- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Mastering Zelle Transfer Limits for Smooth Money Transfers

Image Source: pexels

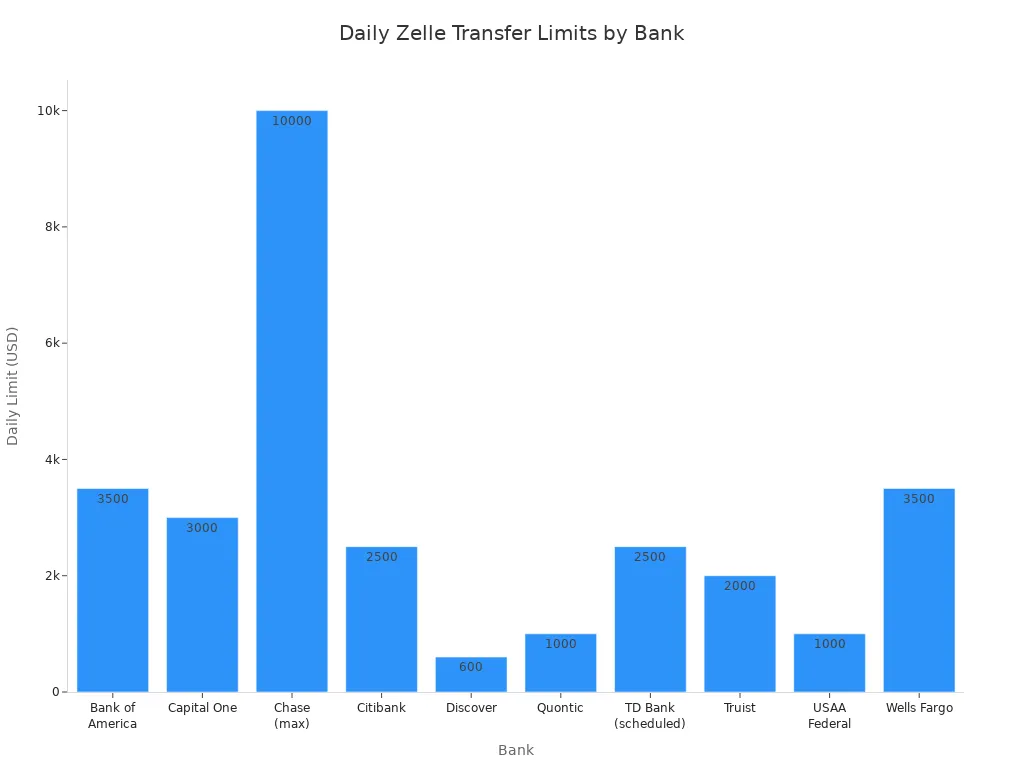

You need to know your Zelle transfer limits before sending a payment. In 2025, most daily transfer limits range from $500 to $3,500, while monthly limits can reach $20,000, depending on your bank and account type. Check the chart below for a quick look at daily transfer limits across major banks:

Since April 2025, you must use Zelle through your bank or credit union app, as only about 2% of users could use the standalone app. Knowing your Zelle transfer limit helps you avoid payment problems and keeps your money moving without delay.

Key Takeaways

- Zelle transfer limits vary by bank and account type, usually ranging from $500 to $3,500 daily and up to $20,000 monthly in 2025.

- You must use Zelle through your bank or credit union app since the standalone app no longer works after April 2025.

- Always check your daily and monthly transfer limits in your bank’s app before sending money to avoid failed payments.

- If you reach your transfer limit, you can ask your bank for a higher limit, split payments, or use multiple accounts to manage transfers.

- Zelle offers fast, fee-free transfers within the U.S., but for larger or international payments, consider other apps or methods.

Zelle Transfer Limits 2025

Image Source: unsplash

Daily and Monthly Limits

You need to understand how Zelle transfer limits work in 2025 to avoid problems with your payment. Zelle does not set a universal limit for everyone. Instead, each bank or credit union decides its own daily transfer limits and monthly transfer limits. After April 1, 2025, you can only use Zelle through your bank or credit union’s app or website. The standalone Zelle app no longer works for sending or receiving money. This change means your daily transfer limits depend entirely on your financial institution.

