- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

U.S. Stock Trading Platforms for Chinese Investors Analysis

Image Source: pexels

When selecting a U.S. stock trading platform, you’ll encounter options like Interactive Brokers, Futu Securities, Tiger Brokers, Charles Schwab, Firstrade, moomoo, Changfu International, Moomoo Securities, East Money International, and iFast International. Different platforms cater to different investor types. For example, Futu Securities has 5.3 million users, and Tiger Brokers has 1.6 million registered users, both popular among investors under 35. The table below shows user data for select platforms:

| Trading Platform | Total Users | Active Trading Users | Market Share | Notes |

|---|---|---|---|---|

| Futu Securities | 5.3 million | 124,000 | N/A | Targets Chinese investors |

| Tiger Brokers | 1.6 million | N/A | 58.4% (2017) | 71.5% of traders under 35 |

When choosing a platform, consider these factors:

- Trading Fees

- Platform Usability

- Broker Security

- Account Opening Process

- Advantages of Hong Kong Brokers or Banks

- Advantages of Online Brokers

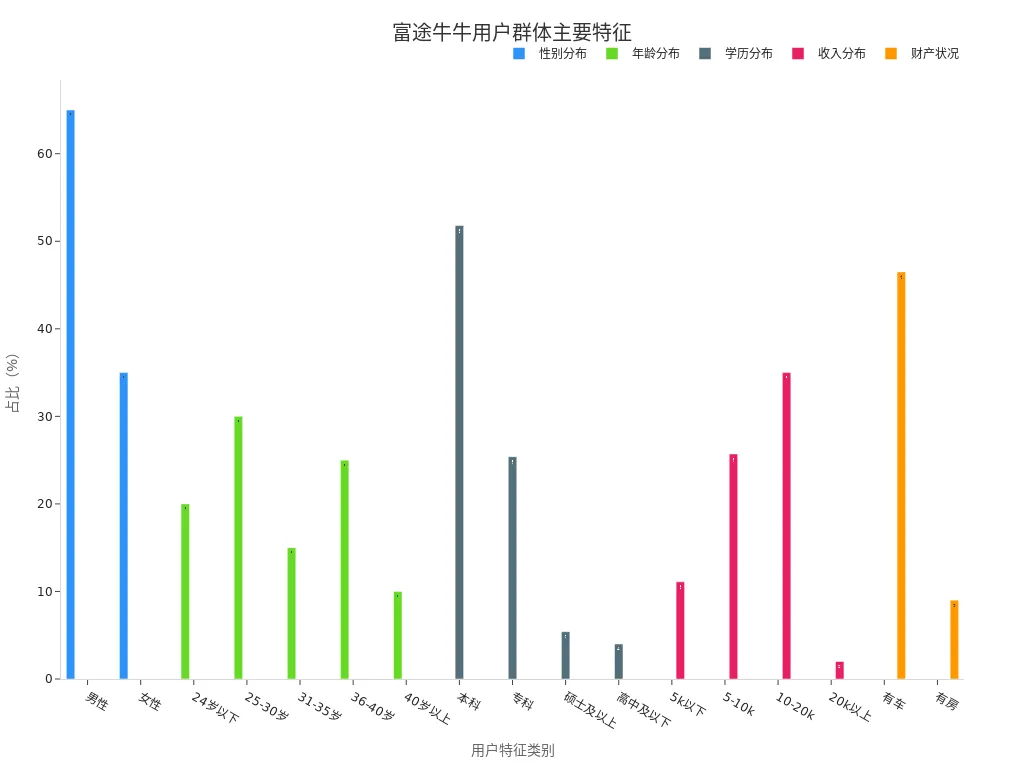

Futu Securities’ users are primarily young to middle-aged, well-educated, and higher-income individuals, with products covering education, account opening, and trading, ideal for investors seeking a one-stop service.

Key Points

- When selecting a U.S. stock trading platform, focus on trading fees, Chinese language support, security, and account opening processes to ensure ease of use and fund safety.

- Different platforms suit different investors: beginners can choose Firstrade, iFast International, or moomoo; intermediate investors may prefer Futu Securities or Tiger Brokers; professional investors should consider Interactive Brokers or Charles Schwab.

- Multiple funding and withdrawal methods are available; Hong Kong bank transfers are fast and low-cost, enhancing capital efficiency.

- Quality platforms typically offer robust trading tools and real-time market data, helping investors seize market opportunities and improve their experience.

