- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Wise Works as a Bank Account Substitute

Image Source: unsplash

You might wonder if you can use Wise as a bank account. Wise is not a bank, but it gives you many features that feel similar to a bank. You can hold and manage your money in different currencies, and send or receive funds almost anywhere. Wise lets you open an account in 74 countries and territories。

Many people turn to Wise for these reasons:

- You get fast, low-cost money transfers using real exchange rates.

- Wise lets you spend and receive money worldwide, making it easy for travel or business.

- You see all fees upfront, with no hidden costs.

- You can hold over 40 currencies in one account.

Wise works well for managing money across borders, but you should know it has some limits compared to a traditional bank account.

Key Takeaways

- Wise lets you hold and manage money in over 40 currencies with one easy account.

- You can send and receive money worldwide with low, clear fees and real exchange rates.

- Wise offers a multi-currency debit card to spend or withdraw cash in over 150 countries without hidden fees.

- Wise is not a bank and does not provide loans, cash deposits, or deposit insurance like traditional banks.

- Opening a Wise account is fast and simple online, making it great for travelers and international business.

Wise as Bank Account?

Image Source: unsplash

Wise is not a bank. Instead, Wise operates as a Money Services Business. You get many features that feel like a bank account, but there are some important differences. Let’s look at what you can do with a Wise account and where it falls short compared to a traditional bank.

Wise Account Features

When you open a Wise account, you unlock a lot of useful tools for managing your money. Here’s what you can expect:

- You can hold money in other currencies. Wise lets you keep balances in over 40 currencies, including USD, GBP, and EUR.

- You receive local bank details for up to 9 currencies. This means you can get paid like a local in places such as the US, UK, or Hong Kong.

- You can send money and receive payments internationally to more than 80 countries.

- Wise gives you a Wise multi-currency card. You can use this debit card to spend or withdraw cash in over 150 countries. There are no foreign transaction fees if you pay in a currency you already hold.

- You can make transfers using the real exchange rate. Wise always shows you the fees upfront, so you know exactly what you pay.

- Wise accounts work for both personal and business needs. Business users get extra features like batch payments and accounting integrations.

- You can manage all your currencies in one place. This makes Wise a strong choice if you travel often or work with international clients.

- Wise offers strong security. You get two-factor authentication, instant notifications, and the ability to freeze your card if needed.

- There are no monthly account fees. You only pay for the services you use.

Here’s a quick look at how Wise is regulated in different regions:

| Region | Wise Entity | Regulatory Body | License/Registration Details |

|---|---|---|---|

| United Kingdom | Wise Payments Limited | Financial Conduct Authority (FCA) | Authorised as an Electronic Money Institution (EMI), Registration number 900507 |

| European Union | Wise Europe SA | National Bank of Belgium | Payment Institution authorised, with passporting rights across the EEA |

| United States | Wise US Inc. | Financial Crimes Enforcement Network (FinCEN) and various state regulatory authorities | Registered with FinCEN, licensed as a money transmitter in multiple states, supervised by state regulators. In states without a license, services are provided by partner Community Federal Savings Bank, supervised by the Office of the Comptroller of Currency. |

You can use your Wise account for many daily needs. You can pay for things, receive payments, and manage your money in different currencies. Wise makes it easy to handle international transactions and exchange money at fair rates.

Account Limitations

Wise gives you a lot of freedom, but it does not replace every feature of a traditional bank account. Here are some key limits you should know:

- Wise is not a bank. Your Wise account is not a checking or savings account. Wise does not offer loans, overdrafts, or check writing. You cannot deposit cash directly into your Wise account.

- Wise does not lend out your money. Unlike banks, Wise keeps your funds safe by holding them in accounts with large, highly rated banks or in secure government bonds. Wise does not use your money for lending or investments.

- Your Wise account does not have deposit insurance. Traditional banks in the US offer FDIC insurance, and banks in the UK offer FSCS protection. Wise does not provide this kind of deposit guarantee for your standard balances. If you use Wise’s investment features in the UK, you may get FSCS protection up to £85,000, but this does not apply to regular balances.