Most banks set daily transfer limits between $500 and $3,500. For example, Chase allows you to send up to $2,000 per day and $10,000 per month. Wells Fargo sets a daily transfer limit of $3,500 and a monthly cap of $20,000. Bank of America uses different tiers based on your account history, so your daily transfer limits may change over time. If you try to send a payment that goes over your limit, the transaction will not go through.

Tip: Always check your daily transfer limits before you send a payment. This helps you avoid failed transactions and keeps your instant transfers smooth.

Limits by Account Type

Your Zelle transfer limits also depend on your account type and how long you have had your account. Banks often give higher daily transfer limits to customers with older accounts or special account types. For example, Capital City Bank lets new clients send up to $500 per day for the first 30 days. After that, existing clients can send up to $3,000 per day. Private banking clients may have a Zelle max transfer limit of $5,000 per day. Navy Federal Credit Union sets different daily transfer limits based on how fast you want your payment to process. You can send $1,500 per day for instant transfers or $3,000 per day for payments that take 1-3 business days.

Here is a table showing sample daily transfer limits for different account types:

| Bank / Credit Union | New Client Daily Limit | Existing Client Daily Limit | Private Banking Daily Limit | Instant Transfers Limit |

|---|---|---|---|---|

| Capital City Bank | $500 | $3,000 | $5,000 | $3,000 |

| Chase | $2,000 | $2,000 | N/A | $2,000 |

| Wells Fargo | $3,500 | $3,500 | N/A | $3,500 |

| Navy Federal Credit Union | $1,500 (instant) | $3,000 (standard) | N/A | $1,500 |

Note: These daily transfer limits can change. Your bank may adjust your Zelle transfer limit based on your account activity or payment history.

How to Check Your Limit

You can check your Zelle transfer limits by logging into your bank or credit union’s app or online banking platform. Most banks show your daily transfer limits and Zelle max transfer limit in the Zelle section of their app. If you cannot find your limit, you can contact your bank’s customer service for help. Some banks also list their daily transfer limits and payment rules on their websites.

To make sure your payment goes through, always check your daily transfer limits before you send money. If you plan to send a large payment, you may need to split it into smaller amounts or wait until your limit resets. Instant transfers can help you move money quickly, but you must stay within your Zelle transfer limits to avoid delays.

If you reach your Zelle transfer limit, your payment will not process. Plan your payments ahead of time to keep your instant transfers smooth and hassle-free.

Why Zelle Has Limits

Security Reasons

You might wonder why your bank sets a limit on how much you can send with Zelle. The main reason is to keep your money safe. Banks use several security tools, such as multifactor authentication, identity checks, and data encryption. These tools work together with the transfer limit to protect your account.

- The limit helps stop large unauthorized transfers if someone tries to access your account.

- It also reduces the chance of mistakes, like sending too much money by accident.

- Your bank may set different limits based on your account type, how long you have used Zelle, and your transaction history.

Note: Banks often review your account activity and may adjust your limit if they see changes in your usage or security needs.

You can help keep your account secure by checking recipient details, turning on payment alerts, and reviewing your transaction history often. These steps, along with the Zelle limit, give you more control over your money.

Fraud Prevention

Fraud prevention is another key reason for Zelle’s transfer limit. By capping how much you can send each day or month, your bank lowers the risk of large losses if a scammer gets into your account.

- The limit acts as a first line of defense against fraudsters who want to move big sums quickly.

- Banks look at factors like your account age, transaction patterns, and how well they know you when setting your Zelle limit.

- If you try to send more than your limit, the transaction will not go through. This helps stop fraud before it happens.

Zelle’s limit works with other fraud prevention tools, such as monitoring for unusual activity and checking where transactions come from. Even though Zelle does not offer purchase protection, these limits help protect your finances. If you need a higher limit, you can ask your bank, but they will check your account for security risks first.