- U.S. stock investments require risk management; choose regulated platforms, enable two-factor authentication, diversify investments, and continuously improve investment skills.

Recommended U.S. Stock Trading Platforms

Image Source: pexels

Interactive Brokers

You can choose Interactive Brokers for U.S. stock trading. It supports Chinese investors with a straightforward account opening process, requiring no proof of existing assets. You can invest in U.S. Treasuries and other global assets. Idle funds in your account can earn approximately 4.1% interest. Interactive Brokers offers 24-hour global market trading, covering over 10,000 securities. You also benefit from up to $2.75 million in fund insurance. The platform provides multiple trading software options, catering to different investor needs. Professional investors can use API interfaces for automated trading.

Futu Securities

Futu Securities is highly popular among Chinese investors. You can use the Futu NiuNiu App for a seamless U.S. stock trading experience. Operating in Hong Kong, the U.S., and Singapore, Futu has seen its U.S. stock trading volume grow 84.1% year-over-year. It offers diverse asset trading and rich investment education content. You can enjoy commissions as low as 0.03% and fast trading channels. Futu provides multilingual customer support and AI-driven services to enhance your experience. However, some Chinese users report delays in withdrawals, and compliance risks should be noted.

Tiger Brokers

If you prefer a full Chinese interface and convenient services, Tiger Brokers is a great choice. It supports long and short positions and options trading with robust features. The account opening process is simple, with commissions as low as $0.01 per share. Tiger Brokers offers real-time U.S. stock market data and an online investment community. It integrates U.S., Hong Kong, and A-share funds, ensuring strong liquidity. Your assets are regulated by the SEC and protected by multiple insurance layers. Tiger Brokers suits young, higher-income investors.

Charles Schwab

Charles Schwab offers full Chinese-language phone support and a robust trading network. You can access Chinese-speaking investment advisors at many branches. It provides diverse investment products, including funds, ETFs, options, and fixed-income products. You can use its online platform for one-stop services. Charles Schwab applies a flat commission rate, ensuring consistent service quality regardless of investment size. You also benefit from robo-advisory and satisfaction guarantee services.

Firstrade

Firstrade provides a full Chinese interface and 24/7 customer service. You only need an ID to open an account, with no minimum deposit. It supports web and mobile trading, offering stocks, ETFs, options, and bonds. You can enjoy commission-free trading, reducing costs. Firstrade offers diverse order types and margin trading to meet various needs. You also get free market research reports and educational resources.

moomoo

moomoo is ideal if you seek intelligent and user-friendly trading. It offers commission-free trading and robust investment tools with a Chinese interface and simple account opening. You access real-time market data and diverse products. moomoo’s active investment community and rich market insights help improve your skills.

Changfu International

Changfu International primarily serves high-net-worth individuals and families. If you focus on family wealth management, it’s a strong choice. Emphasizing “wealth creation and preservation,” it offers risk diagnostics, tailored solutions, and ongoing support. You can engage in family legacy planning and long-term wealth management with its professional team and extensive resources, ideal for entrepreneurs and industry elites.

Moomoo Securities

Moomoo Securities offers a simple interface and rich trading features. You can access real-time market data and in-depth insights to stay on top of market trends. It supports multiple trading methods, suiting investors who prefer straightforward operations. While less known than Tiger Brokers or Futu, it’s popular among Chinese investors.

East Money International

East Money International leverages East Money’s strong financial services background, offering a convenient U.S. stock trading platform. You benefit from Chinese support and diverse investment products. It’s ideal for investors seeking one-stop global asset management, with rich market data and insights.

iFast International

iFast International provides a full Chinese interface and streamlined account opening. You can trade U.S., Hong Kong, and other markets through its platform. It focuses on user experience, suiting beginners and moderately experienced investors. You access real-time market data and diverse tools to boost efficiency.

Core Features and Needs

Chinese Language Support

When choosing a U.S. stock trading platform, Chinese language support is crucial.

- Chinese interfaces and customer service help you quickly resolve account opening and trading issues.

- Chinese support improves response speed and professionalism, directly enhancing your trading experience.

- Mainstream platforms like Futu Securities, Tiger Brokers, and Webull offer Chinese interfaces and services for ease of use.

- Beyond fees, consider Chinese support and platform stability to improve investment efficiency.

Account Opening Thresholds

When opening an account, note the varying thresholds.

- Minimum funding requirements range from $500 to $10,000, with some margin accounts requiring $25,000.

- Age requirement is generally 18 or older.

- You need to provide ID and address proof.

