels

Knowing your chase withdrawal limit helps you manage your cash needs and avoid surprises. Each chase account comes with its own withdrawal rules, and your limit can change depending on which ATM you use. Some chase ATMs allow higher withdrawal amounts, while others may set stricter limits. If you plan ahead, you can use your chase withdrawal limit to prevent extra fees or delays. Your chase account gives you options, but understanding your withdrawal limit keeps your money safe.

Key Takeaways

- Chase ATM withdrawal limits vary by account type, ATM location, and card status, so always know your specific limits to avoid surprises.

- In-branch Chase ATMs allow higher daily withdrawals, up to $3,000, while non-branch ATMs usually limit you to around $500 per day.

- You can check your withdrawal limit using the Chase Mobile App, online banking, or by contacting customer service for the most accurate info.

- If you need more cash, request a temporary or permanent limit increase through customer service, explaining your reasons clearly.

- Avoid extra fees by using Chase ATMs, planning withdrawals carefully, and considering alternatives like cashback or branch withdrawals when you reach your limit.

Chase ATM Withdrawal Limit

Image Source: pexels

Understanding your chase atm withdrawal limit helps you plan your cash needs. Each chase account has its own rules. The amount you can take out depends on your account type, the ATM location, and your card status. You should know these limits to avoid problems when you need cash.

Daily Limits by Account Type

Your chase withdrawal limit changes based on your account. Most chase checking account holders have a standard daily atm withdrawal limit. For example, if you use a Chase Total Checking account, your daily withdrawal limit is usually $500 to $1,000 at most ATMs. Some accounts, like Chase Private Client, offer higher chase atm limits.

Here is a table to help you see the differences:

| Account Type | Daily ATM Withdrawal Limit | Notes |

|---|---|---|

| Chase Total Checking | $500 - $1,000 | Standard limit for most debit cards |

| Chase Private Client | Up to $3,000 | Higher limit with Private Client status |

| Chase Student Checking | $500 | Lower limit for student accounts |

You should check your specific chase debit card limits because they may change. Debit card withdrawal limits help protect your money. If you need more cash, you can ask chase to raise your limit for a short time.

Note: The daily withdrawal limit applies to all your chase debit cards combined, not just one card.

In-Branch vs. Other ATMs

The chase atm withdrawal limit also depends on where you use your card. Chase in-branch atm limit is higher than the limit at other ATMs. If you use an ATM inside a chase branch, you can withdraw up to $3,000 each day. This is the highest chase in-branch atm limit.

If you use a non-branch chase ATM, your limit drops. Most non-branch chase atm limits are around $500 per day. This lower limit helps keep your account safe if your card is lost or stolen.

| ATM Type | Withdrawal Limit (per day) | Notes |

|---|---|---|

| In-branch Chase ATM | Up to $3,000 | Higher limits during branch hours; applies to all debit cards you own |

| Non-branch Chase ATM | Around $500 | Lower limit; you can make more withdrawals, but each is limited |

If you use a non-chase ATM, you may face extra fees. Chase charges $3 for each withdrawal at a non-chase ATM in the US. The ATM owner may also charge you. These fees add up, so you should use chase ATMs when possible.

Private Client and International Limits

Chase Private Client accounts give you higher chase atm withdrawal limits. If you have this account, you can take out up to $3,000 each day at a chase ATM. At non-chase ATMs, your limit is up to $500 per day in the US. If you travel, your international atm withdrawal limit is up to $2,000 per day at non-chase ATMs.

| Account Type / ATM Type | Daily ATM Withdrawal Limit | Notes |

|---|---|---|

| Chase Private Client (Chase ATM) | Up to $3,000 | Use your Private Client debit card for this higher limit |

| Chase Private Client (Non-Chase ATM, US) | Up to $500 | Standard limit; may change based on your account history |

| Chase Private Client (International ATM) | Up to $2,000 | International withdrawals capped at $2,000 |

When you use your chase debit card outside the US, you pay extra fees. Each international withdrawal at a non-chase ATM costs $5. You also pay a 3% fee on the amount you take out, which covers currency exchange. These fees make it important to plan your cash needs before you travel.

Tip: Always check your chase atm withdrawal limit before you travel. This helps you avoid running out of cash or paying high fees.