Zelle Transfer Limit by Bank

Understanding bank-specific limits is key to making smooth payments with Zelle. Each bank sets its own daily transfer limits and monthly caps. These limits can change based on your account type, how long you have used Zelle, and your payment history. You should always check your bank’s rules before sending money. Below, you will find a breakdown of Zelle transfer limits for major banks in 2025.

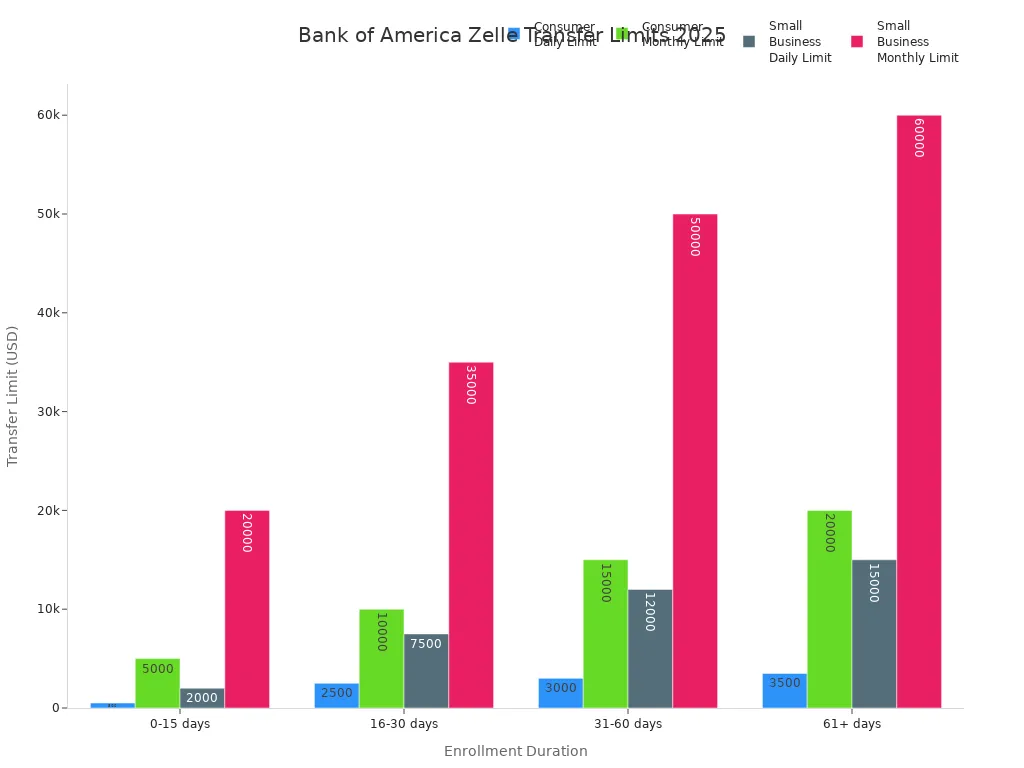

Bank of America

Bank of America uses a tiered system for Zelle transfer limits. Your daily transfer limits depend on how long you have been enrolled and whether you use a consumer or small business account. For new users, the daily limit starts low and increases over time. Small business accounts have higher limits to support larger payments.

| Account Type | Days Enrolled | Daily Transfer Limits | Monthly Transfer Limits |

|---|---|---|---|

| Consumer (Personal) | 0-15 days | $500 | $2,000 |

| Consumer (Personal) | 16-60 days | $2,500 | $10,000 |

| Consumer (Personal) | 61+ days | $3,500 | $20,000 |

| Small Business | 0-15 days | $2,000 | $10,000 |

| Small Business | 16-60 days | $10,000 | $40,000 |

| Small Business | 61+ days | $15,000 | $60,000 |

Note: If you send money to a new recipient, Bank of America may set a temporary cap of $1,000 for personal accounts and $4,000 for business accounts during the first five days. These limits help protect your account and keep your payments secure.

