- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

U.S. Stock Trading Basics and Popular Investment Strategies

Image Source: unsplash

Are you looking to enter the U.S. stock trading basics stage? Many young Chinese investors are actively participating, with the investor demographic showing a trend toward youth and diversity, with post-80s and post-90s accounting for over 80%.

Common beginner challenges include:

- Difficulty maintaining long-term holdings, especially when facing unrealized gains;

- Many struggle to deeply understand company fundamentals;

- Need to clarify investment goals and select appropriate strategies;

- Beginners are advised to start with blue-chip stocks or ETFs;

- Market volatility brings psychological pressure, making risk management crucial.

You can gradually learn the foundational rules and strategies of U.S. stock trading through a low entry barrier and simple account opening process.

Key Points

- Understand the three major U.S. exchanges (NYSE, Nasdaq, AMEX) and choose appropriate stocks based on investment preferences.

- U.S. stock trading hours include regular, pre-market, and after-hours sessions; prioritize regular hours to reduce risk.

- U.S. stocks support fractional share trading, allowing participation in high-priced stocks even with limited funds, enhancing flexibility and market liquidity.

- Beginners should opt for cash accounts and zero-commission brokers to avoid complex operations and high fees.

- Focus on company fundamentals and risk management during investment, prioritizing blue-chip stocks and mainstream ETFs while avoiding blindly following trends.

U.S. Stock Trading Basics

Image Source: pexels

Major Exchanges

At the U.S. stock trading basics stage, you first need to understand the three major exchanges: New York Stock Exchange (NYSE), Nasdaq, and American Stock Exchange (AMEX). Each exchange has distinct listed company types and representative industries. The table below helps you quickly distinguish them:

| Exchange Name | Key Differences | Representative Industries | Typical Companies |

|---|---|---|---|

| New York Stock Exchange (NYSE) | Long history, large scale, stable development, dominated by traditional large enterprises | Traditional large enterprises, energy, telecom, etc. | Alibaba, Coca-Cola, IBM, China Telecom, China Mobile, PetroChina, GSX Techedu, New Oriental |

| Nasdaq | Electronic exchange, focused on technology and growth companies, divided into three tiers | Technology and growth companies | Facebook, Apple, Google, Amazon, Sina, Sohu, NetEase, Baidu, Ctrip, Futu Holdings |

| American Stock Exchange (AMEX) | Focuses on small- and mid-cap stocks, active in financial derivatives and ETF trading | Small- and mid-cap companies, financial derivatives | Ambow Education (AMBO.US), Dunxin Financial (DXF.US) |

You can choose stocks from different exchanges based on your investment preferences. During the U.S. stock trading basics stage, focus on Nasdaq’s tech stocks and NYSE’s blue-chip stocks.

Trading Hours

U.S. stock trading hours are divided into regular, pre-market, and after-hours sessions. You need to plan your trading based on Beijing time. U.S. markets use daylight saving time (DST) and standard time, with specific hours as follows:

| Time Type | DST (Beijing Time) | Standard Time (Beijing Time) |

|---|---|---|

| Regular Trading | 9:30 PM - 4:00 AM next day | 10:30 PM - 5:00 AM next day |

| Pre-Market | 4:00 PM - 9:30 PM | 5:00 PM - 10:30 PM |

| After-Hours | 4:00 AM - 8:00 AM | 5:00 AM - 9:00 AM |

Tip: Pre-market and after-hours trading have lower liquidity and wider bid-ask spreads, increasing risk. During the U.S. stock trading basics stage, prioritize regular trading hours.

Trading Units

During U.S. stock trading basics, you’ll notice that the minimum trading unit for U.S. stocks is one share, with no concept of “lots.” Some brokers support fractional share trading, allowing purchases of 0.1 shares or smaller. Fractional trading enables you to invest in high-priced stocks with limited funds. For example, Amazon’s share price once exceeded $3,000, but through fractional trading, you can buy partial shares with less capital. Brokers like Robinhood have popularized fractional trading, attracting many young investors.

- U.S. markets allow fractional share trading, with buy orders typically in whole shares, but sell orders can include fractional shares.

- Fractional trading meets diverse investor needs, especially for small investors with limited funds.

- In June 2022, fractional trading accounted for about 19% of trading volume, with high-priced stocks exceeding 39%.