- Wise has account and transaction limits. For example, if you have a personal Wise account in the US, you can receive up to $20,000,000 per transaction and per day, with a yearly limit of $35,000,000. Business accounts have higher limits. Some payment types, like ACH or card payments, have lower limits.

| Account Type | Per Transaction & Daily Limit (USD) | Yearly Limit (USD) |

|---|---|---|

| Personal | 20,000,000 | 35,000,000 |

| Business | 50,000,000 | 150,000,000 |

Other payment limits also apply:

| Category | Limit Type | Amount (USD) |

|---|---|---|

| Wire transfer | Per transfer | Up to 1,000,000 |

| USD balance top-up | Per transfer | Up to 6,000,000 |

| ACH payment | Per transfer | 50,000 |

| ACH payment | Daily | 50,000 |

| ACH payment | 60-day period | 250,000 |

| Debit/credit card | Per transfer | 2,000 |

| Debit/credit card | Daily | 2,000 |

| Debit/credit card | Weekly | 8,000 |

| SWIFT | Per transfer | 1,600,000 |

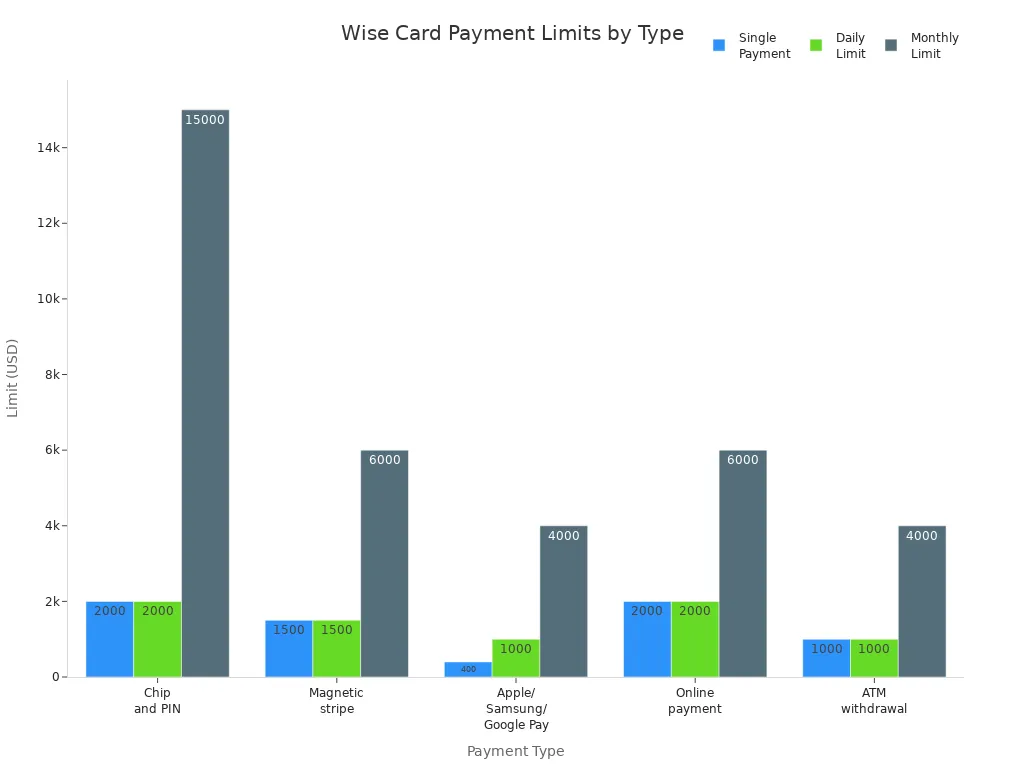

Wise multi-currency card limits:

| Payment Type | Single Payment | Daily Limit | Monthly Limit |

|---|---|---|---|

| Chip and PIN | 2,000 | 2,000 | 15,000 |

| Magnetic stripe | 1,500 | 1,500 | 6,000 |

| Apple/Samsung/Google Pay | 400 | 1,000 | 4,000 |

| Online payment | 2,000 | 2,000 | 6,000 |

| ATM withdrawal | 1,000 | 1,000 | 4,000 |

- Wise does not offer all banking services. You cannot get a loan, mortgage, or credit card from Wise. Wise does not provide checkbooks or cash deposit services.

- Wise accounts are not always accepted for every payment type. Some employers or government agencies may require a traditional bank account for direct deposit or certain payments.

- Wise follows strict rules as an Electronic Money Institution. Wise is regulated by financial authorities, but the rules are different from those for banks. Wise protects your money by keeping it separate from company funds, but you do not get the same consumer safeguards as with a bank account.

Note: Wise works best if you need to manage money in different currencies, make international transfers, or spend abroad. If you need loans, deposit insurance, or full banking services, you may still need a traditional bank account.

Wise Account Setup

Image Source: unsplash

Opening an Account

You can open a Wise account in just a few minutes. Wise makes the process simple and fully online. You do not need to visit a branch or fill out piles of paperwork. Just download the Wise app or go to the Wise website. Start by entering your email and creating a password. Wise will then guide you through the steps to verify your identity.

