- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Credit Card APR Explained: How U.S. Credit Card Rates Are Calculated

Image Source: pexels

Credit card APR, or Annual Percentage Rate, is the yearly interest rate that measures the cost of borrowing on your credit card. You can estimate interest expenses with this formula: Interest = (APR ÷ 365) × Average Daily Balance × Days. The average APR for U.S. credit card users has reached 20.72%, rising to approximately 22% in 2025, the highest since 1996. Higher APRs increase your borrowing costs. Understanding credit card APR helps you assess the true cost of each dollar borrowed, avoiding unnecessary interest burdens.

Key Points

- Credit card APR is the annual interest rate reflecting the true cost of borrowing; higher APRs mean heavier interest burdens.

- U.S. credit card interest is calculated based on the average daily balance and billing cycle, with unpaid balances accruing compound interest.

- APR types include purchase APR, cash advance APR, balance transfer APR, and penalty APR, with cash advance and penalty APRs typically higher.

- 0% APR promotional periods offer interest-free borrowing but require full repayment within the term to avoid sharp rate increases.

- Paying in full on time and managing billing dates effectively can avoid interest, while strategic use of promotional rates reduces repayment pressure.

What is Credit Card APR?

Image Source: pexels

Definition and Purpose

- You can think of APR as the Annual Percentage Rate, or the yearly cost of borrowing.

- When applying for a credit card, banks use APR to inform you of the total annual cost of borrowing.

- The APR is expressed as a percentage, e.g., 22%, meaning borrowing $100 for a year costs $22 in interest.

- Credit card APR includes not just the base interest rate but also certain additional fees.

- Comparing APRs across cards helps you quickly identify which card has lower borrowing costs.

APR’s primary role is to measure the interest you pay on unpaid credit card balances. Paying in full each month minimizes APR’s impact. If you carry a balance, APR directly affects your interest costs. The U.S. financial system emphasizes credit history, and APR influences your credit behavior and score. APRs vary widely by card type; for example, secured cards may have APRs up to 25%, while unsecured cards can be as low as 10%.

Included Fees

When examining credit card APR, note that it’s not just interest. APR typically includes:

- Base Interest: Charged on unpaid balances daily.

- Annual or Management Fees: Some cards include annual fees in the APR calculation.

- Other Fees: Such as account opening or service fees.

You can use APR as a standardized metric to compare the true borrowing costs across banks and card products. For instance, APRs for Hong Kong versus U.S. banks may differ due to varying fee structures.

APR vs. Nominal Rate vs. Effective Annual Rate

When choosing a card, you’ll encounter nominal rate (APR) and effective annual rate (EAR or IRR). Key differences are:

| Metric | Description | Includes Compounding | Includes Fees | Purpose |

|---|---|---|---|---|

| Nominal Rate (APR) | Published annual rate, total fees divided by principal | No | Yes | Compare total costs across products |

| Effective Annual Rate (EAR/IRR) | Accounts for compounding and time value, reflecting true cost | Yes | Yes | Shows actual total cost paid |

Note that APR is a standardized metric banks disclose for easy comparison, but the effective annual rate is higher due to compounding and time value. For example, a card with a 9% APR for installments may have an effective rate of 16.43%. When selecting a card, consider both APR and effective rates.

Credit Card APR Calculation

Calculation Formula

When using a U.S. credit card, banks calculate interest with this standard formula:

Interest = Average Daily Balance × Number of Days in Billing Cycle × (APR ÷ 365)

Follow these steps to understand the process:

- The bank tracks your daily outstanding balance during the billing cycle.

- These daily balances are summed and divided by the number of days in the cycle to get the Average Daily Balance.

- Multiply the Average Daily Balance by the number of days, then by the APR, and divide by 365 to calculate the interest for the period.

APR is an annual percentage rate, typically shown as a percentage (e.g., 22%). Different APR types apply to different balances, such as purchases, cash advances, balance transfers, or penalties.

