- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Select U.S. Stocks with Both High Dividends and High Growth

Image Source: pexels

When selecting quality U.S. stocks, you should focus on long-term investment value. U.S. stocks that combine high dividends and high growth are extremely rare, but holding such companies long-term typically yields an annualized return of 9%-15%. Data shows that dividend returns and earnings growth in quality U.S. stocks jointly drive returns, often providing substantial rewards for long-term investors.

Key Points

- High-dividend stocks offer stable cash returns, suitable for defensive investing, but you should pay attention to dividend sustainability and company profitability.

- High-growth stocks have rapid future earnings and revenue growth, and investing in such companies can achieve asset appreciation through compounding.

- U.S. stocks that combine high dividends and high growth have the greatest investment value, delivering both stable dividends and stock price appreciation.

- When selecting stocks, focus on dividend yield, growth rate, ROE, free cash flow, and valuation, using professional tools to improve screening efficiency.

- Adhering to diversified investment and long-term holding, combined with dividend reinvestment, can effectively reduce risks and achieve steady return growth.

Definition and Value

Meaning of High Dividends

When selecting U.S. stocks, you often focus on dividend levels. High-dividend stocks typically refer to companies that allocate a large portion of their net profits to dividends, with a dividend yield higher than the market average. You can measure this using the dividend yield (dividend per share/stock price per share). High-dividend stocks are often leaders in mature industries, with stable profitability and ample cash flow. Holding such stocks long-term provides direct cash returns. High-dividend stocks also offer defensiveness, providing stable returns for your portfolio during market fluctuations. You need to note that dividend sustainability and company profitability are equally important, and you should not focus solely on the surface dividend yield.

Significance of High Growth

High-growth stocks represent companies with earnings and revenue growth significantly above the market average in the coming years. When analyzing, you can focus on the following financial characteristics:

- The company’s growth rate over the next five years consistently exceeds twice the U.S. nominal GDP.

- ROE (return on equity) consistently above 12%.

- Ample cash flow, with cash collection and net cash ratios not below 100%.

- Reasonable capital expenditure, with the ratio of capital expenditure to depreciation and amortization not exceeding 100%.

- Strong dividend willingness, with a payout ratio consistently not below 50% and growing annually.

High-growth companies are often industry leaders with strong management and governance, continuously creating value for shareholders. By investing in such companies, you primarily rely on the company’s rapid growth to achieve compounding.

Combined Advantages

When you find quality U.S. stocks that combine high dividends and high growth, their investment value is extremely high. These companies not only provide stable cash dividends but also drive stock price appreciation through performance growth. You can achieve dual returns, benefiting from both defensiveness and growth dividends. Quality U.S. stocks with both dividends and growth are ideal for long-term allocation, helping to achieve steady asset appreciation.

Quality U.S. Stock Selection Metrics

Image Source: pexels

When selecting quality U.S. stocks, you need to focus on core metrics such as the company’s financial strength, profitability, cash flow, and long-term growth potential. Only when these metrics perform outstandingly can you ensure the company has sustained dividend and growth capabilities. You can use professional analysis tools like Gurufocus to quickly screen high-quality companies, improving selection efficiency.

Dividend Yield

Dividend yield is a key metric for measuring a company’s willingness and ability to reward shareholders. When screening quality U.S. stocks, it’s recommended to focus on companies with dividend yields in a reasonable range. According to historical data from the S&P 500 High Dividend Index, the dividend yield of quality U.S. stocks is typically around 2% to 3%. Specific performance includes:

- From 2003 to 2019, dividend yields fluctuated between 1.6% and 2.8%.

- During the low-interest-rate period from 2011 to 2019, dividend yields were around 2.8%.

- Dividend yields vary significantly by industry, with communication services reaching 5.5%, real estate at 4.1%, and energy at 3.6%.

- Overall, quality U.S. stocks’ dividend yields are generally around 3%, balancing dividend quality and stability.

You can screen companies with stable cash flow and dividend capabilities through dividend yield, avoiding focusing solely on high dividends while ignoring fundamentals.