- Fractional trading enhances market liquidity and lowers the barrier for high-priced stocks.

Settlement and Delivery

U.S. stocks operate on a T+0 trading model, allowing you to sell stocks bought on the same day. From May 28, 2024, the U.S. settlement cycle shortened from T+2 to T+1, meaning funds and securities are settled within one business day after a trade.

The settlement process is as follows:

- After your order is executed, the broker deposits collateral with the Depository Trust & Clearing Corporation (DTCC).

- Funds and stocks are settled within one business day after the trade.

- T+1 settlement reduces default risk and improves capital efficiency.

- Funds from stock sales arrive faster, enhancing the trading experience.

Note: While T+0 settlement is technically feasible, T+1 is currently used due to high operational costs and risks.

Price Limits and Circuit Breakers

U.S. stocks have no price fluctuation limits like China’s A-shares but have circuit breaker mechanisms to prevent extreme market volatility. During the U.S. stock trading basics stage, you must understand the circuit breaker trigger conditions:

| Mechanism Type | Trigger Condition | Trigger Time | Halt Duration | Notes |

|---|---|---|---|---|

| Market-Wide Level 1 | S&P 500 drops 7% | 9:30 AM - 3:25 PM ET | 15 minutes | Triggers once daily, adjusted for half-days |

| Market-Wide Level 2 | S&P 500 drops 13% | 9:30 AM - 3:25 PM ET | 15 minutes | Same as above |

| Market-Wide Level 3 | S&P 500 drops 20% | Any trading session | Until next trading day | Halts entire market |

| Stock-Specific 1 | 5-min price change ≥10% | 9:45 AM - 3:35 PM ET | 5 minutes | Applies to S&P 500, Russell 1000, some ETPs |

| Stock-Specific 2 | 5-min price change ≥30%, price >$1 | Same as above | 5 minutes | Applies to other stocks |

| Stock-Specific 3 | 5-min price change ≥50%, price ≤$1 | Same as above | 5 minutes | Applies to other stocks |

In March 2020, U.S. markets triggered circuit breakers four times in eight trading days due to the COVID-19 pandemic and oil price crashes. You need to monitor market sentiment and unexpected events, managing positions prudently.

Fee Structure

U.S. stock trading fee structures are complex, including the following components:

- Trading Commission: Some brokers, like Robinhood and Charles Schwab, offer zero-commission trading. Traditional brokers charge $4.95-$14.99 per trade.

- Platform Fee: Some brokers charge monthly or annual platform service fees.

- SEC Fee: Charged on sell orders, approximately 0.00051%, minimum $0.01.

- Trading Activity Fee (TAF): Charged on sell orders, about $0.000119 per share, minimum $0.01, maximum $5.95.

- Clearing Fee: $0.003 per share.

- ADR Custody Fee: About $0.03 per share, applicable to some Chinese ADRs.

- Dividend Withholding Tax: 10% for Chinese investors, 30% for others.

During the U.S. stock trading basics stage, prioritize zero-commission brokers. Robinhood holds a 60% share of monthly active users in the U.S. mobile trading market, with zero-commission models becoming mainstream.

Account Types

U.S. stock accounts are mainly cash accounts and margin accounts. During the U.S. stock trading basics stage, prioritize cash accounts for lower risk. The table below helps you understand the differences:

| Account Type | Cash Account | Margin Account |

|---|---|---|

| Funding Source | Must use own funds for full payment | Can borrow from broker to buy securities, paying interest |

| Trading Scope | Allows stocks, ETFs, funds; no shorting/overdrafts, some restrict options | Supports shorting, day trading, advanced options strategies |

| Trading Rules | T+3 settlement, cannot retrade same security before settlement, max 3 GFV violations | Allows trading with unsettled funds, flexible day trading, but must maintain margin or face forced liquidation |

| Risk | Lower risk, no borrowing risk | High leverage risk, potential margin calls or forced liquidation exceeding principal |

| Suitable For | Beginners or those avoiding complex operations | Experienced investors willing to take higher risks |

Opening a margin account requires a minimum net asset value (typically $2,000), and frequent day trading requires over $25,000 in assets. Margin accounts suit experienced investors willing to take higher risks.

