- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Set Up Zelle with a Prepaid Card Instead of a Bank Account

Image Source: unsplash

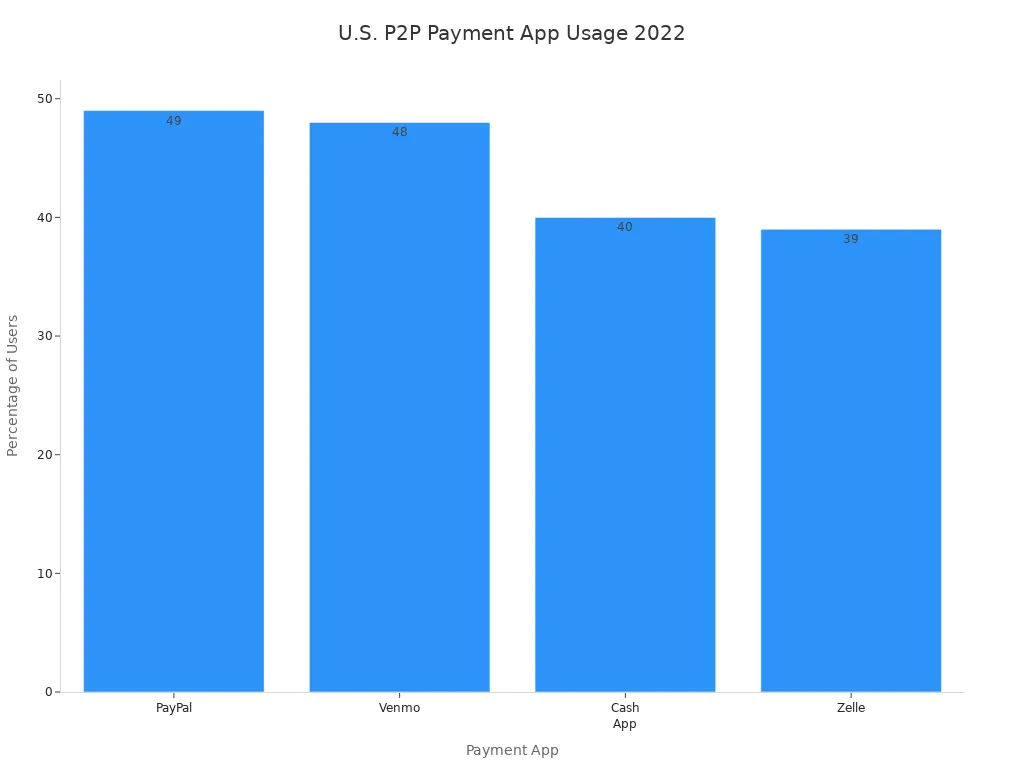

You might wonder if you can use Zelle without a bank account. The answer is yes, but only in some cases. Zelle asks for an eligible U.S. bank, credit union, or a supported prepaid debit card. Not every prepaid debit card will work, so you need to check if yours qualifies. Zelle ranks just below PayPal and Venmo in popularity, with 39% of U.S. adults using it for money transfers.

Key Takeaways

- Zelle works with some prepaid debit cards only if they come from a bank that partners with Zelle.

- You must link a reloadable prepaid card to your U.S. phone number or email and verify your identity to use Zelle.

- Download the Zelle app, enter your card details carefully, and test with a small transaction to confirm it works.

- If your prepaid card is not accepted, try other apps like Venmo, Cash App, or PayPal that support more prepaid cards.

- Always use strong security settings, send money only to people you trust, and check for fees with your card provider.

Use Zelle Without a Bank Account

Eligibility for Prepaid Debit Card

You might want to use Zelle without a bank account. Zelle usually asks for a bank or credit union account, but some prepaid debit cards can work if they come from a bank that partners with Zelle. Not every prepaid debit card will let you send and receive money through Zelle. You need to make sure your card meets certain rules.

