- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Tips for Managing Fees and Limits on Walgreens Money Orders

Image Source: pexels

You can manage fees and limits on a walgreens money order by staying informed about current charges and restrictions. Walgreens partners with Western Union for money order services. Their fees start at $0.99, which is higher than some other options. For example, MoneyGram begins at $0.70, and USPS charges between $1.45 and $1.95. The maximum amount you can send money at walgreens is $6,000, while the receive limit is $300. This is lower than what MoneyGram allows, but higher than USPS for sending.

Knowing these details helps you avoid extra costs and pick the right money order service. Walgreens offers convenience, but you should compare options before you send money.

Key Takeaways

- Check the current fees at your local Walgreens before buying a money order to avoid surprises, as fees usually range from $1 to $2 and can vary by location.

- Walgreens limits each money order to $1,000; split larger amounts into multiple money orders and keep all receipts for your records.

- Bring a valid photo ID every time you buy a money order, especially for transactions over $900 or $1,000, to comply with store and state rules.

- Fill out the money order form carefully with the correct recipient name, amount, and your signature to prevent delays or extra fees.

- Keep your receipt and tracking number safe to track your money order, and contact Walgreens promptly if you need to cancel or replace it.

Walgreens Money Order

What Is a Money Order

A money order is a secure way to send money without using cash or checks. When you use a Walgreens money order, you rely on Western Union’s system. Unlike some stores that give you a physical money order document, Walgreens helps you send money directly to the recipient through Western Union. You visit the store, go to the customer service or Western Union desk, and request to send money. You fill out a form, pay with cash or a debit card, and keep your receipt. This process is different from other retailers, such as USPS or Walmart, where you purchase money orders directly and receive a paper document to mail or hand to the recipient. Some people find that using cash advance apps can be faster and more convenient than visiting a store.

Money Order Fees

Walgreens money order fees are not always listed in the store or online. The cost depends on where you send money and how you pay. Most Walgreens locations charge between $1 and $2 per transaction, but the fee can change if you send money internationally. Western Union may add extra costs for currency exchange. You should always ask about the current money order fees before you purchase money orders. Fees can change without notice, so checking each time helps you avoid surprises.

Limits and Restrictions

Walgreens sets a $1,000 limit for each money order you send. You can purchase money orders as many times as you need, but if you send money over $10,000 in one day, Walgreens must report your transactions to the government. The store may ask for identification if your transaction is over $900 or $1,000, depending on state rules. The table below shows some key requirements:

| Requirement | Details |

|---|---|

| ID Needed | For transactions over $900–$1,000 (varies by state) |

| Daily Reporting Threshold | Over $10,000 in one business day |

| Suspicious Activity Review | Transactions of $2,000+ or $5,000+ may be reviewed |

| Record Keeping | Walgreens keeps records for at least 5 years |

| Number of Money Orders | No strict limit, but large sums require ID and reporting |

You should know that money order limits and rules can change. Always check with your local Walgreens before you send money, especially if you plan to send large amounts. If you need to send more than the allowed limit, consider using a wire transfer or another method.