Growth Rate

Growth rate reflects a company’s potential for future earnings and revenue expansion. When selecting quality U.S. stocks, focus on the compound annual growth rate of revenue or net profit. High-growth U.S. companies typically have a compound annual growth rate of 30% or higher, with some leading companies exceeding 50%. For example:

- Amazon’s net profit compound annual growth rate over the past 10 years is 33%.

- Microsoft’s net profit grew by 136% in 2019 and 14% in 2020.

- Facebook’s net profit compound annual growth rate over the past 10 years is 54%, with revenue growth at 45%.

- NVIDIA’s performance compound annual growth rate over the past 10 years is 32%.

- Tesla’s revenue compound annual growth rate over the past 10 years is 75%, with net profit growth at 119%.

- Apple’s net profit compound annual growth rate over the past 10 years is about 15%.

By comparing these data, you can assess whether a company has sustained growth potential. High growth is a key characteristic of quality U.S. stocks.

ROE and Cash Flow

ROE (return on equity) and free cash flow are critical metrics for evaluating a company’s profit quality and risk resilience. When analyzing quality U.S. stocks, prioritize companies with stable ROE and ample free cash flow. Free cash flow reflects a company’s cash generation ability, determining its capacity for sustained dividends, buybacks, and expansion. ROE stability indicates consistent profitability.

U.S. market data shows that a free cash flow strategy outperforms dividend and value strategies long-term, navigating bull and bear markets. You can combine ROE and free cash flow to screen financially robust, profitable, and cash-flow-stable quality U.S. stocks. These companies not only have strong risk resilience but also deliver long-term capital appreciation for investors.

Tip: Use tools like Gurufocus to quickly screen companies with stable ROE and positive free cash flow, improving selection efficiency.

Valuation

Valuation is a crucial aspect of assessing the investment value of quality U.S. stocks. You need to consider whether the current valuation is reasonable to avoid risks from overvaluation. High-dividend, high-growth U.S. stocks typically exhibit the following valuation characteristics:

- High-dividend stocks have longer durations, with greater price volatility during interest rate changes.

- High-dividend, high-growth companies are often concentrated in emerging growth industries, such as pharmaceuticals, information technology, and discretionary consumer sectors.

- Growth companies’ valuations are driven more by future earnings growth expectations, with markets having high expectations for technological breakthroughs and future potential.

- Experience shows that a duration of about 20 years is the critical threshold for high-dividend portfolios to outperform the market, with positive annualized excess returns when duration is below 20 years.

You can use professional tools like Gurufocus, leveraging methods like the Guru Value Line, to assess a stock’s fair value and safety margin, avoiding valuation traps.

Recommendation: When selecting stocks, consider not only dividends and growth but also valuation levels to ensure a reasonable purchase price, enhancing long-term return potential.

Stock Selection Steps

Initial Screening of Index Constituents

When selecting quality U.S. stocks, you can start with mainstream ETFs or index constituents like the S&P 500, VOO, or QQQ. These indices cover the most representative companies in the U.S. market, offering a broad screening range and diversified risk. You can access constituent lists through public channels to quickly identify financially robust, highly recognized companies. For beginners, this step effectively reduces selection difficulty, avoiding missed opportunities due to information asymmetry.

Recommendation: Regularly monitor index constituent adjustments to identify newly added quality companies and seize investment opportunities from market changes.

Financial Data Screening

After initial screening, you need to further filter through financial data to identify companies with both dividend and growth potential. Focus on these key metrics:

- Dividend Yield: Measures the company’s dividend level. Excessively high yields may signal financial risks, so evaluate in conjunction with dividend growth stability.

- BSD Formula (BigStrongDividend): Focus on dividend growth sustainability and financial health, avoiding risks from focusing solely on high dividend yields.

- Free Cash Flow: Reflects profit quality and dividend capacity. Use the three-stage DCF model to evaluate stock value from profitability, growth, and discounting perspectives.