You need to upload a clear photo of your ID and proof of address. Wise accepts many types of documents, such as a passport, state ID, or driver’s license in the US. If you live in Canada or Europe, you can use a permanent resident card or a refugee travel document. Wise provides tips to help you upload documents that meet their requirements.

If you are a US resident, Wise may ask for your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN) when you open a Wise account or order a Wise card. This is a one-time check and does not affect your credit score. If you do not have an SSN or ITIN, you can verify your identity with an ID and a selfie. Non-US citizens can use non-US ID documents.

Here is a quick look at how Wise compares to traditional banks when you open an account:

| Step | Wise Account | Traditional Bank Account |

|---|---|---|

| Application | Online or app | Often in-branch or online |

| ID & Address Verification | Upload documents online | Submit documents, sometimes in person |

| Minimum Deposit | None | Often required |

| Approval Time | Fast, usually immediate | Can take days |

| Credit Check | No | Sometimes required |

Once you finish verification, you can start using your Wise account right away. There are no minimum balances or monthly fees. You can manage your money from anywhere in the world.

Tip: Make sure your documents are clear and up to date. This helps Wise verify your account faster.

Managing Multiple Currencies

A Wise account gives you the power of a true multi-currency account. You can hold, send, and receive money in over 40 currencies. In fact, you can manage balances in up to 50 different currencies all within one Wise account. You do not need to open separate accounts for each currency.

With Wise, you can open new currency balances in just a few taps. You can switch between currencies and see your balances in real time. Wise lets you convert money between currencies at the real exchange rate, so you always know what you are getting. You can also receive payments in several currencies using local account details.

Managing multiple currencies in one place makes life easier if you travel, shop online, or get paid from other countries. You can keep your money in the currencies you use most and avoid extra conversion fees. Wise keeps all your balances together, so you can track your money and spending with less hassle.

Note: Wise’s multi-currency account is perfect if you want to manage money across borders without the stress of juggling different bank accounts.

Wise Account vs Bank Account

Features Comparison

When you look at a wise account vs bank account, you notice some big differences in features. Wise gives you a modern, digital way to manage your money. You can open your account online in minutes. You do not need to visit a branch or fill out stacks of paperwork. Wise lets you hold and convert over 40 currencies, which is great if you travel or get paid from other countries. You can send and receive payments almost anywhere, and you always see the real exchange rate.

Traditional banks work differently. Many banks still want you to visit a branch for some services. Their online banking is helpful, but you might need to go in person for certain transactions. Most banks only let you hold money in one currency unless you pay extra for a special account. If you need help, you can call, email, or walk into a branch for support.

Here’s a quick table to show how a wise account compares to a regular bank account:

| Feature | Wise Account | Traditional Bank Account |

|---|---|---|

| Online Banking | Accessible anywhere with internet; easy online account opening and money transfers. | Usually tied to local branches; online access available but may require branch visits for some services. |

| Mobile App | User-friendly app with fingerprint login; supports batch payments and holding 40+ currencies. | Mobile apps often include transaction alerts, bill pay, and other banking services. |

| Customer Support | Customer support is slow and lacks in-person options; no branch support. | Typically offers phone, email, and in-branch support; generally more comprehensive and responsive. |

| Banking Protections | FCA regulated but no banking license; no FSCS or FDIC insurance. | Usually covered by FSCS (UK) or FDIC (US) insurance, providing deposit protection. |

| Fees & Transparency | Low and transparent fees, especially for international transfers; real exchange rates used. | Often higher fees and less transparent exchange rates for international transfers. |

| Multi-currency Support | Hold and convert 40+ currencies; receive payments like a local in 10 currencies. | Usually limited to local currency accounts; multi-currency accounts less common or more costly. |

Wise makes it easy to manage your money online and on your phone. You can see all your balances and transactions in one place. Banks offer more in-person help and extra services, like loans or checks, but they may charge higher fees and do not always support many currencies.

Note: Wise does not offer loans, mortgages, or checkbooks. If you need these services, you still need a traditional bank account.

Security and Regulation

You want your money to be safe. Wise takes security measures seriously, even though it is not a bank. Wise uses strong encryption to protect your data when you use the app or website. The company updates its servers often and runs a bug bounty program to find and fix problems fast. Wise has a team that watches for strange activity and keeps your account safe.

Here are some of the security measures Wise uses:

- Wise encrypts all your communications with strong encryption.

- The company keeps your data safe by storing it in secure servers and encrypting it when not in use.