Minimizing Money Order Fees

Image Source: unsplash

Compare Fees

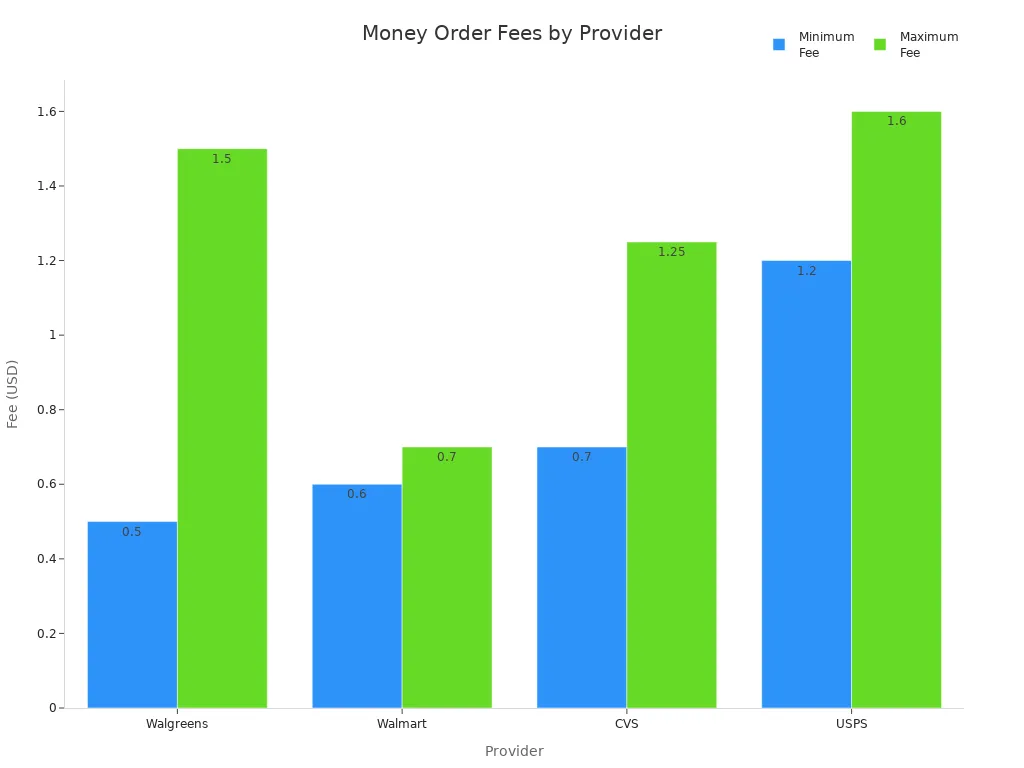

You want to save money when you send money. Comparing fees at different stores helps you choose the best option. Walgreens works with Western Union, so the fee for a money order can change depending on where you live. Most Walgreens stores charge between $0.50 and $1.50 for each money order. This fee is similar to what you pay at other stores, but it can be a little higher or lower.

Look at the table below to see how Walgreens compares to other places:

| Provider | Fee Range (USD) | Maximum Money Order Limit (USD) |

|---|---|---|

| Walgreens | $0.50 - $1.50 | $1,000 (varies) |

| Walmart | $0.60 - $0.70 | $1,000 |

| CVS | $0.70 - $1.25 | $500 |

| USPS | $1.20 (up to $500), $1.60 (up to $1,000) | $1,000 |

You can see that Walmart usually has the lowest fee for a money order. CVS charges a little more, and USPS has the highest fee for sending up to $1,000. Walgreens falls in the middle. If you want to send money and save, check the fee at your local Walgreens before you buy. Some Walgreens stores may charge more or less than others.

You should also think about the maximum amount you can send with one money order. Walgreens and Walmart both let you send up to $1,000 per money order. CVS only lets you send $500. USPS lets you send up to $1,000, but you pay more for higher amounts. If you need to send money often or in large amounts, Walgreens and Walmart give you more flexibility.

Avoid Extra Charges

You can avoid extra charges by planning ahead. Always ask the Walgreens staff about the current fee before you buy a money order. Fees can change, and some locations may have higher costs than others. If you send money to another country, Western Union may add more fees for currency exchange. You should check if these extra costs apply to your transaction.

Some stores offer add-ons, like faster delivery or tracking. These services can make your money order more expensive. Only choose these options if you really need them. For most people, the basic money order works well and costs less.

Tip: Bring the exact amount you want to send, plus the fee, in cash. Some Walgreens stores do not accept debit or credit cards for money orders. This helps you avoid extra trips or ATM fees.

Check your receipt before you leave the store. Make sure the amount and the recipient’s name are correct. If you make a mistake, you may have to pay a fee to fix it. Double-checking saves you money and time.