Average Daily Balance and Billing Cycle

The most common U.S. credit card interest calculation method is the Average Daily Balance method. Your daily overdraft amounts are recorded throughout the billing cycle. The bank sums these amounts and divides by the cycle’s days (typically 28–31 days, set by the issuer) to get the Average Daily Balance.

Example:

| Date | Daily Balance (USD) |

|---|---|

| Days 1–10 | 500 |

| Days 11–20 | 1000 |

| Days 21–30 | 0 |

Calculate the Average Daily Balance:

- Days 1–10: 500 × 10 = 5,000

- Days 11–20: 1000 × 10 = 10,000

- Days 21–30: 0 × 10 = 0

- Total: 5,000 + 10,000 + 0 = 15,000

- Billing Cycle: 30 days

- Average Daily Balance: 15,000 ÷ 30 = 500 (USD)

If you don’t pay in full by the grace period, the bank uses this Average Daily Balance to calculate interest. U.S. law requires banks to clearly disclose billing cycle and grace period dates. The Average Daily Balance method boosts bank interest revenue, so monitor daily balance changes closely.

Compound Interest Impact

During repayment, you’ll encounter compound interest effects. While APR is a nominal rate excluding compounding, banks add unpaid interest to the principal monthly. The next billing cycle calculates interest on this higher principal, creating compounding.

For example, with a 20% APR and monthly compounding, a $500 unpaid balance incurs interest that’s added to the principal. The next month, interest is calculated on the new principal ($500 plus prior interest). Over a year, your actual interest paid exceeds the simple 20% due to compounding.

Compound interest increases your true borrowing cost. Although APR is the standard rate, the effective annual percentage yield (APY) is higher due to interest rolling into the principal. Paying only the minimum amount long-term causes debt to snowball due to compounding.

Credit Card APR Types

Purchase APR

The most common APR you’ll use for daily shopping is the purchase APR, which determines interest on unpaid monthly bills. Per Bankrate, the average purchase APR for U.S. cards in 2024 ranges from 20% to 22%, a 30-year high, up from 15% two years ago. Prioritize purchase APR when choosing a card, as it directly impacts repayment pressure.

Cash Advance APR

Using your card for ATM cash withdrawals incurs a higher cash advance APR. Key points:

- Cash advance APR is typically 21.99% plus the prime rate, e.g., 3.25%, much higher than purchase APR.

- Cash advances have no grace period; interest accrues from the withdrawal date.

- Banks charge additional fees, e.g., 3% per transaction, minimum $5.

- Cash advance costs are significantly higher than regular purchases.

Avoid cash advances to minimize high interest and fees.

Balance Transfer APR

Transferring balances from other cards to a new card involves the balance transfer APR. The table below outlines common settings:

| Item | Rate/Fee Range | Conditions |

|---|---|---|

| Balance Transfer APR | 26.99% | New accounts, based on credit and prime rate |

| Balance Transfer Fee | $10 or 5% of transfer amount | Charged on transfers |

| Purchase APR | 19.24%–33.24% | Varies by credit and prime rate |

| Cash Advance APR | 34.24% | Applies to cash advances |

| Cash Advance Fee | Greater of $10 or 5% of advance | Charged on cash advances |

| Foreign Transaction Fee | 3% | Applies to USD-based foreign transactions |

Carefully review terms when transferring balances to avoid high APRs and fees.

Penalty APR

Late payments or breaches of card agreements trigger a penalty APR, often exceeding 29%, higher than purchase or cash advance APRs. This significantly increases repayment pressure. Maintain timely payments to avoid high penalty interest.

Tip: Always review APR terms when applying for a card and plan usage carefully to control interest costs.