Here’s what makes a prepaid debit card eligible for Zelle:

- The card must come from a bank or credit union that works with Zelle.

- It should be reloadable, so you can add money when you need it.

- The card must link to your U.S. phone number and email address.

- You have to verify your identity when you sign up.

- Some cards from banks like Wells Fargo, Chase, PNC, Green Dot, Bluebird by American Express, and Netspend may work.

- You can only link one payment method to your Zelle account at a time.

Tip: Not all prepaid debit cards are eligible prepaid cards for Zelle. Cards like the Walmart Money Card do not work because they are not issued by a Zelle network bank.

Before you try to use Zelle, check if your prepaid debit card is supported. You can do this by asking your card provider or by starting the setup process in the Zelle app. If your card is not accepted, you may need to use a traditional bank account or look for another way to send money.

What You Need

To use Zelle with a prepaid debit card, you need a few things ready. Here’s a simple checklist:

| Step | What You Need to Do |

|---|---|

| 1 | Get a prepaid debit card from a Zelle network bank. |

| 2 | Make sure your card is reloadable and linked to your phone number or email. |

| 3 | Download the Zelle app on your phone. |

| 4 | Start the setup and enter your email or phone number. |

| 5 | If your bank is not listed, choose “Don’t see your bank?” to enter your card details. |

| 6 | Type in your card number, name, expiration date, security code, and billing address. |

| 7 | Finish the setup and check if Zelle accepts your card. |

If your prepaid debit card is not accepted, you cannot use Zelle with it. In that case, you may need to link a bank account or try another payment app. Always check with your card provider for any fees or limits before you use Zelle.

Note: Zelle does not charge fees, but your prepaid debit card provider might. Always use a secure internet connection and turn on two-factor authentication to keep your money safe.

Zelle Prepaid Card Setup

Image Source: pexels

Download and Register

You want to use Zelle prepaid card features, so you need to start by downloading the Zelle app. Go to the App Store or Google Play Store and search for “Zelle.” Download the app and open it on your phone. You will see a screen asking you to register. Enter your U.S. phone number or email address. Zelle will send you a code to verify your information. Type in the code to continue.

Tip: Make sure your phone number or email matches the one linked to your prepaid debit card. This helps avoid problems during setup.

Link Prepaid Debit Card

Now you can move on to linking Zelle to a prepaid card. When the app asks for your bank, tap “Don’t see your bank?” This lets you enter your prepaid debit card details. Type in your card number, name, expiration date, security code, and billing address. Double-check your information. Many users run into trouble here. Sometimes, the Zelle app rejects prepaid debit card numbers even if you enter them correctly. This can happen if you add spaces or dashes, or if your card is not supported. Some prepaid debit cards just do not work with Zelle. Cards with holds, blocks, or fraud alerts may also fail.

Note: Zelle prepaid card setup only works with cards from banks that partner with Zelle. Zelle does not accept all prepaid cards, business debit cards, or international cards. You cannot use credit cards either.

Verify and Test

After you finish linking Zelle to a prepaid card, Zelle will try to verify your card. If your card is accepted, you can start to send and receive money. Try a small test transaction first. Send $1 to a friend or family member to make sure everything works. If you get an error, check your card details again. Update your app and restart your phone if needed. If you still have problems, your prepaid debit card may not be eligible.

| Step | What to Do |

|---|---|

| 1 | Check your card for holds or fraud alerts. |

| 2 | Make sure your card is reloadable and from a Zelle partner bank. |

| 3 | Try updating the Zelle app and restarting your device. |

Most banks do not charge fees for using Zelle prepaid card features. Zelle itself does not charge you to send or receive money. Always check with your card provider for any extra fees or limits before you use Zelle.

Troubleshooting and Security

Image Source: pexels

Common Issues

You might run into a few problems when you try to use Zelle with a prepaid debit card. Here are the most common issues people report:

- Zelle only works with Visa or Mastercard debit cards that link to a U.S. bank account. It does not support business debit cards, credit cards, international cards, gift cards, or prepaid cards from outside the Zelle Network.