Account Opening and Operations

Broker Selection

Choosing the right broker is crucial during the U.S. stock trading basics stage. Evaluate brokers based on:

- Broker Reputation: Choose reputable brokers to ensure trading safety.

- Fee Transparency: Understand and compare fee structures to avoid hidden costs.

- Platform Stability: Ensure the trading platform is reliable to minimize disruptions.

- Account Types: Choose cash or margin accounts based on risk and return preferences.

- Funding Requirements: Check minimum deposit thresholds to match your financial situation.

Mainstream brokers supporting Chinese investors include U.S.-based and Chinese/Hong Kong brokers. The table below compares account opening support and fees:

| Broker Type | Representative Brokers | Account Opening Support and Requirements | Fees and Commissions |

|---|---|---|---|

| U.S.-Based Brokers | BBAE, Firstrade, Interactive Brokers, Charles Schwab | Mostly zero or low commissions, funding via wire transfer, platforms may not suit Chinese investors | Low or zero commissions, high wire transfer fees |

| Chinese/HK Brokers | Zero Securities, Futu Securities, Longbridge Securities | Zero Securities requires no overseas proof, Futu needs overseas living/working proof, Longbridge requires work visa (mostly closed) | Fees vary; Zero lower, Futu higher, Longbridge restrictive |

Account Opening Steps

You can follow these steps to open a U.S. stock account:

- Choose a suitable broker or trading platform, considering regulation, services, and commissions.

- Prepare identity proof (e.g., passport or ID), address proof (utility bill or bank statement), and W-8BEN form.

- Complete the online application, setting username, password, and PIN.

- Upload scanned documents for identity verification.

- Complete risk assessment and identity authentication.

- After approval, some brokers may require mailing original documents.

- Fund the account to activate it.

When opening an account, prepare proof documents like utility bills from the past three months. If you have a Hong Kong ID, address proof verification may be waived.

Funding and Withdrawal

After opening an account, you need to fund your U.S. stock account. Common funding methods include bank wire transfers, ACH transfers, and checks. Bank wire transfers typically take 1-2 business days, with fees varying by broker, usually higher. ACH transfers take longer but have lower fees. You can also use Hong Kong bank accounts for securities transfers, with some brokers supporting instant transfers. For withdrawals, banks supporting securities transfers enable instant receipt, while others vary by timing, with the fastest arriving same-day. Some brokers offer convenient funding/withdrawal platforms, simplifying processes, reducing fees, and improving capital efficiency.

Order Types

During U.S. stock trading basics, you’ll encounter various order types. Common types are shown below:

| Order Type | Use Case | Main Risks |

|---|---|---|

| Market Order | Suitable for investors wanting instant execution, less sensitive to price | Price jumps may lead to unfavorable execution |

| Limit Order | Suitable for setting target prices for high-low trading | May miss execution, losing opportunities |

| Stop Order | Prevents loss expansion by auto-selling stocks | Execution price may be suboptimal after triggering |

Choose order types based on market conditions and risk tolerance. Market orders suit speed seekers, limit orders suit those with clear price targets, and stop orders help manage risk.

Common Issues

Beginners in U.S. stock trading often face these pitfalls:

- Blindly chasing highs or selling lows, with emotional trading leading to losses.

- Ignoring fundamental analysis, overly relying on technical indicators.

- Neglecting continuous learning and investment knowledge accumulation, impacting long-term returns.

- Overlooking the importance of stop and limit orders, failing to secure profits or limit losses.

- Trading with unsettled funds, risking account restrictions.

Avoid these errors, focus on risk management, and enhance knowledge to grow steadily in the U.S. stock market.

Investment Strategies and Products

Image Source: pexels

Stock Investment

In the U.S. market, you can directly buy listed company stocks, known as stock investment. This makes you a shareholder, entitled to dividends and voting rights. You can hold quality companies long-term, sharing in their growth. According to Sina Finance on August 13, 2024, the U.S. stock market’s average annualized return from 2010 to date is 12.3%. Goldman Sachs’ October 2024 report predicts the S&P 500’s average annualized return over the next decade may be only 3%, reflecting lower future returns in a high-valuation environment. Historical data shows the U.S. market’s 80-year average valuation is 14x, rising from 20x to 30x over the past decade. Long-term, stock investment yields an average annualized return of about 10%.