If you need to send money more than once, compare the total cost at Walgreens and other stores. Sometimes, a small difference in fees adds up if you send money often. You can also ask if Walgreens offers any discounts for frequent customers, but most stores do not.

By following these steps, you can keep your money order costs low and avoid surprises. Always compare, ask questions, and check your details before you send money.

Managing Limits at Walgreens

When you use a money order at walgreens, you need to know the rules about limits. Walgreens sets a $1,000 cap for each money order. If you want to send more than $1,000, you must find a way to work within these limits. Walgreens also tracks how much you send in a single day. If you send over $10,000 in one day, walgreens must report your transactions. You should always plan your payments so you do not run into problems with these rules.

Splitting Transactions

If you need to send more than $1,000, you can split your payment into several money orders. For example, if you want to send $2,500, you can buy two money orders for $1,000 each and one for $500. This method helps you stay within the walgreens limit for each money order.

Note: Walgreens may ask for identification if you buy multiple money orders in a short time. The staff may also ask questions about your transactions if the total amount is high.

Here is a simple way to split your payment:

- Decide the total amount you want to send.

- Divide the amount into parts of $1,000 or less.

- Buy each money order separately at walgreens.

- Keep all your receipts for your records.

| Total Amount to Send | Number of Money Orders Needed | Amount per Money Order |

|---|---|---|

| $1,500 | 2 | $1,000 + $500 |

| $3,000 | 3 | $1,000 each |

| $4,500 | 5 | $1,000 x 4 + $500 |

You should not try to avoid the reporting rules by sending money on different days if your total is over $10,000. Walgreens must follow government rules and may still report your transactions. Always follow the law when you use a money order.

Preparing Identification

Walgreens often asks for identification when you buy a money order, especially if you send large amounts. You should bring a valid photo ID, such as a driver’s license, state ID card, or passport. If you plan to send money over $900 or $1,000, you must show your ID. Some states have different rules, so check with your local walgreens before you go.

Tip: Bring your ID every time you buy a money order. This saves time and helps you avoid delays.

Here is a checklist for what you need:

- Government-issued photo ID (driver’s license, state ID, or passport)

- The exact amount of cash for the money order and the fee

- The name and address of the person who will receive the money order

If you do not have the right ID, walgreens cannot process your money order. You should also make sure your ID is not expired. If you need to send money often, keep your ID ready for each visit.

Walgreens keeps records of large transactions. If you send money often or in large amounts, the staff may ask you extra questions. This is normal and helps prevent fraud. Always answer honestly and keep your receipts in a safe place.

Always double-check the amount and the recipient’s information before you buy a money order. Mistakes can lead to extra fees or delays.

By understanding the limits and preparing your identification, you can use a walgreens money order with confidence. You will avoid problems and make sure your money reaches the right person.

Buying a Money Order

Image Source: pexels

What to Bring

When you visit Walgreens to purchase money orders, you need to prepare a few important items. Bring enough cash to cover both the money order amount and the fee. Some Walgreens locations do not accept debit or credit cards for this service. Always carry a valid government-issued photo ID, such as a driver’s license, state ID, or passport. You also need the full name and address of the person or business receiving the money order. Having these details ready will help you complete your transaction quickly.

Tip: Double-check that your ID is current and not expired before you go to Walgreens.

Filling Out the Form

Knowing how to fill out a money order at Walgreens helps you avoid mistakes and delays. Follow these steps to complete the form correctly:

- Write the recipient’s full legal name or the company name in the “Pay to” field.

- Enter your own name and address in the purchaser section for record-keeping.

- Fill in the amount of the money order in numbers, including cents, to prevent fraud.

- Write the amount in words to match the numeric value and avoid confusion.

- Sign the front of the money order to validate it. Unsigned money orders may not be accepted.

- Keep your receipt as proof of purchase until the recipient cashes the money order.

If you want to know how to fill out a money order, always ask the Walgreens staff for help if you feel unsure. They can guide you through each step.