- Many users find their prepaid cards are not eligible, or the card information they enter does not match what the bank has on file.

- You must enter the name, address, card number, expiration date, and CVV exactly as they appear with your card provider.

- If you do not meet these requirements, you will see error messages or your enrollment will fail.

- Zelle suggests you double-check all your card details and contact your card issuer’s customer service if you still have trouble.

Solutions

If you face any of these issues, you can try a few steps to fix them. First, check your card details and make sure everything matches what your bank or card provider has on file. If you still cannot enroll or send money, reach out to customer support. Here is a quick guide to help you find the right support:

| Issue/Question | Support Details |

|---|---|

| Cancel a Zelle payment | You can cancel only if the recipient is not enrolled. Check your activity page and select Cancel Payment. If you need help, call 1-800-242-7338. |

| Sent money to wrong person | Call customer support at 1-800-242-7338 or 800-500-6328 right away for help. |

| Scam victim | Contact customer support at 1-800-242-7338. Some scams may qualify for reimbursement. |

| General customer support | Phone: 1-800-242-7338 or 800-500-6328 |

If you sent money to the wrong person and they refuse to return it, you can also call U.S. Bank 24-Hour Banking at 800-872-2657 to file a dispute.

Security Tips

When you use Zelle for a money transfer, you need to stay alert. Zelle does not offer purchase protection or refunds if you send money to a scammer or the wrong person. Once you send money, you cannot reverse the transaction if the recipient is already enrolled. Here are some tips to keep your account safe:

- Only send money to people you trust.

- Watch out for urgent payment requests, especially from people you do not know.

- Scammers may pretend to be from your bank or Zelle to trick you.

- Use strong passwords and turn on multi-factor authentication for your accounts.

- Check your account activity often to spot anything unusual.

- Remember, using prepaid cards with Zelle may carry extra risk because there are fewer protections.

If you ever feel unsure, contact your card provider or Zelle support before you send money.

Alternatives to Zelle

Other Money Apps

If you find Zelle does not work with your prepaid debit card, you still have plenty of ways to send and receive money. Many popular money transfer apps let you use prepaid cards without needing a bank account. Here are some options you can try:

- Western Union lets you send money online, by phone, or in person. You can use a debit card, including prepaid cards, and you do not need a bank account.

- Cash App accepts most prepaid cards from major networks. You can link your card and use it for payments and transfers.

- PayPal allows you to send money using a linked debit card or your PayPal balance. If you do not have a bank account, you can even ask for a check to be mailed to you.

- Venmo lets you link debit cards, including prepaid cards. You can also use a Venmo card, which works like a prepaid debit card.

- Google Wallet (also called Google Pay) offers a debit card for transactions and withdrawals. You can use prepaid cards without a bank account.

- Facebook Messenger supports payments with debit cards, including prepaid cards that do not need to be linked to a bank account.

- Wise helps you send money internationally. Many prepaid cards with standard details and 3DS security work with Wise. You can send money to over 80 countries, and the fees are clear and often lower than other services.

Tip: Always check if your prepaid card is accepted before you sign up for a new app.

Choosing the Right Option

You want to pick the best app for your needs. Each app has different features, fees, and limits. Here is a quick look at how Zelle compares to Venmo and Cash App:

| Feature | Zelle | Venmo | Cash App |

|---|---|---|---|

| Transaction Fees | No fees from Zelle; some banks may charge | Free standard transfers; 1.5% fee for instant transfers | Free for standard transfers; instant transfer fees (0.5%-1.75%) |

| Transfer Speed | Near-instant between U.S. bank accounts | 1-3 business days; instant with fee | Instant with fee; 1-3 business days for standard |

| Prepaid Debit Card Support | Limited or not supported directly | Supports prepaid debit cards | Supports prepaid debit cards |

| Geographic Limits | U.S. only | U.S. only | U.S. and UK supported |

When you choose an app, think about what matters most to you. Some apps support international transfers, while others focus on fast payments in the U.S. Wise, for example, lets you send money to over 80 countries and uses low, transparent fees. Venmo and Cash App both support prepaid cards and offer instant transfers for a small fee. Zelle works best if you already have a bank account, but it does not support prepaid cards for everyone.