Stock investment requires significant capital, suiting investors with substantial funds seeking long-term stable returns. Focus on company fundamentals, industry position, and valuation. You can buy or sell stocks via broker platforms, enjoying the security of real asset ownership. Stock investment does not support leverage, keeping risks relatively low but less flexible.

Tip: When choosing stock investment, prioritize industry leaders and financially healthy companies, avoiding chasing hot trends.

ETF Investment

ETFs (exchange-traded funds) are funds listed on exchanges, traded like stocks. You can invest in a basket of stocks through ETFs, achieving risk diversification. ETFs cover indices, sectors, themes, and factors. In 2024, U.S. equity ETFs total about $7 trillion, with Smart Beta ETFs at $1.82 trillion, accounting for 26%. The market is highly concentrated, with the top 10 ETFs holding 40% of assets, managed primarily by BlackRock, Vanguard, and Invesco, accounting for nearly 70% of the market.

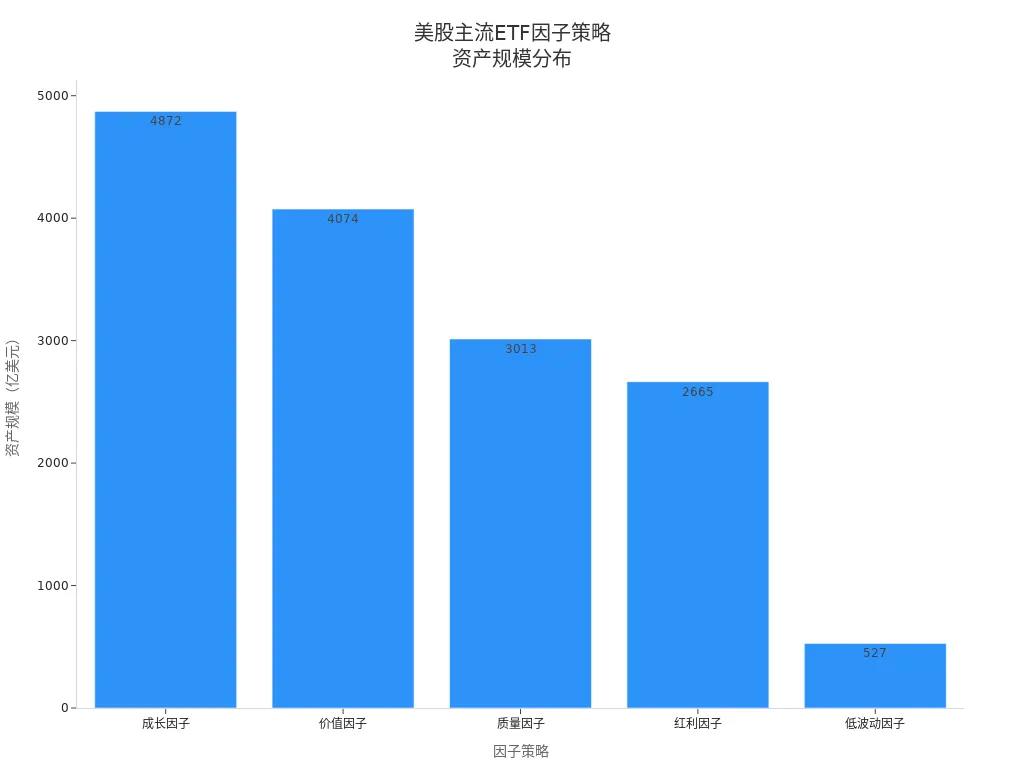

The table below shows asset sizes and representative products for mainstream U.S. ETF factor strategies:

| Factor Strategy | Asset Size ($B) | Representative ETFs | Key Features |

|---|---|---|---|

| Growth Factor | 4,872 | VUG, IWF, IVW, SCHG, SPYG | Driven by earnings growth, tech-heavy, 100%-136% 5-year returns |

| Value Factor | 4,074 | VTV, IWD, IVE, VBR, SPYV | Focus on valuation, large/small caps, over 165% 10-year returns |

| Quality Factor | 3,013 | QUAL, DGRO, FNDX, MOAT, SPHQ | Financially healthy, blue-chip focus, ~13% annualized 10-year returns |

| Dividend Factor | 2,665 | VIG, VYM, SDY, DVY, NOBL | Stable dividends, defensive, over 175% 10-year returns |

| Low Volatility | 527 | USMV, SPLV | Risk control, low volatility, suits volatile markets |

| Multi-Factor | N/A | 214 products, 30% of total | Combines multiple factor strategies, most numerous |

When choosing ETF investment, you can achieve diversified investing with a low capital threshold. ETFs are flexible, with low fees, suiting investors seeking stable growth and risk diversification. You can select ETFs based on risk tolerance, such as growth, value, or dividend types. ETFs are ideal for beginners as a starting point for U.S. stock investment.