- Most platforms support online account opening, though some require mailing original documents.

- Funding methods often include wire transfers, with some platforms supporting local bank deposits for convenience.

Trading Fees

U.S. stock trading platforms are trending toward commission-free and low platform fees. Choosing a low-cost platform reduces investment costs. For instance, moomoo offers permanent zero commissions and platform fees in Singapore. Tiger Brokers claims commission-free trading but charges $0.005 per share platform fees, with a $1 minimum per order. Mainstream platforms have transparent, competitive fee structures, driven by market competition.

Funding and Withdrawals

You can fund and withdraw through multiple methods.

| Method | Processing Time | Fees (USD) |

|---|---|---|

| Credit/Debit Card | Instant | Varies by bank |

| International Wire | 1-3 business days | 20-50 |

| HK Bank FPS | Instant | Free |

| USD Withdrawal | 1-2 business days | 10-20 |

| HKD Withdrawal | 1-2 business days | Free |

Interactive Brokers partners with Velocity Clearing, supporting ACH transfers with instant deposits and fees as low as $1-5. Withdrawals can be transferred to global banks, offering high efficiency and low costs.

Trading Tools

When selecting a platform, consider the richness of trading tools.

| Platform | Key Tools and Features | Target Users |

|---|---|---|

| QMT (Xuntou) | High-speed data, strategy trading, basket trading | High-performance traders |

| PTrade (Hengseng) | Smart trading, grid trading | Strategy-focused traders |

| Mobile App | Real-time data, community, events | Convenience seekers |

| PC Platform | Multi-screen monitoring, advanced analysis | Heavy traders |

Market Data

You need to focus on the real-time accuracy of market data.

- U.S. stock market APIs provide millisecond-level real-time data, meeting high-frequency trading needs.

- Multi-node CDN and load balancing ensure stable data transmission.

- AllTick API averages 170ms latency, ideal for those needing high real-time performance.

- Reliable market data services help you seize market opportunities.

Fund Security

For fund security, choose platforms with strict compliance measures. Platforms require ID and asset proof, using encryption to protect your data. Client funds are segregated from company funds, and platforms undergo regular regulatory audits. Some join investor compensation funds, ensuring your funds are safe in extreme scenarios.

Customer Service

Quality customer service is critical when issues arise. Mainstream platforms offer 24/7 Chinese support via phone, online chat, and email. You can get help with account opening, trading, and funding/withdrawals. A robust customer service system ensures your investment experience and rights are protected.

Platform Pros and Cons Comparison

Image Source: pexels

Interactive Brokers Pros and Cons

Interactive Brokers excels in security and compliance, regulated by the SEC and FCA, with advanced encryption for data protection. Client funds are segregated, ensuring safety even if the company faces issues.

- Pros:

- Supports major global markets, enabling one-stop multi-market investing.

- Transparent fees, ideal for high-frequency and large-fund trading.

- Stable platform with robust risk management, suiting professional investors.

- Cons:

- Complex interface, challenging for beginners.

- Limited Chinese customer support, potentially causing communication issues.

- Lengthy account opening with extensive documentation and longer review times.

| Aspect | Pros | Cons |

|---|---|---|

| Trading Fees | Low costs, suits high-frequency/large funds | None |

| Chinese Support | N/A | Limited Chinese support |

| Account Opening | N/A | Complex process, long review |

| Trading Features | Diverse products, stable platform | N/A |

| Market Coverage | Supports major global markets | N/A |

If you prioritize ultimate security and global asset allocation, Interactive Brokers is a strong U.S. stock trading platform.

Futu Securities Pros and Cons

Futu Securities offers a full Chinese interface and 24/7 Chinese support, reducing language and operational barriers. Its proprietary system covers account opening, fund management, market data, trading, news, and settlement, ensuring secure and stable operations.

- High security: Device locks, two-factor authentication, and data vaults protect accounts.

- Advanced technology: Low-latency trading system, stable under high volumes.

- One-stop service: Fully online account opening, as fast as 3 minutes to register and 1 hour to complete.

- Comprehensive features: U.S./HK stock LV2 data, news, live streams, and courses.

- Strong user experience: Rapid product updates, multi-device support, 98% client retention.

- Cons:

- Slower withdrawal processes, with compliance risks to monitor.

- Some advanced features require payment, suiting moderately experienced investors.

If you value Chinese support and a one-stop experience, Futu Securities is an excellent U.S. stock trading platform.