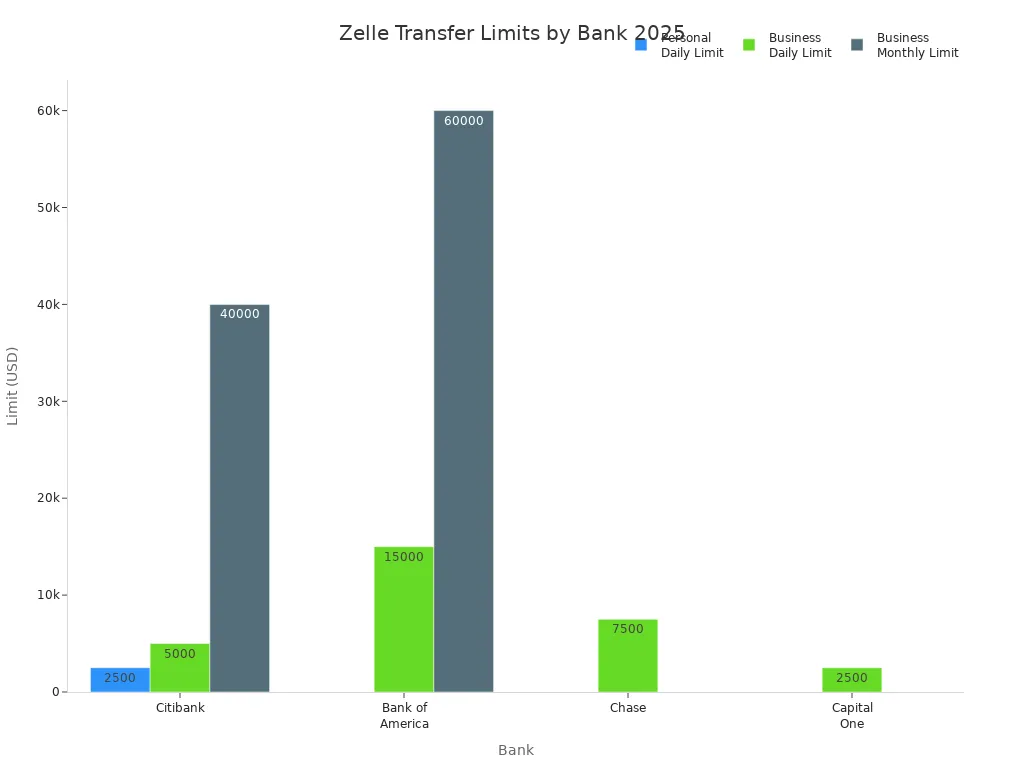

Chase

Chase sets flexible Zelle transfer limits based on your account type and payment history. For most personal checking accounts, daily transfer limits range from $500 up to $10,000 per transaction. The bank does not publish a fixed monthly limit, but your Zelle max transfer limit will always be higher than your daily cap. You should check your specific limit in the Chase app or online banking portal before making a payment.

- Personal accounts: $500 to $10,000 per day

- Business accounts: Up to $7,500 per transaction

Your daily transfer limits may change if your account history or balance changes. Chase reviews your payment activity to keep your account safe.

Wells Fargo

Wells Fargo offers some of the highest daily transfer limits for Zelle users. The bank sets different caps for consumer and business accounts. Your limit depends on your account type, online banking history, and payment patterns.

| Account Type | Daily Transfer Limit | Monthly Transfer Limit |

|---|---|---|

| Consumer | $3,500 | $20,000 |

| Small Business | $15,000 | $60,000 |

Wells Fargo may adjust your Zelle transfer limits at any time for security reasons. If you have a Premier Checking or Private Bank account, you might see even higher limits. Always check your daily transfer limits before sending a large payment.

Capital One

Capital One sets its Zelle transfer limits based on your account type and how long you have used Zelle. Most personal accounts have a daily transfer limit of $2,500. Business accounts have a $2,500 daily cap, but there are no set weekly or monthly limits. If you are a new user, your daily transfer limits may start lower and increase over time.