Chase atm withdrawal limits for UK customers and international users may differ. If you have a chase account in the UK, your atm withdrawal limits and fees may not match those in the US. Always check with chase for the latest rules in your country.

Chase atm limits protect your money and help you manage your spending. You should know your chase withdrawal limit, chase in-branch atm limit, and debit card withdrawal limits. This knowledge helps you avoid fees and keeps your money safe.

How to Check Your Chase Withdrawal Limit

Image Source: pexels

Knowing your chase withdrawal limit helps you plan your cash needs and avoid surprises. You have several ways to check your current limit. Chase gives you tools on your phone, computer, and through customer service.

Mobile App Steps

You can use the Chase Mobile App to check your atm withdrawal limit. Follow these steps:

- Sign in to the Chase Mobile App.

- Select your account from the home screen.

- Tap on “More Options.”

- Look for “Account Services” or “Card Settings.”

- Find the section for withdrawal limits.

The app may not always show your exact daily limit. If you do not see the information, you can use the app to schedule an ATM withdrawal. This feature lets you set up a withdrawal in advance. When you arrive at the ATM, your scheduled withdrawal will appear. You can use your card or cardless access to get your cash.

Tip: Scheduling your withdrawal in the app helps you avoid mistakes and makes your visit to the ATM faster.

Online Banking Steps

Chase online banking gives you access to your account details. You can sign in on your computer and look for your atm withdrawal limit. However, the online portal does not always display your exact withdrawal limits. You may see information about deposit limits for services like QuickDeposit, but not about atm withdrawal limits. If you need to know your limit, you may need to contact Chase or use the mobile app.

Customer Service Options

If you cannot find your chase atm withdrawal limit online or in the app, you can call Chase customer service. A representative can tell you your current limit and help you with questions about your account. You can also visit a Chase branch and ask for help in person. If you want to increase your atm withdrawal limit, you must speak with customer service and explain why you need a higher limit.

Note: Customer service can help you with both temporary and permanent changes to your withdrawal limits.

Checking your chase withdrawal limit keeps you prepared. Use the mobile app, online banking, or customer service to stay informed about your atm withdrawal limits.

How to Increase Chase ATM Limits

If you need more cash than your current limit allows, you can adjust your chase atm withdrawal limit. Chase gives you two main ways to do this: a temporary limit increase or a permanent increase. Knowing how to request these changes helps you avoid problems when you need extra funds.

Temporary Limit Increase

Sometimes you need more cash for a special reason, like travel or a big purchase. You can adjust your chase atm withdrawal limit for a short time. Here is how you can request a temporary increase:

- Call Chase customer service using the number on your debit card or 1-800-935-9935.

- Tell the representative you want to adjust your chase atm withdrawal limit temporarily.

- Explain why you need a higher limit. The representative may ask questions about your situation.

- Most temporary increases add only a few hundred dollars to your standard limit.

- You usually do not need to provide documents, but you should be ready to answer questions.

- If you have a long history with Chase or a premium account, your request may be approved faster.

Note: Temporary increases are easier to get than permanent changes. Always plan ahead if you know you will need more cash.

Permanent Limit Change

If you often need more cash, you can request a permanent increase. This change lets you adjust your chase atm withdrawal limit for the long term. Follow these steps:

- Contact Chase customer service by phone.

- Explain that you want a permanent increase and give reasons for needing a higher limit.

- Chase looks at your relationship with the bank. If you have been a reliable customer, you have a better chance.

- You may need to show that you regularly need to withdraw larger amounts.

- Upgrading to a premium Chase account can also help, as these accounts come with higher limits.

- Chase cares more about your trustworthiness and history than the number of accounts you have.

Tip: If you want to adjust your chase atm withdrawal limit for good, make sure you can show why you need a permanent increase.

By knowing how to adjust your chase atm withdrawal limit, you can make sure you always have access to the cash you need. Chase wants to keep your money safe, but they also give you options to fit your lifestyle.

What to Do If You Reach Your Limit

Sometimes you may reach your daily withdrawal limit and still need more cash. Chase gives you several ways to access your money when this happens. You can use these options to avoid stress and keep your plans on track.

Branch Withdrawals

If you cannot withdraw cash from an atm because you hit your limit, visit a Chase branch. You can speak with a teller and request a withdrawal directly from your account. Tellers do not follow the same daily limits as ATMs. Bring your debit card and a valid photo ID. The teller will help you get the amount you need. This method works well for large withdrawals or when you want extra security.