You should also look at security, transfer limits, and whether you need to share your Social Security Number. Some apps, like BOSS Revolution and Wise, do not require an SSN for basic transactions. If you want extra features, PayPal and Venmo let you buy crypto or earn rewards.

Note: Always read the app’s terms and check for hidden fees before you start a money transfer. Pick the app that fits your needs and makes it easy to send and receive money with your prepaid card.

You now know that using Zelle with a prepaid debit card is tricky. Most prepaid cards do not work unless a Zelle partner bank issues them. Always check if your card is eligible before you try to sign up. Here are the main things to remember:

- Zelle needs a U.S. bank account or a supported prepaid card from a partner bank.

- Most prepaid cards will not work.

- Always double-check recipient details and use strong security settings.

If Zelle does not support your card, you can try these other apps:

| Alternative App | Suitable For | Funding Sources Accepted |

|---|---|---|

| PayPal | General money transfers | Bank accounts, credit cards, debit cards, digital wallets |

| Venmo | Sending money to friends | Bank accounts, credit cards, debit cards |

| Cash App | Multiple payment options | Bank accounts, credit cards, debit cards |

| Google Pay | Google users | Bank accounts, credit cards, debit cards, digital wallets |

| Apple Pay | Apple users | Bank accounts, credit cards, debit cards, digital wallets |

| Western Union | Traditional transfers | Cash, bank accounts |

| Remitly | International transfers | Bank accounts, debit cards |

| Wire Transfer | Large, fast transfers | Bank accounts |

Pick the app that fits your needs and always keep your money safe.

FAQ

Can you use any prepaid debit card with Zelle?

You cannot use just any prepaid debit card with Zelle. Only cards from banks or credit unions that partner with Zelle will work. Always check with your card provider before you try to link your card.

What should you do if Zelle rejects your prepaid card?

First, double-check your card details. Make sure your card comes from a Zelle partner bank. If you still see an error, contact your card provider or try another payment app.

Does Zelle charge fees for using a prepaid debit card?

Zelle does not charge you any fees. Your prepaid card provider might charge fees for transfers or balance checks. Here is a quick look:

| Service | Zelle Fee | Card Provider Fee |

|---|---|---|

| Send Money | $0 | Varies |

| Receive Money | $0 | Varies |

Can you use Zelle for international transfers with a prepaid card?

You cannot use Zelle for international transfers. Zelle only works with U.S. bank accounts and eligible prepaid cards. For sending money abroad, try apps like Wise or Western Union.

This guide shows you that while Zelle is a popular tool, its limited compatibility with prepaid cards can be a significant roadblock.1 You’ve learned about several alternatives like Venmo and Cash App, but what if your financial needs extend beyond domestic transfers? Many popular apps still fall short when it comes to low-cost, efficient, and flexible international payments. In a world where your financial transactions should be as simple as a tap on your phone, you need a solution that truly breaks down barriers, not one that creates them. This is where BiyaPay offers a modern, transparent solution, providing a new level of financial freedom for both domestic and global needs. Our platform provides real-time exchange rate queries and conversions for a wide range of fiat and digital currencies, with remittance fees as low as 0.5%.

With BiyaPay, you can seamlessly send and receive money, whether you’re paying a friend in your home country or a supplier overseas. Our fast registration and support for same-day delivery to most countries and regions worldwide help you avoid the frustration of compatibility issues and high costs. Don’t let the limitations of one app hold you back. Open a secure account with BiyaPay in minutes and experience a new standard for global finance. Register now to streamline your international transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.