- Profitability Metrics: Such as ROE and net profit growth rate, to assess growth potential.

- Valuation Metrics: Such as PEG ratio, to determine if the stock price is reasonable, balancing growth and dividends.

You can use professional tools like Gurufocus to batch-screen companies meeting these criteria. Historical cases show that excessively high dividend yields can carry risks. For example, Sunberg Real Estate Investment Trust went bankrupt due to a dividend yield as high as 20%, while FPL Group, with a moderate and stable dividend yield, became a model of balancing dividends and growth.

Industry Classification

When selecting stocks, you also need to consider GICS industry classifications to refine your screening direction. Consumer staples, healthcare, information technology, financials, and industrials have consistently performed well, making them more likely to yield high-dividend, high-growth quality U.S. stocks. The consumer staples industry, with stable demand and strong profitability, is a long-term favorite among investors. You can also consider strong cyclical industries like financials and energy, investing at cycle lows to achieve higher returns.

You can refer to the approach of famous investors like Buffett, prioritizing consumer staples and healthcare industries. For example, companies like Coca-Cola and Johnson & Johnson maintain high dividends and steady growth, becoming core assets in portfolios.

Fundamental Analysis

Finally, you need to conduct fundamental analysis on screened companies to ensure the scientific rigor of your investment decisions. You can start with the following aspects:

- Corporate Governance: Is the management stable, and is governance transparent?

- Business Model: Does the core business have a competitive edge, and is market share growing?

- Profitability: Are gross and net margins above industry averages, and is the profit structure healthy?

- Cash Flow Status: Is operating cash flow consistently positive, and is capital expenditure reasonable?

- Dividend Policy: Does the company have a clear dividend commitment, with a stable and growing dividend history?

You can use annual and quarterly reports, combined with professional analysis tools, to comprehensively evaluate a company’s fundamentals. Only companies with solid fundamentals can maintain steady growth amid market fluctuations, making them quality U.S. stocks for long-term holding.

Tip: Throughout the stock selection process, always adhere to diversified investment and risk management principles. Don’t change judgments due to short-term market fluctuations; long-term holding of quality U.S. stocks can achieve steady asset appreciation.

Case Studies

Image Source: pexels

Microsoft

When selecting quality U.S. stocks, you can focus on Microsoft. In Q1 2024, Microsoft’s revenue grew 17% year-over-year, with net profit increasing by about 20%. The company reduced total shares by about 12%, boosting earnings per share and demonstrating strong growth. Microsoft effectively uses cash for business reinvestment, with total investment returns far surpassing many high-yield companies. Its payout ratio has steadily declined over the years, from over 50% to below 30%, ensuring dividend safety with room for growth. Even during economic downturns, Microsoft maintains stable dividends. During the 2008 financial crisis, the company did not cut dividends, showcasing robust cash flow and dividend stability. You can see that Microsoft combines high dividends and high growth, making it a model for long-term investment.

Apple

Apple is also a representative of quality U.S. stocks. Early on, Apple chose to retain profits for rapid growth, achieving a stock price annualized compound return of 38%. When growth-driven returns exceeded what shareholders could achieve through reinvestment, profit retention became the better choice. Subsequently, Apple boosted earnings per share through large-scale stock buybacks, maximizing capital returns and shareholder value. Since 2009, Apple has repurchased nearly $200 billion, with a profit compound growth rate of 21.73% and an earnings per share growth rate of 24.17%. Buybacks not only provide tax advantages but also act as forced dividend reinvestment. You can see that Apple balances growth and dividends through profit retention and buybacks, delivering sustained returns to shareholders.