- Wise limits who can see your personal data. Only trained employees and trusted partners can access it, and only if they need to.

- Wise runs regular audits and follows strict rules to keep your information private.

- You get two-step authentication and can use fingerprint or face ID to log in.

- Wise lets you freeze your card if you lose it and set up alerts for transactions.

- Wise holds over 65 licenses worldwide and follows the rules in every country where it operates.

- A team of over 1,000 anti-fraud specialists checks millions of transactions every day.

Wise keeps your money separate from its own funds. The company puts your money in top banks like Barclays, JP Morgan Chase, Goldman Sachs, and Wells Fargo. Wise does not lend out your money or use it for investments. This means your money is always available when you need it.

Banks use a different system for safety. If you have a bank account in the US, your money is usually protected by FDIC insurance up to $250,000. In the UK, banks offer FSCS protection up to £85,000. Wise does not offer this kind of insurance. Instead, Wise uses a safeguarding system. The company keeps your money in safe, short-term assets or in trusted banks. Wise’s rules make sure your money is always there, even if something goes wrong.

Tip: Wise’s security measures protect your account and data, but you do not get deposit insurance like you do with a bank. Always think about what level of safety you need for your money.

Fees and Costs

Wise stands out for its low and clear fees. You see all costs before you send or receive money. Wise uses the real exchange rate, so you do not lose money on hidden markups. You pay a small fee for most transfers, starting from 0.29% of the amount. If you send money between Wise accounts in the same currency, it is free. Wise does not charge monthly account fees or fees for holding different currencies.

Banks often charge more for similar services. If you send money by wire transfer, you might pay $15 to $50 for a local transfer and $30 to $80 for an international transfer. Banks also add extra fees for currency conversion, and you may not see the real exchange rate. Some banks charge to receive money, and you might pay $10 to $20 just to get a wire transfer.

Here’s a table to compare the typical fees:

| Fee Type | Wise Fees | Traditional Bank Fees |

|---|---|---|

| Sending Money | From 0.29% of transfer amount; free for transfers between Wise accounts in the same currency | Wire: $15–50; International wire: $30–80 |

| Receiving Money | Free for most currencies; $6.11 flat fee for USD wire/Swift | $10–20 for receiving wire transfers |

| Holding Money | No fees for holding over 40+ currencies | Usually no multi-currency holding; fees vary |

| Currency Conversion | Uses mid-market exchange rate with transparent percentage fees | Often includes hidden markups and currency conversion fees |

| Domestic Transfers | Free between Wise accounts in the same currency (except Hungary) | Usually charged, varies by bank |

If you send $1,000 internationally, Wise usually costs much less than a bank. Banks like Bank of America or Chase may charge $40 to $50, plus extra for currency conversion. Wise shows you the fee upfront and uses the real exchange rate.

Wise lets you hold and manage over 40 currencies without extra fees. Banks rarely offer this feature, and if they do, it often costs more. Wise also does not charge you to open or keep your account.

Note: Wise gives you a cheaper way to send money and manage different currencies. Banks offer more services, but you often pay more for them.

Using Wise Account

Daily Spending

You can use your Wise account for everyday spending just like a regular bank account. The Wise multi-currency card lets you pay for groceries, coffee, or shopping in over 150 countries. You do not pay foreign transaction fees if you spend in a currency you already hold. You can set daily spending limits in the Wise app, which helps you control your money. If you lose your card, you can block it instantly from your phone or laptop. Wise gives you two free ATM withdrawals each month up to $200. After that, a small fee applies.

Here are some common ways people use Wise for daily spending:

- Pay for things worldwide with the Wise card, avoiding extra fees.

- Set and adjust spending limits easily in the app.

- Use two-factor authentication for secure transactions.

- Block your card right away if it gets lost or stolen.

- Pay bills and subscriptions using Direct Debits in USD, GBP, EUR, CAD, or AUD.

- Automate payments for utilities, gym memberships, or streaming services.

You can also send money directly to service providers through the Wise app. Wise supports paying bills even if they are in a different currency. The app will convert your balance at the real exchange rate.

Receiving Payments

Wise makes it simple to receive payments from employers, clients, or friends. You get unique account details in several currencies, such as USD, GBP, EUR, CAD, and AUD. Share these details with anyone who needs to send you money. You can receive payments like a local, which means you avoid extra fees and delays.

You can:

- Invoice customers using your Wise account details.

- Get paid from global platforms like Amazon, Etsy, Upwork, or Fiverr.

- Track all your payments and manage different currencies in one place.

- Use payment links to request money quickly.