Tip: When selecting ETFs, focus on the fund manager, tracking error, and liquidity, prioritizing large-scale, high-volume mainstream products.

CFD Contracts

CFDs (Contracts for Difference) are derivative instruments allowing you to speculate on U.S. stock prices without owning the stocks. CFDs support long and short positions, with leverage to amplify returns. Platforms like Bybit offer CFDs on 78 U.S. stocks, with up to 5x leverage. You only need a low margin to participate, suiting investors with limited funds seeking high flexibility.

Key CFD risks include:

- Leverage Risk: Up to 5x leverage amplifies gains but also losses, with forced liquidation if account margin falls below 50%, potentially at unfavorable prices.

- Liquidity and Execution Risk: ECN spread structure, opaque liquidity and order execution, with possible slippage in extreme markets.

- Asset Rights Limitation: You don’t own the underlying stocks, missing shareholder rights; cash dividends adjust based on position direction, with no stock dividends.

- Regulatory Compliance: Some platforms restrict CFD services for U.S., Japan, etc., users; you must confirm compliance.

- Holding Cost Risk: Trading involves spreads, commissions, and overnight interest, eroding long-term returns.

When choosing CFDs, you need strong risk tolerance and trading experience. CFDs suit short-term trading and swing trading, not recommended for beginners holding long-term.

Note: CFDs are not suitable for long-term investment due to high risks; participate cautiously after understanding product characteristics and risks.

Strategy Comparison

You can choose stocks, ETFs, or CFDs as primary U.S. market investment methods. The table below compares their advantages and disadvantages:

| Investment Type | Advantages | Disadvantages |

|---|---|---|

| Stocks | Mature trading, real asset ownership | High capital needs, lacks leverage flexibility |

| ETFs | Diverse products, flexible trading | Possible premium/discount, market volatility impact |

| CFDs | Bidirectional trading, high leverage | No asset ownership, high risk, suits short-term |

Choose strategies based on your capital size, risk tolerance, and goals. For long-term stable growth, stocks and ETFs are better. For short-term trading with leveraged returns, try CFDs but manage risks.

Recommendation: Beginners should prioritize ETFs or stocks, gaining experience before exploring high-risk CFDs.

Target Selection

When selecting U.S. stock investment targets, consider these core metrics:

- Fundamental Analysis: Focus on revenue, net profit, and balance sheet structure to assess financial health and profitability.

- Industry Position: Prioritize industry leaders with competitive advantages and pricing power.

- Valuation Metrics: Use P/E and P/B ratios to judge price reasonableness.

- Macro Environment and Industry Cycles: Choose outperforming industries based on economic expansion or contraction phases, e.g., consumer and tech in expansions, defensive sectors in recessions.

- Market Trends: Assess overall market direction, selecting strong sectors or avoiding high-risk assets.

- Technical Analysis Indicators: Use moving averages, RSI, and MACD to aid timing and price trend decisions.

Combine fundamental and technical analysis for a scientific selection strategy. Beginners should focus on large blue-chip stocks and mainstream ETFs, gradually building experience.

Tip: Research target companies or ETFs thoroughly before investing, avoiding impulsive or emotional decisions.

Advantages and Risks

Market Advantages

Investing in the U.S. market offers globalization and high liquidity advantages:

- S&P 500 companies, with global operations, derive 41% of revenue from non-U.S. sources, diversifying income and mitigating U.S. economic fluctuations.

- Information technology and materials industries have over 50% overseas revenue, showing strong international competitiveness.

- The U.S. market is highly open, with over 530 international leaders from 48 countries listed on the NYSE.

- As of July 2025, the U.S. market has over 14,000 listed companies, with 1,080 headquartered or registered outside the U.S., far more internationalized than other developed markets.