- Personal accounts: $2,500 per day

- Business accounts: $2,500 per day

You should check your Zelle max transfer limit in your Capital One app before making a payment, as bank-specific limits can change.

Citibank

Citibank keeps its Zelle transfer limits simple. Most personal accounts have a daily transfer limit of $2,500 and a monthly cap of $15,000. Business accounts can send up to $5,000 per day and $40,000 per month. New business users may have a lower daily limit of $1,000 until they build a payment history.

| Account Type | Daily Transfer Limit | Monthly Transfer Limit |

|---|---|---|

| Personal | $2,500 | $15,000 |

| Business | $5,000 ($1,000 for new) | $40,000 |

These limits help you manage your payments and keep your account secure.

TD Bank

TD Bank offers different Zelle transfer limits depending on your account type and the speed of your payment. Standard accounts have daily transfer limits between $1,000 and $2,500. Private client accounts enjoy higher limits. Instant transfers have lower caps, while scheduled payments allow for larger amounts.

| Account Type | Daily Transfer Limits | Monthly Transfer Limits |

|---|---|---|

| Standard TD Bank Accounts | $1,000 to $2,500 | $5,000 to $10,000 |

| Higher Limits (Private Client) | $1,500 to $3,000 | $7,500 to $15,000 |

If you use instant transfers, your daily transfer limits will be at the lower end of the range. Scheduled payments give you more flexibility for larger payments.

Business Accounts

Business accounts usually have much higher Zelle transfer limits than personal accounts. This helps you handle larger payments and more transactions. For example, Bank of America business accounts can send up to $15,000 per day and $60,000 per month. Citibank business accounts can send up to $5,000 per day and $40,000 per month. Chase business accounts have a $7,500 per transaction cap. Capital One business accounts have a $2,500 daily cap, but no set monthly limit.

Not all banks support Zelle for business accounts. You must enroll your business account through your bank’s app. Personal accounts cannot receive business payments. Always check your bank’s rules for business Zelle payments.

Bank-specific limits can change at any time. Your daily transfer limits may increase as your account ages or if you have a strong payment history. Always check your Zelle transfer limits before sending a payment to avoid delays or failed transactions.

Reaching Your Zelle Limit

What Happens Next

When you reach your Zelle transfer limit, your payment will not go through. The bank will decline the transaction if you try to send more than your allowed limit. You must wait for your limit to reset, which usually happens daily or monthly, depending on your bank’s policy. If you need to send a payment right away, you can contact your bank to ask for a higher limit. Some banks may review your account and increase your limit if you have a good payment history.

If your payment fails because of the limit, check your bank’s app to see when your limit resets. Planning ahead helps you avoid delays.

Steps to Take

If you need to send a payment that is larger than your Zelle limit, you have several options:

- Contact your bank and request a limit increase. Explain why you need to send a larger payment.

- Upgrade to a higher-tier account that offers a higher Zelle limit.

- Complete extra identity checks with your bank to qualify for a higher limit.

- Link more than one account to Zelle and split your payment across them.

- Use Zelle through different banks if you have multiple accounts, since each bank sets its own limit.

- Ask your bank for a temporary limit increase for a one-time large payment.

These steps can help you manage your payments and avoid failed transactions.

Alternatives

If you cannot wait for your Zelle limit to reset, you can try other ways to send your payment. The Gerald app offers a fee-free Buy Now, Pay Later service and instant cash advances. You can use Gerald to cover large payments without interest or fees, even if your Zelle limit is too low. Other options include:

- Splitting your payment over several days until your limit resets

- Using other digital payment services like Apple Pay, PayPal, Venmo, or Cash App

- Sending a wire transfer or a cashier’s check

Always talk to the person or business you are paying. Let them know if you need more time because of your Zelle limit.

Managing Zelle Transfers

Planning Ahead

You can avoid problems with your transfers by planning ahead. Zelle limits can stop you from sending large amounts at once, but you have several ways to work around this. Here are some strategies you can use:

- Wait for your daily or monthly limit to reset before sending more money.