Cashback at Stores

You can also get cash by using your Chase debit card at many grocery stores or retailers. During checkout, enter your PIN and select the cashback option. The cashier will give you the cash along with your receipt. The maximum amount you can get depends on the store’s policy, not Chase. This process lets you access cash even after reaching your ATM withdrawal limit. Other ways to get cash include withdrawing from linked accounts, cashing a check, or visiting a bank teller.

- Request cashback at checkout with your debit card and PIN.

- Receive cash from the cashier with your purchase receipt.

- Store policies set the cashback limit, not Chase.

- Use this method if you need cash after reaching your ATM withdrawal limit.

Cash Advance Options

If you need more money and cannot use the above methods, you can consider a cash advance with your Chase credit card. You can get a cash advance at an ATM or a Chase branch. The fee is either $10 or 5% of the amount, whichever is greater. Interest starts right away and is higher than for regular purchases. For example, a $300 cash advance will cost you $15 in fees, plus high interest. The cash advance limit is part of your total credit limit. You can check this limit online or on your statement. Use cash advances only in emergencies because fees and interest add up quickly.

| Aspect | Details |

|---|---|

| Cash Advance Fee | $10 or 5% of the transaction amount, whichever is greater |

| Cash Advance APR | About 29.24% (variable), interest starts immediately |

| Cash Advance Limit | Part of your total credit limit; check online or on your statement |

| Access Methods | ATM (with PIN), Chase branch |

| Additional Fees | Possible ATM operator fees for non-Chase ATMs |

Note: Cash advances are expensive. Try other withdrawal options first before using this method.

Fees and Restrictions

ATM Fees

You need to understand how ATM fees work before you make a withdrawal. If you use a Chase ATM, you do not pay a fee. When you use a non-Chase ATM in the U.S. or its territories, Chase charges you $3 for each withdrawal. If you use an ATM outside these areas, the fee rises to $5. The ATM owner may also charge you extra. These charges add up quickly, so always check the ATM screen for any extra fees before you finish your transaction.

| ATM Withdrawal Type | Fee Charged by Chase | Additional Notes |

|---|---|---|

| In-network (Chase ATMs) | $0 | No surcharge fee from Chase |

| Out-of-network (Non-Chase ATMs) in U.S. and territories | $3 | ATM owner/network surcharge fees may apply |

| Out-of-network (Non-Chase ATMs) outside U.S. and territories | $5 | ATM owner/network surcharge fees may apply; Foreign exchange fees may apply for non-USD withdrawals |