Other Quality U.S. Stocks

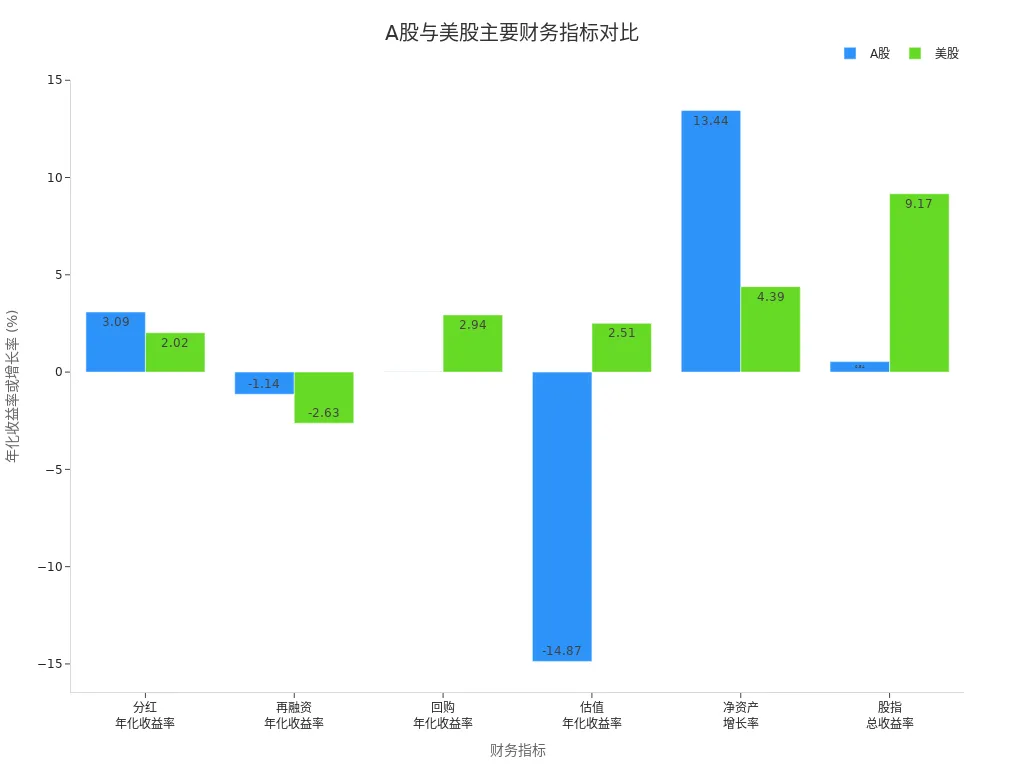

Starbucks and McDonald’s are also well-known companies in the U.S. stock market. You can review their performance in dividends, buybacks, and growth through the table below:

| Metric | U.S. Stocks (%) |

|---|---|

| Dividend Annualized Yield | 2.02 |

| Buyback Annualized Yield | 2.94 |

| Net Asset Growth Rate | 4.39 |

| Index Total Return | 9.17 |

Starbucks and McDonald’s are active in buybacks, contributing significantly to shareholder returns but also introducing structural risks. In fiscal 2024, Starbucks’ net profit fell 8.8%, with its stock price declining 16.4% over three years. Revenue in the U.S. and China markets both declined, with frequent management changes. When investing, you need to monitor growth changes and potential risks in these quality U.S. stocks, ensuring reasonable diversification.

Risks and Considerations

Balancing Dividends and Growth

When investing in quality U.S. stocks, you must focus on balancing dividends and growth. The U.S. stock market has no price fluctuation limits, so stock prices can be highly volatile. You should allocate funds reasonably based on your risk tolerance. High-dividend companies provide stable cash flow, but limited growth can constrain long-term returns. High-growth companies have great potential but carry higher risks when valuations are excessive. You can leverage long-term holding and dividend reinvestment to fully utilize the compounding effect. For example, Standard Oil of New Jersey, through long-term dividend reinvestment, achieved stock share growth far exceeding high-growth but overvalued companies. You should focus on the company’s dividend policy and growth potential, avoiding a one-sided approach.

Metric Pitfalls

When selecting stocks, you may encounter the following common pitfalls:

- Liking to bottom-fish historically low-priced stocks, ignoring the risk of further declines.

- Reluctance to stop losses, leading to expanded losses.