- Break up large payments into smaller amounts and send them over several days.

- Use other financial apps, such as Gerald’s Buy Now, Pay Later or instant cash advance services, to cover bigger expenses.

- Choose wire transfers or other payment methods if your transfer is too large for Zelle. Always check for fees and processing times.

- Monitor your account activity and check your limits through online banking or customer service.

Tip: Plan your transactions in advance. This helps you avoid hitting your limit when you need to send money quickly.

Using Multiple Accounts

You can manage your transfer limits by using more than one bank account. Zelle lets you link one email address or U.S. mobile number to a single bank account. However, you can register different email addresses or phone numbers with different accounts. This setup allows you to spread your transfers across several banks, which can help if you often reach your limit on one account. Make sure you keep track of which contact details go with each account to avoid confusion.

Staying Safe

Keeping your money safe should always be your top priority. Follow these steps to protect your funds when using Zelle:

- Only send money to people you know and trust. Once you send a payment, you cannot cancel it.

- Treat Zelle payments like cash. If you send money to the wrong person, you cannot get it back.

- Confirm the recipient’s phone number or email address before sending money.

- Never share your online or mobile banking credentials with anyone.

- Watch out for scams. Government agencies and utility companies will not ask for Zelle payments.

- Send a small test payment to new recipients before sending larger amounts.

Note: Zelle does not offer purchase protection. If you are unsure about a payment, consider using a credit card for added security.