Wise supports several ways to receive payments:

- Set up local account details in over eight currencies and share them with payers.

- Receive payments in more than 19 currencies through the Swift network.

- Use direct debits for regular payments.

- Create payment request links for quick transfers.

- Withdraw money from platforms like Shopify or Stripe straight into your Wise account.

- Accept Wise-to-Wise payments for free in over 40 currencies.

Most payments arrive within minutes to a day, but international transfers can take up to five working days, especially if sent through Swift. If a payment is late, Wise suggests checking with the sender and providing proof of payment.

| Currency | Domestic Payment Time | International Payment Time |

|---|---|---|

| USD | Hours up to 4 working days (ACH), minutes to 1 working day (wire) | 1 to 5 working days |

| GBP | Minutes to 1 working day | 1 to 5 working days |

| EUR | Minutes to 1 working day | 1 to 5 working days |

| AUD | Minutes to 1 working day | 1 to 5 working days |

| CAD | Few hours to 1 working day | 1 to 5 working days |

Wise helps you manage payments from around the world, making it easy to keep track of your money and convert currencies when needed.

Travel and International Use

Wise is a favorite for travelers, digital nomads, and anyone who deals with international transactions. You can hold and exchange over 40 currencies in your account. The Wise multi-currency card works in 174 countries, so you can spend or withdraw cash almost anywhere. You pay low, transparent fees, starting at 0.41% for sending money, and you always get the mid-market exchange rate.

Wise offers these advantages for international use:

- Hold, send, and spend in multiple currencies at once.

- Order a Wise card for a one-time fee of $9.

- Make international money transfers faster than most banks, often within 24 hours.

- Avoid hidden markups on currency exchange.

- Manage your account easily with the Wise app.

Wise does have some restrictions. You cannot use your card in certain countries, such as Crimea, Lebanon, or Vietnam, depending on where your card was issued. Some cards, like those from Singapore or Canada, cannot withdraw cash locally but work for international withdrawals.

Wise gives you a simple way to handle international transactions, save on fees, and manage your money across borders.

Wise works best if you want to send or receive money across borders, manage many currencies, or spend while traveling. You save on fees and get a simple way to handle international payments. Wise is not a full bank, so you miss out on loans, interest, or in-person help.

- Wise fits you if you need:

- Fast, low-cost transfers to over 80 countries

- One account for 40+ currencies

- A card for spending abroad with no hidden fees

- Wise does not suit you if you want cash deposits, loans, or branch visits.

Before you switch, check Wise’s help center for guides on setting up your account and security. If you want to try Wise, open an account online, verify your details, and order a card. Wise makes global money management easy, but always think about what you need most.

FAQ

Can you use Wise as your only bank account?

You can use Wise for many daily needs, but it does not replace a full bank account. Wise does not offer loans, cash deposits, or deposit insurance. You may still need a traditional bank for some services.

Does Wise offer interest on your balance?

Wise does not pay interest on regular account balances. If you want to earn interest, you need to use Wise’s investment features, which are only available in some regions. Always check the latest options in your Wise app.

How safe is your money with Wise?

Wise keeps your money in top banks, such as Barclays or JP Morgan Chase. Wise does not lend out your funds. However, you do not get FDIC or FSCS insurance. Wise uses strong security and follows strict rules to protect your account.

Can you receive your salary or payments from clients in Wise?

Yes, you can receive payments from employers or clients. Wise gives you local account details in USD, GBP, EUR, and more. Some companies or agencies may require a traditional bank account, so always check with your payer.

Tip: Share your Wise account details with clients for fast, low-fee payments in multiple currencies.

While Wise offers many benefits for international money management, it’s important to find the right platform for your unique needs. As this guide shows, Wise has some limitations—it’s not a bank, and it lacks certain services. For those who demand a truly powerful and comprehensive solution for global finance, including both fiat and digital currencies, it’s worth exploring the options that can take your financial freedom to the next level. This is where BiyaPay offers a modern, transparent, and superior alternative. Our platform provides real-time exchange rate queries and conversions for a wide range of fiat and digital currencies, with remittance fees as low as 0.5%.

With BiyaPay, you can experience a new standard in cross-border payments. We offer same-day delivery to most countries and regions worldwide, helping you avoid the delays that can come with traditional transfers. Our fast registration process and powerful app make it easy to manage your money and send payments without the hassle. Don’t settle for a service that only meets some of your needs. Open a secure account with BiyaPay in minutes and discover a platform that delivers speed, low costs, and unparalleled flexibility for all your global transactions. Register now to streamline your international transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.