Tiger Brokers Pros and Cons

Tiger Brokers uses proprietary technology, offering a trading interface with fundamental, technical, and community features. Account opening takes minutes, with approvals in 1-3 business days.

- Pros:

- Low commissions, HK stocks at 0.029% plus fixed fees, ideal for smaller funds.

- No upper limit on fund transfers, no extra fees, multiple funding methods.

- New clients receive free stocks and LV2 market data.

- Strong community features aid learning.

- High R&D investment ensures innovation and security.

- Cons:

- UI and user experience need improvement, especially for younger users.

- Complex features increase learning curve for new users.

- Revenue structure is single, with some advanced features requiring payment.

- Limited Hong Kong market coverage.

If you value rich trading tools and community interaction, Tiger Brokers is worth trying.

Charles Schwab Pros and Cons

Charles Schwab offers full Chinese phone support and diverse investment products.

- Fund security: Stable asset allocation and bank deposit management ensure safety, with low-risk held-to-maturity securities.

- Customer service: Offers “quality guarantee” and “satisfaction guarantee,” with refunds for unsatisfactory fees or commissions.

- Fee advantage: Zero commissions for U.S. stocks, ETFs, and options, supports fractional shares.

- Brand culture: Prioritizes client interests, with a strong service ethos.

- High efficiency: Large client base reduces operating costs, improving experience.

- Cons:

- Complex account opening, with some services requiring funding thresholds.

- Limited Chinese interface and documentation, some operations require English.

Firstrade Pros and Cons

Firstrade’s account opening is simple, with no minimum funding or account management fees.

- Easy account opening: Full Chinese web and phone support, applications completed in minutes.

- Funding: Clear guidance on remittance details, improving success rates.

- Trading fees: Fixed $6.95 per trade, simple and transparent, suiting smaller investors.

- Strong Chinese support: Ideal for retail investors, with fast customer service.

- Cons:

- Fixed fees are costly for high-frequency, small trades.

- Platform features are basic, best for beginner investors.

moomoo Pros and Cons

moomoo offers commission-free trading and rich investment tools.

- Pros:

- User-friendly Chinese interface, simple account opening.

- Real-time market data and diverse products, ideal for tech-savvy investors.

- Active investment community with rich market insights.

- Cons:

- Some advanced features require payment.

- Customer service response times need improvement.

Changfu International Pros and Cons

Changfu International serves high-net-worth individuals and families.

- Pros:

- Focuses on family wealth management and legacy planning, highly professional.

- Offers risk diagnostics and tailored solutions, ideal for entrepreneurs and elites.

- Strong team and resources, with consistent service.

- Cons:

- Limited to high-net-worth clients, less accessible to average investors.

- Higher fee structure and thresholds.

Moomoo Securities Pros and Cons

Moomoo Securities provides a simple interface and robust trading features.

- Pros:

- Real-time data and in-depth insights for market tracking.

- Multiple trading methods, user-friendly operations.

- Suits those preferring simplicity.

- Cons:

- Less brand recognition than major platforms.

- Limited customer service and community resources.

East Money International Pros and Cons

East Money International leverages a strong financial services background for convenient U.S. stock trading.

- Pros:

- Strong Chinese support, diverse products.

- One-stop global asset management with rich market data.

- Cons:

- Basic platform features, suiting beginner to intermediate investors.

- Limited advanced tools.

iFast International Pros and Cons

iFast International offers a full Chinese interface and streamlined account opening.

- Pros:

- Supports U.S., Hong Kong, and multi-market trading.

- User-focused, ideal for beginners and moderately experienced investors.

- Real-time data and diverse tools boost efficiency.

- Cons:

- Limited advanced features and data depth.

- Community and news services need improvement.

Target Audience Comparison

When choosing a U.S. stock trading platform, align with your experience and needs.

- Beginners: Firstrade, iFast International, moomoo—user-friendly interfaces, easy account opening, strong Chinese support.

- Intermediate Investors: Futu Securities, Tiger Brokers, East Money International—rich features, multi-market trading.

- Professional Investors: Interactive Brokers, Charles Schwab—high security, broad global market coverage, ideal for high-frequency/large funds.

- High-Net-Worth/Family Wealth: Changfu International—customized services, extensive resources.

Choose a platform based on your funds, habits, and service needs.