Promotional APR

0% APR

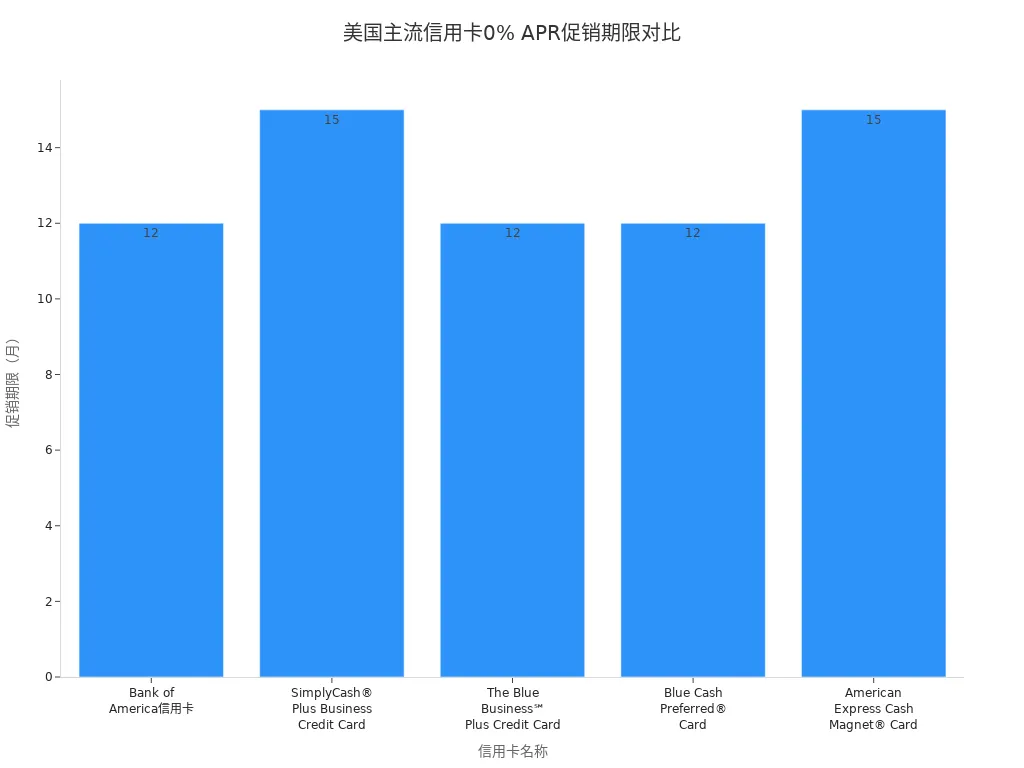

When applying for U.S. credit cards, you’ll often see “0% APR” promotions, allowing interest-free borrowing for new purchases or balance transfers during a set period, typically 12 to 15 months. After the promotional period, rates revert to standard levels, usually 15%–23%. The table below details 0% APR promotions for select cards:

| Card Name | 0% APR Period | Applicable Transactions | Post-Promotion Rate |

|---|---|---|---|

| Bank of America Credit Card | 12 billing cycles (~12 months) | Purchases | 15.24%–23.24% variable |

| SimplyCash® Plus Business Credit Card (American Express) | 15 months | Purchases | No annual fee, rate unspecified |

| The Blue Business℠ Plus Credit Card (American Express) | 12 months | Purchases & Transfers | 15.49%–21.49% variable, based on credit |

| Blue Cash Preferred® Card (American Express) | 12 months | Purchases | 13.49%–23.49% variable, based on credit |

| American Express Cash Magnet® Card | 15 months | Purchases | Rate unspecified post-promotion |

Be aware of common pitfalls when using 0% APR:

- Balance transfer fees are typically 3%–5%, payable even during 0% APR.

- Cash advances don’t qualify for 0% APR and incur high interest and fees.

- Missing minimum payments triggers penalty APR, significantly increasing interest.

- 0% APR has a time limit; rates rise sharply post-promotion.

- Some 0% APRs apply only to purchases or transfers; other transactions accrue normal rates.

- High credit utilization may harm your credit score.

Tip: Read terms carefully when using 0% APR cards to avoid unexpected costs.

Usage Strategies

Maximize 0% APR promotions with careful planning:

- Make large purchases or balance transfers during the promotional period and plan repayments to avoid interest. For example, Capital One Quicksilver offers 15 months 0% APR, reverting to 19.99%–29.99%.

- Use cashback rewards to offset bills or withdraw funds, improving capital efficiency.

- Choose no-annual-fee, flat-rate cashback cards to simplify management, ideal if you dislike tracking complex reward categories.