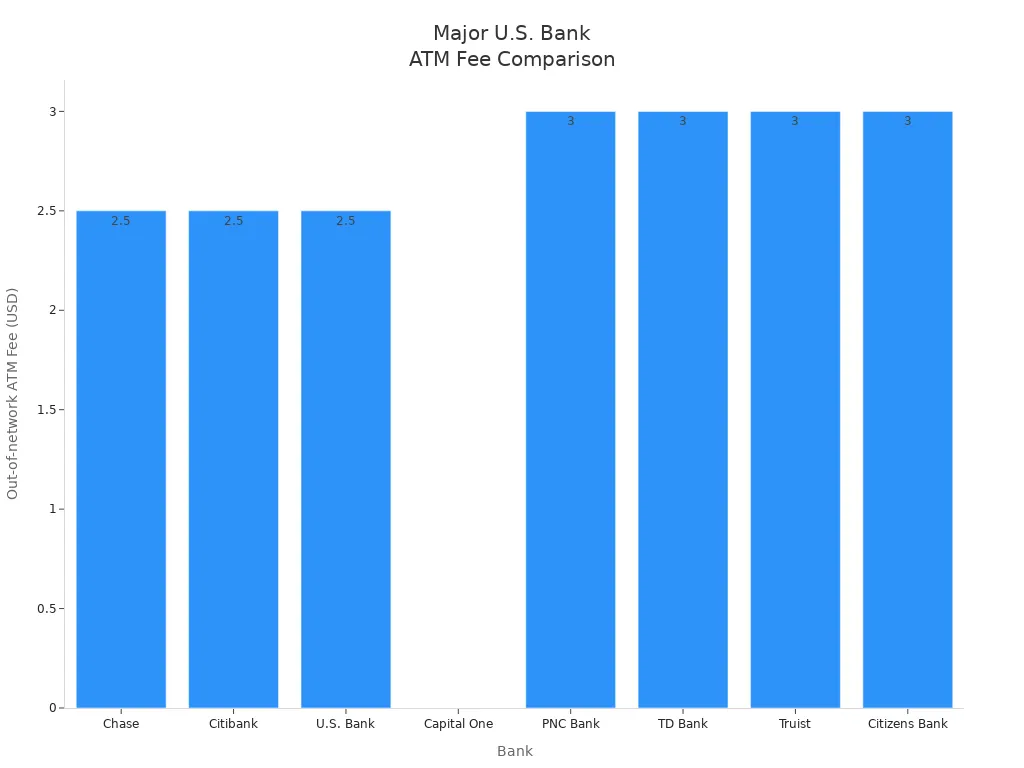

Chase withdrawal fees are not the lowest among banks, but they are not the highest either. Some banks, like Capital One, do not charge out-of-network ATM fees. Others, such as TD Bank and Citizens Bank, charge $3 or more. You can see how Chase compares to other banks in the chart below.

If you have a premium account, you may get some ATM fees waived. Always review your account details to see if you qualify for fee waivers.

Over-Limit Charges

You cannot withdraw more than your daily limit at an ATM. If you try to take out more, the ATM will deny your request. Chase does not charge a separate over-limit fee for ATM withdrawals, but you may face other problems. For example, if you try to get cash after reaching your daily limit, you may need to visit a branch or use another method. Planning your withdrawals helps you avoid these issues and keeps your money safe.

Security Holds

Chase uses security holds to protect your account. If you make several large withdrawals in one day or use many different ATMs, Chase may place a hold on your card. This hold stops you from taking out more cash until Chase can confirm the activity is safe. Security holds help prevent fraud and keep your money secure. If you find your card blocked, call Chase right away. You can also visit a branch to resolve the issue quickly.

Tip: Spread out your withdrawals over several days to avoid security holds and make sure you stay within your daily limit.

Managing your withdrawal limit helps you avoid surprises and keep your money safe. Always check your limit before planning a large cash withdrawal. To reduce fees and get the most from your account, try these expert tips:

- Use in-network ATMs to avoid extra charges.

- Make fewer, larger withdrawals instead of many small ones.

- Choose digital payments when possible.

If you have questions or need a higher limit, contact customer service for help.

FAQ

How do you find your current Chase ATM withdrawal limit?

You can check your limit in the Chase Mobile App or by calling customer service. The app may show your daily limit under “Card Settings.” If you cannot find it, ask a Chase representative for help.

Can you raise your Chase ATM withdrawal limit permanently?

Yes, you can request a permanent increase by calling Chase customer service. You may need to explain why you need a higher limit. Upgrading to a premium account, such as Chase Private Client, can also give you higher limits.

What happens if you try to withdraw more than your limit?

The ATM will deny your request if you exceed your daily limit. You will not pay an extra fee, but you must wait until the next day or use another method, such as visiting a branch, to get more cash.

Are there extra fees for using non-Chase ATMs?

Yes. Chase charges $3 for each withdrawal at a non-Chase ATM in the United States. If you use an ATM outside the United States, the fee is $5. The ATM owner may also charge you an extra fee.

This guide shows you that even with a major bank like Chase, accessing your own cash can be a complex and restrictive experience. You’re forced to choose between the inconvenience of visiting a branch, the low limits of a store’s cashback program, or the hassle of calling customer service for a temporary increase. These experiences highlight a broader truth in today’s financial world: traditional banking systems often lack the flexibility and speed you need. This problem becomes even more pronounced when dealing with international transactions, where you face high fees, unfavorable exchange rates, and slow transfers. This is where BiyaPay offers a modern, transparent solution, providing a new level of financial freedom without the traditional constraints. Our platform enables real-time exchange rate queries and conversions for a wide range of fiat and digital currencies, with remittance fees as low as 0.5%.

With BiyaPay, you can move money across borders with the speed and efficiency you expect. Our fast registration and support for same-day delivery to most countries and regions worldwide help you avoid the delays and high costs of traditional banking. You get to control your money, not be controlled by it. Don’t let domestic or international limits hold you back. Open a secure account with BiyaPay in minutes and experience a new standard for global finance. Register now to streamline your international transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.