Key Parameters Comparison Table

| Platform | Commission (U.S. Stocks) | Minimum Deposit | Products and Features |

|---|---|---|---|

| Interactive Brokers | $0.005/share | $0-$10,000 | Global markets, high-frequency/large funds, secure |

| Futu Securities | $0.003/share | $0 | Full Chinese support, fast account opening, robust |

| Tiger Brokers | $0.01/share, min $2.99/trade | None | Multi-market, active community, strong regulation |

| Charles Schwab | $0/trade | $1,000 | High security, zero commissions, long-term focus |

| Firstrade | $6.95/trade | None | No account fees, easy opening, beginner-friendly |

| moomoo | $0/trade | $0 | Zero commissions, smart tools, young user focus |

| Changfu International | Customized | $10,000+ | Family wealth management, elite-focused |

| Moomoo Securities | $0.01/share | $0 | Simple interface, rich insights, user-friendly |

| East Money International | $0.01/share | $0 | One-stop global assets, strong Chinese support |

| iFast International | $0.01/share | $0 | Multi-market, beginner-friendly, efficient tools |

Compare commissions, minimum deposits, and features to select the best platform.

Selection Advice

How to Screen Platforms

When choosing a U.S. stock trading platform, consider these steps:

- Define your investment goals, such as long-term holding or short-term trading.

- Compare platform fees and minimum deposits, using a table to track structures.

- Check for Chinese interfaces and customer support for faster issue resolution.

- Verify platform security, including regulatory credentials and fund segregation.

- Ensure market data and tools meet your investment needs.

Tip: Use a demo account to test platform operations and features.

Account Opening Notes

Prepare ID and address proof for account opening. Most platforms offer online processes, but note:

- Ensure information is accurate and complete.

- Use high-resolution images for document uploads.

- Hong Kong bank transfers are fast and low-cost for funding.

- Save account opening and funding records for reference.

Risk Management

U.S. stock investing offers opportunities but carries risks. Be cautious:

- Choose regulated platforms to ensure fund safety.

- Avoid high-return promises and beware of scams.

- Limit investment amounts, avoiding over-concentration in one product.

- Regularly check account security settings and enable two-factor authentication.

Enhancing Investment Experience

Improve your experience with these steps:

- Use platform learning resources and communities to build knowledge.

- Follow market insights and analysis reports to stay informed.

- Contact customer service promptly to resolve issues.

- Regularly review trades to optimize strategies.

Selecting the right platform and continuously learning will smooth your U.S. stock investment journey.

Choose a U.S. stock trading platform based on your habits, fund size, and service needs. Each platform has unique strengths and weaknesses, catering to different audiences. Focus on Chinese support, fees, security, and one-stop services. Avoid following trends blindly and prioritize platforms suiting your needs. Continuously learn U.S. stock investment knowledge to enhance risk awareness and skills.

FAQ

What documents are needed for U.S. stock trading account opening?

You need ID, address proof, and sometimes Hong Kong bank account details. Ensure all documents are valid and accurate.

What are common funding methods for U.S. stock accounts?

Options include Hong Kong bank transfers, international wires, or third-party payments. Hong Kong transfers are fast and low-cost. International wires take 1-3 business days.

Are U.S. stock trading platforms secure?

Regulated platforms (U.S. or Hong Kong) segregate client funds from company assets. Some offer investor protection insurance for added security.

What fees apply to U.S. stock trading?

You typically pay commissions, platform fees, and transfer fees. Some platforms offer zero commissions but may charge other small fees. Review fee disclosures carefully.

How to access Chinese customer support?

Contact support via platform apps, website live chat, or phone. Mainstream platforms generally provide 24/7 Chinese support to address your issues.

This article provides a detailed comparison of various U.S. stock trading platforms, offering valuable insights for different types of Chinese investors. However, no matter which broker you choose, you’ll face a core challenge: how to safely and efficiently transfer funds from China to your U.S. brokerage account. Traditional bank wire transfers are often accompanied by high fees, long transfer times, and complex procedures, which are significant pain points for investors who want to seize opportunities in the fast-moving U.S. market.

Now, there’s a financial tool designed specifically to solve this problem. BiyaPay is dedicated to providing you with seamless global financial services. We support the conversion between various fiat and digital currencies and offer a real-time exchange rate query to ensure you get the best rate for every dollar. With remittance fees as low as 0.5% and same-day delivery, we significantly reduce your transaction costs and help you quickly capitalize on investment opportunities in the U.S. stock market. What’s more, our platform enables you to invest in both U.S. and Hong Kong stock markets from a single account, all without the need for a complex overseas bank account. Say goodbye to complexity and embrace efficiency. Register with BiyaPay today to start a new era of global investment.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.