- Fear of chasing highs, missing out on upward opportunities.

- Avoiding leading stocks and opting for lower-gain follower stocks, limiting returns.

- Over-predicting market trends, ignoring the difficulty of short-term predictions.

- Holding too many stocks, lacking a systematic selection method.

- Lacking understanding of major players’ trading strategies, leading to disorganized operations.

- Frequent trading, making it hard to achieve long-term gains.

You also need to note that fund net value does not indicate cheapness or expensiveness, and dividends are not extra “bonuses” but merely a change in asset structure. You should focus on cumulative returns and company fundamentals rather than single metrics.

Diversification and Long-Term Holding

When allocating U.S. stock assets, diversification and long-term holding are crucial. Diversification reduces risks from single industries or market fluctuations. You can invest in ETFs covering multiple industries and quality U.S. stocks to enhance portfolio stability. Long-term holding with dividend reinvestment significantly boosts returns. Historical data shows that holding underperforming industry stocks long-term with dividend reinvestment can still yield excellent returns. You also need to consider U.S. stock trading rules and tax matters. U.S. stocks have no price fluctuation limits, with trading hours from 9:30 PM to 4:00 AM Beijing time (summer) or 10:30 PM to 5:00 AM (winter). Chinese residents investing in U.S. stocks must declare global income, and dividend taxes can be reduced by filing Form W-8BEN for tax treaty benefits. You should plan your portfolio and tax declarations reasonably to ensure compliance and minimize tax risks.

When selecting high-dividend, high-growth U.S. stocks, focus on profitability, cash flow, and valuation. It’s recommended to prioritize technology growth and high-prosperity industries, combined with diversification and long-term holding strategies. You can dynamically optimize your portfolio based on your risk tolerance and investment goals, continuously monitoring company fundamentals and market changes to achieve steady asset appreciation.

- Focus on profitability, cash flow, and valuation

- Prioritize technology growth and high-prosperity industries

- Adhere to diversification and long-term holding

FAQ

How to determine if U.S. stock dividends are sustainable?

You can review the company’s dividend history over the past five years. Consistent dividend growth indicates stable profitability. You should also check free cash flow and payout ratio to ensure the company’s long-term dividend capacity.

What tax issues should I consider when investing in U.S. stocks?

When investing in U.S. stocks, you need to declare global income. U.S. dividend tax is generally 30%. You can file Form W-8BEN to enjoy U.S.-China tax treaty benefits, reducing the actual tax rate to 10%.

How can beginners reduce U.S. stock investment risks?

You can choose ETFs like the S&P 500 for diversified investment. Avoid concentrating funds in a single stock. Hold quality companies long-term and avoid frequent trading to reduce volatility risks.

What’s the difference between U.S. stock dividends and buybacks?

Dividends are direct cash payments to you. Buybacks involve the company repurchasing shares, reducing outstanding shares and increasing earnings per share. Both enhance long-term returns.

Is valuation important when selecting high-dividend, high-growth U.S. stocks?

You should focus on valuation. Even with good dividends and growth, overvaluation increases investment risks. You can use metrics like P/E and P/B ratios to assess whether the purchase timing is reasonable.

This article offers an in-depth guide on how to select high-quality U.S. stocks that combine both high dividends and strong growth. However, for many Chinese investors, the first step into the U.S. stock market is often the most challenging. Traditionally, you’d need to open a complex overseas bank account and endure high cross-border remittance fees and lengthy transfer times. These cumbersome processes create unnecessary barriers to your global asset allocation.

Now, you can overcome these pain points. BiyaPay offers a one-stop solution designed for global investors. Our platform allows you to easily participate in both the U.S. and Hong Kong stock markets without the need to open a complicated overseas account. You can use our real-time exchange rate query feature to get the best rates at any time and benefit from remittance fees as low as 0.5% with same-day delivery. BiyaPay not only makes your global investments simple and efficient but also ensures every step is secure and reliable. Register with BiyaPay today to easily cross borders and seize global asset opportunities.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.