Zelle vs Other Apps

Image Source: pexels

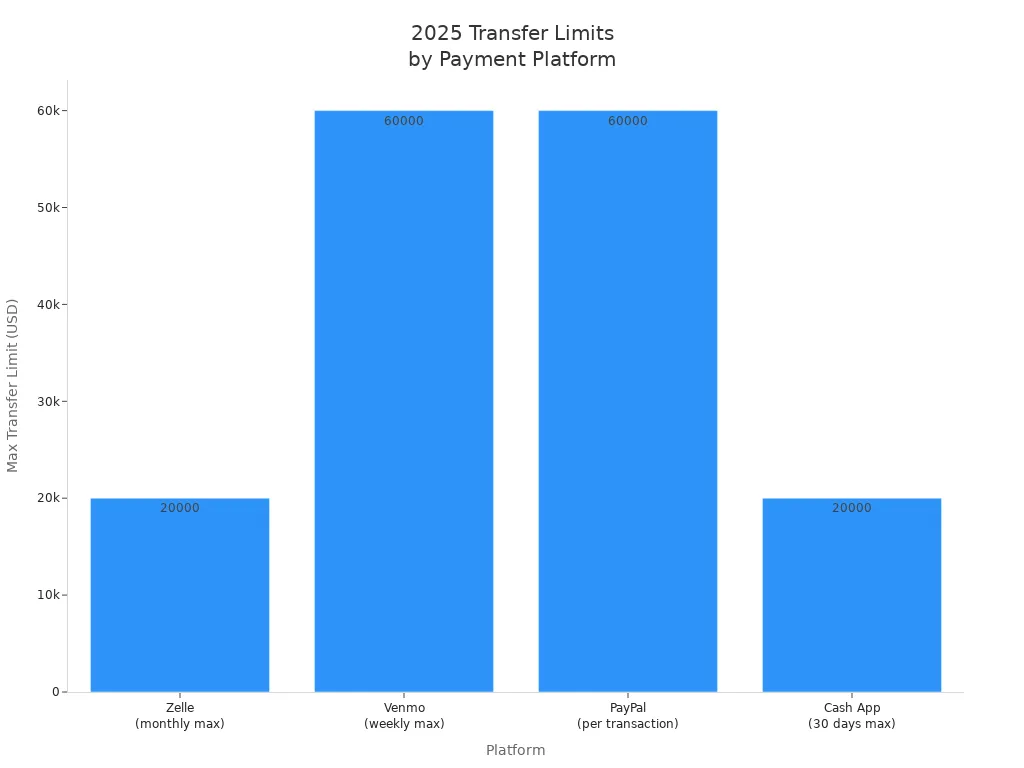

Transfer Limits Compared

You need to know how daily transfer limits for different payment apps compare before you choose the best way to send money. Zelle stands out because banks set your daily transfer limits, which usually range from $500 to $3,500 each day and up to $20,000 each month. These daily transfer limits are lower than what you get with Venmo, PayPal, or Cash App. Venmo gives you a weekly send limit of about $60,000 after you verify your identity, and you can send up to $6,999.99 per week for person-to-person payments. PayPal lets you send up to $60,000 in a single transaction if you are a verified user, which is the highest among these apps. Cash App starts with a $250 weekly limit for new users, but after you verify your identity, your daily transfer limits can go up to $20,000 every 30 days, with a weekly send limit of $7,500.

Here is a table to help you compare daily transfer limits across these popular apps:

| App | Daily Transfer Limits | Monthly/Weekly Limits | ID Verification Needed for Max Limit |

|---|---|---|---|

| Zelle | $500 – $3,500 | $15,000 – $20,000 monthly | Yes |

| Venmo | $1,000 (unverified) | $6,999.99 weekly (verified) | Yes |

| PayPal | Up to $60,000 per transaction | N/A | Yes |

| Cash App | $250 weekly (unverified) | $7,500 weekly (verified) | Yes |

Tip: Always check your app’s daily transfer limits before sending money. This helps you avoid failed payments and keeps your transfers smooth.

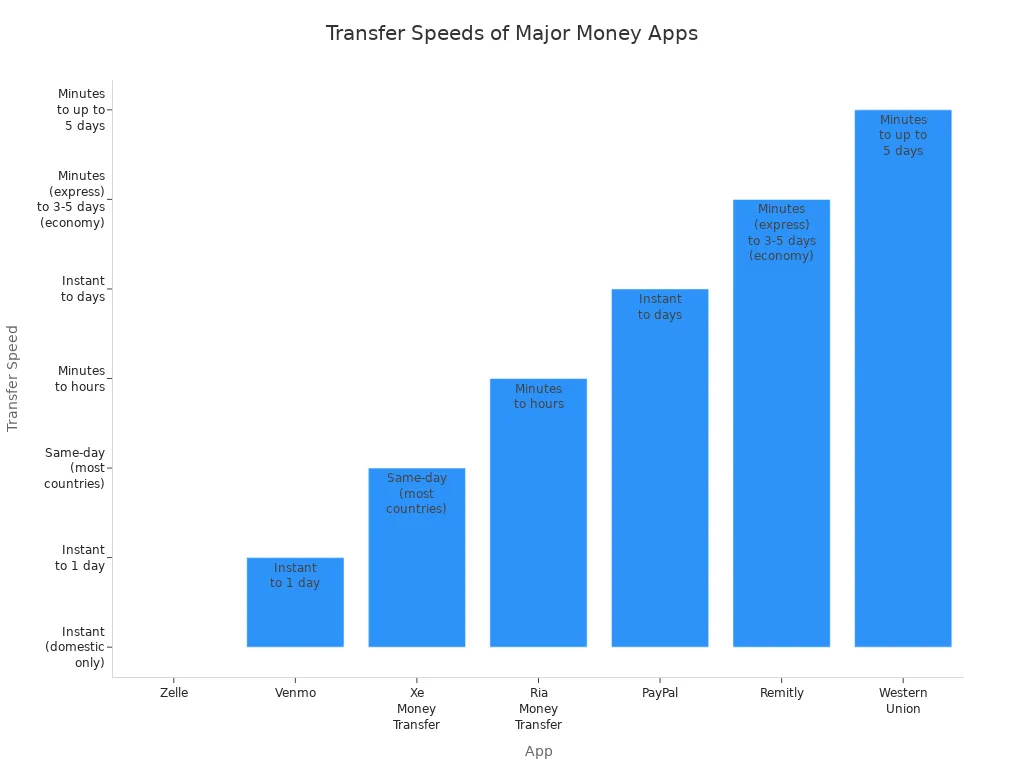

Speed and Fees

You want your money to move fast and without extra costs. Zelle gives you instant transfers between U.S. bank accounts with no fees. Your money usually arrives within minutes, and you do not pay to send or receive funds. However, Zelle only works for payments inside the United States.