- The open market mechanism provides broad financing channels for global companies, allowing investors to share in global economic growth.

Key Risks

When investing in U.S. stocks, monitor multiple risks. The table below summarizes common risks and historical cases:

| Key Risk Factors | Description and Historical Cases |

|---|---|

| Fed Tightening | 2004-2006 rate hikes from 1% to 5.25% triggered the housing bubble burst, leading to the 2008 financial crisis. |

| Housing Bubble Burst | 2006 housing price decline sparked the subprime crisis, with Lehman Brothers’ bankruptcy. |

| High Valuation Risk | 1929 Great Depression, 1987 crash, 2000 dot-com bubble driven by overvaluation. |

| Trade Tariff Policy | Tariffs create uncertainty, potentially exacerbating inflation and stagflation risks. |

| International Tensions | Political-economic tensions increase market volatility and investment risks. |

| Earnings Downgrades | Lower corporate earnings expectations pressure stock prices. |

| Inflation and Stagflation | Rising inflation and stagflation risks impact market performance. |

Risk Management

Manage investment risks with these methods:

- Monitor global political and geopolitical risks, adjusting positions timely.

- Closely track Fed rate adjustments and monetary policy changes.

- Analyze industry cycles and future trends, selecting promising sectors.

- Stay rational, avoiding emotional trading.

- Control position sizes and risk exposure, preventing over-concentration in single assets.

- Use leverage cautiously, understanding your risk tolerance and setting strict risk controls.

Tip: Regularly review your portfolio to identify and address potential risks.

Investment Cases

The U.S. market has faced multiple major risk events. For example, during the 2000 dot-com bubble, tech stock prices soared then crashed, with many internet companies collapsing. In 2008, the financial crisis saw Lehman Brothers’ bankruptcy and Wall Street’s downturn. Yet, the U.S. market has repeatedly recovered post-crisis, showing strong resilience. When investing, learn from history, prioritize risk management, and progress steadily amid volatility.

You can enhance U.S. stock investment skills through continuous learning and practice. Develop a long-term plan, focusing on risk management. Each trade is a growth opportunity.

On your investment journey, continuous learning and rational thinking will take you further. Start your U.S. stock investment now!

FAQ

What documents are needed for U.S. stock account opening?

You need a passport or ID, address proof (e.g., Hong Kong bank statement), and W-8BEN form. Some brokers require utility bills from the past three months. Complete documents ensure a smoother process.

Is there a minimum funding requirement for U.S. stock trading?

Most brokers have no strict minimum funding requirement. Some U.S. brokers may require a minimum of $100 (USD); check the broker’s website for specifics.

What taxes apply to U.S. stock trading?

You pay a dividend tax (typically 10%), plus SEC and trading activity fees on stock sales. Additional broker-specific fees may apply, so review in advance.

Which currencies are supported for U.S. stock trading?

You typically trade in USD. Hong Kong bank accounts can directly exchange to USD, with some brokers supporting multi-currency deposits, ultimately converted to USD.

How to arrange U.S. stock trading hours?

Regular trading hours are 9:30 PM to 4:00 AM Beijing time (DST) or 10:30 PM to 5:00 AM (standard time). Pre-market and after-hours trading are available but have lower liquidity.

This article provides a comprehensive analysis of the fundamental rules and popular strategies for U.S. stock trading. However, regardless of how sophisticated your trading strategy is, the issue of fund transfer is unavoidable. For many Chinese investors, the primary challenge in starting their investment journey is how to securely and efficiently transfer funds from their domestic accounts to a U.S. stockbroker. The cumbersome process of opening an overseas account, high wire transfer fees, and uncertain arrival times can all become barriers to your global asset allocation.

Now, you can choose a simpler and more efficient solution. BiyaPay is designed for global investors, offering a one-stop, seamless financial service. We support the mutual conversion of various fiat and digital currencies and provide a real-time exchange rate query service to ensure every transfer is worthwhile. With remittance fees as low as 0.5% and same-day delivery, we help you significantly save on transaction costs and time. What’s more, our platform supports you to invest in both U.S. and Hong Kong stock markets from a single account without the need for an overseas bank account. Register with BiyaPay today to bid farewell to complicated cross-border remittance processes and easily embark on your global investment journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.