Common Mistakes

Many people make errors when they fill out a money order. These mistakes can lead to extra fees or even make the money order invalid. Here are some common problems to watch for:

- Leaving the recipient’s name blank or spelling it incorrectly

- Forgetting to sign the money order

- Writing the wrong amount or making it unclear

- Using a nickname instead of your legal name

- Losing your receipt before the money order is cashed

Note: Always review your completed money order before leaving Walgreens. Fixing mistakes later can cost more money and take extra time.

By preparing the right documents and following each step carefully, you can use a Walgreens money order with confidence.

Tracking and Resolving Issues

Tracking a Money Order

You can track a money order after you buy it at Walgreens. Tracking helps you know if the recipient has received the funds. Keep your receipt because it has the tracking number. Visit the Western Union website or call their customer service. Enter the tracking number from your receipt. You will see the status of your money order. If you have questions, ask the Walgreens staff for help. Always keep your receipt until the money order is cashed.

Tip: Write down the tracking number in a safe place. If you lose your receipt, you may have trouble tracking your money order.

Canceling or Replacing

Sometimes you need to cancel or replace a money order. If you made a mistake or changed your mind, act quickly. Go back to Walgreens with your receipt and photo ID. Ask the staff to help you start the cancellation process. Western Union will check if the money order has been cashed. If not, you can request a refund or replacement. You may need to fill out a form and pay a small fee. The process can take several days. Always check the status before you try to cancel.

Lost or Stolen Orders

If you lose your money order or someone steals it, do not panic. Take these steps right away:

- Go to Walgreens and explain the situation.

- Show your receipt and photo ID.

- Ask the staff to help you report the lost or stolen money order.

Western Union will investigate. If the money order has not been cashed, you can request a replacement or refund. You may need to pay a fee for this service. If someone has already cashed the money order, it is harder to get your money back. Always keep your receipt and tracking number safe to make this process easier.

You can manage Walgreens money order fees and limits by staying informed and planning ahead. Always check the fee at your local store, since it usually ranges from $1 to $2. Review store policies for limits and bring the right ID. Consider fee-free alternatives, like cash advances from certain apps, if you want to save more. Double-check all details before you finish your transaction. Careful preparation helps you avoid extra costs and keeps your money safe.

FAQ

How long does it take for a Walgreens money order to process?

You can expect your Walgreens money order to process right away. The recipient can usually access the funds within minutes after you complete the transaction at the store.

Can you get a refund if you make a mistake on a Walgreens money order?

Yes, you can request a refund if you make a mistake. Bring your receipt and photo ID to Walgreens. The staff will help you start the refund process. You may need to pay a small fee.

What do you need for cashing a money order received from Walgreens?

You need a valid photo ID and the original money order. Visit a bank or a Western Union location. The staff will check your ID before giving you the cash.

Are there limits on how many money orders you can buy at Walgreens?

Walgreens does not set a strict limit on the number of money orders you can buy. If you purchase large amounts, the staff may ask for your ID and report your transactions as required by law.

This guide shows you how to manage the fees and limits of a Walgreens money order, but it also reveals the many steps you have to take to use this service. The manual process, the low $1,000 limit, and the need to keep a paper receipt all create friction. For any amount over that limit, you must split your transaction, incurring extra fees and hassle. In a world where you expect convenience and speed, your money transfers should be just as easy. This is where BiyaPay offers a modern, transparent, and direct solution that eliminates the friction of traditional money orders. Our platform provides real-time exchange rate queries and conversions, with remittance fees as low as 0.5%, significantly lower than what many services charge.

Instead of visiting a store and dealing with a paper-based system, you can send money securely from your phone in minutes. BiyaPay allows you to send larger sums without the hassle of splitting transactions or worrying about a lost receipt. Our same-day delivery for many transfers ensures your recipient receives the money quickly, without the need for a trip to the store or a complex deposit process. Don’t let low limits and inconvenient fees hold you back. Open a secure account with BiyaPay in minutes and experience a new standard for global finance. Register now to streamline your international transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.