Venmo also offers instant transfers, but you may pay a small fee for instant service. Standard transfers take about one day and are free. PayPal lets you send money quickly, but international transfers come with higher fees and may take longer. Cash App gives you instant transfers for a fee or free transfers that take one to three days.

If you need to send money outside the United States, you can use apps like Remitly, Xe Money Transfer, Ria Money Transfer, or Western Union. These apps support international payments, but their fees and speeds vary. Remitly charges $3.99 for express transfers that arrive in minutes or $1.99 for economy transfers that take up to five days. Western Union’s fees depend on the amount and where you send the money, and transfer times can range from minutes to several days.

Here is a table to compare transfer speeds and fees:

| App | Transfer Speed | Fees | International Transfers Supported |

|---|---|---|---|

| Zelle | Instant | Free | No |

| Venmo | Instant to 1 day | Free (standard), fee (instant) | No |

| Xe Money Transfer | Same-day (most countries) | Low, transparent fees | Yes |

| Ria Money Transfer | Minutes to hours | Variable fees | Yes |

| PayPal | Instant to days | Higher for international | Yes |

| Remitly | Minutes (express), 3-5 days (economy) | $3.99 (express), $1.99 (economy) | Yes |

| Western Union | Minutes to up to 5 days | Varies by amount/location | Yes |

Note: Zelle is your best choice for fast, fee-free transfers within the United States, but you need other apps for international payments or higher daily transfer limits.

Understanding your Zelle transfer limits helps you avoid delays and failed payments. Limits can change without notice, so you should always check with your bank for the most accurate information. If you plan ahead and use the tips in this guide, you can keep your money transfers smooth. If you need help, contact your bank using the number on your debit card or reach out to Zelle support by phone or through their website. This way, you can get answers and avoid disruptions in your payments.

FAQ

What happens if you try to send more than your Zelle limit?

Your bank will block the payment. You will see an error message in your banking app. You cannot send the money until your daily or monthly limit resets.

Can you increase your Zelle transfer limit?

You can ask your bank for a higher limit. Some banks may approve your request if you have a good account history. You may need to provide extra identification or upgrade your account.

How do you check your Zelle transfer limit?

You can log in to your bank’s app or website. Look for the Zelle section. Most banks show your daily and monthly limits there. If you cannot find it, contact customer service for help.

Which banks offer the highest Zelle limits?

Some banks offer higher Zelle limits than others. Here is a quick comparison:

| Bank Name | Daily Limit (USD) | Monthly Limit (USD) |

|---|---|---|

| Wells Fargo | $3,500 | $20,000 |

| Bank of America | $3,500 | $20,000 |

| Citibank | $2,500 | $15,000 |

Note: Limits may change. Always check with your bank for the latest information.

This guide shows you how to navigate Zelle’s limits, but it also reveals the major challenges of relying on a service built for domestic use. The need to constantly check transfer limits, split payments, or deal with a complete lack of international support can be a significant roadblock for your global financial life. You need a platform that is built to handle cross-border payments without the daily caps and frustrating restrictions. This is where BiyaPay offers a modern, transparent, and direct solution. Our platform provides real-time exchange rate queries and conversions for a wide range of fiat and digital currencies, with remittance fees as low as 0.5%.

Unlike Zelle, BiyaPay is designed for a global audience, allowing you to send money to most countries and regions worldwide with the speed and efficiency you deserve. We offer same-day delivery for many transfers, helping you avoid the delays that come with low daily limits. Don’t let confusing caps and domestic-only restrictions hold you back. Open a secure account with BiyaPay in minutes and discover a platform that delivers speed, low costs, and unparalleled flexibility for all your global transactions. Register now to streamline your international transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.