- Leverage travel insurance, purchase protection, and other card perks to enhance your experience.

- Prepare required documents before applying and select cards matching your needs to avoid high rates post-promotion.

Promotional 0% APR is a short-term benefit. Clear balances within the promotional period to avoid high interest rates.

Reducing Credit Card Interest

Image Source: pexels

Full Payment

The most effective way to avoid credit card interest is to pay your balance in full each month. This reduces your effective APR to 0%, eliminating interest costs. Data shows that paying only the minimum amount could take 206 months to clear a debt, with $7,575 in interest, significantly increasing financial pressure. Make full monthly payments a habit to avoid long-term debt. If funds are tight, consider installment plans to reduce interest.

Billing Date Management

Strategically managing your billing date can extend the grace period, minimizing interest. Practical tips:

- Time large purchases after the billing date to maximize the grace period. For example, if your billing date is the 5th, purchases after the 6th roll into the next month’s bill, extending the interest-free period.

- Understand the grace period, from purchase date to the next payment due date, to reduce interest.

- Monitor billing and payment due dates, ensuring full payment before the due date to avoid interest.

- Use mobile apps for timely payments to prevent late fees.

- Avoid minimum payments; if unable to pay in full, request installments to lower interest.

- Leverage bank “grace time” and “grace amount” services, allowing a 3-day payment extension or small unpaid balances (e.g., $10) without interest. Check bank policies to avoid small-balance interest.

Using Promotional APR

When using 0% APR or other promotional rates, consider:

- Post-promotion, unpaid balances accrue interest at standard rates, often above 17%, sometimes exceeding 25%.

- Pay off all balances within the promotional period to avoid high interest.

- Minimum payments only prevent late fees; unpaid balances still accrue interest, leading to significant long-term costs.

- Some cards use double-cycle billing, where losing the grace period triggers interest from the first purchase, increasing costs.

- Manage credit limits carefully to avoid over-limit fees and credit score damage.

Tip: Fully understand APR terms and plan repayments to minimize interest costs.

By understanding credit card APR, you can grasp the annual costs and associated fees. U.S. credit card APRs follow a standardized framework, offering transparency to compare products and plan repayments. By aligning card usage with your habits and choosing strategic repayment methods, you can reduce interest expenses and enhance credit management.

FAQ

How does credit card APR differ from Chinese credit card rates?

U.S. credit card APRs are typically higher and include more fees than Chinese cards, which often use a single rate, generally lower than U.S. rates. Pay close attention to APR when using U.S. cards.

What happens if I only pay the minimum amount?

Paying only the minimum leaves the remaining balance subject to APR interest. Compounding can significantly increase your debt. Total interest may exceed the principal. Pay in full monthly to avoid this.

Does the APR change after a 0% APR promotional period?

After the promotional period, unpaid balances accrue interest at the standard APR. Plan repayments to clear balances during the promotion to avoid high interest.

Can credit card APR change with market conditions?

Your card’s APR may be variable, tied to the prime rate. Banks adjust APR based on market changes. Monitor bank notifications for APR updates.

How do I check my credit card APR?

Log into your issuer’s website or app to view account details, or check monthly statements. Banks are required to disclose APR and related fees.

This article provides an in-depth analysis of credit card APR calculations and risks, revealing the hidden, high costs behind the convenience of credit cards. When you face an annual interest rate often exceeding 20% and a debt that compounds over time, you realize how crucial it is to have an efficient, low-cost financial management solution. Instead of letting high interest costs erode your wealth, choose a tool that truly saves you money and improves your financial efficiency.

Now, you can say goodbye to high-interest debt and embrace a better financial solution. BiyaPay is designed for those who value efficiency, allowing you to participate in both the U.S. and Hong Kong stock markets from a single platform. It also completely simplifies the complexity of cross-border fund transfers. You can use our real-time exchange rate query feature to convert funds at the best rates, and benefit from remittance fees as low as 0.5% with same-day delivery.

Register with BiyaPay today to leave behind complexity and high costs, and let every dollar you have work harder for you.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.